When the question of whether one should buy or rent a home comes up, the usual answer is “Run the numbers.” A good tool for running the numbers is the Buy-or-Rent Calculator from The New York Times.

This calculator thoroughly takes into account the price of the home, how long you’ll stay in the home, mortgage rate, down payment, home price growth rate, rent growth rate, investment return, inflation, property tax, the tax rate, closing costs, maintenance costs, insurance, utilities, and HOA fees. It calculates a rent-equivalent number. If you can rent a similar home for less than this number, then renting is better.

The Daily podcast from The New York Times put out this episode recently: Should You Rent or Buy? The New Math. The gist of it is that the double-whammy of higher home prices and higher mortgage rates has made renting more favorable than buying. Here’s a shorter interview with the same author on PBS NewsHour:

Most people saying that renting is better than buying aren’t renters themselves. They only talk about renting in the abstract when they don’t have real-world experience in renting these days. I rented in the last four years before I became a homeowner again last month (I owned a home for 18 years before renting). My experience from four years of renting tells me that a buy-or-rent calculator should be the last step you take when you explore whether you should buy or rent, not the first step. Only running the numbers misses a big part of the picture in buying versus renting.

Here are 9 things I learned in real life that a buy-or-rent calculator doesn’t tell you.

- 1. You have fewer choices when you rent.

- 2. Just because you see a listing doesn’t mean you get to rent it.

- 3. Just because you have pristine financials and a great credit score doesn’t mean you’ll get the rental.

- 4. Homes for rent are in general of lower quality than homes for sale.

- 5. You have to ask for permission in how you live.

- 6. Renting doesn’t mean maintenance-free.

- 7. You don’t necessarily get to renew even if you’re a good tenant.

- 8. Your rent can increase a lot on renewal.

- 9. Renting is less flexible than you think.

1. You have fewer choices when you rent.

This was the first surprise when I tried to rent. It may be different if you’re renting an apartment but I can only comment on renting versus buying single-family houses and townhouses because I was only in that world. You don’t need a calculator to tell you that renting a one-bedroom apartment costs less than buying a three-bedroom house.

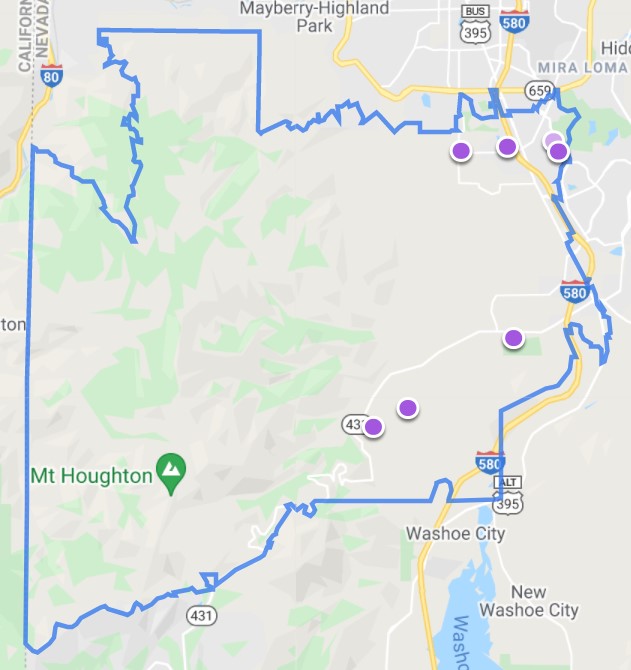

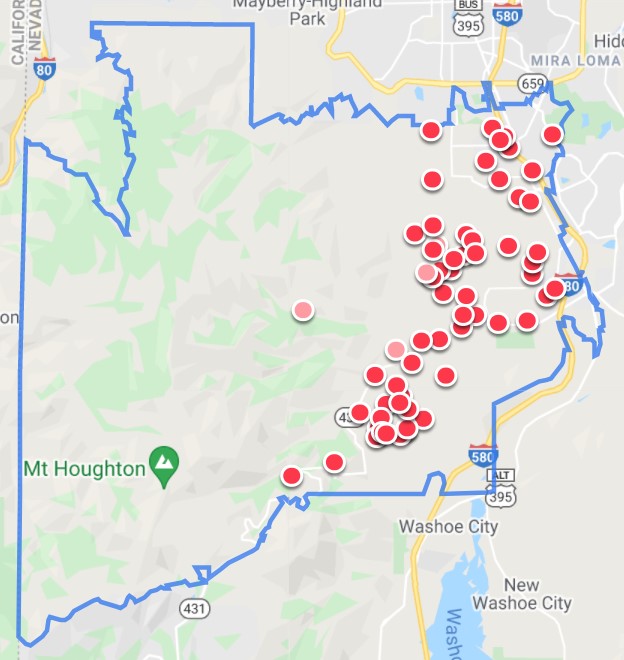

These two maps from Zillow show homes listed for rent (excluding apartments) and homes listed for sale in my previous zip code in 2021:

