I went through the questionnaire for Schwab’s new robo-advisor product Schwab Intelligent Portfolios. There were 12 questions. The interface looked very good.

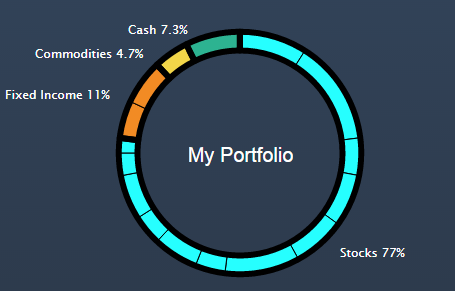

Asset Classes Breakdown

I answered the questions truthfully as myself. I was given this portfolio of 16 asset classes, 77% invested in stocks, 11% in fixed income, 4.7% in commodities, and 7.3% in cash. The 16 asset classes were exactly the same as the ones given in Schwab’s FAQs for Investor 1 and Investor 2.

This is more aggressive than how I currently invest. So are the portfolios recommended to me by Wealthfront and Betterment, and Vanguard’s target retirement fund for my age. Both Wealthfront and Betterment gave me 90% in stocks when I answered their questionnaires. Vanguard’s target retirement fund for my age invests 83% in stocks.

ETFs Used

You don’t see the actual ETFs used in Schwab Intelligent Portfolios before you sign up. However, in the appendix of a whitepaper on the effect of rebalancing and tax loss harvesting, Schwab showed the primary and alternate ETFs used as assumptions in the whitepaper. Granted that those may very well be purely for the purpose of calculation in the whitepaper, chances are that they are the actual primary and alternate ETFs used in Schwab Intelligent Portfolios at this time. The portfolios shared on investment forums by customers who already signed up seem to confirm this.

I list the primary and alternate ETFs for the asset classes included in the portfolio recommended to me and their expense ratios here. The ETFs used are of course subject to change.

US Large Company Stocks

- Primary: Schwab Large-Cap Core ETF (SCHX, 0.04%)

- Alternate: Vanguard S&P 500 ETF (VOO, 0.05%)

US Large Fundamental

- Primary: Schwab Fundamental U.S. Large Company Index ETF (FNDX, 0.32%)

- Alternate: PowerShares FTSE RAFI US 1000 Portfolio (PRF, 0.39%)

US Small Company Stocks

- Primary: Schwab Small-Cap Core ETF (SCHA, 0.08%)

- Alternate: Vanguard Small-Cap ETF (VB, 0.09%)

US Small Fundamental

- Primary: Schwab Fundamental U.S. Small Company Index ETF (FNDA, 0.32%)

- Alternate: PowerShares FTSE RAFI US 1500 Small-Mid Portfolio (PRFZ, 0.39%)

International Developed Large Company Stocks

- Primary: Schwab International Multi-Cap Core ETF (SCHF, 0.08%)

- Alternate: Vanguard FTSE Developed Markets ETF (VEA, 0.09%)

International Developed Large Fundamental

- Primary: Schwab Fundamental International Large Company Index ETF (FNDF, 0.32%)

- Alternate: PowerShares FTSE RAFI Developed Markets ex U.S. Portfolio (PXF, 0.47%)

International Developed Small Company Stocks

- Primary: Schwab International Small/Mid-Cap Core ETF (SCHC, 0.18%)

- Alternate: Vanguard FTSE All-World ex-US Small-Cap ETF (VSS, 0.19%)

International Developed Small Fundamental

- Primary: Schwab Fundamental International Small Company Index ETF (FNDC, 0.48%)

- Alternate: PowerShares FTSE RAFI Developed Markets ex-U.S. Small-Mid Portfolio (PDN, 0.50%)

International Emerging Market Stocks

- Primary: Schwab Emerging Markets ETF (SCHE, 0.14%)

- Alternate: iShares Core MSCI Emerging Markets ETF (IEMG, 0.18%)

International Emerging Market Fundamental

- Primary: Schwab Fundamental Emerging Markets Large Company Index ETF (FNDE, 0.47%)

- Alternate: PowerShares FTSE RAFI Emerging Markets Portfolio (PXH, 0.49%)

US Exchange Traded REITs

- Primary: Schwab Real Estate ETF (SCHH, 0.07%)

- Alternate: Vanguard REIT ETF (VNQ, 0.10%)

International Exchange Traded REITs

- Primary: Vanguard Global ex-U.S. Real Estate ETF (VNQI, 0.24%)

