Using a security-based line of credit or a margin loan is one way to get some short-term cash. I also read about using a “short box spread” in this blog post from Karsten on Early Retirement Now: Low-Cost Leverage: The “Box Spread” Trade. I decided to look into it and see how it works.

What Is a Box Spread

A box spread is a specifically constructed set of option trades with a guaranteed outcome on a preset date no matter how the underlying market moves. The trades are typically implemented as buying and selling options on a stock index such as the S&P 500 index (SPX) because options on the S&P 500 index can’t be exercised early (“cash-settled European options”). This guarantees a predictable result on the option expiration date.

You can either sell (“short”) a box spread or buy (“long”) a box spread. We only look at the short box spread in this post. We cover the long box spread in Long Box Spread Trade vs Buying Treasury Note or CD.

Short Box Spread

When you sell (“short”) a box spread, you —

(a) receive a sum of cash upfront; and

(b) are guaranteed to pay a known larger sum on a specified future date.

When you receive cash upfront and you must pay a larger sum on a future date, you’re effectively taking out a loan with a balloon payment at the end. The difference between the amount you receive and the amount you must pay back in the future is your effective interest payment for having the cash upfront.

When Is It Useful?

Selling a short box spread is useful in the same scenarios you may consider tapping a security-based line of credit or a margin loan.

Suppose you need some cash but your money is tied up in a CD. You must pay a hefty early withdrawal penalty if you break the CD. Selling a short box spread gives you the cash. You can pay back the box spread when your CD matures. The cost of borrowing from the short box spread may be much less than the early withdrawal penalty.

Suppose you’re buying a house before you sell your existing house. Selling investments to buy the house will trigger taxes from realizing capital gains. You can use the cash from selling a short box spread to buy the house and pay it back after selling your previous house.

Suppose you need some cash but the stock market is down and you don’t want to sell your stocks low. You can sell a short box spread to get cash and wait for the stock market to recover.

How Is It Better?

Getting your effective loan from selling a box spread is better than tapping a security-based line of credit or a margin loan because the implied interest rate is lower. It’s also independent of the broker you use.

Low Fixed Rate

The effective interest rate from a short box spread is about 0.3% – 0.5% above the Treasury yield of a comparable term.

The implied interest rate is also fixed for the term whereas the interest rate in a securities-based lending program is typically a variable rate. If you do a short box spread that expires in two years, you’ll have the rate locked in for two years.

Use Any Broker

You’re getting the money from the market participants when you sell a box spread. Your broker doesn’t control your effective interest rate. The broker only receives a small commission for facilitating the trade.

You don’t have to transfer your account to Interactive Brokers only to access their low margin rates. You don’t have to have a large balance with your broker and beg for an unpublished rate in their securities-based lending program. You can still do it even if you use Vanguard, which doesn’t offer low margin rates or a separate securities-based lending program.

Favorable Tax Treatment

Another advantage of a short box spread is that the effective interest payment is an investment loss in Section 1256 contracts, which is treated as 60% long-term loss and 40% short-term loss. The investment loss can offset your capital gains. You don’t have to itemize deductions to use your investment loss.

If you borrow from a securities-based lending program, the interest is often effectively not tax-deductible when you don’t itemize deductions.

What Are the Downsides?

The biggest downside is that you may make a mistake in entering the trade and screw it up. If you accidentally choose the wrong direction (buy versus sell), the wrong strike price, or the wrong expiration date for one part of your order, your trade as a whole won’t guarantee that you’ll only lose a preset amount on a preset date. The sky is the limit if you screw up.

If you already have a low interest rate from your broker and you don’t mind that the rate is variable, getting a loan from your broker is much simpler and less error-prone.

Rule #1 if you’re going to venture into box spreads: Don’t screw up. I don’t blame you if you decide not to do the box spread simply to avoid possible screwups.

Another downside that comes with the fixed rate is the fixed term. The date you must pay it back is fixed after you execute the trade. If you’d like to pay it back sooner, you’ll have to buy back your box spread, which will be subject to the market conditions at that time. If you’d like to pay it back later, you’ll need to sell another box spread with a later expiration date.

If you borrow and pay back frequently for the short term, it’s more convenient to use a securities-based lending program. The variable rate doesn’t matter much in the short term. If you borrow a large sum for a long period, a short box spread can get you a low fixed rate for a fixed term.

How Much Can You Borrow?

The amount you can borrow doesn’t change between securities-based lending and selling a box spread.

