Most brokers let you automatically reinvest dividends into the same stock, mutual fund, or ETF without charging any fee. If it’s a taxable account and you don’t want to automatically reinvest dividends, you don’t have to remember to transfer the dividends out manually on your own. You can set it up to automatically transfer out to any bank account you designate.

Fidelity

To set this up online with Fidelity, if you’re transferring to an external bank account, you need to link it for Electronic Funds Transfer (EFT) if it isn’t linked already.

Link Account for EFT

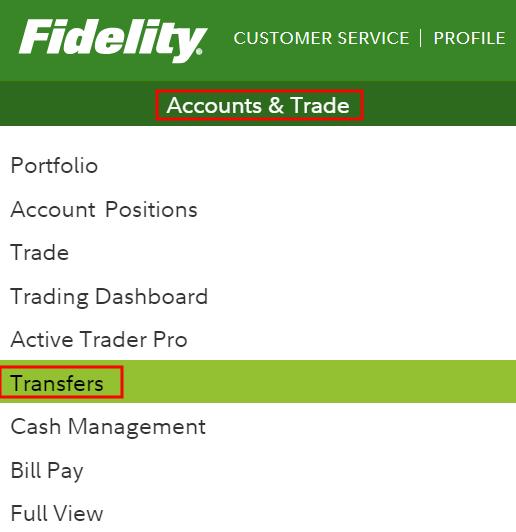

Click on “Accounts & Trade” and then “Transfers.”

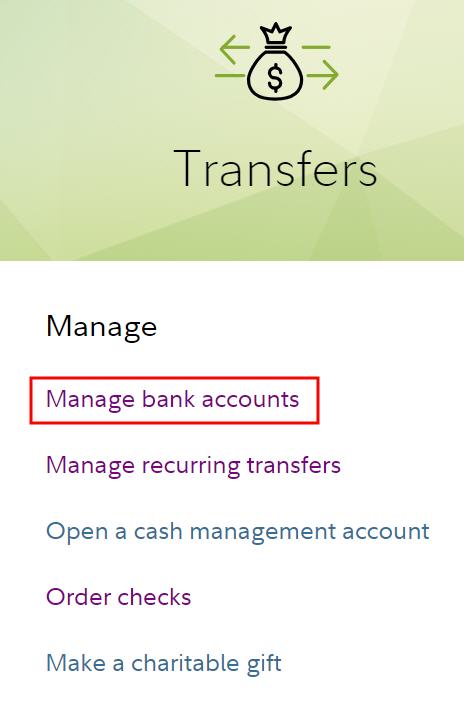

Click on “Manage bank accounts” under the “Manage” heading.

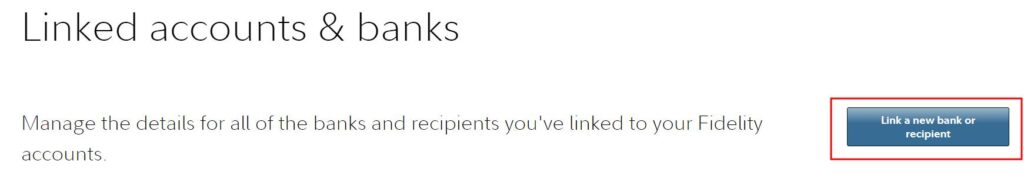

Click on the “Link a new bank or recipient” button to the right.

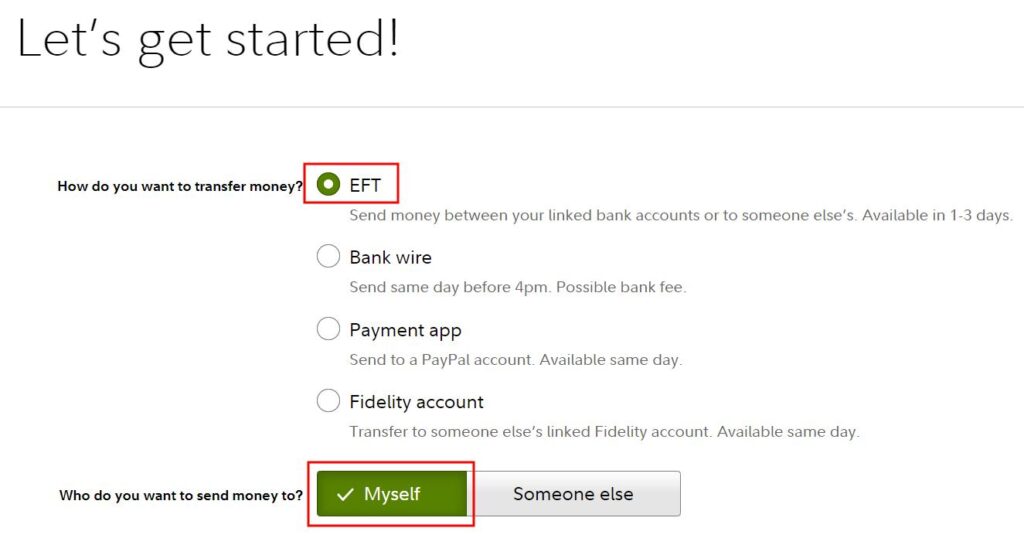

Choose “ETF” and “Myself” and go from there. You can either link instantly by logging in to online banking or use the random deposit process to link and verify your bank account.

