[Rewritten on June 20, 2024 after Fidelity made a money market fund available as the default option in the Cash Management Account. Also added a section on debit card security.]

Fidelity Investments is best known as an administrator for workplace retirement plans and an online broker for retail investors. In addition to 401k/403b accounts, Traditional and Roth IRAs, HSAs, and taxable brokerage accounts, Fidelity also offers accounts that can be used for the same purpose as a checking account and a savings account.

Because Fidelity is interested in having a full relationship with its customers for both banking and investing and its primary focus is on the investing part, it’s in a good position to offer better rates and features than banks in the banking part.

This is not a sponsored post. Fidelity isn’t paying me to promote it. I’m only writing as a satisfied customer of over 20 years. Here are two ways to use a Fidelity account to manage day-to-day spending and savings.

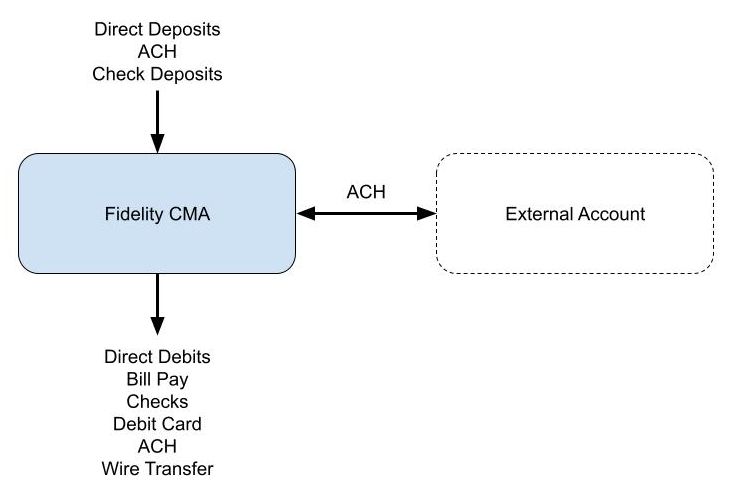

1. CMA as Checking

Fidelity Cash Management Account (CMA) is a separate account type from Fidelity’s regular taxable brokerage account officially called “The Fidelity Account.” You have to choose the account type when you open the account. A Cash Management Account can’t be changed to a regular taxable brokerage account after you open the account. Nor can an existing regular taxable brokerage account be changed to a CMA.

Included Features

The Cash Management Account is specifically designed to meet banking needs. It has pretty much everything people need for a checking account and nearly everything is free.

– FDIC-insured balance (2.72% APY as of June 19, 2024) or a money market fund (4.95% 7-day yield as of June 19, 2024).

– No minimum balance. No maintenance fee. It does not require direct deposit.

– It provides a routing number and an account number for direct deposits and direct debits.

– It accepts check deposits by mobile app or in person at a Fidelity branch.

– Free checkbook. No minimum amount for writing a check.

– Free Visa debit card for purchase, ATM withdrawal, and teller cash advance. No foreign transaction fee on the debit card when you always transact in the local currency. It does not require using the debit card a minimum number of times per month.

– No fee to use any ATM worldwide. Reimburses the ATM fee charged by the machine.

– Free Bill Pay service with eBill.

– Free same-day ACH. Push $100,000 per business day out of Fidelity and pull $250,000 per business day into Fidelity by online self-service. Call customer service to transfer a higher amount.

– Free wire transfers. Same $100,000 per business day by online self-service. Call customer service to wire a higher amount.

Choose Core Position

The “core position” in a Fidelity account is the default holding in the account. Money coming into the account lands in the core position. Money going out of the account is withdrawn from the core position first.

You have a choice to keep your core position either in FDIC-insured banks or in the Fidelity Government Money Market Fund (SPAXX). The money market fund isn’t FDIC-insured but its underlying holdings are short-term government securities. I’m comfortable keeping my money in the money market fund for a higher yield. See No FDIC Insurance – Why a Brokerage Account Is Safe.

To switch the core position from the FDIC-Insured Deposit Sweep Program to the Fidelity Government Money Market Fund (SPAXX), log in on Fidelity’s website, click on the “Positions” tab, and select your cash balance. You will see a “Change Core Position” button.

Your chosen core position stays effective until you change it again. If you make Fidelity Government Money Market Fund (SPAXX) your core position, your existing core balance and all future deposits will automatically go into the money market fund.

The 4.95% yield from the money market fund is higher than the yield on many high-yield savings accounts as of June 19, 2024. For example, Ally Bank pays only 4.2% on its high-yield savings account, which doesn’t have all the checking features such as Bill Pay.

