Reader Ben asked me whether it would be a good idea to invest some of his spare cash in peer-to-peer (“P2P”) lending, such as Lending Club or Prosper.

Lending Club and Prosper offer a platform where investors can lend to a pool of individual borrowers, bypassing banks. They are both pretty transparent with their loan performance data. This chart from Lending Club shows a seasoned portfolio had a median return of 6.9%, with the 10th percentile at 5.4% and the 90th percentile at 8.6%.

Considering that bank accounts and bonds don’t pay that much these days, this level of returns look pretty good. When I asked Ben how much money he was thinking of investing in P2P lending, he said $2,000.

I told him no, because there’s a better way to make a higher return with no risk and less work.

Here’s how.

[Update on April 23, 2016: Santander Bank notified customers it will discontinue this product after June 2016.]

Go to Santander Bank’s website: www.santanderbank.com. Santander (pronounced as “saan-taan-DARE”) Bank, formerly Soverign Bank, is a bank headquartered in Boston. It’s owned by Santander Group in Spain, which owns Banco Santander, the largest bank in the Eurozone.

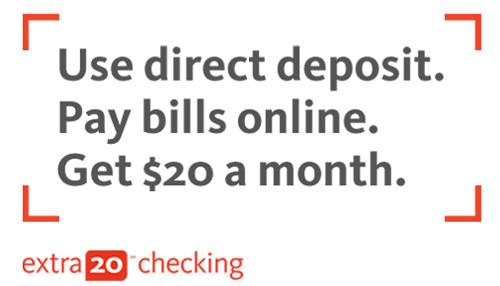

You will see this on Santander Bank’s home page:

Clicking on Learn More from there will show this:

That pretty much sums up the deal:

- You open the extra20 checking and savings account package.

- You make direct deposit(s) totaling $1,500 or more in each statement period into the checking account (ACH push credits into it from some banks or credit unions also count; see below).

- You use its bill payment service to pay two bills, which can be scheduled as recurring.

- The leftover money can be pulled back by ACH as there is no minimum balance requirement and no monthly fee if you have the $1,500 direct deposit.

- The bank will credit you $20 each month into the savings account after the statement closes.

That’s it. Investing Ben’s $2,000 spare cash this way will earn $240 a year. That’s a 12% return, easily beating P2P lending, with full FDIC insurance.

It requires less work than P2P lending as well. The direct deposit, the recurring bill payments, and the ACH pull out can all be set on auto pilot up front. Once it’s set up, it just runs on its own.

I’ve had the extra20 package since November 2013. It works exactly as advertised.

Now some pointers if you also want to get a better return than P2P lending with no risk and less work:

1. After you do the online application, you will get an email with a link to your online application. It’ll process faster if you go back in and upload the identification documents it needs: a copy of your driver’s license and a utility bill.

2. After you get the email saying your application is approved, just wait. You will get a letter in the mail with your account numbers. You will get another letter in the mail telling you that you use your Social Security Number as your login ID when you register for online banking. You will get a third letter with your temporary password. Register for online banking only after you get all three letters.

3. The routing number is 231372691. Use it to set up your ACH. You will also get it in one of the letters.

4. If you are not familiar with the Fiserv CheckFree bill payment interface also used by many other banks, scheduling a recurring bill payment can be a little unintuitive. First you add a biller under “Add a company or person to pay.” Then you go to Manage My Bills, select the biller, and then “Add an automatic payment.”

You can pay the same payee twice on different days in the statement cycle or you can pay two different payees. Most bills (electricity, Internet access, credit cards) take partial payments. You can schedule two fixed dollar payments from here and still pay the remainder the usual way from your current bank.

5. Statement period starts from the date your accounts are opened.

6. If you want to use ACH push as direct deposit, it works from some banks or credit unions but not from some other banks or credit unions. The ones that don’t work code their outgoing ACH transfers as P2P payments, which Santander doesn’t count as direct deposit.

Of course the 12% return with FDIC insurance is limited to $2,000. But if you are not willing to risk more than that on P2P lending anyway, it makes sense to go with the bank accounts.

P2P lending would only make sense when you are investing $20,000, or ideally $200,000, where a 7% median return would make a difference, but then again you would have to question whether you really want to risk that much in P2P lending.

If you still want to invest in P2P lending, sign up using my affiliate link (tongue in cheek).

[Photo credit: Flickr user Jeremy Vohwinkle]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Marc says

Sounds like a good deal as long as you have the ability to make a $1500 ACH push in each month (or get direct deposit of at least that amount from your employer). Otherwise, getting hit with a $10 monthly account service fee does not sound like fun.

