[Updated on Oct. 28, 2008. All yields are real yields, after inflation/deflation adjustments.]

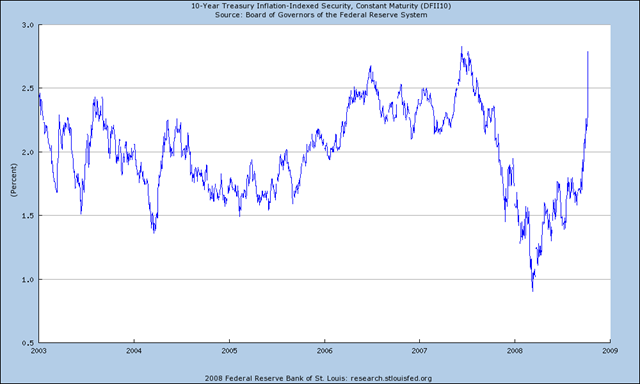

While the stock market was in turmoil, the real yields on Treasury Inflation Protected Securities (TIPS) rose to an attractive level. The real yield on 10-year TIPS broke the magic 3% number, a level that hasn’t been reached for many years.

Many TIPS buyers including myself thought the high real yields in the first few years after TIPS first came out in the late 1990s were a fluke. The real yields were high because TIPS were new and illiquid at that time. I thought we’d never see 3% again. It’s amazing how fast things change. Back in the spring, the 10-year TIPS real yield was under 1% while the 5-year TIPS real yield was negative (please note all yield numbers for TIPS are expressed as real yield, which is on top of inflation).

It’s always hard to explain why the market moved the way it did because previously when the stock market ran into trouble, the bond prices went up (real yields down ). The concern for deflation was raised as one possible explanation for the rising TIPS real yields. A poster on the Bogleheads forum asked whether the real Yield to Maturity (YTM) number quoted when an investor buys a TIPS on the secondary market will still hold if there is deflation instead of inflation.

It’s a good question. So I created an online spreadsheet for the calculation.

Spreadsheet: TIPS During Deflation

I drew the following conclusions from the spreadsheet exercise:

1. As long as there is cumulative inflation between the date you purchase the bond and the date the bond matures, and you hold the bond to maturity, the actual real Yield to Maturity (YTM) will match the real YTM quoted at the time of the purchase. It doesn’t matter whether the bond was purchased at the initial offering or purchased a few years later on the secondary market.

If you buy bonds with a long maturity, say 10 years or more, it’s hard to imagine there will be cumulative deflation for that long. Even Japan didn’t have deflation for more than a few years. It doesn’t matter if there is deflation in some years and inflation in some years, as long as there is net cumulative inflation between the purchase date and the maturity date, the above conclusion holds true. If you don’t believe we will have net deflation lasting a decade or longer, you can skip the rest of the conclusions because they become only academic exercises. Plus if we have deflation for that long, there are probably bigger problems to worry about than TIPS yields.

If you buy TIPS with short maturities, like a 5-year TIPS, it’s possible to have deflation for 5 years. Read on.

2. If there is net cumulative deflation, there’s a chance your real YTM can increase but it will never go lower than what you were quoted when you bought the bond. The possible boost to real YTM comes from the par floor feature in all TIPS. United States Treasury will pay the deflation adjusted principal at maturity or the face value, whichever is higher. If there is net cumulative deflation between the date the bond was originally issued and the date the bond matures, you will be paid more than the deflation adjusted principal value and therefore your real yield will be higher. Please note the relevant date is the original issuing date, not the date you purchased the bond if you bought it on the secondary market. It’s possible that even if there is only deflation after you bought the bond, the bond itself could still experience net inflation during its full lifespan due to inflation between the original issue date and your purchase date.

3. All else being equal, a TIPS bond with a lower index ratio at the time of the purchase can receive a higher boost to real YTM during deflation. The index ratio reflects net inflation from the original issuing date to the date you buy the bond on the secondary market. A lower index ratio gives you a better chance for a bonus from deflation.

4. All else being equal, a TIPS bond with a lower coupon rate can receive a higher boost to real YTM during deflation , although the boost to real YTM is not as sensitive to the coupon rate as to the index ratio.

