[Completely rewritten on February 22, 2015 using new screenshots from TurboTax Online for 2014 tax year.]

One of the most popular posts on my blog is one I wrote four years ago about reporting tax on RSU. Although I try to do the best I can in deconstructing it, I still get many questions about it every year at tax time.

It’s a difficult topic because there can be many variations. Employers issuing the RSUs don’t help because they are afraid of liabilities. They just say “consult your tax advisor” as if everyone has one. Tax software doesn’t make it easy either. Although there are many variations, the software tends to go by just one. If your situation fits it, you may be able to muddle through. If it doesn’t, the software confuses you more than it helps you because your situation doesn’t match what it thinks you have.

For the longest time I only addressed the issue generically. I refused to work as free tech support for the software companies. If you paid for the software, they should help you with how to use it. Now I give up. I realize people are looking for step-by-step help and the software companies aren’t providing it.

The following is a sequence of screenshots taken from TurboTax Online. If you use the installed software, your screens may be different but similar. I show TurboTax only because it has the largest market share.

In this post I will use the most straight-forward case: Net Issuance. It’s probably the most common. I may do other variations in future posts.

In Net Issuance, the employer withholds a number of shares for taxes before giving the employee the remainder. For example suppose you have 100 shares vested but you only receive 60. You just don’t see the other 40 shares. The employer doesn’t use a broker to sell the 40 shares for taxes. It just keeps the 40 shares and puts some numbers on your W-2.

When to Report

Before you begin, be sure to understand when you need to report when you have RSU under Net Issuance. You report when you sell. If you only have some RSUs vested but you didn’t sell, there’s nothing to report yet.

Wait until you sell, but write down the per-share price when your shares vested. If you have multiple lots, write down for each lot the date, the closing price on the vested date, and the number of shares released to you. This information is very important when you sell.

Let’s use this example:

You had 100 shares vested on 8/1/2013. 40 shares were withheld for taxes. The closing price on the vesting date was $50/share.

You would write down:

| Vesting Date | Shares Received | Price Per Share |

|---|---|---|

| 8/1/2013 | 60 | $50 |

Keep this information until you sell.

1099-B

When you sell, you will receive a 1099-B from the broker in the following year. You will report your gain or loss using this 1099-B and the information you accumulated for each vesting.

Let’s continue our example:

You sold 60 shares from your vesting above on 2/10/2014 at $70 per share. After commission and fees, you netted $4,180. In 2015, you received a 1099-B from your broker showing a sales proceed of $4,180.

Now let’s account for it in TurboTax Online.

TurboTax

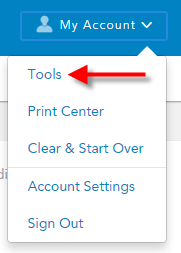

Click on My Account on the top, then Tools.

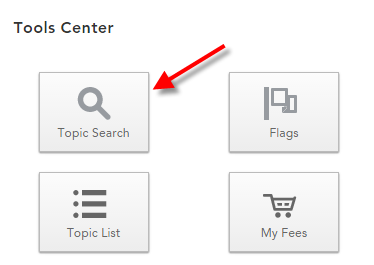

Click on Topic Search.

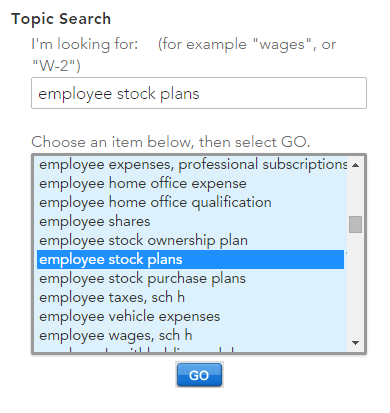

Enter employee stock plans. Click on Go.

