More and more people are on high deductible health insurance these days. Most people on high deductible insurance don’t meet their annual deductible when the deductible is $3,000, $5,000, or sometimes over $10,000 a year. In such case you are responsible for 100% of the healthcare cost unless there’s a catastrophe. When you have to pay 100% of the cost, having insurance feels like not having insurance.

On one hand we can argue that’s way it should be with insurance. Insurance should be only for catastrophes. After all homeowner’s insurance works this way. You don’t file a homeowner’s insurance claim for normal maintenance. Most people never filed any homeowner’s insurance claim in their life. On the other hand, having high deductible health insurance works quite differently than when you only have to pay a $20 copay or 10% co-insurance. A new situation requires learning new tactics.

I included this article in New York Times in a weekly digest email a few weeks ago: Shopping for Health Care Doesn’t Work. So What Might? The tag line for the article said “It’s often too complicated. And even when it isn’t, almost no one does it.” My comment was that we shouldn’t give up too easily. With something as complex as healthcare, we can’t expect something to “work” 100% of the time for 100% of the people. There is no magic wand. Every bit helps.

Shopping doesn’t work when you are unconscious in an ambulance, but it can work when you are not in a hurry. Even if “almost no one does it” you can still do it and tell others how you did it. Then more people will do it. Even if you did it once and it didn’t quite work, you can still do it again in a different situation and it may work the second time, or the third time, or the fourth time.

A shopping “opportunity” came up for us recently. My wife hurt her shoulder in doing sports. She went to physical therapy. It helped somewhat but not completely. She was concerned there might be a tear. Maybe she needed an MRI. If she did, we would be on the hook for 100% because our health insurance through ACA has a $9,600 annual deductible, which we don’t expect to meet.

Our doctor works at a clinic owned by a large integrated health system. This health system has doctors, labs, urgent care centers, hospitals, … everything. Through mergers and acquisitions, they occupied a large footprint in our area. As a result, they have huge power over insurance companies. Even though they are not-for-profit, their prices are much higher than others. In a strange way, not-for-profit in healthcare often means higher prices, not lower prices.

In the ACA marketplace, this health system contracted with only one insurance company. No other insurance companies can list their doctors and facilities as in-network. In exchange, the insurance company that had exclusive access agreed to the high prices charged by this health system. Of course the insurance company just charges a higher premium to the policyholders. It’s a win-win for the insurance company and the health system, and a lose-lose for the citizens (higher premium and higher out-of-pocket before meeting the deductible).

We are OK with paying a higher price for office visits. Normally we don’t go to the doctor that much. However, if my wife needed an MRI, the easiest thing for the doctor to do would be to order one at their in-house facility, which would cost much more than an MRI done at an outside, independent facility.

Fortunately the insurance company offers a cost estimator tool that can give us an idea ahead of time how much more it would be if it’s done in-house versus outside.

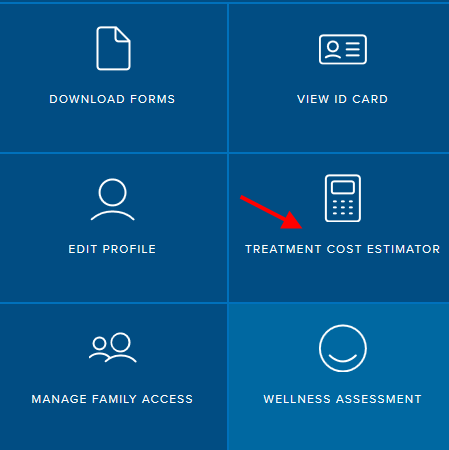

When I logged in to the insurance company’s website (Blue Shield of California), I saw a graphic of a treatment cost estimator on the right hand side. It links to a site run by a third-party contractor.

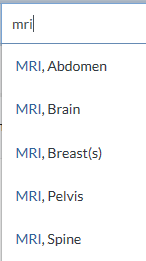

When I typed in ‘mri’ as a treatment, I saw it further divided into MRI for different parts of the body.

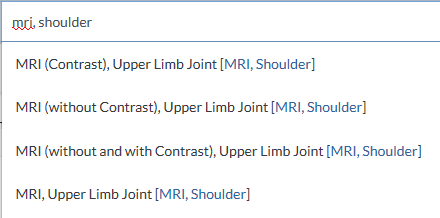

When I continued with ‘mri, shoulder’ I saw different types of MRIs, with contrast or without. I didn’t know which type she would need but that wasn’t important. I only needed to see the relative cost difference. If I wanted, I could also explore each option, with contrast, without contrast, both with and without, etc.

