I read this post on Reddit a while ago: Vanguard closed my account for fraudulent activity.

I sold a property, received my payment via check and decided to invest the money in Vanguard. I opened a Vanguard account online and linked my bank, transferred $10 to my Cash Plus account, opened a brokerage account and deposited my check on Friday to the brokerage account. The check was accepted. On Tuesday, I received a call from the check issuer that the check cleared. I logged in Vanguard and I can see it was processed but not available till after 7 days. Everything seems easy, so I thought. Later the same day, I tried to log in and I got an error message, “Access to your account has been disabled. Please contact us.” I called Vanguard and spoke to a rep. They told me my account is being reviewed by the research team and they will be contacting me in 72 hours. I waited 72 hours and called again. Same response. 2 days later, I received a voicemail from the Vanguard fraud team.

“Hello, this is the fraud team calling to let you know the account you inquired about has been restricted due to fraudulent activity. The attempts to bring funds into the account have been rejected. Any electronic bank transfer can be recalled through your bank. Again the account is permanently restricted and there will not be a follow-up to this issue.”

This poster eventually got the money back when Vanguard returned the money to the check issuer.

This type of fraud restriction isn’t limited to Vanguard. Fidelity has had a wave of fraud attacks recently. Criminals recruited existing customers as collaborators (“mules”) for a 50/50 split to make fake deposits and withdraw the money.

Fidelity turned up their anti-fraud measures to thwart these attacks. Many customers reported seeing their accounts restricted, debits declined, Bill Pay canceled, mobile deposit limit cut to $1,000, or the deposit hold times extended to up to 21 days. No doubt many of these are false positives. Attacks from existing customers recruited as mules are the most difficult to combat. It’s hard to distinguish who’s legit and who’s knowingly or unknowingly working with criminals.

I use Fidelity for all my spending. As I mentioned in the previous post Ditch Banks — Go With Money Market Funds and Treasuries, I have under $100 in outside bank accounts. All my cash is in a Fidelity account in money market funds and Treasuries. All my bills are paid out of this Fidelity account. It’ll cause problems if Fidelity restricts my account. I’m not concerned about that possibility because I follow this one simple rule:

Make all deposits by ACH push.

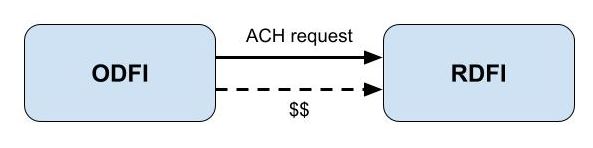

An ACH push is initiated at the same place where the money currently resides (see ACH Push or Pull: The Right Way to Transfer Money). Employer or government direct deposits also come in by ACH push. I make all deposits to my Fidelity account by ACH push. For example, when I transfer the credit card rewards earned in a Bank of America account to Fidelity, I initiate the ACH at Bank of America (see How to Link Another Account to Bank of America for ACH Push).

Money received by ACH push is trusted money. It’s available right away because the receiving institution isn’t responsible for it. You have nothing to worry about having your account flagged for fraud when all the money coming into the account comes by ACH push.

The Reddit poster at the beginning of this post didn’t follow this rule. I venture to say that everyone who had their Fidelity account restricted recently also didn’t follow this rule. Check deposits and ACH pulls are untrusted by the receiving institution. Not every check deposit or ACH pull will get the account restricted for fraud concerns but those who had their account restricted most likely had made check deposits or ACH pulls.

My Fidelity account is functioning normally as usual. I wouldn’t have known this storm was happening if I hadn’t read Reddit. My mobile check deposit limit is still a whopping $500,000 per day although I have no physical checks to deposit. All debits for estimated taxes, credit card bills, utility bills, and PayPal and Venmo payments went out without a hitch. I don’t know what the hold time will be if I do an ACH pull right now because I don’t make deposits by ACH pull anyway. I initiated another ACH push from Bank of America to my Fidelity account as a test. The money arrived the next day and it was available immediately as expected. No hold.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

August West says

You can not ACH push to transfer money to Vanguard. You can request that they do an ACH pull, or you can do a wire transfer to/from Vanguard. It is not possible to do ACH push from an outside financial institution to a Vanguard brokerage account. You can, with some difficulty, get them to give you the routing and account numbers to use for direct deposit but you can not use that mechanism for depositing checks as described in the example that you cited where a real estate sale check was deposited to Vanguard (i.e., the account holder could not have deposited that to Vanguard by ACH push from the check-writer).

Harry Sit says

Yes you can ACH push to a Vanguard Cash Plus account.

Steve says

Large proceeds at title company from sale of real estate:

Wire directly to Fidelity/Vanguard? or

Wire to local bank first, then wire/ACH push to Fidelity/Vanguard? or

Other method?

What is best approach?

Ouzel says

I have the same question. A few years ago I sold my condo and deposited the title company’s check in my Wells Fargo checking account, then after the check cleared, logged into my existing Vanguard account and moved the amount into my money market account. As far as I know, there was no way to push the amount from Wells to Vanguard.