Although your broker isn’t coming up with the money for your effective loan, they aren’t going to let you get into a position such that your other investments can’t cover the required balloon payment when the term ends. You’re still subject to the same margin requirements. If the values of your other investments drop in a crash, your broker can still sell them at the bottom to meet margin requirements.

Treat selling box spreads the same as borrowing from securities-based lending. Don’t go overboard. Limit your borrowing to no more than a small percentage of your account value. Borrow for the shortest term you need. Repay as soon as you can.

How to Do It at Fidelity

If you decide to sell a box spread, here’s an example of how to do it at Fidelity. It may be similar at other brokers.

First, you need to apply for options trading in your taxable account. Fidelity categorizes options trading into three tiers by the risks. You need to apply for at least Tier 2 (or Tier 1 plus spread in an IRA). Applying for Tier 2 options trading also automatically applies for margin. Your investment objective in the application must be Growth or above.

Four Legs

You’ll be able to enter option trades on an index after your account is approved for options trading Tier 2.

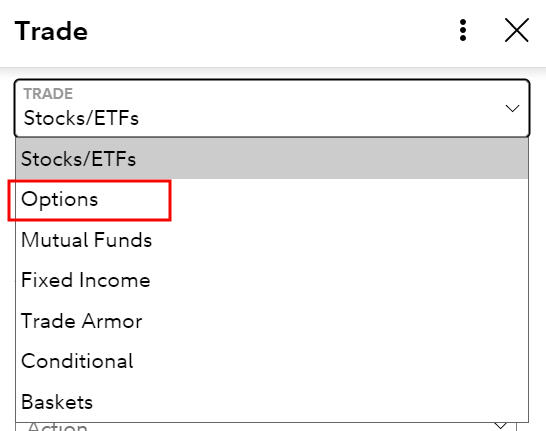

Choose “Options” in the Trade popup.

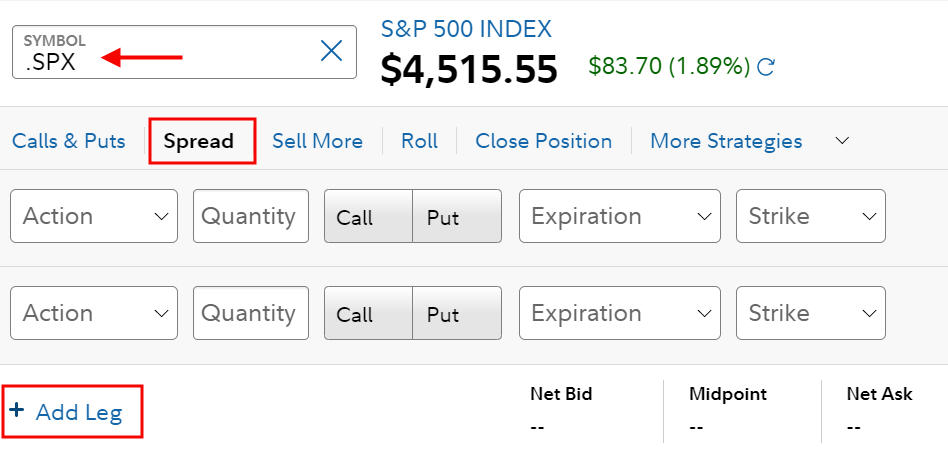

Enter “.SPX” in the symbol field. This is for the S&P 500 index. We use the S&P 500 index (SPX) as opposed to the S&P 500 ETF (SPY) because SPX options can’t be exercised early, whereas SPY options can be. Your box will be knocked out of balance if one of your legs is exercised early.

Click on “Spread” as the options strategy. You automatically get two legs. Click on “Add Leg” twice to add two more legs.

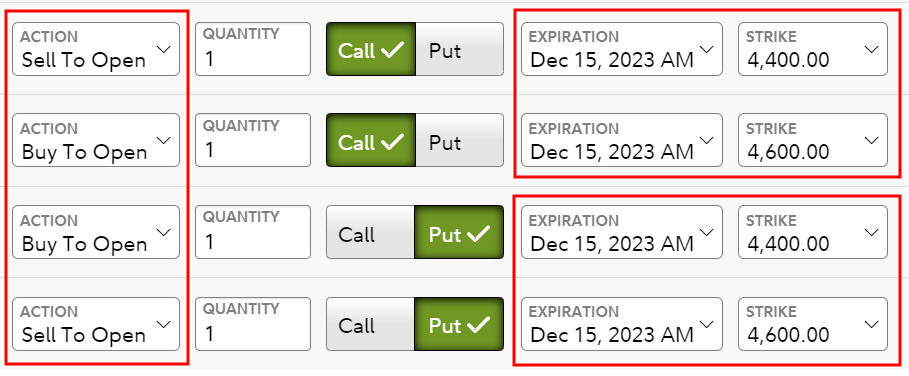

Click on the “Call” button for the first two legs and the “Put” button for the next two legs.