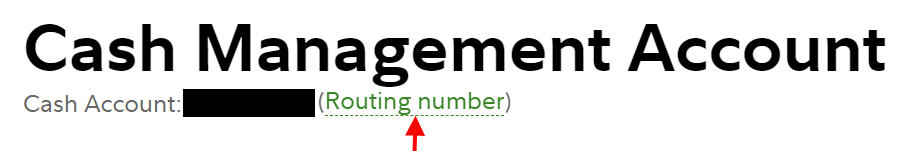

Routing Number and Account Number

You see the routing number and the account number for direct deposits and direct debits when you click on the routing number link below the account name.

Choose “checking” as the account type if you’re asked to select one.

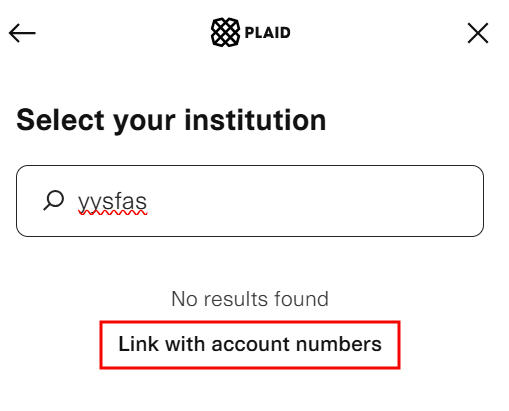

If your bank uses Plaid to add a Fidelity account as a linked bank account, search for a non-existent bank and then click on “Link with account numbers.” It will make Plaid use a micro-deposit to verify your Fidelity account.

You go back to verify the link after you receive the micro-deposit in your Fidelity account.

Limitations

Fidelity Cash Management Account has some limitations that aren’t a deal-breaker to me.

– It does not accept deposits of physical cash or money orders.

– It does not support Zelle in the account. You can link the debit card in the Zelle mobile app (through March 31, 2025). See How To Use Zelle App With Debit Card on YouTube. The sending and receiving limits may be low when you use the Zelle mobile app with a debit card. Venmo or Cash App are better alternatives.

– It does not link instantly through Plaid (see screenshots above for how to link with account numbers in Plaid using micro-deposits).

– It does not offer sub-accounts for tracking separate goals.

– It does not provide cashier’s checks.

– Recurring ACH pushes out of Fidelity only support monthly and annual frequencies. Recurring ACH pulls into Fidelity only support weekly, biweekly, and monthly frequencies.

I use my otherwise dormant Bank of America checking account on those rare occasions when I need to deposit physical cash or a check, get a cashier’s check, or set up recurring transfers on an odd schedule. I don’t use sub-accounts to track separate savings goals.

Transfer Money by Push

Fidelity may hold ACH pulls and check deposits for up to three weeks. The money still earns interest. It’s just not available for withdrawal while it’s on hold. When you ask Fidelity to transfer money from your external bank account, you see this warning before you hit Submit:

Stop, read, and take it seriously. This applies to mobile check deposits as well. You won’t be subject to the hold if you use the right way to transfer money. When you transfer money out of Fidelity, initiate the transfer at Fidelity. When you transfer money into Fidelity, initiate the transfer at your external bank. When you have a check to deposit, deposit it at your external bank account and then initiate a transfer at the external bank.

I make all deposits by an ACH push. Following this simple rule avoids holds or getting the account restricted for fraud.

Secure Your Debit Card

The account comes with an optional Visa debit card. The debit card can be used for purchases without a PIN when it’s run as a credit card. This creates a problem in case your debit card is lost or stolen. A user posted on Reddit that he or she was having a hard time getting the money back after thieves bought $6,000 worth of gift cards with the stolen debit card.

It’s better not to carry the debit card with you in your wallet. If you prefer to use a debit card for purchases, put the debit card in Apple Pay or Google Pay and tap your phone to pay. It’s more difficult for criminals to crack a phone than to tap your lost or stolen debit card everywhere. Keep your debit card at home and only take it with you when you anticipate needing to withdraw cash at an ATM.

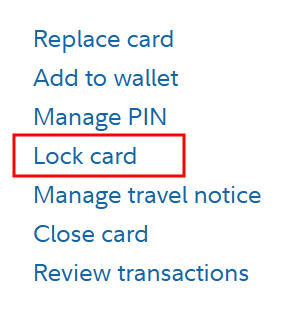

You can also lock your debit card on Fidelity’s website or in the Fidelity mobile app. Locking the card makes it decline all transactions. I previously used the debit card in Venmo to pay friends for shared expenses. Venmo also works with a bank account. I added the Fidelity account as a bank account in Venmo and removed the debit card. Now my debit card is securely locked at all times. I’ll only unlock it when I need to use it to withdraw cash.