Harry Sit says

Ouzel – There was no way to pus from Wells to Vanguard a few years ago. Now you can push if you have a Vanguard Cash Plus Account. Vanguard Cash Plus Account gives you a routing number and an account number to receive deposits and pay bills.

Harry Sit says

It would be the easiest to wire directly to Fidelity/Vanguard. Wiring to Fidelity/Vanguard requires a “For Further Credit to” field in the wire. Title companies know how to do it because they do it all the time.

Drew Ward says

I would recommend a mobile deposit straight to Vanguard – it has worked well for me. They take up to $500,000 checks.

ME says

Harry – how would you deal with check deposits? Deposit them first in your backup brick-and-mortar checking account and then push the funds to your Fidelity pseudo-checking account?

Harry Sit says

I would first take a hard look at why I’m getting paper checks. I can’t remember the last time I had a check to deposit. Sign up for direct deposit if possible. If I have a check to deposit, I would deposit it to my otherwise rarely used Bank of America account. If it’s a small amount, I would use it up by making a one-time payment to my credit card. If it’s a large amount I would then push it to Fidelity.

RobI says

Hi Harry

Is there a way to push monthly dividends to Fidelity brokerage/ bank account from my credit union CD account. That institution uses Plaid for push. The Plaid UI is telling me It does not support Fidelity connectivity. I’m currently using ACH pull from Fidelity to work around this, but this article has me concerned.

RobI says

Actually Googled and found an answer on Reddit. Seems like Fidelity has recently blocked Plaid Connectivity. Some speculation on reasons in the thread

https://www.reddit.com/r/fidelityinvestments/comments/16vl2cp/fidelity_no_longer_supported_by_plaid/

I’m now torn on pushing from my CD holder using Plaid to BoA and then pushing to Fidelity, or continuing to use Fidelity pull method.

Harry Sit says

You can still add your Fidelity account at your credit union when the credit union uses Plaid. Search for a non-existent bank in the Plaid UI and then click on “Link with account numbers.” It will make Plaid use a micro-deposit to verify your Fidelity account. I have a screenshot here:

https://thefinancebuff.com/fidelity-cash-management-checking-savings.html#htoc-routing-number

RobI says

Thanks Harry. Unfortunately the option to just add account numbers is no longer available via Plaid UI, at least in my institution. If institution is not found in search, if just offers to Exit and go back. I’m thinking they maybe blocked this back door as a security concern?

Harry Sit says

It could be a configurable setting disabled by your credit union or it could an older version that didn’t have the option to link by account numbers.

Craig says

Love your work Harry.

Like you I’ve used Fidelity as a one stop shop for many years. This event has shown me that lightning can strike at anytime – I’m moving my cash management back to my long-standing local credit union checking and forgo the interest earnings on my cash float. I’m also moving some of my investments to another brokerage to be able to manage through weeks or months long account locks.

It sickens me that this is necessary, but my cash management account must be rock solid and unquestionably secure.

M. Smith says

Harry,

You are very likely wrong on this for several reasons.

First, there are a ton of details about this story that are suspicious. The proceeds of the sale of a house would not normally be delivered by business check. They are almost always wired or second using a cashier’s check. And the issuer of a check would almost never call someone to tell them that they check has been cashed, as this storyteller claims.

Second, even assuming that the above details were true, it is still very unlikely that a large opening deposit **by check** was the reason the account was flagged. If it were, Vanguard would likely not have negotiated the check, which they did here before returning the funds.

Financial institutions often have seemingly arbitrary reasons for flagging a new account as fraudulent. It could be an inconsistency between the amount of the deposit and his stated income, and that would have been an issue regardless of how the money arrived. I’ve seen financial institutions refuse new accounts for fraud concerns simply because I used a VOIP telephone number or a unique or privacy email address on the account application. (By contrast, I’ve never had an account closed if I changed the phone number of email address after the account was opened). People also get flagged because their name is on the OFAC list, and sometimes even because their name is similar to a name on the list.

Often banks use a points-based system to flag new (and existing) accounts for fraud. A new account application by itself has a certain number of points. A similar name to one on the OFAC list by itself, might not be a problem, but a similar name, plus a VOIP phone number, plus a disposable email address together with a new account application might push your score over the limit.

I’ve even had banks decline to open an account because I failed to provide my middle name (even though the application said that providing my middle name was optional) because my last name matched an OFAC name. I’ve had at least two accounts refused merely because I used a unique email address and a VOIP phone number.

I’ve never had an existing account closed, but I’m confident that banks use a similar scoring system to close accounts based upon fraud concerns. One bank that I know of reportedly closed hundreds of accounts shortly after it adopted a new fraud scoring model.

While I totally understand your reasons for using ACH push for all transactions, it is even possible that a bank may someday decide that your ratio of ACH push to other deposits is a hallmark of fraud, and you could find your account flagged and your assets frozen. The risk to the bank of an ACH push coming in is that they make the funds available to you right away, but an ACH (like a check) can be clawed back later. If the bank decides your receipt of ACH pushes creates an unreasonable risk, they won’t hesitate to close your account.

Your decision to keep all your assets at Fidelity is a grave mistake. The axiom to “never keep all of your eggs in one basket” includes keeping your assets with a single custodian. If you have more than $500, you should split your assets between at least two different financial institutions.