Recurring Transfer of Earnings

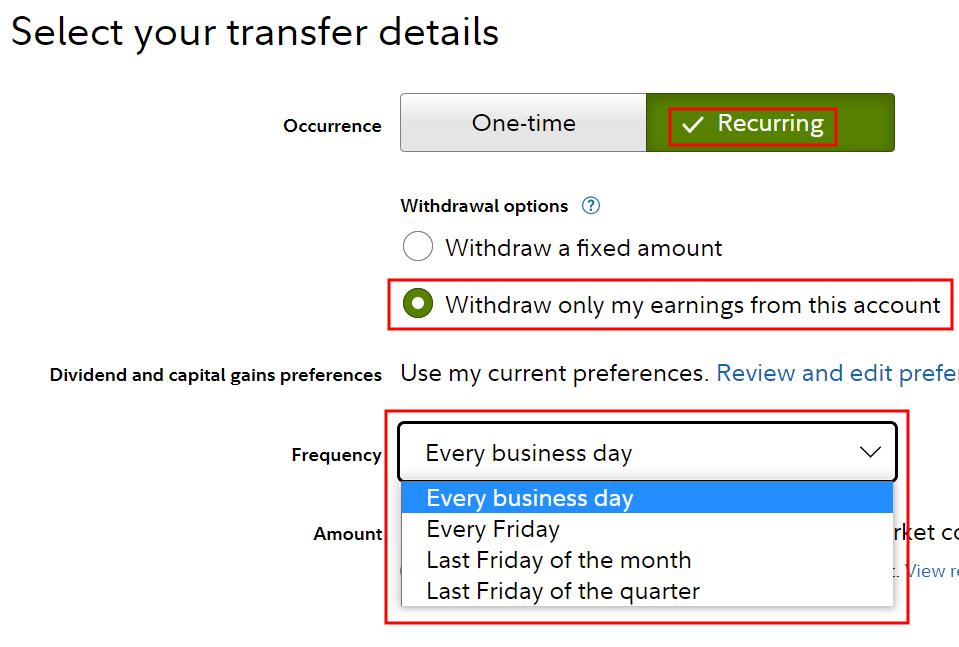

After your bank account is already linked and verified, click on “Transfer” in the ribbon.

Choose the source and destination accounts. The destination account can be another Fidelity account if you’re using Fidelity as a checking or savings account. Chooses “Recurring” and “Withdraw only my earnings from this account.” The frequency can be daily, weekly, monthly, or quarterly. I leave it as “Every business day.”

This will automatically transfer all dividends and interest payments to the chosen destination account. Proceeds from selling shares or matured bonds or CDs won’t be transferred.

Merrill Edge

Merrill Edge requires a form. After you log in, click on “Help & Settings” and then “Forms & Applications.”

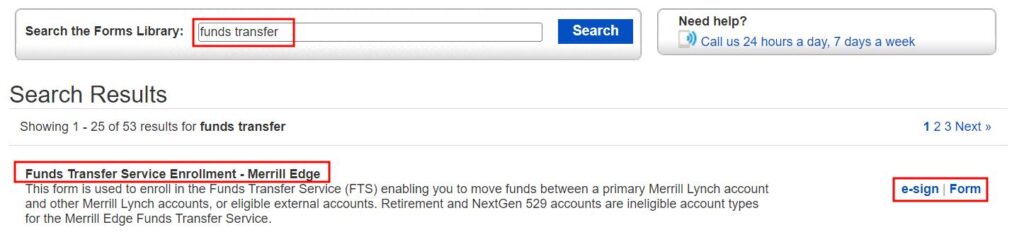

Search for “funds transfer” and find “Funds Transfer Service Enrollment – Merrill Edge.” You can either e-sign the form or download the PDF form, fill out the form and sign, and submit a scan to customer service.