To lock the debit card online, open a new tab in your browser after you log in to Fidelity and go to fidelitydebitcard.com. Find your debit card and click on “Lock card.”

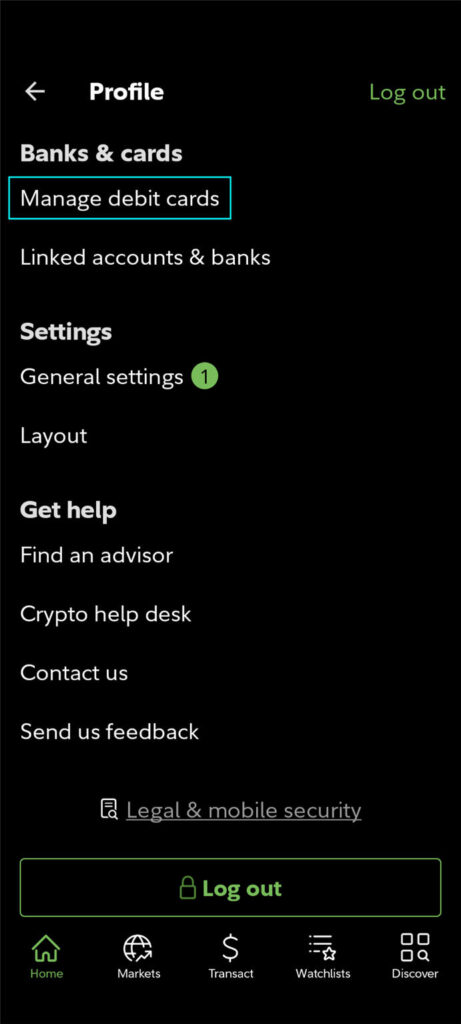

If you install the Fidelity mobile app on your phone, you can unlock the debit card right before you need to use the card to withdraw cash and lock it again when you’re done. Tap the head icon on the top right to find “Manage debit cards” in your profile in the Fidelity app. Tap “Lock or unlock card” on the next screen to lock or unlock the card.

Link to External Account

When you use a Fidelity CMA as your checking account, you can link it to an external account as you normally do with a checking account. For example, the settlement fund in a Vanguard brokerage account pays 5.27% as of June 19, 2024. You can use Vanguard as your savings account to earn a slightly higher yield while using the Fidelity CMA as your checking account. The bulk of your cash earns 5.27% at Vanguard while the amount you need for spending earns 4.95% in the Fidelity CMA.

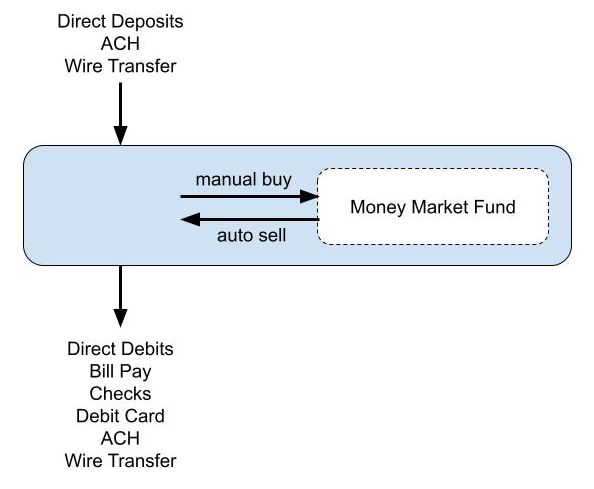

2. CMA as Checking/Savings Combo

Instead of linking to an external account as the “savings” part, you can keep both “checking” and “savings” in the Cash Management Account. This earns less interest but it avoids having to transfer back and forth between two accounts. I do it this way because it’s simpler and it doesn’t forego that much interest.

Buy Another Money Market Fund

Although the CMA is designed for banking needs, it’s still a brokerage account. With some exceptions (no margin or options), you can buy in the CMA pretty much everything available in a regular brokerage account. This includes stocks, bonds, brokered CDs, mutual funds, and ETFs.

The CMA becomes a checking/savings combo when you buy a different money market fund in it. The core balance in the CMA serves as the checking part and the manually purchased non-core money market fund serves as the savings part. Fidelity will automatically sell from the non-core money market fund when your core balance in the CMA is insufficient to cover a debit. This is like having free automatic overdraft transfers from savings to checking.

