[Updated on January 31, 2025 with screenshots from H&R Block tax software for the 2024 tax year.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the tax form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustments on your tax return using H&R Block tax software.

Don’t pay tax twice!

If you use other software, please read:

When to Report

Before you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

- The purchase date

- The closing price on the grant date

- The closing price on the purchase date

- The number of shares you bought

This information is very important when you sell.

Let’s use this example:

You would write down:

| Grant Date | 4/1/20xx |

| Market Price on the Grant Date | $10 per share |

| Purchase Date | 9/30/20xx |

| Market Price on the Purchase Date | $12 per share |

| Shares Purchased | 1,000 |

| Discounted Price | $8.50 per share |

Keep this information until you sell.

1099-B From Broker

When you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

Because you didn’t hold the shares for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in the H&R Block software.

Use H&R Block Download

The screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than online software. If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block download from Amazon, Walmart, and many other places. If you’re already too far along, make this year your last year of using the online service.

Enter 1099-B Form

Click on Federal -> Income. Scroll down to find the Investments section. Click on the “Go To” link next to “Sale of Stocks, Bonds, Mutual Funds, and Other Securities (1099-B).”

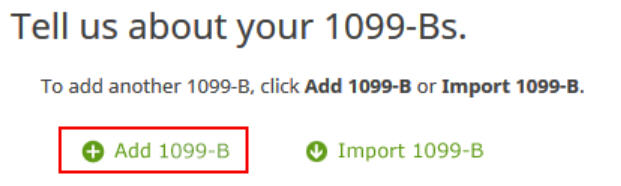

Import your 1099-B if you’d like. I’m adding it manually.

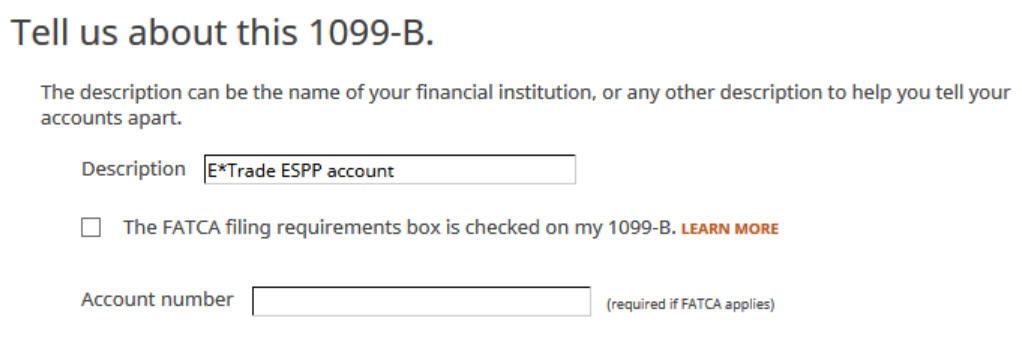

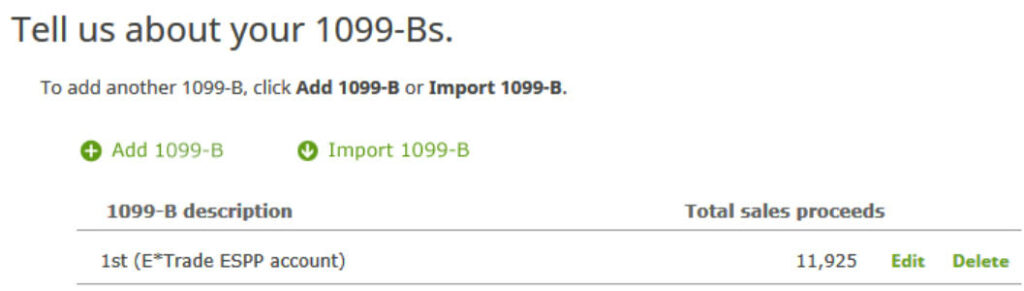

Give your account a description. Suppose this is from the ESPP account at E*Trade.