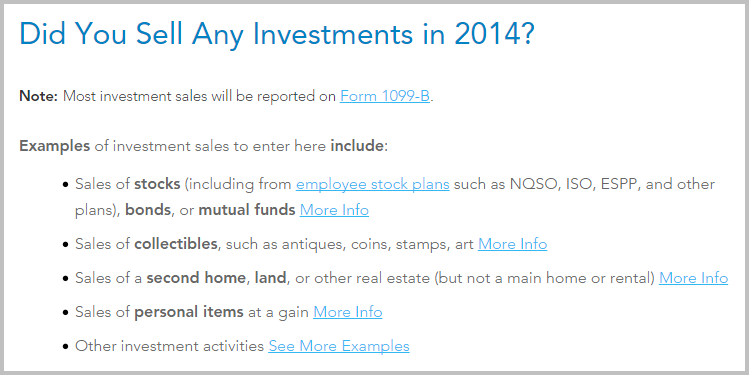

Answer “Yes” to “Did You Sell Any Investments?”

Import your 1099-B if your broker is on the list or just type the numbers yourself from the 1099-B you received. I continue with typing it yourself here.

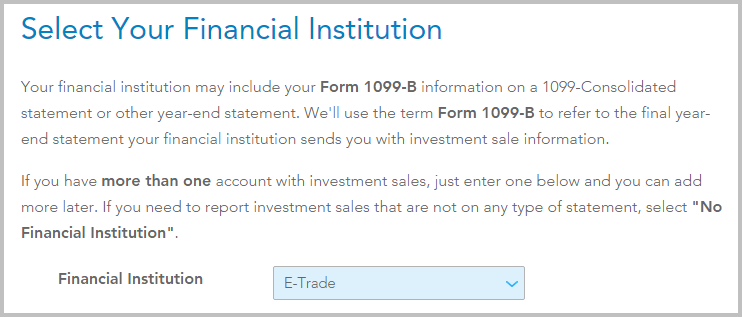

Select or enter the financial institution.

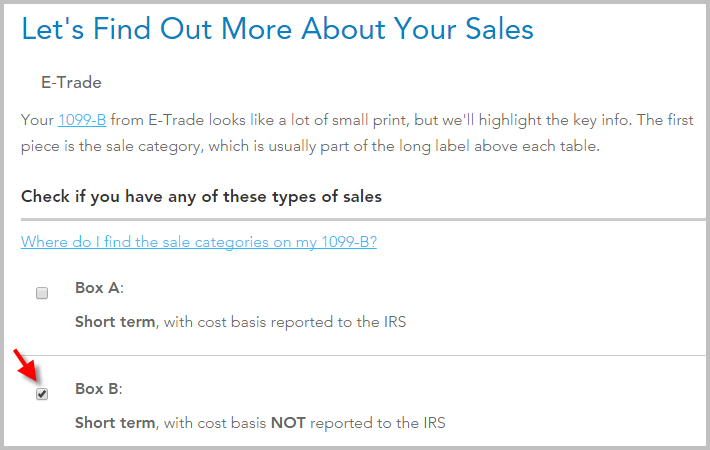

Look carefully which box is checked on your 1099-B. On my form it was Box B.

Now enter the information from your 1099-B. Date of Acquisition is the date the shares vested. If the cost basis is blank on your 1099-B, because it was not reported to the IRS, use your own record to fill it in. The price was $50/share when these 60 shares were vested. Therefore your basis is $50 * 60 = $3,000. If you didn’t sell all the shares vested in that lot, multiply $50 by the number of shares you sold.

If you have more lots, enter in additional rows.

That’s it. You got the shares at $50/share. You sold them at $70/share. You pay taxes on the gain.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Perig says

Thanks for the great guide!

I am having issues with TurboTax being not happy during the smart check because the $ reported on my W2 is much larger that the $ calculated because I had RSU vesting in 2014 that I did not sell and I had vested RSU from 2013 that I sold in 2014. It makes TT confused for some reason.

Would you recommend NOT using the “Add More Details > RSUs” specific section/guide in TurboTax and just use the default stock sale by inputting the cost basis manually?

Thanks

Harry Sit says

As you see from the screenshots, I don’t touch the “Add More Details” box at all. You will only confuse yourself if you do.

Perig says

The thing though is that if I don’t use the interview process, my refund drops by almost half of what it was when I used the interview process.

Must I adjust the basis (reported by my broker) to include the compensation part of the cost basis so I don’t get double taxed. Have you seen this happen as well?

