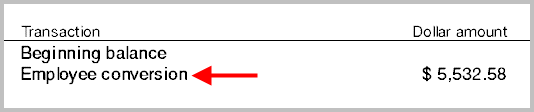

When I was getting my records organized, I saw this on the Vanguard trade confirmation for converting from my traditional IRA to my Roth IRA.

I am an employee somewhere, but my employer doesn’t have its plan at Vanguard. Regardless, what anything does employee or not have to do with converting from a traditional IRA to a Roth IRA? If I’m no longer an employee, would I still get an “Employee conversion”?

Vanguard is just testing to see if you are paying attention. Somebody at some point thought that should be the proper description for this transaction. That somebody may have left Vanguard a long time ago. His or her creation has become legacy.

By the way if you have a hard time reading the font in the screenshot, it wasn’t me. Vanguard chose that blurry font to test your eyesight.

I reported the bugs to Vanguard. Let’s see how long it will take to fix them.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jeff says

You’ll be waiting a long time – I brought this up to them back in late 2013. I see that it hasn’t changed yet. Nor does Firefox work with Vanguard – I have to use Safari. Sometimes, big is not better.

Ryan says

This is likely a reference to the tax law requirement that a person have earned income equal to or greater than the amount contributed to an IRA.

Harry Sit says

No that’s not it. This confirmation was for a conversion, not a contribution. You don’t need any earned income when you convert from a traditional IRA to a Roth IRA.

John says

Ok, here’s my guess: the original traditional IRA contribution must have been from earned income (“employee”). The conversion was at the direction of the “employee” (vs. the employer through a company sponsored plan). Thus it was an employee conversion.

Who knows? Really poor wording.

Harry Sit says

We are really stretching here. If the money in the traditional IRA came from a former employer (401k rollover), it was because you were an employee before. If it was a spousal IRA, the working spouse was an employee even if you the IRA owner never worked. Whenever you convert, therefore it must be an employee conversion. 🙂