- Alternate: FlexShares Global Quality Real Estate Index Fund (GQRE, 0.45%)

US Corporate High Yield Bonds

- Primary: iShares 0-5 Year High Yield Corporate Bond ETF (SHYG, 0.30%)

- Alternate: SPDR Barclays High Yield Bond ETF (JNK, 0.40%)

International Emerging Market Bonds

- Primary: Market Vectors Emerging Markets Local Currency Bond ETF (EMLC, 0.47%)

- Alternate: Vanguard Emerging Markets Government Bond ETF (VWOB, 0.34%)

Gold & Other Precious Metals

- Primary: iShares Gold Trust (IAU, 0.25%)

- Alternate: ETFS Physical Precious Metals Basket Shares (GLTR, 0.60%)

Cash

- Money Market Account at Schwab Bank

Portfolio Overall

Using all primary ETFs the portfolio recommended to me by Schwab Intelligent Portfolios has a blended expense ratio of 0.26%.

The blended expense ratio of the portfolio recommended to me by Betterment is about 0.10%. If I add Betterment’s 0.15% fee for a balance of $100k+, the all-in cost is about the same at 0.25%.

The blended expense ratio of the portfolio recommended to me by Wealthfront is also about 0.10%. If I add Wealthfront’s 0.25% fee, the all-in cost is about 0.35%.

The expense ratio on Vanguard’s target retirement fund is 0.18%.

The Morningstar Portfolio X-Ray of the portfolio recommended to me by Schwab Intelligent Portfolios looks like this:

Is this something I would put together myself? No. I would go simpler: total market funds plus a pinch of value and small caps for stocks, and then conventional US intermediate-term bonds plus CDs for fixed income.

If the imaginary me tells me he’s investing in this portfolio, would I lose sleep over it? No. It’s reasonably diversified, low cost, and less risky than some of the other all-in-one portfolios the imaginary me also mentioned. I would feel much relieved he’s in this as opposed to something else somebody could’ve signed him up for.

Should the imaginary me decide strictly based on the all-in cost: 0.18%, 0.25%, 0.26% or 0.35%? Not at all. The differences in asset allocation will drive a much larger difference in both risk and return.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mark Zoril says

Nice overview! Who ultimately decides? You, or the imaginary you??!!

OB Lation says

The Missus!

OB Lation says

I’m a bit surprised that they didn’t use SCHB or FNDB.

Sam Seattle says

This is another excellent post from TFB. Why don’t the companies give a choice in risk-tolerance? It seems the risk tolerance level is pretty set.

Jim Ryan says

Q. “Why don’t the companies give a choice in risk tolerance?”

A. Schwab does. (I have all my 401k rollover money in Schwab Intelligent portfolios now, so I am sharing what I have experienced, not what I think or read somewhere.) As this author (Harry Sit) explained at the outset of his post, when you set out to create such a robo portfolio with Schwab, they ask you a standard set of questions precisely to assess your risk tolerance. Based on your answers to these questions, they assign 1 of ~10 pre-defined portfolios. (Note that. as of this writing, Schwab has a different set of pre-defined portfolios for what they call their “Global Intelligent Portfolios” versus their “US Intelligent Portfolios”.

Note that if, after answering the questions they pose to you, you don’t like the asset allocation scheme they propose, you can go back and change the asset classes and %s by either (1) answering the questions differently, intentionally or (2) by manually selecting which of the pre-defined portfolios you want. It is in Schwab’s best interests to give you/us choices, and so they do (within limits).

Sven says

I am surprised that they have almost all of the bonds in the low credit quality line. This is well outside mainstream thinking. What happened to taking one’s risk on the equity side and keeping high quality bonds for re-balancing opportunities?

Harry Sit says

Sven – Don’t forget cash, which is both short-term and high quality. They are using a barbell strategy.

dan23 says

Do you like Betterment or Schwab allocation better assuming their current expense ratio (it’s kind of straight up value vs higher fundamental) + the cash?

Harry Sit says

If I have to choose as-is after answering the questionnaire I would pick Schwab. 90% in stocks is just too high for me. If I know enough to dial down I would pick Betterment. In both cases I would use a tax-advantaged account. Too many moving parts will be difficult to unwind when necessary.

Nigel Wiggins says

why is the ER for cash so high?

https://www.schwabassetmanagement.com/products/swgxx

0.44%

Harry Sit says

Schwab sets it high. Vanguard sets it at 0.11% on a similar fund.