Some people prefer to buy Fidelity Money Market Fund (SPRXX) or Fidelity Money Market Fund Premium Class (FZDXX). Their yields were 5.02% and 5.14% respectively as of June 19, 2024, which were slightly higher than the 4.95% yield on Fidelity Government Money Market Fund (SPAXX) in the core position. Some people prefer to buy Fidelity Treasury Only Money Market Fund (FDLXX), which had a 4.93% 7-day yield as of June 19, 2024 but more of the income is exempt from state income taxes. None of these funds can be set as the default core position but you can buy them manually. See Which Fidelity Money Market Fund Is the Best at Your Tax Rates.

Because Fidelity will automatically sell from the non-core money market fund to cover debits, if you’re so inclined, you can be aggressive in keeping the core balance in the CMA low while keeping the bulk of your account in a non-core money market fund earning a slightly higher yield. Or you can set a maximum target balance alert with the Cash Manager to buy more shares of the non-core money market fund when you have excess cash in the “checking” part.

Some people prefer to just keep everything in the default Fidelity Government Money Market Fund (SPAXX) because the extra yield from a non-core money market fund is quite small.

Cash Manager Not Needed

You may have seen some convoluted setups using the Cash Manager overdraft feature in the Fidelity CMA. It’s unnecessary and undesirable.

The only thing remotely useful in the Cash Manager is the maximum balance alerts. An alert only tells you that your CMA core balance exceeded the maximum target balance. It doesn’t automatically buy a non-core money market fund in the CMA for you. You still have to buy it manually if you want.

You don’t need an alert for the CMA core balance dropping below a minimum balance when you have enough savings in a non-core money market fund held in the CMA. Selling from the non-core money market fund held within the CMA to cover debits works out of the box. It happens automatically anyway even if you don’t set up anything in the Cash Manager.

The Cash Manager has a “self-funded overdraft protection” feature to link the CMA to another Fidelity account. This is unnecessary and undesirable when you want the CMA to stand by itself. You don’t want unauthorized debits to affect your other accounts.

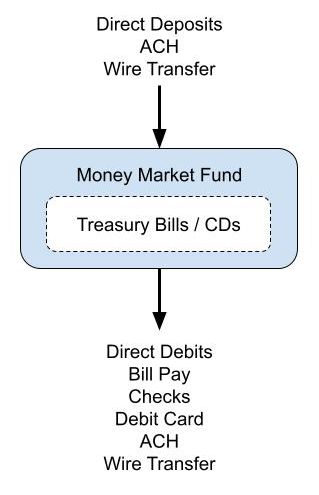

Add Treasury Bills or Brokered CDs

If you’d like to take it one step further, you can also buy Treasury Bills or brokered CDs in the CMA when you have money that you know you won’t need for some time. The CMA then becomes a checking/savings/CD combo. The money automatically goes into the “checking” part when the Treasury Bill or brokered CD matures. For example, the amount set aside for the next property tax bill can go into a Treasury Bill or a brokered CD. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy CDs in a Fidelity Brokerage Account.

Please note if you enable the “auto roll” feature when you buy new-issue Treasury Bills or brokered CDs in the CMA, the amount for the next roll reduces your “available to withdraw” number for a few days during the roll. A debit may fail if you don’t have enough available to withdraw. It’s not a problem if you don’t use auto roll or if you keep a substantially higher amount in a money market fund than the amount for the next roll.

Using a Fidelity CMA for spending and savings becomes truly set-and-forget. All deposits automatically earn about a 5% yield as of June 19, 2024. All debits come out of this money market fund. It’s like using a savings account as a checking account. You can manually buy a non-core money market fund but you don’t have to. The yield on the default Fidelity Government Money Market Fund (SPAXX) is close enough to the yield on another Fidelity money market fund.

You can still buy Treasury Bills or brokered CDs to set aside money for specific bills in the future. Please note the caveat on “auto roll” and “available to withdraw” mentioned above. It’s better to do it in a different brokerage account if you prefer to use “auto roll.”

***

The biggest draw of using the Fidelity CMA for spending and short-term reserves is the checking features. You effectively use a savings account as a checking account and earn a good yield from the first dollar. Everything is seamlessly together.

A Vanguard money market fund and some less well-known high-yield savings accounts pay more but they don’t offer checking features. When you pair it with a checking account that pays close to zero, the blended yield on all your cash goes down. For example, if you have $5,000 in a checking account that pays 0.1% and you have $50,000 in a Vanguard money market fund that pays 5.27%, your blended yield on $55,000 is 4.8%. You might as well put the whole $55,000 in a Fidelity CMA earning 4.95% and eliminate the need to watch your checking account balance and transfer back and forth between two accounts.

Transitioning a checking account takes some time and effort. Banks know it. That’s why they pay you close to zero in checking accounts. They bet that you think it takes too much work to switch. Don’t fall for it. It’s easier than you think when you take your time to make the move.

