I mentioned in previous posts that the best way to transfer money between two accounts you own at different institutions is by an ACH push. When you’re moving money from Bank A to Bank B, ask Bank A to send the money to Bank B. Don’t ask Bank B to grab the money from Bank A. Following this one simple approach avoids 99% of problems with money transfers.

Wire transfers are faster than an ACH push but there’s usually a fee for sending and/or receiving a wire. Most banks don’t charge a fee for an ACH push. The money from an ACH push is available immediately at the receiving end and you avoid getting your account flagged for fraud. See ACH Push or Pull: The Right Way to Transfer Money and Follow This Rule to Avoid Long Holds and Account Restrictions.

Bank of America is the second largest bank in the U.S. after JPMorgan Chase. It has a good credit card rewards program (see Bank of America Travel Rewards Card Pays 2.625% on Everything). However, some parts of its online banking interface are tricky to figure out. The way to set up auto pay on Bank of America credit cards is the most convoluted I have seen. Adding an external account for ACH push out of Bank of America isn’t as bad but it isn’t straightforward either. Here’s a walkthrough.

Enroll in Secured Transfer

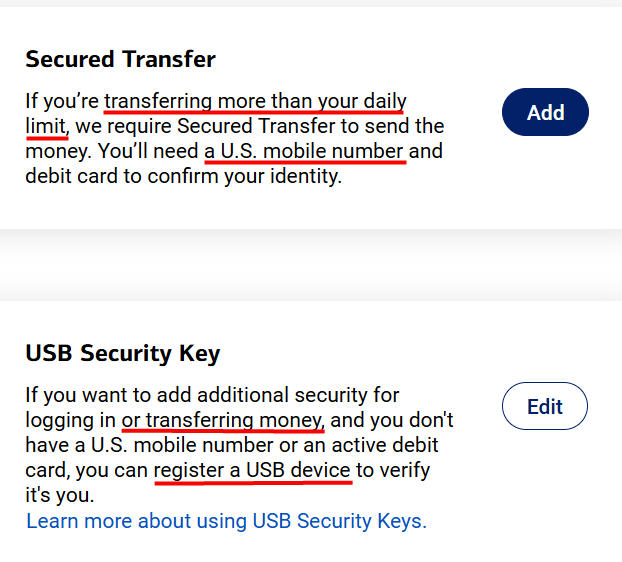

Secured Transfer at Bank of America means adding a mobile phone number or a hardware security key to authorize transfers. If you don’t enroll in Secured Transfer, your transfers may be limited to $1,000 per day. You can transfer $50,000 or more in one go after you enroll in Secured Transfer.

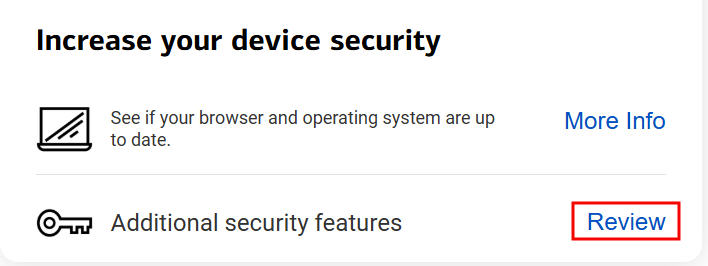

Click on “Security Center” on the top and then “Set up two-factor authentication.”

Scroll down to find “Additional security features” in the “Increase your device security” box. Click on the link next to it. Mine says “Review” because I already set it up. The link says something else when you don’t have it yet.

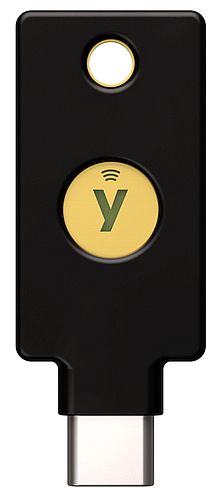

The first option uses a mobile phone number to receive security codes. The second option uses a hardware security key such as a Yubikey.

