Some of you may remember this post I wrote last year: Circular Reference In Self-Employed Health Insurance Deduction Under Obamacare Premium Subsidy. It pointed out a circular reference math problem between the premium subsidy under Obamacare and the health care premium deduction for the self-employed.

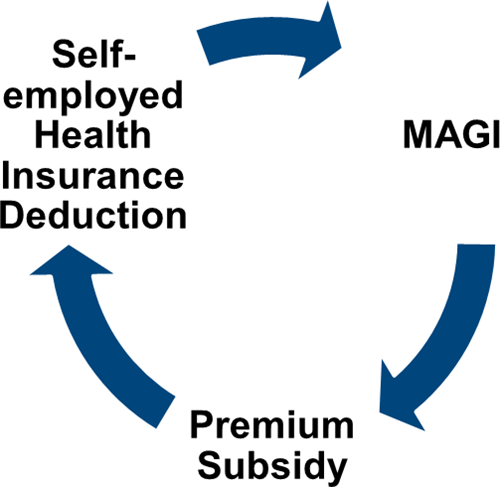

If you are self-employed, the health care premium is deductible, which lowers your MAGI, which potentially qualifies you for a premium subsidy, which lowers the amount you can deduct because you can’t double dip, which raises your MAGI and reduces your premium subsidy, which increases the amount you can deduct, and on and on.

I wrote last year the math problem can be solved iteratively by a computer but it would be difficult to do on paper forms and worksheets.

The IRS issued guidance on this issue recently in Rev Proc 2014-41. First it acknowledged the circular reference problem:

Thus, the amount of the § 162(l) deduction is based on the amount of the § 36B premium tax credit, and the amount of the credit is based on the amount of the deduction – a circular relationship.

It confirmed iterations are the right way to solve it:

… … If the change in either the § 162(l) deduction or the premium tax credit from Steps 2 and 3 to Steps 4 and 5 is not less than $1, repeat Steps 4 and 5 (using amounts determined in the immediately preceding iteration) until changes in both the § 162(l) deduction and the premium tax credit between iterations are less than $1.

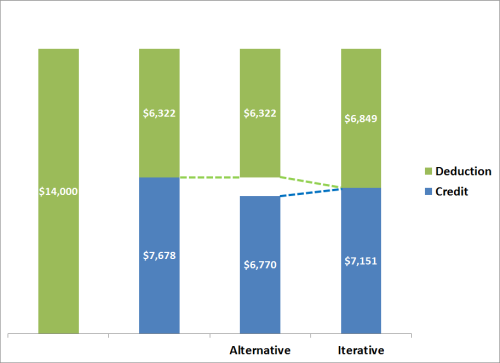

For those who don’t want to do the math over and over, the IRS also gave an alternative method, which basically stops after two iterations. Unfortunately, the alternative method gives you a lower subsidy and a lower deduction. If you want the full credit, don’t be lazy — do the math!

Graphically speaking, the alternative method and the iterative method work like this, using one of the examples given by the IRS:

First you take the whole unsubsidized premium as a deduction. It gives you a tax credit, leaving the rest as your deduction. Taking the smaller deduction gives you a smaller tax credit. The alternative method just stops there.

More iterations will drive up both your deduction and your tax credit. Eventually they converge. In the example given by the IRS, if you don’t do the extra iterations you will leave on the table $381 in tax credit plus $527 in tax deduction.

Iterations are easy to do for a computer. I expect the tax prep programs such as TurboTax, HR Block, and TaxACT will incorporate this when they come out later this year. It will be an interesting test to see who’s on the ball, because not doing it the right way can mean a difference of $500 in how much tax you pay.

[Update:] Now we know which software programs took on the challenge and which dropped the ball. See Tax Software Bake-Off: Self-Employed Health Insurance and ACA Premium Tax Credit.

Reference: Rev Proc 2014-41, Internal Revenue Service

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Don Luke says

Thanks for your follow-up. When I read your post last year, I wondered, “Could we make this harder?” I guess the answer is “Yes.”