The most frequent problem I see when people use a Fidelity CMA is an unexpected long hold on check deposits and ACH pulls. You won’t have this problem when you do all your deposits with an ACH push. In other words, initiate the transfer into Fidelity outside Fidelity. See 3 Lessons Learned From a Botched Money Transfer.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

RayK says

Hello Harry,

I transferred money to my CMA from my other bank 3 days ago, but am still seeing that the cash is not available for withdrawal and only for trading.

How many days do I have to wait to use the money to pay a bill on my new Fidelity Visa credit card?

Harry Sit says

You used the wrong way to transfer money. See the section “Transfer Money by Push.” You may see a date when it’ll be available for withdrawal under More -> Manage Cash. Look under “Upcoming activity.”

You also didn’t need to transfer into a Fidelity account if you only wanted to pay the credit card bill. Add your bank account to Elan and make the payment on Elan. Use Elan for everything related to the credit card.

RayK says

You are awesome Harry. I will go through Elan for the Visa credit card, but now question what good is the Fidelity CMA? Can it be used as my settlement account?

Thanks in advance.

Harry Sit says

This post is about what good is the Fidelity CMA. Please scroll up to the top and read it from the beginning. The Fidelity CMA can replace your checking account or both your checking account and your savings account if you use it the right way.

Jen says

Has someone used the CMA debit card overseas recently? I just opened an account and talked to the debit card division of Fidelity and they said they have a new issuer and she said the ATM network has to say All Point or Money Pass to be reimbursed. I said those are mostly domestic networks, she didn’t even know what I was talking about. That was after being transferred 3 times.

Harry Sit says

If the machine is in the Allpoint or Money Pass network, the machine won’t charge a fee. Otherwise the machine will charge a fee but Fidelity will reimburse it when they see the fee spelled out separately in the data feed from the charge. I used the card outside the U.S. last month. The fee was reimbursed as it always has been.

If the ATM operator doesn’t break out the fee separately in the data feed for the charge, Fidelity doesn’t know there was a fee. You’ll have to present the ATM receipt to get reimbursed manually. So save the receipt until you see the reimbursement.

Finally, be sure to select the charge in local currency when you use a machine in a foreign country. If the machine tricks you into selecting the charge in US dollar, Fidelity won’t reimburse you because technically you paid a currency exchange fee, not an ATM fee.

Jen says

Thank you Harry!

Unmesh says

Thanks, Harry.

I haven’t even been checking whether the foreign ATM fees were called out separately for reimbursement but will do so on an upcoming overseas trip.

Cam says

I have no idea what circuitous route took me to your page, but I’ve found a number of your articles (including this one) enormously helpful. I have, among other things, begun the process of switching my checking from BoA to Fidelity CMA and streamlining my setup. Thank you.

Steve says

Question about using Fidelity Billpay with Fidelity CMA:

If I arrange a Fidelity Billpay payment that will cause Fidelity to mail a check to the recipient, I am asked to enter a deliver by date. Will Fidelity mail the check on the deliver by date, or will Fidelity mail the check some days in advance so that the check should be delivered to the recipient on or before the “deliver by” date?

Harry Sit says

Who are you paying that may go by a paper check? Fidelity’s Bill Pay is provided by Fiserv, which also handles Bill Pay for many other banks and credit unions. They’ll mail the check a few days before but whether it gets delivered by the given date is out of their control. It’s better to avoid mailing checks and set up electronic payment on the biller side. Use Venmo or Cash App for person-to-person payments.

Brent Elkins says

@Harry Sit – That’s ideal, yes, but not possible for a lot of small businesses like tradesmen, etc.

Unmesh Agarwala says

Now that the Zelle app will be deprecated this March end, has anyone found a different workaround?

Harry Sit says

Use Venmo, which works directly with a linked bank account and lets you keep the Fidelity debit card locked. My haircut place displays their Venmo QR code by the mirror. All the Facebook Marketplace buyers and sellers I dealt with use Venmo. I paid a home inspector by Venmo.

I haven’t run into anyone who only uses Zelle. If I must pay someone by Zelle, I’ll ACH push to my otherwise dormant US Bank account and use Zelle from there. ACH push from Fidelity usually arrives on the same business day if you do it early enough. It’s only a half-day delay, not too bad.

Unmesh Agarwala says

Thanks, Harry.

As luck would have it, the new eldercare person we’ve hired only accepts Zelle. Maybe it is a matter of educating them about other systems!

Lori says

FYI, Zelle is exempt from IRS reporting requirements that they might prefer so it isn’t exactly apples to apples.