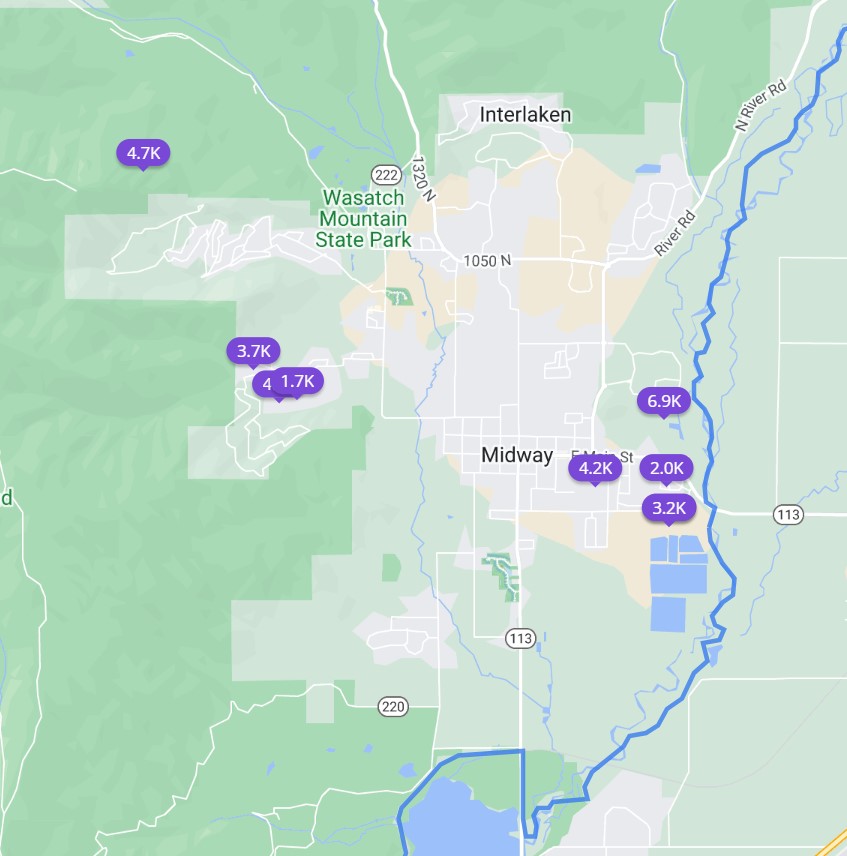

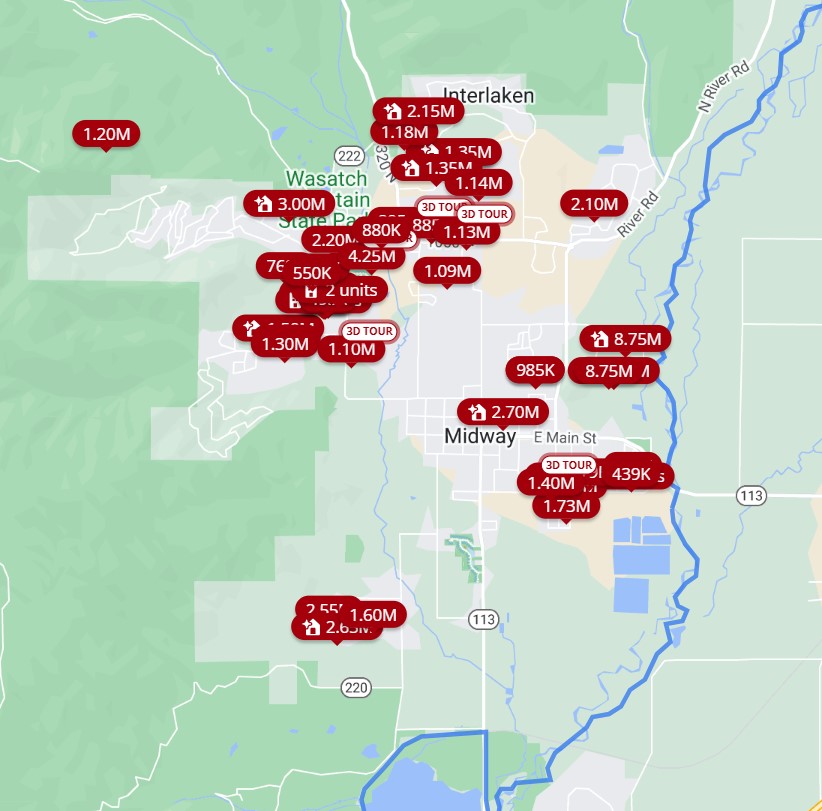

The two maps below show homes listed for rent and homes listed for sale in my current zip code in 2024:

Different times, different places, same story. Before considering prices, sizes, or desirability, you start with fewer choices when you try to rent.

Look at the map from Zillow in both ways for your area. Is it any different?

2. Just because you see a listing doesn’t mean you get to rent it.

Renting a home isn’t like buying something from a store. Just because you see a listing and you’re OK with the asking rent doesn’t mean you get to rent it. You can only apply to rent it. The owner decides whether to rent it to you. Rightly or wrongly, the owner can insert personal preferences in picking the tenant.

Owners aren’t supposed to discriminate but as long as they don’t say it aloud, you can’t do anything when an owner discriminates against you because you’re young or old, male or female, single or married, because you have kids or dogs, or for a multitude of other reasons.

When I was looking for rentals in another city, someone refused to show me the home before a local person saw it first even though I was willing to drive over to see it. Maybe she was burned by an out-of-town renter before. I was guilty by association.

There’s less prejudice and discrimination when you try to buy a home because buying is a one-time transaction. The seller is gone after you buy it. Renting is an ongoing relationship between the owner and the tenant. The owner cares deeply about what you do after you rent it. If the owner suspects you’ll do something he or she doesn’t like because you’re young or old, male or female, single or married, you have kids or dogs, etc., etc., the owner will choose to rent it to someone else.

3. Just because you have pristine financials and a great credit score doesn’t mean you’ll get the rental.

Even if the owner doesn’t discriminate, he or she only needs a good tenant. The owner isn’t running a contest to see who has the strongest financials.

I once applied for a rental and the owner didn’t even look at my application. He said he received 30 applications in a few hours, found one acceptable after reading several, and discarded the rest. Continuing to review all 30 applications would’ve been a waste of his time.