Since the example seems independent of external factors, why won’t the following approach work? Say my medical expenses are $11,720, and using the example, could I take (6849/14000)*$11,720 (i.e. $5,733.59) as my deduction and (7151/14000)*$11,720 (i. e. $5,986.41) as my credit, provided my other tax factors put me in the range where I had to contend with this? This approach seems easier and more straightforward than iterating numerous times. How many more iterations to get convergence? Would my tax saving be $418.57 (11720/14000)*$500)? Even an additional $419 would be worth iterating for!

(Imagine a new T-shirt for CPA’s “I iterate, Do You?”)

Harry Sit says

The example is very much dependent on one’s exact income, not just a range. Sorry you have to use software that does the right math. Maybe I should build a spreadsheet or web page for this.

JWoodring says

A spreadsheet for this would be a great tool for those of us who are self-employed and are receiving premium credits!

Worthless Degree says

Thanks for the post. I echo JWoodring’s sentiment. Hopefully, one of you geniuses can make this Excel spreadsheet or some kind of calculating program. Otherwise, hopefully someone can verify whether Turbotax is doing the calculations correctly when it gets released. Unfortunately, I, with an applied mathematics masters degree from an Ivy League School forgot all his skills that day he graduated.

Ken says

My thoughts based on the above is that if your income is going to be close to the ceiling for your household size, another words close to the 400% ceiling for any tax credit it may just be better to forgo the credit and be able to take the full amount of your health care payments as an adjustment.

We are self employed and in 2015 we will drop from a home of 4, me, spouse and two children to just the two of us. That dramatically reduces the income level that qualifies for a tax credit. Ex. Fam of 4, approx. $94k for 2014, Fam of 2, approx. $60k for 2015. Since this ruling only applies to exchange policies due to the double dipping issue, there would be NO add back or iterative calculations if we chose a direct pay health plan and paid the full amount on our own. I wonder if it would work out better even if we just barely qualified for a credit but did not participate in an exchange. We could deduct the full premium paid as a direct adjustment if we avoid the exchange. The flip side is we would loose the 9.5% max of income health insurance premium limit if we did not go through the exchange. At some point it comes down to what is the difference between 9.5% of your income, what you actually pay for premiums and deduct as an adjustment and the final impact it would have on your tax bracket.

Harry Sit says

The whole purpose of worrying about the 400% FPL is to qualify for the premium subsidy tax credit. Your deduction is reduced 1:1 only if you qualify for the credit. Because $1 credit is always better than $1 deduction, I don’t see how forgoing the credit will do any good.

Boggled says

Self-employed in California. We had to guess our 2014 income in 2012. Then, our premiums were adjusted by Covered California. Now, instead of paying $800 per month, we are paying $300 per month. When we do our 2014 return, what will be our self-employed health insurance premium deduction on Page 1 of the 1040? Am I going to be stuck paying federal and state taxes on an extra $6,000 of income? Should I have paid 100% of our premiums all year and then taken the tax credit later?

Harry Sit says

The tax software (or accountant using software) will tell you what the deduction should be. Depending on your actual income, you may end up paying back the $6,000 in full or in part. Paying 100% up front doesn’t make you better off financially, except the budgeting and surprise factors.

Lee says

Please help

(T) & another are each 50% shareholders in s-corp

There are 2 f/t EEs who get their insurance thru the mrkplace

One of the shareholders gets ins thru the mktplace for he and his family & the business reimburses

THe other shareholder does not get his hlth ins thru the mktplace & the business pays his premiums

For W-2 purposes do these reimb premiums get reflected in box 1 only & then reported on tx rtn as wages and also as above the line deduc?????

Someone recently told me that the reimb premiums had to be reflected in bxes 1,3 & 5 and are not an above the line deduc

Any advice would be appreciated

Harry Sit says

Sorry, don’t know the answer. Please consult the business’s CPA.

Edmund says

Harry,

this issue affects me directly as I am self-employed S-corp owner and take deduction as well as subsidy. Do you know whether or which personal tax software deals with this problem correctly?

Thanks.

Harry Sit says

I haven’t tried any yet.

Freelancer says

Just a heads up — I use H&R Block software for tax prep and I just ran a set of hypothetical numbers through – for purposes of the calculation I assumed a single taxpayer, $30K net income from self-employment, $500 monthly premium, & $400 monthly benchmark premium level (2nd lowest cost silver plan).

