While I’m currently traveling in Spain, every time I buy something, I’m asked whether I’d like to transact in Euros or U.S. dollars. This happens when I buy tickets to attractions online, on the credit card terminals at supermarkets, and on ATMs when I withdraw cash. Every. Single. Time.

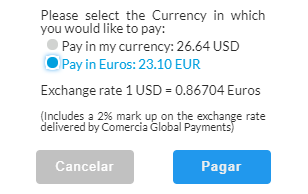

Here’s an example when I was buying tickets to an attraction:

They are trying to catch people who don’t know what the going exchange rate is. The going exchange rate is 1 Euro = 1.11 U.S. dollars, but they proposed to charge me at 1 Euro = 1.15 U.S. dollars. The small print said it was a 2% markup. It’s actually more like a 3.6% markup. On one ATM I saw the rate proposed was 1 Euro = 1.28 U.S. dollars, a 15% markup!

At least on this web page it said something about the markup. At the supermarket and on ATMs, the machines don’t say anything. They just list two amounts: one in Euros or another in US dollars. If I pick the wrong one, they profit.

How do they know you are from the U.S.? The card you use gives you away. The first few digits of a credit card or debit card identifies the bank that issued the card. Their database can tell that your card is from a bank in the U.S. They then impose dynamic currency conversion, hoping to catch people not paying attention or accidentally hitting the wrong button. Although they must offer both the local currency and the home currency, they can engineer the screen to make it confusing and make you choose the home currency more easily.

The currency conversion prompt on ATMs is new to me. Sometimes the language on the screen also switches (in my case to Spanish) even if I selected English at the beginning. Some ATMs only have the local language, which makes it even more challenging to say no to the currency conversion prompt. From Wikipedia:

The screen on an ATM announces the exchange rate that will be used and asks whether the customer accepts or refuses that rate. It appears to be “take it or leave it.” There is NO explanation that refusal will not end the transaction, but rather means the exchange will be done without charging the commission.

So you have to remember this rule when you travel to another country: always transact in the local currency. Do what locals do. Forget that you even have U.S. dollars in your account. Pay in the local currency. Withdraw in the local currency. If you even see a mention of U.S. dollars, look for No or Cancel. Of course also use a card with no foreign transaction fee for purchases and a card that rebates ATM fees. When the charge comes in a foreign currency, your bank will convert it using a more favorable rate from Visa or Mastercard.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Joe McNeill says

I agree 100% – I always transact in the local currency.

I want to add, that Amazon is now doing the exact same thing to buyers with foreign cards. They make it very confusing and ask what currency your card is denominated in. This is a red herring – if you say it’s in a foreign currency, they convert the cost at an inflated exchange rate. Much better to say your card is in US dollars and let your card convert to your home currency.

always_gone says

What up-charge, if any, does Visa charge on exchanges?

Harry Sit says

Visa’s online calculator shows a 100 Euro charge submitted today will come in as $110.79 to a card in the U.S. Mastercard’s online calculator shows the same charge will be $110.95. TransferWise shows if I want someone to receive 100 Euros, it will cost me $110.85 before fees added by TransferWise. In this instance Visa’s rate is the lowest. On a different day or for a different currency, Mastercard may be the lowest. When the three rates are within 0.15% of each other, that’s close enough to zero up-charge to me.

Sam Seattle says

This is good info to know, Harry. Thank you for posting.

Mike Blast says

Thank you, great tip! I’ve been using it while traveling for quite some time now and it saved me big time. It feels bad to think that they are trying to literally rob you on such small things though but what can you do, right? Another great tip is that you should always carry local cash with yourself, at least a small amount. It will save you hundreds of times, trust me. From a moment that you want to take a quick taxi in case of emergency to being stuck somewhere with your car broken in the middle of the country – cash is king for me. I’ve read an article about it a few years ago and can’t describe how many times it saved me on the road!

Dave R. says

Just to add… if you pay with a card that charges a foreign transaction fee, you will likely still be assessed the fee even if you chose to pay in dollars.

Reference: https://www.valuepenguin.com/credit-card-foreign-transaction-fees

Nine says

Just had the same experience but the other way around, online store selling in USD offered a 5% markup when I tried to make a purchase using my EUR card.

And in some convoluted way they made it look like it’s actually cheaper! Thanks but no thanks, just saved 20 bucks.

Thanks for the tip!

Gina says

Thank you. I used an AMEX which states there is no foreign transaction fee. Does that mean that AMEX will still charge more if I don’t use the local currency? I read every one of your articles. They are invaluable.

Harry Sit says

The banks in those countries are converting your purchases and ATM withdrawals into US dollars at exorbitant rates if you’re not careful. It doesn’t matter which card you use. The conversion happens before they send the charge to your card.

Gina says

Thank you. I will use this information going forward!

Big George says

Great advice. It is amazing how many otherwise financial savvy people fall for this.

On the subject to international travel, we just returned from 2 weeks in Europe, our first international trip since COVID. There were two things that I noticed that were different (and better) than our previous trips.

1) eSIM. To save on international roaming charges, I used to buy a physical SIM after arrival in another country. If you have a newish phone (iOS or Android), you likely have dual SIM capability, where the 2nd SIM is a virtual SIM or eSIM. For around $20, I purchased an Orange Travel eSIM that included 15 GB, unlimited calls and texts in Europe and 30 minutes of worldwide calling that was said to be good for 14 days. We were there for 16 days, and it was still working when we left, so I guess they round up a little. I had either 5G or very good LTE coverage everywhere we went in Italy, Austria and Germany. Bought the eSIM before we left. Installation, using the Orange-provided instructions, was simple.

2) Everywhere we went, the credit card machines all supported ApplePay (and other touchless payment). A major advantage of using ApplePay over the physical card was that no signatures were needed, whereas the friends witwhom we were traveling were almost always asked to sign. Not a big deal, but took them longer. (I used my Capital One QuickSilver card with no foreign transaction fees. The conversion rate was OK, though it seemed like cash from the ATM using my Schwab Debit card (Schwab covers ATM fees anywhere in the world) seemed to have a little bit better rate.

Harry Sit says

Thank you for sharing your experience. It’s amazing how inexpensive on-demand mobile data is in other countries. We’re being price gouged here in the U.S.

Dave says

You can actually get similar eSIM deals for the US as well (check out esimdb.com for example). I just back from Europe and did the eSIM thing and it was easy and flawless.