Retirees on Social Security receive an increase of their Social Security benefits each year known as the Cost of Living Adjustment or COLA. The COLA was 2.5% in 2025. Retirees on Social Security will once again receive a COLA in 2026. The increase will be similar to the one in 2025.

Automatic Link to Inflation

Some retirees think the COLA is given at the discretion of the President or Congress, and they want their elected officials to take care of seniors by declaring a higher COLA. They blame the President or Congress when they think the increase is too small.

It was done that way before 1975, but the COLA has been automatically linked to inflation for nearly 50 years. How much the COLA will be is determined strictly by the inflation numbers. The COLA is high when inflation is high. It’s low when inflation is low. There’s no COLA when inflation is zero or negative, which happened in 2010, 2011, and 2016.

CPI-W

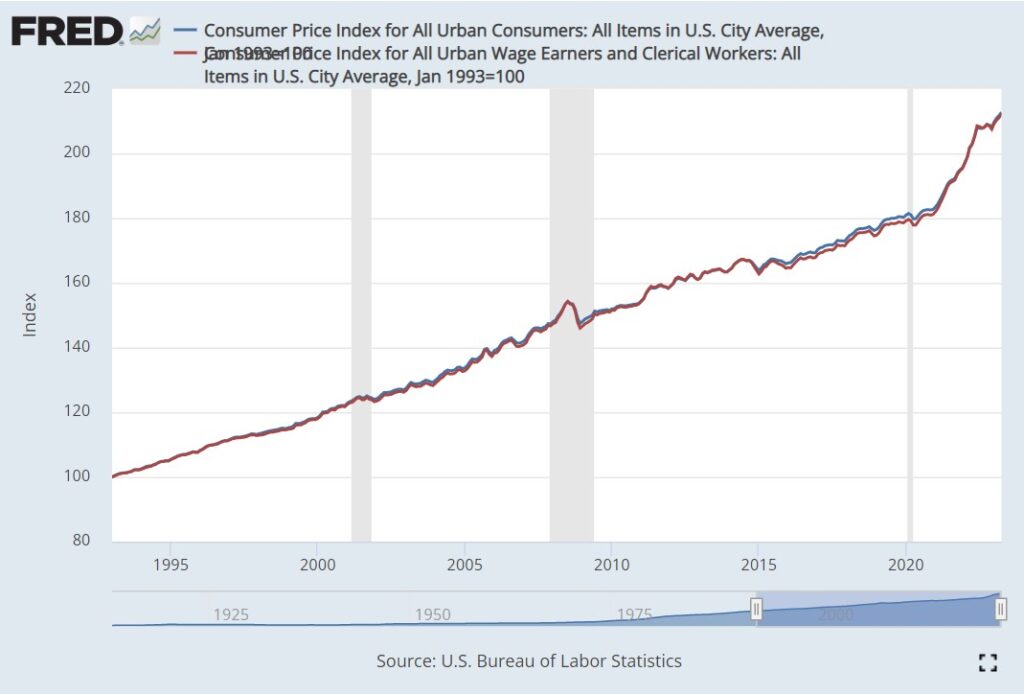

Specifically, the Social Security COLA is determined by the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-W is a separate index from the Consumer Price Index for All Urban Consumers (CPI-U), which is more often referenced by the media when they talk about inflation.

CPI-W tracks inflation experienced by workers. CPI-U tracks inflation experienced by consumers. There are some minor differences in how much weight different goods and services have in each index but CPI-W and CPI-U look practically identical when you put them in a chart.

The red line is CPI-W and the blue line is CPI-U. They differed by only smidges in 30 years.

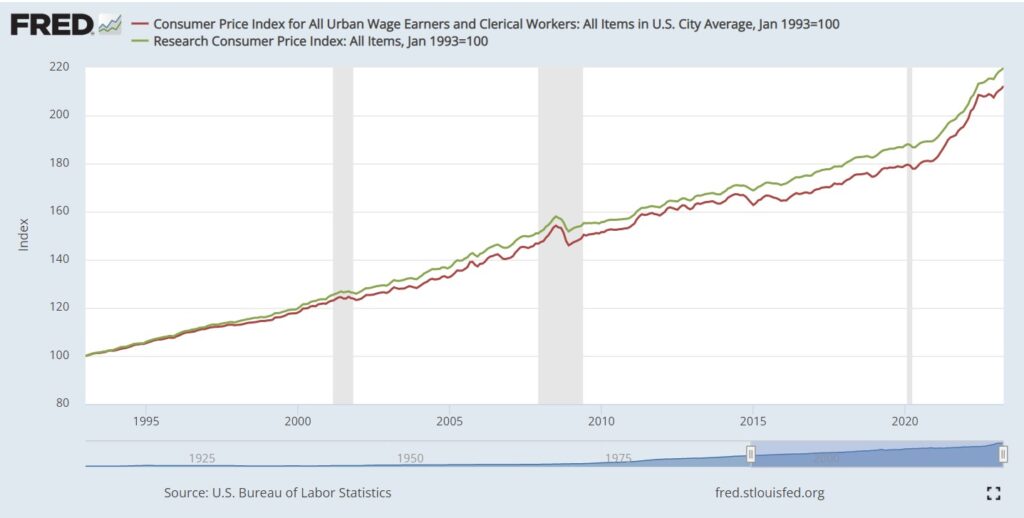

There’s also a research CPI index called the Consumer Price Index for Americans 62 years of age and older, or R-CPI-E. This index is weighted more by the spending patterns of older Americans. Some researchers argue that the Social Security COLA should use R-CPI-E, which has increased more than CPI-W in the last 30 years.

