The HSA provider my employer chose isn’t very good. The interest rate is very low if I leave the money in cash. The investment options are very expensive, with no index funds. I still use it because contributions through the employer are exempt from Social Security and Medicare taxes.

I take the money out once a year and put it into the HSA account I prefer for a better interest rate and better investment options. Here’s how I did it. If you are looking for a better HSA, see Best HSA Provider for Investing HSA Money.

Request Withdrawal

I logged on to the website of my employer’s HSA provider. I requested a withdrawal to my personal checking account. Leave a few dollars behind if you don’t want them to close the account. If you don’t want this account anymore, you can withdraw everything and call to close the account after the rollover is done.

You don’t need to give a reason for the withdrawal or submit receipts. Some HSA providers make you add details for a provider name and dates of service as if you’re reimbursing yourself for healthcare expenses. Just use a provider name to the effect of “HSA Rollover” or “Rollover to XXXX” with some random dates of service.

Deposit to New HSA Provider

I mailed a personal check together with a rollover contribution form to my preferred HSA provider. If your preferred HSA provider accepts deposits by electronic fund transfer from a linked bank account, that works only if you can mark the deposit as a rollover, not a normal contribution.

Ask the receiving HSA provider for the rollover contribution form if you can’t find it on its website. If your preferred HSA provider is Fidelity Investments, fill out the deposit slip and mark the box for “60-Day Rollover.”

That was it. If you have a checkbook for the current HSA, you can also write a check and send it to the new HSA together with the rollover contribution form.

One Rollover Every Rolling 12 Months

The amount rolled over isn’t taxable. You can do this DIY rollover only once every rolling 12-month period. The clock starts on the date you take the money out of an HSA, not January 1. You have 60 days to deposit it to a new HSA.

Start your next withdrawal request 13 months after the deposit is cleared in the new HSA to stay clear of the frequency restriction.

Trustee-to-trustee transfers aren’t limited in frequency but HSA providers usually charge a fee to the tune of $20 to $30. It’s not worth it if your HSA provider charges a fee for trustee-to-trustee transfers. Just do the rollover on your own.

Form 1099-SA

After the end of the year, the HSA provider that sent you the money will send you a Form 1099-SA showing the distribution. In May each year, the receiving HSA provider will send you a Form 5498-SA, which confirms the normal contributions and the rollover received in the previous year. Save the 1099-SA and the 5498-SA in your tax files to show that you did a rollover.

Report Rollover in Tax Software

You will report the rollover in your tax software. Here’s how to do it in TurboTax download software:

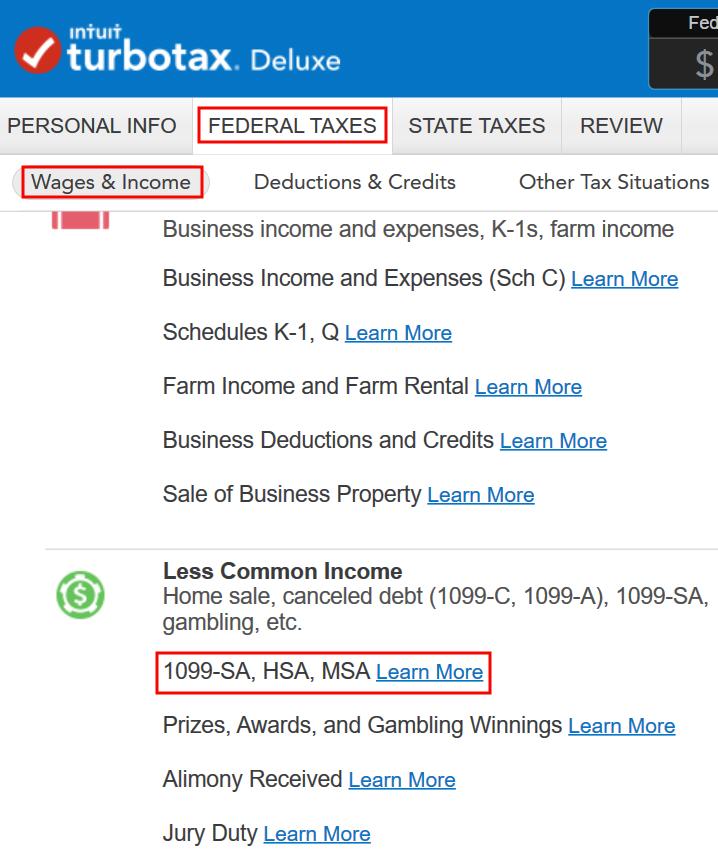

Click on “Federal Taxes” and then “Wages & Income.” Scroll down to the heading “Less Common Income” to find “1099-SA, HSA, MSA.”

