A long box spread trade earns a little more than buying Treasuries or CDs. A short box spread trade gives you a loan at a good rate. If you trade box spreads, whether long or short, you’ll have to report taxes on these trades.

Form 1099-B

Closed contracts generate realized gains and losses. Open contracts at the end of the year are “marked to market” and you pay taxes on any unrealized gains and losses up to that point.

The broker will include the necessary information on a 1099-B form. The 1099-B form may be a part of the broker’s consolidated 1099 form package. I’m using the 1099-B form from Fidelity as an example. The form from a different broker works similarly.

Fidelity reports box spread contracts in three sub-sections in its consolidated 1099 package. Find the heading “Section 1256 Option Contracts” under “Form 1099-B 20xx Proceeds from Broker and Barter Exchange Transactions.”

Fidelity gives a total realized gain or loss after a detailed listing of all the closed contracts.

“Total 8” refers to Box 8 on the 1099-B. A listing of unrealized gain or loss on open contracts as of 12/31 of the prior year appears next.

“Total 9” refers to Box 9 on the 1099-B. If this is the first year you traded box spreads, this section is empty and the total is zero. Finally, you have a listing of unrealized gains or losses on open contracts as of 12/31.

“Total 10” refers to Box 10 on the 1099-B. The Box 10 listing and total this year will become the Box 9 listing and total next year. The Box 11 amount “aggregate profit or loss on contracts” is calculated as:

Realized This Year (Box 8) – Unrealized Prior Year (Box 9) + Unrealized This Year (Box 10)

You first reduce the realized gains by the unrealized gains you already paid taxes on the previous year. Then you add the unrealized gains on contracts you held open as of December 31.

This Box 11 amount is the critical data point for your taxes on box spread trades. If you import 1099 forms into tax software, the numbers in Boxes 8 through 11 may not come through. My import from Fidelity didn’t bring them over. I had to enter the number into the software by hand.

Here’s how to put the information from the broker into tax software TurboTax, H&R Block, and FreeTaxUSA.

TurboTax

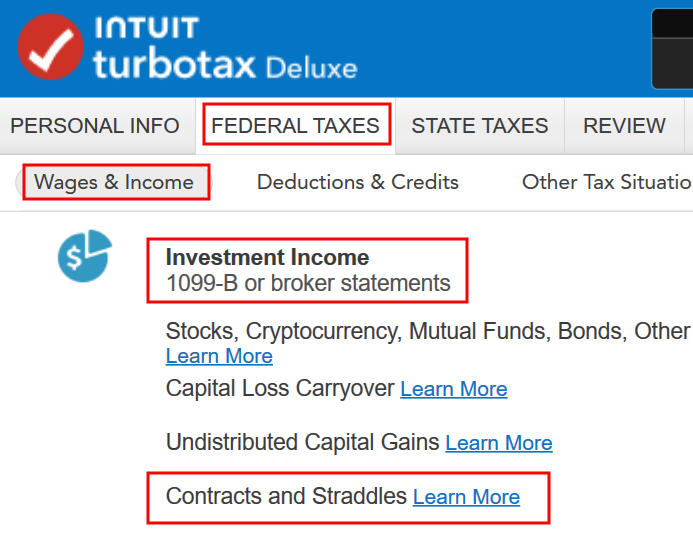

Go to “Federal Taxes” -> “Wages & Income.” Find “Contracts and Straddles” in the “Investment Income” section in TurboTax. Click on “Start.”

Box spreads fall under Section 1256 contracts. Answer “Yes.”

