[Updated in November 2018 after Fidelity Investments started offering HSA to the general public.]

An Health Savings Account (HSA) has triple tax benefits: tax deductible contributions going into the account, tax free growth within the account, and tax free distributions coming out the account if used for eligible medical expenses. In addition, the required High Deductible Health Plan (HDHP) usually has a lower premium. For most people who are healthy, HDHP + HSA is the best combination. See Do The Math: HMO/PPO vs High Deductible Plan With HSA.

The money contributed to the HSA can be invested for long-term growth. However, until recently, it wasn’t easy to find a no-fee HSA provider with good investment options. Most HSA providers usually require any combination of:

- A monthly or annual maintenance fee

- A minimum amount that must be held in cash

- Transfers between one entity holding cash and another entity holding investments

- A limited investment menu, sometimes with additional expenses on top of normal fund expenses

Now an industry giant entered the room. Fidelity Investments started offering HSA to the general public on November 15, 2018. Fidelity used to offer HSA only to people whose employer chose Fidelity as the HSA provider. Now individuals can open HSA on their own directly with Fidelity. When you have an HSA directly with Fidelity, not through an employer or an insurance company, you will have:

- No minimum amount to open the account

- No monthly or annual maintenance fee

- No minimum balance that must be held in cash

- Just one integrated account; no transfers back and forth between different entities

- All the investment options available in a regular Fidelity brokerage account, including commission-free low-cost index funds, ETFs, Treasuries, CDs, and more. See also: Best Index Funds and ETFs at Fidelity.

No other HSA provider comes close to what Fidelity offers. Compare with some other popular HSA providers that offer investments:

Lively: transfer between Lively and TD Ameritrade for investments.

HSA Bank: monthly fee if not holding a minimum amount in cash; transfer between HSA Bank and TD Ameritrade for investments.

HSA Authority: annual fee; fixed menu of investments.

Further: monthly fee; fixed menu of investments or transfer between Further and Charles Schwab.

Saturna Brokerage: higher-expense mutual funds or commission on each investment purchase and sale.

Bank of America: monthly fee (waived for highest tier in Preferred Rewards); fixed menu of investments.

Through Your Employer AND On Your Own

If you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a chosen provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

That doesn’t stop you from having another HSA on your own. You can have two HSAs at the same time. The investment options in the HSA chosen by your employer may not be as good as those in a Fidelity HSA. After the contributions are made to the HSA chosen by your employer, you can move the money to your own HSA for better investment options. You can keep the existing HSA open to accept additional contributions. When you leave the employer or when you no longer have an HDHP, you can close the existing HSA and consolidate into your own HSA.

If you get health insurance outside an employer, you are on your own. The insurance company may offer an HSA but you are free to choose your own provider. You get the tax deduction on your tax return.

Transfer From an Existing HSA

If you’d like to move money an existing HSA to a new HSA, you can do it either as a transfer or as a rollover.

A transfer doesn’t pass through you. There is no frequency limit on transfers. You don’t receive any 1099 forms for transfers. You don’t have to report transfers on your tax return. However, your HSA provider may charge you a fee for the outgoing transfer (some banks and credit unions don’t charge).

You start the transfer by filling out a transfer request from the new HSA provider. A transfer can be full or partial. You send the completed transfer request with any required documents to the new HSA provider. They will take it from there and request the transfer from your current HSA provider. Your current provider may charge you a fee for the outgoing transfer or account closure. If the account will still receive payroll contributions, you can tell the current HSA provider to keep the existing account open when you do the transfer.

To request a transfer into your Fidelity HSA, you can do it online:

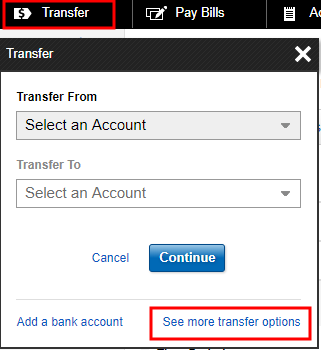

Click on Transfer and then See more transfer options.

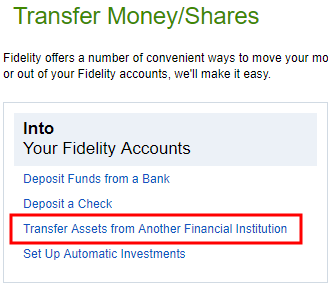

Click on Transfer Assets from Anther Financial Institution in the next screen and follow the steps from there. You will be asked for a recent account statement from your other HSA.

