The new 2025 Trump tax law — One Big Beautiful Bill Act — created several new tax deductions. Some people say they’re above-the-line deductions, but that’s not true. These new deductions are all below-the-line. This post explains the difference between the different types of tax deductions.

Not a Tax Credit

First of all, a tax deduction is not a tax credit.

A tax credit directly reduces your tax dollar-for-dollar. If you’re supposed to pay $5,000 in tax, a $1,000 tax credit reduces your tax to $4,000.

A tax deduction lowers your taxable income, which indirectly reduces your tax. If you’re supposed to pay $5,000 in tax, a $1,000 tax deduction lowers your taxable income by $1,000, which then reduces your tax by a fraction of it, depending on your marginal tax rate.

Therefore, a $1,000 tax deduction is worth a lot less than a $1,000 tax credit.

Within tax deductions, there are above-the-line deductions, standard deduction, itemized deductions, and a set of deductions that are neither above-the-line nor itemized.

Above-the-Line Deductions

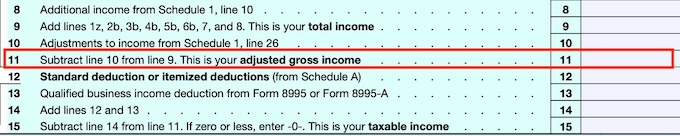

Above-the-line deductions are officially called adjustments to income. The “line” refers to the line on the tax form for your Adjusted Gross Income (AGI). Your AGI is a key number that determines your eligibility for many tax breaks. It’s the starting point for Modified Adjusted Gross Income (MAGI) for various purposes, for instance, child tax credit, ACA health insurance premiums, and IRMAA.

A tax deduction is either above-the-line or below-the-line. Above-the-line deductions lower your AGI and help you qualify for other tax breaks. Below-the-line deductions don’t affect your AGI, and they don’t help you qualify for other tax breaks.

Therefore, a $1,000 above-the-line tax deduction is better than a $1,000 below-the-line deduction.

Only specific tax deductions are designated as above-the-line. They are listed on page 2 of Form 1040 Schedule 1. Here are some examples:

- HSA contributions made outside of payroll

- Deductible Traditional IRA contributions

- Educator expenses

- 1/2 of the self-employment tax

- Contributions to small business retirement plans

- Self-employment health insurance deduction

Standard Deduction Or Itemized Deductions

The standard deduction and itemized deductions come after the AGI. They are below-the-line.

The standard deduction and itemized deductions are mutually exclusive. If you choose to take the standard deduction, you give up itemizing your deductions. If you choose to itemize, you forego the standard deduction.

Typically, you itemize only when the sum of your itemized deductions is greater than your standard deduction. You keep it simple and take the larger standard deduction when you know you don’t have that much in itemized deductions.

Taking the standard deduction is a win because you’re deducting more than your allowable itemized deductions. Over 80% of taxpayers take the standard deduction. So do I.

Itemized deductions are listed on Form 1040 Schedule A. Mortgage interest, state income tax, property tax, and donations to charities are typical itemized deductions (except for the new $1,000/$2,000 charity donations deduction when you don’t itemize).

Floors and Caps

Just because something is tax-deductible, it doesn’t mean you can deduct 100% of it. This is because some deductions must first clear a floor.

For example, medical expenses are tax-deductible, but you can only deduct the portion that exceeds 7.5% of your AGI. That comes to zero for many people.

Some deductions have a cap. You can deduct only up to the cap, even if you paid more. State and local taxes (SALT) are a well-known example of this.

The new 2025 Trump tax law increased the SALT cap. More people are expected to itemize deductions, but they’re still a minority. Over 80% of people will still take the standard deduction.

Below-the-Line, Available-to-All

In the old days, individual tax deductions were either above-the-line or itemized deductions. Only above-the-line deductions were available to everyone. Below-the-line deductions were only the standard deduction or itemized deductions. After taking the above-the-line deductions, you could only take the standard deduction if you don’t itemize.

This dichotomy between above-the-line and must-itemize no longer holds. Congress has created several deductions in recent years that are below-the-line but don’t require itemizing. You can still take these deductions when you take the standard deduction, but they don’t affect your AGI. A deduction available to everyone doesn’t necessarily mean it’s above-the-line.

| Itemize | Don’t Itemize | |

|---|---|---|

| Above-the-Line Deductions | ✅ | ✅ |

| Standard Deduction | 🚫 | ✅ |

| Itemized Deductions | ✅ | 🚫 |

| Below-the-Line, Available-to-All | ✅ (unless specifically excluded) | ✅ |

Both above-the-line deductions and this new set of deductions are available to everyone (unless it’s specifically excluded). The difference is in whether it affects your AGI. Only the standard deduction and itemized deductions are still either-or.

Congress created these below-the-line, available-to-all deductions because they wanted to make them available to more people. Giving them to only those who itemize deductions (10-20% of taxpayers) would be too limiting. But Congress didn’t want these deductions to lower the AGI and trigger other tax breaks. Some of these deductions themselves have limits based on the AGI. Making them above-the-line would create a circular math problem.

Here are some of the below-the-line, available-to-all deductions:

- Qualified Business Income (QBI) deduction for small businesses

- Senior Deduction

- Car loan interest deduction

- Charity donations when you don’t itemize

- Tips income deduction

- Overtime pay deduction

All of these deductions are still available if you take the standard deduction, but they don’t lower your AGI.

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Paul DeLeo, CPA says

The confusion stems from authors relying on the outdated July 1 Bill Summary on Congress.gov, which incorrectly states the deductions are above-the-line. The bill passed on July 3 changed them to below-the-line, but the summary wasn’t updated.

Harry Sit says

There were no changes after the Senate passed it on July 1. The summary was plainly wrong to begin with.

Scott P says

I am aware that many people struggle to understand the differences around tax credits, tax deductions, above the line, below the line, etc., as you discuss in this article. Thanks for a great explanation that I can share with others that are confused on this topic.

I always chuckle to myself when people proudly proclaim they don’t mind certain expenses because it is a tax-deduction for their business. I wonder if they are thinking it is a tax credit? An expense is still an expense, even if it is an allowable deduction that may yield a tax benefit equal to the {expense x marginal tax rate}.

There has been an explosion of tinkering both with the tax code “by Congress” and GAAP (generally accepted accounting principles) by FASB (Financial Accounting Standards Board) over the last 10 years that is giving accountants and CPA’s overwhelming headaches. And no, it is not job security for them – that already existed because of significant staffing shortages in the profession.

Harry Sit says

Along the same line, some people think they’re worse off because they don’t have enough deductions to itemize. They’re actually better off because they get to deduct everything, plus a bonus amount. This old post from 2008 presents the argument: Mortgage Interest and Property Tax Deduction for Homeowners Who Don’t Itemize.

Jeff Enders says

Harry – do you read the tips deduction as $25,000 whether filing Single or Joint, i.e. it’s another stealth marriage penalty?

Harry Sit says

True. I guess the idea is that usually only one person in a married couple receives qualified tips. The legislators don’t know how valid that is because they’re quite far from that world.

Robert W. says

The Qualified Charitable Distribution from a traditional IRA works like an above-the-line deduction, although since the amount claimed is not directly entered on the 1040, perhaps it could be called an “exclusion.”