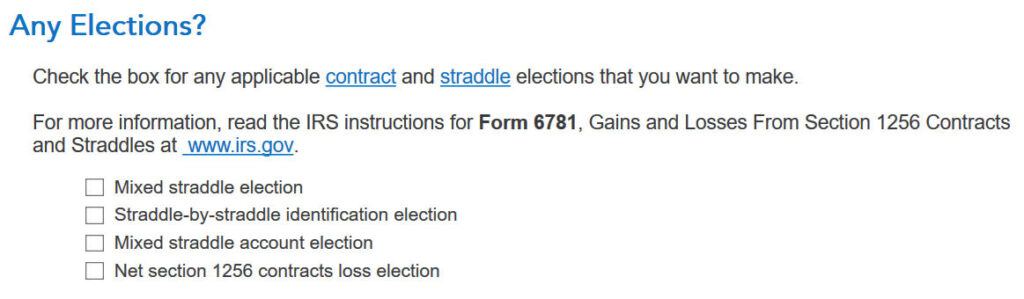

Keep it simple and leave everything blank here.

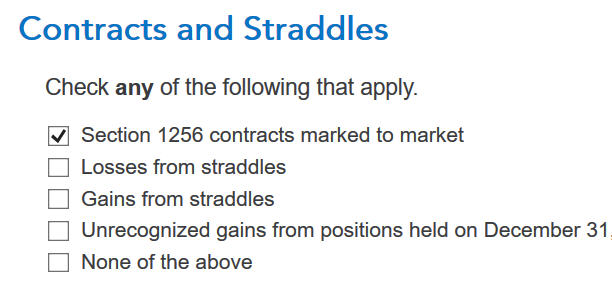

Only check the first box “Section 1256 contracts marked to market” unless you also have something else besides box spreads.

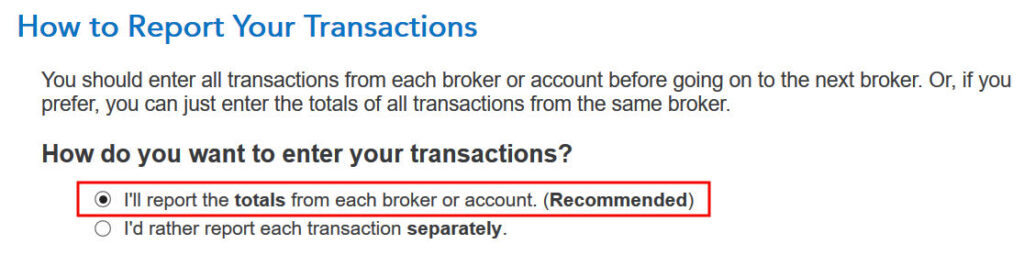

Take the recommended approach to report the totals from each broker.

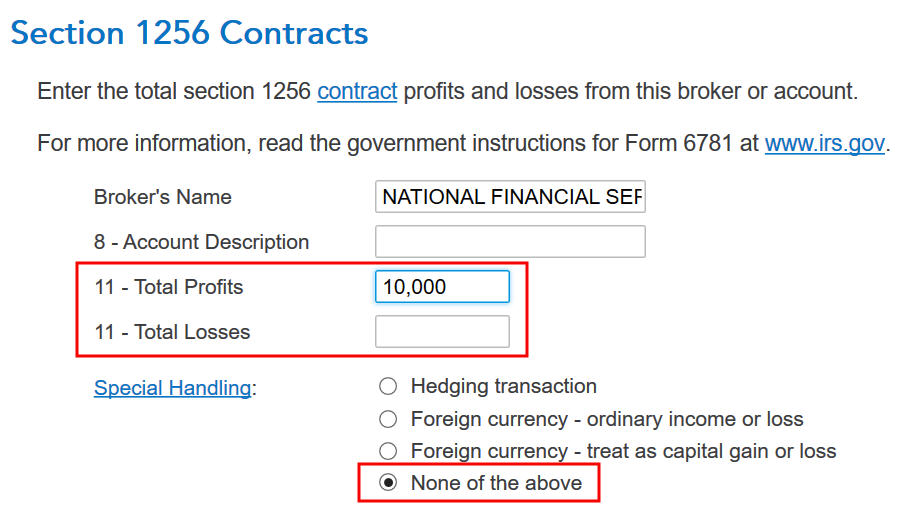

Enter the broker’s name as shown on the 1099-B form. If Box 11 shows a profit, put it in the Total Profits box. If it shows a loss, put it in the Total Losses box as a positive number. Special Handling defaults to “None of the above.” Keep it that way.