If you already have Yubikeys, it’s better to use your existing Yubikeys. You can register multiple Yubikeys. If you don’t have Yubikeys, it’s worth buying at least two Yubikeys and using them to secure your financial accounts and email accounts. See Security Hardware for Vanguard, Fidelity, and Schwab Accounts and Secure Your Email Account to Prevent Wire Fraud.

If you don’t want to use a Yubikey, a mobile phone number also works but it’s less secure.

Add External Account

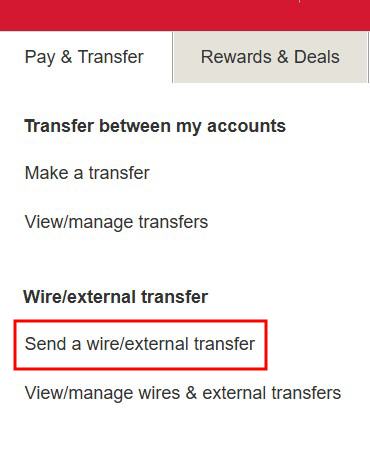

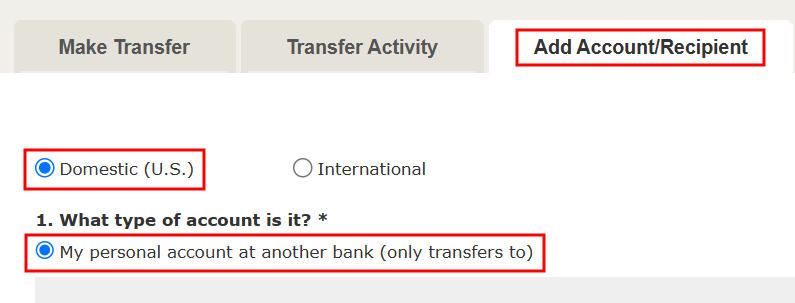

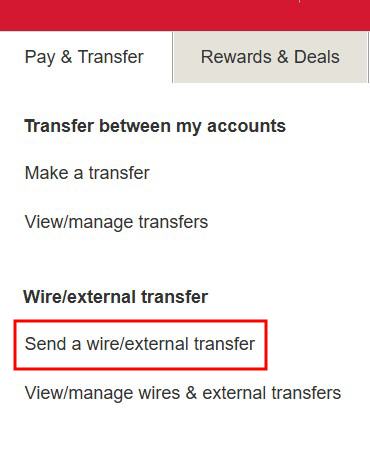

After enrolling in Secured Transfer, click on “Pay & Transfer” in the top menu and then “Send a wire/external transfer.”

Click on the “Add Account/Recipient” tab. Select “Domestic” and “My personal account at another bank (only transfers to).” Selecting “only transfers to” means you will use this link only to push money from Bank of America to the external account. To push money from your other account to Bank of America, you would add the Bank of America account as a linked account at your other bank.

Selecting “only transfers to” is important when you’re linking a brokerage account such as a Fidelity account. If you select “both transfers from and to” Bank of America will ask you to log in online to prove that you own the external account. You can’t pass this verification when your brokerage account isn’t with the bank that owns the routing number. The verification isn’t required if you select “only transfers to.”

