I had high hopes for Charles Schwab’s upcoming robo advisor product Schwab Intelligent Portfolios. It’s supposed to have Schwab’s brand, scale, customer service, IT infrastructure, low-cost ETFs, and zero fees above the underlying ETF expenses.

However, Schwab had to make it not so clean-cut. What could’ve been a very compelling product all around is now a little difficult to explain. Instead of an unequivocal “sign me up” people are given some reasons to debate, hesitate, and possibly be consumed by procrastination and inertia.

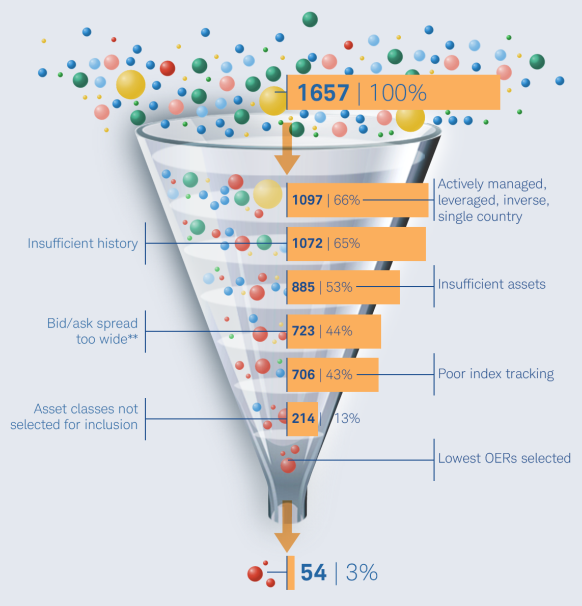

ETF Selection

Schwab revealed more information about Schwab Intelligent Portfolios in a series of FAQs. It’s going to use Schwab and non-Schwab ETFs selected through objective screening.

The 54 ETFs coming out of the funnel are qualified candidates. It doesn’t mean that the recommended portfolio will have 54 ETFs.

Sample Portfolio

Schwab gave an example for a 30-year old with high risk tolerance saving for retirement. The sample portfolio consists of:

| US Large Company Stocks | 10% |

| US Large Fundamental | 16% |

| US Small Company Stocks | 6% |

| US Small Fundamental | 8% |

| International Developed Large Company Stocks | 8% |

| International Developed Large Fundamental | 12% |

| International Developed Small Company Stocks | 4% |

| International Developed Small Fundamental | 6% |

| International Emerging Market Stocks | 4% |

| International Emerging Market Fundamental | 6% |

| US Exchange Traded REITs | 3% |

| International Exchange Traded REITs | 2% |

| US Corporate High Yield Bonds | 2% |

| International Emerging Market Bonds | 3% |

| Gold & Other Precious Metals | 3% |

| Cash | 7% |

That’s a total of 16 ETFs, with the required appearance of sophistication. Nobody in their right mind will want to contribute to and rebalance a portfolio like this on their own.

Many equity asset classes are broken down to 60% fundamental 40% market-weight. It’s interesting that Schwab places so much weight on fundamental indexing. By coincidence Schwab has a lineup of fundamental ETFs that other large ETF providers Vanguard and iShares don’t have. The other large provider for fundamental ETFs PowerShares is a Schwab ETF OneSource partner.

I worry that the heavy allocation to fundamental ETFs increases the blended cost of the underlying ETFs. Fundamental indexing proponents will say they increase returns and/or reduce risk. Are fundamental ETFs a poor man’s DFA? Only time will tell whether the added cost will be worth it.

Under the Hood

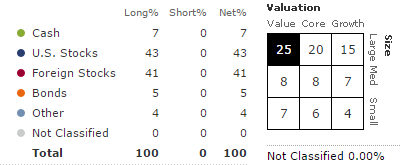

I ran the sample portfolio through Morningstar Portfolio X-Ray using some ETFs I think are good candidates for the asset classes. The result looked like this:

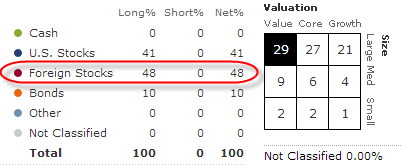

Compare it to a portfolio I ran from Betterment:

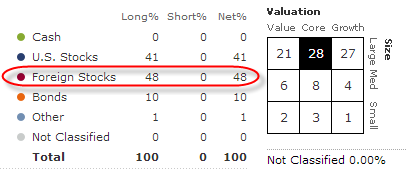

Compare it to a portfolio I ran from Wealthfront:

The Schwab portfolio allocates slightly less to stocks (85% vs 90%), more to small caps (17% of stocks vs 5-6%), and more to cash (7% vs 0%). It has similar tilt to value as Betterment, more than Wealthfront. Which one will do better? Who knows.