After learning that lesson, I applied for the next rental minutes after Zillow sent me the alert of a new listing. I paid the $50 non-refundable application fee with complete documentation of my financials right away. That was how I got the rental.

When I gave my notice to vacate this rental two years later, the property manager listed it for rent on Zillow on a Saturday evening. By the following Monday, they already lined up 8 showings for Tuesday afternoon. I received another slew of texts on Tuesday morning saying that they canceled 7 out of the 8 showings because one of the 8 signed the lease already without seeing the rental.

The other 7 renters may have stronger financials than the one who signed but they still lost out because they weren’t aggressive enough.

The buy-or-rent calculator showing that it’s better to rent is irrelevant if you don’t actually get the opportunity to rent.

4. Homes for rent are in general of lower quality than homes for sale.

The best ROI in rentals comes from renting cheap homes for not-as-cheap rents. Renters as a whole have lower incomes than buyers. These factors make it rare to see good-quality homes for rent. Good-quality homes for rent are also taken away by the rise of Airbnb and VRBO. Most of the remaining homes offered as long-term rentals don’t look that great.

A home also deteriorates over time after it becomes a rental. You’ve heard of the saying that nobody washes a rental car. The owner doesn’t keep it up because renters don’t have an incentive to take good care of it. Some homes for sale specifically advertise that they have never been a rental.

The owner of my last rental home didn’t do much maintenance when I rented it. When the dishwasher broke, the owner replaced it with a $300 dishwasher, which was the cheapest you could find at The Home Depot. The dishwasher worked but I bet she wouldn’t have chosen that one if the home weren’t a rental. Doing much beyond the bare minimum isn’t worth the investment to the owner, which is understandable but this contributes to the lower quality of rentals.