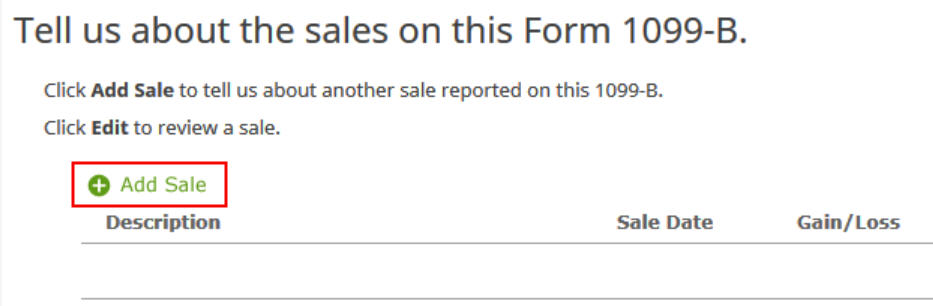

Now we add a sale.

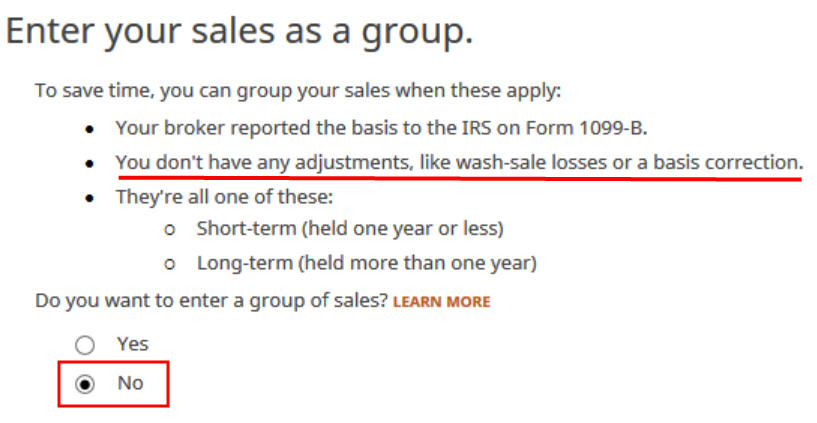

We don’t want to add sales as a group because we need to make an adjustment.

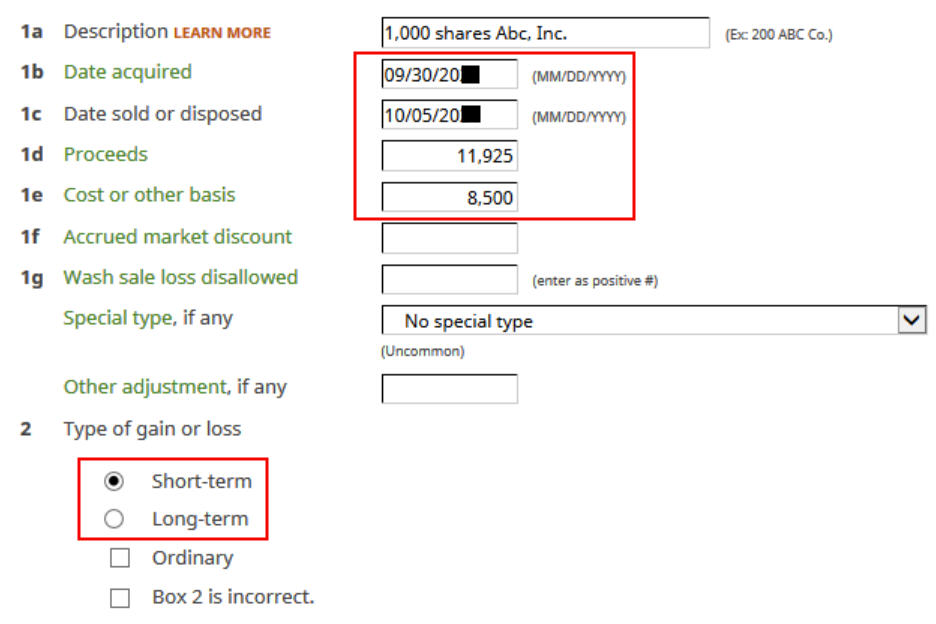

Enter a description. Enter the dates and numbers from the 1099-B form as they appear. Make sure to match the type of gain or loss reported on your 1099-B form. It was short-term on my form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

