If you are not married yet, and you plan to qualify for the premium subsidy under Obamacare, think twice before you tie the knot.

Marriage gets in the way of getting affordable health care in several ways.

Employer Coverage

If you don’t have health insurance and you marry someone who does, chances are you won’t qualify for the tax credit to buy health insurance any more.

Most employers offer coverage to an employee’s spouse but they don’t subsidize dependents or they subsidize dependents much less than they subsidize employees. At my employer, an employee’s cost to cover the employee plus spouse is not just 2x the cost to cover only the employee. It’s 3.2x. In other words the coverage for spouse costs more than double the coverage for the employee him- or herself.

Although covering a spouse through an employer can be expensive, the spouse won’t be eligible for the premium subsidy because the spouse has access to an employer coverage and the employee-only coverage is still affordable. This is Box B in the flowchart posted by Professor Austin Frakt at The Incidental Economist.

Afford One Policy With Two Incomes

Now suppose you are thinking of marrying someone who’s on Medicare but you are not. Medicare is an individual thing. If you are not 65 yet, you don’t qualify for Medicare just because you marry someone who does. You still have to buy your own policy.

Remember the subsidy, called the Premium Tax Credit, is calculated as the difference between the cost of the second least expensive Silver plan and a percentage of your income.

Subsidy = Cost – Income * x%

If you don’t marry, the subsidy is calculated from your own income. If you marry, it will be calculated from your two incomes combined, even if you are buying only one policy.

The cost of the second least expensive Silver plan for one person doesn’t change. Your affordability as measured by a percentage of your combined income goes up. Chances are you will no longer qualify for the subsidy when you marry. If you still qualify, the subsidy will be much less.

Afford Two Policies With Two Incomes

If you have a low income and you marry someone who has a higher income, your combined income may be over the 400% FPL cutoff. You lose the subsidy. That’s intended because we expect the higher-earning spouse to subsidize the lower-earning spouse.

Except even when the two of you each qualifies for a subsidy on your own, both of you may lose the subsidy when you marry. That’s because the subsidy’s cutoff point for two people isn’t twice as much as the cutoff point for one. The FPL for two is only 1.35x for one. When you put two incomes together, you can fall off the cliff together.

For instance suppose two of you have a MAGI of $35k each. If you don’t marry, both of you qualify for the subsidy. After you marry, neither of you will qualify for the subsidy.

Meanwhile the insurance company doesn’t care whether you are single or married. The cost to cover two people is simply the sum of the cost to cover each person.

Lower Subsidy

Even if you manage to stay on the cliff, you will still receive a lower subsidy when you marry, due to the fact that the FPL for two is much less than twice the FPL for one.

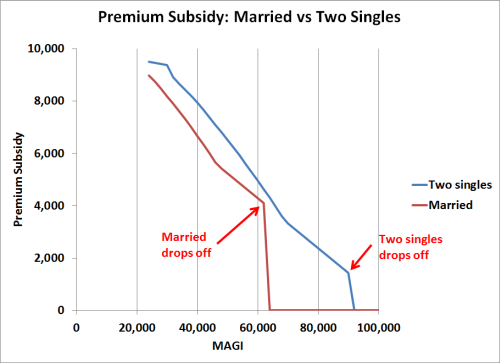

This chart shows the subsidies two people with the same income will receive when they marry versus when they stay as two singles. It’s based on quotes I see in my area for my age group.

You see two singles receive more subsidies than a married couple at all income levels. Two singles each with $20k in MAGI will receive $7,900 in subsidies between the two of them. If they marry, as a couple with $40k in MAGI, they only receive $6,700.

After the married couple drops off the cliff at ~$62k in combined income, two singles continue to receive subsidies until their income reaches $45k each for a total of $90k combined.

Married Filing Separately?

If you are thinking a simple trick of doing married filing separately will fix all these, no dice.

The law says if you file as married filing separately, you will not be eligible for any premium subsidy at all, regardless of income. Only domestic abuse, abandonment, or other special circumstances (pending divorce?) may be exempted from the requirement to file a joint return in order to qualify for the premium subsidy.

Reference

TD 9590, IRS

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Rebecca @ Stapler Confessions says

Good to know, thanks! We tied the knot 5 years ago, but we were thinking of going to the exchange for health insurance because it costs less than my husband’s employer’s plan (I was laid off, so I can’t get coverage through an employer). For some reason, I thought we could qualify for a subsidy, but I think I was using the single income x 2 formula in my head 🙁

David C says

There are multiple factors as to why covering a spouse typically costs more than just 2x the cost of the employee, of which lower employer subsidies are just one factor. For one thing, business have found that spouses (which are typically women) tend to have higher health costs that in turn require higher premiums from the employer and employee (http://www.forbes.com/sites/nextavenue/2013/04/25/employers-penalizing-spouses-for-health-insurance/).