5. You have to ask for permission in how you live.

You acted fast and you got the rental. You don’t mind its lower quality. You just pay the rent and live your life, right?

Remember that buying is a transaction and renting is a relationship. The relationship means you need permission from the owner in how you live when you rent.

Here are some terms of the lease for my last rental:

Occupancy by guests remaining over three consecutive days or more than five days in any calendar quarter will be considered to be a violation of this provision unless prior written consent is given by Owner. Owner may restrict any guest for any or no reason.

Resident is required to get approval for any companion or service animal PRIOR to the animal coming onto the Premises. Failure to obtain prior approval is a significant violation of this agreement which shall allow for immediate eviction.

Your sister is coming to visit you and she has a dog? She doesn’t have a dog but you want her to stay with you for 4 days? Ask for approval from the owner, please.

Reject these terms and negotiate? Forget about it. See 1 through 3.

6. Renting doesn’t mean maintenance-free.

If you think all maintenance is the owner’s responsibility when you rent, think again. From my last lease:

Resident shall be responsible to maintain the Premises including the exterior. It shall be the specific responsibility of Resident to maintain the sprinkling system and to care for and maintain the lawn and landscaping. This shall include but is not limited to; weeding, watering, mowing, edging, fertilizing, and anything else necessary to maintain the landscaping. In the event Resident fails to maintain the lawn and landscaping, Owner in its sole discretion may cause such to be maintained and shall be entitled to reimbursement from Resident for the costs incurred in such maintenance. Tenant shall be responsible for normal daily maintenance of the Premises and to keep the Premises clean and orderly. Other such maintenance may be assigned to Resident by Owner through the Rules and Regulations or by other written agreement. All costs of such maintenance shall be the responsibility of Residents.

Yes, you can hire lawn service but it’s still your responsibility to maintain the lawn and landscaping.

7. You don’t necessarily get to renew even if you’re a good tenant.

A typical lease term is one year. If the buy-or-rent calculator continues to say it’s better to rent and you’d like to continue, you still don’t necessarily get to renew the lease for another year.

Renting is a relationship. The other party in the relationship has to agree to continue the relationship. The owner may decide to sell, turn it into a short-term rental, rent it to a family member or a friend, or make it his or her primary or secondary home. It doesn’t matter how good a tenant you are.

The owner of our first rental notified us in the middle of the year that he wouldn’t renew the lease because he wanted to move into it. He was kind enough to give us notice six months before the lease expiration and he waived the early termination charge if we moved out sooner. Had he strictly gone by the terms of the lease, he only needed to give us notice 30 days before the end of the lease term and we would’ve had to scramble to find a new place in 30 days.

A buy-or-rent calculator implicitly assumes that you can always renew or you can always find another equivalent rental. The real world doesn’t work like that.

8. Your rent can increase a lot on renewal.

The New York Times buy-or-rent calculator has an input for the rent growth rate. It defaults to 2.5% per year. If the owner offers you to renew the lease, there’s no limit to how much the rent can increase absent local rent control laws.

The renewal I was offered in the second year of my last rental went up by 25%, not 2.5%. The owner threw me a bone and lowered it to 23% when I begged for mercy. If I didn’t accept the renewal, my only choice was to find another place in 30 days.

Hiring movers would’ve eaten up a large part of any savings assuming I was able to get a less expensive rental in 30 days. That also doesn’t count the hassle of packing, unpacking, and disruptions to life. I relented and renewed for a 23% increase.

If you move every time you have an unreasonable rent increase, you’ll be tired of it very soon. The unreasonable rent increase will look quite reasonable when your family asks you why you’re moving again. It’s rational for the owner to charge a premium for renewals because you get to avoid moving when you renew.

After we vacated the rental, it was listed for rent at a much lower rent than we were paying. New tenants don’t pay the renewal premium because they’re moving anyway.

9. Renting is less flexible than you think.

Flexibility is touted as a major benefit of renting. If something comes up in your life, you can just leave. It’s true when it happens close to the time of lease expiration but the owner isn’t obligated to let you out of the lease at other times. You don’t get to break the lease for only one extra month of rent.

From my last lease again:

If Resident vacates prior to the end of the initial term, all future rents under this Agreement shall accelerate and become immediately due.

