Banks and credit unions offer savings accounts and CDs. Brokers such as Vanguard, Fidelity, and Charles Schwab offer money market funds and Treasuries. They serve similar purposes at a high level. Both a savings account and a money market fund allow flexible deposits and withdrawals. Both CDs and Treasuries offer a fixed interest rate for a fixed term.

| Banks and Credit Unions | Brokers | |

|---|---|---|

| Flexible Deposits and Withdrawals | High Yield Savings Account | Money Market Fund |

| Fixed Term | CDs | Treasuries |

While most discussions on these products from banks and brokers center around having FDIC insurance or not (see No FDIC Insurance – Why a Brokerage Account Is Safe), many people don’t realize that there’s a fundamental difference between the roles banks and brokers play. I mentioned this difference in my Guide to Money Market Fund & High Yield Savings Account. It’s worth highlighting it again.

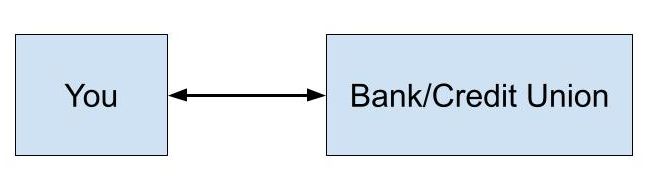

The fundamental difference is that banks and credit unions offer a two-party private contract while a broker serves as an intermediary between you and the public market.

Two-Party Private Contract

A two-party private contract means anything goes as long as one party makes the other party agree to the terms. If a bank gets you to agree to a 0.04% rate in a savings account or a 0.03% rate in a 12-month CD (these are actual current rates from a large bank), that’s what you’ll get regardless of what the rate should be. The bank sets the rate. They don’t need to justify it. You get a bad contract if you aren’t aware of the going rate.

A bad contract doesn’t have to be this obvious. The rate on a “good” online high-yield savings account such as the one from Ally Bank is currently 3.5% while a money market fund pays 4% or more. It’s 3.5% from the bank only because the bank says so. You’re paying a “familiarity penalty” when you stay with Ally.

I’m not picking on Ally specifically. It works the same at Marcus, Synchrony, Amex, Discover, Capital One, or Barclays. Ken Tumin, the founder of DepositAccounts.com, made this observation in April 2024:

If you take a step back and ask why banks can benefit from customer inertia in the first place, you realize that’s the nature of a two-party private contract. Customers must take the initiative to break out of a bad contract.

Some banks play tricks by offering a new savings account under a different name with competitive rates while keeping the rate low on the existing savings accounts. The rate is low on the existing account only because that’s the contract you agreed to. The bank isn’t obligated to move you to the new program because that’s not in the contract. Nor does the bank have to tell you that you can switch to the new program to get a higher rate. It’s up to you to find out and take action.

Rates at many large credit unions aren’t any better. I’m a member of a well-regarded credit union. It’s the largest credit union in the country by far, with three times the assets of the second-largest credit union. The rate on its savings account is 1.65% when you have $100,000 in the account. That’s more than 3% lower than the yield in a money market fund.

A good contract today can turn into a bad contract tomorrow. How the contract will change is in the contract itself. A bank offers 4.35% APY on a 13-month CD today. That’s an OK rate, but what happens after 13 months? You agree in the contract that it will automatically renew to a 12-month CD at a rate set by the bank at that time, unless you take specific actions to stop the renewal within a short window. Guess what rate the bank will set on its 12-month CD? Almost always a bad one. It works this way because you agreed to the contract.

When you have a two-party private contract, your interest is in direct conflict with the other party in the contract. The onus is on you to know whether the contract is good or bad. It’s on you to watch when a good contract turns into a bad contract. Caveat emptor. You’ll have to jump from contract to contract if you don’t want to get stuck in a bad contract.

Some people are more alert in monitoring and jumping. They have a chance to “beat the market” but they pay for it with a heavy mental workload and time spent on opening new accounts and closing old accounts. Many fail to be vigilant at some point. They start paying the “familiarity penalty” because it’s too tiring otherwise.

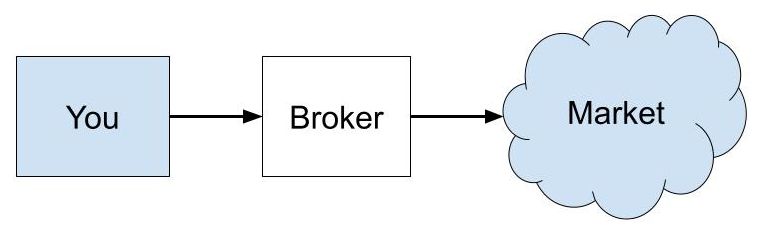

Market Intermediary

A broker acts as an intermediary. They get you the market rate and take a cut. A broker doesn’t set the rate. The market does. The broker only sets its cut.