The green line is R-CPI-E. The red line is CPI-W. R-CPI-E outpaced CPI-W in 30 years between 1993 and 2023, but not by much. Had the Social Security COLA used R-CPI-E instead of CPI-W, Social Security benefits would’ve been higher by 0.1% per year, or a little over 3% after 30 years. That’s still not much difference.

Regardless of which exact CPI index is used to calculate the Social Security COLA, it’s subject to the same overall price environment. Congress chose CPI-W 50 years ago. That’s the one we’re going with.

Q3 Average

More specifically, the Social Security COLA for next year is calculated by the increase in the average of CPI-W from the third quarter of last year to the third quarter of this year. You get the CPI-W numbers in July, August, and September of last year. Add them up and divide by three. You do the same for July, August, and September this year. Compare the two numbers and round the change to the nearest 0.1%. That’ll be the Social Security COLA for next year.

2026 Social Security COLA

The average of CPI-W from the third quarter in 2025 is known now after the government released inflation numbers for September. The 2026 Social Security COLA will be 2.8%. It’s slightly higher than the 2.5% increase for 2025.

Medicare Premiums

If you’re on Medicare, the Social Security Administration automatically deducts the Medicare premium from your Social Security benefits. The Social Security COLA is given on the “gross” Social Security benefits before deducting the Medicare premium and any tax withholding.

Medicare will announce the standard Part B premium for 2026 in October or November. The increase in healthcare costs is part of the cost of living that the Social Security COLA is intended to cover. You’re still getting the full COLA even though a part of the COLA will be used toward the increase in Medicare premiums.

Retirees with a higher income pay more than the standard Medicare premiums. This is called Income-Related Monthly Adjustment Amount (IRMAA). I cover IRMAA in 2025 2026 2027 Medicare IRMAA Premium MAGI Brackets.

Root for a Lower COLA

People intuitively want a higher COLA, but a higher COLA can only be caused by higher inflation. Higher inflation is bad for retirees.

Whether inflation is high or low, your Social Security benefits will have the same purchasing power. You should think more about the purchasing power of your savings and investments outside Social Security. When inflation is high, even though your Social Security benefits get a bump, your other money loses more value to inflation. Your savings and investments outside Social Security will last longer when inflation is low.

You want a lower Social Security COLA, which means lower inflation and lower expenses.

Some people say that the government deliberately under-reports inflation. Even if that’s the case, you still want a lower COLA.

Suppose the true inflation for seniors is 3% higher than the inflation numbers reported by the government. If you get a 3% COLA when the true inflation is 6% and you get a 7% COLA when the true inflation is 10%, you are much better off with a lower 3% COLA together with 6% inflation than getting a 7% COLA together with 10% inflation. Your Social Security benefits lag inflation by the same amount either way, but you’d rather your other money outside Social Security loses to 6% inflation than to 10% inflation.

Root for lower inflation and lower Social Security COLA when you are retired.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve Smith says

“Some researchers argue that the Social Security COLA should use R-CPI-E, which has increased more than CPI-W in the last 30 years.” Do you think those researchers would advocate for R-CPI-E if it were lower? I have to believe that people want to use R-CPI-E because it’s a little higher and not because it more accurately reflects senior spending.

Thanks for the article Mr. Buff. As usual, spot on.

Freda says

Thanks for a very clear explanation of all these acronyms and the importance of lowering inflation over getting a higher COLA. As always, you give us common sense that makes sense. As far as lower inflation, looks like Biden’s soft landing is easing down.

John L says

Excellent point that high inflation reduces the purchasing power of assets other than Social Security, so we should root for low inflation!

Howard says

Thanks for a very clear explanation. It is excellent to know that this is not a political issue regardless of what we may hear otherwise. We need to thank the folks long ago who had the wisdom to remove this from the hands of future politicians.

Tom H says

I’ll root for a lower COLA, but not because it’s good for me. Over the past 10 years, my personal inflation rate (for medical, groceries, auto, taxes, and utilities) has been quite low, near zero. This was largely due to reducing medical expenses. My Medicare Advantage Plan stopped charging premiums and primary physician co-pays, and now has begun to cover basic dental and vision services. We get one tank of gas a month. Beyond that, and more importantly, the inflation that gives rise to higher COLAs also gives rise to much higher returns on money market funds – like 5% instead of approximately zero %. That’s a $5,000 annual increase on just $100,000 of “cash”. I can’t be the only one.

Arun says

Excellent explanation opf all topics; especially the section, “Root for Lower COLA”!!

Don G says

The phrase “you are much better off” IF certain things occur. When I see an assertion like that it seems to omit whether social security is my only income, a small percentage of my income, or omit the age I decided to take social security in the first place.