Harry Sit says

Believe it or not, some title companies issue checks. Ouzel in the reply to comment #2 also received a check after selling real estate. The title company may not proactively call to tell the seller that the check cleared but maybe the Reddit poster inquired about the status of the check after depositing it and the title agent returned his or her call. It sounds like the poster opened an empty account and deposited the check at a later time, which is quite common. Let’s not be too cynical. The poster was asking how to get the money back after Vanguard cleared the check but rejected the deposit.

A check can be clawed back because a check is like an ACH pull. It’s different than receiving an ACH push. Yes, a financial institution can decide to close an account for many reasons but receiving ACH pushes won’t be one of them. All payroll direct deposits and government benefits deposits come by ACH pushes. Ironically, I don’t receive that many ACH pushes when I have all my cash at Fidelity because the money is already there. Splitting among many institutions and moving the money around actually creates more transactions that may trigger fraud restrictions.

M. Smith says

I’m sure that the sale of a home can be paid by check, but it’s probably only common when the purchaser’s share (after the loan is paid off) is relatively small. And again, the points that I’ve made don’t depend upon the validity of the story. My point is that the person telling the story is probably not including all the relevant details.

Any ACH can be clawed back. Only a wire cannot be pulled back.

There’s no reason to move your money back and forth between two custodians, and thus no reason why having two custodians would cause an increase in the number of transfers.

Again, never keep all your eggs in one basket.

Ouzel says

M. Smith – re your comment below, I just looked up the amount of the check I received from the title company in Central Texas for the sale of my condo – it was $298,094.03.

–Ouzel

M. Smith says

One more important thought: Banks read the memo lines on ACH, Wire, and Checks. If a partial name is written in the memo line that matches an OFAC, that’s a red flag.

I’ve sent wires to other people that included a last name on the memo line that turned out to match the name of someone on the OFAC list, and the wire got flagged by the recipient bank and held up for a week while the recipient bank demanded that the sending bank (my client) provide a full name. Once I gave that to my bank and my bank sent it to the recipient bank, they cleared the wire and delivered it. In the meantime, the recipient bank was lying to their customer telling them that there was no wire at all. If the account had been a new account, it might well have resulted in a closure.

Unfortunately, many common hispanic surnames are on the OFAC list. So, if someone bought a house from someone named Gonzalez and received a large transfer on a new account with the words “Gonzalez Escrow” on them, that might well be enough to trigger an OFAC closure. Many banks would rather lose a customer than risk criminal liability for aiding a transaction involving funds on behalf of a person on the OFAC list. I’ve even seen reports that ACH, Wires, and Checks have been flagged because they had the word “Cuba” in the memo lines, since financial transactions with Cuba are illegal.

The point here is that it would not matter whether this was an ACH push, a wire, or a check. The thing that triggers the flag (and potential closure) is the memo line or the name of the sender.

The solution is this: Always leave the memo line blank. If you must include a name on a financial transaction, include the full name. If you include only a surname, and it matches, that’s considered a 100% match. If you include first, middle, and last, and only the surname matches, that’s a 33% match.

Steve says

M. Smith: Thank you for comment about wire memo line info and possible matches with OFAC list.

Leaving wire memo line blank can be a problem. Title company receiving wire with buyer money wants info identifying the buyer and property. Bank receiving wire for payment for line of credit wants name, LOC account number, and whether funds are for interest or principal reduction or both.

Good tip about reducing problem by using full name instead of last name only.

M. Smith says

As I said before, I suspect there’s a “points” based system. Go over the number of points and you’ll get an account closure. A relatively new account (open less than a certain number of days) has a certain number of points. An OFAC match has more points. Too many points and they just close out the account and send all the money back to you. An OFAC match with fewer points will result in a delay.

The best way to avoid problems is to use a very small bank or CU for your banking, and wait at least 60 (or more) days before you do anything with the account. A smaller bank is far more likely to give you a chance to explain things before they close your account. Stay away from the larger banks. The larger banks are far more likely to just close the account and ghost you.

Don’t use a brokerage for banking **ever**. The only money that should come into our out of a brokerage account is money that comes from your bank account.

When you’re moving your own money from one of your own accounts to another, you should always leave the memo blank. If the recipient needs a memo to route the funds, try to make it a code (such as a numerical identifier, an address, etc.) rather than a name if at all possible.

I recommend a similar strategy for digital accounts: Never use your AppleID or Google account to login to services from other companies, even if that is an option. And if you use multiple Google or Apple services, have different accounts for each. Otherwise, you run the risk that Google or Apple decides to block your accounts, and you lose everything that they login to as well. And yes, this happens more often than you might think.

Wade says

Harry I was hoping you’d do a post on this topic. Since reading your original article on the “push” method for ACH, I always do push. Unfortunately, it’s not a 100% guarantee of success so wanted to share my experience to see if you can identify a flaw in my process.