A money market fund gives you the market rate on money market securities minus a cut by the fund manager. Some fund managers take a bigger cut than others, but the difference between major players is much smaller and more stable than the difference between rates offered by different banks and credit unions. If you use a money market fund with the smallest cut, such as one from Vanguard, you almost guarantee you’ll have the best rate in a money market fund at all times.

You still pay a “familiarity penalty” when you use a money market fund from Fidelity or Schwab versus one from Vanguard, but the difference is in the 0.2%-0.3% range, whereas the “familiarity penalty” in bank savings accounts can be more than 3%. The “familiarity penalty” is zero or negligible in buying Treasuries through Fidelity, Schwab, or Vanguard.

Treasuries don’t trick you into renewing at a bad rate. They automatically pay out at maturity. You’ll get the market rate when you buy again. If the broker offers the “auto roll” feature and you enable it by choice, your Treasuries will automatically renew at the market rate. You can rest assured that you won’t be cheated.

Money market funds and Treasuries paid very little when the Fed kept interest rates at zero and ran several rounds of Quantitative Easing a few years ago. That wasn’t the money market fund’s fault or the broker’s fault. Those were the market rates at that time. Like investing in index funds, you give up the dream of “beating the market” when you put your money in a money market fund and Treasuries, but you also consistently get the market rates at all times. It doesn’t require keeping your guard up, monitoring carefully, or jumping.

If you want to consistently earn a good yield with low maintenance, ditch banks and credit unions. If you normally keep money in a savings account at a bank or a credit union, put the money in a money market fund at a broker. Here are some choices at Vanguard, Fidelity, and Schwab:

| Vanguard | Fidelity | Schwab | |

|---|---|---|---|

| Default | VMFXX | SPAXX | None |

| Higher yield, higher risk | SPRXX or FZDXX | SWVXX | |

| Higher quality, higher state tax-exemption | VUSXX | FDLXX | SNSXX |

These are good starting points. You can find more money fund choices in Which Vanguard Money Market Fund Is the Best at Your Tax Rates, Which Fidelity Money Market Fund Is the Best at Your Tax Rates, and Which Schwab Money Market Fund Is the Best at Your Tax Rates.

If you normally buy a CD from a bank or a credit union, buy a Treasury of the same term at Vanguard, Fidelity, or Schwab. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market.

I used to have many accounts with banks and credit unions. I have only $60 in bank accounts now. My cash is in money market funds and Treasuries in a Fidelity brokerage account. Credit card bills automatically debit Fidelity on the due date. Fidelity automatically sells a money market fund to cover the debits. See 2 Ways to Use Fidelity as a Bank Account.

The Fed is expected to lower interest rates soon. I don’t think they will cut rates all the way back to zero again. If one day banks and credit unions start paying more on their savings accounts and CDs than money market funds and Treasuries, which I doubt will happen, I will still stick to money market funds and Treasuries because I like the transparency and fairness. I’d rather get the market rate at all times than count on the benevolence of a bank or a credit union.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Craig says

Great article. There’s also VMRXX for Vanguard. I don’t think it’s a “higher yield, higher risk” money market fund since it just drops the expenses another basis point which translates directly into the yield.

Harry Sit says

Vanguard has more money market funds than I highlighted in the table. The ones I listed are a good starting point for people currently keeping cash at banks and credit unions. You can easily switch if you find another one that works better. See Which Vanguard Money Market Fund Is the Best at Your Tax Rates. That said, a mere 0.01% difference in the expenses isn’t worth getting out of the default VMFXX and having to manually buy or sell VMRXX in my opinion.

Gordon says

Thanks Harry. It’s been interesting to see your perspective on yield-chasing shift over the years. The only counterpoint to everything you say here is what happens when yields are close to zero. I have a credit union checking account that’s currently paying 4%, which you correctly point out is about a 1% familiarity penalty (I’ve moved money to a Fidelity CMA as you have suggested). However, I run many of my small monthly transactions through my credit union account to meet its transaction requirements to receive the interest and ATM fee benefits. So, there are two negatives to moving away from this account completely: 1. I would need to spend the time to rewire a dozen small transactions, and 2. The credit union paid me 2% on this account for many years when the MM rate was essentially zero. We forget it now, but 2% (on up to $20k, $400/yr) was a pretty good deal for those many years. I was getting a familiarity bonus! As of now, I’m keeping the credit union account with a lower running balance of about $5k, which is a familiarity penalty of $50/yr. Saves me the effort of rewiring my bill payments, and if and when the interest rates go back to zero, I’ll have an account that historically pays above MM rates when rates are low. No guarantee of that, as you point out, but it’s less effort, and minimal cost, to keep it open.

