We looked at the short box spread as an alternative to securities-based lending in the previous post. This time we look at its mirror image: the long box spread. Once again, this post is more on the “advanced” side of things. It’s totally optional. Please feel free to skip it if you prefer to stick with safety in the mainstream.

Long Box Spread

A long box spread is also a specifically constructed set of four option holdings, which are typically implemented on a market index. When you buy (“long”) a box spread, you —

(a) pay a sum of cash upfront; and

(b) are guaranteed to receive a known larger sum on a specific date in the future.

When you pay upfront for a guaranteed larger sum on a future date, you’re effectively lending at a fixed rate for a fixed term. The difference between the amount you pay and the amount you will receive in the future is your effective interest income for giving the cash upfront.

How Does It Help?

If you want a guaranteed return for a fixed term, you can already buy a Treasury note or a CD. A long box spread gives you a slightly higher yield than buying a Treasury note or a CD.

Slightly Higher Yield

As we learned from the previous post on the short box spread, the implied interest rate in a box spread trade is about 0.3% – 0.5% above the Treasury yield of a comparable term. Brokers also sell brokered CDs. The best yields on a one-year or two-year brokered CD sold through Fidelity and Vanguard at this time are worse than the Treasury yields.

You’re getting paid a small premium over the Treasury yield when you hold a long box spread.

Low Credit Risk

Even though your money initially goes to the market participant who sold the box spread to you, you’re not relying on their goodwill to be paid back. You’re paid back by the options exchange through your broker when the options expire. The options exchange debits the other party’s broker. If the other party can’t come up with the money, their broker will go after them by selling their investments. It’s not your worry.

No New Accounts

When you want the best yield on a bank CD, you may have to open a new account at a bank or a credit union you’re not familiar with. When you buy a long box spread, you’re getting a higher effective yield than a CD while staying in your existing brokerage account. You don’t have to open new accounts with banks and credit unions all over the place.

Favorable Tax Treatment

Your effective interest income in a long box spread is an investment gain in Section 1256 contracts, which is treated as 60% long-term gain and 40% short-term gain, whereas your interest from a CD is 100% ordinary income.

A higher yield, the convenience of staying in your brokerage account, plus a favorable tax treatment make it attractive to buy a long box spread.

What Are the Downsides?

The biggest downside in a long box spread trade is the same as in a short box spread trade: the risk of screwing up when you enter your order. If you accidentally make a mistake, you may turn a small guaranteed gain into a big loss.

Rule #1 if you’re going to venture into box spreads: Don’t screw up.

Another downside is liquidity. If you want your money back sooner, you’d have to sell your long box spread, which isn’t nearly as liquid as a Treasury note.

How To Do It at Fidelity

If you fully understand what you’re doing and you’re super careful, here’s an example of how to do a long box spread at Fidelity. It may be similar at other brokers.

Four Legs

As in doing a short box spread trade, you must be approved for options trading Tier 2 (or Tier 1 plus spread in an IRA).

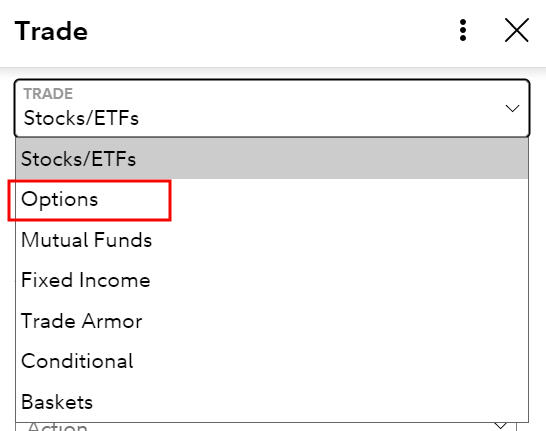

Choose “Options” in the Trade popup.