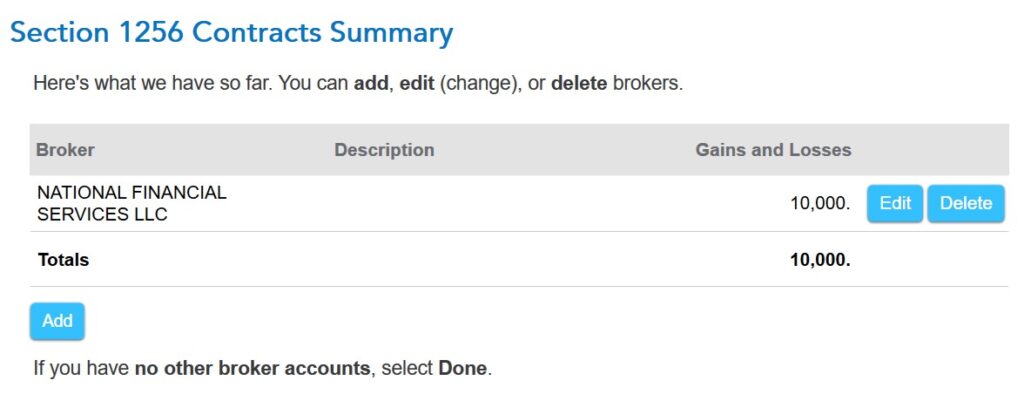

You’re done with one broker. Click on “Add” and repeat if you also traded box spreads at another broker.

Before you click on “Done” on the “Section 1256 Contracts Summary” screen, let’s see how the total profit or loss shows up on the tax return.

Click on “Forms” at the top.