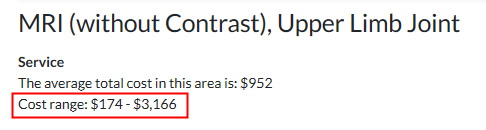

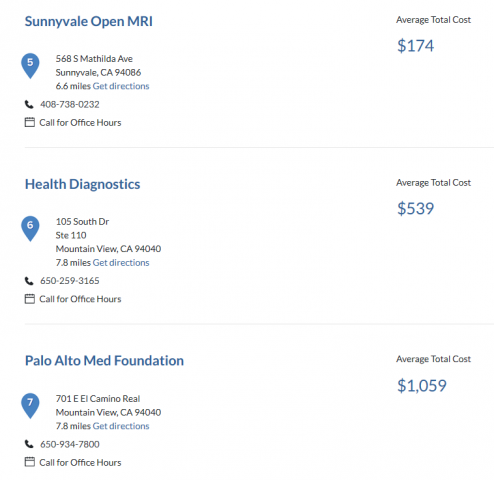

I just picked without contrast. It gave me an average cost of $952 and a cost range between $174 and $3,166. Wait, for the same service, you can spend $174 or you can spend $3,166. Do you think you should shop?

The treatment cost estimator listed the average total cost by each specific provider in the network, in the same fashion as when you look for airfare on Expedia or Kayak. I printed out the list. My wife took it to the doctor. When the doctor said she needed an MRI, she asked the doctor to order it at one of the lower-cost facilities as long as the doctor’s assistant was able to confirm that the facility could do what the doctor wanted. It turned out the $174 place couldn’t but the $539 place could. So the order was sent to the $539 place. Although $539 wasn’t the lowest on the list, it was lower than the $952 average, lower than the $1,059 price you see above, and far lower than $3,166 at the high end.

She did the MRI. The provider billed insurance. The in-network price came out to $861.48 – $348.64 = $512.84. It was close enough to the $539 estimate.

There, that was how shopping worked. Spending 15 minutes before going to the doctor saved us at least $500 versus just going with the flow and letting the doctor order it at their in-house facility.

When you are about to spend $500, $1,000, or $3,000, you would normally shop around, right? Why should healthcare be any different? The doctor’s assistant had to make a few phone calls. That’s part of the service we are paying for with the office visit. It’s our right to select the imaging facility. We are not obligated to use the in-house facility. The doctor didn’t mind at all. The doctor was only interested in getting good images for an accurate diagnosis. Extra money earned by the in-house facility doesn’t flow to the doctor anyway.

It probably won’t work every single time, but every time it works it’s a win.

I didn’t know my insurance offered this very useful cost estimator tool before I looked for it. Your insurance may already offer a similar tool but you don’t know either. Here are some links for the major health insurance companies:

- UnitedHealthcare Cost Estimator

- Cigna Cost Estimator

- Aetna Cost Estimator

- Humana Cost Estimator

- Kaiser Permanente Cost Estimator

If your insurance company isn’t on this list, Google the name of your insurance company plus “cost estimator.” It may be tucked away somewhere.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Frugal Professor says

Great article. While doing my phd, I had a crazy idea to start a healthcare business centered around price comparison to facilitate exactly the process that you went through. I’m elated to see that insurance companies are beginning to make this price comparison process much more transparent. Hopefully more of us will follow your example forcing the medical industry to compete on price (and quality) some day, just like every other industry on the planet.

financeBuffReader says

I think its bad health care policy to expect us to be able to get health care quotes in advance. The system is too complicated. The result will be incomplete quotes where people end up paying vastly higher bills than expected.

I once asked for an out the door price quote from my Doctor and he couldn’t give me one. He could tell me the numbers that he would bill my insurance. But he couldn’t tell me what the hospital and other players would charge. I can easily see a scenario where the patient gets an unexpected bill from a player that they didn’t even know they needed to obtain a quote from. And if this player happens to be out of network, they may not have any obligation to charge usual and customary prices.

There’s also the complication of a medical plan not going according to plan, forcing the medical crew to perform activities beyond the scope of the estimate, possibly pushing the patient into medical facilities not anticipated and/or staying longer at the facility than originally estimated.