Select Action in this sequence for your four legs:

- Sell To Open

- Buy To Open

- Buy to Open

- Sell to Open

Remember: Sell – Buy – Buy – Sell.

Set the expiration to the same date for all four legs. This is the date you will effectively pay back the loan. If the same date has both AM and PM expirations, choose the AM expiration. As Russell suggested in comment #6, avoid expiration dates that fall on the last two business days of the year. Some brokers don’t report taxes correctly for contracts expiring on the last two business days of the year.

Choose a spread around the current index value for the strike price (4,400 to 4,600 in the screenshot when the index was around 4,500). The size of the spread times 100 is the amount of your effective loan. If you need to borrow $20,000, make the spread 200-wide. The spread goes from low to high in your two calls and two puts. Match the two spreads exactly between your two calls and two puts. Finally, enter the same quantity for all four legs.

When you need to borrow $40,000, you can choose a spread of 400 (for example, 4,300 to 4,700) with a quantity of 1, or you can choose a spread of 200 with a quantity of 2. All else being equal, a smaller quantity with a larger spread saves a small amount of money on commissions, but a larger quantity with a smaller spread may be easier to execute. The commission at Fidelity is $2.72 for each set of four legs at a quantity of 1.

Limit Price

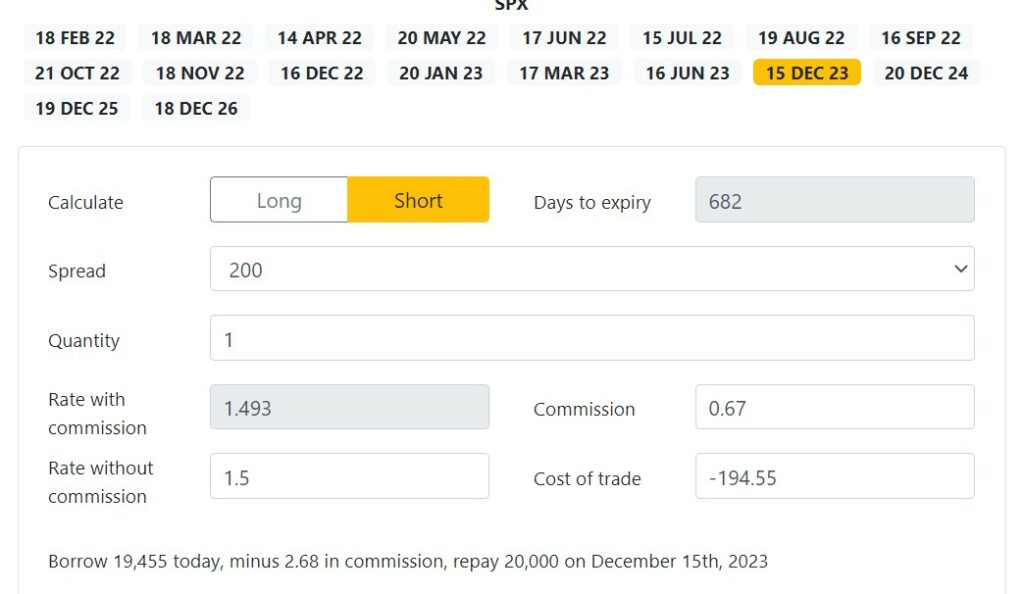

Now you need to enter a limit price for your order. Look up recent trades on boxtrades.com. Boxtrades.com gives you a target price when you enter a desired APR.

This screenshot shows that when you’re willing to pay 1.5% APR for a spread of 200 until December 15, 2023, you should enter a limit price of 194.55.

Make sure the order type is Net Credit. You’re asking someone in the market to pay you $19,455 now for you to pay back $20,000 on December 15, 2023.

Execution

After you place the order, you wait to see if someone takes your offer. Your four-leg option trade is offered as a full package. Someone can’t pick it apart and accept some legs of your trade but not the others.