Harry Sit says

It sounds like you already ditched the credit union for the bulk of your cash. The only thing is that I have $60 in bank accounts and you have $5,000. We don’t worry about this last $5,000.

However, having to maintain a dozen small transactions to keep an account active is a negative, not a positive for the credit union. We should do our transactions the way we want and not be beholden to a bank. If the credit union didn’t require a dozen transactions a month, would you naturally choose to do them? I wouldn’t do them even if they pay me $400/year now. Doing them for a rate 1% below the market? Forget it. This goes along with the previous post Why I Stopped Chasing Bank and Brokerage Bonuses.

I treat the zero interest rate years as an aberration. I hope the Fed has learned its lessons. We’re not going back to those years.

Janet says

“I have only $60 in bank accounts now” – I’m curious, how do you pay for purchases? Personally I put everything on a credit card and repay from my checking account, but that requires me to have enough in my checking to pay off the credit card. Can you pay off a credit card directly from a money market fund, and if there are restrictions do you do this one a month only?

Harry Sit says

I use credit cards for purchases. Credit card bills automatically debit Fidelity on the due date. Fidelity automatically sells a money market fund to cover the debits. There aren’t restrictions. See 2 Ways to Use Fidelity as a Bank Account (I’m using the second way).

Wade says

Great article. While I keep the bulk of my money in VUSXX i do keep a HYSA at Ally mainly to pay quarterly taxes , property taxes , home owners insurance that gets automatically deducted. I move the money over from VUSXX just before those bills are due. As far as i know i don’t think i can set up bill payments with VUSXX or the sweep account at Vanguard. I poked around and didn’t see an obvious way.

Harry Sit says

Vanguard has a Vanguard Cash Plus Account. It gives you a routing number and an account number for automatic debits. It can hold VUSXX too. While debits can’t hit VUSXX directly, selling VUSXX within the Cash Plus account to the sweep is easier than transferring it out to Ally.

KJ says

Thanks Harry! I knew about this but noticed something interesting in your post. I’ve been saving money in Vanguard’s CashPlus account to buy a house in the next year or two. So not a small amount of money. But since I live in Oregon I think the interest on that account, currently 4.6%, is taxes by the state. So you inspired me to move than money into VUSXX since it seems to earn more and also should be state tax free. Sounds about right?

Harry Sit says

Absolutely. VUSXX pays a higher yield than the default bank sweep and it’s mostly state tax-exempt. You can buy VUSXX within the Cash Plus account. Just remember to claim the state tax exemption when you file your taxes. Here’s how: Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA.

Jim Watson says

I learned this lesson the hard way. For years I had a Money Market account at Capital One, naively assuming that the interest rate on the account was somehow linked to prevailing interest rates set by the market. This was OK when Vanguard was paying beans on their MM funds. When interest rates started rising recently I was stunned to discover (a) that the rate on the Cap One MM account did not keep up with prevailing market rates and, (b) even more galling, Cap One had created a high-yield savings account that had, for some time, been paying much higher interest rates than my MM account. I moved all my cash savings to Vanguard and started a 6-mo T Bill ladder. Oh well, c’est la vie.

EJ says

You briefly mention in the post about the difference being FDIC insurance in bank accounts. But you don’t explore this seemingly important difference between MMF and bank accounts.

Harry Sit says

It’s explored in the linked post No FDIC Insurance – Why a Brokerage Account Is Safe. The link is included in the same sentence where FDIC insurance is mentioned. A bank account needs FDIC insurance to make you comfortable because it’s a promise from a private entity. A money market fund that invests in government securities and Treasuries doesn’t need FDIC insurance because the holdings are promises from government entities.

Peter says

Harry, do you worry about fraud having all of your money at one institution? Things will eventually get straightened out, yes, but in the meantime I worry about not having a backup. This is the main thing keeping me from consolidating. What do you think?

Harry Sit says

I’m not concerned but if I wanted a backup I would use another broker as the backup, not a bank or a credit union. Brokers have better security in general because they deal with higher account balances. Vanguard, Fidelity, and Schwab all support security hardware for authentication whereas few banks and credit unions do. Consolidating doesn’t mean you must have only one institution. It’s OK to have two.

