When you roll over a 401k from a previous employer, most 401k providers will sell all your investments and send a check to your new 401k or IRA provider. Some 401k providers will make the check payable to “[new provider] FBO [your name]” but they will send the check to you. You then forward the check to the new provider, together with any forms the new provider requires. See my experience in Fast and Easy Rollover From Schwab 401k to Fidelity IRA.

Either way, your money will be out of the market from the time the old provider liquidates your investments to the time your new provider receives the check and you reinvest the money. Although I haven’t heard much talk about missing the best 10 days lately, when the stock market is going gangbusters, some understandably don’t want to miss a beat, even for just a week or two for the rollover to complete.

How do you roll over a 401k without going out of the market? If you must go out of the market, how do you make the time as short as possible? Note I’m using 401k as a shorthand for employer-sponsored retirement plans. This applies equally to 403b and 457 plans as well.

In-House IRA

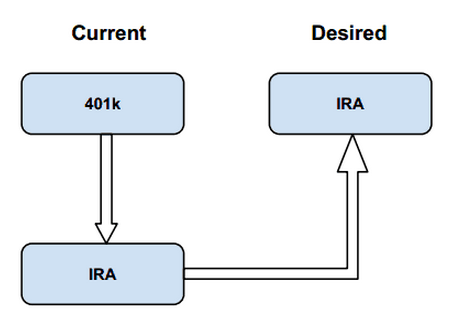

Some 401k providers such as Fidelity or Schwab also offer IRAs. If you roll over to an IRA “in house” they’re often able to roll over the 401k assets in kind — moving the shares instead of selling them for cash. I know Fidelity can do that for sure. When they move the shares, your money stays in the market at all times.

Once you have the assets in an IRA, you can transfer the IRA to your desired destination, again in kind.

This two-step process keeps your money in the market.

The outgoing IRA custodian may charge you an account closing fee. The new custodian often reimburses you for the fee. Some even give you a good bonus for bringing money over. If you are going this route, be sure to ask about the account closing fee, any reimbursement, and bonus.

Once the assets arrive at your new account, you can take your sweet time in reallocating to the investments you want.

Fill With Bonds

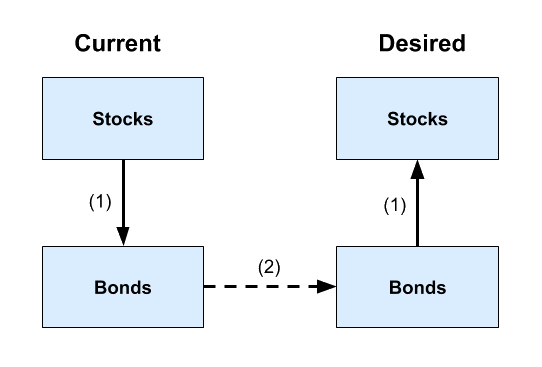

If the account you’re trying to roll over is relatively small, you can exchange the stock funds in it for bond funds while simultaneously exchanging bond funds for stock funds in your other accounts. Because bond fund prices don’t fluctuate as much as stock funds, you will be less affected when your bond funds are out of the market during the move.

This only works if you currently have more money invested in bonds in your other accounts than the amount in stock funds in your 401k.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Roger @ The Chicago Financial Planner says

Good tips but in my experience as a financial advisor being out of the market for a few days while the rollover is in process is not all that tragic. I’ve read the “best 10 days” papers and agree with the premise. What is most important in my opinion is that folks make a proactive decision about what to do with their old 401(k) when they leave a job. I’ve seen far too many people with 3-4 old 401(k)s and a “portfolio” that can best be called cluttered.

Terry says

One more thing to consider (so you’re not surprised by it): Say you have 10 Fidelity funds and transfer to Schwab IRA, Schwab may charge as much as $50 for each sale of a Fidelity fund.

Harry says

Good point, Terry. In that case, you can sell the house funds in the in-house IRA and buy ETFs before moving to the final destination.

Steve says

I have never bothered doing a rollover in-kind. For when I eventually rollover my current 401(k), my employer recently switched to collective investment trusts for slightly lower expenses. CIT’s can’t be rolled over in-kind since they aren’t traded on the open market.

Dave R says

Thankfully I didn’t read this article a few years ago when rolling over my 401k. What I missed more resembled the worst 10 days. I think I “made” $3000 or so while waiting for my former 401k provider to issue a check, send it to me, and then I forward it to my broker.

Of mine and my wife’s current 401k providers, only one would offer your option. I suppose buying on margin while waiting for the funds to be deposited is another idea.