In short, when you buy a TIPS bond on the secondary market, be confident that your real YTM will never go lower than the quote even if there’s deflation after you buy the bond. If the real YTM and maturity are comparable between two bonds, first choose the bond with a lower index ratio, then choose the bond with a lower coupon rate, for a better chance of a bonus from deflation. Finally, remember all these finer points are moot unless there is net cumulative deflation from the purchase date to the maturity date. If there is no net cumulative deflation, all bonds receive the quoted real YTM. One should never say “never” but it is very unlikely to have net cumulative deflation for many years.

If you’d like to play with the spreadsheet, go ahead. The numbers in blue are inputs. The other numbers are calculated from the inputs.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

enonymous says

honestly, this is as good as it gets.

i can’t thank you enough for going through the time and exercise of posting/ doing all of this hard work

these are interesting times, who would have ever thought that we would be spending this much time discussing the deflation feature of TIPS?

Stock Tips Guy says

This is a discussion that we are going to see more and more of given the current state of our economy and stock market. You do a great job of giving us a heads up on what we will be facing in the near future.

Dividend Growth Investor says

Thanks for writing this review. It answered my question about the value of the TIP bond and deflation..

thanks says

excellent analysis! thank you very much.

softwarenerd says

Is there any situation where the YTM on TIPs should be higher than the yield on a non-inflation-protected treasury Note or Bill of similar duration? If I read my Barron quotes correctly, there are currently many such examples.

I could understand why that would be so, unless the YTM calcs were done so that deflation between now and TIPs maturity would affect the calc. You say it will only increase it further. So, I’m stumped — how to explain the facts I see?

Harry Sit says

softwarenerd – I said the real (after inflation/deflation) yield can only be higher than quoted. If you convert the real yield into a nominal yield after inflation/deflation is known, it can be higher or lower than the nominal yield on the nominal notes at the time of purchase.

softwareNerd says

Thanks for taking the time to clarify. I missed that it was the real yield. Thanks for the spreadsheet too.

I still don’t think I understand the rationale between the yield difference between the TIPs and Bonds/Notes. For instance, Barrons (Oct 27th) shows the following TIP:

Coupon: 3.5%, Maturity Jan 2011, Price 97 5/32, YTM (on accrued principal) 4.558%, Accrued Principal 1259 (which I assume is an index of 1.259)

Now, unless their calc for yield is something different, this would imply that one can get a real YTM of 4.858% regardless.

Now, when I look at a regular (non inflation indexed) Treasury for approx. the same maturity (Feb 2011), it has Yield of 1.322% (nominal Yield).

Does this imply that from now to early 2011, the market showing a nominal yield of 1.322%, while the real yield is 4.858% ? (i.e. annualized deflation of over 3% from now to 2011)?

Harry Sit says

softwarenerd – That’s correct. It’ll take about a 3% deflation in the next 1 year and 2 months for the TIPS note to match the nominal note. If actual deflation is worse than 3%, nominal note wins; otherwise TIPS wins.

Speedy says

Hi TFB: Thanks very much for this writeup and the spreadsheet for TIPs in deflation. Also for your posts on Bogleheads. The first several times I read the following sentence I thouhgt you were saying that an investor could not wind up with a ytm less than the quote even if there’s deflation. Certainly for short term TIPs that is not the case. Since I’m not sure what the point of the sentence is I’ll refrain from a specific suggestion on how it could be worded better, but you might want to take another look.

“In short, when you buy a TIPS bond on the secondary market, be confident that your YTM will never go lower than the quote even if there’s deflation after you buy the bond.”

Harry Sit says

Speedy – I thought I prefaced everything at the beginning by saying “please note all yield numbers for TIPS are expressed as real yield, which is on top of inflation” because whenever I think about TIPS, I’m thinking in real terms. Within this entire post, wherever you see yield or YTM, it is the real yield or YTM, after-inflation/deflation. The purpose the post was to answer these questions:

1. “I know when I buy TIPS I will receive a guaranteed real yield when there is inflation. Is that still the case when there is deflation?” — the answer is yes.

2. “Is the guaranteed real yield only for original purchase at auction or is it for purchases on the secondary market as well?” — both auction and secondary market.

3. “If there is deflation, is one TIPS bond better than another?” — all else being equal, lower index ratio first, then lower coupon.