Michael Kehoe says

When I search for the VUSXX symbol it comes up as Invesco Quality Income R6 (VUSSX).

And a comment on another message board from 1 yr. ago had this to say: “Before changes recently to vusxx it was a treasury mmf which would qualify for state tax exemption now it holds 34 percentish in repos.” Could you clarify this?

Harry Sit says

You must have mistyped. The Vanguard link shows up first in both Google and Bing when I searched for VUSXX.

VUSXX held some repos at some point last year but currently the Vanguard page shows it’s 98.6% U.S. Treasury Bills. Even with those repos last year, its income was 80% state tax-exempt. I expect the percentage will be much higher this year.

Mandy D says

I wonder if FZFXX and FXCXX are also exempt for California taxes. If not are there choices other than FDLXX with Fidelity? Thank you!

Harry Sit says

FZFXX and FZCXX aren’t exempt for California taxes. More choices are in Which Fidelity Money Market Fund Is the Best at Your Tax Rates. That post also includes the link to a tool to evaluate which fund is slightly better at different tax rates.

Michael says

VUSXX may be closed to new investors. This is from 2020:

https://corporate.vanguard.com/content/corporatesite/us/en/corp/who-we-are/pressroom/Press-Release-Vanguard-Closes-Treasury-Money-Market-Fund-New-Investors-041620.html

Harry Sit says

VUSXX was closed for only a few months in 2020. It quickly reopened and it has been open ever since. Please stop looking for gotchas. VUSXX is as good as it gets.

TJ says

Have you finally dumped Alliant Credit Union? I’m still using them…too lazy to change all my auto pays, I suppose. 😀

Harry Sit says

I dumped Alliant Credit Union some time ago. I’m only keeping the membership in Navy Federal in case I need a mortgage.

AngryLawyer says

Their 2.5% cashback credit card can’t be beat but it has requirements. What do you use instead?

Harry Sit says

I use Bank of America Travel Rewards Card Pays 2.625% on Everything, which requires holding $100k worth of investments at Merrill Edge.

Walt says

My Fidelity account has a core position but I will add the Treasury only ( FDLXX ) MMF and transfer the core funds into it for the added safety. I did not know that I could do this. Thanks for the article.

Jeff says

Merchants Bank of Indiana has a flex CD that is tied to the prime rate minus 2.75%. So the CD rate is currently 5.75% with an APY of 5.92%. Any thoughts on this approach of tying up money?

Harry Sit says

The compound yield on a Treasury money market fund like VUSXX is 5.39% today. It’s more like 5.8% after adjusting for the state tax-exemption on VUSXX. Prime rate minus 2.75% from this variable-rate CD pays only a hair more than VUSXX. You might as well put the money in VUSXX, which gives you more flexibility than tying up money in a CD.

Some bank somewhere may offer an attractive product today. The question is always what happens after the deal is over. A Treasury money market fund will always be at the market rate. Not so much for a flex CD. The bank may not offer a flex CD anymore when your initial term ends. Or it may not be primate rate minus 2.75% anymore. You can’t count on your next two-way private contract to be attractive.

TJ says

@Harry How times have changed. 🙂

https://thefinancebuff.com/why-investors-dont-realize-cds-are-a-better-deal-than-bonds.html

I agree that a lot of banks and CU’s have archaic processes for providing maturity instructions. The nice part about Navy Federal is you can toggle the change in maturity instruction at any time on their website.

Harry Sit says

TJ – Both are true at the same time. You can still find deals in CDs if you hunt for them, open new accounts, establish login credentials, link accounts, transfer money to meet a deadline for the deal, create a calendar reminder to stop the renewal or transfer the money back for the next deal somewhere else, keep the account open with a minimum amount just in case another deal comes up, download 1099 forms from 10 different places, … Been there. Done that. Still doable. I worked for money when I needed it. It’s much simpler now when I don’t need it as badly.

Marie says

I agree with the advice given in the article, as far as most tech-savvy people goes. However, CD and savings account options at local banks work for older people who aren’t all that tech savvy. We have elderly family friends who use their local bank. I’ve long recognized that they don’t get as good a rate, with the excellent flexibility and rates that I’ve been getting lately with Vanguard’s VUSXX, and VMFXX (as a settlement account).

But, there’s no way they could handle an online brokerage. The difference of a few hundred to maybe closer to a thousand dollars they’d get annually right now on their money just isn’t worth the added hassle for their kids to set up a brokerage account for them, and the loss of control the elderly couple would lose. For most Americans, the difference in earnings isn’t great, given they don’t have a lot of money invested (and most younger Americans should keep most of theirs in low fee, total market equities funds). And it’s only been in the last couple years that rates on money market accounts have made them worthwhile.