Harry Sit says

Maybe it should drop because you entered it wrong before. What was the per-share price when the shares vested? What was the basis reported by your broker divided by the number of shares you sold? If they match then you don’t need any adjustment.

Perig says

Nevermind.

I followed a few threads on the TT support pages and found that the best answer is to follow the interview and just tell TT that the amount included on the W2 matches the amount that TT calculates (even though it is higher in W2).

This seemed the best solution out of all of them.

(I tried to enter a sale of 0 shares and include the share that vested and it then matched my W2 and the end refund number ended up the same, so I feel good telling TT that the number on W2 matches the partial calculation).

Cindy says

Excellently worded response. I completely understand my situation. Thank you again!!!!!

ahmar says

Hi,

correct me if I am wrong that in this case we only need to pay taxes on gains and when Turbotax asks if this amount is included in W2 then we need to choose that yes it is included in wages section of W2?

second query is is this same rule applied incase of long term RSU sell too?

Gabby says

Hi,

Thanks for your explanation. I’m having the same problem as Steve above. I have vested RSUs that I didn’t sell. They appear on my W2 in box 12, code V as (exercised stock options). I did also exercise NQSO last year so they are also added in box 12, code V. When I fill out everything on TT from my 1099-B, I can’t get past the check because there’s the difference between what I entered for my NQSO transactions and what appears in box 12, code V because that also includes vested RSUs! From everything that I’ve read online, I shouldn’t need to enter in anything for vested RSU’s that I haven’t sold.

mg says

Hi Harry –

Thanks for this article! You mention “If the cost basis is blank on your 1099-B, because it was not reported to the IRS, use your own record to fill it in.” I did not take notes at the time of sale so do not have the vesting price for the RSU to use as a cost basis.

Do you know a way to find out which RSU grants were associated with each sale. My call to ETrade yielded nothing – I will try again. Considering the insights you provided in the article I thought you might have some guidance.

Thanks!

MG

Harry Sit says

You are in luck. My employer also happens to use E*Trade. E*Trade has everything here:

https://us.etrade.com/e/t/stockplan/taxablegainssnapshot

Be sure to keep expanding on each row, first on stock symbol, then on each sale.

mg says

You are awesome! I totally missed expanding on the sale.

Jurgis Bekepuris says

Thanks for your writeup. Do you know how to handle ESPP disqualifying dispositions?

Etrade seems to suggest that you report 1099B as ESPP cost (e.g. $10 at 10% discount = $9 ) and then you file form 8949 ( http://www.irs.gov/pub/irs-pdf/f8949.pdf ) to adjust the basis for the cost that was reported as regular income ($1 regular income in this case if you sold at $10 as disqualifying disposition, so adjustment would bring cost basis to $10). However, I can’t find how to do this in TurboTax. Is it OK to just adjust the basis to $10 in TurboTax? But if IRS gets 1099B, it would seem that they would want 8949 instead of me adjusting the basis which would cause inconsistency with 1099B? Or will TurboTax report this correctly anyway?

Thanks

Harry Sit says

Sigh. Doing tech support for TurboTax again. I just wrote it up here:

Adjust Cost Basis for ESPP Sale In TurboTax

NNS says

This is indeed a great summary for many people who are doing it the first time like myself.

I had a question on entering the Vesting and Grant Information in Turbo Tax for my RS that vested in Nov 2014. Should be entering the total of 34 shares that were vested or the 21 that were granted to me after withholding taxes. I ended up selling all the 21 shares in Dec 2014 and need to figure out what to report. In-dependent of this, the cost basis is still being calculated on the 21 shares that I sold.

Thanks for all your help.

-NNS.

Harry Sit says

NNS – You don’t see any “Vesting and Grant Information” in my screenshots. If you avoid it altogether you won’t be confused by it.

Tim D says

Thank you, very helpful. I now feel as if I have consulted my “tax professional.” =-)

it’s amazing how much of this everyone keeps secret. And the only person that gains from these secrets is the government from getting a lot more of my tax money than I can afford.

So glad you updated this for the current year also, made it very easy to follow along.

