[Updated on November 28, 2024.]

I have auto pay set up on all my bills: credit cards, utilities, insurance, everything. Whatever amount comes due, the company pulls the money from my checking account on the due date. Some people worry that the companies might pull more than the billed amount from their bank account. I can only say that in over 20 years among all the companies that I had auto pay with, no one ever pulled the wrong amount or a duplicate from my bank account.

I like auto pay because I don’t ever have to worry about paying bills or whether the companies credit my payments on time. Once I set up auto pay, paying the bill in full on time becomes their responsibility. I only need to make sure I have enough money in my checking account. I still look at the paperless bills to make sure they are correct, but I don’t do anything to pay them. If I go out of the country for a year, all my bills will still be paid like clockwork without me ever logging into my bank account.

Most companies make it easy to set up auto pay. They too love to have the assurance that their bills are paid in full on time. They usually have a place on their website for you to give them the routing number and the account number of your checking account. Some companies do a test deposit to validate the account. Some don’t even do that.

However, it isn’t so obvious how to set up auto pay for a Bank of America credit card. If you must do it online, you have to go through the Bill Pay system as if you are paying a bill from a third party. Here’s a walkthrough of how to do it.

Add Pay From Account

You can pay your Bank of America credit card from a Bank of America checking account or a different checking account elsewhere. Your external checking account must be added to the system first.

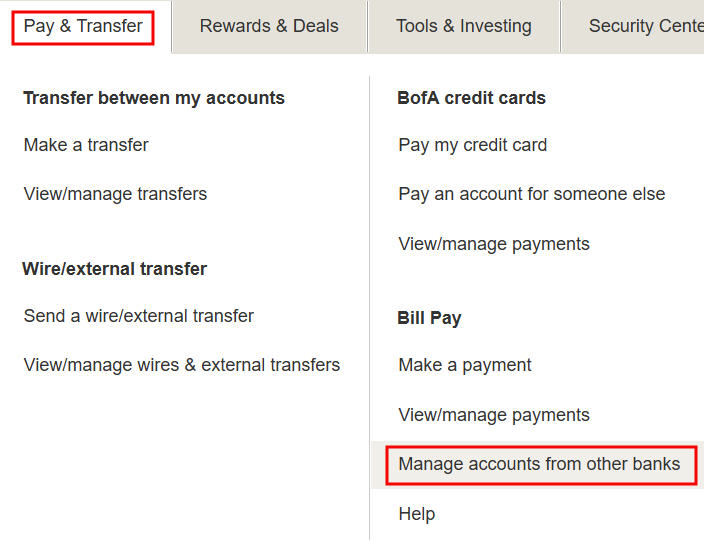

Log in to Bank of America’s website. Click on “Pay & Transfer” at the top and then “Manage accounts from other banks.”

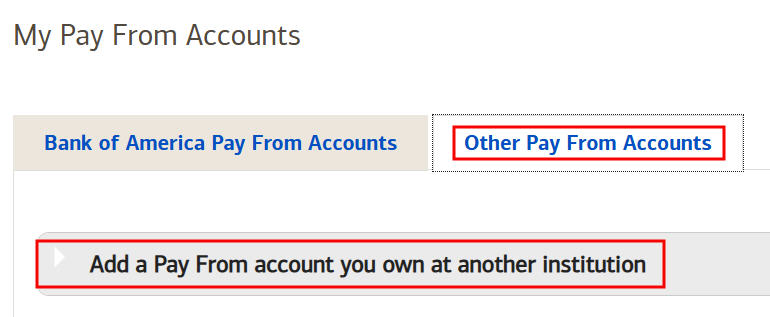

Click on the “Other Pay From Accounts” tab and then “Add a Pay From account you own at another institution.”

You’ll see a form asking you for the routing number and the account number of the account you want to use. Bank of America will send small deposits to the account. You come back in a day or two to verify the amounts.

Add Credit Card as a Bill

Bank of America uses its Bill Pay system to pay its credit cards.