If you must move two months into a one-year lease, paying rent for another 10 months isn’t much less than paying the transaction cost of selling a home. You don’t have the right to sub-lease when you rent.

Some leases automatically become month-to-month after one year. That’s not always the case. If the owner only wants 12-month renewals, moving is your only choice even though you know you’ll have to move again in two months.

On the other hand, if you chance upon a good-quality rental with a nice owner who doesn’t maximize their economic interest, you’re as locked in as someone who bought a home. You hesitate to let go of this great rental even if your needs changed because you suspect your next rental won’t be this good. Your flexibility goes out of the window when you’re afraid to exercise it.

***

Buying versus renting is much more about the price but a buy-or-rent calculator only tells you about the price. Consider these other factors before you jump into the buy-or-rent calculator.

Did I just have bad luck and run into unreasonable rentals? I doubt it. Basic economics says that lower-priced products see a higher demand. The higher demand creeps into non-price factors such as low availability, discrimination by some owners because they can, a large number of renters chasing after a small number of rentals, lower quality, and onerous lease terms.

A buy-or-rent calculator implicitly assumes a fantasy world in which rentals of equal quality to homes for sale are abundantly available, you get to rent a home of your choice as long as your financials qualify, you can renew for as long as you want for a reasonable increase in rent, and the lease terms are flexible and accommodating to you. If that’s the case in your area, great, run the numbers using the buy-or-rent calculator. Otherwise, not so fast.

Renting by choice looks good on paper but it gets messy in real life. Renting isn’t like buying regardless of the price. Buying is a transaction. Renting is a relationship. I’m happy to be a homeowner again and out of my renting relationship.

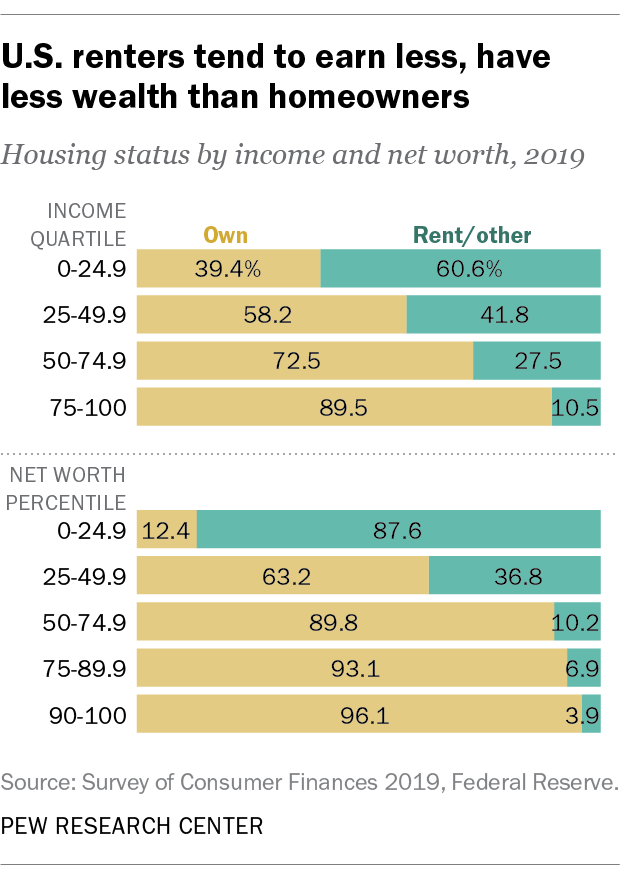

Buying may be more expensive (or it may not be) but price isn’t everything. According to a report by Pew Research Center, 90% of people in the top income quartile and 90% of people in the top half in net worth own their homes. Close to 40% of all homes in the U.S. don’t have a mortgage. People who own their homes free-and-clear don’t sell their homes to become renters when the buy-or-rent calculator says it’s better to rent because they know to look beyond the numbers.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Matthew A-B says

Hey, Harry! Great post, and I hope you’ve been well.

These downside of renting are absolutely real. I’ve lived them all my life! The question is: How does life look on the other side and how much does it cost? Because for many families, the choice is “rent and have some financial flexibility, or buy and be house poor.”

I have never been a homeowner and don’t know what house poor feels like, personally. But I have seen it up close and it is nasty. The main features are: (1) constant fear of major repairs, (2) a maintenance backlog that quickly gets worse than what the average renter experiences, and (3) a general sense of “my house was supposed to be a source of personal and financial security, but instead it’s a source of discomfort and financial instability.”

