As I’m self-employed and under 65, I buy health insurance through the health insurance marketplace established under the Affordable Care Act (ACA). It’s for people in jobs that don’t offer health insurance, 1099 contractors, part-time employees, freelancers and gig workers, self-employed business owners, retirees under 65, and others who don’t get health insurance through an employer or a government program.

I’ve been doing this for eight years. Nationwide, over 20 million people buy their health insurance this way. It’s still a small percentage relative to the number of people who get health insurance from employers (165 million), Medicare (68 million), or Medicaid and CHIP (78 million).

If you’re among these 20 million people, you may qualify for a Premium Tax Credit (PTC) to buy health insurance. The tax credit is based on your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size. In general, the lower your MAGI is, the less you pay for health insurance net of the tax credit.

MAGI for ACA

Your MAGI for ACA is basically:

- Your gross income

- plus tax-exempt muni bond interest

- plus untaxed Social Security benefits

- minus pre-tax deductions from paychecks (401k, FSA, HSA, …)

- minus above-the-line deductions listed on page 2 of Form 1040 Schedule 1, for example:

- Pre-tax traditional IRA contributions

- HSA contributions made outside of payroll

- 1/2 of the self-employment tax

- Pre-tax contributions to SEP-IRA, solo 401k, or other retirement plans

- Self-employed health insurance deduction

- Student loan interest deduction

Wages, 1099 income, rental income, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond interest and untaxed Social Security benefits also count in the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t increase your MAGI for ACA.

Side note: There are many different definitions of MAGI for various purposes. These different MAGIs include and exclude different components. We’re only talking about the MAGI for ACA here.

2021-2025: 400% FPL Cliff Changed to a Slope

Your premium tax credit goes down as your MAGI increases. Up through the year 2020, the tax credit dropped to zero when your MAGI went above 400% of the Federal Poverty Level (FPL) for your household size. If your MAGI went $1 above 400% of FPL, you had to pay the full premium for your ACA health insurance with zero tax credit.

Laws changed during COVID. This 400% of FPL cliff became a downward slope for five years, from 2021 to 2025. The tax credit continued to decrease as your MAGI increased, but it didn’t suddenly drop to zero if your income went $1 above 400% of FPL ($81,760 in 2025 for a two-person household in the lower 48 states). The tax credit at income levels below 400% of FPL also became more generous during those five years.

The Cliff Returns in 2026

The new 2025 Trump tax law — One Big Beautiful Bill Act (OBBBA) — didn’t extend the enhanced tax credit after 2025. The 400% of FPL cliff is scheduled to return in 2026. The premium tax credit for incomes below 400% of FPL will also drop back to the pre-COVID levels.

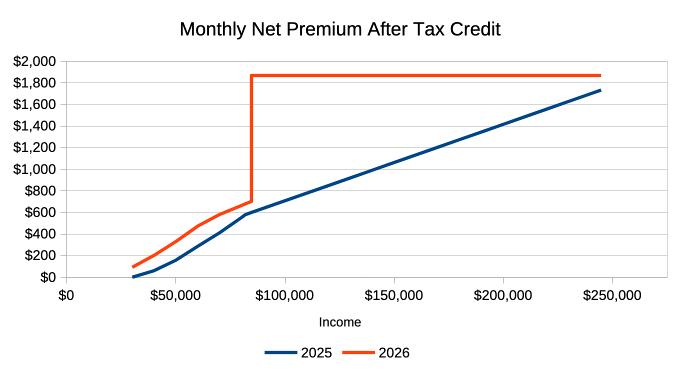

A decrease in the premium tax credit translates into an increase in the monthly premium net of the tax credit. The chart above illustrates the monthly net premium at various income levels for a sample household. The blue line is for 2025, with the enhanced tax credit. The orange line is for 2026, without the enhanced tax credit. The sharp vertical rise shows the cliff’s effect.

Variable Impact

How your net premium after any tax credit will change in 2026 depends on your position in the chart.

If your MAGI is to the left of the vertical cliff in the chart, your premium net of the tax credit will go up slightly in dollar terms. It goes from $158/month to $331/month at a $50,000 income in this example. Although the net health insurance premium more than doubles between 2025 and 2026, a $173/month increase may be manageable if you’re prepared.

Your net premium will increase by a higher amount if your income is to the far right in the chart. At a $200,000 income in this example, the net premium increases from $1,417/month to $1,872/month, up $455/month. No one wants to pay $455 more per month, but at least you have the income to afford it.