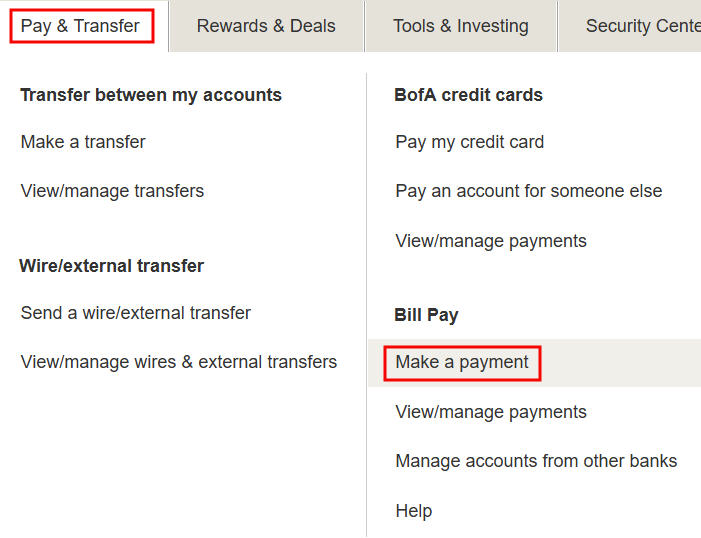

Click on “Pay & Transfer” at the top and then “Make a payment” under the Bill Pay heading.

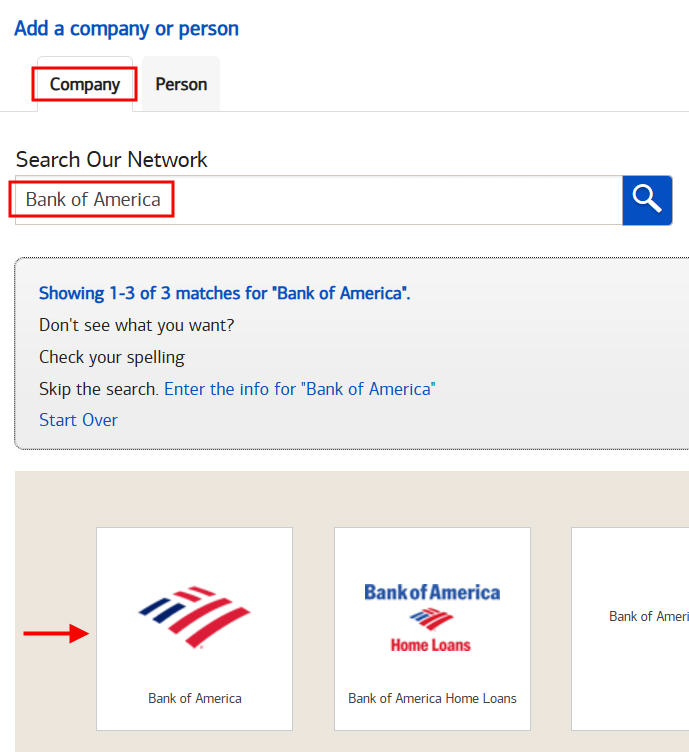

Your Bank of America credit cards don’t automatically appear in your list of bills. You’d have to add them manually. Click on “Add a Company or Person.”

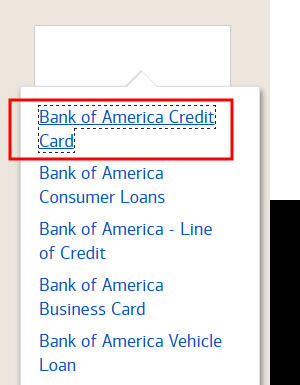

Search for “Bank of America” and click on the first Bank of America logo.

You see a list of different types of bills from Bank of America. Choose the first one — “Bank of America Credit Card.”

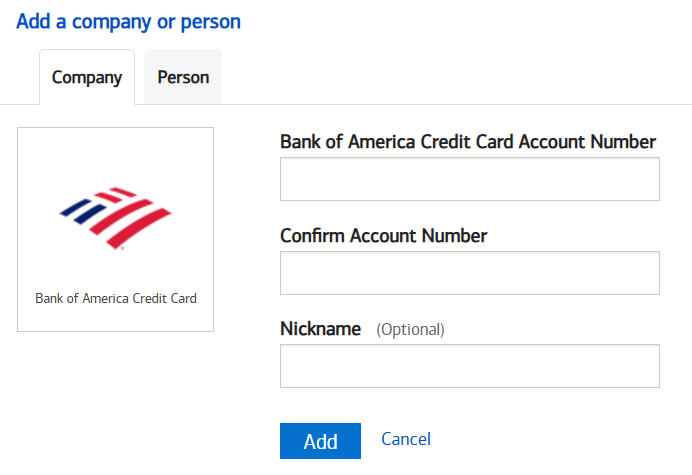

Type the full credit card number and give it a nickname. Now you’ll see the card listed as a bill ready to be paid.