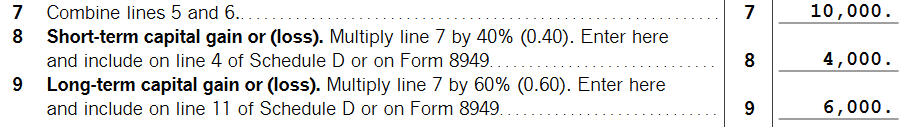

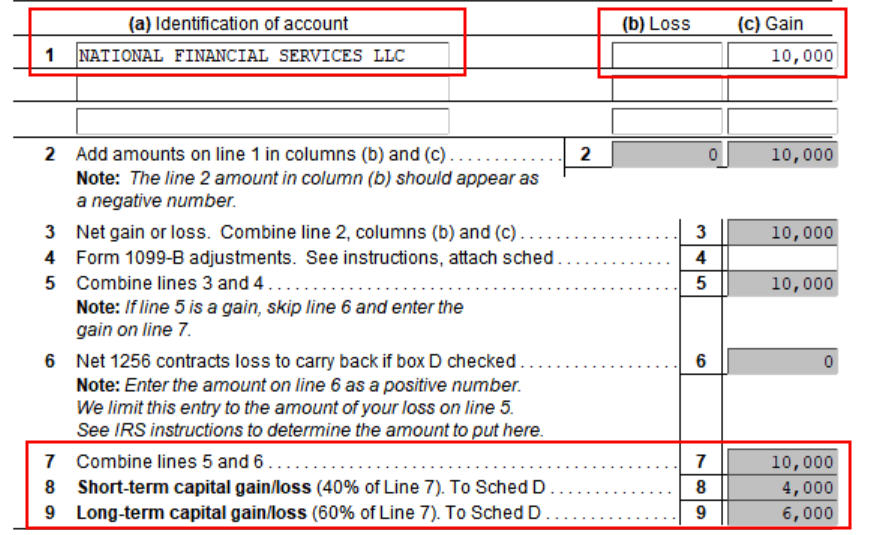

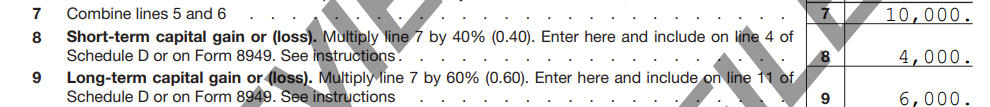

If Form 6781 doesn’t open automatically, find it in the list of forms on the left. Scroll down on the right to Lines 7 – 9. You see here that the total profit from box spreads is broken down as 40% short-term capital gain and 60% long-term capital gain.

Click on “Step-by-Step” at the top to return to the interview.

H&R Block

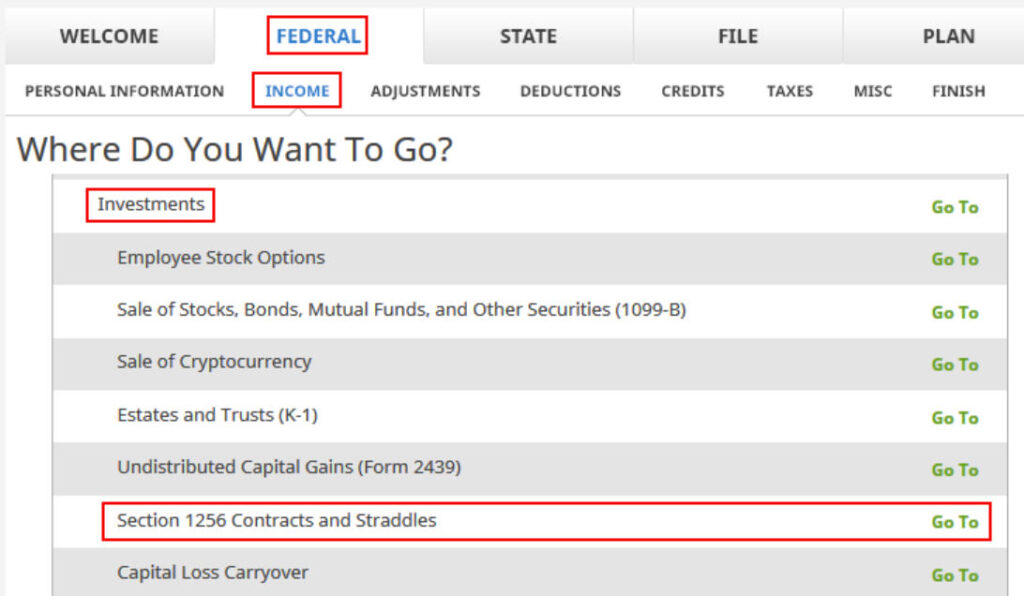

In H&R Block tax software, click on Federal -> Income. Scroll down to find “Section 1256 Contracts and Straddles” in the Investments section.

H&R Block asks you whether you had any open contracts as of December 31. You must answer “Yes” here even if you didn’t have any open contracts as of December 31 because H&R Block will end the interview abruptly if you answer “No.”