The increase is precipitous immediately to the right of the cliff. We’re talking about going from $602/month in 2025 to $1,872/month in 2026 at an income of $85,000. That’s an increase of $1,270 per month or $15,240 for the year. How do you come up with an extra $15,000 for health insurance when your income is $85,000?

Premium Increase Calculator

I created a calculator that shows how much more you can expect to pay in 2026 compared to 2025. This doesn’t include the relative price changes between the plan you choose and the benchmark plan. You’ll pay extra if the price for your plan increases more than the benchmark plan, or less than the amount shown if the price for your plan goes up less than the benchmark plan.

Know Your Cliff

You must know first and foremost where the cliff is for you. The table below shows the 400% of FPL cliff for various household sizes in 2026:

| Household Size | Lower 48 States | Alaska | Hawaii |

|---|---|---|---|

| 1 | $62,600 | $78,200 | $71,960 |

| 2 | $84,600 | $105,720 | $97,280 |

| 3 | $106,600 | $133,240 | $122,600 |

| 4 | $128,600 | $160,760 | $147,920 |

| 5 | $150,600 | $188,280 | $173,240 |

| 6 | $172,600 | $215,800 | $198,560 |

| 7 | $194,600 | $243,320 | $223,880 |

| 8 | $216,600 | $270,840 | $249,200 |

Source: Federal Poverty Levels (FPL) For Affordable Care Act.

Coping Strategy

The chart I used as an example is for a two-person household. A chart for your specific situation will have the same shape but different numbers on the axes.

If your MAGI is safely to the left of the cliff and there’s no risk of going over, be prepared for an increase in your health insurance premiums in 2026 due to the decrease in the premium tax credit. If it’s far to the left, watch out for a different cliff at the low end, which I’ll explain later in this post.

If your MAGI is too far to the right of the cliff and you have no way to bring it to the left of the cliff, you’ll have to pay 100% of the health insurance premium starting in 2026, which can be well over $20,000 a year.

The tricky part and the opportunities are in the middle. If your MAGI is close to the cliff on each side, you should manage it carefully to keep it from going over the cliff.

Manage Your Income

The most critical part is to project your MAGI throughout the year and not to realize income willy-nilly. You can still adjust if you find your income is about to go over the cliff before you realize income. Many people are caught by surprise only when they do their taxes the following year. Your options are much more limited after the year is over.

If income from working will push your MAGI over the cliff, maybe work a little less to keep it under.

Tax-free withdrawals from Roth accounts don’t count as income.

Take a look at the MAGI definition. Minimize items that raise your MAGI, and maximize everything that lowers your MAGI.

When you have W-2 or self-employment income, you have the option to contribute to a pre-tax traditional 401k and IRA. These pre-tax contributions lower your MAGI, which helps you stay under the 400% of FPL cliff.

Choose a high-deductible plan and contribute the maximum to an HSA. The new 2025 Trump tax law made all Bronze plans from the ACA marketplace automatically eligible for HSA contributions starting in 2026.

On the other hand, Roth conversions, withdrawals from pre-tax accounts, and realizing capital gains increase your MAGI. You should be careful with doing those when you’re trying to stay under the 400% of FPL cliff.

Shifting Income

If you’re at risk of going over the cliff in 2026, consider accelerating some income from 2026 to 2025 when the premium tax credit is still on a slope. If pulling income forward to 2025 helps you stay under the cliff in 2026, you lose much less in premium tax credit from your additional income in 2025 than in 2026.

On the other hand, if you’re going over the cliff in 2026 no matter what, consider postponing some income from 2025 to 2026. Once you’re over the cliff in 2026, you have nothing more to lose, while less income in 2025 will give you more premium tax credit.

Borrowing

If you have a temporary spike in your need for more cash, consider borrowing instead of withdrawing from pre-tax accounts or realizing large capital gains. Spending borrowed money doesn’t count as income.

When you need cash to buy a new car, instead of realizing large capital gains and pushing yourself over the cliff, take a low-APR car loan to stretch it out. HELOC, security-based lending, and selling short box spreads are also good sources for borrowing.

You can repay the loan when you don’t need as much cash or when you no longer use ACA health insurance.

Bunching Income

If you can’t avoid going over the 400% of FPL cliff, consider bunching your income. When you’re already over the cliff, you might as well go over big. Withdraw more from pre-tax accounts or realize more capital gains and bank the money for future years.