Harry says

I can’t think of anybody who would not have the ability. If your own bank doesn’t provide free ACH push out, you can set up automatic investments and automatic withdrawals in a money market fund or a brokerage account.

Ben says

It also sounds like you dont have to keep the $1,500 in there. You can make the ACH push deposits, then the bill pays, then pull the money back out and start the process again next month.

I just signed up…ill see how it goes…..

Michael says

Clever. If you pay two bills that total less than $20, you can automate the process without ever having to add new money once you get the process started. Push $1500, pay 2 bills, get $20 deposited, pull $1500, re-push $1500, and repeat.

Harry says

The $20 credit goes into the savings account, not checking. So you need to add an auto transfer from savings to checking in your setup. I just push $1,500, pay 2 bills (say total $100), pull $1,400. The $20 credits pile up in the savings account earning nearly nothing. I’m OK with it.

harry @ 4HWD says

Sounds good to me. Is there a hard credit inquiry though when you apply for an account?

Harry says

No hard inquiry.

Ben says

I started the account opening process last night (also uploaded the documents as described). Just got the account is approved email today and now just waiting for my log in information in the mail.

Pretty easy process.

Now just waiting to enable my automation…..

Does a push transfer from Capital One 360 to Santandor count as ACH? I assume so…

I have also never used bill pay in the past and dont have any bills which are low in $ amount and consistent each month. Wondering if a Credit Card payment would work? I have 3-4 ‘back of the wallet’ cards I can just put lunch on once a month.

Harry says

Yes all push transfers count. Most bills (electricity, Internet access, credit cards) take partial payments. You can schedule two fixed dollar payments from here and still pay the remainder the usual way from your current bank.

John says

When you mention ACH from Capital One 360 works is it the same thing as “P2P payment” link on the capital one 360 menu?

washerdreyer says

I agree this is a good offer and one I’ve been considering taking advantage of. That said, its not totally clear to me that it’s better than, say a $150 bank account opening promo (http://su2c.53.com/) that only requires 3 bill pays and one direct deposit eve (plus they make a $150 charitable donation). Haven’t fully investigated terms & conditions, but it seems like the effective interest rate is going to be higher (say it’s $150 in three months, some information makes it appear to be $150 in mere days, but I can’t tell if there’s a minimum period to keep the account open or an account closing fee), and there is no risk of the bank deciding they are no longer interested in offering this deal after they pay you, as there is in any given month with Santander.

Ben says

I thought of that as we’ll. they might cancel this program if too many ppl are taking advantage of it. If that’s the case, I’ll just close the account and move on.

dan23 says

Not sure whether those seasoned returns factor in time to invest your money which makes IRR significantly lower.

In addition, heavy computer based note picking going on lately (many notes are fully subscribed within minutes), so if someone is not using an automated tool to buy notes, they are likely missing the cream – so I expect the average investor’s return to be lower than the average return going forward.

Ben says

uh?

Harry says

Ben – @dan23 is talking about P2P lending, not Santander.

@dan23 – I bet the chart only starts counting when the money is invested into a note.

Jim says

Article discussing the idea that Banco Santander may actually be a safe investment again. Not exactly a raving review, but more of a “things are looking better than they were last year.”

http://247wallst.com/banking-finance/2013/12/10/is-banco-santander-becoming-safe-to-invest-in-again/

Tyler says

I set my bill pay up to send deposits to my primary rewards checking account. My deposits alternate between $750 and $770 biweekly. The bill pay deposits hit same day (perhaps they are being sent electronically?). Net result, I cycle $1500 through the account each month for a grand total of four days of lost interest and get $20 each month for doing so. Annualized return of approximately 120%.

Lynn says

Tyler, did you list yourself or your bank as the biller? In trying to do this myself, it appears that they will physically mail a check to my institution for deposit. This makes me wonder how your bill pay deposit appears so quickly.

Harry Sit says

The date you specify in the bill payment system powered by Fiserv CheckFree is the “arrive date.” If they must mail a paper check, they mail it a few days before.

Lynn says

So it seems a little risky to schedule the bill pay “arrive date” to be the same date as the deposit (assuming there is no buffer in the account). If the mail processes a little quicker than normal, you’d get hit with an NSF fee, right? I’m a little disappointed that Santander does not provide an option for transferring funds to another institution. Having checks mailed to oneself seems awfully inefficient.