Some HSA providers can transfer investments out without selling them. Some HSA providers can only transfer out cash, in which case you will have to sell the investments in your existing HSA to cash first before you request the transfer. Selling investments inside the HSA is not taxable at the federal level. It’s not taxable in most states either, except in California and New Jersey, where selling investments inside an HSA is treated as a taxable event at state income tax level.

Rollover

If your existing HSA provider charges a fee for the outgoing transfer and you’d like to avoid the fee, you can do a rollover yourself, but you can only do it once per rolling one-year period (not calendar year). A rollover can only be done in cash. You request a distribution from your current HSA provider as you normally would when you reimburse yourself for eligible medical expenses. The distribution is deposited into a personal checking account. Then you send a check within 60 days to the new HSA provider as a rollover contribution.

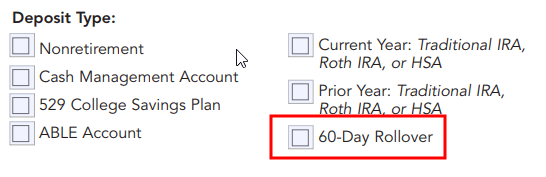

Rollover and normal contributions are reported differently by the receiving HSA provider to the IRS. While there’s an annual dollar limit for normal contributions, there is no dollar limit for a rollover. When you send the rollover to your new HSA provider, be sure to indicate the money is a rollover, not a normal contribution. That way it doesn’t use up the annual limit for your normal contributions. For rolling over into a Fidelity HSA, attach your check to a completed Deposit Slip and mark the box for “60-Day Rollover.”

After the end of the year, the HSA provider that distributed the money will send you a Form 1099-SA showing the distribution. You will report on IRS Form 8889 line 14b how much of the distribution was rolled over. The amount rolled over isn’t taxable. In May each year, the receiving HSA provider will send you a Form 5498-SA, which confirms the normal contributions and the rollover received in the previous year. Save the 1099-SA and the 5498-SA in your tax files to show that you did a rollover if you are ever asked for proof.

See also: How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Money Beagle says

I’ll have to check that out. I pretty much refuse to pay an annual or monthly fee for an HSA account (it’s akin to paying a monthly fee for my checking account), so I was planning on using my credit union. I think they offered a no-charge option but I’m not sure what the interest rate they paid (if any) was. I don’t think our balance will be that high since we’re planning on just starting off next year, so it might not even be worth it to use Alliant just yet. But, I will make sure to run the numbers, because that’s pretty sweet!

Jay says

Don’t believe it!!! HSA Bank just informed me that due to change of employer I’ll be paying $66/year!!! Balance well over $10,000…avoid them!!

John says

I’ve been with HSA bank for many years, if your paying $66 its because you don’t have 5k left in account an you have it all invested. IF you don’t want the fee keep 5k in the HSA account and the rest in the investment account. (if you can’t make 1.32% invested ($66/5000), you probably shouldn’t have the amount over the 5k invested either..) Move to a place that doesn’t offer investment options for your HSA account and make 1% or less, see how well that grows your HSA account.

Patrick Connelly says

Check out Lively. No Investment minimum, No monthly fees for your account. $2.50/month to add investments.

https://livelyme.com/

Matt says

Lively has the same issue as Elements, the TD Ameritrade Account. No good commission free ETFs anymore!

nickel says

Be aware that if you have the option for payroll deduction directly into your employers custodian of choice, you get the tax deduction plus you avoid FICA taxes. If you instead opt to make the contributions to another custodian yourself, you still get the tax deduction, but you don’t get out of the FICA taxes. Something to keep in mind…

Andrew says

My employer set up accounts for us at Bank of America, but I opened an account for myself at HSA Administrators and got my employer to change the direct deposit info (routing/transit and account #). It worked, though it did require some communication with the new custodian. And I still avoid FICA. The main downside is that my employer isn’t paying the fees on my account, but you can’t have everything.

Eric says

I am an employee of my business so I have this option of contributing as the Employer. It is indeed my intent to do so to avoid FICA taxes but your post leads me to ask a couple of questions:

1. Does the Employer have to chose the HSA ?

2. Would the Employer have to choose a more expensive plan with Fidelity, instead of using the private, inexpensive plan mentioned in this article ?

Thanks!

Harry Sit says

In order to save FICA taxes, the employer has to establish a Section 125 flex plan and include contibuting to HSA as part of it. Probably not worth it for a very small employer.

