When savings bonds were only on paper, there were no accounts. If you wanted to name a co-owner or a beneficiary, it had to be printed on the paper bond itself. The paper bond had room for only one co-owner or beneficiary.

After Treasury started issuing savings bonds in the online TreasuryDirect account, they continued with this setup. You have an online account but you can’t set your secondary owner or beneficiary at the account level as you normally do in your other investment accounts. You set it at the holdings level — bond by bond — and each bond can have only one person as the secondary owner or the beneficiary. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Split for Multiple Beneficiaries

If you have two children, you can’t name both of them as 50/50 beneficiaries on the same bond. You’ll have to buy two bonds, one with each child as the beneficiary. See How to Buy I Bonds.

What if you didn’t realize this and you only placed one order for $10,000? How do you split your existing $10,000 bond into two $5,000 bonds and name a different child as the secondary owner or beneficiary for each half?

There’s no direct way to do this in TreasuryDirect, but I figured out an indirect way.

Custom Linked Account

TreasuryDirect lets you open a Custom Linked Account linked to your main account. It’s like a sub-account or a goal savings account. In their words:

This is a flexible account you can establish to meet specific financial goals. You can even create a customized name, such as “Vacation Fund,” for the account. We offer the same convenient capabilities as in your Primary TreasuryDirect account.

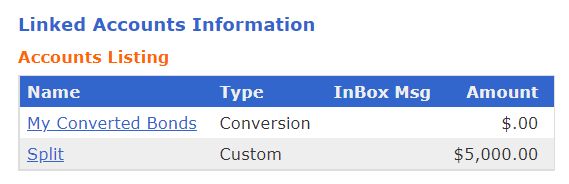

The Custom Linked Account doesn’t have a separate login. It can only be accessed through your main account. Having a Custom Linked Account doesn’t increase your annual purchase limit. It only lets you organize your holdings for tracking purposes. Most people don’t need a Custom Linked Account. We will use one to split your existing bond.

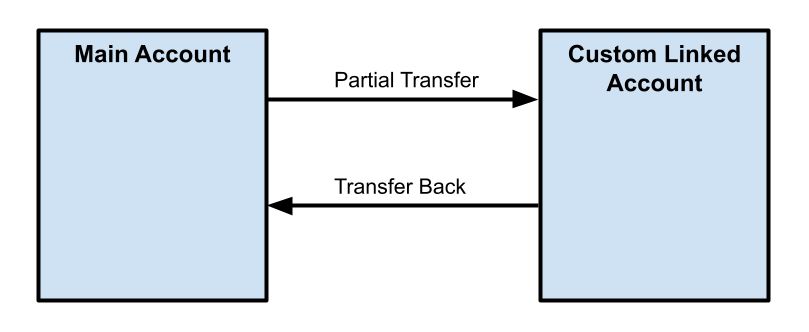

The idea is that you’ll do a partial transfer of your existing bond to this Custom Linked Account. This will split your existing bond into two places — one part is in the Custom Linked Account and the other part stays in the main account. If you need to split an existing bond into more than two parts, repeat the partial transfer. After you’re done with splitting, you transfer the split parts back to your main account.

Transferring parts of an existing bond back and forth between your main account and your Custom Linked Account doesn’t trigger taxes. Nor does it eat into your annual purchase limit.