Janessa Det says

Hi Harry,

I have been doing a lot of reading to make sure I fully understand my RSU’s and 1099-B and have seen warnings to make sure I am reporting the correct tax basis which also includes a “compensation component” i.e. the tax basis should be: price paid to acquire shares + compensation recognized for acquiring them (reported on Form W-2). I am wondering if this means I must adjust the cost basis provided on my 1099-B for my RSU sales (which are specified as not including the compensation portion). According to the formula and your example above, however, it seems to suggest that I don’t need to make an adjustment to the cost basis? I did not pay a price to acquire shares they were granted. Also, if there is a missing compensation element, how do I calculate it?

Just want to ensure I am not double-paying tax on my RSU’s. Also, according to what I can tell, my situation is not net issuance, but instead my company is selling RSU’s to cover tax which are reported on my 1099-B as Box B sales.

Harry Sit says

Janessa – In RSUs your acquisition cost is zero. Your compensation component is the per-share price at time of vesting times the number of shares sold. If the broker already reported the basis as such then you don’t need to adjust anything.

Janessa Det says

Thank you Harry for the quick response. I see that I’ve just been misunderstanding some tax vocabulary.

Thanks!

Janessa

David says

Hi Harry;

Thank you so much for your article. It’s very helpful.

I have questions related to the shares withheld for taxes portion in Net Issuance.

As you know, estimated taxes was calculated based on the estimate tax rates (45% was used by my employer. But my real tax rate closes to 25%) on RSU vesting date. The taxes reported in W-2 covers both shares withheld for taxes and reminding shares.

You mentioned we do not need to do anything specially for shares withheld for taxes portion in our tax return. If we do not do anything for this. will we end up to overpay the taxes because an estimate tax rates was used by employers? if the answer is yes, what should we do to make sure we do not overpay taxes?

Here are two examples.

Example One (Estimate Tax Rate = 45%).

1. RSU Vested Date: 8/15/2014

2. Total Shares Vested: 100

3. Faire Market Value (FMV): $30.00

4. Award Price: $0.00

5. Total Market Value (Gain) =Total Share Vested * (FMV – Award Price) = 100 * ($30 – 0) = $3000.00

6. Total Tax = Total Market Value (Gain) * Tax Rate = $3000*45%= $1350.00

7. Shares Withheld for Taxes= Total Tax /FMV= $1350/$30 = 45 Shares

8. Shares Issued = Total Share Vested – Shares Withheld for Taxes = 100 – 45 = 55

Example Two (Real Tax Rate = 25%).

1. RSU Vested Date: 8/15/2014

2. Total Shares Vested: 100

3. Faire Market Value (FMV): $30.00

4. Award Price: $0.00

5. Total Market Value (Gain) =Total Share Vested * (FMV – Award Price) = 100 * ($30 – 0) = $3000.00

6. Total Tax = Total Market Value (Gain) * Tax Rate = $3000*25%= $750.00

7. Shares Withheld for Taxes= Total Tax /FMV= $750/$30 = 25 Shares

8. Shares Issued = Total Share Vested – Shares Withheld for Taxes = 100 – 25 = 75

As you can see from those two examples, people only need to pay $750.00 instead of $1350.00 when a real tax rate 25% is used.

Thank you, Harry.

David

Harry Sit says

David – Take a step back and forget all these about shares. If your employer paid you $3,000 cash bonus and it withheld $1,350, but you have a lower tax rate because you have 5 kids, a big mortgage and what not, you just get a refund when you file your tax return. The $1,350 is included on your W-2 as tax withheld. You don’t have to do anything special beyond entering your W-2 into the tax software.

David says

Thank you, Harry.

One more question. Should RSU Net Issuance Compensation Income be noticed in Box 12 with “V” code in W-2 Form? What problem will it cause if the answer is yes but RSU is not noticed in Box 12?

thanks

David

Harry Sit says

David – It shouldn’t, therefore not a problem when it’s not.

David says

Hi Harry;

If RSU Net Issuance Compensation Income is not noticed in Box 12 with code “V”, how does tax return software such as TurboTax calculate the tax people need to pay using real tax rates?

Back to my previous examples, people need to know $3000, Total Market Value (Gain), in order to calculate the total tax. Right?

thanks

David

Harry Sit says

David – Again, think cash bonus. It’s not listed separately, just part of the total number in W-2 box 1. You don’t say how much was salary and how much was bonus. You just say you were paid total X and you had total Y withheld.