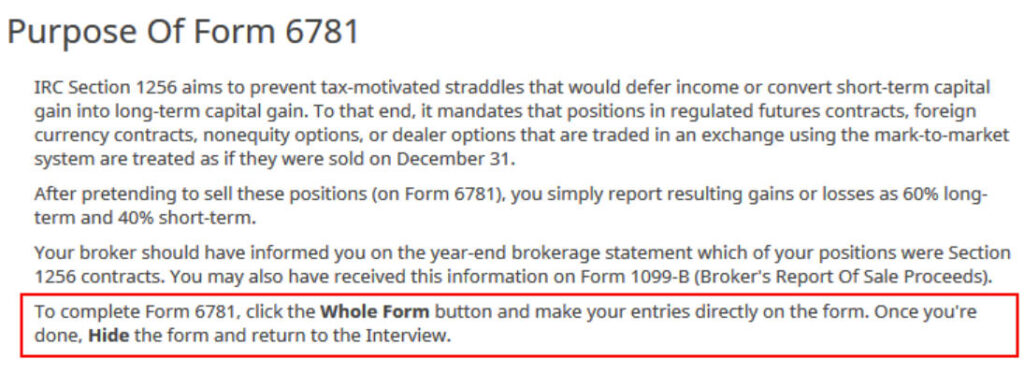

H&R Block goes into the lazy mode again. It wants you to fill out Form 6781 directly yourself without much guidance. Click on “Whole Form” to expand the form below.

Thankfully the form isn’t too complicated if only you know what to do with it. Put the name of the broker from the 1099-B in Line 1 column (a). If the amount from Box 11 of the 1099-B (“aggregate profit or loss on contracts“) is a loss, put it in Line 1 column (b) as a positive number. If it’s a profit, put it in Line 1 column (c).

The rest of the lines calculate automatically. You see the aggregate profit is broken into 40% short-term capital gain and 60% long-term capital gain.

FreeTaxUSA

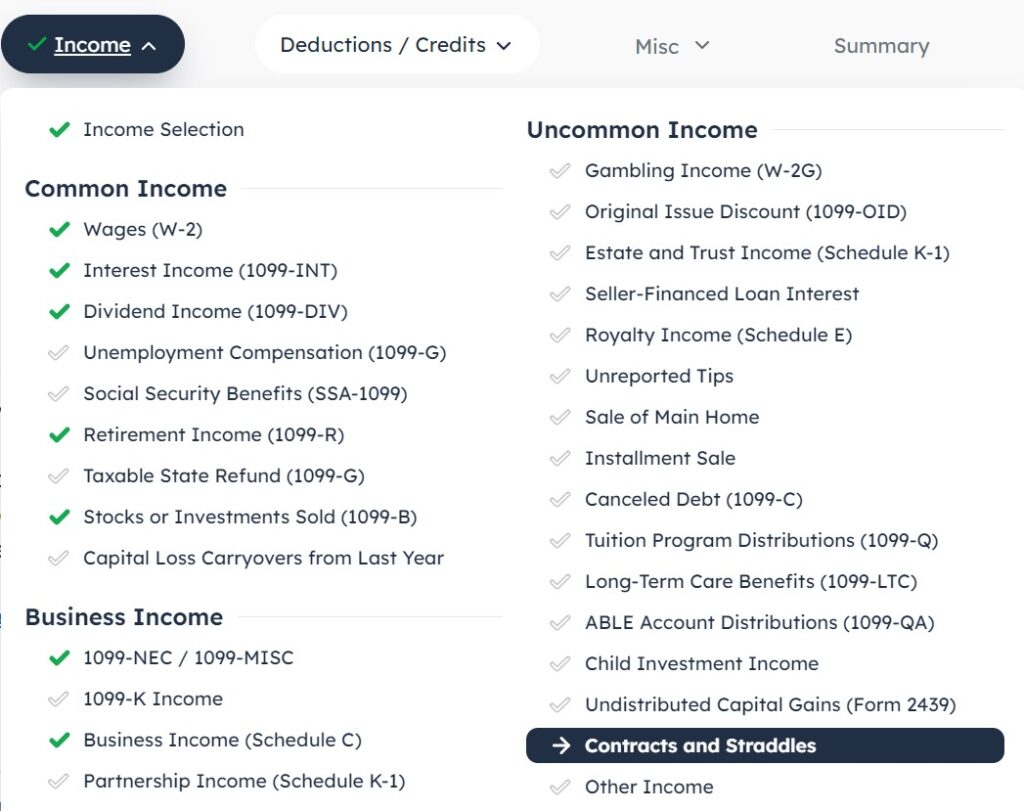

In FreeTaxUSA, find “Contracts and Straddles” under Uncommon Income in the Income section.