This is between Ally Bank (12 year customer) and Vanguard (20+ years). I did an ACH push from Ally to Vanguard. The specific Ally account ( I have 3) was linked to Vanguard about a week before the ACH push (possibly the issue? but Im not aware of any holding or aging period on ACH bank links once established). I did the ACH push, all cleared to VG sweep account, I then bought VUSXX, let it sit for a month, then a sold a small portion ($15k) to sweep account, this was less than 1/4 what I deposited the month before, and maybe 1/10th of my preexisting balance in the MM fund. There was more than enough aged money in the account to cover the withdraw not even including the deposit from a month earlier. Vanguard then refused to allow me to send that money to any other account (even ones that had been linked for about 6 months) other than the original account it initiated from. Keep in mind, all the accounts are with Ally. So both ways, push to Vanguard, push out, yet still blocked. This was all between early august and middle of Sept. Im sharing only because even doing the push, waiting what I believe was the correct amount of time, still locked up my funds, and not just the original amount, ALL of the funds in my VG MM fund I was unable to move anywhere! I was moving the money for quarterly tax payments, so I ended up doing as VG said and returned the smaller withdraw to the original account and fortunately, I was able to then move that money to the account at Ally I wanted it in for my tax payment. If not, this could have turned into a big issue. I think the most frustrating part of all of this is that I felt I was following the rules, waiting an appropriate amount of time, yet still blocked.

Wade says

actually disregard. I just double checked and it was a Pull from Vanguard on the original deposit. Still the whole larger balance getting blocking a smaller transfer didn’t make any sense to me even protecting from the original deposit, the math didn’t make sense.

Craig says

I like doing ACH pulls at Fidelity because I can invest the money immediately instead of having to check back the next day. It’s really a shame if these fraudsters prevent us from doing the most optimal thing.

Scott D says

The attempts to bring funds into the account have been rejected.

Doesn’t this mean that Vanguard shut down the account because his bank failed to deliver the money? Could be a mistake on the bank’s part but if they aren’t releasing the funds I can’t imagine how Vanguard would do it any differently.

Harry Sit says

No, Vanguard received the money but didn’t want it. Vanguard eventually returned the money to the check issuer. See the update in the Reddit post at the end.

Steve says

Bogleheads forum thread about Fidelity locked/restricted accounts. 178 posts in last two days:

https://www.bogleheads.org/forum/viewtopic.php?p=8043097#p8043097

Besides a locked account, concerns on the forum include:

–suspected fraud on a single account leads to all accounts being locked

–three week wait to be able transfer funds received at Fidelity from external institutions originated as an ACH pull at Fidelity

–if account is locked, must resolve with fraud department 9-5 weekdays, long waits

–scheduled billpay payments are not issued leading to overdue payments.

These concerns make me re-think my plans to rely on Fidelity CMA as primary “banking” account.

Harry Sit says

The difference in the recent attack at Fidelity is that some customers were recruited as collaborators/mules. If they gave their login credentials to criminals to deposit a check, all accounts are at risk. It doesn’t only affect the recently deposited check or only the account that received the check.

russt says

I had a nightmare experience last year, exactly as described by the Reddit poster. It took nearly 3 months, numerous exchanges of documentation, visits to the local office, and finally a 3 hour conference call with Fidelity and a trust attorney to get my account cleared. Fidelity had immediately accepted my opening deposit check, which I posted via their mobile app, but then revoked all online access after a few days.

The only good thing is they paid interest on the money during the period when I was locked out.

One thing I can advise, is to do the initial deposit in person at your local Fidelity branch, and do not open an account online. Open it in person. This might have avoided my nightmare.

Another thing I learned is that the “fraud” unit at Fidelity is separate from the “cyber” unit. Once my account was finally cleared by the fraud unit, the cyber unit shut off my access after one day. Then they did it again. It took three tries before whatever was bothering them stopped bothering them.

After this experience, I’m very reluctant to do business with Fidelity.

I had a more recent problem with Chase, pushing ACH to Schwab. Verified with micro-deposits, but as soon as I did the first push, Chase cancelled the transaction and revoked our online access. Customer support was no help, except in reestablishing access. Tried again after access restored, same result: online access revoked. I’ve always been able to do pulls, but I gave up trying to push. I still don’t know what the problem was.

Be aware that the rules have changed radically in the last few years. The “know your customer” doctrine is in full force, and banks have no incentive to take on any liability for deposits or transfers.

Those of you who think this can’t happen to you, because it has never happened to you, are living in a house of false hope. I’d never had it happen to me in the 50+ years I’ve been doing banking, and in the 30+ years I’ve been banking and trading online. Just be very careful, and do business in person where possible.

Steve says

russt: Thanks for sharing your experience. Three months locked out…. ugh.

Was this particular account your first account at Fidelity, or had you done business at Fidelity previously?

Did you ever get an explanation of what caused the account to be locked?

russt says

We have an HSA account with them, and I had an old 401k account with a former employer, zeroed out a decade earlier.

Weirdly, they forced me to use my old credentials for the 401k account, as it was tied to my SSN. For a while, I thought that might have been a problem.

First, I had to verify my identity, which I did at the local office, who forwarded the info to the fraud unit. Before that, the reps wouldn’t talk to me. After that, I was able to email with a rep who was assigned to my account. That was some help, but not much.