You and softwarenerd seem to be asking a different question:

4. “How does TIPS compare to the yield on a nominal bond or CD if we have deflation?”

I addressed that in the latest spreadsheet. Thank you for the note though. I will add “real” in front of every mention of yield in this post.

Stephen says

TFB,

Do you mind sharing the spreadsheet and sending it to my email so that I could see how you calculate the TIPS price, duration, etc ?

Thanks a lot,

Stephen

Joaquin says

If there is inflation, is one TIPS bond better than another?

(The nice lady at the bond desk at suggested there is a difference. I must not have understood her explanation, since I can’t reproduce it here. Right now there are long bonds with similar maturity dates, very different prices, and slightly different (real) yield to maturity.)

Harry Sit says

Joaquin – “If there is inflation, is one TIPS bond better than another?” If the real yield to maturity and maturity dates are similar between two bonds, the one with a lower coupon (and therefore a lower price) is slightly better because it has lower reinvestment risk, especially if you think the yield at the current level will not last very long. The YTM calculation assumes reinvesting the interest payments at the same yield as the YTM. If at the time when you receive the interest payments, the real yield isn’t as high, you cannot achieve the YTM you thought you’d have. Of course the reverse is also true. If you are able to reinvest the interest payments at a higher yield, your actual return is better. Because the future is unknown, if you don’t depend on the future as much, you have lower risk.

Joaquin says

Thanks. I’d like to confirm my understanding. Here are two quotes from Schwab just now.

Coupon Due Price YTM

1.750 January 15,2028 79.50400 3.185

3.625 April 15,2028 104.73000 3.294

Ignoring the difference in maturity, the difference in YTM is the premium the higher coupon bond demands to compensate for its higher reinvestment risk. Do I get it?

….

Then, a less technical question: A person like myself, age 68, who plans to spend the interest, might prefer the higher priced bond (while, for example, an endowment might prefer the lower priced bond). Do you agree?

Harry Sit says

Joaquin – Yes to the first question, except there are also other factors influencing the yield difference, for example size of bond issue and trading volume (“liquidity”). I can see why you prefer the higher yield bond, because you don’t quite care about reinvestment. I’m not sure how an endowment values the reduction in yield versus reinvestment risk and other factors including liquidity. One institution may or may not prefer it, but collectively, the market has signaled the buyers’ preference for the lower priced bond by setting its yield lower than the other one.

Dara says

TFB– Thanks for a great explanation of a puzzling phenomenon! One thing is still bothering me. Here are quotes in today’s Barrons for 2 TIPS issues.

Maturity Coupon Bid Asked Chg Yield* Index ratio

2013 Apr 15 0.625 92.05 92.06 – 8 2.511 1035

2013 Jul 15 1.875 94.12 94.13 – 19 3.175 1191

Why would the YTM for the .625 coupon issue be so much lower than for the 1.875 coupon issue?

Harry Sit says

Dara – If you plug the numbers in the spreadsheet, you will see if we have -1.50% annual inflation for the next 4-1/2 years, the 0.625% issue will receive a bonus in the end to make it match the 1.875% issue. It’s hard for me to see we will have deflation for that long, but unthinkable things have happened. I also read somewhere the usual arbitrage trades are not happening as often these days as before. In the old days if traders saw the 0.625% issue priced too high, they would sell 0.625% issue and buy 1.875% issue, which would narrow the yields between the two issues. Now they have other things to worry about so they leave the pennies and quarters on the street and don’t bother picking them up.

Bob says

Thanks for your analysis, much appreciated. I have heard that, for tips on the secondary market, the additional principal paid for accrued inflation is at risk in a deflationary period. Can you explain how this happens? Is this true if you hold to maturity? Or only true if you sell on the secondary market?

Harry Sit says

Bob – Don’t confuse nominal money with real money. If you pay $200 for a bond and you get $190 back, you lost nominal money, but if inflation was -10% during the period, you didn’t lose real money because you only need $180 to have the same purchasing power as your old $200. With TIPS you will never lose real money, although you may lose nominal money if there is deflation.

marbles says

I just stumbled across this amazing post yesterday… THANK YOU for doing all this analysis and posting it so that others can potentially benefit.