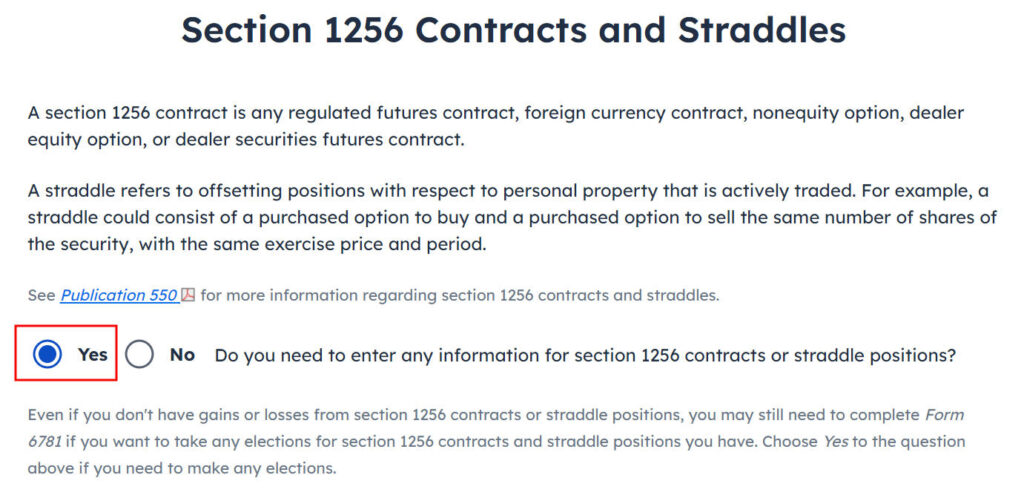

Answer “Yes” to get into the interview.

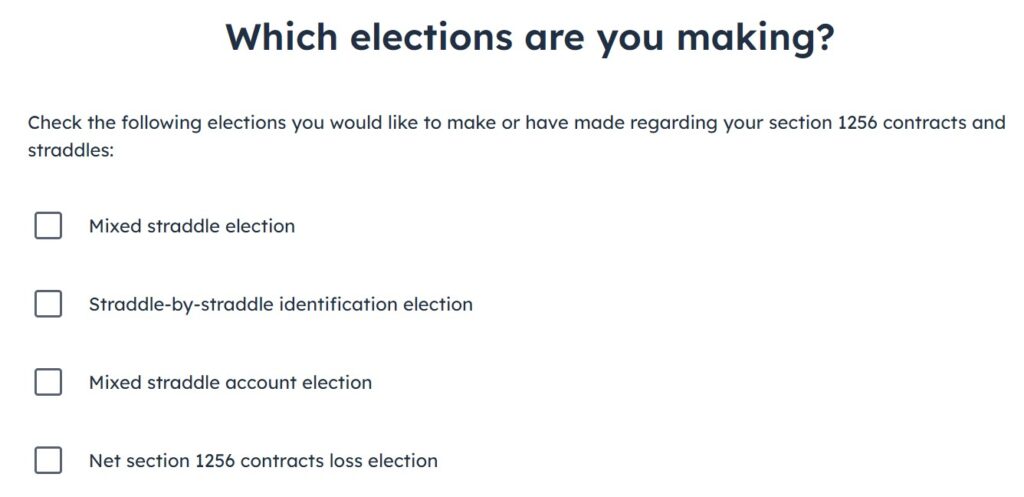

Keep it simple and leave everything blank here.