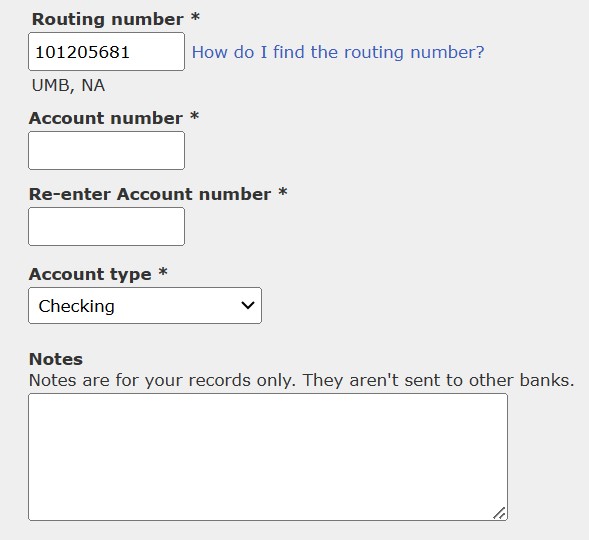

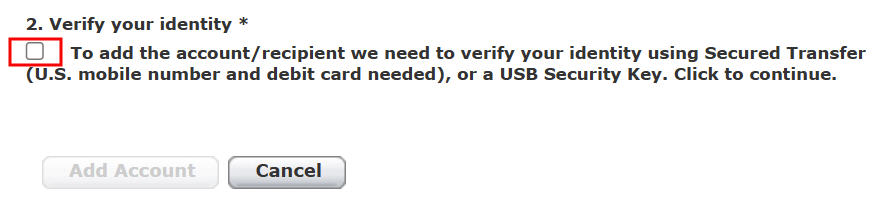

Enter the routing number and the account number of your other account. Adding an external account for “only transfers to” doesn’t require verification. You should make sure to enter the correct routing number and account number.

The “Add Account” button isn’t enabled until you check the box to verify your identity. Bank of America will ask for the Yubikey or the security code sent to the number you set up in Secured Transfer.

Send an ACH Push

Sending an ACH only works in online banking. Bank of America’s Android mobile app doesn’t support it.

Click on “Pay & Transfer” in the top menu and then “Send a wire/external transfer.”

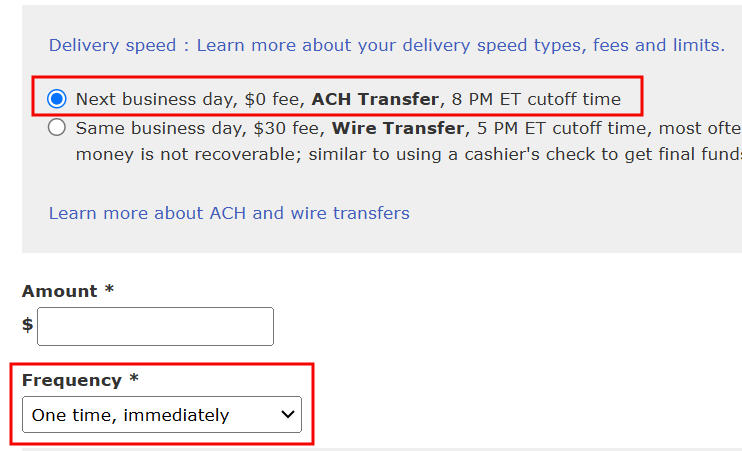

Choose the source and destination accounts. Bank of America used to charge $3 for slow ACH. Now it’s free and the transfer arrives on the next business day if you request it before 8 p.m. Eastern Time. Bank of America will ask you to use your Yubikey or the security code to confirm the transfer when you’re sending a large amount.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Barbara says

Maybe you could help me with an issue I have with BOA credit card. Our checking acct is at USAA and I love the bill pay feature. The only problem I have is with trying to autopay the BOA credit card. When I try to setup automatic payment, it says “ebill is already set up. ” USAA told me to delete the info and start it as a new biller–no change. The only thing I can figure is that I setup BOA for paperless settings and I receive 2 emails from them monthly: one that says I have a new bill from BOA and the other that my statement is ready. I have turned off paperless statements but that didn’t help. I don’t see an option for turning off paperless bills. Should I just setup BOA to automatically draft my checking account and be done with it?

Harry Sit says

Log in to Bank of America’s website. Click on “Pay & Transfer” at the top and then “Make a Payment” under the “Bill Pay” heading. If you see your credit card listed there as a bill in the Payment Center, look to see whether you have “eBills ON” at the bottom right of the listing. If so, click on eBills and then you’ll see an option to cancel eBills. After canceling ebill in Bank of America, you can set up ebill in USAA again.

Barbara says

Thanks for your reply. I did as you suggested and, when I got to the bill pay section, it asked me to confirm my email to setup bill pay. Then it asked me to accept terms of service so I assume this means I am not enrolled in ebill? This makes sense since I have to login to website each month to get my statement. Should I go ahead and setup under bill pay and cancel ebill?