Cash at Schwab Bank

The allocation to cash is another monkey wrench that Schwab throws to its otherwise compelling offer. In the example above, 7% of the portfolio will be held as cash at Schwab Bank earning a money market yield, currently at 0.08%.

Schwab makes the case that cash acts as a stable foundation in a portfolio. At the theory level, it’s defendable, especially when you are also allocating more to small caps. It just so happens that Schwab Bank makes money from the idle cash, which it contributes to offset the cost of the program. This convenient coincidence weakens Schwab’s argument for cash. It makes people suspicious.

The arrangement isn’t necessarily a bad one. If the 7% in cash otherwise would earn 2%, which is subject to risk, not guaranteed, you are losing 0.14% from keeping it in cash. If you consider it the cost of using Schwab Intelligent Portfolios, it’s still very reasonable.

However, trying to explain it and making people do math just make it not very clean. It may be really true that holding cash is good for you but people love to see their money put to work. Schwab shouldn’t give people a reason to question its motive.

Incumbent robo advisors Wealthfront, Betterment and others must be breathing a good sigh of relief. Whether it’s significant, the cash drag is something obvious to point to.

Bottom line, Schwab Intelligent Portfolios is still a good product. It would be much better if Schwab didn’t mess with the cash part.

In the end it’s not about Schwab vs Vanguard vs Betterment vs Wealthfront. It’s about low cost indexing vs speculating vs active management vs high sales commissions and management fees. Whether investors choose the service by Schwab, Vanguard, Betterment, or Wealthfront, they ultimately benefit from low cost indexing. Rather than trying to pick hot stocks, timing the market, or being sold expensive load mutual funds or wrap accounts, they just send money over to the service of their choice. All the rest will be taken care of at a low fee.

[Photo credit: Flickr user bigbrand .]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mark Zoril says

Nice work on this. Your comment about the “required appearance of sophistication” speaks to much of the marketing work of the financial services industry!

13owie says

At first I thought the title might have been related to what feels like a delay in roll-out. I took a 6mo free promo from Betterment in the meantime when grew tired of waiting [in cash]. Great insights on the portfolio makeup.

indexfundfan says

I am shocked at the number of ETFs this monster is using!

Harry Sit says

To be fair, Betterment also uses 12-13 ETFs, fewer, but not that much fewer. More ETFs might provide an easier transition for people coming from Ameriprise, Edward Jones or the like who are used to having many positions. I read people felt cheated when they saw Vanguard only recommended 4 funds.

B says

Great write up. I’m a current Wealthfront customer but was thinking of switching to Schwab after they revealed the amount. Also, some relatives have extremely large portfolios that were nervous about giving 7 figure accounts to a startup, and had planned to move to Schwab on my advice. But I’ve got to say, Schwab got me. I actually thought they wouldn’t come up with such a one-sided product offering. The cash position is inexcusable in my opinion. If they are going to finance this offering by borrowing cash from you and paying you basically no interest, in order to loan to their margin customers elsewhere, then they should just come out and admit it. To try to make the argument that they are doing it for the good of the customer is ridiculous. And then they went fundamental weighting indexes so they can charge 5x as much for those funds, and miraculously in a space Vanguard doesn’t offer? I’ll stick to Wealthfront I think. It’s just a shame, as who wouldn’t want “free” robo-management… except it’s far from free, isn’t it? Shame on me for expecting more.

Jack says

Shame on you for thinking anything is free. Even if you don’t see the fees, they exist. This is America and businesses exist to make money. And that’s not a bad thing.

Lynne says

It looks overly complex with 16 funds. And 8 different international funds, really?

B says

The number of funds helps with the tax loss harvesting. So I think that’s about the one positive coming out of this whole disappointing Q&A release.

mrknowitall says

How come Discover and Ally can offer .008% and Charles Schwab offers .0008% and screw up the whole thing. Also I have Wisebanyan which is actually robo at no cost.

Harry Sit says

If you look at banks that offer high yield savings accounts, they all have a natural “out” for the money they collect. Schwab isn’t able to earn as much on the money as those other banks.