The main problem they presented me with was to prove that the check, which they had already deposited, was valid.

That was the real nightmare, as it was a one-of-a-kind check from a trust. After 2 more months of going around, it got resolved by the conference call. The trust attorney waited patiently with me for nearly 3 hours, listening to horrific background music. Turns out all the documentation I had sent had been lost, due to an clerical error at the local office.

So they released the fraud hold, and then the “cyber” unit closed the account again. Probably because my email and SSN etc was stolen multiple times, but just speculating. Took another week of back-and-forth between the fraud unit and the cyber unit before they finally released the account.

Harry Sit says

Your case was another example of fraud restrictions triggered by a check deposit. Not all check deposits cause problems but many problems start with a check deposit.

Bob S. says

Harry,

Reading russt’s post (specifically: “my email and SSN etc was stolen multiple times”) got me thinking this wave of fraud restrictions by the financial institutions is somehow related to the recent NationalPublicData.com Hack whereby millions of records were stolen that included people’s names, dates of birth, Social Security Numbers, current and previous addresses, phone numbers, and email addresses. All of this personally identifiable information was exposed on the dark web for fraudsters to have at it.

Harry Sit says

The massive leaks could be an exacerbating force. As russt noted, there was a “fraud” concern and a separate “cyber” concern. The fraud unit was concerned about the validity of the check deposit. The cyber unit was concerned about the integrity of the login. The massive leaks made it easier to create new accounts or take over existing logins. If criminals take over an existing login or entice a customer to hand it over for a share of the profit, they have multiple paths to drain all accounts under the same login. Therefore all the exit paths must be locked down for all accounts under the same login when the integrity of the login is called into question.

Some customers only got a reduced limit for mobile deposits and a lengthened deposit hold time (no ‘cyber’ concerns). Some customers got the full lockdown (flagged by ‘cyber’).

russt says

During my Fidelity nightmare experience, I found that the AML (anti-money laundering Act) had been updated during the final days of 116th congress. Here is a reference: https://www.fincen.gov/anti-money-laundering-act-2020

The act freaked out the banking and brokerage industry. They are still promulgating rules, as recent as June 2024. Financial institutions do not want to accept *any* possible liability. The number of complaints from customers has skyrocketed (there are news articles about it). I thought about making a complaint, but it is a arduous process. I did file a complaint with CFPB, but they immediately closed the complaint, and referred me to FINRA. CFPB only deals with banks and check-cashing outfits. Securities industry answers only to FINRA, and they make it extremely hard for a consumer to file a complaint.

My own feeling is to only deposit checks with banks or brokerages you have a longstanding relationship with, and in-person if possible. Then transfer the money to the new place. I might have avoided trouble this way, but not sure. As I said earlier, open new accounts in person, so they know who you are from the get go.

M. Smith says

I deposit over USD$5M in checks annually.

For account closure purposes, the banks do not care how the money comes in: Checks, ACH, and Wires only impact how long they hold the funds. The source/purpose of the funds is what matters. A $10,000 deposit with the memo line that matches OFAC or suggesting an illegal purpose will trigger the same result whether it is a check, a wire, or an ACH push.

INDRA PATEL says

Are the issues of fraud lockout etc only occurring with Brokerage houses, and not at brick and mortar banks?

Harry Sit says

These issues occur with both. The one simple rule works for both brokerages and banks.

INDRA PATEL says

Harry, at the beginning of the article you wrote “Check deposits and ACH pulls are untrusted by the receiving institution. Not every check deposit or ACH pull will get the account restricted or flagged for fraud but those who had their account restricted most likely had made check deposits or ACH pulls.”.

That would imply that a check deposit in any institution (bank or brokerage) can be subject to fraud alert and lockout. So how does one ever deposit a check in ones account?

Thanks for the article response to comments.

Harry Sit says

See my reply to comment #3. If I have a check to deposit, depositing it to an otherwise rarely used bank account isolates any potential problem. It won’t affect the primary account used to pay bills.

Allan says

I have been used ACH pull into Vanguard for over 4 years, twice every month, one from a bank and one from a CU with no problems. I talked to my Vanguard advisor yesterday about your comments, and he said if you’ve experienced no problems using ACH pull to continue using it.

Thomas Martin says

I’ve been using pulls into Fidelity for years from Bank of America (rewards) and Schwab (dividends) with zero issues. The money pulled in is available for trading the day it is pulled! I do have a running balance higher than the pulls (usually). Reading between the lines in the forums it seems like fraud locks seem to be triggered by new accounts and large check deposits. Also, many of the people posting on reddit etc seem kind of skatey in their descriptions of what they were trying to do. YMMV

Bill in NC says

It’s available for trading immediately, but check the balance “available for withdrawal.”

That will tell you if your account is restricted.

Thomas Martin says

Yeah, it is usually available for withdrawal the following day, not the day I pull it in. Not a problem since as stated I keep a buffer in the account. I usually have several weeks worth of bill payments invested in FDLXX which gets liquidated for payments

DPO says

Harry,

Question about Bill Pay, like for Credit Card payment, mortgage payment,

do you set up bill pay on Fidelity side to push the payment, or set up on payee side to pull the payments?

