California leads the nation with starting the open enrollment for ACA health insurance on October 15, versus November 1 in the rest of the country. As I mentioned in the previous post When ACA Insurance Does Not Include Your Doctor, we are switching from a PPO to an HMO next year to save $5,600/year.

As I went through the open enrollment process, I noticed one thing that I didn’t know before. Although you report your total household income to the health insurance exchange, you don’t have to sign up all members of your household for the same plan. When different household members have different healthcare needs, you can choose to enroll them in separate plans. Say within a married couple, one of you is healthy and the other has more health issues. You can put the healthy person in a less expensive Bronze plan with a higher deductible, and you can put the other person in a Gold plan with no deductible and a low out-of-pocket maximum.

It gets a little more complicated when you have more than two people in your household who need ACA health insurance. You can have everyone in a Bronze plan, everyone in a Gold plan, or some in a Bronze plan and some in a Gold plan. The good thing is ACA open enrollment runs for a long time. In California you can make changes through December 15 for coverage starting on January 1. That gives you a lot of time to do the math multiple ways and see which way works the best for you.

Here’s how to enroll different household members in different plans in California’s ACA health insurance exchange (called Covered CA). For other exchanges, you can ask customer service how to do it.

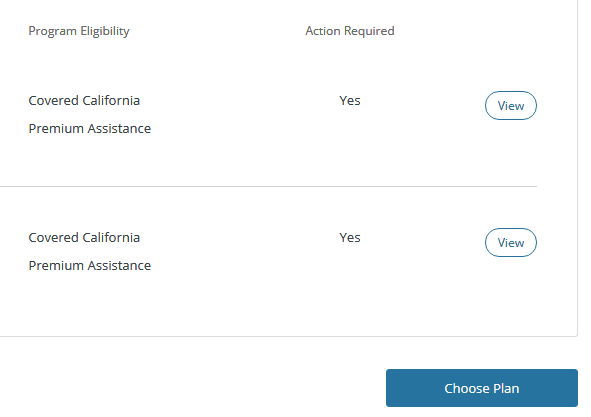

You see a list of household members and you click on Choose Plan.

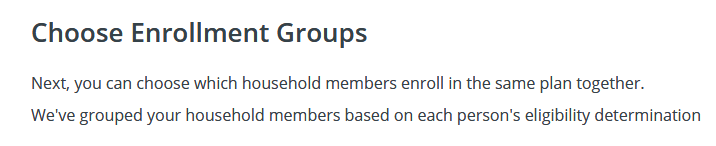

Next you see the concept of Enrollment Groups. An enrollment group is a subset of household members who will enroll into the same insurance plan. If you are having Mom plus two kids going into a Bronze plan and Dad going to a Gold plan, you will have two enrollment groups: Mom plus two kids in one group and Dad alone in a second group.

By default they will create just one group and put everyone in it. You click on the Edit Groups button to split up.

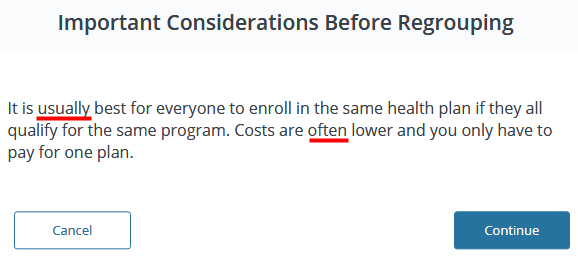

They say it’s usually best to go with just one group but you should do the math before you get here. Click on Continue if you already determined that doing separate plans works the best for you.