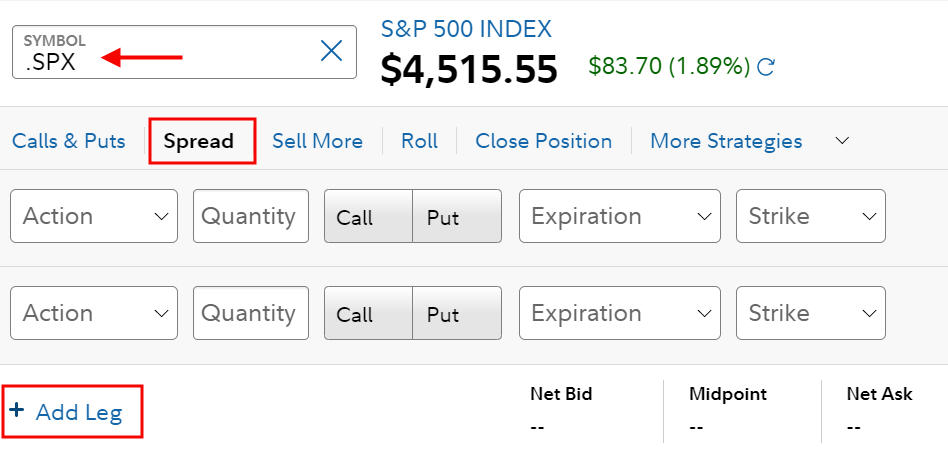

Enter “.SPX” in the symbol field. This is for the S&P 500 index. Again, we use the S&P 500 index (SPX) as opposed to the S&P 500 ETF (SPY) because SPX options can’t be exercised early whereas SPY options can be. Your box will be knocked out of balance if one of your legs is exercised early.

Click on “Spread” as the options strategy. You automatically get two legs. Click on “Add Leg” twice to add two more legs.

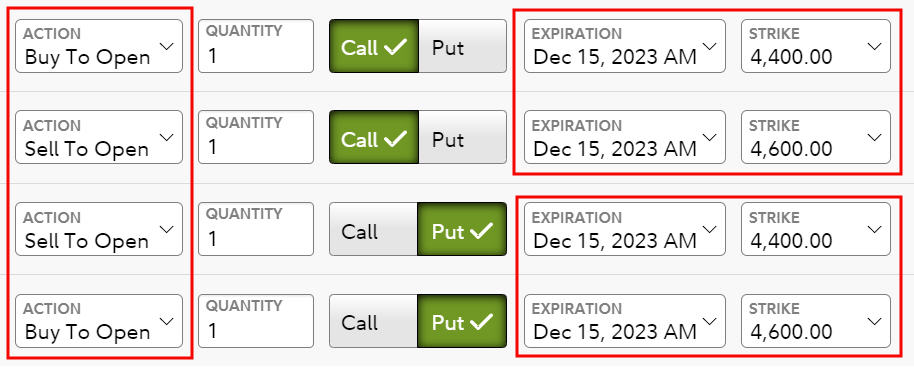

Click on the “Call” toggle for the first two legs and the “Put” toggle for the next two legs.

Select Action in this sequence for a long box spread, which is the opposite of a short box spread:

- Buy To Open

- Sell To Open

- Sell to Open

- Buy to Open

Remember for a long box spread: Buy – Sell – Sell – Buy.

Set the expiration to the same date for all four legs. This is the date you will get paid back.

Choose strike prices around the current index value (4,400 to 4,600 in the screenshot when the index was around 4,500). The gap between the strike prices times 100 is the amount you’ll be paid back. If you have $20,000 to invest, make the gap 200 wide. The strike prices go from low to high in your two calls and two puts. Match the two spreads exactly between your two calls and two puts. Finally, enter the same quantity for all four legs.

When you need to invest $40,000, you can choose a spread of 400 (for example 4,300 to 4,700) with a quantity of 1 or you can choose a spread of 200 (for example 4,400 to 4,600) with a quantity of 2. All else being equal, a smaller quantity with a larger spread saves a small amount of money on commissions and fees but a larger quantity with a smaller spread may be easier to execute. The commissions and fees at Fidelity are $2.72 for each set of four legs at a quantity of 1 ($0.68 per leg).