It may take some time for your trade to execute. If no one is interested after an hour, you may need to lower the offering price (receive less, a higher effective APR). Or you can try another day if you aren’t in a hurry. Again, you can calculate the effective APR for your new lower price at boxtrades.com.

After Execution

If your order is filled, you’ll receive a sum of cash in your account. You can do whatever you want with this cash, including withdrawing from your account for your cash needs.

You’ll also have four option positions in your holdings. These option positions added together have a net negative value. They will turn into the predictable cash debit when you hold them to the expiration date. When you have cash in your account on the day after the expiration date, your cash will be used to offset the debit. You effectively pay off your loan at that point. If you don’t have enough cash at that time, you’ll have a negative cash position, which will incur margin interest from the broker.

If you’d like to exit the box spread positions before the expiration date, which effectively pays back the loan sooner, you can execute trades in the opposite direction to close them out. The price for your close-out trades will depend on the prevailing interest rate at that time. It should be less than the amount you’ll pay on the expiration date. Closing out early also reduces your risk. See how to do it in Close Out a Box Spread Early at Fidelity.

Ignore Values in the Evening

The values of the option positions will fluctuate with the market, even though they will converge to the predictable value on the expiration date. The prices used to calculate their values are especially wild when the market is closed. You’ll have to learn to ignore the account balance you see in the off-hours.

Don’t be alarmed when you see your balance drop by a huge amount in the evening. They’ll return to more reasonable values when the market is open.

Mark-to-Market Gain/Loss for Taxes

The year-end 1099 form you receive from the broker will include realized and unrealized gains and losses for your Section 1256 contracts. Enter the information from the 1099 form into your tax software. See Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA. The tax software will handle it with the proper tax treatment.

***

A short box spread can be a good alternative to securities-based lending when you execute it correctly. This is especially helpful when you can’t get a good rate from your broker. You must be super careful not to screw up in placing your order. Don’t do it if there’s even a slight chance you’ll make a mistake. The loss from your mistake can be many times your potential gain from having a low-interest loan. It’s perfectly valid to avoid a potential disaster and only stick with safety in the mainstream.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Frugal Professor says

This was fascinating! I think I may use it as an interesting case study in my derivatives class!

EarlyRetirementNow says

Great summary! The Step-by-step instructions for Interactive Brokers:

https://earlyretirementnow.com/2021/12/09/low-cost-leverage-box-spread/

Harry Sit says

I read another report of someone forgetting to put a negative sign in front of the price when they placed an order at Interactive Brokers. Placing a buy order for a short box spread with a negative price trips up people there.

SFGiantsFan says

This is interesting. Thanks for sharing this. I currently have about $100K and 5 years left on my mortgage and I’m thinking of doing this using Dec. ’26 options to pay it off. What are your thoughts on that? Also, in Etrade they call this strategy an Iron Condor, they show that it is priced as: 1x1x1x1, and they have an “All-or-none” check box. Any guidance on these? As you mentioned above, I don’t want to screw this up.

EarlyRetirementNow says

Iron Condor is different. Though it also involves 4 options, 2 long, 2 short. But the strike pattern and payoff diagram are different!

You will likely get a lower rate than a mortgage and the interest is tax-deductible! So, this box trade is a really neat tool!

Go, Giants!

SFGiantsFan says

Thanks for the reply. At Etrade, if I use Harry’s example, when I enter the sell-buy-buy-sell sequence, the strategy automatically changes to “Iron Condor.” Is there a way around this or does it not matter? Does the below look OK? And should the “All-or-none” box be checked?

=========================================================

Symbol Last price x Size /Exch Volume

SPX 4500.53 +23.0900 (+0.52%) 3.00M

Select a strategy

Iron Condor

Action Quantity Expiration Strike Type

Sell Open 1 Dec 15 ’23 AM 4400 Call

Buy Open 1 Dec 15 ’23 AM 4600 Call

Buy Open 1 Dec 15 ’23 AM 4400 Put

Sell Open 1 Dec 15 ’23 AM 4600 Put

Price Type Net Credit Priced as: 1x1x1x1

Net Credit 194.55 Spread qty: 1

Duration

Good for day x All or none

EarlyRetirementNow says

@SFGiantsFan

Well, I guess it is an Iron Condor of sorts with very specific strikes. So, as long as you are able to set the strikes as specified by Harry you should be good to go.

SFGiantsFan says

@EarlyRetirementNow Thank you so much. I’m looking forward to executing this soon. You and Harry are a real asset to all of us. Thanks again and yes, “Go Giants!”