This process feels really weird. You have a Bank of America credit card but it’s as if Bank of America’s payment system doesn’t know it. Repeat the steps above if you have more than one credit card from Bank of America.

Auto Pay Full Statement Balance

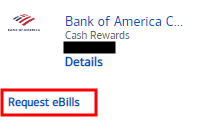

Having your credit card listed as a bill only allows you to make a manual payment at this point. To enable auto pay of the full statement balance, you have to Request eBill for this card.

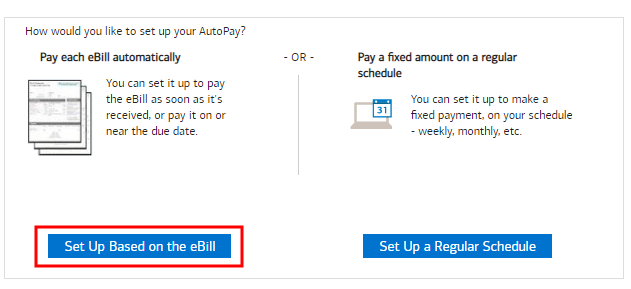

Then you wait for the first eBill to come into the Bill Pay system, which happens after your next statement closing date. Now when you click on Auto Pay, you will have an option to pay a variable amount based on the eBill.

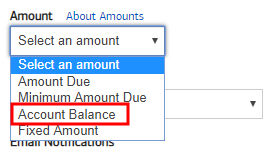

Be sure to select Account Balance because both Amount Due and Minimum Amount Due will have you only make the minimum payment. Basically the Bill Pay system looks at the statement balance and the due date on each eBill and then it schedules the payment. The credit card side receives the payment from the Bill Pay system as if you paid through Bill Pay manually.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Barbara B says

Recently First Tech Federal Credit Union double paid one of my auto-transfer (not pay) transactions (an amount in excess of $1500). When I noticed it they told me it had happened to more than just me and would be correcting the transactions and fixing the problem. It pays to have Quicken and download transactions regularly for review.

Crispy Doc says

I currently use B of A auto pay in a similar manner, but I’m considering trying to credit card hack and switching all routine utilities to the card, then paying the credit bill through the bank to accumulate airline miles. Is there a reason you aren’t doing this, Harry?

Fondly,

CD

Harry Sit says

My gas & electricity and water utilities don’t take credit cards. I do charge my auto insurance to a credit card and then pay the credit card bill with autopay.

Ann M says

I always wondered what I must have been missing! My husband and I keep our cards separate so it’s easier to track. I have Chase and he has BOA. BOA has received more than one late fee from me. We recently applied for a new card and it’s thru Chase. So long BOA. I won’t be missing them. Everything autopay was easier than anything BOA. But I’m sure it’s a money maker for them. Wish I had known this sooner! 🙂

Enjoy reading your posts.

mike says

All these traditional big banks are horrible. Wells Fargo, Chase, BOA. They are designed to make the customer screw up and incur fees. It is their business model. They obscure fees, set arbitrary limits on how much cash you transfer out, to another bank, and try to sell you by entrapment on them being the solution to all your financial needs.

Check out your local credit union. Also, Ally Bank. I love Ally. Ally is an online banking only. A combination of a good local credit union that you can walk into and conduct business as needed, and Ally is the way recommend people to go.

JAMES A. KRUMM says

All I am trying to get done is “GET AUTO PAY FOR MY B. OF A. CREDIT CARD. Had it for my C.C. for a long time, just found out I no longer do ! What happened ?? Now told you now have it within the Bank itself ? What does that mean & how do I get it for my present B. OF A. Account ??

Marc says

I pay everything through my Fidelity Cash Rewards credit card (including autopay for utilities, auto/homeowner/motorcycle/umbrella insurance), and then I just have to pay a single credit card bill each month, which I pay electronically in full to avoid interest charges. I prefer this because my bank accounts are not subject to erroneous debits, and I earn typically an extra $600-$800 per year in cash back from the credit card.

Forrest says

Bank of America interprets ‘Amount Due’ as ‘Minimum Amount’. Very stupid. The bank needs to hire someone who understands English. This goes along with the whole stupid process, I guess. All other credit cards make it easy.

KATELYN M SIBREL says

I agree! I can’t seem to find out if I have what every card company calls “auto pay” set up! I tried to do the ebill and now it says that it will take about 2 billing cycles to complete? I feel like screaming!

KP says

Chase has good Autopay, and its Seamless..

BoA on the other hand is un-necessarily complicated and I think its true that they dont want their customers to be able to utilize this feature..

joe blow says

They keep it complicated to make money on late fees.