When it asks you whether you used your HSA to pay for anything, answer Yes even though you only did a rollover and didn’t use it to pay for anything.

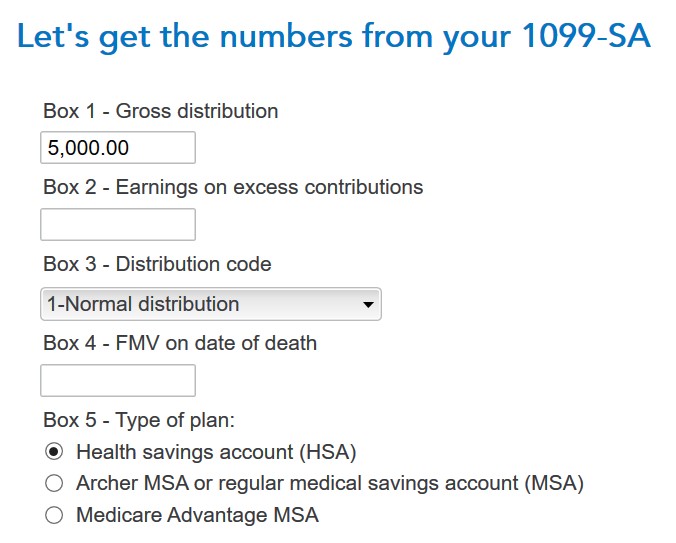

Enter the numbers from your 1099-SA form. Suppose you took out $5,000 from your HSA last year.

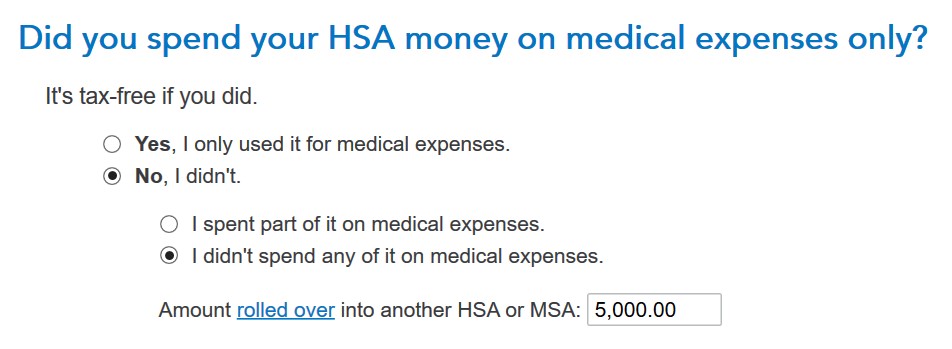

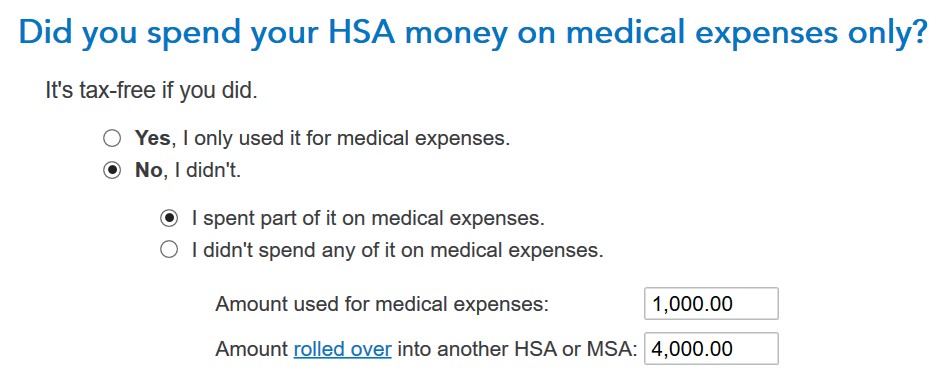

If you only did a rollover and didn’t spend any HSA money on healthcare expenses, answer No and enter the amount you rolled over.

