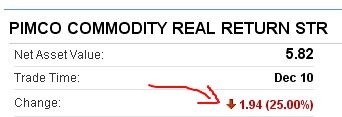

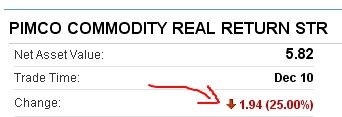

I wrote on Tuesday that I bought PIMCO CommodityRealReturn Strategy Fund D (PCRDX) on Dec. 5, 2008. It’s a good segue to today’s post. As luck had it, only a few days later, my jaw dropped when I saw the price of the fund dropped 25% in one day.

It turned out it was just some year-end distributions. You probably heard or read about the usual advice “don’t buy a fund distribution” or more generically “don’t buy a dividend.” So how do fund distributions affect investors? What exactly is so bad about buying a distribution?

Let me explain with this real life example in my account. I bought only a few days before the fund made the year-end distributions. The day before the distributions, I had 262.123 shares at $7.76 per share worth $2,034.07. I received $547.66 in capital gains distribution. After the distributions were reinvested, I had 356.222 shares at $5.82 per share worth $2,073.21. More shares at a lower price. My account value actually increased. Because my fund is held in an IRA, there is no tax implication anyway.

Reminder #1: If you are investing in a tax deferred account, don’t worry about buying a fund distribution.

If you only invest in tax deferred accounts (401k, 403b, 457, traditional IRA, Roth IRA, etc.), buying a year-end distribution is not a problem.

What if it’s a taxable account? In my example, I would have to pay tax on the $547.66 distributions even if I reinvested them into the same fund. But my cost basis also would increase by the same amount. When I eventually sell the fund, I will have a smaller capital gain at that time. Therefore,

Reminder #2: Taxes paid on capital gains distributions now will be at least partially offset by lower taxes in the future.

What if I invested in a taxable account and I took the usual advice of waiting until the distributions are done? I paid $2,000 for my shares on Dec. 5. Had I known that the fund will have a large distribution in a few days and I decided to wait until Dec. 10 to make my purchase, to acquire the same number of shares I now have, I would’ve had to pay $2,073.21 on Dec. 10 whereas I only paid $2,000 on Dec. 5. The extra $73.21 due to price changes would take a big chunk out of the tax savings from avoiding the distributions while I would still have a higher capital gain and higher taxes in the future. Waiting until year-end distributions are done is not necessarily the best in all cases.

Reminder #3: Price movement can trump tax savings.

If the distribution is small, it may not be worth avoiding.

So why do they say “don’t buy a fund distribution”? Because if you do, in a taxable account, you pay more taxes now and less taxes in the future. That’s the mirror image of deferring taxes. You accelerate the taxes from the future years into the current year. You can also turn a long term capital gain in the future into a short-term gain in the current year. Short-term gains are taxed at higher rates than long-term gains.

What do you do if you invest in funds that tend to make large distributions? Such funds are said to be “less tax efficient.” First, ignore the issue if you are investing in a tax deferred account. Tax efficiency simply doesn’t affect you in 401k, 403b, IRA or Roth IRA. Second, consider if you should invest in the less tax efficient funds at all. More tax efficient funds may perform just as well after you take taxes into consideration. Third, if that’s your only choice, consider trading places with some more tax efficient funds in a tax deferred account. Move the less tax efficient fund into a tax deferred account and move some more tax efficient funds to the taxable account. Finally, harvest tax losses when you can so you have a reserve of tax losses which can be used to offset the capital gains distributions.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Ole says

Question for you. Lets say you bought 100 mutual fund or EFT shares for $10 a share in a taxable account. Lets say the fund/etf paid a $2 cap gain distribution at year end and you still held the fund and plan to hold it for the next 20 years.

For this current year when you have a cap gain distribution. What kind of cost would you match it up agains?

If you match the $2 distribution against a $10 cost you’ll claim a loss for the year which doesn’t make any sense. Should it be matched against a zero cost for that year instead?

Harry Sit says

Ole – You don’t match it against anything, or match it against zero if you’d like to think about it that way. Short-term capital gain distributions are reported as dividends by the mutual fund/ETF on 1099-DIV. You report them on Form 1040 Schedule B. Long-term capital gain distributions are also reported by the mutual fund/ETF on 1099-DIV, but in a different box. You report them on line 13 of Form 1040 Schedule D (2008 version). In your example, the $2 per share capital gain distribution is taxable in the current year. If you didn’t reinvest the distribution, you have $800 worth of shares with a $1,000 cost basis. If you reinvested the distribution, you have $1,000 worth of shares with a $1,200 cost basis. Either way, you have a built-in unrealized capital loss which reduces your gain when you sell in the future. That’s what I meant in Reminder #2.

anon says

>The day before the distributions, I had 262.123 shares at $7.76 per share worth $2,034.07. I received $547.66 in capital gains distribution. After the distributions were reinvested, I had 356.222 shares at $5.82 per share worth $2,073.21.

>

But you traded a cost basis of $7.76 for a much lower cost basis of $5.82.

So when you finally sell, you will be paying capital gains tax on an extra $1.94 x 356 shares = $690 which comes to a lot more than your $40 instant gain in total value.

How many years will it take that $40 to grow enough to equal the cap gains you will pay?

Harry Sit says

@anon – You got it entirely backwards. The cost basis is the original investment plus reinvested distributions. If I bought before the distribution, my cost basis was

$2,034.07 + $547.66 = $2,581.73

If I bought after the distribution, my cost basis would be $2,073.21. The cost basis is higher if I bought before the distribution. When I finally sell, the capital gains will be lower.