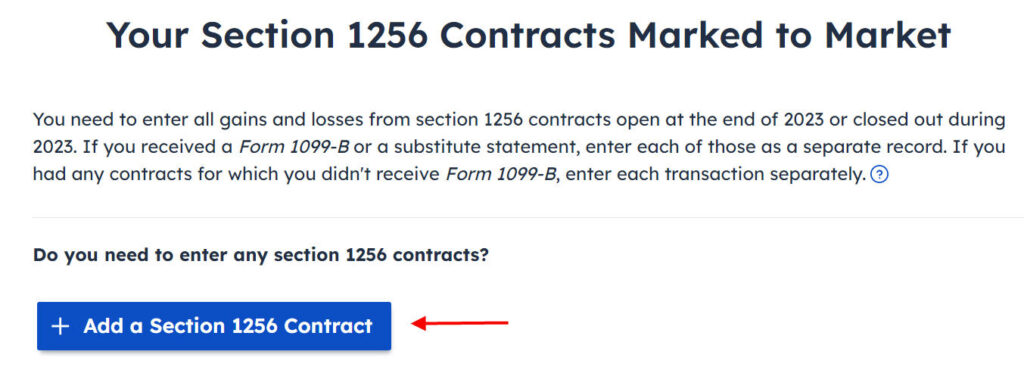

Click on the “Add a Section 1256 Contract” button. Although the blurb and the button give the impression that you must add each contract separately, the next screen will mention that you can enter only the total amount.

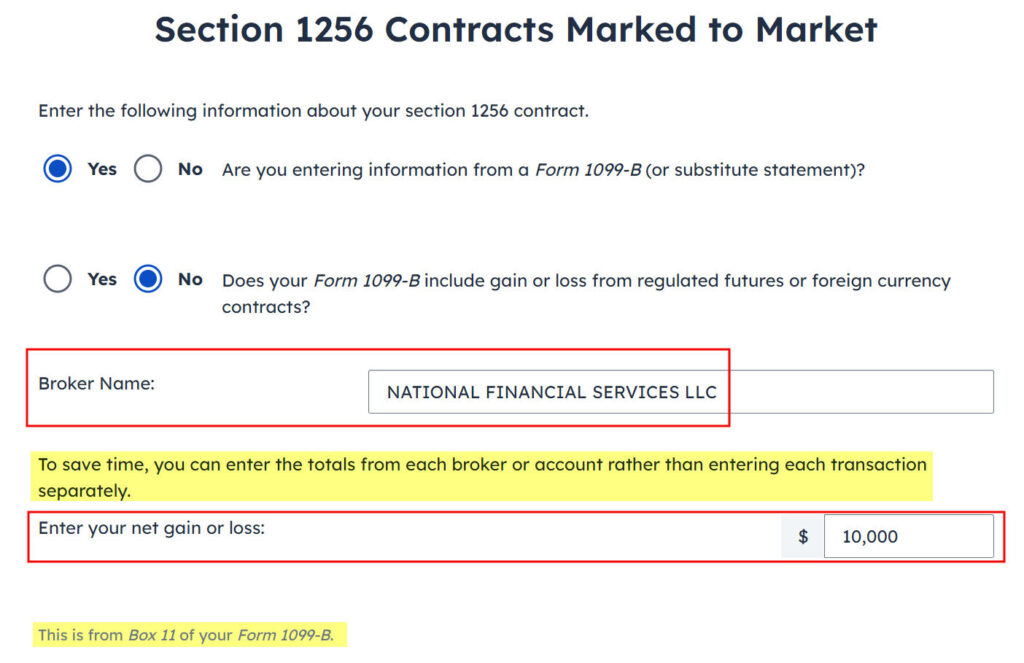

Enter the name of the broker and the total profit or loss from Box 11 of the 1099-B form. Enter a negative number if it’s a loss.

Repeat to add another 1099-B if you traded box spreads at another broker.