Spending the banked money doesn’t count as income. Going over the cliff big time in one year may help you avoid going over again for the next several years.

100% and 138% FPL Cliff

There is another cliff at the low end, although you can easily overcome it if you have pre-tax retirement accounts.

To qualify for a premium tax credit for buying health insurance from the ACA marketplace, your MAGI must be above 100% of FPL. In states that expanded Medicaid, your MAGI must be above 138% of FPL. This map from KFF shows which states expanded Medicaid and which states didn’t.

The marketplace sends you to Medicaid if you don’t meet the minimum income requirement. The new 2025 Trump tax law required reporting work and community engagement in Medicaid. You don’t want to have your income fall below 100% or 138% of FPL and be subject to those new requirements in Medicaid.

If you see your income is at risk of falling below 100% or 138% FPL, convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income above the minimum income requirement.

Other Changes to ACA

Besides letting the Premium Tax Credit cliff return, the new 2025 Trump law also made these other changes to the ACA:

All Bronze Plans Will Be HSA-eligible

All Bronze plans and catastrophic plans offered through the ACA marketplace will automatically be eligible for HSA contributions starting in 2026.

Before this change, an HSA-eligible plan could be more expensive than a high-deductible plan not eligible for HSA, which negates the benefit of contributing to an HSA (see Downsides of HSA: When It’s Not Worth It to Contribute). Starting in 2026, you can choose a less expensive plan and still contribute to an HSA, which lowers your MAGI and helps you stay off the premium cliff.

Repayment Cap Eliminated

Currently, if you underestimated your income when you enrolled and received more subsidy than your actual income qualifies, you would pay back the difference when you do your taxes, but the repayment has an upper limit. See 2025 Cap on Paying Back ACA Health Insurance Subsidy.

The new 2025 Trump tax law eliminates the repayment cap starting in 2026.

No More Auto-Renewal

Right now, if you don’t actively renew for next year during open enrollment, you will automatically continue with your current plan or a replacement plan selected by the marketplace.

The new 2025 Trump tax law requires re-verification at each renewal, starting in 2028. You may be dropped if you miss the deadline to re-verify. Set up multiple calendar reminders for the open enrollment deadline — don’t miss it!

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Tom says

Hi Harry, how best to look at using a HELOC to fill the gap of required spending over above the MAGI limit to receive the PTC? We are planning on using the ACA for the first time next year at age 59, so would have 6 years of having to draw $30k annually from our HELOC and could pay it back using Roth, Traditional (or perhaps inherited money) in the future.

Harry Sit says

Think of borrowing as time shifting. You keep the money you would otherwise withdraw at 59 to pay back the loan at 66. If the after-tax growth covers the interest on the loan, the lower health insurance premiums are pure savings. Of course the loan interest is a guaranteed expense but your asset growth is uncertain. So you must also consider the risk.

You don’t need to borrow if you have enough in your Roth accounts to cover the $30k/year for six years. Tax-free Roth withdrawals don’t raise your MAGI.

Susan Harkema says

Hi Harry: Since you are self employed and getting subsidies, how do you handle that on federal tax return? Are you taking the form 1040 schedule 1, line 17 deduction for a portion of your self-employment health insurance premiums AND getting premium tax credit? I need to decide if I should keep working in 2026 with the cliff to get a deduction even if it’s reduced by the tax credit. Hope I’m being clear. Thanks!

Harry Sit says

Tax software such as TurboTax will calculate a split between a deduction on Schedule 1 Line 17 and a tax credit on Form 8962. The two numbers added together will cover the total unsubsidized premium.

Angela says

Thanks for this info and explanation. I have a question. I was in a 403b for 16 years while teaching then converted to a managed IRA. Its about 30k. I left teaching and now have a minimal self employment income playing poker. how do I nicely tell the Advisor I dont want to use him anymore and should I move to a Robo type w low fees? I want minimal work just think I want to set and forget. thanks

KJ says

Such an unfortunate situation. In 2026 I’ll likely be about $20k to $25k over the 400% limit. The increase in the insurance rate is pretty big. Yeah I can engineer a method to lower my income to go under, say by moving investments around to get a lower interest/dividend. But that also means I’ll lose that income. Net net, if I calculate the extra cost for ACA vs the money I need to lose, I believe they seem to be about the same 🙁 🤔

Larry says

KJ,

Can you “lose” income for ACA not by making less but by contributing more of it to Traditional retirement accounts?