Ben says

@Lynn. Can u not just use the bill pay process to pay a partial credit card? Seems complicated to have to pay yourself via a paper check each month. I just set up a recurring $5 payment to my credit card (two different days) to meet the BP requirements.

Lynn says

@Ben – Yes, paying a couple of bills through Santander is not a problem. The question is how to get back the remainder of the deposit afterwards. You either have to set up an ACH pull (which my local bank does not offer), or you have to billpay yourself. Not impossible by any means, just awkward.

Harry Sit says

@Lynn – I read Tyler’s comment “bill pay deposits hit same day” as saying the bill payments arrive at the destination on the same day as scheduled, not that they are scheduled on the same day as the deposits into the Santander account. Yes you should leave a few days as buffer there.

Many places will do ACH pulls. A brokerage account for example.

Ben says

I received my extra20 savings and checking welcome package in the mail yesterday. As stated in the article, you just need to sign the signature card and mail it back

They have a strange privacy policy stating where they can provide your information to affiliates. It stated you need to opt-out by calling the number listed. I called and the out-out process was simple (just spoke to someone on the phone).

Just a heads up for those thinking about doing this process above.

Ill post a few more times with an update on the set up process.

Jim says

I applied on Feb 27 and have received a welcome packet with the signature pages. About how long does it take to get everything else? I have not gotten a temporary password for instance.

Harry says

About two weeks from the date the accounts are opened.

Ben says

2 weeks feels about right. I received my welcome packet and log in information saying to use my SSN. Still have not received my temp password though, which comes in another letter

I did also get the associated debit card and activated that, but it was optional when you set up the accounts

Ben says

I received my temp Password over the weekend. Was able to get logged in and view my two new accounts (extra20 savings and checking).

I also set up the Bill Pay as described in the article. It was not very intuitive as mentioned, but I got through it. My first two bill pays went through today (credit card payments, partial) and ACH push has been scheduled from my main online bank.

I think Im all set….just need to set this up so that it occurs during my statement period, which is yet to be determined. My first transfer and bill pay were manual so I could learn the system. Once I know when my statement period starts and ends, Ill set up the automatic ACH and Bill Pay.

On my way to an easy 12% on my investment principal…all while being insured. If you are an organized person and dont mind spending ~1 hour (total ‘touch’ time) getting this set up, I think its worth it. Hopefully they will not cancel this program…

BH says

Can anyone comment reguarding the amount of time they leave their ~$1,500 in the extra20 account before pulling it back into another bank?

Harry says

I give it about two weeks. My billpays sit in the middle of the two weeks.

BH says

Both $10 bonus’ posted to the savings account today.

Thanks for the tips here!

Matt says

I’m still in the middle of the process. I received two signature cards and two debit cards. I also received a letter indicating the two separate accounts will be linked to a single login. Did anyone else experience this?

Harry says

Matt – The package includes one checking account and one savings account. That’s two accounts, no surprise there. Your bonuses will be paid into the savings account. Did you open the checking account with a joint owner? If so, that explains the two debit cards.

Matt says

Not a joint account. Both debit cards are in my name. One more oddity – I’m not even certain I elected to receive debit cards. I thought I opted-out because I didn’t plan to use them. I’ll report back when I can log in.

Ben says

@Matt: It sounds like you (or Santandar by mistake) has set up two Extra20 Checking accounts. You should actually have 1 Extra20 Checking account which is linked to an Extra20 Savings account.

Once you get your log in info, I would quickly log in an check. I believe there are fees ($10/month) if an Extra20 Savings account is not linked and Extra20 Checking account without a balance of $100.

I did receive 1 debit card (linked to my Extra20 Checking Account). Then a few days later my log in information arrived in the mail.

BH says

Just received an email from this bank stating they would now pay me $10 if I used my checking debit card for at least 3 purchases in 60 days.

Will be using the debit card for the work lunches I was already planning to buy this week 🙂

FYI – during sign up for the extra20 accounts, we are asked if you would like a debit card to be included. I opted in for it. The email I mentioned above came about 3-4 months after I opened my extra20 savings and checking account.

Adam says

Thanks for providing this info…I think I’ll sign up!

However, your article poses an “either/or” decision between p2p and the Santander account…but really, Ben could still do both as there is no requirement to have his $2000 tied up at Santander. He could set up an account with Santander and also invest in p2p lending. Alternatively, he could put the $2,000 in Mango.