The H&R Block numbers came up $358 short – $2120 deduction, $3761 credit — so basically the geniuses who design the software appear to have embraced the “alternative” rather than “iterative” approach. I haven’t worked out the math independently — but that $358 certainly is well within the range of the difference between alternative & iterative results.

As it happens, this won’t matter this year for me — my MAGI this year will be too high to qualify for a tax credit this year — but I do want to make others aware of the need to double check their software’s calculation. I would expect better from the software programmers.– they might address this issue with an upgrade, but as of right now it looks like they took the easy way out. (I’d note that H&R Block still offers a “maximum refund guarantee” — so at least in theory, purchasers of their software could simply look to H&R block to pay the difference. )

CJ says

thanks for the update….i would appreciate if someone can check taxact and turbotax can do the iterative approach

Freelancer says

I called H&R Block and was advised that issues concerning calculation of the subsidy and self-employed health insurance deduction were being addressed in the next update, now due on January 22nd — so I will test again after that point.

A contributor to my blog has corresponded with TaxAct and has now been informed that as a result of his input, their programmers will be correcting the problems with that software.

We also have a TurboTax user who has been told to expect resolution of current problems with the next update.

I am following this issue on my blog at https://obamacareguide.wordpress.com/2015/01/15/tax-software-fail/

Freelancer says

Both TurboTax and HR Block software had updates pushed out today, and neither program is doing any sort of calculation or reconciliation between the Line 29 (self employed health insurance deduction) and form 8962.

This is based on my own experimentation with HR Block and a report from a user (“Richard”) to my blog at https://obamacareguide.wordpress.com/2015/01/15/tax-software-fail/

Michael says

Great post, still trying to wrap my head around it. Anyone have an idea of how the following situation works?

1) I took excess advanced payments during 2014

2) Have now determined that I owe $x.xx (8962, line 29)

Is the $x.xx that I now owe deductible as Self Employed Health Insurance? Or did I shoot myself in the foot by taking too much credit initially?

Harry Sit says

It is. Deducting it makes you qualify for a little more credit, which makes you deduct a little less, which gives you a little less credit, which makes you deduct a little more … It goes around and around and then it all stabilizes in the end. In most cases it doesn’t matter how much advance credit you took. If anything you can only be better off by taking advance credit but never worse off.

Michael says

Thanks for the reply Harry!

Does this logic make sense?

1) On my initial 1040 I enter ‘0’ for the Self-Employed Health Insurance deduction

2) My 8962 says therefore says I owe, say $900

3) I rework my AGI on the 1040 by taking the $900 deduction

4) I rework my 8962 with the new MAGI

5) Repeat until settled…

Freelancer says

Are you saying that your APTC covered 100% of your insurance premium?

If not, you can start by entering the actual amount you paid out of pocket for the SEHI deduction.

So hypothetically if you paid $50/month for insurance, with an APTC of $350 — (total premium= $400) — then you could start be entering $600 as the SEHI (12 x $50).

Then let’s say that the 8962 says you owe $300.

Now you add that $300 to the $600, enter $900 — and see where that leads.

The numbers will seesaw back & forth, but will generally resolve in about 4-6 iterations. (You stop at the point when there is less than $1 difference between results)

Michael says

Yes, APTC covered 100% – failure/curiosity on my part to update income fluctuations throughout the year.

In my case, I was able to get the numbers to settle down to the penny after 7 iterations. I did discover that I had to round to the nearest penny while making calculations – if I rounded to the nearest dollar, the closest I could get the numbers to settle was within ~$3.

Thank both of you so much for the very useful info, I’m glad to have this sorted out!

Cary Snyder says

I’m stymied! I am using software to determine my SE health insurance deduction and premium tax credit. I took no advance premium payments and paid about $5,700 in premiums.

When I let the software determine the proper outcome, I am allowed only $3,015 as an SEHI deduction, and based on the higher AGI that results, qualify for no premium tax credit.

This can’t be right, can it?

Freelancer says

No, that’s definitely wrong — if you paid $5700 in premiums and don’t qualify for a credit, then your SEHI should be $5700 and credit -0- — just as it would have been in past years.