Chris says

If I was going to do this as a mortgage substitute for 5 years, would there be any downside to doing a series if these with expirations over a year? Like 20k a month, 5 years down the road?

calwatch says

You can’t be busted out of a box early. However, the underlying securities could be busted instead if your underlying value falls below the margin requirement. You could be subject to a margin call, although if you are not using Interactive Brokers you would have a couple of days to pay it off instead of auto liquidation. Therefore, it is important to not overleverage yourself.

Matthew says

The only part of this that I’m confused about is, “When you put cash back into your account before the expiration date, your cash will be used to offset the debit.” If I do the box spread and take out the cash, then want to buy more stock by putting cash back into the account, does that somehow lock up my cash deposit so that I can’t buy any more stock?

I understand that I would need to have enough cash in the account to cover the box spread by the date it expires, otherwise my securities could be liquidated. Until that date, I should be able to add cash to the account, provided my securities values don’t drop below margin requirements.

Harry Sit says

Day 1, zero cash, box positions worth -1,000

Day 2, add 1,000 cash

Day 3, buy stocks, use up cash

Day 4, box expires, no cash, -1,000 margin loan

Alternative:

Day 1, zero cash, box positions worth -1,000

Day 2, add 1,000 cash

Day 3, box expires, use up cash

Day 4, buy stocks, no cash, -1,000 margin loan

Whether you use cash to buy stocks first or you use it to cover the box first, the end result is the same.

Russell says

One important warning to add about box spreads: AVOID options that expire on the last two business days of the year. They can result in a huge tax burden and/or make filing taxes a huge pain.

Why? Because long options are taxed in the year they close, while short options are taxed in the year they settle. With settlement taking two business days, you can end up with the long and short legs being taxed in different years. If the longs have a gain and the shorts have a loss, you’re stuck paying taxes on the gain and waiting another year (or more in some cases) to claim the loss.

“But these are Section 1256 contracts,” you say. “Any unrealized losses will be marked to market and applied to the current year.” Yes, they should be. But your broker (*cough*, TD Ameritrade, *cough*) might have other ideas. After hours of back and forth, they will get stuck on the following:

“We can’t give you realized P&L because the trade settled in January.”

“And we can’t give you unrealized P&L because the trade was already closed at end of year.”

You’ll be stuck either accepting the tax burden or figuring out how to work around an incorrect 1099 (which the IRS will have received from your broker).

Note that these can very large amounts — the taxable gain can be much larger than the credit you received for the box spread.

Here’s a Reddit post with even more details: https://reddit.com/r/options/comments/ddokzu/taxation_for_options_contracts_closed_on_last/

@Harry — would you consider making a post about this, or perhaps adding a warning about it in this post?

EarlyRetirementNow says

Shouldn’t be an issue for most box trades with a long enough time to the expiration. Imagine you want to do the Dec 2026 box trades. The only contracts you can trade expire on 18DEC26. For December 2023, we’re looking at 15DEC23.

I trade with Interactive Brokers and hope that they would be better with the settlements. But I will still make a mental note and make sure I never use the 31DEC expirations for box trades. Thanks for sharing!

Harry Sit says

Thank you for sharing the real-life experience with tax reporting from a broker. Maybe only TD Ameritrade has this problem, but I agree it’s better to avoid such situation as opposed to fighting the broker for reporting it correctly. I added a note about this in the post.

John says

Thanks for this!

Is there anyway you can payback the loan before the expiration date?

Harry Sit says

You enter an opposing long box spread order to close it out. Buy to close, sell to close, sell to close, buy to close.

James says

@Harry Sit

Does an opposing long box spread truly close it out, or are you simply lending money to someone else, which is paid back to you at the same day the previously taken out short box spread is due?

Harry Sit says

It truly closes it out. You can’t hold open both long and short positions in the same option at the same time. The OCC doesn’t settle with you on the option expiration date when you have no open positions.

James says

Other than Buy to close, sell to close, sell to close, buy to close, does everything else stay the same as shown in the screenshots? Call, Call, Put, Put. 4,400, 4600, 4,400, 4,600?

Maybe this information how to pay it back early could be the 3rd post in the series, or perhaps an update to this post.

Harry Sit says

That’s correct, the same expiration date (and am/pm) too. You can also close it out partially if you don’t have enough cash to pay it back in full. I’ll write a new post about it.