Thanks!

Harry Sit says

I set up autopay on the payee side to have them pull the payments. The billers are responsible for getting the bills paid once I set up autopay. If I set up Bill Pay, I would be responsible for any problems in the links between the Bill Pay provider and the billers.

TJ says

Harry, you asked why people would be receiving checks. Whenever I’ve received reimbursement from any sort of insurance company – whether that’s a claim fora car accident or something more mundane like vision insurance reimbursement for buying some glasses, they don’t ask me how i want to receive the payment, they just send me a check.

Fred says

subscribing

Zack says

Hi Harry,

Thanks for covering the Fidelity issue. Although personally I wasn’t impacted by account restriction, I did experience a 3-week hold for ACH pull initiated from Fidelity. ACH push from another bank into Fidelity cleared out immediately though.

But I did see data points that even ACH push from external banks could be hold by Fidelity. Check https://www.reddit.com/r/fidelityinvestments/comments/1fj85a8/comment/lnoh8bm/ and https://www.reddit.com/r/fidelityinvestments/comments/1fj85a8/comment/lo1ohx0/ (Search “ACH push” in comments). My point is that ACH push isn’t guaranteed to be clearly quickly. It’s really up to Fidelity that makes the decision when to release funds.

I used to keep all my assets at Fidelity due to their high APY money market fund. After this incident, I have started to put some money into a regular HYSA from another bank, even though the APY is lower, which doesn’t matter too much given the recent interest rate decline. It’s just too risky to keep all eggs in one bucket.

Harry Sit says

Not everyone is experiencing a 3-week hold on check deposits and ACH pulls. I just read this report:

“Just thought I’d provide one point of data…been a Fido customer for about 10 years. Opened a CMA about 5 months ago to use as primary checking. I deposit (electronically) at least 1 check per month.

Have not encountered any of the lengthy holds mentioned in this thread.”

Out of hundreds of posts on Reddit reporting a long hold, only u/Lurch98 reported getting a hold on an ACH push. We don’t know whether it was a misunderstanding or something unique to that person’s account. Suffice it to say, the Reddit megathread would’ve been a lot quieter if everyone followed this rule to transfer money the right way with ACH pushes. It’s not just happenstance. There’s a logical reason why ACH pushes are treated differently than ACH pulls. As u/Careful-Rent5779 wrote in your second link:

“A push from a banking entity is deemed good funds. The entity doing the push is responsible for the funds being good; they can’t come back four days later and say, sorry, our bad. Pulls can be rescinded at the institution pulled from even after they have honored the original request.”

The gut reaction from this episode is to put money in different financial institutions to avoid keeping all eggs in one basket. The irony is that there wouldn’t be any need to pull or push if we use only one institution. The money needed to pay bills is already at the place where it’s needed. The problem is caused by the mismatch between where money is at and where money is needed. If you use Fidelity to pay bills, keep the money at Fidelity. If you use a bank to pay bills, keep the money in a high-yield savings account at the bank. It’s more about matching the funds and the outflow than how many institutions you use.

John M says

As the first commenter said: “It is not possible to do ACH push from an outside financial institution to a Vanguard brokerage account.” Vanguard needs to fix this to follow your advice.

Harry Sit says

It is possible if you open a Vanguard Cash Plus account.

John M says

Yes, I know. But I prefer not to have an extra lower interest rate account. Thanks.

Harry Sit says

The interest rate doesn’t matter when you use the Vanguard Cash Plus account only as a conduit to other Vanguard accounts. Besides, the interest rate isn’t that low. The current 4.15% rate is similar to the rate on a high yield savings account from Ally, Marcus, Capital One, AmEx, and Discover. You can also buy a money market fund in it. VUSXX pays 4.96% with (almost) no state income tax. I would use it if I still have Vanguard accounts.

Steve says

Question about Fidelity CMA and “Fidelity Money Lockdown”.

My understanding is that if I enable money lockdown on CMA, checks I write will still be paid.

For one payee I write checks to, that payee seems to convert the check into an electronic check that show up on my bank account as a different kind of payment than the other checks. The transaction has the check number, but it seems different. Will such a transaction still be paid if money lockdown is enabled?

How about bill payments that I originate from the biller’s website, giving them the bank ID number and my account number – will those payments be allowed if CMA money lockdown is enabled?

Info about this from Fidelity online is confusing.

Steve says

After I posted my questions about CMA and Fidelity Money Lockdown, I saw a post in Bogleheads forum (link below) which were test results of various transfers from CMA with lockdown enabled.

That post says that ACH pulls originated from an external business (such as the biller) will still occur as withdrawals from CMA even if lockdown is enabled.

https://www.bogleheads.org/forum/viewtopic.php?p=6792563#p6792563

Harry Sit says

That’s correct. From Fidelity’s info page on Money Transfer Lockdown (requires logging in):

“What’s not protected during lockdown?