Harry Sit says

You said you receive an email monthly that says you have a new bill from Bank of America. The email I receive looks like this:

From: Bank of America (billpay [at] billpay.bankofamerica.com)

Subject: You have a new online bill from Bank of America Credit Card

Content:

Bank of America logo

A circle with a dollar sign and an arrow pointing to the right

You have a new online bill from Bank of America Credit Card

Account Number: ************xxxx

Due Date: xx/xx/xxxx

Total Minimum Payment Due: $ xx.00

Statement Balance: $ x,xxx.xx

“View of Pay” button

If the email you receive looks like this, click on the “View or Pay” button in the email and see where it leads you after you log in. Doing that in my email puts me in the Payment Center where I can cancel eBill if I want to set it up elsewhere. If your email looks different, it may also have a similar “View or Pay” button. Clicking on that may lead you to where the email comes from and give you an option to cancel the ebill in order to set it up with USAA.

Clement says

I am unable to set up the ACH transfer to my brokerage account at Fidelity. I get to the ‘Add Account’ step which gives an error stating that the ‘Account Number’ and ‘Re-enter Account Number’ fields are not identical. I have tried this several times and don’t believe I have entered the account number wrongly.

I am fairly new to Fidelity, so it’s certainly possible I’m misinterpreting something about my Fidelity account number (which starts with a ‘Z’, so it’s not really a number.

Harry Sit says

You need to get the account number for ACH from Fidelity. Click on the “routing number” link under the account name in the right pane on Fidelity’s website. It’s a 17-digit number. All numbers, no letter.

Clement says

This worked, thank you.

BRIAN LOPEZ says

Does anyone know if Wells Fargo has this capability?

And if so, where it is on the website/ap or what it’s called?

I’m currently sending wires (with $15 sender + $15 receiver charges).

Any tips (including that WF does not have it) appreciated.

Thanks!

-brian

Harry Sit says

If this video is still current, look under Transfer & Pay -> Transfer Money in online banking.

https://www.youtube.com/watch?v=DBbBXUnx1EE

BRIAN LOPEZ says

Thanks for the quick reply, Harry.

I use that feature to send money from my WF account to *myself* at other banks/brokerages/etc, but you can’t use that to push ACH transfers to accounts not owned by me.

The BofA example above made me think that BofA allowed you to do push ACH transfers to external accounts that you didn’t own.

Harry Sit says

I also use it to transfer to another account that I own elsewhere. Because Bank of America doesn’t require verification when it’s one-way outbound, I guess technically you can push to someone else’s account. The note from Wells Fargo in the video wants you to use Zelle to pay someone else.

BRIAN LOPEZ says

Zelle is taking very limited accountability for where money goes.

I would prefer to push ACH.

As always, thanks for surfacing these topics.

You always provide something to think about.

Jessie says

Harry, thanks for all the great posts. You mention that external ACH transfers aren’t supported in the mobile app. However, when I go to the Pay and Transfer tab in the app and select Transfer between my accounts, I can add an external account there, (subject to micro-deposit verification), and transfer funds to it. I previously enrolled in secured transfer. Interestingly, when I went to do a transfer on the full site the way you laid out, my external account wasn’t listed, so I had to add it. It was as if the mobile and desktop interfaces offer different transfer types or maybe don’t sync properly. Would you mind clarifying?

Harry Sit says

I’m using the latest Android app (version 24.12.02) available to me in the Google Play Store. I have no option to add an external account under Pay & Transfer -> Transfer. My existing external account added in online banking doesn’t show up in the list of destination accounts either. Maybe the iOS app is different?

