Selling a short box spread is a way to get a loan at a good rate using your investments as collateral. I sold some short box spreads to get cash for building a home because I didn’t want to sell stocks when stocks were down. Now that stocks recovered, I sold stocks to close out the box spreads before the expiration date.

When you close out a box spread early, you may end up with a gain or loss depending on the interest rate changes. The interest rate happened to have gone up since I originally sold the short box spreads. I ended up with a small gain.

The broker will include the realized gain or loss on a 1099-B form. See Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA for how to report it on your tax return.

Here’s how I closed out my short box spreads early.

Close Out a Short Box Spread

I executed these trades when I originally sold the box spread:

- Sell to Open a call on SPX in December 2027 at 4,300

- Buy to Open a call on SPX in December 2027 at 5,000

- Buy to Open a put on SPX in December 2027 at 4,300

- Sell to Open a put on SPX in December 2027 at 5,000

Sell – Buy – Buy – Sell.

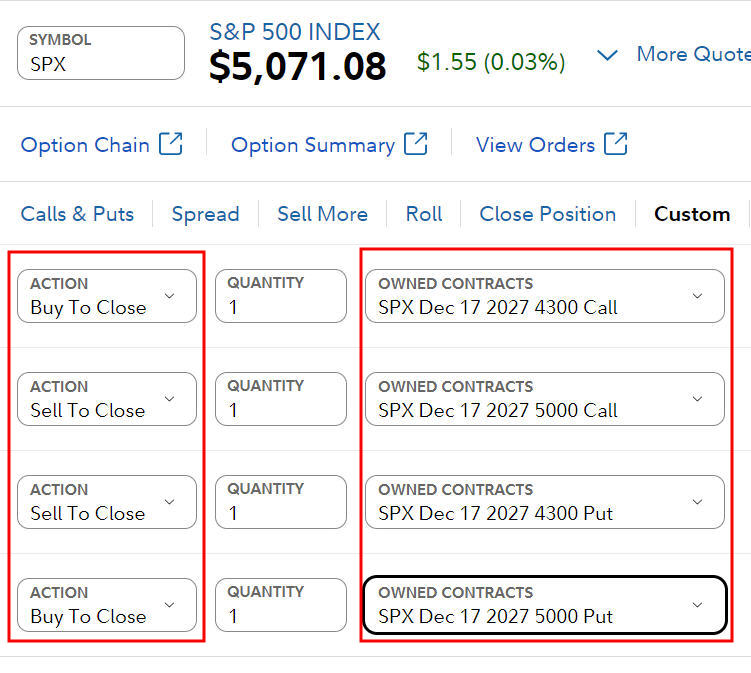

To close out this box spread, I needed to execute trades in the opposite direction. “Sell to Open” becomes “Buy to Close” and “Buy to Open” becomes “Sell to Close.” Therefore, these are the closing trades:

- Buy to Close a call on SPX in December 2027 at 4,300

- Sell to Close a call on SPX in December 2027 at 5,000

- Sell to Close a put on SPX in December 2027 at 4,300

- Buy to Close a put on SPX in December 2027 at 5,000

Buy – Sell – Sell – Buy.

Set Up Four Legs

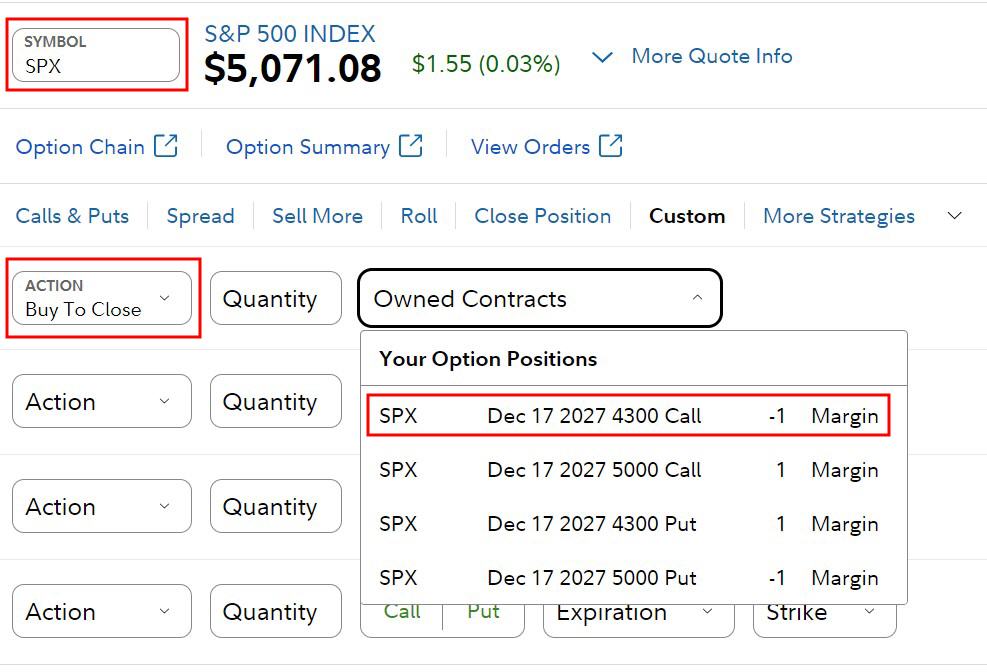

I held the box spreads through Fidelity. Fidelity shows the contracts you hold when you enter the ticker symbol and choose “Buy to Close” in the action dropdown.