KJ says

Larry, I was recently thinking something along what you said. I need to drop my income by $25k. So maybe an $8k contribution to an IRA from me and another from my wife. Still got $9k to go. I read somewhere that from 2026 (?) all bronze ACA plans are HSA eligible? if that’s true then perhaps I can change to a bronze plan (hopefully I’ll find one I like) and max out the HSA or maybe a silver plan that has HSA (?). So yeah I agree with you, for IRA+HSA it is not really losing anything. But for someone slightly higher than $25k then they will need to give up some income. Right?

Harry Sit says

There’s an income limit for deducting contributions to a Traditional IRA, depending on whether you’re covered by a workplace retirement plan (no limit if neither of you is covered). Be sure to double-check the income limit.

https://thefinancebuff.com/401k-403b-ira-contribution-limits.html#htoc-deductible-ira-income-limit

It’s true that all Bronze ACA plans will be HSA eligible in 2026. It’s mentioned right here near the end.

Harry Sit says

P.S. I’m not sure whether you’re working or retired. Contributing to an IRA requires income from a job or self-employment. You can’t contribute to an IRA if you don’t have income from a job or self-employment. Pensions, rental income, and investment income don’t qualify.

KJ says

You know this entire business doesn’t make sense to me. The point of the hard stop 400% limit. Yeah a person like me can drop his combined income to some fictitious limit. But not sure how this makes sense. With HSA is like let me bank some money that I will only use for medical expenses, for something I was going to pay for anyway. So here’s $8k but I get to spend $8k. Okay, well. And then IRAs for money that can grow tax free until someday I can use and then pay the tax. I already have an IRA and don’t want to add more to it. It already has too much that come RMDs but make our, also, healthcare costly (yeah nice problem to have). So why not just keep the current system vs the 400% cliff and keep it more straight forward without jumping through all these hoops. It just doesn’t make any sense honestly.

KJ says

Sorry Harry. I forgot that I read about the bronze plans from your article.

I retired a little over a year ago. So only income is some deferred compensation, dividends/interest and capital gains. So HSA seems to be the only thing I can do? say about $8k for a family. In that case I still need to lower my income about $17 more. I would need to “lose” income to get to that… right?

Harry Sit says

The 2026 HSA contribution limit is $8,750 for family coverage, plus $1,000 extra for each person 55 or older. $10,750 total if both of you are 55+, but you must use separate accounts.

https://thefinancebuff.com/hsa-contribution-limits.html

If you can’t bring the MAGI below 400% FPL, consider bunching income. For instance, do three years worth of capital gains in one year and don’t realize capital gains in the next two years. You go over one year and stay under for two years. Or do it in 2025 and stay under for three years.

KJ says

I just found this doc: https://www.irs.gov/publications/p590a and it seems to say that deferred compensation is excluded from income eligibility for IRA in table 1-1 and the info below it:

> Compensation doesn’t include any of the following items.

…

> Deferred compensation received (compensation payments postponed from a past year).

that’s unfortunate…

Harry Sit says

That’s right. I’ll remove my comments about deferred comp to avoid confusing others.

John says

My son is 25 and full time student. Turns 26 in Sept 2026 . I can’t claim him as a dependent on my tax return but can be on my ACA healthcare plan. My income in 2026 will be above 400% FPL. Should I have my son get his own ACA health insurance with a MAGI at 138% FPL and have him file his own 2026 tax return? Or just keep him on my ACA health insurance above 400% FPL?

Harry Sit says

When you can’t claim your son as a dependent, you and your son will have to file two tax returns anyway. He’ll need his own policy after he turns 26 in September 2026. The only question is about the first nine months of 2026.

If you include him on your policy, you won’t receive any subsidy when you enroll, because your income is over 400% of FPL. When you receive the 1095-A tax form in January 2027, you’ll allocate a part of the premiums to your son. Your son will file his 2026 tax return with the allocated premiums from you for the first nine months plus the premiums of his own policy from September to December. He’ll get a tax credit if his income is between 138% and 400% of FPL. The pros for this approach would be that you can allocate more premium to your son to use up his tax credit. The cons are it’s more complicated and you have to pay upfront and wait for a tax refund going to your son in 2027.

If you don’t include him on your policy, you and your son will apply separately, which will be the case after September 2026 anyway. It’s easier – no mid-year switch, no allocating premiums, not paying upfront and getting reimbursed by a tax credit after the fact. However, if your son chooses a Bronze plan because he’s young and healthy, it may cost less than his tax credit, and you can’t use the remaining part of his tax credit.