If you take the full $5700, does that bring your AGI down enough to qualify for a credit? If so, you would then have to go through the iterative procedure to figure out how to reconcile both credit and SEHI adjustment. What software program are you using?

Cary Snyder says

I am using Intuit ProSeries. When I go through the iterations, this is what I get. Reduced deduction and no credit. And I am on the 400% poverty line–the full SEHI deduction gets me the credit, but the program isn’t creating the credit–just reducing the deduction. Sounds like an issue for Intuit?

Harry Sit says

That’s not right. Ask Intuit then. As you see in the bar chart, if you qualify for credit you will have part of the deduction replaced by a credit, which is better for you, but you shouldn’t just lose deduction with no compensating credit.

Karen in NC says

Cary,

I believe this can be possible if you’re a >2% shareholder of an S-corp that pays or reimburses you for your premiums and you’re “straddling” the 400% line.

This is because these premiums are reported to you as wages on line 1 of your W2. Once you claim the subsidy on your tax return, it reduces the amount (that is already included in your W2 income) you can deduct as the SEH deduction. So any subsidy you’re qualified for is basically switching those “wages” on your W2 from deductible premiums to regular wages, which can put you over the income threshold for getting subsidies.

That said, I don’t know if it really matters to >2% shareholders of S-corps, because if the S-corp doesn’t claim the full premiums as wages on the W2 (and pass it through to the employee that way), it’ll have to pass that “income” through to the shareholder some other way, so it may end up being a wash. Unless there’s some other business expense that the S-corp could use the money for.

David says

Hello:

I am a bit confused here.. I am 1099 self employed and qualified for the credit based on MAGI in 2014. I actually earned slightly more this last year and will now have to pay back some subsidy.

My accountant just sent over my tax return for review and on line 29 for Premium Deduction it shows only the premiums I actually did pay…..

It also shows on line 29 of 8962 that I will need to REPAY $ 144 of assistance I did not qualify for.

My accountant said that I DO NOT get to add that 144 onto the deduction because I will be paying it in “2015” but I can deduct it, in addition to any 2015 premiums next year. Does that sound right?

Am i Missing something here?

Harry Sit says

Send the link to IRS Rev Proc 2014-41 to your accountant and ask him or her how he or she applied it to your return?

Harry Sit says

The tax software results are in. See Tax Software Bake-Off: Self-Employed Health Insurance and ACA Premium Tax Credit.

Priscilla says

As far as I can tell, the special calculations do not resolve all situations because the ptc doesn’t taper down to nothing but instead drops to nothing at the threshold. and because premiums are so high, a one dollar overshoot in MAGI can mean a $9000 difference in your self-employed health insurance deduction due to the loss of the PTC. So then you’re back down under the threshold, qualifying again for the PTC and losing most of your deduction. An unresolvable circle.

what I want to know is, is it acceptable to take a smaller PTC, less than the 9.69 percent of MAGI? I don’t see any mention of this anywhere, but it seems like the obvious solution.

Priscilla says

oops. should have said :

what I want to know is, is it acceptable to take a smaller PTC, that is, to contribute more than 9.69 percent of MAGI? I don’t see any mention of this anywhere, but it seems like the obvious solution.

Tom says

Well, this problem is still a problem.

I just used TurboTax for my 2021, and it seems it is still using the “alternative method” rather than the full iterative method.

BTW, TurboTax was able to handle the situation for an S-Corp owner who is an employee for income tax purposes, with health insurance reported as W-2 box 1 income (with informational note on the amount in box 24). But it does so by inputting it as a Schedule K box 17 input, which TurboTax for Small Business does not actually generate in that same box 17. So S-Corp owners can take the health insurance deduction for the self-employed (now on form 1040, Schedule 1, line 17), despite the fact that the amount was reported on a W-2 (and theoretically on a Schedule K) and is not reported on Schedule C. Very helpful IRS notice 2008-1 gives very detailed breakdown of precise scenarios when S-Corp owners can and cannot take the deduction.

Still, we paid $3,482 in premiums and Turbo Tax calculated a $423 premium credit, but TurboTax but only $2,922 as the health insurance deductions, leaving $137 on the table.

No way to manually adjust the numbers in TurboTax, even if constructed a little model in Excel to do the iterations, I so I decided it was small enough to let it slide.