This is very, very common. The solution, of course, is to have enough income that you can buy the house you want in the neighborhood you want and still have a big financial cushion to cover the new furnace, the property tax assessment, and so on. Plenty of people are in that situation, and they end up in the yellow bars on the Pew Research chart. It’s unlikely that most of those people ever sat down to do a buy/rent analysis.

Anyone who is genuinely doing the buy/rent analysis is probably in a high-cost city where their income will make it possible but difficult to afford the house they want. Those people are probably better off renting. They won’t see the downside of buying more house than they can afford until after they buy.

Harry Sit says

Hi Matthew, my favorite writer! I see you’ve moved to podcasting. I just subscribed to your podcast.

As a life-long renter, how did you navigate the challenges of renting?

I think the question of “How much housing can I afford?” requires a different calculator. A buy-or-rent calculator assumes you can afford both. It only shows which way is better. Going overboard in housing isn’t good whether one buys or rents.

Pete says

Ok, you’re Harry’s favorite writer. How do we find your writing and podcasts?

Joel Voelz says

Great article but is there a calculator/article on making the decision to sell vs rent your house?

Harry Sit says

I don’t know any calculator on sell-or-rent a house you own. As a first pass you can use the buy-or-rent calculator in reverse. Pretend that you’re buying this house at the net price after the selling costs. Use 100% down payment if you own it free-and-clear. Use the home equity percentage and your current mortgage rate if you have a mortgage. If buy-or-rent favors renting you should sell. If buy-or-rent favors buying you should consider renting.

Keep in mind that if this is a primary residence, selling it is tax-free (subject to a maximum of $250k/$500k in capital gains) while the rental income is taxable. Most owners just sell, which is why it’s difficult to find good-quality single family rentals.

Mighty Investor says

Yeah, now I’m intrigued, too. What’s the podcast called?

ReaderInCA says

I wish I had paid attention to wisdom like yours years ago when others were advising me to buy a house, which I could have easily afforded at that time. When I divorced in my early forties, we sold our very beautiful house (with a garden and pool) in a very desirable college town (we broke even, no profit). I was anxious for freedom and mobility, moved to the ocean and rented an apartment for eight years, then moved to the mountains and rented an apartment for another three years, and then realized the desirable college town was the perfect place for me to grow older. I rented an apartment there for another eight years, became more and more upset about my loud apartment neighbors (mostly college kids) and the constant leaf-blowing by maintenance. That’s when I was advised to buy a house and I should have. But I rented a duplex house, and my life has been hell ever since. I despise my very loud and rude duplex neighbors. And now I’m almost 70 years old and retired, and this desirable college town has exorbitant prices for not only sale of homes, but rentals, and I’m stuck in this duplex and at the mercy of a landlady who could sell this house at any time. She raises the rent $150/month every year. The house we sold when I was in my forties is now worth $1.5 million. I hope your readers pay close attention to your words of wisdom and avoid the nightmare that I find myself in. I can live with either of my children as I get older, but I would hate to burden them in any way and would much prefer to live by myself in a lovely home, which I should have purchased 15 years ago. Thank you for spreading the word about how the negatives of renting are often much more than you can imagine.

GaDon says

This and Harry’s are two super thoughtful posts. Thank you for sharing, and I wish you much luck in the years ahead.

Mighty Investor says

Thanks for sharing this thoughtful and sincere perspective.

Matthew A-B says

Hey, Harry! Thanks very much for the kind words.

I think the downsides of renting are just more widely understood than the downsides of owning. Another finance blogger (I can’t find it now!) wrote a post that complements yours well, focusing on the (relatively unusual) situations where renting is a better overall choice. One of their situations was “landlord is hesitant to raise the rent,” and that’s where we’ve been for quite a long time. It’s not a mom-and-pop landlord; I think we’re just relatively good tenants. (Don’t point them to this post, please. 🙂

Is it an amazing place to live? Nah. The walls are paper-thin, and you can hear toilets flushing from many units away. The baseboards heaters try their best but it’s usually too cold or too hot. Like you, we had a better dishwasher replaced with a worse one. I think we have a total of 2 square feet of kitchen counter space. I’m a musician and would love to be able to step into my basement or garage and play loud, but instead I pay to rent a practice space half a mile away.

