[Updated on December 15, 2020 with the latest rates.]

Selecting investments to match your time horizon is arguably the #1 rule in investing. If you have a long time horizon, you can invest more in risky investments with a better long-term expected return. If you only have a short time horizon, you can only afford to invest in more stable instruments with a lower expected return.

529 plans for college expenses present such a classic case. As each year passes, your investment time horizon shrinks. When the child gets to the senior year in high school, your investment time horizon becomes really short. You know you will need 1/4 of the money in one year, and another 1/4 in two years, three years, and four years. However, Vanguard gives this asset allocation for students age 17-18 in the 529 plan it manages:

- 21% in stocks

- 52% in bonds

- 27% in short-term reserves

With 21% in stocks and over half in intermediate-term bonds, some investors may think this is too aggressive for money that will be needed soon. When you need 1/4 of your money in one year, another 1/4 in two years, another 1/4 in three years, and the final 1/4 in four years, on average your money is only invested for 2-1/2 years. Some investors prefer to invest money that will be needed in such a short time frame in principal-guaranteed options.

Many 529 plans offer a money market fund option. You can choose the money market fund for the stable principal but sitting in the money market for up to four years feels a bit of a waste. Is there something in between, something that gives you slightly better returns than the money market but has less risk than bond funds?

Only some 529 plans offer CDs and stable value funds. They strike that happy medium between risks and returns for students who are close to going to college or who are already in college.

FDIC-Insured CDs

Ohio’s ColleageAdvantage Direct 529 Plan offers FDIC-insured savings accounts and CDs. As of December 2020, the yields are 0.3% for 1-year to 4-year CDs. The yields are slightly better than the prevailing money market fund yields.

Stable Value Funds

A Stable Value Fund is like a bond portfolio with an insurance contract. It’s guaranteed by the insurance company, not by the government. A stable value fund can offer both a stable principal and a higher yield than a money market fund. However, unlike CDs, their yield isn’t guaranteed for a fixed term. It’s subject to periodic adjustments.

Washington DC’s DC College Savings Plan offers a Principal Protected Portfolio backed by Ameritas Life Insurance Corp. The crediting rate is 2.3% in the fourth quarter of 2020.

Colorado’s CollegeInvest Stable Value Plus plan is backed by Nationwide. The rate for the full year 2021 is 2.09% net after fees.

Utah’s My529 Plan offers PIMCO Interest Income Fund as a choice under its Customized Static option. The yield shown on the fact sheet was 2.41% as of September 30, 2020. The PIMCO fund has the advantage of investing in contracts from multiple financial institutions.

All three plans above are a good option. By comparison, the 30-day SEC yield on the Vanguard Total Bond Market Index Fund was 1.14% as of December 4, 2020.

Moving 529 Plans

Although 529 plans are offered by each state, you are not necessarily limited to using only your own state’s plan. If you like the CDs and stable value fund options offered by one of the plans mentioned above, it’s possible to move your 529 plan account to those plans when your child gets close to going to college.

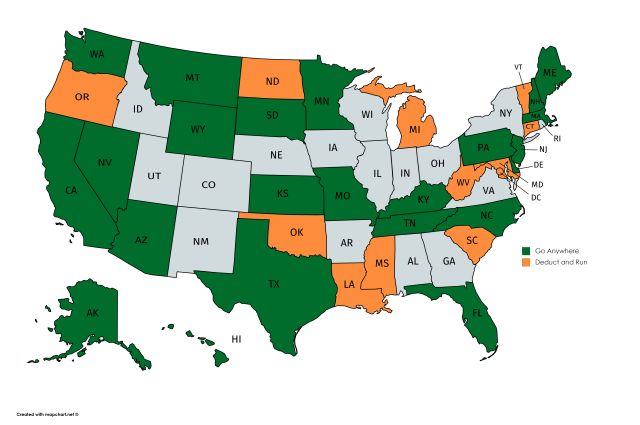

State tax benefits vary. Based on my own research, if you live in the states colored green and orange below, moving a 529 plan account does not have a negative impact (in Oklahoma and Washington DC, only after satisfying a minimum stay requirement).

In the other states, you’d be better off staying with the state’s own 529 plan. See Using a 529 Plan From Another State Or Your Home State?

Before you choose a 529 plan from another state or move your 529 plan account, find out:

- whether your state offers tax benefits on 529 plan contributions;

- whether it limits the tax benefits to a plan sponsored by itself; and

- whether it claws back the benefits you previously received if you move the money out to a plan from another state.

The map here is based on my own research to the best I can. It may not be 100% accurate. State laws can and do change. Please always double-check with your state’s tax authorities.

If you decide to move a 529 plan account, the logistics are quite simple, although you are limited to only one move in every rolling 12 months. See Rollover a 529 Account From One Plan To Another.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Alvin Care says

What about CA 529 plan no love for CD ?

Harry Sit says

California’s ScholarShare 529 Plan offers a Guaranteed Portfolio Option. Its 1-year return as of 11/30/2018 was lower than that of the Vanguard Federal Money Market fund.

https://www.scholarshare529.com/research/guaranteed.shtml

FinancialDave says

Harry,

I moved my Oregon 529 to Vanguard this year and there were no fees.

Vanguard has a suitable Money Market earning over 2% right now. Like you say I don’t think it’s necessary to put the whole 4 years into a CD or money market, but it does depend on the size of the college fund and when you anticipate using it.

Arun says

The Utah (My529) Pimco fund has a fee of 0.319%, of which 0.129% is the expense ratio and 0.19% is an administrative asset fee.

DW says

Harry – I have to agree that it doesn’t look like Vanguard’s take is a good match for funds that will needed in 1-4 years. That said, do you have a suggested asset allocation for the 0 – 23 years of saving/spending on the typical college education?

Harry Sit says

It’s a tough one. Christine Benz at Morningstar highlighted the challenges in coming up with an asset allocation for a 529 plan in her article How to Allocate Assets for College Savings. Back in 2010, likely influenced by the stock market crash in 2008-2009, I proposed a very conservative allocation here:

https://thefinancebuff.com/asset-allocation-for-a-529-plan.html

Of course the stock markets did very well since then. The age-based allocations available in most plans did much better than my proposed allocation.

It’s difficult to balance growth and risk in a 529 plan. For the sake of simplicity, I would pick Vanguard’s Conservative (as opposed to Moderate or Aggressive) age-based option if a plan has that option.

Ned Puddleman says

When my child was a senior in high school I moved all the 529s fund to ultra conservative investments and locked in the gains from the previous 15 years. This was important because the bulk of the dollars were put in post the ’07-’08 crash. I benefited from the slow 10 year market recovery and the ’16-’19 boom. Considering this was the nest egg for college without many other options, capital preservation took on more importance than ROI. I also found that the freshman year is a lot more expensive than future years. Two years into college, I haven’t had to touch anything other than the 529 to pay for college. That’s really important as I stood a 50/50 chance of being unemployed in 2020 and 75/25 chance in 2021.