Ally – finance car dealerships

Discover – credit card revolving balances

Barclays – credit card revolving balances

Capital One – credit card revolving balances

CIT Bank – loans to small and medium businesses

Synchrony – finance retail purchases

indexfundfan says

Schwab bank is said to lend out “money for mortgages at 3.4% and 4% for home equity lines of credit. Schwab Bank has already been a dramatic growth story for the firm. Charles Schwab Bank’s balance sheet grew to $111.2 billion at the end of 2014, up 11% from the previous year. There are currently $11.1 billion in outstanding mortgage home equity loans.”.

Harry Sit says

90% of the money they collected is not loaned out as mortgages or home equity lines of credit. That’s not very efficient use of the money. It affects their ability to pay good interest.

indexfundfan says

How do you know 90% is not loaned out?

Harry Sit says

I was going by $11.1 billion in mortgages and home equity lines of credit out of $111 billion on the books.

JohnInIowa says

I had never heard of “fundamental ETF” until reading your blog posting, Harry. I was struck that Schwab was using them a lot.

Since you hinted at Schwab’s self interest in the cash allocation, I’m wondering whether you think that Schwab is similarly serving itself by weighting its fundamental ETFs so heavily. I took a quick look, and it seems that these “fundamental” ETFs cost about 0.35% vs. about 0.03% for the usual market-cap-weighted index ETFs. It also seems that Schwab is merely replicating a “fundamental” index that consists of weightings prescribed by Russell, so I don’t see why the 0.35% fee is deserved.

Do you have any thoughts on Schwab’s use of its own expensive ETFs?

Harry Sit says

I thought I hinted the same with “by coincidence.” They will have research from Russell and RAFI to show they should be included because they are better. We don’t know which fundamental ETFs will be used. It could be a mix of Schwab, PowerShares, and WisdomTree. PowerShares and WisdomTree participate in Schwab’s ETF OneSource program.

TJ says

This is definitely not the game changer that I expected it to be. Indeed – can we say underwhelming? If I had a larger taxable portfolio, I’d strongly consider Betterment for the stock portion of my asset allocation. Harry ~ what do you think about the “Direct Indexing” option at Wealthfront for those with huge taxable accounts?

Harry Sit says

Look at the bright side. 🙂 Today if you go to Schwab and you want Schwab to manage your portfolio, you can get Windhaven with $100k minimum, 0.95% fee for the first $500k. Or you can get Schwab Managed Portfolios in either mutual funds or ETFs with $25k minimum, 0.9% fee for the first $100k. If you get the new Schwab Intelligent Portfolios instead, I would say it’s so much better. In terms of half full vs half empty, it’s at least three quarters full!

I don’t like direct indexing. I don’t want that many entries on my tax return. It would be impossible to untangle if I ever want out.

Kevin Osborn says

Could you list the ETFs you used. I am comparing expense rations vs. Betterment and Wealthfront. For just an ordinary average (non weighted), I came up with an average expense ration at Betterment of 0.13%. For Wealthfront, it came in at 0.20% for taxable and 0.17% for non-taxable. Wealthfront expenses were thrown off by their commodities and emerging market bonds ETFS.

Harry Sit says

If you are doing this you might as well calculate weighted average. When commodities and emerging market bonds ETFs only make up a small percentage, they shouldn’t carry the same weight. We don’t know which exact ETFs Schwab will use yet. I did the Portfolio X-Ray with primarily Schwab ETFs.

SCHX

FNDX

SCHA

FNDA

SCHF

FNDF

SCHC

FNDC

SCHE

FNDE

SCHH

VNQI

JNK

EMB

GLD

Kevin Osborn says

Thanks. I definitely agree that a true analysis would be weighted, I am just trying to get a general comparison, especially since I won’t know my weights at Schwab. The average expense ration I got at Schwab was 0.27. It was generally weighted upwards by the fundamental ETFs. I really don’t know enough about fundamental ETFs to see if they are worth their slightly higher expense ratio.

Jonathan Petts says

This was an excellent blog that has helped me to weigh whether to move my portfolio to Schwab. Thank you for your insight Harry!

Mike says

Harry, they are actually allocating between 6%-30% to cash. Is that really because they are interested in “risk management” or because they earn money from the cash? You can read our full review here – [spam link removed]

B says

I personally think direct indexing is the best thing since sliced bread, and is the reason that I’m pretty sure Wealthfront is going to own the market for medium to large accounts (medium greater than $100k), large (greater than $1,000,000). It’s about 75% of the reason I’m using a roboadvisor. The robot does it faster, better, and more often than a human ever could, no matter what I paid him. Watching the Wealthfront robot manage tax loss harvesting and other transactions at a detail is a thing of beauty.