So how do we deal with the downsides? By enjoying the fact that we built up large retirement savings, travel often, and raised a kid and sent them off to (state) college, for which we’re paying cash. We also have very unstressful jobs and live close to my parents.

A couple years ago, a some good friends of mine sold their house and went back to renting. The thing they said to me over and over was how much less stress they felt. (Again, this was in Seattle, and they were house poor.) Their lives contained much less choice and more daily annoyances, but also, in some ways, more freedom.

So I’m agreeing with you! Buy vs rent are usually completely different things, and most people prefer what you get when you buy. My perspective is certainly very warped by living in a VHCOL coastal city, but it’s hard for me not to see homeownership as a trap that I’m lucky to have avoided.

KD says

Great post, Harry! In our journey, I found that expectations and inclination were the key to finding contentment. Owning a home has to work beyond the numbers and affordability. We lived in 3 bd, 1 bath cute home in a modest neighborhood that was in an amazing location from commute and lifestyle perspective. Eventually all the old ladies in the neighborhood starting aging and leaving. A shark landlord bought up over 20 houses. The color of the neighborhood changed with renters moving in. My spouse had lived in the neighborhood for 25 years, and I was really attached to the house. Deciding to give it up for a new one seemed like a big risk. We picked the neighborhood we liked first, and then a house in that location that met our needs. We doubled our square footage. Seemed ridiculous back then to take on more and spend more. But 4 years in, we have a completely different understanding and perspective. I have developed a whole new hobby and skill of gardening that I didn’t knew I had, we locked in a 2% mortgage, home prices have gone up, the neighborhood is everything we wanted, larger space works out great when company comes to visit. We also had to do a lot of work – painting practically every room, putting in a new HVAC and furnace, finding the right furniture and light fixtures, restoring the charming Tudor exterior that was covered in vinyl, putting in landscaping from scratch, repairing electrical, moving gas lines, and now working on replacing a portion of the fence. It never ends. We are pragmatic that things may change, and we may want to move again. As they say with real estate, it is all about location, location, location. Some people understand nesting, homesteading, property value etc and act accordingly to improve it and maintain it. Others simply are not cut out to nurture a property. It is not a part of their aesthetic. No matter how much money they have, how few problems in life they have, they simply don’t have the awareness to care for their property. It is not in their bones. And there is always one house that brings the neighborhood down. LOL. Joys of owning a home!

Brian S says

As always excellent perspective and insights beyond the “calculations”.

Dan says

Your experiences are only in high cost of living areas.

You also eliminate apartments, a category where most great deals on rental are to be had.

Single Family Homes are expensive.

Matthew A-B says

I don’t want to plug my stuff here without Harry’s explicit permission! But I host a comedy podcast and write food and travel books. Years ago I wrote a weekly personal finance column for Mint.com, and that’s how Harry and I first crossed paths, but I don’t think any of that stuff is still online.

Harry Sit says

Matthew cohosts a podcast called Spilled Milk. Here’s his author page on Amazon.

Kay B says

For those with allergies or chemical sensitivities renting can be a nightmare. You could share public hallways with tenants who smoke, vape, use heavy art supplies, or burn incense or scented candles daily.

The building management may use strong pesticides both inside and out. You can only hope they are applied correctly and EPA approved chemicals. The tenant has no say in it.

Aside from the management/owner putting in low quality “dishwashers”, as has been mentioned, there are other concerns along that line. The cheap new carpets or flooring installed, could be off-gassing massive amounts of formaldehyde. The newly painted walls could be off-gassing high VOC’s. The HVAC system may be infested with mold.

Some of the larger, newer apartment complexes now have each individual unit’s washer and dryer appliances out-venting on the side wall instead of the roof. This means you will smell all of your neighbors heavily performed laundry- good luck opening the windows for some “fresh air”. Indeed, if there are many units sharing that side wall the constant perfume will leak into your apartment even with windows closed.

Sam S says

Hi Kay B, thanks for the reminder of the potential smells from scented laundry detergents & dryer sheets. I never thought about those possibilities. Some people are very sensitive to fragrance.

Monica says

Just for the benefit of readers, there are some clearly illegal terms in the sample leases in the article. A landlord can’t restrict a service animal. That violates the Fair Housing Act. I wouldn’t strike the term but would likely sign the lease and simply ignore the term. Also, acceleration of rent is one I haven’t seen but would seem to be prohibited by a landlord’s duty to mitigate. That is, a landlord has the responsibility to attempt to rerent the unit and if they do so, offset the previous tenant’s liability by that mitigation. That isn’t to say you wouldn’t be on the hook for rerenting costs and the difference between the two rent amounts.