John Bynum says

Harry,

Thank you for this article and your other excellent resources. I have run into an unexpected issue trying to open a Fidelity CMA. I want to open our CMA in the name of our Revokable Trust with my wife and I as Trustees, but had questions with how to complete their application form. After spending some time on the phone with Fidelity I was informed that this is not an option at this time. However I have read to the contrary. Do you happen to know if this is indeed a limitation with the Fidelity CMA? Thank you.

Unmesh Agarwala says

We have both a Brokerage account and a CMA in the name of our Revocable Test

Harry Sit says

A trust account can’t be opened online. You need to fill out the application form, attach the required documentation, and mail it in or drop it off at a local office.

CMA: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/cash-management-account-application-trust.pdf

Brokerage: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/trust-account-application.pdf

RobI says

I looked at the CMA paper application linked above but it indicates that Beneficiaries must be real persons. I prefer a spouse trust to be listed. Does anyone know if this is possible in Fidelity CMA?

Harry Sit says

The paper application linked above is for a CMA owned by a trust. Fidelity wants the trust’s beneficiaries to be all natural persons. A CMA owned by a person (or persons jointly) can have a trust as the beneficiary.

John Bynum says

Thank you Unmesh. I suspect I just got someone who was unfamiliar with their CMA. I will try again.

John Bynum says

Thank you Harry!

Steve says

Thanks Harry!

I tried to manually add Fidelity CMA to my Citi credit card online, so I can can use it for autopay purpose (full statement balance on due date). When adding on the Citi online, after entering routing and 17-digit account number, it prompts for security check, then shows “Looks Like We Couldn’t Verify This External Account. We aren’t able to verify this account right now. Please try adding a different account.”. It did not even get to the trial deposits for verification step. Tried two days, no luck.

For other banks that I have credit cards with, they seem to work just fine for me to setup CMA to autopay, just not Citi bank. Called Citi, they couldn’t help. Do you know if this is a known issue on Citi? or any workaround?

GeezerGeek says

I’m using my Fidelity CMA to autopay my Citi credit card without any problems. I set it up last July and have made 8 payments with it so far.

Harry Sit says

Citi likely used a service called EWS when it tried to verify your account only based on the routing number and the account number before doing trial deposits. If your CMA is new, EWS doesn’t know about it, and therefore Citi couldn’t verify it through EWS. Just start using it for other debits and pushes to other banks. Fidelity and other banks will report successful transactions to EWS. It will pass Citi’s verification step after some time.

Steve says

Thank you both!

Still can’t pass that error message so far. Hoping it can be setup soon, as it was the main reason that I opened the Fidelity CMA. 🙂

Jacob Marshall says

Is a Fidelity brokerage account alone able to handle day to day needs, bill pay, direct deposits, etc.?

JT says

If you already have a significant-to-you amount invested in the brokerage account then why open it up to ACH fraud?

Create a CMA account without overdraft protection to shield the investment account from this risk.

To mediate against ACATS fraud enable money transfer lockdown on all accounts.

Harry Sit says

A regular Fidelity brokerage account provides everything a Fidelity CMA does except:

(a) It doesn’t create a separation between day-to-day needs and long-term investing, which many people prefer and I would recommend. You can use two regular brokerage accounts for this separation, but then you might as well use a CMA plus a regular brokerage account.

(b) The ATM fee reimbursement in a regular brokerage account requires Premium Services or above relationship designation, whereas everyone gets the ATM fee reimbursement in a CMA.

(c) The Cash Manager features aren’t available in a regular brokerage account. These features — maximum target balance alert, minimum target balance transfer, self-funded overdraft protection — aren’t that useful and may be counter-productive in my opinion, but if you want them, they’re only available in the CMA.

If you don’t care about creating a separation and your account relationship already gives you ATM fee reimbursement, a regular brokerage account will work. Otherwise a CMA is better for the day-to-day needs as its name suggests.

GeezerGeek says

Every time I have set up an account for transfers, the institution has sent trial deposits of a few cents to the account I’m trying to link. I then have to verify the amounts sent to the linked accounts before the linked account becomes available for transfers. I’ve also heard that ACATS fraud is a account security problem but how can any scammer work around the trial deposits verification?

GeezerGeek says

I think I understand now. ACATS is for securities transfer, not cash. I think I have probably used ACATS when transferring stocks between brokerage firms. So, disregard my previous comment about account verification.

SEO says

A Fidelity brokerage doesn’t support all the bank-like activities you mention, like bill pay and I think direct deposits. A Fidelity Cash Management Account, however, does.