Joseph G Rietdorf says

Absolutely! I’m going to small claims court with BOA over this same exact scam you mention. BOA has little scams hidden away in just about all their “products.”

Connie says

Bank of America has a scam going!! Make it hard to setup the automatic payment for your monthly credit card balance and they will easily get you for $25.00 if you miss your due date. Great card benefits but tacky approach to making money, shame on you BOA!!

TK says

Thanks Harry.

I google around regarding BoA AutoPay and landed your page. This is very useful information and I should have read this before.

I agree with everyone, BoA has the most complex AutoPay setup process than other CreditCard. I have AMEX and Barclay Card, both of them are easy to set that up from day one.

More than a year ago with BoA, I still didn’t know how I can setup AutoPay by BoA CC, was managing manually online.

Then I noticed I made late pay by accident and they charged fee. I searched for how I can setup up AutoPay then finally figured out that I first need to setup eBill, wait for the first eBill, then setup AutoPay. Exactly as you have explained on your article. This wasn’t straight forward.

I wasn’t 100% sure I setup properly, thus I actually continued paying online, to be on safer side. Last month, I forgot doing that, then found another interest charge on my bill. Sigh. I checked my setup and found I chose “Amount Due”. They have two options. “Amount Due” and “Minimum Amount Due”. Don’t you think “Amount Due” is the right option? Seems it is incorrect option, right?

BoA Cash Rewards is good for GAS and Grocery, and that was the reason I was using this but I am started thinking to sunset this and moving to different Credit Card.

Gaya says

Good to know about this . Me and my husband has been struggling to remember and pay each month on-time and it resulted in few late payments as well. I have added e-bills now and will wait for it to get posted and then set my autopay.

Thanks much !!

Ben says

I had autopay scheduled from several years ago (don’t recall it being difficult then) but then made the MISTAKE of manually paying my January CC statement balance from my BOA checking account. Then, they double dipped by also taking the full statement balance from my external account. Now, my external account that had been paying the autopay for years disappeared from their billpay system, it seems like no autopay is scheduled, and they are not showing any ebills from BOA CC so I can’t set up autopay.

Thankfully I noticed this before my next due date and was able to make a manual payment. 50/50 whether they’ll double dip again. I am enrolled in eBills but they aren’t showing any. I was on hold for over an hour before I gave up.

Ben says

I wonder if I have autopay set up from a previous system pre “ebill” similar to your “paper form” option. If so, this is not disclosed on my pdf statements or anywhere on their website. I suppose if my payment is double dipped again that would somewhat confirm this although not sure I want to risk a late fee over it. I guess I’ll call again if it double dips or if I can’t set up autopay when I get my next statement.

Harry Sit says

If you have autopay set up similar to the “paper form” option, your statement will show “AUTO PAY ACTIVE – Your payment of $[amount] will be automatically deducted on [date]” under the Account Summary section, although it doesn’t say which bank account is used for autopay. If you’d like to stop the “paper form” autopay and switch to the ebills setup, you should call the number on the back of your card.

B of A’s autopay does not consider manual payments after the close of statement. It will “double dip” if you make a manual payment. A card doesn’t automatically show up in ebills. If you want ebills you have to add the card manually by typing the full card number and then request ebills.

Ben says

Thanks for the reply – everything makes sense except I looked back at each of my PDF statements for the last year and they do not say “auto pay active” despite them being paid automatically from the external account I set up a couple years ago. I’m guessing this is still active despite not seeing any evidence of it on their site and that they’ll withdraw the statement balance again on the due date like you mentioned. I’ve started using this card more since they let you choose the 3% category so I might try calling again just to make sure it is set up properly.

Truedat says

I have the same situation as Ben, where I set up autopay for my Alaska airlines visa card 3 or 4 years ago, but there is no notation of “autopay active” on any of my bills. I also set up a Premium Visa autopay last year using the paper form method you describe, which does indicate “autopay active” on my bills. It took 4 months to become active.

Hoosier Carry says

Putting you on hold is another tactic of BOA.

JACK says

To view your scheduled payment:

“LOG” into your account

Hover over “BILL PAY” at top of page

Click on “PAYMENT ACTIVITY” and you can see your scheduled payment listed as

“e-Bill Initiated Payment”

James says

BoA is my only credit card that doesn’t reduce the autopay amount by any statement credits received between end of billing cycle and payment due date. Pretty annoying.