KD says

What is opportunity cost of having higher annual deductible and out-of-pocket maximum at hand if needed?

More importantly, are the coverages same between two plans esp. for high dollar prescriptions, treatments, co-insurance etc? I tried to compare that on healthcare.gov and PPO won in instances I checked but the premiums were higher.

I am also queasy about conflating investments and HSA money by saying money is fungible. I don’t think it is that simple. HSA money covers healthcare cost risk. Investments cover different and less critical risk in my opinion.

Harry Sit says

@nickel – Thank you for your comments on saving FICA taxes if you use payroll deduction. If you earn more than the Social Security wage base ($110k in 2012), the FICA savings is 1.45% of your HSA contribution. If you earn less, the FICA savings is 7.65% of your HSA contribution.

@KD – The risk on higher annual deductible and higher out-of-pocket maximum comes from the HDHP, not HSA itself, although you can’t have a HSA if you don’t choose HDHP. The HDHP only makes sense if you are healthy. Of course being healthy doesn’t eliminate the risk. You don’t take the HDHP for the sake of having a HSA. You take the HDHP because you want to save on premiums, in the same way as choosing a higher deductible on car insurance or home insurance. You are hoping over the long term the premium savings will be more than the occasional unexpected expenses. This post is conditioned on having already decided to go with a HDHP.

Eric says

Harry said “You don’t take the HDHP for the sake of having a HSA. You take the HDHP because you want to save on premiums,”

This is a fair rule of thumb but I see it mangled every time I look at the plans offered me on the health exchange. Deductibles and “maximum” out of pocket expenses are almost uniformly high (and above the HSA threshold) in the bronze and silver plans. The HSA eligibility stems from the absence of some trivial benefit. As an employee of my own business the HSA saves me about $2000 a year in taxes spread out between income and FICA*. That is a non-trivial amount, even if I expressed it as a premium difference. You are right about something else, though: living a healthy lifestyle is a financial gold-mine for most people.

*I obviously enjoy the tax savings but the HSA has other substantial benefits to me:

1. It lets me increase my maximum deferred tax savings by another $8k a year for our household.

2. It gives me a way to pay for healthcare costs outside of my income, and thereby keep my income within the 400% FPL required to receive the Federal healthcare credit. I am able to take about $64k of income a year and in conjunction with a bronze plan pay ~ $0 monthly premium. In our case the $2000 annual tax savings easily pays for our out-of-pocket expenses averaged over time.

KD says

OK, got it. As you know healthcare costs are increasing faster than inflation and most likely even faster than most investment returns. In this scenario won’t the risk of increasing healthcare cost diminish the benefit of lower premiums over the longer run. For example, a certain treatment cost $200 today but but due to cost increase costs $350 in a few years. The proportional premium increase may be somewhat lesser due to shared costs – or may be not. Also the risk for out of pocket expenses increases the fastest with HDHP (The probability that you may have to incur those expenses as you age and the hole they will burn in your pocket – larger and faster – shielded by HSA but not really if healthcare costs grow fast). May be I am not viewing this correctly so please correct as necessary. I am trying to understand the nexus of health risk, healthcare cost risk and benefit of lower premiums and HSA. I wish there was a simple algebraic equation to state it. Also if you are healthy then all of this becomes moot.

MC says

If you are in California, one of the few states that does not recognize HSAs, the only way to preserve full tax deferral of HSA accounts is to invest in treasury bills, notes, and bonds. HSA Bank (through TD Ameritrade) provides one way to do that.

Robert Johnson says

The current non conforming states are:

Alabama, California, Maine, New Jersey, Pennsylvania and Wisconsin

Wisconsin passed legislation to conform in 2012.

REFERENCE: http://www.ncsl.org/IssuesResearch/Health/HSAsHealthSavingsAccountsandtheStates/tabid/14462/Default.aspx

Thooda says

I’ve had HSA since 2007 and my Alliant HSA since 2009. I contribute via payroll direct deposit.once a year I do custodian to custodian transfer from alliant to HSA administrators. Been doing this for last couple years.

Andrew says

You might ask your payroll folks to change the direct deposit info to your HSA Administrators account (I did this).

Dan says

A very useful article, TFB. I’ve thought about maxing out my HSA to get a bit more tax-advantaged space for investments, but with such high fees it seemed pointless.