Limit Price

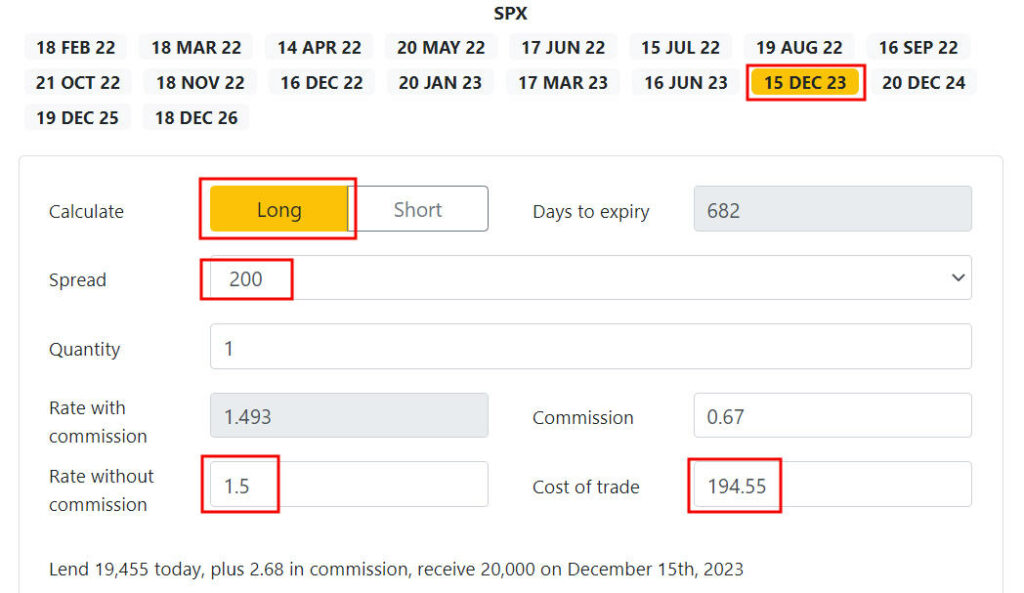

Now you need to enter a limit price for your four legs. Look up recent trades on boxtrades.com. Boxtrades.com gives you a target price when you enter the desired yield.

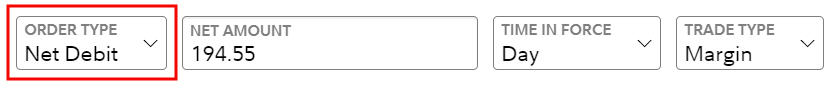

This screenshot shows when you’re willing to accept a yield of 1.5% per year for a spread of 200 until December 15, 2023, you should enter a limit price of 194.55.

Make sure the order type is Net Debit. You’re offering to pay someone in the market $19,455 now for you to receive $20,000 on December 15, 2023. You’ll pay $19,455 + $2.68 = $19,457.68 after commissions and fees.

Execution

After you place the order, you wait to see if someone accepts your offer. Your four-leg option trade is offered as a full package. It’s not possible for someone to pick it apart and accept some legs of your trade but not the others.

It may take some time for your trade to execute. If no one is interested after an hour, you may need to raise the offering price (pay more and receive a lower effective yield). Or you can try it on another day if you aren’t in a hurry. Again, you can calculate the effective yield for your new higher price at boxtrades.com.

After Execution

If your order is filled, you’ll pay a sum of cash in your account. You’ll also have four option positions in your holdings. These option positions added together have a net positive value. They will turn into a predictable cash credit when you hold them to the expiration date. You’re effectively paid back at that point.

If you need cash before the expiration date, you can execute trades in the opposite direction to exit the box spread positions. The price for your close-out trades will depend on the prevailing interest rate at that time but it’ll be less than the amount you’ll receive on the expiration date because you’re getting the money sooner. See how to do it in Close Out a Box Spread Early at Fidelity.

Ignore Values in the Evening

The values of the option positions will fluctuate with the market even though they will converge to the predictable value on the expiration date. The prices used to calculate their values are especially wild when the market is closed. You’ll have to learn to ignore the account balance you see in the off-hours.

Don’t be alarmed when you see your balance drop by a huge sum in the evening. They’ll return to more reasonable values when the market is open.

Mark-to-Market Gain/Loss for Taxes

The year-end 1099 form you receive from the broker will include realized and unrealized gains or losses for your Section 1256 contracts. Enter the information from the 1099 form into your tax software. See Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA. The tax software will handle it with the proper tax treatment.

***

A long box spread can be a good alternative to buying a Treasury note or a CD when you execute it correctly. You must be super careful not to screw up in placing your order. Don’t do it if there’s even a slight chance you’ll make a mistake. The loss from your mistake can be many times your potential gain from a slightly higher yield. It’s perfectly valid to avoid a possible disaster and only stick with safety in the mainstream.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Roy haya says

Harry, your conclusions on the taxation of a long box are incorrect. Although 1256 contracts are taxed 60/40, the long box. Is a conversion transaction as defined by 1258. Since all of the gain is a function of the time value of money, the gain is ordinary, not 60/40.

Sake says

I’ve never heard of this, can you point to further details?

CrookedYams says

Would it make a difference to section 1258 if the long box wasn’t held until expiration? The logic would be that the positive return of the long box is only guaranteed at expiration. Up until that point, the value of the options that make up the long box are set by interest rate changes/other market forces.

Harry Sit says

The speaker in this AICPA Personal Financial Planning podcast episode explained why section 1258 doesn’t apply when the holdings are section 1256 contracts.

https://www.aicpa-cima.com/resources/podcast/how-to-earn-interest-rate-equivalents-and-pay-less-in-tax

Here’s the link to the slide deck for this talk:

https://www.aicpa-cima.com/resources/download/earning-interest-rate-equivalents-in-the-listed-options-market

Sake says

Even the OCC’s white paper (google “OCC box spreads”) refers to box spreads having 1256 tax treatment, are you sure?