Do the math both ways at open enrollment, see how much you can save by including your son (if any), and then decide whether the savings is worth the complexity.

Harry Sit says

The IRS published the applicable percentages table for 2026 today. I added a calculator using the official data to show how the net premium will increase between 2025 and 2026. The KFF calculator linked previously used estimates that were lower.

https://thefinancebuff.com/stay-under-obamacare-premium-subsidy-cliff.html#htoc-calculator

Tim says

I plan on retiring in April of 2026, ACA is a big part of retiring early for me. In 2025 my income will be over inflated due to taking some withdrawals to pay down some debt. Can I still estimate my 2026 income in April of 2026 or am I going to be forced to show a 2025 return ?

Harry Sit says

You can still estimate. They may or may not challenge your estimate. If they challenge it and don’t accept your explanation, you won’t get the subsidy upfront, but you’ll get it as a tax credit when you file your tax return.

Jess says

Hi Harry, thank you for this helpful post. I’m planning for early retirement and building my Safe Withdrawal Rate around a budget that includes ACA health insurance, with subsidies helping cover the cost until I turn 65. I’d like to get your opinion — given that policies can change, do you think it’s wise to base my future SWR on ACA coverage and rely on it as part of my early retirement plan?

I’ve built in a buffer to account for rising premiums, but I know the ACA could be modified or even phased out in the future. How much risk do you think that adds to my plan? Is it unwise to rely on the ACA in my budget, or do you see it as a reasonable assumption for the future?

If you were in this situation, how would you factor that policy risk into planning your SWR or determining the net worth needed for retirement? I want to make sure I’m not putting my retirement plan at risk if those subsidies or rules were to change.

Harry Sit says

The future is unpredictable. Our plan has to be robust enough to deal with unexpected changes. Relying on ACA coverage and relying on ACA subsidies are two different things. I don’t think many people want to go back to the days when some people can’t get coverage, period, regardless of how much it costs. I’m comfortable with a plan that assumes you’ll have coverage in one form or another. How much that coverage will cost is a different matter.

Look at the monthly premium chart in this post. If your post-retirement income is over the cliff, you’ll pay the full price. That full price also increases rapidly year after year. My insurance company sent me a renewal notice with a 20% increase of the full price in 2026. That’s not unusual. You must be prepared to absorb such increases. A plan that’s fully prepared to pay the full price with large annual increases has the least risk.

If your post-retirement income is before the cliff, your net premium after the tax credit is capped to a percentage of your income under the current system. Increases in the full price won’t affect you. If the full price doubles, you still pay the same percentage of your income. This makes it much easier to budget, if you assume that the current structure of the ACA will stay in place.

Is there a risk that the structure can change? Absolutely. The cliff can be lowered to make you more exposed to the price increases (think of abolishing the ACA altogether as lowering the cliff to zero). Your “fair share” as a percentage of your income can be lifted upward from today’s single-digit percentage to 10-20%. The MAGI definition can be changed to include Roth distributions. The structure can be turned around to cap the subsidy to a percentage of your income or a fixed dollar amount, instead of capping your net premium after the subsidy. There are many ways to alter the split between you and the government. Don’t underestimate policymakers’ creativity. I think the closer your post-retirement income is to the left side of the current cliff, the more risk you have in adverse changes in the future.

A plan with a post-retirement income farther to the left of the current cliff has a lower risk. If the cliff is moved lower, it’s more likely that you’re still under the cliff. If the cost sharing percentage is pushed from 5% of your income to 10%, you only need to squeeze another 5% from elsewhere in the budget.

erik says

Hi Harry, your above post is exactly why even thought according to your post “When to Claim Social Security: How Much Does It Matter, Anyway?” I should claim SS at age 62, I want to maintain maximum flexibility with all aspects of my financial plan while in early retirement and wait to claim SS at 65. There are no guarantees, which reminded me of the saying, “the only thing constant is change.” Your financial plan has to be adaptable under all future unknow circumstances. The one scenario you pointed out; “the MAGI definition can be changed to include Roth distributions,” would be catastrophic in my opinion, because that is the one safety valve to evade all the other massive what-if policy changes you describe.

Jess says

Hi Harry, Thanks for your insight. What’s the best way to estimate how much net worth would be needed for retirement, considering that withdrawal needs will decrease once Medicare and Social Security benefits begin? For example, using a 3.5% safe withdrawal rate doesn’t factor in those reductions. Do you have a specific method or calculator you’d recommend to incorporate those future adjustments for a more accurate estimate? Thank you.