If you withdrew some money from the HSA to cover healthcare expenses in addition to a rollover, choose the option “I spent part of it” and enter the split accordingly.

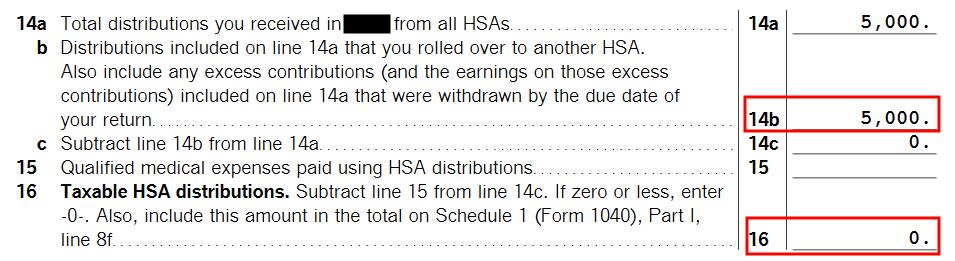

To confirm that your withdrawal is tax-free, click on Forms and look at Form 8889.

You will see the withdrawal on Line 14a and the rollover on Line 14b. Line 16 shows that the taxable amount is zero.

***

My payroll deductions and my employer’s contributions are still going to the provider chosen by my employer. I’m going to roll over the balance in the account again next year after I clear the one-year mark from this rollover.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

The curious says

How should one report his/her HSA rollover (not a transfer) on tax return? Thanks!

The curious says

More specifically, I can’t find a place in form 8889 to report the rollover amount.

Harry Sit says

Form 8889, line 14b: Distributions included on line 14a that you rolled over to another HSA.

TenBlinkers says

Why not just leave your employers HSA at $1 or something, and make your contributions post-tax to the desired HSA, then deduct it from your tax return? You still get the full tax benefits.

Am I missing something?

Harry Sit says

Contributions made through payroll are exempt for social security and Medicare taxes.

Bruce Nelson says

I have a PayFlex HSA account thru Aetna with about $37000.00. I will keep the PayFlex account. Can I roll over a portion to IRA Services in San Carlos, CA for a self directed HSA account? I have several IRA accounts (Traditional/Roth) with them and invest in a real estate private mortgage lending LLC, paying 8%. Can I put this money to work like the IRS’s mentioned above?

Brad says

Both HealthEquity and Saturna customer service representatives have told me that there is no fee for a trustee-to-trustee transfer but I have not been able to find anything online that confirms this. HealthEquity advises I use the Account Closure form to complete a transfer to another HSA custodian and select the option to do a partial transfer/will not close account. They really need to update this form because everything on it talks about closing the account, even though there is an option to leave it open. But that’s neither here nor there. One representative told me that I can request to have the $25 “account closure fee” waived and transfer the full balance and leave the account open with a $0 balance. Apparently, I don’t have any monthly account maintenance fees and there is no minimum balance requirement to keep the account active (not sure if this is the same for everyone’s HealthEquity account). It sounded like a lot of follow-up with no real guarantee, though. So, I will probably just transfer the (full amount – $25). If this works out, this will be the way to go in the future because the trustee-to-trustee transfer doesn’t generate a 1099-SA and I will be able to do next year’s much earlier in the year!

Harry Sit says

I read elsewhere although it’s true in theory you can do a transfer and leave the account open, in actual operation HealthEquity sometimes closes the account in error and charges you the $25 account closure fee. You can call back and have the account re-opened and get the fee credited. So it depends on your luck in avoiding their error and your tolerance for correcting the error versus getting a 1099-SA for a rollover.

Brad says

So I just chatted with HealthEquity again and was told that if I do a partial transfer and want to leave the account open then the amount requested has to leave over $25 in the account. For clarification, here is what I asked:

BG: If I selected partial transfer and left $25 in the account, it would be closed. But if I selected partial transfer and left $25.01 in the account, it would not be closed. True or false?

Lisa R.: Correct. If you leave 25.00 only, that is our account closure fee so then your account would be zero and closed. If you check the partial closure and leave 25.01 in there then we will leave it open.

We will see how this goes. Going to wait until the end of the month for my interest payment to be credited to my account and then submit this account closure form.

