We are finally done with buying all the items for our kitchen remodel. We had to make a careful decision on what type of sink we would use. Once it’s mounted under the countertop, if we want to replace the sink, it can cost several times more than the cost of the sink itself.

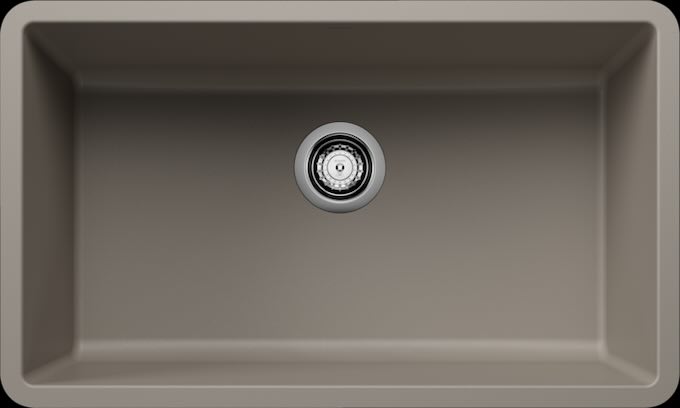

Stainless steel is a popular choice for kitchen sinks. Some sources say 70% of homeowners now choose stainless steel. I happen not to like stainless steel very much. When I looked for alternatives, I came across granite composite sinks, specifically a brand called Silgranit by Blanco.

The granite composite material is made to be scratch-resistant, stain-resistant, and heat-resistant. I also like the texture and color. There’s just one potential downside. I hear it can crack, either from impact with something heavy or from sudden contact with hot liquids. Cracking is only a possibility. It won’t necessarily happen, but it potentially can happen.

From what I read, most of the cracks happen during transportation, or an undiscovered crack caused during transportation then gets exacerbated after it’s installed. Some people say that previous generations of granite composite sinks and other brands may have this problem, but the latest generation Silgranit brand, with its patented technology, has eliminated the problem. Many owners don’t have any problems with their Silgranit sinks. In all likelihood, we won’t either.

In the end, we still chose stainless steel, because there is safety in the mainstream. Stainless steel isn’t perfect, but it’s robust enough. Although we probably won’t have problems with a granite composite sink, we just didn’t want that possibility. I don’t have to figure out whether cracking is real or a myth. Worrying whether our sink will crack tomorrow just isn’t worth it.

This is called a tail risk. It’s the opposite of insurance. You derive some benefits in normal times, but you pay a large cost when the unexpected happens. Staying in the mainstream helps reduce the tail risk.

Index Funds vs Real Estate Crowdfunding

Investing in broadly diversified index funds has become mainstream. If the market crashes, you know it’s not your fault, and you are not alone. It helps you stay in it. You won’t second-guess whether you made a mistake.

Just the other day, a reader asked me about investing in real estate crowdfunding. Basically, you fund real estate developers who buy real estate, improve them, and then sell them. For some reason, these real estate developers don’t want to or can’t get bank loans for their business.

Investing in real estate crowdfunding is not mainstream. It may be a good way to earn a good return, but the thing is, you don’t have to venture outside the mainstream. Investing in index funds already works well enough. There is safety in the mainstream.

Employee vs Entrepreneurship

Successful entrepreneurship builds wealth faster because you leverage other people’s labor and money. However, working as an employee is still the mainstream. It’s not as fast, but it works more reliably.

I recall this story on PBS NewsHour: 55, unemployed and faking normal: One woman’s story of barely scraping by. Elizabeth White has a Harvard MBA. She worked at the World Bank until she got the itch to start her own business. She had a chain of stores selling home decoration items, but the business failed. That took away a chunk of her savings. Now she’s scraping by, unable to find a job.

I imagine if she had stayed at the World Bank, the mainstream, she would’ve done much better in terms of her financial situation. Two friends of mine work at the World Bank in Washington, DC. They were hired right after they got their degrees, and they have worked there ever since. They are not scraping by.

It takes a certain mentality not to fall for the lure when news headlines are more about exceptions (“man bites dog“). You don’t get bragging rights when you go with the mainstream. You don’t get to feel clever about having found something that others didn’t. There is safety in the mainstream when the mainstream already works well enough. By staying in the boring mainstream, you will miss some opportunities, such as buying Bitcoin. You will also avoid the fate of Ms. White.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sam Seattle says

I like this post. Thank you for reminding us about this, Harry.

always_gone says

Fantastic reminder and great post.

(P.S. We have the Silgranit sink, lol)

Mark Zoril says

Really well done presentation of investing and taking personal risk. So many people are susceptible to this!

TheGipper says

Same could be said of factor investing or portfolio tilting. Perhaps why some of the wiser giants in our field still advocate against it.