Harry Sit says

I agree it won’t work in all situations and it may be incomplete. Before the policy gets better, we do what we can in tilting at the windmills. I wonder how many people with the same insurance company as I do even know about the treatment cost estimator. Some other insurance companies may also offer a similar tool. How many people know about those? Using the tools we already have is the first step.

SV says

Thanks for sharing this. Our experience with Stanford for my toddler son has been difficult. The doctors refused to see the ultrasound from El Camino hospital stating that the quality outside is very bad and that we’d need to repeat it with Stanford.

CuriousGeorge says

Your doctors at Stanford aren’t, by any chance, investors in the preferred lab are they? This maybe the case if you are strongly steered to a particular facility.

David Cantor says

If its a straightforward procedure like an MRI, and if you are in a progressive state like California, then getting an estimate in advance is fairly easy and certainly advised. If you need a complicated procedure (e.g. hip replacement), or if you live in a less patient-centric state, it can be nearly impossible to find out in advance what a given facility will charge you. In many cases, the hospitals themselves simply don’t know in advance how their systems will cost things out. I have heard many examples where people tried their hardest to get this information, and were unable to do so. I think that price transparency is an area where governments can and should do more to help patients.

Harry Sit says

For kicks I searched for hip replacement in the cost estimator tool. Because the cost is above my out-of-pocket maximum, it gives me that maximum regardless where I go. It also shows the total estimated in-network price for each hospital, ranging from $20k to $62k.

I would consider having a cost estimator tool as an important factor in choosing an insurance company. I would also welcome a government mandate for all insurance companies to provide such a tool. Providers all say they can’t know how much your insurance will pay because there are simply too many plans. They have a point. Your insurance should tell you the in-network prices and how much you will be expected to pay.

Bob says

Great topic, Harry. I posted a link to it over at the fragile deal website. I found a web page at the California Dept of Insurance web site that allows your readers who are on Medicare to shop for Medigap policies. California has something called the birthday rule that allows you to switch policies every year for the month following your birthday without undergoing medical underwriting. With this I was able to save some money on my premiums for the coming year.

CA Dept Insurance

Harry Sit says

It turns out several large health insurance companies also offer a similar cost estimator tool. I added a paragraph to the end with links. Let’s put together a list and help more people save some money in shopping for healthcare.

CuriousGeorge says

Kaiser Permanente Cost Estimator – http://info.kaiserpermanente.org/html/estimating_your_treatment_costs/

Harry Sit says

Thank you! I added it to the list.

Sammy says

Harry: ” Let’s put together a list and help more people save some money in shopping for healthcare.”

North Carolina BCBS

http://www.bcbsnc.com/content/providersearch/treatments/index.htm#/

Vikas says

Hi Harry

Same thing I noticed in the cost of medicines (covered under insurance) across CVS, Walgreens, Harris Teeter and Walmart. For the medicine I was checking and at that time, found Walmart Pharmacy to be cheapest. Moved my prescription from CVS to Walmart.

There are online tools to compare medicine costs.

It pays to shop around.

Regards

Vikash

gmshedd says

My brother-in-law’s insurance company (he works for an S&P 500 company) has been delaying approval of his $10k/month chemotherapy drugs, which, according to the oncologist, should have been started the day following his radiation treatments (brain tumor). The delay has been at least a week, even with daily follow-up phone calls. It is better for the insurance company’s bottom line if he dies quickly. Tell me again, please, the one about how the free market makes our healthcare system work better for patients.

Harry Sit says

Delaying approval is bad, for sure. I imagine they are trying to control cost by making sure the drug is medically necessary and cost effective. Would a different system make the approval come faster? Would it not also have cost control mechanisms?

gmshedd says

I would contend that approval through Medicare/CMS should be faster if the drug and its applications have been through the decision process. One insurer, one decision. We have a system in which separate decisions are made for microscopic subsets of the total population–Northeast PA for example. There are probably more than 100 separate BC/BS organizations, each one negotiating and deciding for themselves. My understanding is that Medicare gets the best price for most healthcare services because of its size. Of course our Congress, beholden as it is to corporate interests, doesn’t allow Medicare to negotiate drug prices, but that’s another Free Market success story. If you can afford to buy Congress, then you can improve profitability!

gmshedd says

Yesterday the WSJ had a piece about how the free market is working for insurers and healthcare systems under industrialized medicine. Can’t paste the link, but for those with a subscription to WSJ, see

articles/behind-your-rising-health-care-bills-secret-hospital-deals-that-squelch-competition