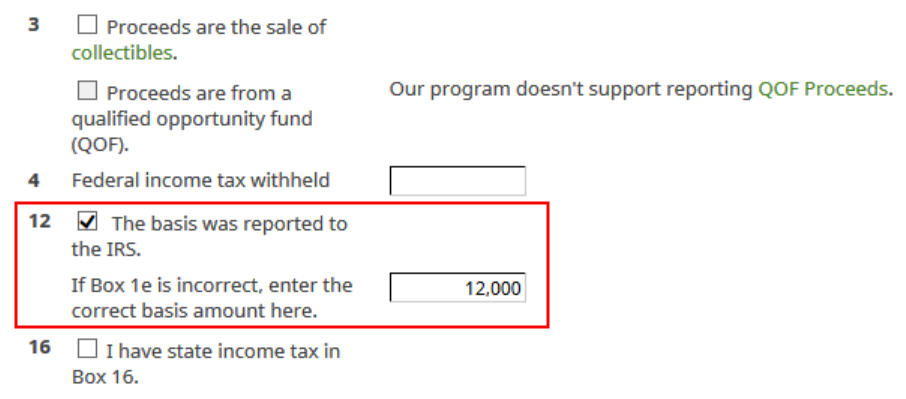

Scroll down and check the box for “The basis was reported to the IRS.” Enter your purchase cost plus the amount added to your W-2 as your correct basis amount.

When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

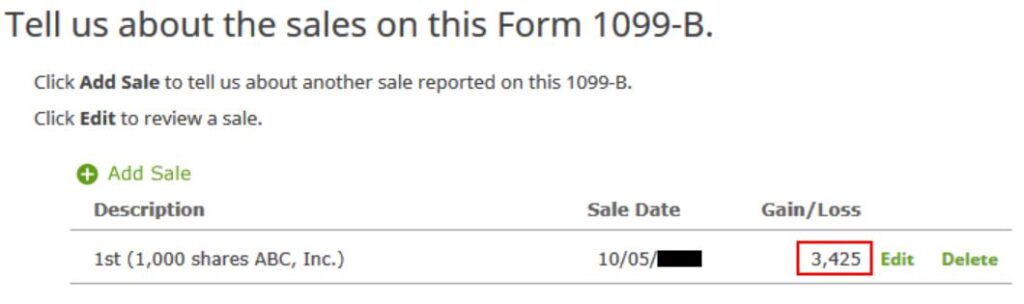

You are done with this entry. The summary gives the impression that you are paying tax again on a large gain, but don’t panic. We’ll verify it’s done correctly in the next section.

This shows a summary of the 1099-B form.

Verify on Form 8949

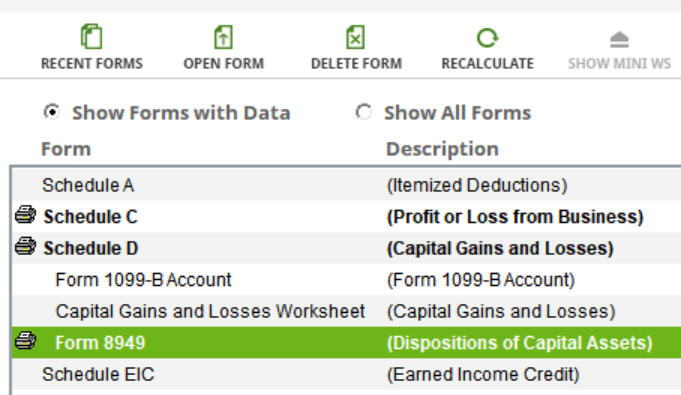

Click on the “Forms” button in the toolbar. Find Form 8949 and double-click on it.