Open Custom Linked Account

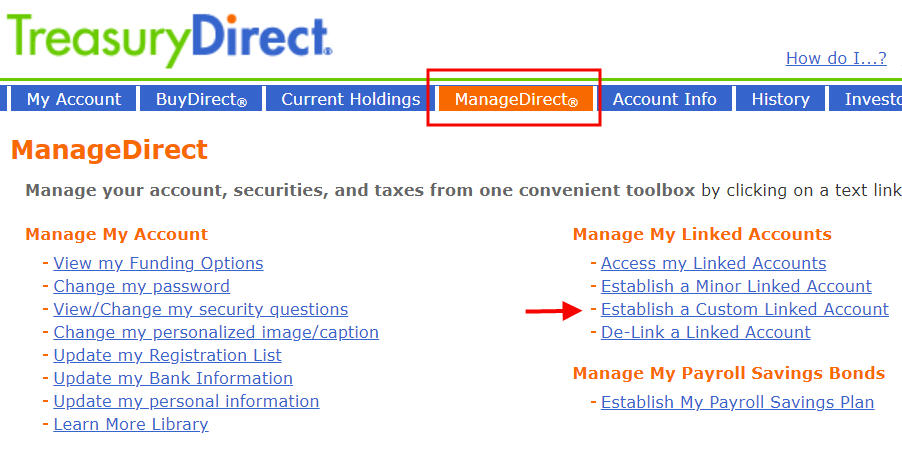

To open a Custom Linked Account, go to ManageDirect and then click on “Establish a Custom Linked Account.”

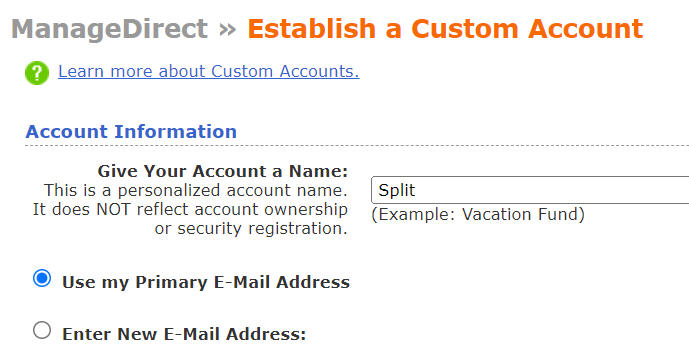

You’ll be prompted to answer a security question. Then it will ask you to give a personalized name for this new account and whether to use the same email address or a new email address. I just called this new account “Split” because I’ll use it to split an existing bond.

Your existing personal information and bank account information will copy over to the Custom Linked Account but we’re not going to buy new bonds in this account. After you submit the information, you will see an account number for the Custom Linked Account on the top right. Copy that account number and save it somewhere. You’ll need it when you do the partial transfer.

Partial Transfer

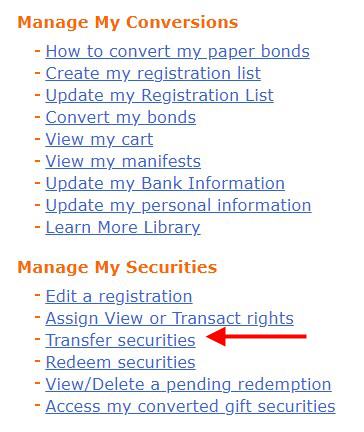

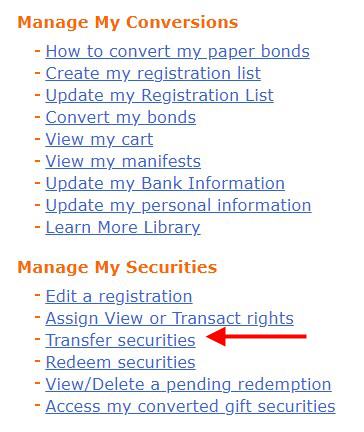

Click on the link to your main account on the top right to go back to your main account. Go to ManageDirect and then click on “Transfer securities” under the heading “Manage My Securities” (not under “Manage My Shared Securities“).

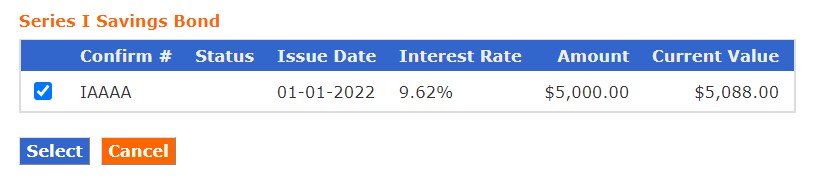

Select one of your existing bonds. You can only split one bond at a time.