Harry Sit says

You have to prioritize. After 401k, IRA, HSA, Santander, Mango, Union Plus, BBVA, index funds and ETFs, student loan, home downpayment, pretty soon you exhaust the amount of money available to invest before you come down to P2P lending.

jz says

On 11/25/14, I had a charge of MONTHLY MAINTENANCE FEE FOR PRIOR PERIOD for $10. I did the ACH transfer from capitalone as usual, but I noted the transaction is “MY NAME P2P 141027” instead of “CAPITAL1 TRANSFER ###########” for October ACH transfer.

Also I forgot to pay two bill payments in October. I don’t think this caused the fee.

Can anyone confirm ACH may not work anymore and we have use real DD? Thanks.

B says

It still worked for me….and has been since Feb of this year. I use Cap One as well and the Transaction showed as “CAPITAL1 TRANSFER ###########”. It did not say “P2P” anywhere in the transaction name.

I also think you still need to pay 2 bills, so I suspect that might be the first item to target….

Also – my accounts account at Cap One “pushes” the funds to the Satnan. account….not sure if you are “pulling” from Santan or not….

jz says

Thanks, B. I pushed it from Cap1 to Santander. It was fine until October, probably because I didn’t make 2 bill payments. I’ll report back for Nov. transactions.

jz says

So in December, I got the bonus. I think I didn’t get it last time, it’s because of the transfer from Cap1 to Santander was shown as “MY NAME P2P 141027”. For Nov transfer, it was shown “CAPITAL1 TRANSFER ###########”. I’m not sure if that was caused by Santander or Cap1.

Harry Sit says

Which code to use for the ACH credit is controlled by the originating bank, in your case Capital One. There’s a new code for P2P transactions. If you find that your bank uses the P2P code which makes Santander not give you the bonus, you will have to find a different bank that doesn’t use the P2P code. It looks like Capital One used the P2P code in October but it reverted back to the transfer code. Or did you do the transfers differently in October?

jz says

I didn’t get the bonus by transferring the money from cap1 for Jan and Feb since it uses p2p code now. Just wanted to let people know that. I’ll switch to either bank of america or chase. Can anyone confirm Bank of America transfer works? Thanks.

BH says

I am aware of the CAP1 changes to make their transfers now appears at P2P vs DD. However, I am still getting the $10 DD Bonus and $10 BillPay Bonus. The bonuses came in today for March. My transfers now showing CAP1 in the name vs my name (this was effective as of Feb).

So I have now gone an extra 2 months longer than expected…I assumed I would just cancel this all together once these changes went into effect and I would no longer get the DD Bonus.

BH says

I know this is an older post, but I was just running the year end benefit for this (I signed up in late Feb, first benefit month was March).

So = I earmarked $1,534 for this. Each month, the money is pushed into Santandar, sits for about a week, then comes back to my primary bank account. Next month, repeat. I pull back $1,524, so $10 is left for 2 bill pays of $5 each. Works like clockwork.

Summary = 10 months * 20 = 200. Plus another $10 promotion they ran w their debit card. So, $210/1534 = 13.6% return. Take out the taxes (this extra20 income counts as interest income) and its around a 10% effective return.

Not bad considering the risk. Really didn’t think this program would last this long….im happy. Thanks finance buff!

malav shah says

for my other bank, cap 1 shows Direct deposit so not sure if it gets changed or it depends on bank to bank. Do you still get p2p even if you do ach push (instant transfer) from cap 1 360? Please let me know, as i have to decide to open the account or not based on this..

thanks

caba says

I can confirm that it still works with CapOne360. I just got my extra $20 bonus from a Capital One 360 ACH linked account transfer (not P2P) in April. Pushed it in, let it sit for a couple days, pulled it back.

Jeremy Lee says

Thanks for this! One quick question: to qualify for the $10 via Billpay, do I have to use Santander’s Billpay system explicitly? Or could I setup auto-payments via my utility provider? I’d rather pay the bill off in full than have a portion of it paid via Billpay (since Santander Billpay cannot pay off the full balance due automatically)

Harry Sit says

You have to use Santander’s Billpay. Set up both. The partial payment from Santander will create a partial credit at the utility provider. When the utility auto-debits you the following month, the amount will be less.

Sam Seattle says

I’m late to the party, since I’ve just signed up, but thanks, Harry, for this great info.

What do you suggest to simplify my finance life? If I do a direct deposit of my paycheck to this bank and pay ALL my bills from this bank, wouldn’t it make life simpler, instead of logging in to this account to pay just 2 bills and then logging in to my Fido cash-management-account to pay the rest of my bills, and at the end of the month transfering leftover money to brokerage account to buy stocks?