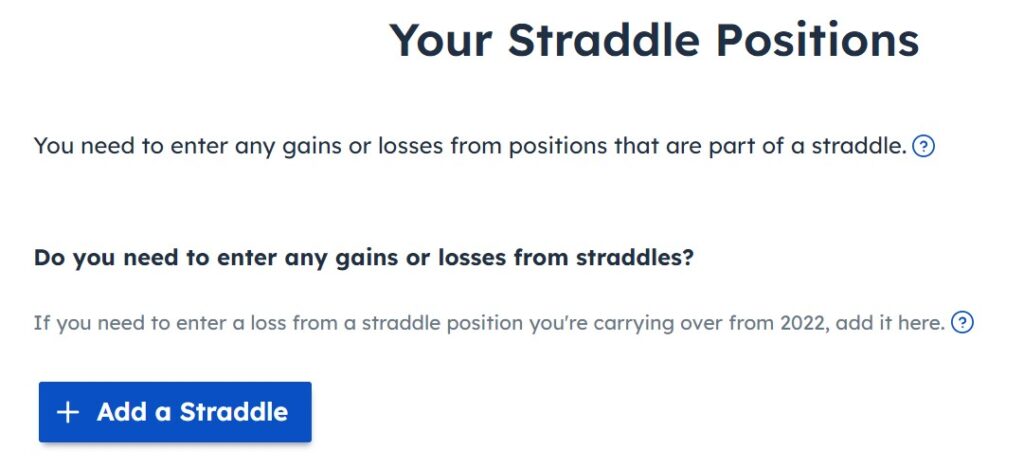

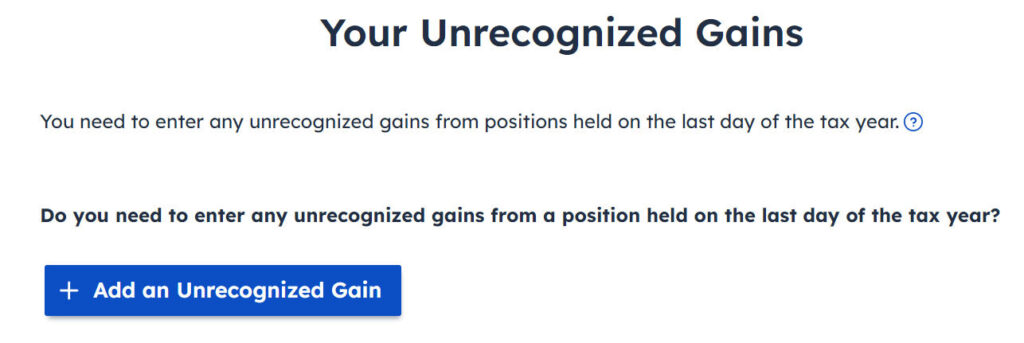

Click on “No, Continue” here because box spreads aren’t straddles.

Click on “No, Continue” here even though you do have unrecognized gains or losses in open contracts held December 31 because those unrealized gains and losses are already included in the aggregate profit or loss in Box 11 of the 1099-B.

To verify that the software treated the gains or losses correctly, scroll down to the bottom of the income summary page and find the small “view PDF” link under Contracts and Straddles.

You see it’s broken into 40% short-term capital gain and 60% long-term capital gain.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

TNT says

Wow. Thank you for this post. This really helped me figure out how to enter the data in H&R block. The instructions from the H&R block software were not clear.

Unmesh says

I’m thinking of buying a long box spread and am somewhat mystified as to the tax treatment. If I open the position this year for an expiration next, year, will my 2024 taxes show an imputed taxable gain that I will have to offset in next year’s taxes?

And is the LT/ST CG split independent of holding period between purchase and expiration?

Thanks

Harry Sit says

Whether it’ll be a gain or loss depends on how the option contracts are valued at the end of this year. If the 1099-B form shows a gain in Box 11 and you don’t have losses elsewhere to offset it, you’ll pay tax on the gain. The long-term/short-term split is independent of the holding period.

Unmesh says

Thanks for the clarification.

Now to investigate why some redditors are saying that Fidelity requires you to create the synthetic long and the synthetic short on separate tickets.

remarkL says

My understanding is that the “conversion” rule of section 1258 applies to long box trades, making the gain ordinary income. How does Turbotax handle that?