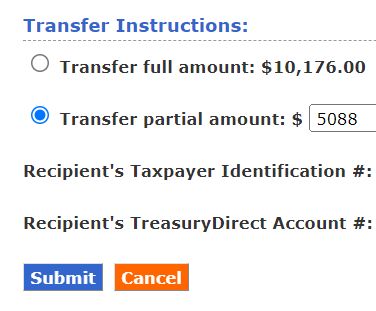

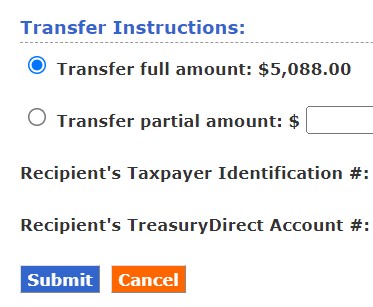

Choose “Transfer partial amount.” I divided the current value by two because I’m splitting this bond 50/50. If you’d like to split it three-way or in different percentages, adjust your partial amount off of the full amount including interest. Give your own Social Security Number as the “Recipient’s Taxpayer Identification #” because you’re transferring to a Custom Linked Account owned by yourself. You give the account number of the Custom Linked Account as the “Recipient’s TreasuryDirect Account #“.

The transfer happens instantly. Repeat this process if you’d like to split your bond into more than two parts.

(Optional) Wait a Few Days

You may be able to transfer the split part from your Custom Linked Account back to your main account right away, but I waited a few days just in case it needed to age a little bit and get settled in the new home. I wasn’t in any hurry anyway. This may not be necessary but I figured it couldn’t hurt.

Transfer Back

The process to transfer the split-off bond from the Custom Linked Account back to the main account is just the reverse of the previous move.

Log in to your main account. Scroll to the bottom to find your list of linked accounts. Click on the link for the Custom Linked Account.

Go to ManageDirect, and then click on “Transfer securities.”

Answer the security question. If you split your bond into more than two parts, you can select all the bonds in the Custom Linked Account. If you only have one bond in the Custom Linked Account, select it and choose “Transfer full amount” this time.

Give your own Social Security Number as the “Recipient’s Taxpayer Identification #” and give the account number of your main account as the “Recipient’s TreasuryDirect Account #“.

Click on the link to your main account on the top right to go back to your main account. Click on Current Holdings. You’ll see all the parts of your original bond.

Now you can assign a different secondary owner or beneficiary for each part. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Joyce Jowett says

My securities haven’t populated after establishing the custom linked account. So I’ll wait a few days and try again?

Harry Sit says

The securities are in your main account. Log in to your main account to see them and do the partial transfer to the Custom Linked Account.

Joyce Jowett says

There is a five day grace period before it can be moved into the custom linked account.

Harry Sit says

Ah, I didn’t realize you were trying to split a freshly bought bond. The hold will come off after five business days.

Shaya says

I’m assuming this can also be used to cash out just part of a bond too. Useful knowledge.

Harry Sit says

Cashing out part of a bond is supported out of the box. You don’t need to split a bond only to cash out part of it.

Burke Angstman says

I bought my I Bond on August 1, 2022. It is now August 11th and when I try to do the partial transfer to the Custom Linked account it states I do not have any securities eligible for transfer at this time. Since it has been more than 5 business days I am confused why I can’t transfer. Any ideas? When I look at the details for the bond, under Rights is says None. Not sure what that means.

Harry Sit says

Because you have both the main account and the custom linked account, it can be confusing which account you are currently in when you do the partial transfer. Maybe log in fresh and make sure you are in the main account when you transfer.

None under Rights just means you haven’t assigned View or Transact rights on this bond to anyone. It doesn’t affect the transfer.

Burke Angstman says

Thank you. I figured this out. I was clicking on Transfer a Security under Manage My Shared Securities rather than Transfer Securities under Manage My Securities. So I’m good and was able to successfully add beneficiaries to my split I-Bond. Appreciate you providing all this helpful information.

Karen Young says

I was doing the same as Burke Angstman was doing. Thanks for clarifying the process. It was successful! I really appreciate this article. It was very helpful.