Which bank/ brokerage cash mgmt acct do you use for salary direct deposit and pay all or most of the bills?

Thank you.

Harry Sit says

I use a credit union as my primary checking account. All my bills are automated. I don’t log in anywhere to pay them. The billers either charge a credit card or debit my checking account. I included how to automate the deposit, the two bill payments, and the withdrawal from Santander in this article.

Sam Seattle says

Thanks, Harry. Awesome automation system! Will do the same here, but does automating bill-paying make it less risky or more risky to prevent missing paying a statement? I want to prevent creating late fees.

You let companies debit your checking account? How if they continue debiting, after we terminate business with them, like the horror stories I heard on gym membership auto-debit? It’s not to worry?

Santander rep said, “ACH push-credits into the account” did NOT count. Only things like direct deposit from your employer qualifies. Based on your post, he is incorrect?

Since ACH push-credits qualify, why not open 1 for you and 1 for wife, get two times $20 each mo?

I was thinking of opening 1 for me and 1 for hubby. Will it be too much work?

Thanks.

Harry Sit says

Some ACH credits count; some don’t. It depends on which code the outgoing bank puts into the ACH.

Sam Seattle says

Harry, the sign-up process online and offline is exactly the way you explained it. Thank you so much for this info. I am looking forward to my first $20

Sam Seattle says

Is there a minimum balance requirement on the Extra20 checking to avoid monthly fee?

I want to figure out how much $ to pull back after 2 bills are paid.

I deposited $25 when I opened the account.

Then I direct deposited $1500. So the balance is now $1525.

After paying 2 bills of $50 each, can I pull out $1425 and make the balance zero, until the cycle continues the following month?

Harry Sit says

It would be much easier to simply deposit $1,500, pay two bills totaling $100, and pull back $1,400. Set it up to repeat every month and it makes the math easy. There’s no minimum balance requirement. Leaving $25 there at all times is not the end of the world. No need to wring out every last drop.

malav shah says

let me know if you are using cap1 360 for ach push?

just want to know if it still works or not as DD.

thanks

Sam Seattle says

No need to wring out every last drop. Wise thinking. Thank you again, Harry.

mahesh says

Can anyone tell me, ACH transfer(not P2P) from Capital One 360 works as DD? Please let me know.

Thanks

caba says

I can confirm that it still works. I just got my extra $20 bonus from Capital One 360 ACH linked account transfer (not P2P) in April. Pushed it in, let it sit for a couple days, pulled it back.

Chinmay Trivedi says

Does any body know if the ACH from Synchrony works as DD? I will be trying it soon, but if somebody has already done it, it would be of great help! Thanks. 🙂

Chris says

Hello, I am a new to your blog. I am truly excited of finding such a useful blog. I wonder is there anyway I can download all of your previous blogs all together for offline reading? Thank you.

Regards,

Chris

Harry Sit says

The “everything” link on the top right gives you a list of all the blog posts since the very beginning. I don’t know a way to download them all for offline reading.

TJ says

Is there a reason you guys are doing two $50 bill pays? i always just go in and do two $10 bill pays to one of my credit cards.

Harry Sit says

It’s really up to you how much you pay. One way or another you will have to pay the bill anyway. If you pay $10 instead of $50 from here you will have to pay $40 more from elsewhere. I don’t “go in” every month to pay the bills. They are set up as recurring payments.

TJ says

Thanks for the tip – automating that process would save a bit of time.

TJ says

Ok, now I see why I had the bills smaller. I have $750 of my paycheck deposited into this account every two weeks to trigger the bonus. I only keep a small buffer and I have the $740 of the 750 automatically ACH’d to my checking account the day after the paycheck is received, this is why I keep the bill pay’s small. I never thought to set up the auto pay though, that will save a few minutes every month.

John says

Where do you come up with this stuff? These sites and info, dude this is awesome! You got a follower for life thanks for posting!

Harry Sit says

It’s been reported that Santander will discontinue this product for existing customers after June 2016. I will close my accounts after I receive the extra $20 in June.

dus says

Harry

Given Brinks and NEtSpend curtailed their savings ceilings from $5K to $1K, starting JULY 01 2016, what are you planning to do with those accounts?

Thanks

Harry Sit says

Drop down to $1,000.

Lynn says

I was unable to close my account over the phone. They said I needed to visit a branch. After a little prodding, I learned that you can close your account by sending a notarized letter.

Harry Sit says

I closed my accounts over the phone just fine. Received the check in a week.

BHH says

Same here. Closed over the phone. Got a check a week later for whatever balance I had left.