I am sure the higher spouse premium also historically existed as a nudge to encourage spouses that can get insurance elsewhere to do so. Of course now many companies are adding an additional explicit surcharge (or rarely denying coverage like UPS) to reinforce that message.

Jackie says

My small company provides me insurance & pays all the premium, & also offers spouse insurance for $675/month, which I have to pay. Because my employee only premium is affordable, my spouse is unable shop on The Exchange & get any type of subsidy – even though our income is below the $62,040 threshold for 2. If company cancelled all our insurance, we could both be insured through The Exchange, with subsidy, for around $500/month – or 9.5% of our total family income. That is less than we are paying now just for spouse coverage at work. Why would I want my company to provide me with insurance? But if it is offered, I have to take. How can this possibly be fair? Also, since my husband is over 30, he can’t opt for catastrophic insurance.

Jerry says

My wife and I are in EXACTLY the same situation! Because it is “affordable” for me, it is considered “affordable” for her. THIS, EVEN THOUGH THE PREMIUM FOR “FAMILY” COVERAGE GOES UP TO 30% OF OUR MONTHLY INCOME!! This particular is getting almost NO ATTENTION IN THE PRESS! And there must be thousands of couples in the same situation.

Sarah says

I’m in the same boat. I’m a stay at home mom – my husband pays about 48.00 a month for his plan at work. If he adds me, it jumps to around 700 a month!! Because HIS plan is considered affordable to him, I don’t qualify for any type of subsidy on the exchange. If his employer would drop insurance, we would both have a plan for around 300 a month. It’s maddening!!

Lexi says

Same here. Family (3 people total) cost per mo is 6.5x as much as just my husband, the employee. This takes 40% of our income. It is outrageous. I had a navigator and lawyer tell me that this is a loophole and “not in the spirit of the law” but that it won’t be fixed/addressed because the issue of the ACA is so contentious in Congress.

Harvey says

one amplification might be in order here, relating to eligibility for a subsidy in a married setting. if the employer of partner #1 offers a plan that is affordable and has “minimum value” benefits, partner #1 would not be eligible for a subsidy, should he or she decide not to join the employer’s plan but instead bought a plan through the marketplace. BUT — for the spouse of partner #1, assuming partner #1 is in the employer’s plan but if that employer’s plan DOES NOT OFFER benefits to spouses, THEN the spouse (only) would POSSIBLY qualify for a subsidy through the marketplace. other eligibility standards exist for this to happen, primarily income qualification.

having “access to” an employer plan does not mean simply that an employer plan exists. it must also be offered.

best source on these things day in and day out is a good licensed agent who is qualified by the federal government to work with the marketplace. go to NAHU’s agent-finder.org and you can search by zip code for these agents.

Harry says

Thank you Harvey for the amplification. I edited the wording to make it clear.

Janet Smolenski says

So based on all of this information shared by so many couples, I feel as though we live in a system that PENALIZES people for marrying. They are discouraging marriage, plain and simple. And I don’t doubt that there was/is some awareness of that fact in the architecture of these programs and how they operate. It’s disgusting.

Alex says

DOESN’T THIS STINK! My spouse and I are in the same boat! He has “affordable insurance” through his company for himself and because they OFFER it to me as the spouse, (but don’t pay any of the spouses premium which is almost $700 a month) I cannot get a subsidy if I went through Obama care. You call that affordable care for all family members?? WHAT A JOKE and yes I have noticed as one commenter already stated, hardly no one is addressing this goofy loophole!

Employers are putting families into a trap they cannot get out of. The employer SHOULD NOT OFFER spousal insurance if they’re not willing to pay for any of it. This would allow the spouse to then qualify for a subsidy on Obama care. Do I have to divorce my husband in order to get affordable insurance? What a piece of garbage!

Sarah says

I’m in exactly the same boat. it’s maddening.

Sara Lynne says

My husband and I are actually considering legal divorce due to a similar situation. He is self employed but makes about 65k a year, I am currently unemployed-we pay 1100 monthly for a policy with a 7.5k co-insurance, before it kicks in and pays 100%. It has no RX coverage.

We also file separate tax returns.