Andrei says

Brad, when I rolled over my HSA funds from HealthEquity to Saturna last month, I just took a distribution and left $25 in the account. More details on that in Harry’s response on March 20, 2018 at 10:38 am

Then I mailed/faxed the forms with the check to Saturna. This way, i didn’t have to use any account closure form. Hope this helps.

Sam says

If I do a rollover by withdrawing from HSA1 in December 2018, and depositing in January 2019 at HSA2 (and making sure HSA2 knows it is a rollover), how is this reported? When it comes to doing my 2018 tax return, how exactly will HSA2 report to the IRS the rollover they received in January 2019, so that it is matched with the withdrawal from HSA1 in December 2018.

I understand I would report the rollover amount on Line 14b of F8889 for my 2018 tax return. And I believe HSA2 would report the rollover contribution on F5498SA box 4. But for which tax year would the F5498SA report the rollover contribution. Could it be that it is reported for 2019 instead of 2018? Would this mean that the IRS might disbelieve the rollover amount I report if it didn’t appear on the 2018 F5498SA?

You might think I should avoid such a scenario, but I do actually want to float the 5 figure balance as a loan to myself from mid-December to mid-January.

Harry Sit says

HSA1 will report the total distribution during the year, including money you withdrew for qualified medical expenses on a 2018 Form 1099-SA in January 2019. You will report the total distribution and the amount you rolled over on you 2018 Form 8889. HSA2 will report the rollover contribution received on a 2019 Form 5498-SA in May 2020.

Sam says

Does that mean that the IRS would likely question my 2018 tax return, and send a tax bill based on the assumption that the the withdrawal from HSA1 was kept by me instead of being rolled over to HSA2? Presumably I could send them documentation of what actually happened, to fix it, but this seems a pretty uncomfortable situation to be in.

Harry Sit says

I don’t know what the IRS would do. Maybe they will take your words for it. Maybe they will ask for evidence.

Becky says

Can you DIY a rollover via ETF from existing HSA to newly established HSA instead of writing and depositing check? Apologize if this was addressed previously. Thank you for all the insights and discussion.

Harry Sit says

I assume you mean EFT, electronic funds transfer, not ETF, exchange traded fund. The distribution from the existing HSA to your personal account can be via EFT. The rollover contribution from your personal account into the new HSA can be done by EFT only if the receiving HSA has a way for you to specify it’s a rollover, not a normal contribution. If not, it’s better done by a check with accompanying deposit form or letter noting it’s a rollover, not a normal contribution.

Tim says

Hi Harry,

I have the following proposed actions which involves three HSA accounts. I’m not sure if my actions violate anything:

1. Take a full distribution from HSA1 to my checking account.

2. Take a full distribution from HSA2 to my checking account.

3. Write a check to myself from my checking account and deposit the above combined distributions as a rollover contribution to HSA3.

Would this count as one rollover in the eyes of the IRS?

Harry Sit says

Two rollovers.

Tim says

I see. Guess I’ll have to absorb the direct transfer fee on one of them.

Robert says

Is it possible to do 1 HSA, 1 IRA, and 1 Roth self-directed rollover within the same 12 month period, or is it 1 per 12 months regardless of type?

Harry Sit says

You can do one HSA rollover per rolling 12 months plus one IRA (regardless Traditional or Roth) rollover per rolling 12 months.

Jules says

I found it easier to absorb the $25 closing fee from HealthEquity and just do the transfer directly from custodian to custodian online. HealthEquity provided all the online forms to initiate the transfer, and it took about a week for it to process.

Not a big deal, and I don’t have to think about doing a roundabout transfer (custodian-checking account-custodian) to save $25 (which I will make back in a little over a year anyway by avoiding HealthEquity’s monthly account fees, plus lower investment costs at the new custodian).

Andrei says

Looking for help on how to do HSA rollover to Fidelity.

I already have an HSA with Fidelity. I’m trying to find the right form for this.

I only found this form – https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/hsa-application-only.pdf which appears to be for new accounts. Has anyone done an HSA rollover to Fidelity while already having an account? Could you assist with the steps please?

I already have a check from another HSA provider and ready to deposit it with the rollover.

Harry Sit says

Fill out the deposit slip, mark the box for “60-Day Rollover” and mail it in to the address on the form.

Andrei says

Thanks! Oh, this was already in the article. Apologies for not paying attention.

