[Updated on January 31, 2025 with screenshots from FreeTaxUSA for the 2024 tax year.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using FreeTaxUSA.

Don’t pay tax twice!

If you use other tax software, please read:

When to Report

Before you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

- The purchase date

- The closing price on the grant date

- The closing price on the purchase date

- The number of shares you bought

This information is very important when you sell.

Let’s use this example:

You would write down:

| Grant Date | 4/1/20xx |

| Market Price on the Grant Date | $10 per share |

| Purchase Date | 9/30/20xx |

| Market Price on the Purchase Date | $12 per share |

| Shares Purchased | 1,000 |

| Discounted Price | $8.50 per share |

Keep this information until you sell.

1099-B From Broker

When you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase. Some brokers will supply supplemental information for your purchases.

Let’s continue our example:

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

FreeTaxUSA

Now let’s do it in FreeTaxUSA. Find “Investments & Savings” in the “Common Income” section under “Income” in the menu. Click on “Add Another Investment.”

Choose “Stock Sales (1099-B).”

Enter the name of the broker from the 1099-B form.

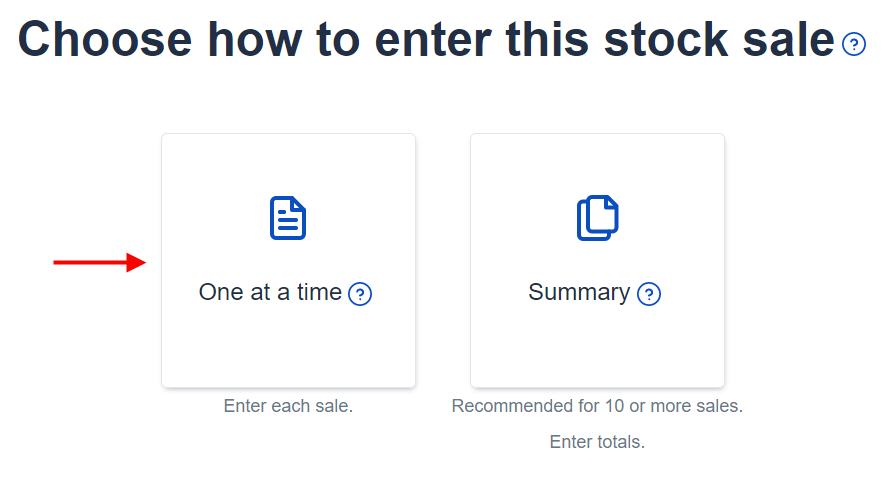

Choose “One at a time.”