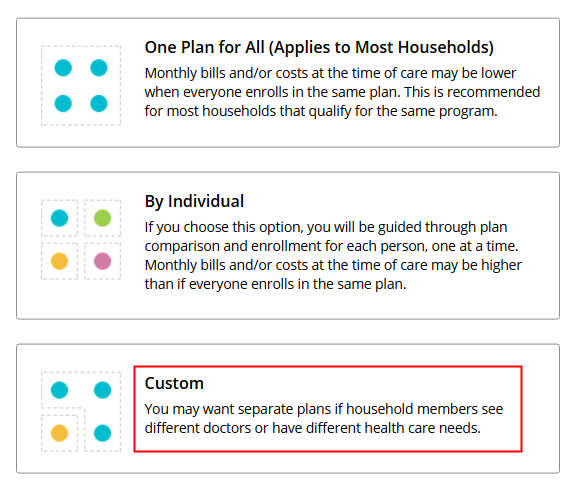

The last option, Custom, allows you to split up your household the way you’d like. I would think it’s quite common for different household members to have different healthcare needs. If you choose a Bronze plan for everyone, you will pay a higher deductible. If you choose a Gold plan for everyone, you will pay higher insurance premiums. You may very well be better off by splitting up so that the healthy members will pay a lower premium and only the member with more health issues will pay a higher premium but will have lower out-of-pocket expenses.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

MikeG says

Harry, DW and I do just this. We file our taxes as MFJ. I have assumed that neither of us qualifies for a subsidy using the MAGI off our MFJ return and assumed that is the measure that would be used. Is there any basis to apportion our joint MAGI and see if my DW might qualify for the subsidy if say most of our income flows to my SS#? I doubt it, but your article got me to wondering.

Harry Sit says

If you are in California, you can enroll as one household but buy two separate policies within the same household. The Covered CA exchange will automatically figure out the estimated subsidy based on your reported household income and the total premiums of your two separate policies.

If you are not in California and if the health insurance exchange can’t do it (sometimes customer service or an agent can do more than you can do online), keep in mind the _advance_ subsidy is just an estimate. The final subsidy is determined when you file your tax return. Even if each of you reports the MFJ income, which makes your income look like double and you receive no advance subsidy during the year, when you file your tax return you may still qualify for tax credit based on your MFJ income and the total premiums paid. You will get money back as a tax refund.

MikeG says

We currrently buy two individual policies -sorry I was not clear on that – and we live in NJ.

My question goes to how the IRS will determine what the MAGI is for “each of us” since we file a joint return. I have simply looked at our MAGI – we are way over the cutoff for a couple – and assumed we get zero.

However, if the vast majority of that income comes to my SS#, such that my wife’s income would appear to be under the subsidy cutoff for a single person, then I would like to at least know if this is an option for us.

My assumption is that if you file MFJ, then you use the cutoff for a couple – period. There is no apportioning of income to see if you are under the cutoff for one of the spouses. Honestly, I think I am trying to be too cute by half.

Harry Sit says

It’s based on the household income, period, even if only one person needs ACA insurance. If your MAGI is over the cutoff for a couple, you don’t get a subsidy. There is no apportioning of income to each person. If you choose married filing separately you don’t get any subsidy no matter how low your income is.

John says

Harry, how does this work in CA when it is one adult (some income) and parents (2 adults with no income)? Does tax filing need to be head of household or is it more advantageous to do 2 tax filings and then have different plans?

Harry Sit says

If the parents’ income is below 138% of FPL ($22,715 for 2019 coverage), they don’t qualify for ACA health insurance on their own. They will be referred to Medicaid. The three of them can apply together only if the parents are claimed as dependents on the adult child’s tax return (the adult child providing more than 1/2 of the support, etc.).

Jim Callinan says

DW and I have done this for three years on the ACA. She’s high use and has a Gold plan. I’m low use and have an HSA.

She had two abdominal surgeries recently (December 2018 and January 2019). Unfortunately she was discharged from hospital at the end of December and readmitted January 2, 2019. Pretty much two $7500 out-of-pocket maximums in less than a month plus ER and ambulance expenses not covered.

Got nowhere with Blue Cross, hospital, surgeon, hospitalist, etc.

With separate health plans she is here own responsible party (ie, they don’t have my social security number on file. As her agent (general and medical powers) this made it much easier to negotiate settlements.