Stephen says

I can confirm that ACH direct deposit works for the brokerage account and our ROTH IRA accounts. (My Fidelity NetBenefits company sponsored account does not offer this though.)

In order to see the ACH information look under More > Account features > Direct Deposit > Eligible Fidelity Accounts (Select Account) > Do it yourself and you will see your Routing number and Account number for ACH deposits.

Jacob Marshall says

Fidelity online appears to offer direct deposit and direct debit options for my brokerage. I do not have CMA, so was wondering what I am missing. I can also get a debit card for the brokerage.

Lori says

If for some reason you didn’t want to use a money market as your core cash account, I believe CMA is the only one that offers FDIC-insured balance. So that or SPAXX.

Regular brokerage has SPAXX, FZFXX, FCASH. Also it’ll show up in the “Spend & Save” category among your accounts and show slightly different options/info in the summary page like the Income section with interest/dividend earned YTD rather than Performance with returns.

bill says

so, I have my power company pull a various amount monthly and another company pulls my rental amount, I don’t understand if “money lockdown” will or will not prevent this?

Fido just says “Outbound money transfers (previously scheduled electronic fund transfers from your account may still be processed)” ; Kind of vague what “from” means, is that a push or a pull or ?

I don’t really want to “test it” by having it fail to pay my bills , thanks in advance

Harry Sit says

Money Transfer Lockdown will not prevent direct debits (or checks or ATM withdrawals).

Unmesh Agarwala says

Can I manage Money Transfer Lockdown on the Fidelity website?

Lori says

Yes. Go to your profile, then security center. It’ll be one of the options there.

JT says

Yes its at the bottom of the Security Center page.

https://digital.fidelity.com/ftgw/digital/security/lockdown

RobI says

Harry

I hit a limitation in Fidelity for transferring money to ANOTHER person’s bank account on a RECURRING basis. In this case it was to SOFI but TDBank was the same. The recurring or scheduled option does not exist in the UI for externally linked accounts. I confirmed this restriction with a Fidelity rep. This was using a brokerage account cash features but the rep indicated that CMA was also restricted in a similar manner.

Can you think of any workarounds for streamlining regular PERSONAL bank transfers from Fidelity? Many thanks.

Harry Sit says

Use Venmo linked to the Fidelity account as the funding source? The recipient can spend the money directly out of Venmo or transfer it to their bank account.

Steve says

Today I got email from Fidelity indicating that a billpay payment was made by a “single-use virtual card”. The email warned me that if vendor did not accept this form of payment in five days, my payment would be canceled.

Until now my billpay payments have been by paper checks or electronically, depending on the payee. Everything has worked well.

Any thoughts on what this method of payment actually is, and why Fidelity is warning me that it may not be accepted?

Fidelity email text:

On September 09, 2025 you scheduled a one-time bill payment of $nn.nn to VENDORNAME. To facilitate timely delivery, your payment was sent to VENDORNAME as a secure, single-use virtual card. If VENDORNAME does not accept this payment within 5 business days, you will be notified, your payment will be cancelled, and your funds will be returned.

Harry Sit says

As with everything received by email these days, first we have to make sure it’s genuine. Assuming that you did schedule this payment on the said date to this vendor for that amount, Fidelity’s bill payment provider, which I believe is Fiserv, chose to pay it by a single-use virtual card.

A single-use virtual card looks like a credit card to the vendor, with a card number, expiration month and year, and a CVV code. There’s no physical card, hence “virtual.” The vendor receiving it can charge it only once, for the intended payment amount, therefore “single-use.” As with all card payments, the vendor will pay a fee to accept it. The bill payment provider chose this method to capture the fee paid by the vendor, which is likely higher than the fee the bill payment provider receives when it pays by ACH or paper checks.

If the vendor accepts card payments, you could’ve paid by a credit card yourself and received part of the fee in the form of credit card rewards. It’s possible that the vendor doesn’t accept card payments from consumers but has agreed to accept card payments from the bill payment provider for a lower fee. Or the vendor doesn’t accept card payments because it doesn’t want to pay a fee. The bill payment provider on behalf of Fidelity is disclosing to you that possibility.

This is not unique to Fidelity. It would be the same at another bank using the same bill payment provider. Fiserv has a dominant market share in financial institution-hosted bill pay.

This is why I don’t use Bill Pay. When you put another party in the middle, it has its agenda, which may not align with yours (timely and reliable payments). Go to the vendor directly and pay by credit card or direct debit.

Steve says

Harry: Thank you for your reply. I have requested more information from Fidelity. Here are some questions I have about this:

1. How is the virtual card communicated to the vendor? Does it include information about me, my vendor account, and the info I included in the check memo field when I submitted the payment request to Fidelity?