TJ says

Why 100k? Don’t you need 500k to use the direct indexing?

Steve says

I am really surprised that Betterment and Wealthfront have 48% in foreign stocks and less in the US. Not just because the U.S. is outperforming foreign now, but just as an ongoing thing. I would always want more in the US with a good amount in foreign all the time but we are in a cycle of US dominance now so I’m surprised at that.

I was waiting for Schwab’s offering because I don’t see the need to pay for indexing if one will put a little effort into the rebalancing on their own. Maybe the tax loss selling is worth something, but I’m not sure it’s worth what Wealthfront and Betterment are charging. If anyone has any suggestions for a Robo advisor for $2M+ portfolio with a 3% withdrawal, please let me know.

Harry Sit says

WiseBanyan is free. I don’t know much about it. I just mention it since you asked.

t says

Harry, thanks for his review. Found your blog through Oblivious Iinvestor email.I am a Schwab investor who parks a loto of money in cash because I am busy. I have a Vanguard account but switched most to Schwab, I just was not very pleased with Vanguard customer service despite its high ratings. while this intelligent investor portfolio may require holding some cash, I think it looks like a better value than the Windhaven option. Any thoughts on the Thomas Partners product? I don’t have the confidence to put my money in a Wealthfront or Betterment, good as they may be, so after your analysis I am more interested in looking into the “intelligent” product,it may get me out of my excess cash reserves with good rebalancing. I find my Schwab rep does not bother me or push any products, so I look to outside evaluations to try to decide what is best in their product line. I don’t know what a fundamental ETF is, could you explain. Only concern is that this new Schwab product seems to hold a lot of foreign ETFs

Harry Sit says

I agree it’s still a good product. See my reply to TJ in comment #10. PowerShares is a major provider of fundamental indexing ETFs. It explains fundamental indexing in this PDF document:

http://www.invescopowershares.com/pdf/P-FUNDAMENTALS-IVG-1.pdf

Thomas Partners product costs 0.9% with a $100k minimum. If you like dividends, there are also dividend-oriented ETFs such as VIG and VYM with a 0.1% expense ratio. Who knows whether the stocks picked by Thomas Partners will do better than the dividend ETFs.

Brad says

I believe your link is outdated–in any case, it didn’t take me to a PDF–here’s what I found, which perhaps is the document you recommended Harry: https://www.invesco.com/static/us/contentdetail?contentId=986f66b451c41410VgnVCM100000c2f1bf0aRCRD&dnsName=us

Shane says

Great job on this Harry. It will be really interesting to see what happens to fees at Wealthfront and Schwab.

Hedgeable thinks Schwab’s newfound love of cash as an asset class will actually help them aggregate a lot of assets, because Schwab has their 30% constant allocation to cash, and Hedgeable has dynamic asset allocation and alternatives/hedging [spam link removed]

dan23 says

It is out, so more information now available if you want to revisit.

One question I got answered by chat: they do not do fund placement between IRA and taxable. Each account is treated independently.

Harry Sit says

Thanks. I tried it. The questionnaire looks decent. I got a portfolio of 16 asset classes similar to the previous sample in this post (77% stocks, 11% fixed income, 5% gold, 7% cash). I still don’t see which actual ETFs are used to represent the asset classes. It mentioned you can exclude up to 3 ETFs.

dan23 says

I couldn’t find the ETF list either. I answered the survey to get the most aggressive allocation (this did not have bonds or gold for Schwab). I checked the lowest ER in the category in ETFdb – 11/12 Schwab was the cheapest (don’t know if sufficiently liquid to meet their criteria though). I think they designed their categories around what they had cheap Schwab funds in. Despite the existence of value funds with low ERs, there are no value funds in my recommended mix. While this does not necessarily mean they have a bad mix – it suggests they decided the mix at least partially for the wrong reasons. Weighted ER was .23.

On the plus side, fundamental indexing of pretty much any kind is supposed to have an edge vs cap weighted (Greenblatt has been big on this recently), and the portfolio ended up being 47% fundamental.

To compare with :

Betterment: Most aggressive recommended (though you can tweak) was 25.9% value and .26 ER after Betterment fees.