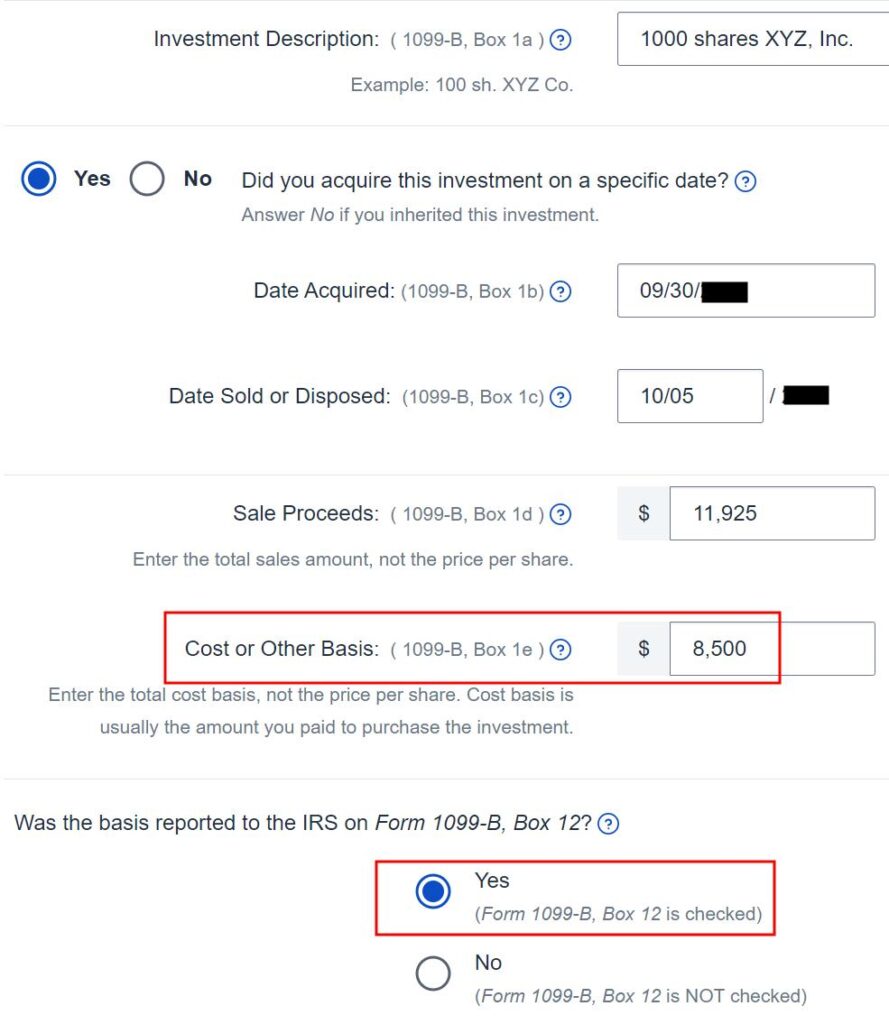

Enter the numbers on your 1099-B as they appear. The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t make any changes here. Your broker sent this information to the IRS. It has to match.

Adjust Cost Basis

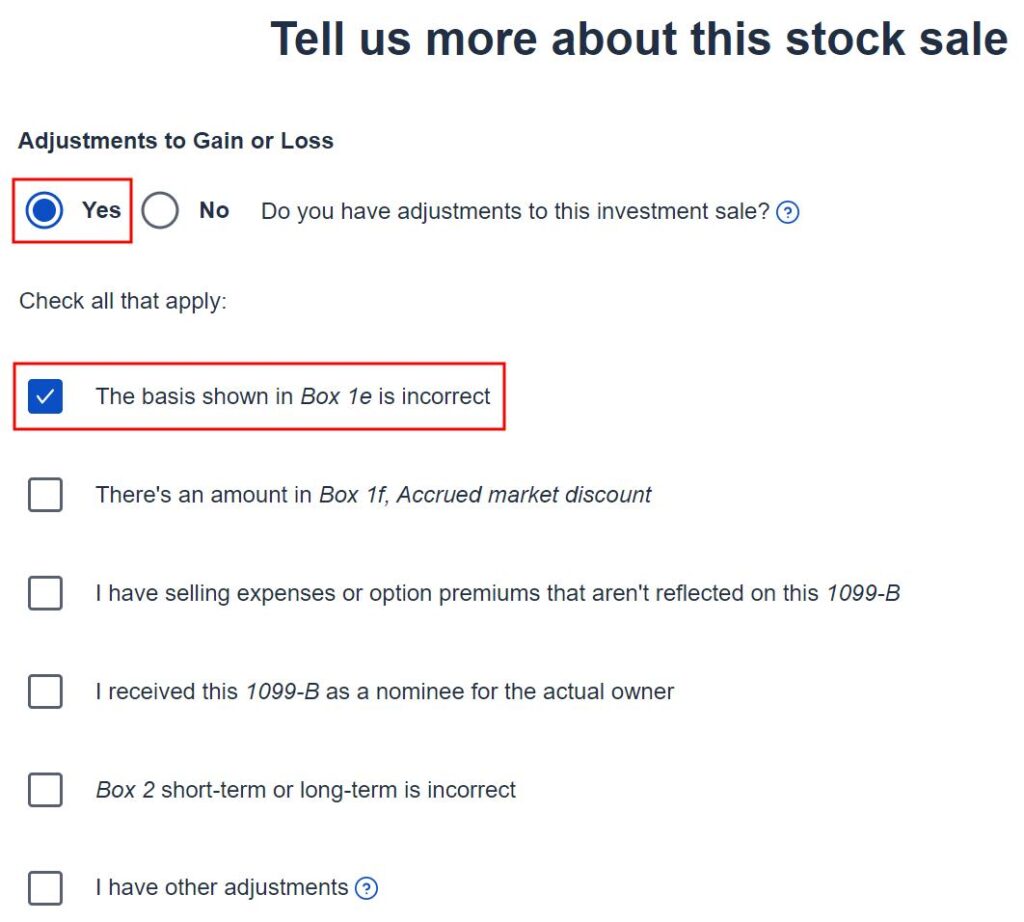

You have an opportunity to make an adjustment on this page. Check the “Yes” radio button and the box for “The basis shown in Box 1e is incorrect.”

Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

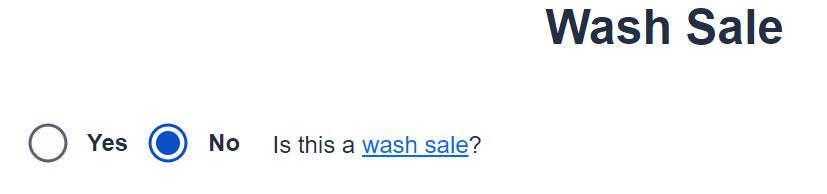

If you had a wash sale, your 1099-B form would indicate it as such. We didn’t have a wash sale in our example.

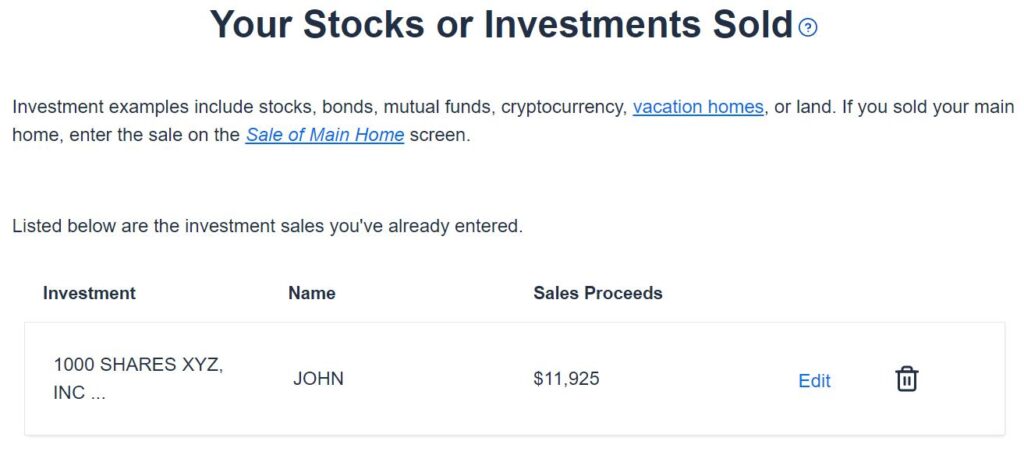

We’re done with one ESPP sale. Repeat if you sold more than once during the year.

Verify on Form 8949

We can verify that the adjustment makes it all the way to the tax form.

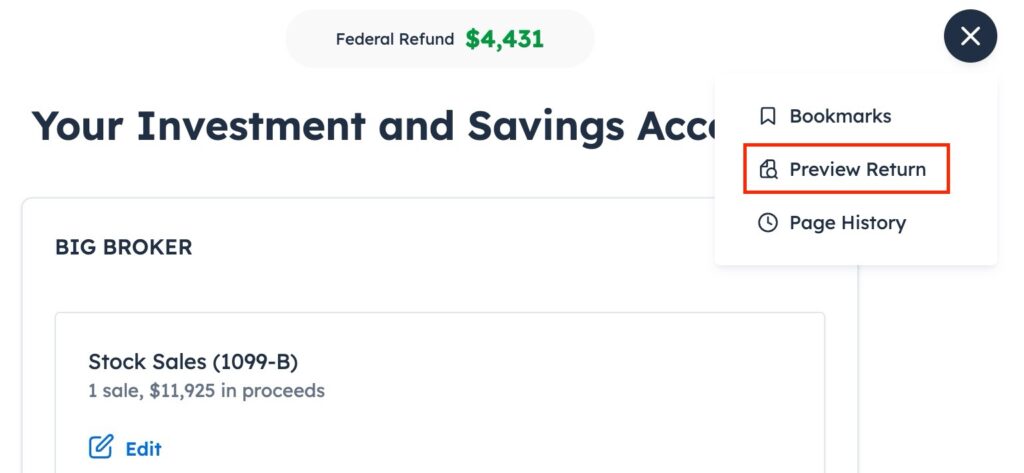

Click on the three dots at the top right on the “Your Investment and Savings Accounts” page and then click on “Preview Return.”