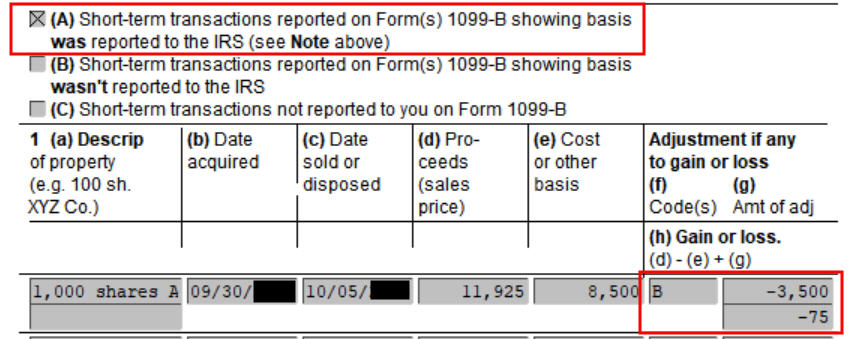

Find your sale in either Part I or Part II depending on whether it was short-term or long-term on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Roger says

Thanks for posting so quickly!

Bruce Brumberg says

Very nicely illustrated examples for steps. Looks like the H&R Block version is doing this differently than the Turbo Tax. Seem like this H &R Block program is reporting the basis from the 1099-B, even when too low, then making adjustment in the column for gain/loss. From my understanding this is the way it should be reported with these steps. Does it seem like this program is doing it the accurate way?

Kevin says

Any suggestions on how to report an ESPP stock donation through HR block’s software?

Sam Seattle says

We use TaxAct Deluxe, and can’t figure out how to do this. Would you show us, please?

Harry Sit says

Please see Adjust Cost Basis for ESPP Sale In TaxACT.

Kevin says

Your example assumes you have a disqualifying disposition, and that makes it a simpler use case for H&R Block. If you have a qualifying disposition that did not appear on a W2 (mine did not), you need to inject compensation income elsewhere. I never found the place to inject that, but I didn’t look too hard. TurboTax Premier appropriately handles the compensation income.

Harry Sit says

That’s correct. I mentioned that the example was for a disqualifying disposition. It’s also consistent with my recommendation in Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal to sell right away and not hold for a qualifying disposition.

I will look into how H&R Block handles a qualifying disposition when the compensation income didn’t appear on a W-2. If it did though, the adjustment for capital gains would be the same way; you just calculate the correct basis differently.

Sundar says

Harry: were you able to find out where to place in HR block amount for qualifying disposition when not reported in W2?

Harry Sit says

No. Maybe the best way is to contact the employer and have them include it on the W-2.

Sundar says

thanks harry. will check with employer. if that does not pan out any specific location in the underlying form(with new 1040 and schedule 1) for 2018.

ex: line 21 in schedule 1 which rolls up into 1040 Line 6?

John Dsouza says

Harry,

How can I check if the ESPP was included in my W2?

Harry Sit says

Add up all your pay stubs and compare with your W-2.

romans pogosovs says

Thank you Harry! Saved me from paying double tax! And great explaining I must add.

Carolyn says

What if we received a form 3922 from a sale of stock. Using H&R Block, where would this be entered? I never received a 1099-B. These were for shares sold in 2018.

I did also sell stock in 2017, but never received a 1099-B for that either. Would I contact the employer or broker?

Sergio says

Hi, Could you please help me, I have added on my federal tax form the adjustment for the cost basis for the ESPP stocks sold, however when I’m doing the California state, the software is showing the 1e cost (not adjusted) as the Federal basis and asking for a California adjustment; should I include the difference between the Box 1e cost basis and the adjusted cost basis from the supplemental information of the 1099B ?