Here are all four legs:

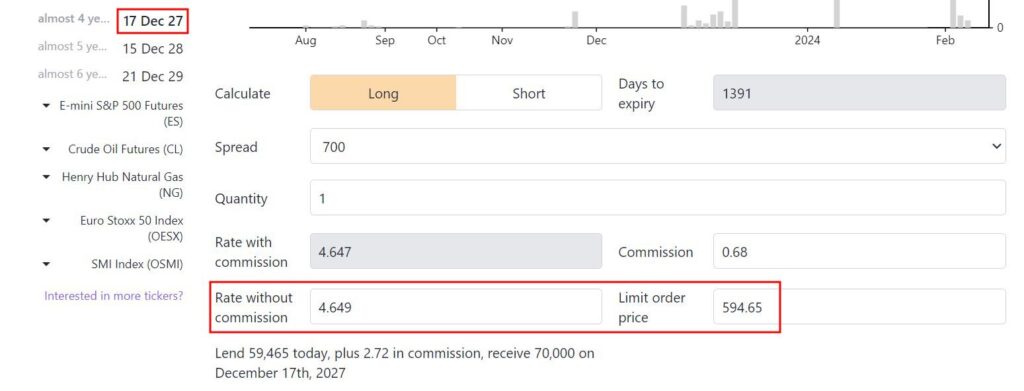

Calculate the Limit Price

I checked the Treasury yields near the expiration date. It was around 4.4%.

Boxspreads.com showed that if I wanted a 4.65% yield (0.25% above Treasury), the target price for a 700-point spread in December 2027 was 594.65.

Use that price for the limit order in Fidelity.

Partial Close

If you don’t have enough money to close out the full box, you can also execute a partial close. You go up from the bottom of your spread or come down from the top of your spread to shrink the spread to a smaller size.

Suppose I want to shrink my 700-point spread to a 500-point spread, I would close at 4,300 and open at 4,500.

It’s still Buy – Sell – Sell – Buy except you’re going up from 4,300 to only 4,500, not from 4,300 to 5,000. After this trade executes, you’re left with a 4,500 – 5,000 box spread.

Alternatively, you can also come down from the top, to close at 5,000 and open at 4,800. Then you’re left with a 4,300 – 4,800 box spread.

- Buy to Open a call on SPX in December 2027 at 4,800

- Sell to Close a call on SPX in December 2027 at 5,000

- Sell to Open a put on SPX in December 2027 at 4,800

- Buy to Close a put on SPX in December 2027 at 5,000

Close Out a Long Box Spread

The same principle applies when you’re closing out a long box spread. These are the original trades for a long box spread:

- Buy to Open a call at X

- Sell to Open a call at X + spread

- Sell to Open a put at X

- Sell to Open a put at X + spread

Buy – Sell – Sell – Buy.

In opposite trades, “Buy to Open” becomes “Sell to Close” and “Sell to Open” becomes “Buy to Close.” These trades will close out a long box spread:

- Sell to Close a call at X

- Buy to Close a call at X + spread

- Buy to Close a put at X

- Sell to Close a put at X + spread

Sell – Buy – Buy – Sell.

Similarly, you can also partially close out a long box spread by using a smaller spread in your closeout trades.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

James says

Help me understand what actually happens when closing out a box spread early. I thought that box spreads are fixed contracts that cannot be closed out early by either side. Therefore, when closing out a box spread early, will both sides of the trade simply stay on the brokers books who will then settle the trade in 2027 behind the scenes (using your example)?

Will paying back a box spread early prevent you from closing your brokerage account / transferring all assets used for collateral, until the box spread is completed in 2027?

Is there demand for yields above treasury rates, or how did you choose the 0.25% premium?

Harry Sit says

Option contracts are intermediated by the OCC. When you execute opposite trades to close out your positions, OCC cancels your original positions and you and your broker are off the hook. The party that takes up your closing trades registers those positions with the OCC. In effect, your original positions are transferred to this new party. OCC will charge their broker when the options expire.

Closing the options positions means you don’t have them anymore. It doesn’t stop you from closing your brokerage account or transferring assets to another broker.

When you borrow, you have to offer a yield higher than the Treasury yield to entice someone to lend to you. Otherwise they would just buy Treasuries. The party that takes up your closing trades is borrowing. They accept a rate slightly higher than the Treasury yield. Whether it’s 0.25% above or 0.5% above is determined by the market. If you set your price and no one fills your order, you’ll have to make it more attractive until a willing party accepts your offer.

Raj says

A question on letting it expire. Say I have a short box spread of $20k that expires 8/16. When it expires, I want to recreate it further out (and perhaps with a larger loan).

I want to avoid some options trading fees, and let it expire before I create a new one. If I close and recreate, that incurs fees.

But as soon as it expires, and say I do not have cash in the account, I will start incurring margin interest fees. Do those fees start on the day of expiration, or the following day? If 8/16 is a Friday, would I have margin fees over the weekend?

Basically I’m trying to understand how to best do a rollout without closing the position. Would I need to create the new loan on the same day of expiration? It seems in that case I would double my margin temporarily while the 2 box spreads exist for the same day.

Thanks!

Harry Sit says

The expired contracts settle on the next business day. You don’t pay margin interest over the weekend. Selling a larger box spread on the date of expiration will effectively extend your loan. Selling a same size box spread won’t give you enough cash.

Raj says

> Selling a larger box spread on the date of expiration will effectively extend your loan.

Yes this is what I want to do. However say I already have a 20k loan and I want to make it 40k. My account shows -20k for the options. On the expiration date, I sell a new 40k spread. Won’t my account now show -60k on that day for my options? On the next day it would go to to the expected -40k. I’m just a bit worried about the -60k when both spreads exist.

Harry Sit says

It will show both but the new positions haven’t settled yet. Nothing changes hands until the settlement date. If you’re concerned, sell the new box spread on Monday. One day worth of margin interest isn’t much, and you’ll pay less interest for the box spread.