Why does Vanguard only offer its funds through HSA Administrators, rather that offering such accounts itself? With the fees, I’d effectively be paying an 3% in expenses for the first year, and at least .32% on an ongoing basis. Vanguard funds are a whole lot less appealing with such high expenses…

Alliant CU does seem like a viable option in terms of paying a decent rate comparable to short-term bonds. Is this the highest interest rate available for an HSA currently?

Is it possible to rollover one HSA into another as often as desired? I’d want to make contributions directly to my employer’s chosen custodian, in order to get the FICA benefit, and then transfer them to something higher-yielding.

Chris says

“The HDHP only makes sense if you are healthy. ”

Arguably, it also makes sense for those who may be very sick and/or have extremely high medical costs, as long as the HDHP has a true maximum out-of-pocket ceiling.

It seems not to work as well for those “in the middle,” who have middling annual health care costs. (But each person has to run the numbers for their individual HDHP to be sure.)

Harry Sit says

@Dan – I’m guessing Vanguard doesn’t want to perform the administrative chores associated with HSAs. It does for IRAs but the IRA market is magnitudes larger. Adirondack Trust Company, a bank in upstate New York, pays 3% on a HSA, but it charges a $25 setup fee and a $4 monthly fee. Ignoring the one-time setup fee, you will have to have more than $5,000 in the account to beat the 2% from Alliant CU. Besides the convenience factor because I’m already a member of Alliant CU, I trust Alliant CU to remain competitive more than Adirondack Trust Company.

You can do a trustee-to-trustee transfer at any time but the outgoing account may charge you a transfer fee. You are allowed to do a rollover yourself once a year – write a check from one account and deposit it in another within 60 days.

nickel says

We’re currently paid a pittance on our HSA balance, but it will go to 2.25% once our balance reaches $15k — assuming they don’t pull the rug out from under us at that point.

In the mean time, I need to keep the employer account open (and contribute to it) to capture my employer’s match. And I need to keep at least a $3k minimum balance (earning close to 0%) in order to avoid the monthly fees ($3-$4/month).

So I can just let the money sit there and earn nearly nothing, but not incur fees, or I could move some or all of it to another provider. If I leave $3k behind to avoid fees and move the rest, then I’ll have $3k earning nothing, which is equivalent to a $30-$60 annual fee (assuming I could earn 1-2% elsewhere).

Once at a new provider, I could either earn a savings-like interest rate, or I could branch out into mutual funds or ETFs. However, many places have a cash balance minimum to avoid fees even if you have a large balance through their investing platform, which could mean another $3k or so sitting idle and earning very little.

I could rate chase with Adirondack or Alliant, but it’s a lot of work, and I don’t trust that they’ll keep their rates high.

This is almost enough to make me just start drawing down my HSA balance and using it to pay for ongoing medical expenses rather than holding the cash back and building up an extra tax-advantaged investment account.

In the short term, we will likely leave it in place. We should reach $15k sometime in the coming year (we’ve contributed the family max of $6k-ish during the past two years, and will do so again this year). At that point, if the bank doesn’t screw us*, we’ll be making 2.25% which isn’t bad at all given the current rate environment.

In the long run, if our employer stops matching funds, I’m not sure what we’ll do. That FICA avoidance, even at just the medicare rate (good point on that, btw), is around $90/year — but that may wind up being a small price to pay in return for simplicity.

*I have a sneaking suspicion that they will screw us, however. The HSA has only been an option for us the past two years, so it’s impossible for anyone at our workplace to have reached $15k. Thus, that 2.25% is a nice, but purely theoretical, carrot. Once people get there, I can easily imagine the bank re-working their rate table.

Sher says

Nickel, you might be onto something here. This seems to be one of the oldest tricks in the book.

Take your cash now (fees), in small amounts, but regularly, each month. Then promise you rewards (always in the future), which they reserve the right to remove at pretty much any time.

Who knows maybe the economy will improve and you’ll get your 2.25% then…

How are your investment options, btw. I found these mostly lacking with the HSAs.

nickel says

The investment options from my employer’s custodian are abysmal. 5% loads and 2%+ expense ratios. Absolutely horrible.

Dan says

Nickel, I have the same problem as you. My employer’s custodian offers abysmal investment options and/or very low interest rates for HSAs. At least there’s no monthly maintenance fee.