For example, the 1099B box 1e has $5000 and adjusted cost on the supplemental information of the 1099B has $6000, for California the H&R block software show me in Capital gain/losses $5000 as the federal basis and asking for a California adjustment, should I include here $1000 ? (to match the adjusted cost basis)

Harry Sit says

My downloaded H&R Block software doesn’t ask me to adjust cost basis for California when everything matches federal. If I force it to go to the interview for California Schedule D, check a box that says “Transfer federal to California” (or something to that effect). After that just keep going to the next screen without entering any specific adjustment for California.

Megh says

I am facing the same issue as Sergio. Sergio what did you end up doing? Putting the difference in california adjustment?

Patty says

Ugh! I just found your article; I was double taxed using the H&R Block software. Unfortunately, it was my 2015 return which I believe is past the date to amend. This is so disappointing to say the least. Is there anything I can do? Thank you!

sri says

Hi harry,

I’m facing same issue as sergio i.e. Adjusted cost basis on federal return not getting reflected on California state return when filing taxes using H& R block online? what are the next steps recommended here?

DO we need to put difference in California adjustment?

Harry Sit says

I just tried it in H&R Block Online. Yes you have to enter the difference between the correct basis and the reported basis on 1099-B again as an adjustment. You shouldn’t have to, because when you checked the box “the basis is incorrect” and you gave the correct basis in the federal part, the online software should’ve copied the correct basis, not the reported basis. It’s another reason when you are paying for software, you should use the downloaded software, not the online service.

https://thefinancebuff.com/tax-software-online-or-desktop.html

Jules says

Harry, how do you deal with this when you’re transferring multiple fractional ESPP shares to a broker, each fraction having different purchase prices on different dates?

Background: My ESPP provider allows me to transfer shares to a broker and sell them, but only in whole units. So I end up having to add fractional pieces of shares purchased on different dates until I equal a whole number. Then transfer to broker. Then sell a few days later.

It seems like quite a pain to figure out the true cost basis when you’re selling multiple shares purchased on different dates. Especially when you’ve sold 24 times in one year.

Bob Zarkoob says

Very helpful. Thanks

April says

In 2019 sold espp shares from 2002 multiple lots with reinvested div. 1099-b form only my shows one totalof proceedss and that they are non-covered. Using H&R tax online, I assume I adjust the basis (+ord income,+ div, + fees) to increase my basis. Then add ord income to 1040 line 1. Correct?

Patrick says

Still helpful in 2021. I couldn’t find this information anywhere else. Thanks very much.

Nancy says

I am following your steps and the Gain/Loss amounts are working out but i am still seeing an additional amount in the Capital Gain distributions row That is then being added to the G/L. So my short term loss is 2529 and my long term loss is 2321. But there is an additional 3606 being added to the long term gain. Is this correct?

Harry Sit says

Maybe it’s unrelated to your ESPP? Capital gains distributions usually come from mutual funds or ETFs.

JPS says

Hi Harry, thx for the post – this is helpful. Question – for long-term ESPP sales, is the adjustment the same? I did receive my 1099 from ETrade that includes the adjusted cost basis for each stock sale – is that number effectively the same adjustment being made as described here in this post?

Harry Sit says

The adjustment process is the same when you know what the cost basis should be adjusted to. Mark it as short-term or long-term according to your 1099-B form.

TP says

Something is off with these instructions. on H&R BLOCK 2024 there is a check box for Sale of stock and there is one for Employer stock transactions. Employer stocks transactions are reported differently on H&R block 2024. What if a 1099 -B was not issued for ESPPs?

Harry Sit says

It’s more confusing to use the Employer Stock checkbox. It’s easier to understand what’s going on when you treat it as a regular stock sale with adjustments to the cost basis. You always get a 1099-B when you sell stocks.

TS says

My husband’s company sent a separate W-2 for the income from the disqualifying disposition. Do I need to include it on our 1040 and go through this process to make adjustments, or can I just not include that W-2 and pay the taxes on the extra gains instead? Seems like not including it would be easier since he has five separate 1099-B entries I would have to adjust.

Harry Sit says

You need to include the W-2.