Harry says

I agree timing cuts both ways. You would’ve made even more if you didn’t reinvest right away after the rollover check arrived but waited until the market got to the bottom. You can’t borrow on margin in an IRA.

harry @ 4HWD says

I probably wouldn’t care much about the 10 days but I am starting to think about what to do with my old 401(k)’s more and more. I have one old one that is of significant amount and in 3-4 years I will have another ‘old’ 401(k) of sig. amount. Will/should open up a solo 401(k) to consolidate all but I think I’m going to wait until you do a couple more posts on it 🙂

Leon says

Thanks for a very useful article — the first I have seen on the subject in the financial press. When she retired last summer, we transferred my wife’s entire 401A account to a regular IRA at Vanguard, with the primary motive being to save about $580 annually on fees (over already reasonable institutional fees at Great West Financial Services) for substantially identical index funds, and to be in position to roll a portion annually into a Roth IRA. Prior to the transfer, we shifted allocations between my plan and hers (with the same employer) to keep the same overall allocation while concentrating her allocation in a way that would save the most on the expense ratio in Vanguard funds compared with the 401A, which happened to be the most aggressive equity funds (100% equity). We didn’t fully realize the potential consequences of having 100% if her account assets completely out of the market for several days before receiving notification that a check had been mailed. Fortunately, the transfer by snail mail occurred during a correction in the last week of August, and she ended up buying into nearly identical investments for $9,300 less, instead of well north of $10,000 more (approximately her annual contribution before she retired) had the transfer taken place during the market surge the following week. After risking over 15 years worth of investment fee savings to make the transfer, we were left with the shaken feeling of having successfully gotten away with picking up nickels in front of a steam roller.

I will have to put more thought into transferring my account when the time comes. Unfortunately, I think with the 401A provider we will be stuck again with a check in the mail – so the options to reduce the downside risk of being an “accidental market timer” seem to be to make smaller transfers (perhaps directly as annual Roth rollovers) and/or to reallocate among our tax deferred accounts before the transfer to maintain our overall equity allocation while concentrating the transferred portion in fixed income investments with low volatility (stable value, cash, intermediate bonds, etc.) that shouldn’t fluctuate much during the transfer.

Harry says

Leon – Thank you for sharing your personal experience. I agree with your two solutions: do it in small batches so your chances of gain and loss can even out or re-position the account to fixed income and increase equities elsewhere prior to liquidation.

Nicole says

Normally unfortunately employer 401k plans will not allow partial rollovers for regular employees. Also you can move money into a money market when the market is high then open your IRA and transfer funds but wait until time is ideal to reinvest. Thing is timing the market for the average person isn’t easy. You have to think about the long term projection, otherwise it really is like gambling.

Also most employer 401k shares are R-Shares and IRA shares aren’t is my understanding therefore in kind transfer may not be possible even if it’s the same custodian.

linda says

Harry, one of my friends is self-employed(he’s the only employee) and has a solo 401K(can contribute more than SEP IRA). but he doesn’t like to be limited to mutual funds and want to invest in stocks. Can he rolls over his 401K into traditional IRA (already has the account)? not 59 1/2 year old yet but IRS allows open and close the plan once every 12 months?

thanks

Harry says

A solo 401k isn’t limited to mutual funds. Any such limit is only imposed by the solo 401k provider. For instance if he has the plan at Fidelity, he can invest in practically anything in a brokerage account (stocks, brokered CDs, ETFs, mutual funds, etc.). Don’t roll it over to an IRA. Move it to a provider than doesn’t limit him to only mutual funds.

On the other hand, it isn’t necessarily a good idea to invest in individual stocks in a solo 401k — not as diversified as mutual funds. He can make a lot of money if he invests in the right stocks at the right times (Netflix in 2013) but he can also lose a lot of money if he invests in the wrong stocks at the wrong times (J.C. Penney in 2013).

The White Coat Investor says

If you’re really worried about missing a huge uptick in stocks, why not calculate exactly how much money as would be invested in stocks in the rollover. Then, in another account, sell that much in bonds and buy stocks. Then, when the rollover is complete, reverse that transaction.

But I agree that you’re unlikely to miss much action, and that there is a decent chance having the money out of the market will save you instead of costing you money. Asset transfers seem to be getting faster and faster all the time now. I noticed some of my recent ones were less than a week.

Harry says

Another account may not have enough assets to do the trade, for example when you are rolling over a 401k after a long tenure with the employer.

Timothy Zhu says

Thanks for this article. I did a Google search about rollovers without leaving the market, and I was shocked that your article was the only one on the first page of results. This seems like such an important topic.

Tj says

Retired Jan 2016 @ 69 yrs old. want to rollover co. 401k to vanguard but with market so far down (Jan 26) I fear selling so low & by the time the rollover check gets to vanguard I would buy in high. Vanguard says you can’t “time” the market. I lost 40% selling low out of fear in 08 & was told not to sell off in a severe down market. S&P having worse month since 2010! Can’t afford missteps. Any thoughts?

Harry Sit says

Just do it the way described in this article?