I’ve read this post thru several times… and fiddled around with your spreadsheet a lot… as well as passed this out to more financially savvy friends of mine for their opinion, as I just can’t quite believe it’s possible to:

— lock in YTM of 4 to 6% for bonds maturing in 2, 3, 4, 5 etc. years… that are backed by the US Gov’t… that will deliver that YTM regardless how much deflation there is… and in the event of inflation, will cover you fully there as well.

I realize the caveat about reinvestment risk but assuming that is able to be done at a level to maintain the YTM… is there some other risk that I’m overlooking? I keep feeling that I’m missing something, that this is too good to be true.

Back to reinvestment risk as perhaps this is where I’m missing things: how much of an impact on YTM would this have for a Tips bond maturing in the 2011, 2012…ie just a few years from now? It seems like it would be negligible?

If this does all stand up to scrutiny… I think all of us fortunate enough to run across your post will owe you a big tip for the TIPS info! I know I will be making good use of it.

Thanks & Regards

Harry Sit says

marbles – What’s being guaranteed is the real YTM. In case there is severe deflation, the nominal YTM can be negative or below the nominal YTM on nominal bonds at the time of purchase. Please read my reply to Bob just above your comment. The “catch” is that it is possible to pay $200 and get $190 back when only $180 is needed to match the CPI change or to pay $200 and get $205 back when other bonds or CDs can get you $210. The impact of reinvestment risk isn’t big. You can get a sense of it by playing with the spreadsheet.

marbles says

TFB … Thanks for the reply to my question. I did actually get the real versus nominal, it was explained well in your article and answers to other questions.

It doesn’t change, at least to me, the great attraction of this investment. Once one accepts, embraces real return… and thinks only in effective purchasing power, the potential “loss in nominal return”, ie recieving “less money” back–190 on a 200 bond–seems irrelevant. And that other bonds might deliver more is quite OK with me: if I can lock in a 4 to 5% real return–a good return by historical standards–that will withstand whatever future inflation/deflation happens, well what am I waiting for?

Many Thanks TFB…

Harry Sit says

marbles – I agree. Once you start caring only about the real return, and that’s what really counts, TIPS is an excellent investment, although I’m looking more toward the longer term bonds. Locking in a 4% – 5% real return for a few years is nice, but it’s only for a few years. If I can lock in 4% or more real return for 20 years, then it gets really interesting. We are not there yet. I’m praying that we will, when everybody is worrying about deflation.

marbles says

You beat my “special notice from my broker” about TIPS opportunities by 2 days… Again, many thanks and I will be tipping you… only fair as you’ve pointed me to a great opportunity I was unaware of.

By the way, do you know offhand if Non resident aliens with no US connection etc…. pay taxes on TIPS? I know NRAs don’t on the nominal US govmnt’ T bond interest etc. but can’t find if this includes TIPS as well.

Best regards

Moonflye says

I’m a novice at these and this article was very helpful. I’m looking at two TIPS maturing fairly soon. The 7/8% TIPS due 4/15/10 and the 4.25% due 1/15/10. the actual dollar price of the 7/8s is 107.5 cents on the dollar and the 4.25s are at 127 cents. if we entered severe deflation from now until say, mid-2010, wouldn’t it be possible for the actual return on these investments to be negative? in that case, wouldn’t you face less risk of actual dollar decline in the price of the security in the case of the 7/8s? if so, would you not rather own that one than the 4.25%? I understand how the real yield would/could still be positive because it would exceed the deflation rate, but you could still lose money by holding them to maturity, no? Thanks in advance.

Harry Sit says

Moonflye – Yes to all your questions, if you are measuring nominal returns. The answers are consistent with what I wrote in the post and in the comments. With the linked spreadsheet, you can calculate what kind of deflation will kick in a bonus for the 4/15/2010 7/8% TIPS which will make it preferable to the 1/15/2010 TIPS.

Harry Sit says

marbles – Thank you very much for the tip. That’s very generous of you. As far as taxes go, I don’t think there’s anything special that singles out TIPS. TIPS are a kind of U.S. Treasury debt. They only differ with nominal Treasury notes in how the interests (paid and accrued) are calculated. The income from TIPS is income from U.S. government debt and is taxed as such. If you are a foreign national, I’m sure you are familiar with the IRS publications 519 U.S. Tax Guide For Aliens and 901 U.S. Tax Treaties.