RDT2 says

Interesting, they don’t pay income tax because they are not US Citizens. https://www.reddit.com/r/government/comments/197rx5/why_are_world_bank_employees_exempt_from_paying/

Harry Sit says

US citizens who work for World Bank get reimbursed by the bank for the tax they pay. Same end result.

T-Rav says

Interesting post Harry. Regarding Ms. White’s story, I recall a weekly update email you sent recently that said someone shouldn’t have put their life savings at risk to start a business.

Whether it’s starting out as an entrepreneur or purchasing a granite sink, I think it would be helpful to note that it is very possible to go outside the “mainstream” and still manage risk. For Ms. White, it could have been by getting an outside investor instead of using her life savings. For you, it could have meant not using an under mount sink that is $$$ to replace. There are of course trade-offs for these decisions, but they offer options to satisfy desires that aren’t firmly within the mainstream.

Harry Sit says

Putting her life savings into the business probably wasn’t her first choice. If she could find outside investors she likely would have. The right choice would be not getting into business (or trying to save her business) when she couldn’t find outside investors. To me, having a top mount sink is also outside the mainstream. Having both granite and top mount puts me further out.

Doug Miller says

Harry, while I have lived in the mainstream most of my life and led a comfortable and prosperous life working for medium to large corporations, I am really thankful for the people who dare to adventure. Someone has to start these businesses we work for, invent the things that make our lives better, etc. And, on a smaller scale, someone has to take a risk on buying these innovative and not entirely proven new products or we’ll never have anything new. Everyone will have stainless steel. Someone had to get into little tiny, leaky wooden ships and make perilous and uncomfortable journeys across the sea, or we wouldn’t be living the American Dream today. But even these brave adventurers will be better off putting their retirement savings in boring index funds 🙂 I enjoy watching the TV program American Greed. In almost every case, people lose their life savings by turning their money over to someone else with a supposedly special method of making extra returns. Dare to do great things, but be careful with your retirement savings!

Harry Sit says

I’m thankful too. Some early adventurers got rewarded. Some paid a big price. Late adopters get to enjoy what they created at a very low price.

Alex says

Hi Harry, great article.

Real estate is an industry that is stuck in the old ways and needs a groundbreaking change ASAP.

I’m part of the project that not only puts Real Estate on the blockchain, letting property developers get funding in a p2p fashion but also is a platform for individuals to make investments as little as $1 in projects they might find interesting.

We’re currently in beta phase but you are more than welcome to take a look at it. We are launching our mobile app next week and very own ICO in a couple of months.

Please let me know what you feel about it.

Joy D. says

I think the recession spooked investors. I remember watching a news segment on CNN that featured hundreds of unemployed people at a recruitment event.The overall synopsis was that hard working, highly educated people had not only lost their jobs and benefits, but their 401ks were essentially worthless as well. The financial fallout was so shocking, that we were bombarded by that bleak scenario at every turn. We saw it in the paper, on the internet, on the news, and heard it from our friends. Unfortunately, I think it created an environment of hysteria and some people responded by throwing good money after bad in desperation to recoup their financial loss. As you pointed out, it usually didn’t work. Of course, big winners like Bitcoin, Uber, and Facebook certainly didn’t help as the race was on to “get rich quick”.

The great recession and the recent presidential election changed my viewpoint too! I thought I had built a balanced portfolio, until I took a hard look at my numbers. My own fear and anger was affecting my choices and my returns. Now, I strictly rely on the professionals at [a newsletter]. For me, fintech is the way to go, since the computer algorithms keep my emotions out of it. I’m no longer stressing out over the market or trying to predict what will happen next. I’m no longer fooling myself that it’s wise to sell an investment when the reality is that I based my decision on anger at the company. The newsletter comes with a fee, but I’m seeing more returns than I ever did before and the developer actually answers my question in plain language. I appreciate blogs like yours that are factual and to the point. It’s also a plus that you allow comments that show a different side of the argument – but you’re rare! In this political environment we’re bombarded with sensationalism and in the past, I would have changed my portfolio if I didn’t like a company’s stance on women’s rights and I would have chased after Blue Apron’s IPO as the next big thing.

Joe says

Do you still consider this area outside the mainstream? My father has been looking into investing with Crowdstreet, including their new “Opportunity Zone”-oriented fund. He’s a real estate lawyer and developer, so I guess he might be able to use it, but he’s also prodding me to look into it and I have never been interested in real estate and don’t want to deal with investing unless it’s entirely passive and mainstream.

Harry Sit says

I still do. Directly owning a rental and managing it themselves or through a property manager is actually quite mainstream, but fractional ownership through a crowdfunding platform isn’t.

Sam Seattle says

Good post, Harry. Thanks for linking to this on today’s news round up.