Augusta says

Old thread, but even to this day (2025) Bank of America does not have a proper system to adjust amount due in real time. Due to partial payments, credits, etc. That’s why they lost my business and trust. Now all I use is Apple Card (awesome features btw).

Harry Sit says

They don’t adjust the auto pay for this month. Partial payments and credits lower the auto pay for next month. It evens out over two months.

Vee says

After 6 years of having my Bank of America credit card bill paid through auto pay in full each month, Bank of America suddenly canceled it without notice or alert. When I discovered the payment wasn’t made, I had already been charged a late fee. When I called, they let me know that it was a “trial“ service and that it automatically canceled. This is unbelievable, as I’ve had this system set up for over 6 years and no where was it stated that it was a “trial”. Although they reversed the late fee, I am now having to set up the whole thing all over again and wait 2 billing cycles for an ebill. As the commentator indicated above, you can go through BOA’s credit card company directly to set up direct auto pay and have them debit the full payment from your account. However, I discovered that they will cancel the payment system if you don’t carry a balance for 2 months. Since this is a secondary card for me, I don’t always carry a balance and is not a reasonable solution for me, so be aware that a 2 month lapse in balance will cancel your payment system with BOA. I don’t know if that’s true for all credit card companies.

Forrest Meiere says

Typical Bank of America. Similar thing happened to me when I first got the card. They did cancel the late fee but it was embarrassing. I don’t use the card anymore.

There is a funny video by a guy who was frustrated about setting up AutoPay. He has a nice explanation of what works after a lot of unnecessary frustration. In the middle he pretends to throw thing around in his office. May want to find it through Google if you want a laugh.

Myrna Courtney says

LI was late on a bill that is on auto pay with BofA. It’s since been set up for the correct monthly payment, the same each time. I want to pay the late fee, but when I try, it changes ALL future to payments plus the one-time late fee. Can’t I just send an extra check to an auto pay account?

Anonymous says

Thanks for this how-to. It’s so ridiculously complicated. I’ve used AMEX, CapitalOne, Barclaycard, Chase, and others I’m probably forgetting; never once have I had to Google how to setup AutoPay! But, at the moment with Preferred Rewards, I see no other option to get 2.62% cashback on all purchases.

SHi ON says

Really Helpful in AutoPay. Thanks.

SJ says

Very very helpful, thanks! This system of paying at BoA credit card w/ an account at BoA is excruciating! Just plain horrible and there’s no excuse!

Ollie says

I called BOA today and asked for a paper form to setup autopay. They said they discontinued the paper form and referred me the bill pay. They did ofer to email me instructions for setting up autopay through bill pay.

Ed says

I wanted to make a large jewelry purchase for our 25th anniversary, so I decided to take advantage of a B of A 15 month interest free credit card offer. So far so good, I purchase the ring on one of my old cards and transfer it to my new B of A card. I set up auto pay to pay the ring off in 15 equal installments. I was left with a $10.63 balance last month. I considered going online and making the final $10 payment, but I thought of course B of A would only take the $10.63 and no longer continue to take $250 out of my bank every month- LIKE EVERY OTHER CREDIT CARD DOES! I would be wrong. They took $250 out on a $10.63 balance. I called and had them deposit it back, but the CS rep told me I had to manually go in and turn off auto bill pay, or they’d continue to take the $250. Shady, bordering on unethical.

dave says

For the autopay, they make it tricky. They have these options.

minimum amount due

amount due

account balance

fixed amount

If you choose one of the first two, it only pays the minimum amount.

They got me for $60 in interest charge because they only paid the minimum amount.

Very tricky. Probably on purpose.

Chigusa Imaoka says

I do not understand what you said.

I just make autopay and pay full amount so that I do not worry about it.

TK says

You have to select “Account Balance” not “Amount Due”, otherwise, you will be charged for interests, that’s what the author explains here. This is really helpful.

Linking my Japanese blog about this, hope this is helpful. https://boston.takarocks.com/2018/11/19/configure-bank-of-america-credit-card-autopay/

Chigusa Watanabe Imaoka says

I only have this account

Bonnie says

It is time for a class action suit against BOA for their unethical, fraudulent, deceptive autopay!

Scott says

I just called the number on the back of my card to try to set this up. I was transferred to Customer Relations (a different department, apparently) and they were able to set up autopay over the phone — with no ebills or Bill Pay involved. They asked for the bank routing number and account number, amount to pay (full balance), and when to pay (the 20th of each month), so it certainly sounded like they were doing the right thing. The current month is handled specially, so it’ll be a month and a half before I can verify it’s working.