Sai kumar says

Hi,

Does form 8889 needs to be filled for direct rollover also. If I do trustee to trustee then can I skip filling that for ?

Thank you

Harry Sit says

If by “direct rollover” you meant a trustee-to-trustee transfer, no, the transfer does not have to be reported. You still need that form for contributions and distributions.

Sai kumar says

Very nice. Thank you for the quick response. Yes trustee to trustee transfer.

Have a nice weekend

Vi ram says

HealthEquity seems to allow free partial transfers to another HSA (takes up to 3 weeks for the transfer). I plan to do this every month, if this works out.

https://answers.healthequity.com/app/answers/detail/a_id/2844/kw/transfer

Steve says

Thanks for the link. I submitted this form exactly two weeks ago, and the funds just showed up in my Fidelity HSA. Health Equity lists the transaction as a trustee to trustee rollover; Fidelity lists it as a transfer of assets which is presumably the same thing. I didn’t have to do anything other than submit the form with HealthEquity. That said, I chose to check daily to see if the transfer had gone through yet. If I were submitting the form every month I wouldn’t do that.

See says

Thanks for the informative article! I am trying to do this with my employer-provided HSA, which is through HSA Bank and Fidelity. I want to transfer from HSA Bank to Fidelity using this approach. I am not planning to close the HSA Bank account at this time and want to continue contributing the max each year.

However HSA Bank seems to have a daily withdrawal limit of $2500, which is below the annual contribution limit.

If I withdraw $2500 on Day 1 and $1000 on Day 2, my understanding is that only one of them can be rolled over to Fidelity as a tax-free rollover within 60 days. Is that correct?

Harry Sit says

That’s correct. Due to the daily limit, you should ask HSA Bank to do the partial trustee-to-trustee transfer and keep the account open.

Mick says

Incorrect. IRS just says “An HSA can only receive one rollover contribution during a 1-year period.” The single contribution can be made of 2 checks or you’d deposit distributions into your own account and write your own check or do EFT for the one rollover contribution.

RT says

I have a technical questions. Fidelity account number doesn’t fit into Fidelity deposit slip pdf. Routing number does fit. Should I use routing number on the slip?

Harry Sit says

It fits. The Fidelity account number shows after the word “Brokerage: ” on the website. The routing number that comes after the Fidelity account number is a link. It shows the routing number 101205681, which is the same for all Fidelity accounts, and a long account number only for bank transfer purposes.

RT says

Thank you. I now understand that 39900001 is generic prefix in front of the actual account number and can be omitted on the deposit slip.

I did not omit the prefix while setting up direct deposit from the payroll and instead used complete number. I hope it is OK. Will see on Fri.

RT says

We can’t decide whether to mail a check via regular mail of overnight mail. 22K is involved. Any suggestions? What are best practices?

Harry Sit says

If you have a Fidelity branch near you, you can drop off the check and the deposit slip there. They will overnight it for you for free (together with all other checks and paperwork they collected from other customers that day). Just make it clear it’s for an HSA account, which has to be forwarded to their central office. If the branch tries to process it right then and there, it tends to go to an IRA account, not to an HSA account, because the branch can only process IRA rollovers.

I usually don’t have problems with just first class mail. If you are concerned but you don’t have a Fidelity branch near you, priority mail flat rate envelope with tracking costs $7.35.

RT says

Thank you for the advice. Everything worked as you described. I ended up sending check priority mail. Fidelity received it today and they deposited today as well. Payroll contribution to fidelity HSA account “long number” via payroll worked as well.

Merv says

No need to mail or fill out any slips if your transferring to a Fidelity HSA. Simply call them and tell them that you want to do an electronic transfer into your HSA and have them code it as an HSA rollover into your Fidelity HSA account. I was told this by a FIdelity transfer specialist.

Anne says

I have saved receipts for medical expenses that are not yet reimbursed from my current HSA. If I transfer, will the new company accept old receipts and reimburse? Or do I need to get all of that done from the old vendor before moving the account?

Harry Sit says

The receipts are between you and the IRS. The HSA custodian does not ask for receipts when you request a reimbursement.

RS says

I checked with employer HSA provider on how to withdraw amount from HSA to personal checking account. I want to open new HSA in Fidelity and mail a personal check together with a rollover contribution form to my new preferred HSA provider. I do not want to close the Employer HSA account.