MHB says

Thanks for this email. I use BOA for small savings and checking and do all of my bill pay from BOA with no issues. I push $ form my TOD brokerage account o BOA checking when I need to replenish checking. I prefer BOA’s bill pay over the brokerage’s bill pay. I recently bought a car and had approved loan form BOA but dealer got me better rate from a local credit union. Great until I went to set them up in BOA bill pay and it shows that paper check will be sent. Huh to a bank? Long story about a few calls to the CU it turns out they will not accept electronic payment – they want you to set-up auto pay and enter your bank info. I do not do that. I was very upset with this as not only did. I have to keep checking that they got the paper check, when they did they put a 10 day hold on it! I asked why I did not receive a payment confirmation email. They said they do not send them out – you have to look at your loan account. They have text or email alerts to remind you when it’s x days before payment is due or if your payment is overdue but no alert that payment has been received. I was pretty annoyed. This CU has been around since the 1930’s and has m any branches so it’s not mom and pop. I called BOA to verify they would not take e-payment and the CSR confirmed (the CU person tried to tell me it was BOA which I knew was not likley correct). They show an option to pay with a credit card with a $3.95 fee. OK I decide I will do this as I will know the payment is made and I’ll get some points. Peace of mind for the fee. Try to set it up but I keep getting error message issue with my card. Try a different card, then a 3rd card – same message. Call back and am told oh we only accept debit cards now – no more credit cards – as we had fraud issues. Sigh. So achaic to have to babysit this monthly. Long way around to say thanks as I was automatically set up with a savings account with $5 when the auto loan was set-up. I just added this as an account with BOA to send money only to and send a few months payments. I will be able to transfer from the savings account to the car loan with no hold etc. Many ways to skin a cat. Not perfect but better than the paper check route. Now if I can only find a work-around to be able to pay our LTC premiums with our brokerage HSA debit card which they wonlt accept as they sell other insurance lines so will only take regular credit card. Thanks and happy holiday!

Rolf says

Hello

I would like help with linking my international transfer agency, (XE) for larger money transfers with Europe. BofA acc: 121000358

Harry Sit says

I don’t have an XE account but I found this help article from XE:

https://help.xe.com/hc/en-gb/articles/360019656558-Paying-for-your-transfer-by-bank-or-wire-transfer

It sounds like you’ll get the bank deposit instructions from XE only after you set up a pending transfer at XE. You can add the account XE gives you to Bank of America by following the steps here.

Kewen Li says

I can’t seem to be able to ACH a vendor also with a BoA account, I can ACH others at other banks. To pay the vendor who also banks with BoA, I can only do immediate wire for $30 per transaction. Is this correct?

Harry Sit says

An internal transfer within B of A uses a separate process. It doesn’t go through ACH or wire. It’s under “Pay & Transfer” -> “Send to Other BofA accounts” (last item in the right column).

Kewen Li says

Thanks, Harry,

Thanks, I just went though the mentioned route. It seems going under the Zeller framework, but the other business needs to activate their Zeller functioins first.

Harry Sit says

Did you go through the process with “Add a recipient”? First it asks you whether it’s a person or a business. Then it asks “How are you adding them?” — by mobile number/email or BofA account number. If you choose “BofA account number” it just asks for an account number and a name. I can’t go further from there because I don’t have someone else’s account number to add.

If it still asks for Zelle setup after that, you can also go to a branch. A teller can do the internal transfer.

Kewen Li says

Yes, I did all that as I did all others before. It’s just that when intiate a transfer to this party with a BofA account, the only option is wire, no next-day or 3-day ACHs. The recipient is relucnant to enroll in Zelle, so that option is out of the door. We may try your suggestion of “go to a branch. A teller can do the internal transfer,” but going to a brach is not a very exciting thing to do… Thank you very much for your help though.

OldLady says

I don’t think you can use bill pay to send a wire or ach to a person, but if you have their routing and account number you should be able to set that up as an external transfer.

Harry Sit says

I meant the “Add a recipient” button on the “Send to Other BofA accounts” page. That page is for both Zelle and transferring to another BofA account. The top part gives the impression it’s all about Zelle, but there may be a path to add a BofA account number without Zelle, which I can’t test all the way through because I don’t have someone’s account number to add.

Kewen Li says

Thanks, I did that part also. But attempting to set up the BoA account that’s not enrolled with Zelle, there’s an error message “the account is currently not able to receive…” or something like that. I tested among some of my BofA accounts with Zeller enrolled, no such error message came up, and those accounts can be easily set up. Thanks,