In a low interest rate environment, the long forgotten EE bonds come back as appealing again, because they offer a guarantee to double the nominal value in 20 years. That comes out to a 3.5% compound annual return if you have the fortitude to hold them for 20 years.

After I wrote the previous post EE Bonds vs CDs and Bond Funds For Long-Term Investment, the government lowered the interest rate on EE bonds from 0.6% to 0.2%. The 20-year guarantee to double didn’t change. It just means the penalty is even larger now if you don’t hold for 20 years.

This reminds me of another beast: whole life insurance. Whole life insurance is shunned in general because it’s mixing insurance with investment. When you haven’t maxed out all your tax advantaged accounts yet, you should go invest there instead of in a whole life insurance policy. When you have the long investment horizon and the risk tolerance to invest in stocks, you should go invest in stocks for the higher expected return. At best, investing in a whole life policy will be a little better than investing in CDs and bonds on your own in a taxable account. If you must cash out early, you will get a poor return.

That’s almost exactly like investing in EE bonds, isn’t it?

I got a quote for a single premium whole life insurance policy from one of the "big four" mutual life insurance companies. The "big four" namely New York Life, Northwestern Mutual, MassMutual, and Guardian, are four largest life insurance companies owned by policyholders. They have the highest or nearly the highest ratings from all rating agencies. I asked for a single premium policy because it’s most comparable to investing a lump sum in EE bonds and holding it for 20 years.

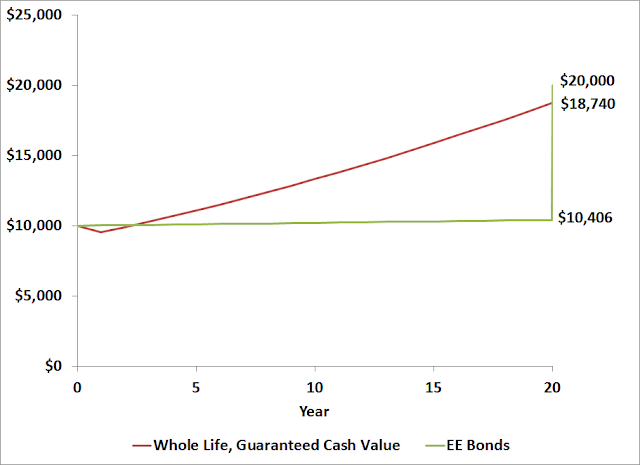

This chart shows the guaranteed cash surrender value over the years:

Guaranteed means just that: the minimum value guaranteed by the insurance company, without any dividends, although the company has a good history of paying dividends in the past. After all, the company is owned by policyholders. If I only base on the guaranteed value, as an investment, this whole life policy isn’t as good as EE bonds but it’s close. The average annual return over 20 years is 3.2% versus 3.5% in EE bonds. If I were to believe the projected dividends, which aren’t guaranteed and may be too optimistic, the return on the whole life policy would be 4.1%. If I discount the projected dividends and take a mid-point between the guaranteed return and the projected return, the return on a whole life policy would be similar to the return from EE bonds.

I’m not counting the value of the life insurance in the calculation above. If I need life insurance anyway and I value the insurance as the best 20-year level-term policy I would otherwise buy, the return on the whole life policy over 20 years would be 3.5% guaranteed and 4.4% with projected dividends, and somewhere in between if the dividends aren’t as good as projected.

This one quote I received likely isn’t the best I can find if I shop around. I would say if you like EE bonds, a whole life insurance policy would be as good or better, for several reasons. EE bonds limit you to buying $10,000 per person per year; you can invest a lot more in a whole life policy. You must hold EE bonds exactly 20 years. As the chart shows, if you cash out early, but after 3 years, you will get a lot less than you get from a whole life policy. After 20 years, EE bonds revert back to earning 0.2%; whole life continues to earn the 3-4% return.

EE bonds can be tax free if you use them for qualified higher education expenses and your income level at that time qualifies for that benefit, but the tax benefits for higher education expenses are better addressed with a 529 plan.

For whole life to work as a good investment, if you don’t need life insurance any more, you have to be young and healthy. Otherwise the cost of insurance would be too much a drag. It’s not an issue if you need life insurance for the next 20 years because you would have to buy a term policy based on your age and health status anyway.

Although whole life can be as good as or better than EE bonds, the question remains whether you have to like EE bonds to begin with. Is that bar too low?

With the recent rise in interest rates, EE bonds’ edge over a regular 20-year Treasury bond already diminished somewhat. As of May 31, 2013, the yield on a regular 20-year Treasury was 2.95%, up from 2.44% on May 1, versus 3.5% on EE bonds held for 20 years. If it continues to move up like this, in another few weeks or months we won’t be talking about EE bonds any more.

For investors who maxed out all tax advantaged accounts and who already invested enough in stocks, munis are the go-to investment. According to Bloomberg, the latest yield on 30-year AAA munis was 3.29% and that’s tax free. 20-year munis would compare favorably against EE bonds.

I decided to stick with munis in taxable accounts and not bother with either whole life or EE bonds.

[Photo credit: Flickr user Keoni Cabral]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Tom says

Currently in a high tax bracket (33%+). In taxable you recommended sticking with munis, what is your target duration and are there any particular funds that you prefer? Thanks for all your good work and posts.

Harry says

I have been using intermediate term (5-6 years in duration). I just started buying a long-term fund from Vanguard. As I mentioned in the previous post Invest In Long Term Bonds Now?, Vanguard’s so-called long-term muni bond funds aren’t that long anyway. It has a fund that invests in bonds from all states, and a few funds that invest in bonds from just one state.

S. B. says

Ah, the good ol’ days before 2003 when EE bonds were guaranteed to double in 17 years…

Ross says

Looks like I am a bit late to this post but I am trying to figure out munis vs max funded whole life insurance. It seems you are assuming that interest rates will rise, as am I. When you purchase a muni are you locked in to the rate at which you purchase it? As far as I understand, the dividend rate each year in whole life insurance changes. So while it could go down if interest rates fall further, it could also go up, which seems more likely. I feel like I am missing something above where you state that munis are paying 3.29% and life insurance is paying 4.1% but you feel the munis are better? What are the historical dividend interest rate averages (or expected over the next 20 years) for the big four and how does that compare to locking in a muni rate today?

Thanks for your insights.

Kevin says

So…. What would the commuted value to your heirs , or whatever your Legacy arrangement happens to be, if you just up and died in the first 3 -5 years of each scenario? Trust owned whole life insurance, Muni Bonds, or treasuries/ gov’t bonds? Every year you age or odds of passing away increase exponentially, no? I think your mourning family might prefer the life insurance decision. The far larger immediate pile of cash from the life insurance benefit comes to them income tax free, and easily within a month of your passing. There is no waiting for the courts to verify the estate and tax arrangements, and probate is not even brought into the equation.

Harry Sit says

If you are going to die before the insurance company thinks you will, buy life insurance, lots of it. Your insurance agent will thank you.

Will Harris says

Life insurance is first and foremost a risk management tool. Although it may provide a return comparable to EE bonds it also will perform if you become disabled for a period of time or permanently with a waiver of premium rider or it can provide a large amount of cash if you become terminally ill or tax free cash through loans against cash value if properly structured. Clearly the comparison to EE bonds is a bit limited . And yes, if you die it will pay your family a large return for the premiums paid

Harry Sit says

Just waiving the premium itself does not create any return. A term life policy can provide a large sum of cash if you become terminally ill as well. All loans are tax free. You pay interest. And yes if you die a term life policy will pay a much higher return.