With the growth of indexing, Charles Schwab’s response is basically “We have them too.” They created some in-house index funds and ETFs. The expense ratios on those index funds and ETFs match or slightly undercut the expense ratios on funds from the indexing leader Vanguard.

When it comes to target date funds — those with a year in the name designed as a one-stop portfolio for people who plan to retire around that year — Schwab now has two sets of them. One set, called Schwab Target Funds, were started earlier. They invest in a mix of actively managed and index funds. Their expense ratios run in the 0.33% – 0.75% range. The second set, called Schwab Target Index Funds, were started more recently. They invest in Schwab ETFs. Their expense ratios are 0.08% across the board after voluntary fee waivers.

That’s very similar to how Fidelity does. Fidelity has Fidelity Freedom Funds and Fidelity Freedom Index Funds. See Fidelity Freedom Index Funds: Hidden Gems For Your IRA and 401k.

Purely based on the expense ratios, these Schwab Target Index Funds are almost 50% less expensive than Vanguard’s Target Retirement Funds and Fidelity’s Freedom Index Funds. They are a good alternative for invest-and-forget if you prefer to use Schwab. There is no minimum investment requirement.

Inside each Schwab Target Index fund, there are more moving parts than the comparable Vanguard Target Retirement funds and Fidelity Freedom Index funds. Equities are broken into US large cap, US small cap, US REITs, international developed markets, and emerging markets. Fixed income investments are broken into total market bonds, inflation-protected bonds, short-term treasury, and cash equivalents.

Roughly 30% of the equities allocation is given to international. This is about the same as in Fidelity Freedom Index funds, but lower than the allocation in Vanguard Target Retirement funds, which invest 40% of the equities in international.

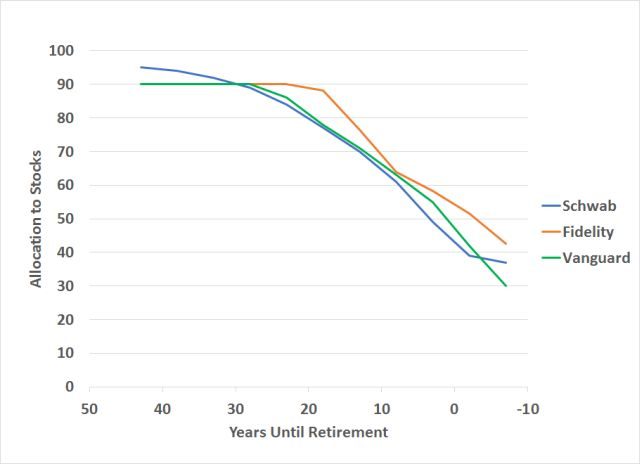

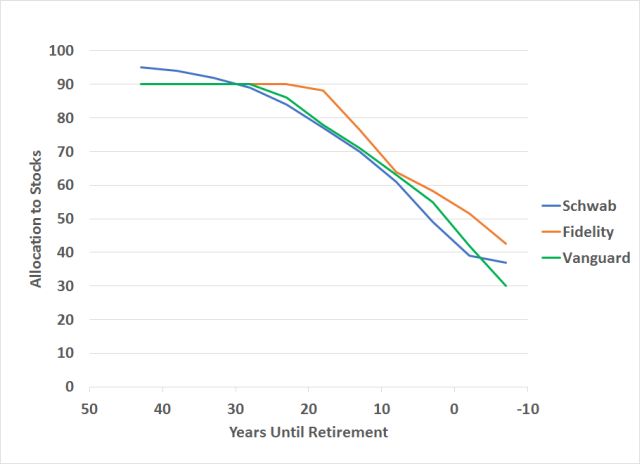

In terms how each fund will adjust over time, if the strategy stays the same, i.e. the 2035 fund in 10 years will be like the 2025 fund today, the path looks very similar to that of Vanguard Target Retirement funds. They are in general somewhat less aggressive than Fidelity Freedom Index funds of the same target year.

Because Schwab Target Index funds are new, they only have one full calendar year of actual performance. In 2017 when stocks did great and when international stocks did better than US stocks, Schwab Target Index funds in general had lower returns than Vanguard Target Retirement funds and Fidelity Freedom Index funds of the same target year. Whether they will perform better in the future will depend on how well stocks do in general and how well international stocks do relative to US stocks.

If you like Schwab’s services and you’d like to buy just one broadly diversified fund that automatically rebalances and adjusts over time, Schwab Target Index Funds are a reasonable choice, especially for an IRA, solo 401k, or a 401k brokerage window. Just remember to double check the word Index in the name.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Been Y says

What about the expense ratios of the underlying funds ETFs. Is Schwab still ahead?

Harry Sit says

They are included in the 0.08%. Vanguard and Fidelity funds are in the neighborhood of 0.15%.

Mark Levy says

It’s noted that the .08 includes “voluntary waivers ” that means after they suck you in then they stop the voluntary waiver & what you thought was a good deal all of a sudden isn’t.

Harry Sit says

It’s 0.13% before the waiver. Not that big a difference even if they stop the waiver.

jci says

For both my wife’s and my 401k (different companies), it’s cheaper to go with Target Date index funds. My ERs are 8 bps and hers are 9 bps vs. if you were to manually allocate it looks like it would be around 11+ bps due to some bad choices in our plans (esp. bad ERs on the real estate funds and bond funds). So it actually makes sense to pick Target Date funds. I assume these funds will trade at the end of each day to keep the allocations right, so for days of extremely high volatility like we had this week (1k+ swing in Dow yesterday), I think the fund would have bought low and sold high in a much more efficient way than a person doing this manually. I certainly don’t log into my 401k to trade regularly. Set it and forget it.

Tj says

What’s interesting is that unlike the Fidelity & Vanguard Target Date funds, the Schwab Index Target Date funds hold ETF’s rather than mutual funds.

A Foster says

What are your views on setting up a Target Funds for college bound who are now at age 8 and age 12 as of this date?