Can’t get a catastrophic policy because of our age-but also can’t seem to get to the magical 7.5k number so any benefits other than our yearly physical kick in.

So the answer may be divorce for us. Sadly.

Jaymie l says

My husband received a letter from his insurance stating that if his spouse was offered health benefits through her employer she must take them in order to stay secondary on his insurance….. problem is that my employer offers them at me paying 100%…. more than I earn. So now I am forced to quit my job because my husband can no longer cover me if I don’t get insurance through my employer…. Is this even legal?? Seems so unfair!!!

Linda says

I am in the same place….I am on Medicare and my husband is working where there is no healthcare so when he looked at the income credit since we are married he has to pay 400 dollars a month for healthcare with a high deductible. I will be getting an additional pension which will elevate our total income and it will raise the cost of his healthcare again. We have spoke about divorcing in order for my husband to get affordable healthcare. That is pretty sad for a couple who had been together for 32 years but last year when both of us were unemployed with minimal income from a small pension and savings we had great and almost free healthcare..I. think it is a crime that we must divorce in order to not loose a lot of our income to get him reasonable healthcare. I am paying out of my Medicare an additional 136.00 in order to have coverage and bought another Medigap for 100.00 a month and also Drug coverage…so he is paying 400.00 and I 236.00 each in order to have healthcare.

Tracy Caron says

So in other words if you’re married you’re screwed. Do I have to quit my job and collect welfare and medi cal just to get coverage. This is ridiculous. Isn’t this called the “Affordable Care Act”. Affordable….what a joke. And to top it off I’m going to be penalized on my taxes just because I can’t afford insurance. Isn’t this America land of the free.

Joe says

My wife and I file “married filing separately (she gets a refund) because of my IRS debt but she was denied this “Affordable Care Act” because of that issue. My wife is not employed and has since filed for SSDI. I have been disabled and getting SSDI for several years but once I remarried (I had no idea) but my SSDI became taxable. What a crock! Get married and get penalized. More than likely when she files her 2015 taxes, she will get penalized for not having insurance. Total balogna! I know the government thinks we are trying to sneak around something but that is simply not the case.

Saralynne says

Yes, I have found that in our age bracket 50-61 you are most definitely screwed if you are married.

I need a knee replacement and am unable to work until I get it but since we are dependent on my husbands income alone-just over the amount to qualify for subsidies we don’t have 7500 laying around for our portion.

So I’m stuck waiting who knows how long? We just got to the year end of our plan and aren’t even close to meeting the co insurance as apparently they don’t count all your rxs you pay out of pocket for.

We pay 1100 a month for insurance for the two of us. We are just screwed. Our plan is now to sell our home to pay the co-insurance and hopefully have enough left over from profit to pay cash for a smaller home and eliminate the mortgage payment so the insurance cost isn’t so hard with my not working hopefully I will be back to full time work after a few months recovery.

There’s no easy solution. We are fortunate real estate is doing well where we live.

Alex says

Reply to Jaymie from Aug 28:

Something does not sound right with what your husbands insurance company is saying.

My understanding is that if your employer does not offer YOU affordable insurance you do not have to take it. The new law states that employers are supposed to offer affordable insurance to their employees (30 hours and over employees). If they don’t do so they will be penalized. If they still decide not to the employee does not have to take it . In this circumstance, if there is no other offer of insurance (say from your spouses company) then you can go to Obamacare and get a subsidy if your total income (you and spouse combined) is at a certain level.

kathy c says

In the same boat here!!!! POS health care legislation! Getting married this year really screwed me out of health insurance, in fact as far as that goes would have been way better off to just cohabitate!! Great job Obamacare! I don’t have any income and hubby makes only $52/yr and we still don’t qualify for any subsidy. His employer which is less than 50 employees, offers a health care plan, but the spouse coverage is 900/month!!!!! An outrageous amount!!!!! We could never afford!!!! Why is this country health care system so broken when other countries (canada, Great Britain, and Germany) clearly have a more affordable system that makes sense!!!

johnfcon says

Because the 535 members of Congress are in the pockets of the Insurance Companies and blind money from PACS. Yes, most other civilized countries have affordable health care. So move, or get divorced. You can game the “system” too! If your tax guy hasn’t told you about getting divorced to save on Healthcare expenses, it’s time to find a new tax person and/or a financial adviser that knows how the tax laws work.