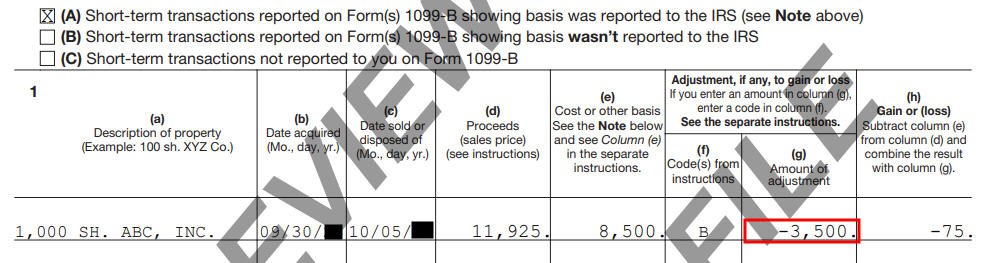

Scroll down to find Form 8949 in the popup. You see the negative adjustment in column (g).

If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

s says

I was super confused doing my taxes since 2022 was the first year participating in my company’s ESPP and I couldn’t find an easy guide anywhere. Thanks so much for posting this, I’ll be bookmarking this for next year as well 🙂 Please never take it down lol.

Sally Liu says

True basis looks like it should = # shares purchased * market price on purchase date. When I was crunching my numbers, I noticed that my 1099-B reported cost basis (which = # of shares purchased * discounted price) + discount received was NOT equal to # shares purchased * market price on purchase date. Do you know why this is the case for me?

Harry Sit says

You could’ve been off by a day on the purchase date. Besides, the true cost basis isn’t always the # shares sold * market price on the purchase date. It should be the # of shares sold * discounted price + the amount added to your W-2. Your employer should’ve provided you with documentation on how much was added to your W-2 and how that amount was calculated.

Anonymous says

Are the instructions the same for qualifying dispositions? What if I only sold ESPP after it would become long term capital gains only?

Harry Sit says

It’s the same. Qualifying dispositions also have an amount added to your W-2, although it’s usually smaller than non-qualifying dispositions. It’s never long-term capital gains only. Get that amount added to your W-2 from your employer. Add that amount to your cost basis as an adjustment.

Steve says

This was a great explanation that helped me figure out my taxes with an ESPP. Simple and easy to understand. Thanks for article!

B says

Sold my ESPP immediately and I was sure I was getting double taxed when I inputted the 1099-B this year. I appreciate the article Harry! Very easy to follow along.

Darren C says

Very helpful! Thank you for posting this. Reporting on adjusted cost basis is tricky for new tax filers and these steps are great.

Andy W says

Thanks for this! Quick question – It’s not clear to me where (or if) my employer reported my ESPP purchase discount on my W2 – where would I see that? I see nothing obvious either on my paystubs or my W2? If it was on my paystub, would that be in 2022 (when I purchased them) or in 2023 (when I sold them?

Harry Sit says

It would be in the year you sold them. Employers do it in different ways. Some employers’ W-2 just shows a higher gross pay than the YTD number on your last paystub. Some employers produce a “hidden paystub.” The YTD gross pay on say paystub #20 is higher than the YTD gross pay on paystub #19 by more than the gross pay on paystub #20. Some employers have informational entries on the W-2 or W-2 supplement. The best way to find out for sure is to ask your stock administration or payroll.

ray says

Hello! This is very helpful as this is my first year handling ESPP taxes, I am a little confused on the adjusting cost basis section though. From what I understand the adjusted cost basis would basically be “1099-B Box E Cost Basis” + “Employer Discounted Amount” and I would be able to find the total employer discounted amount from my W2 Box 12 Code V. Since that amount is for 2 ESPP purchases/batches throughout the year I would only need to add the amount for the batch that I sold (not the entire amount in box 12). Am I understanding it correctly? thanks!

JJ says

E trade gives you a supplemental transaction form. You just use the adjusted cost basis column to fill everything out. makes it very easy you dont have to calculate anything incaes anybody else has etrade.

VM83 says

How does my employer know when I sold my ESPP shares? They don’t have access to my brokerage account. Or I may be working for a different employer when I sell those shares, or I may have transferred the shares to a different brokerage. As I understand, the discount portion needs to be reported as income only in the year when I sell, not when they are purchased

Harry Sit says

The broker that the employer uses to run the ESPP program reports to the employer when you sell. Many employers restrict transferring ESPP shares to a different broker.