Wealthfront: Most aggressive recommended was 5% dividend fund and .38 ER after feeds.

Wealthfront does have fund placement taxable vs IRA and I do not believe Betterment does (though not 100% sure).

dan23 says

Oh to clairfy – by 25.9% value I mean funds with value objectives, not xray of the portfolio.

Larry Ludwig @ Investor Junkie says

“Wealthfront does have fund placement taxable vs IRA and I do not believe Betterment does ”

Betterment does alter the asset allocation if it’s in an IRA account.

Daniel says

I am a current Schwab customer. I just signed up for the Schwab Intelligent Portfolios service today. The portfolio recommended for me is below. I played around with the questions and settings and the lowest cash position I could get was 6%. I am very disappointed in that. The 6% in cash at 12% opportunity cost amounts to an equivalent ER of 0.72%, at 8% opportunity cost an equivalent ER of 0.48%. That makes Betterment and Wealthfront cheaper. I went ahead and canceled my scheduled deposit.

Cash 6%

Stocks 94% as follows:

US Large Company Stocks 11%

US Large Company Stocks – Fundamental 17%

US Small Company Stocks 7%

US Small Company Stocks – Fundamental 11%

International Developed Large Company Stocks 9%

International Developed Large Company Stocks – Fundamental 13%

International Developed Small Company Stocks 4%

International Developed Small Company Stocks – Fundamental 6%

International Emerging Market Stocks 4%

International Emerging Market Stocks – Fundamental 6%

US Exchange-Traded REITs 4%

International Exchange-Traded REITs 2%

Harry Sit says

You are ignoring risk if you put the opportunity cost at 8% or 12%. By that logic everyone should be 100% in stocks, and 100% in the riskiest stocks.

TJ says

Interesting that five years later, they’ve slightly changed the portfolio for the 94/6:

US Large Company Stocks – Fundamental 14%

US Large Company Stocks 13%

US Small Company Stocks – Fundamental 11%

International Emerging Market Stocks – Fundamental 11%

International Developed Large Company Stocks – Fundamental 10%

US Small Company Stocks 7%

International Developed Small Company Stocks – Fundamental 7%

International Emerging Market Stocks 7%

International Developed Large Company Stocks 6%

International Developed Small Company Stocks 4%

US Exchange-Traded REITs 2%

International Exchange-Traded REITs 2%

rgf says

This sure seems complicated compared to Betterment or Wealthfront. The latter gives you a portfolio, identifies the items which you can change and check the costs. Wisebanyan does all this and is free.

RIMD says

I like to share

An Aggressive ETF Saver Portfolio

http://news.morningstar.com/articlenet/article.aspx?id=672743

It was built around 5 ETFs. What do you think?

Difu Wu says

See my article [link requires registration] for more details. Schwab is a wolf in sheep’s clothing. Betterment and Welthfront are a little cheaper, but still charge too much. The simplest thing is to buy and hold a low cost index fund like SCHB or VTI, or spread your money equally among VTI, VBR, VEA, and VWO for diversification with foreign stocks and small value. IF you have high net worth, don’t even waste money on fund expenses. Just buy stocks directly. See [link requires registration] for more info.

To Lee says

Much has been discussed about the 7%+ cash in the Schwab Intelligent Portfolios. More often than not, there seems to be a negative connotation to this cash allocation.

Just wondering…

If interest rates were not at all time lows, the cash allocation may not be an issue.

If, when and how much interest rates rise in the future, will be the true test of it’s performance and cost of management.

Venkat says

At this time, I am considering choosing between Vanguard and Schwab Intelligent Portfolios. I came to know about you blog while googling Schwab Intelligent Portfolios.

Your blog seems excellent to me. [I use the word “seems” instead of a stronger word only because of my lack of knowledge in this field.] I immediately signed up for your newsletter.

“In the end it’s not about Schwab vs Vanguard vs Betterment vs Wealthfront. It’s about low cost indexing vs speculating vs active management vs high sales commissions and management fees. Whether investors choose the service by Schwab, Vanguard, Betterment, or Wealthfront, they ultimately benefit from low cost indexing. Rather than trying to pick hot stocks, timing the market, or being sold expensive load mutual funds or wrap accounts, they just send money over to the service of their choice. All the rest will be taken care of at a low fee.”

I am very glad to read the above. When you mention Vanguard, are you referring to one of their particular products?

Thanks.

RGF says

What is your opinion of Wisebanyan, the no fee robo investor?