Norman R says

I’ve followed all of this but I’m unclear on the punch line. How does this create multiple POD’s? If the bond is in the main account and the POD’s are in the custom linked accounts, which has no funds after the transfer back to the main account, how would those POD’s ever be entitled to the funds of the main account?

Harry Sit says

The POD is per holding, not per account. Think dollar bills. If you can have one POD for each dollar bill and you only have one $100 bill, you need to break it into two $50 bills to have a different POD for each $50 bill.

Norman R says

Thanks, Harry, but I’m still confused. If you turn both 50’s back into a hundred, the heirs to the 50’s (that no longer exist) don’t own the hundred, do they? I guess you’re saying they do. That is the confusing part. The POD’s of the empty subaccounts own what is in the main account? Seems… illogical.

Harry Sit says

Think of the POD being literally written on each dollar bill. It doesn’t matter which pocket you put the bills in. The account doesn’t have any POD. Each dollar bill does.

Rebeccah says

Norman R, You have your hundred dollar bill with a note paper-clipped to it that says, “For beneficiary 1.” It’s sitting in your “Me” drawer. You tell TD to take fifty out of your hundred and move it to your “My other” drawer. TD takes your hundred dollar bill and leaves a fifty dollar bill in each drawer, each with “For beneficiary 1” paper-clipped to it. Now you tell TD to move the fifty dollars from your “My other” drawer to your “Me” drawer. TD moves the fifty dollar bill with its paper-clipped note, and now you have two fifty dollar bills in your “Me” drawer, each with a note, “For beneficiary 1,” paper clipped to it. Now you can take the note off one of them and replace it with a note that says, “For beneficiary 2.”

james b Hawkes says

Does this work if the owner of the bonds has already died? Can the bonds in the owners account be split to transfer to three beneficiaries? Can The new beneficiaries continue to hold the bonds with out cashing them?

Harry Sit says

If the owner already died, the bonds go to the named secondary owner or beneficiary on each bond. If the bonds didn’t have any named secondary owner or beneficiary, the executor of the estate divide the bonds according to the owner’s will. If the will says to split three ways, the executor can work with TreasuryDirect to split them three ways and the new owners can continue to hold them.

Chris J. says

Thanks for this post! Just FYI, though, your post says, “If you already have a Conversion Linked Account from depositing paper bonds to your TreasuryDirect account, you can also use that one to hold the splits. You don’t need to open a Custom Linked Account.” However, when I tried using my Conversion Linked Account, I got the following error message: “The following error(s) have occurred: Securities may not be transferred to a Conversion Linked Account.” I was able to get it to work after creating a Custom Linked Account, though.

Harry Sit says

Thank you for that information. I’ll update the post to remove the part about the Conversion Linked Account.

Beth says

1) Is the split off bond automatically assigned a new, different confirmation number in the Custom Linked Account?

2) After it is split and transferred back, and the two halves are held in the main account, Can you redeem them in different years if needed?

Thank you!

Harry Sit says

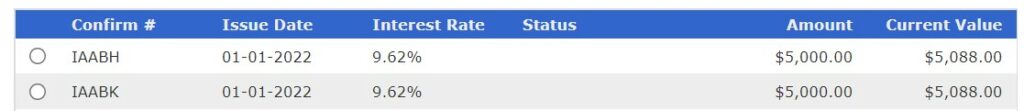

As you see from the screenshots, the $10,000 bond was IAABH before the split. The transferred half became IAAAA in the Custom Linked Account. It turned into IAABK after it came back to the main account.

Like breaking a $10 bill into two $5 bills, the two $5 bills don’t have memory. You can spend them independently.

Elizabeth says

Thank you for this extremely helpful article! My spouse died a month ago and the value of having beneficiaries in place became highlighted in a way I couldn’t fully appreciate until now. We had separate accounts and his was set up such that his bonds were POD to me. But we have two children. So I wanted to make sure my bonds and treasuries had beneficiaries set up instead of going through probate. From now on I’ll make my purchases in two different transactions but I was lost as to how to fix my “current holdings.” Your instructions were very clear and walked me through the process without any hiccups.