Roy haya says

I’m sure. I know the white paper states that, but it’s wrong. This is a conversion transaction as defined by irc sec 1258

https://www.law.cornell.edu/uscode/text/26/1258

And since all gains are a function of the time value of money, the gain should be recharacterized as ordinary income. Tax forms from the custodian will show 60/40 gain, but the onus is on the client to police themselves. Wish it weren’t true, but those are the rules.

Harry says

Any idea what a short box that has a positive MTM value should be taxes as?

Shorted a 2-year box early this year, but due to rising interest rates, I have a gain on it now..

Sake says

Interesting. Your last comment that the onus is on the client makes sense then because I looked in my cost basis information and see that my broker is classifying the trades as 60/40.

Steven H says

Harry, thanks for informing me about this trading opportunity.

Your example shows AM-expiring options. Can PM-expiring options be used instead?

Harry Sit says

The AM-expiring options supposedly have higher volumes and are potentially easier to fill at a better price. I only used AM-expiring options. Some say the end-of-month PM-expiring options work just as well. If those fit your timeline better, you can try and see if you get a fill at a similar premium over comparable Treasuries.

Andrew says

Has anyone used turbotax to file their return while having long box spread positions? One of the interview questions asks you to check all that apply from the following list:

-Section 1256 contracts marked to market

-Losses from straddles

-Gains from straddles

-Unrecognized gains from positions held on Dec 31st

-None of the above

I know “section 1256 contacts MtM” should be checked, but what about the gains/losses from straddles? Are box spreads considered to be straddles? Also, if you hold the box spread position through the new year, should you check the box for “unrecognized gains from positions held on Dec 31”? In my case, I have several long box spread positions that were opened throughout 2023 and are still open, and won’t expire until sometime in 2024 and 2025. Fidelity actually marked them as losses on the 1099, so I suppose I shouldn’t check the box for “unrecognized gains”, but what about “losses from straddles”?

Thanks Harry and whoever else can offer some advice.

Harry Sit says

I’ll write a new post about reporting gains and losses in the tax software after I get my tax forms from Fidelity next week.

Harry Sit says

This new post walks through how to do it in tax software: Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA.

Valentin says

can I buy more Box spreads than I have in the account, for example I have $20,000 in the account and I buy Box for $100,000

Harry Sit says

You can buy a little more by borrowing on margin but not 5x more. I don’t see why you want to do that because your margin borrowing cost is going to be higher than the return from the box spread trade.

Unmesh says

I talked to my guy at Fidelity earlier today and they will no longer do box spreads on a single order ticket 🙁

Andrew says

starting when? I just did one on a single ticket and was charged the normal $2.67

Harry Sit says

I don’t understand what that means. Did you try it? I just entered an order to buy a 5,000-5,500 spread expiring on December 20, 2024 in the same way shown in this post. The order was accepted and active right now.

Mike says

When I try to do this on ThinkOrSwim platform it categorizes it as “iron Condor 5000/5400/5400/5000 call/put”.

Am I doing something wrong or does this makes sense?

Thanks

John says

I had a long box spread expiring this morning (Friday, December 20) at Fidelity. I was going to roll it, but Fidelity didn’t make the proceeds from the automatic exercise today, so I didn’t have enough Buying Power to roll it. Does this mean I have to wait until Monday to roll? (which would mean cash sitting in SPAXX or something for a day, since options settle T+1)

Harry Sit says

First, having cash sit in SPAXX for one day isn’t a big deal. Second, you should have enough buying power because you have margin. You won’t pay margin interest when you use the buying power from margin because the expired contracts and the rolled contracts settle on the same day.

John says

Unfortunately, there wasn’t enough buying power. This account has about $100K long box spread (the one I’m trying to roll) and $30K worth of ETFs. Buying Power of marginable securities was $30K and non-marginable securities was half of that.

John says

Are people frequently running into an issue buying a box spread on Fidelity, where you can’t place an order because Fidelity says the limit price is “too far away” from the last trade price? I tried to buy 5000-5300 box spread, because I saw a good offer with that strike price combo. But Fidelity won’t accept my limit order saying the limit price is too far away from the last trade. When I tried 5700-6000 instead using the same limit price, it worked, but it wouldn’t execute. I waited and waited, and even saw both my Buy order with 5700-6000 and a Sell order with 5000-5300 at the same price on Boxtrades.com/SyntheticFi.com, but my order wouldn’t execute. I ended up increasing my limit price, which eventually executed.

The limit price I was using was also within the Bid/Ask spread for the complex order, so it’s frustrating. I’m guessing they are basing it off of the last traded price for each leg, and there probably is a very low volume for options with strike prices 5000 and 5300.