R Aldr says

It would be great to have the option to have online and physical presence. Not just for the older generation but for anyone that doesn’t trust the technology behind online brokerages/banks. I know that Fidelity has local offices — would those branches provide any support for the Cash Management account — like helping with a large transaction ? I’m assuming those Fidelity offices are just sales/advisor offices for traditional accounts.

R Aldr says

For monthly expenses and general savings, I’m enticed by your use of a brokerage cash management account, instead of an online bank or credit union. Would you say that using the cash management account makes things more complicated? And if you have a spouse or trusted family member, is this complicating their ability to manage, if something tragic occurs [to you]?

You’ve previously written about not optimizing everything [in terms of chasing the last penny] — and we’re onboard with the idea of keeping things as reasonably simple as possible. I don’t mind multiple transactions going on from here-to-there, and keeping track of details, but my spouse does not share that enjoyment.

Harry Sit says

Using a brokerage cash management account makes things simpler. You have fewer accounts, fewer logins, fewer 1099 forms, fewer transfers between different institutions, and fewer details to track.

Mandy D says

Thank you Harry! My cash is now in VUSXX FDLXX and SNSXX as a CA resident. I learnt so much from you!

AngryLawyer says

Holy smokes! I had no idea that MM funds could be exempt from state taxes. I’m going to open a Vanguard cash management account asap and start closing some of my 7 different bank accounts. Quick question, right now I have 6 savings accounts with Discover Bank to save up for different things…do you have an alternative for this? Should I just keep a spreadsheet? Thanks Harry, you rock!

Harry Sit says

You can open 6 Vanguard accounts for different things but I would just use one account and keep a spreadsheet.

Adam says

My grandfather built up his entire life savings in CDs worth a few million dollars between 1950 and 1980 when rates were good. He then kept renewing them over the next 40 years at rates around 0.1%. As a child of the Great Depression he would not trust stocks and bonds…I wish he would have at least been willing to trust money market funds.

Question: my family still has to occasionally write and cash checks and use ATMs. What is the optimal solution for that? We have been using Ally, but after having been victim to SIM jacking recently (luckily they didn’t get anything), I’m increasingly worried about security. We also have accounts at a local CU that pays very little interest. Is there a secure checking option that pays decent interest?

Harry Sit says

Writing checks – Vanguard, Fidelity, and Schwab all have this option. They will send you a free book of checks if you sign up for the option.

Cashing checks – You can deposit checks to the brokerage account by using the broker’s mobile app. Depositing to the local CU also works.

ATMs – Fidelity and Schwab will give you a free debit card if you request it. Vanguard doesn’t have it. Leave $500 at the local CU if you use Vanguard.

Adam says

Thanks for the reply. I use Vanguard, but not Fidelity or Schwab. It appears Vanguard requires minimum $250/check for check writing. Looks like using the CU for ATM and checks might be our easiest option.

Harry Sit says

$250 was the minimum on Vanguard’s old mutual fund platform. They still have the old web page up but I’m not sure whether the brokerage platform has a minimum. Please double-check with Vanguard.

John says

It looks like MYGAs have higher interest than treasuries and CDs.

Insurance companies issue them, not sure if they are safe or not.

A says

Are the interest earned from savings/CDs taxed differently from money market accounts?

Harry Sit says

100% of the interest earned from savings/CDs is taxed by the state, whereas a portion of the earnings from many money market funds is exempt from state and local taxes.

Wayne S says

I recently opened an cash plus account at Vanguard, mainly to act as a high yield savings account using VUSXX, based on the benefits of using brokerages vs banks. There are a few things I learned that I wish I had known in advance.

1) Vanguard does not allow a joint cash account to have beneficiaries. To set up an estate plan like I want (our children as contingent beneficiaries). I will have to open a single owner cash plus account (with my wife as the primary beneficiary), internally transfer money, and close down the joint account.

2) Vanguard spent a month validating the original bank account from which money was obtained to fund the new account, though money transferred and settled within several days. They did not allow me to add another bank until the month long “validation” period was finished. I would have altered the order of banks to add if I had known.

3) To add the new bank for transfers to or from the CashPlus account requires both parties of the joint account to okay the addition. This is an additional step that has not been needed at any of my other joint accounts with my wife. I can see this for individually owned accounts to have an authorized user so I wonder if this is a new requirement or just Vanguard.

4) The learning curve for the Vanguard website is steeper than for Fidelity. Even finding a support number is not as easy as it could be.