Employer HSA provider said: You can transfer your HSA (Health Savings Account) funds to your new HSA administrator. You’ll need to contact your new administrator and obtain their Trustee to Trustee Transfer form. Your new administrator will give you information on when your funds will move to your new account. It can take 2-3 business days to process your request once received. Please note that there is a $25.00 fee for outgoing HSA transfers, the fee will be deducted from your available balance.

Request funds from my HSA screen is only to request funds for expenses that have been paid out of pocket. You will follow the steps above to transfer the funds to another HSA.

Is there a way to withdraw the HSA amount to my personal checking account

Harry Sit says

To the HSA provider, there’s no difference between requesting reimbursement for expenses paid out of pocket and requesting a withdrawal to your personal account, which you roll over to another provider yourself. They will send you money and treat it the same way on the year-end 1099-SA tax form. When you file your taxes, you tell the IRS how much was for expenses and how much was rolled over. Some HSA providers, such as HealthEquity, have an online interface for you to enter eligible expenses but no interface for a withdrawal for rollover purposes. You can make it look like an expense in the provider’s online interface. See comment #50.

RT says

One can use fidelity app on mobile to snap pic of the check and specify that this is 60 day rollover

Super useful

James says

My employer used HSA Bank last year, but this year moved to a new HSA provider. If I do a rollover to avoid any transfer fees, I like the idea of asking HSA Bank for a distribution for my entire account (as if I were reimbursing myself for a medical expense) and then sending a personal check for that amount as a rollover to the new account.

If I leave my HSA Bank account at $0, do I need to worry about any monthly fees or account closure fees they could charge? I can see how having the account at $0 would make sure they do not take out any fees from the account funds, but could they bill me and possibly affect my credit history for not paying? Just wanted to see if there is any issue in leaving my account at $0 and then “forgetting about the account.” Thanks!

Mike says

Harry – thank you – I do the indirect rollover as you describe but I can’t figure out how to report it properly in TurboTax online. It records the 1099-SA (distribution) amount, but I can’t find any way to tell TurboTax that the amount was rolled over to another HSA. I can’t find anything in TurboTax’s help or community addressing this either.

Harry Sit says

I added screenshots from TurboTax download software. TurboTax download software is both less expensive and more powerful than TurboTax Online.

Daniel says

I just wanted to say thanks. I’ve been wanting to make a rollover for similar reasons, but the source account charges transfer and rollover fees. I’ve been wondering if I can use a regular reimbursement distribution as a rollover, and seeing the mechanics, I plan to move forward with this approach.

Bill W says

“You can do this DIY rollover only once every rolling 12-month period.”

Do you know if this is per SS#? In other words, can both my spouse and I each do a rollover from and to our own HSA accounts within the same 12-month period?

Harry Sit says

It’s per SS# because an HSA is owned by only one person. Whether a distribution is taxed only depends on what the owner does with the distribution.

Chuck says

Huge Thank You for this info here! I have Cigna/HSABank through my present employer and it’s “criminal”, IMHO, what is being paid on cash (.05%) sitting in the HSABank cash account, when rates are 5%+. I can open a Schwab HSBA, but they charge $12.50/qtr for that account…again, ridiculous. Fidelity has no fees, so will likely add an HSA there. This is a small inconvenience to do the “free” transfer, but worth it. Thanks again!

marty says

Looks like this doesn’t work for Healthequity anymore. Tried reimbursing to zero the account and an error popped up saying they are holding the last $25 for an account closure fee. Sigh.

JJ says

I asked Fidelity, and they said they will reimburse you the transfer fee from your previous custodian once a year.

Bobby T says

Per https://livelyme.com/pricing, it looks like Lively HSA does not charge a fee for trustee to trustee transfers:

> Funds Transfer (Out/In) Fee $0

which avoids the need for the rollover approach (and once per 12 months restriction) when transferring from Lively to Fidelity. Just posting in case it helps another Lively user that arrives here.

Mick says

Can I make a 60 day rollover deposit to Fidelity HSA for annual max amount using personal funds BEFORE I max out the company-chosen HSA and get its distribution? The numbers shake out end of year but I want to know if there are any problems with doing this. Will max out company’s HSA in a few weeks then take a distribution check, but why not get money into Fidelity now so I can start investing that money, and really never have to worry about 12 month timing?