Patty says

I’m more concerned about losing money than missing a high market. What if I transferred the money in my former employer account to a money market fund and then do the direct rollover and make the rollover go into a money market fund in my new employer account? I could “time” the market in this way because I would know if the market was up or down on the day of transferring the funds into the money market and I could decide when I would reinvest the funds from the money market fund in my new employer account into more aggressive investment funds.

Harry Sit says

Either you sell to a money market first or they will sell when they do the rollover. By the time the money arrives at the new place, the market is either up or down relative to when your shares were sold. If it’s down, you are happy. You get to buy more shares. If it’s up, and you decide to wait for it to come back down, you run the risk of it continuing going up. You keep waiting and it just doesn’t come down to the level when your shares were sold. Finally you are fed up and you end up buying at much higher prices than you otherwise would.

chris says

Harry, I sold on 08/31/2017 to do a 401k rollover at my new employer. I tucked it away in a mutual fund, now the market is up about 2000 points. Keep waiting & market continues to rise or wait for it to drop a little. Figure I missed out on 3g on the timing.

Rick says

I wonder if anyone is still following this thread. I’ve been pondering this exact question and appreciate everyone’s thoughts. But I wonder if we are not all making this too complex??

If an account is worth $100,000, 2 funds 50k each, X number of underlying shares in one, Y number in another. It converts to cash and 100k transfers in cash.

It arrives at the new fund company still worth 100k. If the price of one fund is up your 50k buys fewer shares than you had before but the value is still the same. If the price of the other is down your 50k buys more shares but is still worth 50k. If both are up or down similar results.

Is there any significant risk here? Am I missing something (wouldn’t be the first time).

Harry Sit says

If prices of both funds are up, the value is the same but you have fewer shares now. If you transferred the shares instead of selling to cash, your value would be higher by now.

sadsack says

Harry, I am in a pickle. I did what was supposed to be a direct rollover to Firstrade. The cash arrived okay, but they are rejecting my stock. They only accept ACAT for in-kind transfers, and my 401k only executes DTCs. In the meantime the originating firm is trying to find out where my stock is.

My general question is this: does a 401k have to stay together. Could I keep the cash at Firstrade and send the stock to a different brokerage?

I’m feeling a little low, as I would like to buy VTI if there is a downturn, but I don’t want to have to liquidate it if I have to go to a different brokerage to keep all the assets together.

Any insights would be greatly appreciated.

Harry Sit says

Ask your 401k plan administrator. The law does not require that the money from the 401k stays together. You can have two separate [partial] rollovers. Your 401k administrator may allow only one lump sum distribution versus multiple partial distributions.

Andrei says

We just rolled over my wife’s old 401k from Ascensus(Vanguard) to (NetBenefits)Fidelity and ended up buying 95% of the shares she had in the old 401(k). So sell low, buy high in our case.

We didn’t time it in any way, we didn’t even know when Ascensus was going to sell the shares, as her old employer went bankrupt and she was told that the plan would be terminated once the company is dissolved. As soon as we received the check, she uploaded it via NetBenefits app and it was processed the next business days. So, she’s lost around $4k worth of shares in the process, which is not pleasant to say the least.

I’m now thinking how I could have prevented or minimized that and decided to check my favorite personal finance blog. Should’ve done it before doing the rollover, oh well.

This strategy seems like it would work, but how does it play out with backdoor Roth? Once the old 401(k) is rolled over in-kind to an IRA, then to another IRA. It would need to be hidden again, right? And that could be done in kind too? To summarize, would something like this work?

Vanguard 401(k) –in-kind–> Vanguard IRA –in-kind–> Fidelity IRA –in-kind–> Fidelity 401(k)

Harry Sit says

The money has to go into an employer plan by December 31 in order to preserve the backdoor Roth. The last leg from the IRA to the 401(k) may not be in-kind but it’s always faster and fewer days out of the market when you’re moving in-house. I also added a second method based on comment #8. It works when the account you’re moving is smaller than your other accounts.

Elijah says

Looking for answers like others here. I just executed a rollover in which it took nearly 4 weeks for Transamerica to process my request, and – unluckily for me – they liquidated on January 27th, the day after the recent market low. As a result I realized about a 10% YTD loss and more than likely will be buying back in even higher once that check is processed by the new administrator. Obviously nobody could have foreseen this and it is folly to try and time the market, but for that precise reason how on earth is there no volatility protection built into rolling over a 401k?

Samir says

Can’t believe this is the only article I found on this subject after searching for nearly 30 minutes.

The problem is the ‘in-kind’ part when the 401k has institutional class shares of a mutual fund. Not sure how that will work because those will probably not be available in a regular IRA. But the alternative of a traditional 401k rollover doesn’t help either because of the conversion to cash.

A transfer-in-kind is the only type of move that makes sense in a retirement account, and yet it seems to be so obscure and hard to do–what a pity.