Harry Sit says

The new post is up. How to Close Out a Box Spread Early at Fidelity.

Dan says

So, I can ignore the unrealized gains/losses on the 4 legs?

Harry Sit says

You can ignore them for now. If you carry them until the end of the year, the broker will give you a tax form based on your unrealized gains or losses at that time.

Dan says

Thanks, Harry!

Seeing these huge amounts is unnerving. These unrealized losses also reflected in the house call amount at fidelity, which makes me worry.

I had 20k securities, then borrowed 20k through this. Is there any way this box can be box can be liquidated by fidelity?

Dan says

Following up here…I ended up selling the options at a hundred dollar loss.

The daily fluctuations were just too much for me to bear.

Even during business hours the total value of the 4 legs would diverge in the tens of thousands, showing unrealized loss.

Fidelity not only did not deposit the options proceeds, but took additional cash as a margin call.

While, this would work if you have 500k account and “borrow” 20k, this is a huge risk if borrow even 25% of the account.

Option noobs like me – stay away.

SFGiantsFan says

My short box trade was established in February and is still active. If I understand the above correctly, I should have received mark-to-market gains/losses on my 1099-B this year. It doesn’t look like my broker, E*Trade, reported them as I see no reference to Section 1256 contracts nor any realized or unrealized gains. Does it matter or will they just report them when the option is closed out?

Harry Sit says

They should have reported. Fidelity did for my contracts.

SFGiantsFan says

Thanks, Harry. E*Trade will be sending a corrected 1099.

Ryan says

I tried this strategy with Fidelity but the cash was not deposited into my account as mentioned here. Rather, Fidelity added it into the “Margin Credit” balance of my overall credit / debit balances. It doesn’t look like I’ll be able to actually utilize the cash?

Has anyone else run into this issue?

Thanks,

Harry Sit says

If you see the amount as pending on the Positions page, the trades still need to settle.

Wilson says

Hi All,

I am intrigued by this but I wanted to make sure that my broker Fidelity wouldn’t liquidate me out of the position during after hours market fluctuations.

Say I have about 80k in a conservative portfolio…, and I wanted to borrow 30k over the course of a few years. I know the fluctuations can be extreme like 50k plus drops in value….I just wanted make sure I wouldn’t get a margin call….as a result of the crazy market swings….

Would Fidelity Liquidate or margin call my holdings during overnight as a result of the SPX short box spread price changes?

Harry Sit says

It’s best to ask Fidelity directly. As far as I know, Fidelity doesn’t liquidate you automatically. They will give you time to make up for a shortfall. I don’t suppose that a margin call will be based on values when the market is closed. Please verify with Fidelity.

John says

Has anyone done this at Vanguard? I messaged my rep asking what was required in order to do short box spreads and their response was:

“I contacted our Options Desk to determine whether we offer options spread trading, and they informed me that, unfortunately, we do not offer this at Vanguard.”

Sanjam says

Hi Harry, I never did this because of rule #1. But, what do you think of BOXX ETF offering the same thing at a small cost. https://www.youtube.com/watch?v=zxWuyagI6xA

Harry Sit says

The BOXX ETF is only for going long and only for 1-3 month maturities. It can’t give you a loan. If I’m interested in going long, the extra yield from the box spread minus the expense ratio is too small. I might as well just buy T-Bills. The appeal is in the tax deferral, which is unproven. The prospectus warns the tax risk. I’m not doing it.

Boxer says

Great writeup, thank you!

With respect to this: “Your four-leg option trade is offered as a full package. It’s not possible for someone to pick it apart and accept some legs of your trade but not the others.”

My understanding is, your broker (and their router) is the one who has to ensure you get all 4 legs together. There *can* be multiple counter-parties that pick up various portions of your trade, as long as your broker sees the opportunity to get all four at the same time.

This is largely an academic question, but I’m curious if this is correct.

Harry Sit says

Maybe some brokers do more than other brokers. I think most brokers just send the multi-leg order to the complex order book on the options exchange. The broker doesn’t see or care whether the options exchange executes the order with one or multiple parties. That level of details is managed by the options exchange.

https://www.cboe.com/us/options/trading/complex_orders/

Kristi says

Looks like Fidelity has made it more difficult now?

https://www.reddit.com/r/fidelityinvestments/comments/1fr0rsi/long_box_spread_on_spx_how_does_fidelity_handle/

Harry Sit says

I executed some trades at Fidelity yesterday. It worked the same way as written in this post.