Harry Sit says

Jess – That’s a different topic than the subject of this post. I’ll take it offline and send you an email.

B says

Hello, so lets say during upcoming ACA enrollment I choose a Bronze plan for 2026. I am single and over 55, so I could contribute $5,400 in 2026. I would then use that reduction as part of my 2026 MAGI estimate ?

May I ask if HSA contributions must be pre-tax contributions, how can one fund the HSA if they have no salary, and only Ordinary Income , Dividends, Capital Gains/losses, and Inherited IRA RMDs ? I found this ” individuals can make a one-time contribution from a traditional IRA or Roth IRA into their HSA” ; and I do have both TIRA and a small Roth, but if this is allowed as a “one-time”, is it allowed for 2026 ? and for 2027 forward there’d be no other method to fund the HSA?

Perhaps, then I should be careful to use the MAGI lowering method to a year, I think I’ll less health care, hence using a Bronze plan? (I have many old I-bonds with deferred interest final maturity age 63-65, I want to attempt to avoid the cliffs over next 5 years) . Hopefully, I don’t just go over the cliff, without having benefited from just doing a 1 year lump sum, cash out of the deferred interest.

If one were to just cash out all the I-bonds, what tax bracket should one aim for, to do so ? Perhaps I could cash out a large chunk then the cliff would not be so close, each year. Not sure I can fully understand all the trade-offs in premiums doing this . And am finding that not sure even my local CPA can comprehend the moving parts.

Harry Sit says

You can fund the HSA contribution with any source of money, including dividends, capital gains, and RMDs from an inherited IRA, or just from past savings. Don’t do the once-in-a-lifetime IRA-to-HSA transfer if you want the tax deduction for the HSA contribution to lower your MAGI and help you avoid going over the cliff. Doing the transfer doesn’t give you a deduction.

Wait to see how the cliff will be resolved. Don’t go over it unless you know for sure doing so will help you in future years.

Patrick W. says

Harry, Great article, well written btw, and pretty much spot on from my experience with ACA health insurance. (I’ve been doing our own ACA Marketplace insurance enrollments since 2014). Also, thanks for the tip on HSA contributions for all Bronze plans. That used to be a hangup for us, but now gives ACA policy holders some added flexibility at the end of the year to adjust as needed.

Robert says

Harry, I have always taken my aca tax credit at the end of the year. Would it be better (safer) in 2026 to take the advanced tax credit seeing how Trump changes his mind on so many things so often. If he pulls the plug on subsidies halfway thru the year you would still have half. The other way, you may have nothing coming back in 2027 on 2026 tax return. Thank You.

Harry Sit says

I used to only take the tax credit on the tax return after the end of the year as well, but I was burned one year when people were allowed to keep the advance credit regardless of income and I had nothing to keep. I agree it’s safer to take the advance credit.

robert says

Harry

1. You said you had nothing to keep. I assume your income was too high that one year. But I thought that law that allows people to keep part of the tax credit doing the advance credit was no longer available in 2026. So will you go back to end of year credit?

2. My initial question was if Trump would change the law halfway thru the year and say no tax credit at all (even the original one, before covid). Would it be safer to take the advance credit or could he claw that back as well?

Harry Sit says

I won’t go back. As laws stand now, it makes no difference whether you take the credit upfront or wait until the end of the year if you have the cash. However, you never know what laws they come up with down the road. If laws are changed to stop the credit, it’s possible that you won’t get anything when you file the tax return and any advance credit must be repaid too. In that case, it makes no difference one way or the other, but if the new law only stops the credit but doesn’t claw back the advance credit, you’ll be a sore loser if you didn’t take the advance credit.

It’s safer to take the advance credit. In the worst case, you’ll pay it back, which doesn’t make you any worse off than if you didn’t take it in the first place.

Robert says

Harry,

That’s exactly what I thought – safer to take the advance credit.

The reason I didn’t take the advance credit in the past is I didn’t want to submit paperwork and deal with other ACA employee demands.

I paid in full for the last 5 years and took the full credit on tax return.

Question, if I go the advance credit route in 2026, will the ACA ask for a load of proof (paper work) or will they rely on IRS records they access.

Thank You.

Harry Sit says

They usually don’t ask for any documentation if your income estimate is more or less in line with the income on your latest tax return.