Wellman says

My understanding is that a spouse cannot qualify for a subsidy if offered coverage that is “good” enough AND that is “affordable” (less than 9.5% of w-2 income. Can an employer NOT offer coverage to a dependent spouse so that they could potentially qualify for a subsidy? Can an employer NOT offer coverage by class to avoid potential discrimination issues. As an example, management often will NOT qualify for a subsidy and therefore buy spousal coverage but hourly employees often may not be able to afford group spousal coverage but are denied a subsidy based on bad wording under Obamacare. Potential solution, do not offer spousal coverage by class???

Debbi LeBlanc says

In am planning on getting married at the end of this year. I have no job because I had to quit my job because my daughter has MS and she is unable to stay at home alone anymore. She is covered under her dad’s insurance. I on the other hand have no kind of health insurance and can’t afford any.My question is this once I am married this year will my new husband have to pay a penalty for the months i had no insurance before we got married?

Saralynnne says

I’m not sure about that- I would think if you aren’t married for more than 6 moths in the tax year you are filing you will most likely file married/seperate, correct? If so the penalty would be just as pertains to you as a single person. Double check with a reputable tax accountant to be sure or you can search the healthcare.gov site.

george peter says

i recently got married and now all of a sudden my wife and i can no longer afford the increased premiums we are going to cancel and do without insurance until our next president repeals obamacare in six months unless its hillary she will continue obama care so vote smart anybody but hillary we have also researched other countries and have decided to change citzenship after we retire in a few years and move. we have a great country but the wrong poeple are running it and i fear it wont get any better we should not all be forced into divorce for the sake of health care . i bet the gay people out there are hoppin mad they just got the right to same sex marriage

but now need to think twice before tying the knot ironic

donna says

We are in the same boat! I am a stay at home mom, my husbands company “supposedly” pays his insurance coverage 100%, but to add me to the policy along with one dependent costs over 1000 per month! The plan is terrible, very high deductables. When inquiring how much it costs per individual the company cannot provide details. With the new year enrollment approaching they will not disclose how much more we will be paying in monthly premiums, only say “about the same”. This is crap, they should know how much our premiums are going to be. How is this legal that we have to wait for the first paycheck to see how much its going to cost us next year! Its bad enough this is NOT affordable, we have gone through our savings this year, and barely make ends meet. I also went on the exchange and I could get the same coverage for me and my dependent for almost 300 cheaper a month, but my hands are tied because the employer offers to put us on the plan even though he pays nothing towards the cost or our premiums, only my husband. Its obvious that companies get a huge payoff in taxes credits for offering this horrible plan. I would perfer to go on our own, but we dont have a choice! This is the worst thing that has happened to the middle class, married group.

Harry Sit says

Just to be clear, you *can* buy from the exchange. You just don’t get the subsidy. If the policy from the exchange at full price is less expensive than what the employer offers, feel free to buy from the exchange. You probably also get more options there.

Jewel says

I am in the same situation as a lot of you. Apparently, not only does Obama think people are frivolous with their money (telling people to cancel cable and cell phones to afford health insurance) but that they should be punished for being married.

We don’t qualify for subsidies. My husband’s employer offers coverage for families and spouses but no discounts – for our family it would be more than our mortgage payment! Who can afford 2 mortgages…without the tax break to go along with it either? And it definitely isn’t cheaper to go with the “exchange”. That would be like adding a brand new car payment on top of the “second mortgage”. And then eating Ramen noodles for dinner.

This is robbery!! Seems almost like Obama wants to destroy the middle class. It’s certainly working.

Kris says

My wife has insurance through her work, to add our two children and myself is outrageous I found a plan on the market place much lower for the three of us will I be penalized?

Harry Sit says

Kris – Other than not being able to get a subsidy, no. Also see reply to comment #11 above.

William Renaud says

Im a canadian who just got married to a US CITIZEN in april 2015 and first year filing a Us tax return. I do not have health care, US spouse does. Is the obamacare penalty less if I file married but single? Is it pro rated for my months legal in the US. (8). I earned about 45000 US Gross. Thankyou

Ben says

Hi all,

I wanted to share my experience this year as this law is totally screwed up.

My wife and I got married in October 2015. She turned 26 in June of 2015 and, following the “rules”, got insurance using the premium subsidy available based on her income level, which her income was almost zero at the time. She was insured with her parents January-March, and This insurance lasted from March 2015 to November 2015, then she switched to the health care my employer offers as my spouse.

Well, ACA penalized us on our tax return for the premium subsidy she received in the months of March through October. The tax code looks at year-end earnings, yet doesn’t consider this situation of getting married late in the year.