Tony says

Thanks for the post.

How do you know whether the number of shares withheld is correct? I understand the gain part but wondering if there’s a possibility to get a tax refund for your company withholding too many shares.

Harry Sit says

There is no “correct” number of shares withheld. Everybody’s tax rate is different. If it was too much you get a refund when you file your taxes. If it was too little you pay the difference when you file your taxes.

Dee says

Hi Harry,

I have 1 grant of RSU and each year, 25% of it gets vested. Hence, there are different vesting dates and vesting price per share. In my 1099-B, it was all reported together in 1 line with vesting date as “Various”. And when I try to put in my numbers to TurboTax Premier, TurboTax asks for the vesting price per share. The only problem is that the step-by-step guide only allows me to enter 1 vesting price per share for the entire RSU sale transaction. How do I go about this so I can enter in TurboTax my real cost basis for each vesting?

Thanks,

Dee

Harry Sit says

Dee – Just as the screenshots shown in this article, one row for each vesting? It doesn’t ask anything about vesting if you don’t say they are shares from RSUs.

Srinivas says

Hi,

My (ex) employer reported both vested and released shares. Which one should I enter in Turbotax, where it asks Vested/Released shares?

Thanks for all your help.

srini

Harry Sit says

Srinivas – If you do it the way shown in this article it doesn’t ask and you don’t have to worry about which one.

Anna says

I did sell RSUs and seems like the gain was reported in W2, but I am not 100% sure. So I have eTrade 1099 where the gain reported (with base price 0), and in W2 I have Restricted Stock gain – is is gain of sold RSUs or something else? and in case it is RSUs, how I report it?

thanks

Harry Sit says

See reply to comment #55.

Ko says

I’m not using TurboTax (using TaxCut by HRBlock), but I had a similar question related to Restricted Stock Options. My company was bought out this December 2014. I sold 933 non-qualifying stock options prior to my company being bought out. These 933 shares were included in my W2 income and taxed at that rate. Thereafter, the remainder of my restricted shares (not included in W2) were vested and paid out. According to company documentation, 187 of these new shares had taxes withheld. I do not think these were included in my W2 income. Another 285 shares did not have taxes withheld. I have viewed the 1099-B and it includes all of the details that I need, but I do not know what needs to be reported (since some is already on my W2) and what doesn’t. From my understanding, all of it needs to be placed in the Sale of Stocks portion of my software. However, when I enter the 933 non-qualifying stock options, my refund reduces as it’s taxing me twice as if it was not already included in my income. The questions that I have, how do I distinguish that some options have been taxed and included in my W2, some haven’t, and the break-down structure.

Harry Sit says

Ko – You had two different events.

(1) You exercised non-qualified stock options on 933 shares. If the 1099-B you received only had your strike price times 933 as the cost basis, you will need to adjust it higher to the full price times the number of shares. Please see Adjust Cost Basis for ESPP Sale In H&R Block Software. Even though it was for ESPP, the adjustment part is similar.

(2) It sounds like you had total 472 RSUs vested. 187 shares were either withheld or sold for taxes. You received the remaining 285 shares. You didn’t say whether you received a 1099-B for the 187 shares or whether you sold or kept the 285 shares. If you received a 1099-B for any sales, look carefully to make sure the cost basis is the price on the vesting date times the number of shares sold. If not, you will have to adjust again.

Andy says

Thank you! The included help in TaxCut was nearly useless, and of course I received no help from my employer. This explanation makes perfect sense out of the various forms I was trying to consolidate from my eTrade trade confirmations, the eTrade 1099, and my company’s provided tax information. Your explanation made short work of the confusion.

Thank you!

Ram says

Hey Guys,

I have some RSU’s vested and the full income on that based on the market price on the vested date was reported on my W2. Also a portion of the vested RSU’s were sold to cover for the taxes. But the taxes weren’t reported on my W2. I find this very odd. Since I didn’t sell any of the vested RSU’s, I don’t see anything in the 1099 B about RSU’s.