I’d like to max out my HSA, since it’s a great new source of tax-advantaged space for retirement. But it seems that those of us who are “early adopters” are betting on the appearance of low-cost investment options for HSAs in the near future. As Sher suggests, this is kind of a gamble… current HSA custodians could crank up the fees even further and there’d be no decent place to put the money until someone like Vanguard enters the market directly.

TFB’s 2% rate from Alliant seems decent, and I think a not-for-profit credit union is less likely to screw its customers than a bank. I’m thinking of opening an account just for this reason.

Cleotus says

I’ve had my HSA at HSA Bank since 2008. I have all of my HSA funds at TD Ameritrade. Until a couple months ago the annual fees were only $27 per year; they are now $66 per year (assuming you have all of the funds at TD Ameritrade)

I have an approach that has not been mentioned yet. Note: I plan on contributing the maximum each year and never withdrawing a dime until age 65.

My understanding is at age 65 the HSA turns into both a traditional IRA as well as maintaining it’s HSA status.

So, even in retirement I can withdraw money for qualified healthcare expenses and not pay taxes or I can withdraw money to be used for non-healthcare uses and pay my marginal tax rate.

Considering this, I have my asset allocation somewhat mirror my overall portfolio. I do this because I see this money as having an exclusive use that none of my other retirement money possesses – I can use it tax-free for medical expenses from age 65 until my death.

With TD Ameritrade’s no-commission ETFs (many Vanguard) I have built a garden-variety diversified portfolio a la Fama/French but with a bit of a Swedroe influence as well as value tilt (for instance VIG + VYM & VBR rather than VTI, since I do not pay taxes on the dividends now among other reasons)

Regardless of my asset allocation — is my reasoning sound? Treating this as separate from everything else in my portfolio? If I keep only treasuries in my HSA or keep my HSA money in a savings account I am nearly certain that I will end up with a lower balance at age 65 (just over 25 years from now for me) than if I invest in a diversified portfolio of stocks/bonds.

Thanks to TFB for discussing this important topic.

Josh says

I am doing the same, great plan and makes a lot of sense. I’m tracking all my current medical expenses that I’m not withdrawing funds from currently. I have 21k in the HSA account and around 6k in expenses I haven’t reimbursed yet. Just make sure you keep all your records for when you do finally pull out the funds to reimburse for your expenses.

White Coat Investor says

Great article. I learned two things from it I didn’t know before:

1) You can withdraw HSA money later (2 decades from now) using receipts from now (right?)

2) Alliant 2% HSA/short term bond trick. That’s more than the G fund is paying right now.

dd says

TFB, thanks for writing about Alliant Credit Union. I took a look at the website and opened two accounts at Alliant yesterday.

Rabbmd says

My s corp uses a broker for health insurance. We currently pay $100 a month for all 14 employees to have a hsabank hsa or hra. I have to hsa, and all fees are waived as a result. I use both alliant credit union and td ameriteade for my hsa. Since my wife and i are relatively healthy, and have had an hsa for years, we have like $8000 in alliant and $12,000 in td vanguard etfs/funds. I can not use the cafeteria option as i am an s corp owner, however maybe people could look into getting a broker to use hsabank. This might eliminate a lot of the fees people face.

Harry Sit says

@Rabbmd – HSA Bank isn’t charging you fees because it’s paid by the insurance company. You are still paying the fee, perhaps both for you and your employees, through the insurance premium.

SanDance says

Alliant HSA is now at 1.75%

Dan says

TFB, thanks for the excellent article.

One small point about HSA Administrators: they waive the setup fee if you transfer funds (any amount, seemingly) from your current custodian. And they list an annual fee of only $36 on that form too: http://www.hsaadministrators.info/images/stories/HSA/forms/transwithenroll.pdf

With an annual fee of $36 + 0.32%, I’d effectively be paying 1.52% of the $3,000 I’ve got in my HSA, though that’ll be down to about 0.9% after another year’s worth of contributions. I’m still trying to decide if it’s worth it for me to pay these steep expenses or just leave the money in my employer’s default Chase HSA (0.40% APY) until I’ve got a bigger chunk of money in the HSA to invest.

Brendan says

I’m a little unclear on the mechanics of the FICA benefit people are talking about. I make a small contribution from my paycheck each month (about $160) and then make a roughly $2000 lump sum contribution at year end. I could break the $2000 lump sum into monthly contributions that get deducted from my pay, but don’t I get the same reduction in FICA taxes when I complete my tax return for the year. Making the contribution at year end gets reported on my tax return and I get a larger refund. I understand I lose some time value of money with this approach, but doesn’t the FICA issue become a wash?