2. This vendor did not appear in Fidelity’s pre-populated vendor list, so I added its name, mailing address, and phone number as a payee. When I created the payment, the first available pay by date was 7 days in the future, which is the way paper check payments have worked for other payees. What caused this vendor to be treated as “virtual card payment” recipient unlike all the rest of the other “non-electronic” payees I have paid so far that receive paper checks?

3. Unless Fidelity billpay physically mailed the “virtual card” info to the vendor, how did billpay know how to either email or electronically transfer the card info to this vendor?

I will follow-up with Fidelity to get answers to these questions.

I like billpay, but I need to understand the rules of the game, so I don’t wind up not getting bills paid promptly.

Harry Sit says

The plot thickens. I thought it’s a vendor that already signed up with the bill pay provider to receive card payments. I obviously don’t know how they do it. I imagine it has to be a letter in lieu of a check. “Our shared customer so-and-so asked us to pay you $xxx for account xxxxx. Here’s a card you can charge. The card expires after this date. Sign up here to receive future payments electronically.” If they don’t see the card charged by the deadline, they’ll notify you that the payment is cancelled. Maybe they’re moving to virtual card payments for all new no-relationship business payees while still sending checks to personal payees and businesses that established a relationship but chose to receive paper checks.

I would (a) not use Bill Pay altogether; or (b) if I must use Bill Pay, use it only for large payees that already established a relationship with the bill pay provider. Even in (b), the relationship can change without notice. Some people said their payments had been electronic forever before it suddenly switched to mailing paper checks, which caused non-receipts or delays.

Steve says

Follow-up to my posts with questions about Fidelity BillPay sending payment with a virtual card.

1. Here is response to my questions from Fidelity:

“The virtual cards are single-use card tokens designed to deliver bill payments electronically to participating billers. They provide cost savings, enhanced security, and faster transactions by processing payments quickly and securely without the need for paper checks.

The BillPay system determines payment method – neither Fidelity nor the client can choose which method of payment will be used for a payee. The payee’s ability to receive electronic payments is verified from our BillPay Vendor in advance, and the system will choose the most efficient way to make that payment. The disclaimer is present for situations in which the payee changes their acceptance of electronic payments. Since the system does not check before every payment, there presents a situation where a payee may change their tolerance for electronic payments. ”

2. My payee who was sent the virtual card accepted the payment, so the payment is complete.

3. As long as Fidelity BillPay payments continue to work properly, I plan to keep using the service.

Harry Sit says

Doing it with a biller that already signed up to receive card payments makes sense, but you said it was manually entered into the Bill Pay system. What type of a biller is it? Is it a large biller such as a utility company, or is it a small business such as a solo dentist’s office?

Steve says

Harry:

I did have to enter the payee manually. The first pay by date was a week out, like other billpay payees that receive paper checks.

The payee is a prominent, local, family-owned pest control company, with over 30 employees, in business for more than 30 years.

My payment went through as ‘electronic’. Now the first pay by date shows up as just a couple of days from today.

If I had not received the email warning me about the payee possibly not accepting the virtual card payment, I would not have been aware of anything unusual.

Brent Elkins says

As I’m sure you know, many vendors don’t allow payment by cc, so paying directly via cc or debit is often not an option – but you can always pay via bill pay, which to the OP’s point, he assumed would be by check. unfortunate that there’s this attempt by the 3rd party to capitalize on that.

Harry Sit says

I meant ACH debit aka bank draft or e-check when I said direct debit at the end. Vendors that don’t accept card payments or charge a fee for card payments usually offer bank debits.

Lori says

Basically use bill pay from the vendor, not fidelity?

Todd says

I just moved my emergency fund from my HYSA over to my Fidelity Brokerage account. I was hoping to set up an auto sweep of my interest from my SPAXX holdings to a Stock Index fund within my brokerage account. Basically set up any thing in excess of a set dollar amount gets invested monthly. It looks like the brokerage account doesn’t have an Cash Manager function so I was considering setting up the CMA and then set and forget a sweep for any interest earned into my stock fund at my brokerage account w/ Fidelity. Is this the best way to accomplish this at Fidelity or am I over complicating it? Appreciate your thoughts.

Harry Sit says

You don’t need Cash Manager to do that, and Cash Manager doesn’t do it anyway. Click on the Positions tab, and then the small “Manage dividends” link above the position listing. Click on the Reinvest drop down in the row for SPAXX and choose which Fidelity fund in your holdings you’ll use the dividends from SPAXX to buy. It only works for a Fidelity fund and you must already hold it in your account. If you don’t have the fund yet, just buy a small amount to get it started.