I read a comment that said, in this case, you don’t do any thing. I am trying to understand how so? My income went up by the #of RSU’s * FMV of Stock on the vested date. So TurboTax says I have to pay taxes on the income. My brokerage account shows the shares sold to cover the taxes for vested shares and tax amount. I am trying to figure out how to enter this amount as paid taxes in Turbo Tax.

Thanks, –Ram

Harry Sit says

How do you know the taxes weren’t included in the total taxes withheld numbers on your W-2? If you can prove it, contact your employer and tell them they did it wrong.

PJC says

One quick Q wrt state income tax liability for RSU’s that were issued in VA(SIT @ 5.75%) but were vested and received 3 & 7 years later in TX (SIT 0%)….since they had no intrinsic value until received is all the income received at vesting treated as TX income despite RSU’s being issued years ago in VA? TX is my domicile and my wife remains a VA resident…..

Harry Sit says

Sorry, I don’t know the intricacies of state income tax, especially with regard to Virginia. Maybe ask Virginia Department of Taxation?

Sharaaz Khan says

Harry thank you for helping so many people on this forum. I have been spinning my wheels on this forever and hope you can help because Turbo Tax support is not helping. I just need some validation on this…

875 shares granted to me were vested on 5/15/15 which I believe is part of lot 1

The company sold 288 shares to cover taxes and this appears as a separate entry in the 1099-B (I calculated the cost basis = 288 * price on vest date)

I sold 2 shares on 5/18 (cost basis = 2 * price on vest date)

I sold 585 shares on 5/20 (cost basis = 585 * price on vest date)

That adds up to 875 shares

Please validate the above. Then, my question is that if I enter it in the spreadsheet format, don’t I still need to choose the turbo tax box to specify that I have RSUs. Where would I mention that these are RSUs then?

Harry Sit says

You don’t have to mention they are RSUs. You notice the article didn’t say anything about the shares having been RSUs.

Sharaaz Khan says

I assume that my calculations are good, then. Thank you, Harry. This has been very helpful.

Marie says

I have been granted RSUs in 2011-2015. Each year’s vest after 5 years, starting in 2016. They are now listed as “no longer subject to forfeiture and as such are subject to FICA, Medicare and Local Taxes”. On my 2015 W2 I am showing the RSU non cash taxable income for all five years in those 3 categories and taxed paid in those categories from RSU withheld for taxes. How do I account for this on my 2015 1040? How are the taxes “paid in 2015” accounted for as each year’s RSUs vest starting in 2016? Thanks.

Glen says

Harry,

Thanks so much. You saved my almost big mistake. My HR was not helpful in this area and E-trade can not comment of your taxes. I was at a loss till I found your post. Amen! Thanks again. Also TurboTax 2016 works the same but new screenshots would be necessary.

John says

Harry, thanks so much for the detailed steps and explanation.

My situation is a bit different. My employer was acquired during the time-frame when my RSUs vested. They withheld a portion of the RSUs for tax purposes and cashed out the remaining RSUs. They claim that the transaction is captured on W2, and no other tax forms are needed for this transaction.

Does this seem accurate?

Has anyone been in this situation?

How will the IRS know that the employer withheld correct number of shares for tax purposes, since W2 neither shows the number of shares, nor the price per share?

Harry Sit says

It’s accurate. The number of shares withheld doesn’t have to be correct. If too many shares were withheld you get more back as a tax refund.

John says

Thanks Harry. Just to follow up on my previous question.

Do you think, I’ll need to report the transaction to the IRS, in any other way than it’s already reported in W2. In other words, do I need to go through the steps described in this topic, or simply entering W2 details will be enough?

Harry Sit says

No you don’t have to do anything extra because you didn’t sell any shares.

Kathrin says

I don’t have any experience with RSU’s and need a little clarification. How exactly is it reported on the W-2? Is it in box 12v or should it be in box 14 Other? What tax rate is used?

Thanks,

Harry Sit says

It’s included in the total in Box 1.

Andrew says

Harry, your detailed steps and explanation still useful here in 2017.

Following the TurboTax step-by-step procedure was creating a mess asking questions regarding vesting, share price, etc. I followed your advice and skipped telling turbo tax anything about this being rsu’s.