Harry Sit says

@Brendan – FICA is Social Security and Medicare taxes. If you are not making your $2000 lump sum contribution through payroll, you are not getting a deduction on FICA. Putting it on the tax return on your own gets you a deduction for federal income tax, and state income tax in most states, but not Social Security and Medicare taxes. If you are making your $2000 lump sum contribution through payroll, then it doesn’t matter whether you do it monthly or at the end of the year.

Rick Van Ness says

Update: Alliant interest rate has fallen to 1.25% for HSA but I’m choosing to go with them. Thank you for your informative and helpful article.

I don’t believe it is possible for them to automatically make your donation to Foster Care To Success with either the online or the paper application. You do this separately. I applied to Alliant online. When you get to the page Tell Us About Yourself, select “I below to the following association or organization” and a pop-up box will appear where you then select Foster Care To Success. They generate an interesting set of questions to authenticate your identity. In my case, one of my questions asked me to recognize a phone number from too many years ago (multiple choice) and I failed to get approved immediately. However, after the weekend they sent me an email that I have been approved—so, in the end, it was a piece of cake after all. Thanks again for the helpful article.

Heidi says

I moved my HSA funds to Connexus Credit Union http://www.connexuscu.org . There’s no set up fee, no monthly fee, and it’s currently paying 2%. If you don’t meet their criteria for membership, you can simply make a one-time donation of $5 to join the Connexus Association and you become a member.

Mark Hense says

The APR on this is down to 1.25

JK says

Isn’t Alliant charging a per month fee for self-managed investment account for HSA? I didn’t see it referred in any of previous posts so can someone who has an HSA with Alliant confirm?

http://www.alliantcreditunion.org/depositsinvestments/investmentservices/selfmanagedinvesting/

Harry Sit says

Only if you use the investment option. No fee for the savings account, currently paying 1.25%.

D00D says

Are they still making the donation or the minimum deposit for new members? $10 is no biggie but just thought if they are still doing it, it would be nice to take advantage of it.

Harry says

D00D – It looks like they stopped doing that. I updated the post to remove outdated info.

Michael says

I just came across this thread.

This seems to be a good source for comparing HSA providers & savings rates:

http://www.hsarates.com/

Erik says

I just moved from my bank to HSA Bank in October. Immediately after that, I started seeing posts about Eli Lilly Federal Credit Union (Elfcu) on the Bogleheads forum from what I think was a marketing rep of some kind, because I saw the same post in several locations. Anyway, it immediately made me regret going with HSA Bank, but I chalked up the lack of responses to mean that people were skeptical of Elfcu. Now I see this post update… ugh. I should probably do a rollover to Elfcu. It seems to only make sense, since I’m keeping $5,000 at HSA Bank to avoid the fees and investing the rest in VTI, which I could maximize through Elfcu.

Erik says

Note to self and anyone thinking of switching… I’ve already started investing my HSA for 2014 in TD Ameritrade. If you are thinking of switching, there is a 30-day hold period for ETFs to avoid paying short-term trading fees. So in my case, I purchased VTI shares on 1/17/2014, so now I need to wait until roughly 2/17/2014 to sell those and pull the money back into HSA Bank before I rollover to Elfcu. Damn you TFB for making me do this. 😛

Mike says

Saturna Capital looks like the best deal now. For one trade per year, the cost is only $14.95 and I can invest the whole amount in any ETF or Fidelity/Vanguard mutual fund.

Erik says

After the $5 donation to Elfcu, it doesn’t cost you anything to set up or ongoing. That seems like the best deal.

harry @ 4HWD says

Thanks for the tip on this deal, I’m going to do some more research but it looks like I might be switching from HSA Bank to Elfcu. I pay for all my HSA expenses with after tax money(via credit card) and save the receipts anyways so I don’t need 5k sitting in cash with HSA Bank. I’d rather invest it all.

OB says

ELFCU seems to be the best HSA investment deal followed by Saturna. If you choose Saturna’s inhouse mutual funds, you don’t pay any commission or maintenance fees, just the baked in ERs. Hopefully the other financial institutions would take heed and compete by providing more options and lowered fees.

cowboy Mike says

Howdy,

Thank you for the informative article.

My wife and I have individual HSAs with HSA Bank via Health Savings Administrators. We have 100% of our money invested in Vanguard Mutual funds because we treat the HSAs as a form of IRA. So in addition to the annual fee we pay the following as well.