We following the rules, stayed insured the entire year, and still owed a penalty because we got married in October and our “Year-End Income” combined didn’t allow for a premium subsidy during the months she was not married to me.

Makes no sense whatsoever. Up until October, she needed the premium subsidy because she truly was “single” and didn’t have any income.

I wonder now if it would have been better to not follow the law, meaning not have gotten any insurance for her from the months of March 2015 to October 2015? Either way, this is a huge hole in the tax law and we end up paying for it.

Joy Kendrick says

My daughter has the subsidized insurance because she only works par time and her company doesn’t I sure part time employees. Her fiancé has obamacare thru his work because his company can’t afford to pay for insurance. Since they both have obamacare and get married would she be required to go on his policy or can she keep her own dice both policies are obamacare

Ben says

If they are getting married this year, they need to use their TOTAL combine income when determining the subsidy they are receiving for healthcare, even if they are both not yet living together.

Otherwise, next tax season when they file MFJ they will have to repay the subsidies because they “understated” their income throughout the year.

It’s a huge flaw in the tax code and another reason why obamacare is a terribly flawed regulation.

Does this help?

lisa says

i have a question i got married in June of 2016 and i am on ssdi total disablity and i have medicare and a drug plan for my meds and my kids are on the oklahoma sooner care, and my husband works as a painter but i wanted to know if i was able to add him to my insurance or can i add him to the oklahoma insurance , cause we are legally married and i took his name and i wanted to know what i can do or apply for that my husband and i can be on the same insurance or add him to my medicare plan , cause he works for himself, and sometimes works for a co but they 1099 him and it has not been a full year yet where he had to pay for the 1099 this is all new to us, and i called ssi and they did say if he had no proof of income i could add him to my medicare and could get other benefits but we are just wanting the insurance for him not food benefits or ect but just insurance where can i go to get us as a husband and wife insurance cause the kids get sooner care and i have medicare

Sue Davis says

We got screwed on the “filing separate” problem. Our premiums for two people went from 215 to over 600 dollars a month because we were denied the subsidy and didn’t fall into the right category. We filed separate because we have lived separate and apart for two years for various reasons: First because I cared for my parents until they died and lived with them, and second because, following their deaths, I moved in with a family member who had cancer to care for him. So I have been supporting myself. I think this is unfair. Our combined incomes are less than they were before (since I’m making a lot less money), we’re using the same insurance, and nothing else has changed. Why couldn’t they just charge us as IF we were filing together? It seems they’re punishing us because we’re poor. Also, we can’t afford the premium hike, so now we’re 8800 dollars in debt.

Harry Sit says

What about amending your tax returns and actually filing jointly and reclaiming the tax credits?

Ellen Freilich says

Signing up for Obamacare for the first time. This article was very helpful and the comments were enlightening. Healthcare.gov says in MOST cases being married and filing separately cancels your ability to get a premium subsidy. Since it says MOST, what are the exceptions?

Harry Sit says

“If you’re living apart from your spouse and are a victim of domestic abuse, domestic violence, or spousal abandonment and want to enroll in your own health plan separate from you abuser or abandoner, you can say you’re “unmarried” on your Marketplace application without fear of penalty for mis-stating your marital status.

This will let you (and possibly your dependents) qualify for premium tax credits and other savings based on your income.”

https://www.healthcare.gov/income-and-household-information/household-size/

Ellen Freilich says

Thank you, Mr. Sit. Fortunately those exceptions don’t apply to my case.

Brenda says

Got married in Nov 17,. Husband was on Obama marketplace insurance. I paid my own insurance for 2017 and am retired. We lived in separate homes. I added spouse to my insurance & it was held out of my retirement. Finished our taxes in March 2018 & instead of getting a refund we had to pay in 4200 dollars. Both of us should of gotten refund of 1000 so we are actually 6000 in the hole. Never have either of us ever paid that amount in taxes. We were pentilized for 1 month of marriage and added my income to his. This is horrible since we both retired & are in our 60s. Make sure you wait til Jan to get married. I have family members with no insurance because they can’t pay 1000 a month for it plus huge deductibles. They are paying (as we all are) for this insurance and we can’t afford it. Anyone else have this happen to them?

Kitty says

Now you know how government welfare called Medicaid created the atmosphere for absent men. Low income minorities that avoid marriage to maximize government help for themselves and their children are called lazy. Low Income whites that delay marriage for the exact same reason to obtain Premium Tax Credits consider themselves smart.