I went back and chose “enter information on my own” and entered cost basis using information from Fidelity 1099 supplemental stock plan detail which had adjusted cost listed.

Thanks again!

Bill says

Harry, I am so happy I found your article and explanations.

My company’s W-2 (through ADP) shows both RSU income (in box 12 as V), but also in the summary section “PLUS Misc. Taxable Comp.” which happens to be equal to my ESPP bargain element, and now I know to add that in to get my real total cost basis. I am worried about another line in the summary called “LESS Misc. Non-taxable Comp.” and wonder if it is a negative entry to my gross pay for some portion of either the RSU or ESPP bargain element? 401k has it’s own line, so it isn’t that.

Harry Sit says

You will have to ask your payroll what that “Misc. Non-taxable Comp” is. If it’s non-taxable by definition it doesn’t affect your taxes.

Amanda says

Hi, I wonder if you could help. I received a 1099-B from Fidelity of 55 RSU shares vested various dates with different lots; however, I did not sell any of these RSU (they are short-term uncovered)

I understand the way RSU works is that the company withhold about 45% of shares to cover for tax, but if I don’t sell them, why I receive form 1099B? Also, I’m not sure 55 shares are the # shares vested or the # of shares withheld. Can you please explain? In this case, how do I fill in using Turbo Tax?

Thanks,

Harry Sit says

First contact your employer to find out what the 55 shares were. No one else would know besides yourself and your employer. If you didn’t sell, it sounds like your employer didn’t use net issuance. This blog post here is only about net issuance. See RSU Sell To Cover Deconstructed for what to do when your employer uses a broker to sell shares for tax withholding. If the sale involved multiple lots you will have to get the information for each lot.

Marie says

Dude, your post really helped! I couldn’t figure out why I owed extra tax on my stock sale when my company already taxed it when it was vested.

You do a great service to all taxpayers out there! Well done 🙂

Dave A. says

Hi Harry, Thanks for your comprehensive assistance to our RSU questions. I do have a question that may seem simple, but I’m still confused on it. Here’s my example:

My company provided me 744 RSUs (accrued over a 3 year period), they all became vested (2017) , and they held back 258 for taxes. I sold the remaining 486 shares the day after vesting.

E-trade shows NO taxation form/box info for the 258 shares sold, but lists it in the Vest Schedule as ‘Total Taxes Paid’.

Question 1: There is nowhere in TurboTax to enter in the shares held back to pay the taxes, or the taxes that were paid on the RSUs. I also do not see these taxes included anywhere on my W2s, so where do I enter this info, or do I need to?

Question 2: Since the taxes for the RSUs on the 774 shares were paid for with the 258 shares, is every dollar received on the 486 shares sold, also taxable as income?

Example: 1000 shares vested, 250 sold for taxes (by the company), 750 sold by me

Taxes=fully taxed on the 750 shares with NO cost basis?

E-Trade and TurboTax leave this detail out, and I feel like it’s double taxation…sort of

like if you hit a lottery for $10,000, they take $4,000 for taxes, then at tax time next year, you’re taxed on the $6,000 as income.

If only being taxed on the gains (between the release/vest dates), there is nowhere to enter that number without entering the entire proceed and zero cost basis – which again, leaves out the taxes already paid. Any advice?

Thanks in advance for any help you can provide.

Harry Sit says

Both questions were addressed in the post if you follow along with your own numbers. The value of the shares withheld for taxes were already included in the W-2. It’s not listed separately but it’s included in the total. Nothing extra to do there. The basis for the shares sold is the per share price at vesting times the number of shares sold ($50 * 60 = $3,000 in the example). If you imported the 1099, click on Edit and put the basis in. Or delete it and manually enter it as the screenshots show.

Dave A. says

Hi Harry, THANKS again for your assistance We actually get a refund due to this clarification on cost basis. These tips are highly appreciated. The imported e-Trade form leaves this info out – but does show it in their supplemental pages on their website. Thanks once again!

Dave M says

Thank you Harry. I just needed a little help to validate my thoughts. My software wasn’t very validating, but you were! Many thanks.

Mina says

This is a clear and professionally written article. Thank you very much for sharing it.