– Deposits or transfers into your Fidelity accounts

– Checkwriting and direct debit

– Debit card/ATM transactions

– Trading

– Scheduled required minimum distribution (RMD) or personal withdrawal scheduled plan

– BillPay”

Checks converted to ACH pulls and biller-initiated ACH pulls fall under “direct debit.” A money transfer lockdown stops someone from calling Fidelity to request a withdrawal or by submitting a fraudulent ACATS transfer through another broker. It also stops you from pushing to a linked account before disabling the lockdown.

Craig says

Yep, it’s a little silly to be honest. You can be logged into Fidelity with lockdown enabled and you won’t even be able to transfer money between accounts. But you can get the ACH account and routing numbers, put them into an external bank, and pull money out no problem. The main reason I have lockdown enabled is to prevent attacks where a scammer does a fraudulent account transfer to another brokerage.

Steve says

Harry is right.

Yesterday as a test I initiated an ACH pull at external credit card company as payment from my Fidelity CMA, which had money lockdown enabled. The transaction displays as a direct debit in my CMA transaction history. Later I received an email from Fidelity notifying me about the direct debit withdrawal and advising to call if it was not legitimate.

In telephone and chat conversations yesterday, two Fidelity reps, after checking with their back office, told me externally-initiated ACH pulls would be blocked by money lockdown.

Fidelity needs to clarify the impacts of money lockdown on fidelity.com. Allowing “Direct debits” is not clear.

Harry Sit says

Steve – I also used the term “direct debit” when I wrote in 2 Ways to Use Fidelity as a Bank Account, “It provides a routing number and an account number for direct deposits and direct debits.” It’s the correct terminology but maybe it’s unfamiliar to many people. What phrase do you think is more clear? CFPB calls it “automatic debit payment,” which isn’t exactly accurate because a direct debit can also be a one-time manual payment as you did in your test payment to the credit card.

Steve says

Harry: I’d suggest Fidelity continue to use the term “direct debits”, but give some examples clarifying the term, like you did. Such as: transfers originated externally using routing and account numbers, ACH transfers, etc.

I knew direct debit was some kind of withdrawal but was not sure whether that referred to ATM withdrawal, or debit card originated transaction, etc.

The greatest point of confusion is the lockdown statement that indicates “electronic fund transfers” are blocked by lockdown. “direct debits” as you define them are electronic fund transfers. But direct debits are not ACATS electronic fund transfers.

My guess is that when I and others asked Fidelity reps about ACH pulls, they and the back office read prohibition about electronic fund transfers, assumed that included ACH pulls, and replied that ACH pulls are blocked.

Anyway, thanks to this forum and bogleheads, I have the info I need.

Tom Martin says

Yes, this is why I use one Fidelity Brokerage account for all cashflow, billpaying, checks, etc. A second one contains all my stocks, ETFs, etc. It would be a catastrophe if someone managed an account transfer out of it, so that one is always locked except when I transfer dividends to the “cash” account. And I don’t have margin on the cash account, so they could only get the cash on hand…

Harry Sit says

If you want, you can set up a recurring transfer to automatically transfer dividends from your investment account to your cash account on the following day. It’s under transfer -> manage recurring transfers. That way you don’t have to unlock and relock your investment account only to manually transfer dividends.

Thomas Martin says

Thanks Harry! I didn’t know recurring transfers overrode the account lock. I set it up, hopefully it will work!

John Merriman says

On Monday 10/7/24 I sent a message to Vanguard asking for the routing number and info so I can push a deposit from my bank to my Vanguard Cash Plus account. I have heard nothing as of today 10/12/24 and I can’t find the info on the Vanguard website. I will have to call Vanguard on Monday unless someone has that info available. Thanks.

Leonid says

I find it very interesting that you mention Bank of America specifically because at some point in the recent past they disallowed ACH pushes to Fidelity. I suspect that the reason it works for you is because you have an already set-up connection in your BofA account.

I had always used ACH pulls from Fidelity to fund my CMA. After reading your previous post, I tried setting up an ACH push at BofA, but it turned out that instead of micro-transactions they now ask for credentials (username/password) for the account you’re setting up the connection to (Fidelity in this case). Even after I provided them with credentials, they failed to set it up. Their support claimed that ACH connections are only supported for “deposit accounts” (which the CMA is apparently not).

At this point I was so surprised (how can a national bank not provide such a basic service as an ACH?) that I filed complaints with CFPB, OCC and the state regulator. BofA’s regulatory escalations department considered my complaints for a couple weeks and got back to me saying that they are planning to support this functionality sometime in 2025. In their communications they repeated that ACH only works with deposit accounts, but at the last interaction they said that the problem is that that new account credentials authentication method doesn’t work with Fidelity.

Anyway, the fact of the matter is that you can’t set up ACH pushes from BofA to Fidelity anymore.

Tom Martin says

I just added our Fidelity Brokerage UMB account to both of our checking accounts at BofA as an external transfer account and it works. We do not use Fidelity CMA, we use Brokerage, which uses UMB Bank, NA as the deposit and checking account. So maybe the problem is CMA?

Harry Sit says

CMA and the regular brokerage account use the same routing number from UMB. That’s not a problem.