Harry Sit says

You ignore the term of the lease and bring the service dog anyway. When the owner raises the issue, you call her bluff and cite the Fair Housing Act. The owner doesn’t renew your lease when it ends in a year. You pack up and move. Repeat next year at the next place.

Craig says

This article hits the nail right on the head. I’ve found that many in the FI/RE community treat renting as having access to the same quality and quantity of options as buying, and it’s primarily just a financial decision. This is the first article I’ve seen that goes into the reality of renting.

I would also add that the rental supply can be practically non-existent outside major urban and suburban areas, and if you’re in early retirement some landlords may be hesitant to rent to you regardless of your assets (experience may vary on this one).

Michelle says

You make some excellent points.

Over 30+ years ago my ex and I bought a house. A young couple our age moved into the up/down duplex behind us as renters. They rented that place for 20 years. By the time they moved out, we had WAY more money invested into our place and not all that much equity (this was around 2015). Hindsight showed they came out way ahead financially.

Everything is relative. For every good renter story you can find a bad one I guess.

Al says

As a long-time renter, at times I’ve felt like a pawn in someone else’s plans. One out-of-town owner of a house that I had been renting for a few years arrived out of the blue, wanting immediate access to the interior to do renovations, and then promptly gave me 30 day notice to vacate as they were putting the house on the market. As it turned out, the owner sold the property a few months after I moved out to someone who then promptly put the house right back on the rental market.

Sam S says

Wow! Fantastic post, Harry!

wallies says

25% increase YOY is absolutely outrageous! And it was listed for much less after you moved out? What a slap in the face!

Six months is decent notice to move. My last landlady gave me 45 days notice before she abruptly ended my lease after seven years because “my daughter wants the house.” I had no late rent, no pets, no roommates and no parties. She bragged about how nice she was to give me more than the standard 30 days. Then she said “I knew at renewal time that this would be your last year.” A comparable home down the street went on the market. We both attended the open house and she never mentioned I would need new housing in a few weeks!

There’s a special place in hell for landlords.

Sam S says

Your landlord wasn’t kind to you. The Landlord-Tenant relationship is usually contentious, though.

Larry S says

Hi Harry,

Thank you for another insightful post. I have been a homeowner most of my adult life. But now that my wife and I have comfortably moved into retirement I have seriously considered that our next home would be a rental, and let someone else manage the hassles of maintenance, taxes, and financing, etc. to someone else. Your writing has made me think more deeply about the possible downsides of renting. It hasn’t turned me off of the idea of renting (yet) but you have given me more to think about that I hadn’t considered. Thanks!

Nathan says

How much of that 25% rent increase would you estimate was an adjustment to market rate?

When applying for the rental, did you have to disclose your net worth or any other factors about your financial situation that could leave the impression that you are well off and can easily “afford” the rental increase?

That section about needing approval to have guests stay over is absolutely insane and should have been a red flag. Not sure how this clause could be enforced to the point that it would lead to eviction, unless the owner is constantly watching over you.

Harry Sit says

I would say a 10% increase would be adjustment to market. Everyone applying for a rental has to disclose income. The owner selects one with great potential to afford future rent increases.

The guest clause is there to protect the owner from renting to two people but actually having 8 people living in the house or the tenants running an Airbnb with the rental, which is understandable, but it also serves as a convenient “out” for the owner to end the lease for other reasons.

James says

Was your income qualification based on wealth (dividends, interest, net worth alone) or actual income from your business, spouses job, social security, etc?

I’m asking because many early retiree blogs are making the case that renting is a better deal, but besides the points you are making in this post, I’ve always wondered how someone can qualify as a renter that is living off their wealth.

In my limited experience, someone trying to qualify on wealth alone is so rare that there isn’t a process in place to get approved. Commercial leasing offices will simply not deal with it, and small landlords require huge upfront payments or locking it in escrow (if they even allow it in the first place).

Harry Sit says

It was based on income, documented by tax returns. My experience is the same as yours. Owners want to see gross income at a minimum multiple of rent (typically 3x). It doesn’t matter where the income comes from (dividends and interest count as income) but it has to be income.