Custodial fee: 0.0008 per quarter times account balance (80 cents per $1000), capped at $20,000 account balance per fund. Mutual Fund Account maintenance fees will be deducted from the account balance each quarter.

Does Elfcu have fees like these as well or would be saving those fees if we moved to Elfcu?

Where can I find a list of what Vanguard funds are available via Elfcu?

Thank you very much for this article.

Happy trails, cowboy Mike

Harry says

No it doesn’t have asset-based fees as HSA Administrators does. You invest through a linked TD Ameritrade account. It’s best to use commission-free ETFs instead of open-end Vanguard mutual funds. I linked to the list of 101 commission-free ETFs in the article. 32 of the 101 commission-free ETFs are from Vanguard.

cowboy Mike says

Hi Harry,

Thank you.

We only invest in index funds. We like to employ the KISS to our retirement investments, our HSAs are currently invested in Vanguard’s LifeStrategy Moderate Growth fund (a fund of index funds) that matches our other overall asset allocation strategy. I just prefer index mutual finds over ETFs.

Looking at the list of available funds and Vanguard funds we may have to stay put.

Happy trails, Mike

Harry says

In that case Saturna Capital brokerage HSA that Mike mentioned in comment #33 may be a better choice. If you just buy Vanguard’s LifeStrategy Moderate Growth fund once a year it costs only $15.

mwm says

Be careful with EFLCU, I paid the $5 to the TruDirection “nonprofit” and applied for an HSA account.

I was emailed later and told I need to show up in Indianapolis with my ID to create an account.

Seems like a scam to me. 🙁

Harry says

Others appeared to have signed up just fine. Can you send a copy of your ID to them either by mail or electronically? It’s common for banks to require a copy of your ID.

mwm says

The letter I received says: “you would need to appear in person at one of our Eli Lilly Federal Credit Union branch locations and provide current ID”.

I called and a representative said it had to be in person. I asked if there was any other way such as showing up at another shared CU branch, but was told that wasn’t possible. I asked if they could refund the TruDirection payment and was told they would not.

Sounded like a great deal, but looks like I’ll be stuck paying $66/yr to HSA Bank. Or, perhaps, Saturna as I’ll probably only make 1-2 Vanguard ETF purchases per year and they’re conveniently located in WA.

Mainer says

I was all set to jump on board until I read the post by mwm. Any update on whether joining ELFCU is still doable (without having to show up in person w/ID?)

Harry says

Let’s see if others report the same problem. I’m hoping it was an isolated incidence caused by the automated ID verification system not able to verify ID or random selection like getting the SSSS at the airport.

Sarah says

I am interest in ELFCU account, is there anyone else who have issue set up the account without showing up in person in ELFCU branch? I need to make sure it is possible before sign up since I live far from Indianapolis. Thanks,

Harry says

I just signed up online. You give your name, address, date of birth, driver’s license number, etc. (required by law) and you answer some questions based on information in your credit report — identify the places you lived in the past, loans you had, etc. It took about 5 minutes. I got an application confirmation number, and two account numbers — one for member savings, another for the HSA — both showing an “approved” status.

@mwm – If you are still reading, can you tell us if you also got the application confirmation number and two account numbers? Or were you sent to the physical verification path because the system wasn’t able to match your driver’s license number or date of birth or your answers to those verification questions?

Harry says

I received a welcome email, with the same two account numbers given to me at the end of the online application yesterday. I was able to create a login name and a password. Everything looks good. Next step: mail in the transfer form.

Mainer says

Would you mind clarifying the steps of joining TruDirection and then joining the credit union: Once you’ve joined TruDirection and paid the $5 fee by credit card (on the TruDirection website), does ELFCU know that you have done so and so are eligible to join the credit union (I assume on the credit union’s website)? Or do you need to let ELFCU know that you are a member of Tru Direction? Thanks.

Harry says

They won’t know automatically. You need to let them know in the online application.

BN says

Very interested in transferring my current HSA account with a credit union earning 1.75% APY to Eli Lilly but also need to confirm that everything can be done online before I proceed.

Erik says

So… call them?

Bill says

I successfully applied, all online. I submitted my transfer request the same day.

Mainer says

I applied for credit union membership on-line and received an email requesting a copy of my drivers license and a piece of mail with my current address. I could fax or email this. I faxed it and several days later I received (by email) my acceptance as a member & my account #. Not sure why I had to submit that info but it all worked out. Now I will sign up for the HSA.