Tom Martin says

Also, the setup did not involve either micro-transactions or our login info. It used the Routing and Account numbers for UMB Bank. I did it through the “add external account” page on BofA if that helps. You need to provide your BofA debit card info to validate the addition.

russt says

I’ve had the same problem trying to set up ACH push from Chase to Schwab. It does micro-deposit verification, which works fine. But then when I try a real transfer, they lock the Chase account from online access and delete the transfer account. Have tried three times, once in the presence of customer support. Gave up. Use pulls from Schwab to same account which has worked fine for years but is very slow, about 5-6 business days.

Banks want zero liability, due to new AML regs, according to a friend who is a lawyer that specializes in this area. They effect of these new regulations is to deny basic services to their customers, and complaints have sky rocketed. Good luck setting up new connections. (AML=Anti Money Laundering act)

Harry Sit says

Schwab’s problem is different. Schwab’s brokerage account uses one routing number for incoming and a different routing number for outgoing. Chase doesn’t like it because they want one routing number for both directions. You have to link to Schwab Bank’s routing number. Fidelity uses the same routing number for both incoming and outgoing.

Leonid says

I mentioned micro-transactions based on my previous experience about how accounts linking for ACH purposes usually operates. When I was trying to link my Fidelity account, I didn’t get to that point. I use the “Manage Accounts/Transfers” screen on their website, put in the routing and the account number, it correctly recognizes the routing as UMB, but then fails with an error along the lines of “Failed, some details are incorrect”. (The details are correct).

RobI says

Also had no problem setting this up on BOA web site using the sort code and exact account number from my Fidelity UMB check book, not the Fidelity brokerage account number.

Leonid says

I am really confused right now. (And again — I’m not dreaming this up, there were two levels of customer support and then the regulatory escalations person who told me that this is impossible).

I am doing: “Pay & transfer” -> “Send a wire/external transfer” -> “Add account/recipient” -> “My personal account at another bank (for transfers to and from)” -> Filling out the routing/account number from Fidelity website (it’s not the Fidelity account number, they have a separate “real” number that is exposed when you click “Routing number” on the account’s webpage). This takes me to a webpage that says: “To finish adding your account, we need to confirm that you are the owner. Please provide the online banking sign-in information you use for that account.” I enter my login/password for Fidelity website. It spins for a little while and then says “The information you entered is invalid. Please verify that you have provided accurate information.”

Harry Sit says

Try choosing “My personal account at another bank (only transfers to)” and then account type checking. A bidirectional link requires more verification than a push-only link. You don’t need to pull at B of A because it’s better to push from Fidelity anyway.

Tom Martin says

On the BofA Website

Pay and Transfer -> View/Manage Wires and External Transfers -> Add Account/Recipient -> Personal Account at another bank -> asks for name and routing numbers -> Asks to verify identity (you need your BofA debit card info) – and done

Leonid says

After I feed my name and routing numbers, there is a screen that asks for a login/password for the UMB bank. I obviously don’t have login/password for UMB and when I try my Fidelity credentials, it doesn’t work

Thomas Martin says

@Leonid interesting, I don’t get that. Hope you can get it working.

Thomas Martin says

But for what it’s worth, I’ve been doing pulls into fidelity from BofA for years with no issues.

Tom Martin says

What Harry said. I only set up push from BofA. Maybe that’s it.

Mark says

I can’t push funds from Fidelity to Vanguard Cash Plus when using the routing and account number, because Fidelity online bank linking fails and gives this message:

We tried to link your bank using your account and routing number, but need more information to verify your account.

Harry Sit says

Fidelity has become picky in which accounts they allow you to link lately. They want to use Finicity to verify account ownership, which doesn’t work for Vanguard Cash Plus. You can try setting up a link for wire transfer from Fidelity to Vanguard. A wire transfer is also a push. Fidelity doesn’t charge for sending a wire. Nor does Vanguard charge for receiving a wire.

Mark says

Thanks for the tip on the wire transfer, that worked, and the transfer took less than 5 minutes and ready immediately for buying funds. I figured a wire transfer would have a fee, but in this case, as you indicated, there’s no charge.

Interesting that providing Fidelity the exact same information was okay for a wire transfer, but not okay for ACH.

Harry Sit says

Fidelity is concerned about unauthorized pulls, for which it will be responsible. Even though you only intend to link the account for pushes, Fidelity doesn’t know that. Once you establish an ACH link, it can be used both ways. A wire is always push-only. That’s why Fidelity allows you to link the same account for wire but not for ACH.

Leonid says

As the replies to my thread above (about BofA) correctly pointed out, BofA solved this problem by having two different types of linked accounts on their website, push-only and push-pull (with the latter requiring much more onerous authentication, to the point that I never managed to finish it). In other words, they solve this problem in their website rather than in the underlying banking infrastructure. This is not a terrible idea, Fidelity could do the same. If you linked your another account as push-only, the website won’t even give you the option to do pulls.

Jess says

If we have a check to deposit, would it be better to use a rarely used bank account and then “push” the funds to our CMA, or to open a secondary CMA specifically for check deposits and other higher-exposure activity? Would having a separate CMA for this purpose affect the security or integrity of our other Fidelity accounts in any way? Thank you for your insight.

Harry Sit says

I would use the bank account and then push.