Bill says

TFB,

Thanks for your website and spreadsheet – I found it yesterday. Two questions.

1) How bad was the Japanese deflation and for how long did it last?

2) Why is the spread between the bid and asked for TIPS so great as compared with other treasuries?

Harry Sit says

Bill – I just Googled “Japan inflation” and found this link (scroll down to bottom for IMF data). Assuming the data are accurate (I didn’t verify), Japan had deflation for seven years between 1999 and 2005, averaging -0.45% a year or -3.1% cumulative in those seven years. As to why the spread on TIPS is higher, I have no idea. Dealers set the prices to whatever they can get away with. Competition or lack thereof results in the prices retail investors like you and I see.

Joe M says

Hi TFB,

Thank you for clarifying so much. My question is about the fact that the Index Ratio applied for any particular date is actually the CPI from three months earlier. Does the Quoted YTM on the Purchase Date take into account the already known inflation/deflation change for those first three months of ownership? I am assuming the calculation for YTM uses the known Index Ratios for those first three months of ownership of the TIP.

Is that why the current quotes on near maturity TIPS seem to have so much higher Quoted Yields: example TIP maturing 1/15/10 has 5.23% Yield as compared to the longer dated maturities? Is it because the -3% deflation that is contained in the Sept, Oct and Nov CPIs (and Index Ratios) are reflected to a more significant extent in the short maturing TIPS? Or is something else going on?

Harry Sit says

Joe M – Any point of time you only know maximum 45 days worth of inflation adjustment into the future, not 3 months. But because real YTM is determined by the market price, market participants form a view of upcoming inflation and adjust their bid/ask price accordingly. So the YTM number reflects the market participants’ inflation expectation. That’s why the near term TIPS have higher YTM numbers.

Balabu says

I have a question regarding the effect of deflation on TIP ETFs. Assuming that I buy the ETF now and hold it 4 to 7 years. The current quoted yield on the Canadian ETF is 3.1%. Since the ETF holds TIPs of various maturities and various index ratios, which change as part of the holdings mature and is replaced by new TIP bonds. I assume that if there is deflation the new TIPs will reduce the blended index ratio of the ETFs. I wonder if you could state how will the ETFs affected by this scenario?

Harry Sit says

Balabu – I live in the U.S. and this article pertains to the U.S. While I’m not familiar with Real Return Bonds in Canada, I read the RRB entry on finiki. From what I gathered the RRB in Canada work similarly to TIPS in the U.S. with one exception — there is no par floor. The conclusions #2, #3 and #4 in this post do not apply to Canadian RRB. In terms of the effect of inflation and deflation on the real yield, there is no difference among Canadian RRBs with different inflation ratios. If there is deflation, you will lose nominal dollars but the real yield will still hold.

edward says

I Bonds even protect you from the effects of severe deflation—the earnings rate can’t go below zero and the redemption value of your I Bonds can’t decline.

The preceding is from the Treasury product FAQ for TIPS’s cousin. My interpretation is that this says the fixed rate can’t be less than zero, and, like TIPS, the I Bond has principal protection. However, we now know that come Friday, the next I bond rate will have a -2.86% semi-annual inflation rate. If Treasury stays true to form, announcing the nominal, or combined rate, on Friday, it can be expected to be a negative number, unless Treasury is pleased to offer the highest fixed rate ever for an I Bond. My guess is that they switch to fixed rate for the title, but a negative combined value will still be in the text. This would be a first, regardless.

Do you agree?

Harry Sit says

edward – The combined rate on I Bonds cannot be below zero. It will be zero come May 1. I don’t know if they will change their announcement template. My guess is that the fixed rate will also be zero. If that’s the case, it doesn’t matter how they make the announcement.

edward says

Will do wonders for the sale of I Bonds, one would guess, advertising a 0% interest rate. [I think I miscalculated the semi-annual inflation rate, wrong base; it’s *only* -2.78%]

Richard Staub says

Great (and unique)spreadsheet (Tips during Deflation.

Please define L 25 “Cumulitive Inflation/Deflation until…”

Also, under “Sensivity Analysis” I assume each line is a separate entity rather than representing Year 1,2,3…… ??

Could not import into my Zoho Account spreasheet.Is this possible ?

Or can I copy it into my computer’s Excel ?