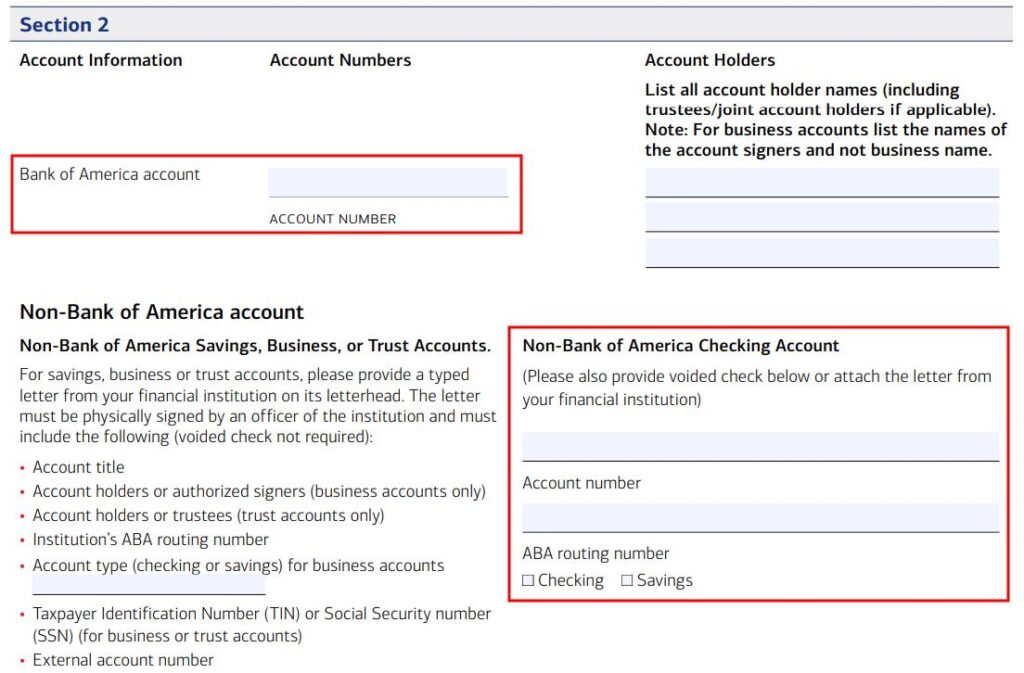

The destination can be either a Bank of America account or an external account.

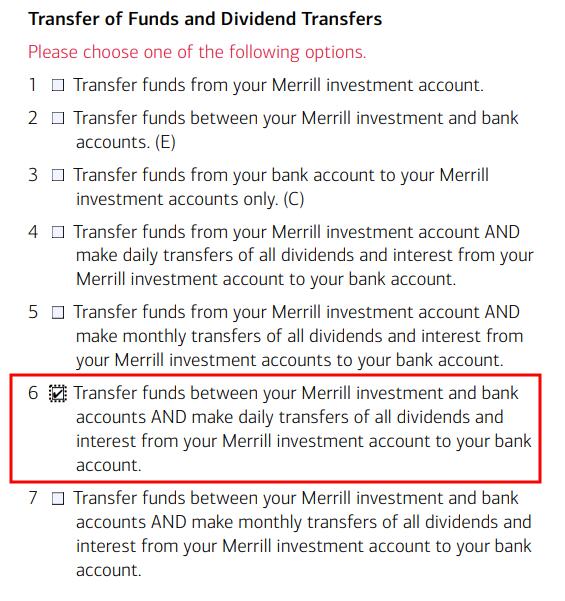

You can choose to link the bank account as one-way out of Merrill Edge or both into Merrill Edge and out of Merrill Edge. Options 4 or 6 will transfer dividends and interest daily. Options 5 or 7 will transfer dividends and interest monthly. I chose option 6 to transfer dividends and interest daily.

Now all dividends will automatically go to your linked external bank account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Clint Logan says

This seems to me to be solving a non-problem. It matters not to me if my dividends and interest sit in my brokerage money market fund paying 0.23% or in my bank account paying 0.01%.

Harry Sit says

Some bank accounts pay 1%. Apparently many think that’s a big enough difference.

dan23 says

1) Have you tried getting a letter from a bank for a savings account (no voided check). Annoys me that you need one for setting up ACH. Will Banks easily give such a letter. I use CIT.

2) If you have ACH set up, do you know if you can you just call or change some online setting to do the dividend to Bank option or do you need to fill out that form again.

Thanks

Harry Sit says

Both are perfect questions for customer service. 🙂 I only linked a “high yield” checking account. Without a voided check or a letter maybe they will let you do one-way out. If you already have the bank linked, I don’t see why they can’t change the dividend options for you if you call.

TJ says

Do you have to mail in this form? I’m only seeing a downloadable PDF option.

Harry Sit says

I mailed it. Ask customer service whether attaching a scanned signed copy to a secure message will work if you don’t want to mail.

Harry Lynch says

Whats the fees for Merrill Edge?

sam says

I was manually transferring dividends and was not regular. This will help a lot as my bank savings pays 1.40% whereas merrill edge pays .23%.

Justin says

Hi,

Do you know how to do this with E*trade? I’m not sure if they have this option.

Thanks.

Harry Sit says

Sorry, no. I don’t have an account there.