Mainer says

Any advice regarding how to invest an HSA (using the TD Ameritrade VG non-commission ETFs)? If one’s portfolio is essentially 50/50, does it make sense to use the same allocation for one’s HSA money? I thought I’d split between VTI/VXUS/BND (per Allan Roth’s Second Grader Portfolio), but VXUS isn’t available, so just split between VTI and BND? Thanks for any help.

Erik says

My asset allocation is spread across my accounts, so I currently just keep VTI in my HSA through TD Ameritrade. I was recently considering what you mentioned with VTI and BND, but I was going to approximate VXUS with 90% VEU / 10% VSS. Alternatively, you could pay the commission and buy VXUS.

Harry says

I agree with Erik. If your HSA is small relative to your other accounts, which is the case for me, just pick one ETF and balance it out in the other accounts. I will buy just VTI.

Mainer says

Thanks for your input. Much appreciated.

Frank says

Mainer said this: “I applied for credit union membership on-line and received an email requesting a copy of my drivers license and a piece of mail with my current address. I could fax or email this.”

*** I was turned DOWN!

I followed their instructions as Mainer described and they said ‘nope’

Outrageously secretive organization. They would not give any reasoning.

I think it was because my drivers license was different from my mailing address but they refused to give any information.

They demanded that I could only physically visit one of their branches…5 states from me! Ridiculous.

Needless to say I’m very disappointed after reading this article and very suspicious of this company and the staff that works there. They were extremely friendly upon applying but then acted like I had leprosy once I was denied and simply tried to get a reason.

I have over an 800 credit score and a high net worth with nothing adverse on ANYTHING!

I guess they don’t want a mid-five figure transfer of my HSA to their account. I guess they don’t like to make money…??

Danny C. says

For the ELFCU account $2,500 minimum, do you have to maintain $2,500 in the HSA checking account portion and then invest the rest or can you invest everything you have as long as its at least $2,500?

Erik says

You have to open the HSA with at least $2,500, but then you can invest 100% of your HSA in TD Ameritrade, leaving a zero balance if you’d like in the savings account portion.

Harry says

Or add enough over time to put you over $2,500 if you don’t have $2,500 when you open the account.

Angela says

My question is for anyone who has transferred successfully from HSABank to ELFCU:

Were you able to transfer your TDAmeritrade ETF holdings “in kind” or did you first have to liquidate them and transfer the $ back into your HSABank cash account?

tim says

I was also rejected 🙁

Their phone support won’t provide a reason and they just say you have to visit a branch in Indianapolis. It seems they’re not very interested in signing people up for their HSA account.

Dave says

As far as ELFCU goes, I was able to open an account without any problems (funded it with my 2013 contribution.) In my case, the driver’s license name and address matched everything on the copy of the bill I sent.

Seems they need to be careful as to not fall prey to an identity thief so if they can’t verify who you are by matching your ID (driver’s license) and billing address (with the application info) they wnat you to verify who you are in person. To me that isn’t a scam, they are doing what they are required to do and could very well explain the problem Frank (and possibly others) have encountered.

Jeff says

Moving money to the TD investment account will incur a $24 wire fee per Elfcu message:

“Effective April 15th, Elfcu will be assessing a $24.00 wire transfer fee for all OUTGOING Wires being debited from HSA Accounts. Wire transfers are generally requested to transfer HSA funds for investment with TD Ameritrade. To correctly fund the wire, you must leave enough funds in the HSA account to cover the $24.00 wire fee. If funds are insufficient to cover the fee, the wire will be rejected and returned by the Special Accounts Department.”

Harry Sit says

Post updated. See follow-up post Elfcu HSA Still The Best Despite New Wire Transfer Fee.

Harrison Chilton says

A group of Stanford grad students are working to make a better experience for high deductible plans and HSA users. We are looking for input from the community and would love to get help from folks interested in the area.

If you have 15 minutes to spare please shoot me an email at [email protected]. Would love to get your input as we try to revamp an area filled with inefficiencies.

Thanks!

Ravi says

As per fees for HSA bank at

http://www.hsabank.com/~/media/files/fees_s1

monthly maintenance fee is $2.50. That would be an annual fee of $30.

Where does the yearly $66 fee for HSA come from?

Harry Sit says

The 3rd item under Service Fees. Monthly Investment $3.00, waived if you maintain a bank account balance at or above the Balance Waiver Amount each day of the month.