Although I stopped chasing bank and brokerage bonuses, it’s still a valid way to make some money. You can easily make $5,000 or more each year with a large enough account. The bonus can fund nice-to-have toys or experiences or simply add to your long-term investments.

I’m not saying you should or shouldn’t do it. If you’re interested but haven’t done it before, here are some pointers to help you pull it off more easily.

The Big Picture

Some brokers want to attract new customers and more activities. Offering a bonus to actual customers can be more effective than spending millions on advertising. You receive a bonus from the broker by participating in the promotion. They get to show growth to Wall Street. Win-win.

Choose a Bonus Promotion

Many promotion offers are listed in Best Brokerage Bonuses on the Doctor of Credit blog at any time. Some offers are from larger brokers you’ve heard of. Some are from smaller brokers you didn’t know. All offers require that you hold the transferred assets at the new broker for some time. I would favor offers from a larger institution with a shorter required holding period.

For instance, as I’m writing this, Webull offers a 2% bonus with a 2-year holding period and Wells Fargo offers a $2,500 bonus for transferring $250,000. Although Webull’s bonus is twice as large ($5,000 versus $2,500 for transferring $250,000), Wells Fargo’s promotion only requires holding the transferred assets for 90 days. You get the bonus sooner and the assets can move again after 90 days to earn another bonus elsewhere. Wells Fargo is also a better-known institution than Webull. I would pick Wells Fargo’s offer over Webull’s.

Transfer an IRA

If the promotion doesn’t exclude IRAs, it’s easier to transfer an IRA than a taxable brokerage account. Although the cost basis for holdings in a taxable account should transfer over to the new broker, there’s a risk that it doesn’t or it’s messed up by the transfer. You avoid this risk by transferring an IRA (either Traditional or Roth), where the cost basis doesn’t matter.

If the bonus is paid into an IRA, it counts as earnings in the IRA. You can still receive the bonus in the IRA even if you already maxed out the IRA contributions for the year or you’re no longer eligible to contribute. If the bonus is paid into a Traditional IRA, it’s not taxable now but it’ll be taxable when you eventually withdraw from the Traditional IRA. The bonus will be tax-free if it’s paid into a Roth IRA. The specific Wells Fargo promotion I used as an example pays the bonus into a checking account, which makes it taxable, but other promotions usually pay the bonus to the account transferred.

There are no tax consequences when you match the IRA type to transfer: Traditional-to-Traditional or Roth-to-Roth. There won’t be any 1099 forms for the transfer.

Transferring an IRA avoids complications otherwise present in a taxable account. Because an IRA is always in only one person’s name, if you’re married, you and your spouse can sign up for the promotion separately and double up on the bonus by transferring your respective IRAs.

Identify Shares to Transfer

You don’t need to transfer the entire IRA. Identify some shares that you won’t touch. Those shares can go to the new broker.

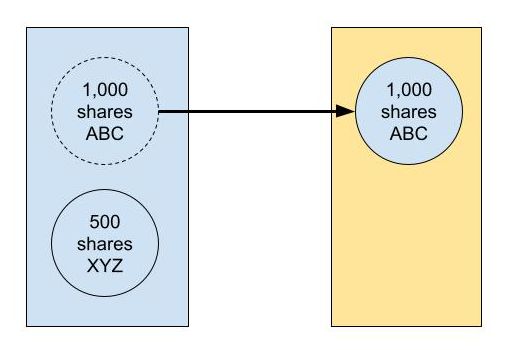

Don’t sell the shares. You’re only moving the same shares “in kind” from one broker to another. Suppose you have 1,000 shares of an ETF ABC. You move these 1,000 shares of ABC to another broker. You still have 1,000 shares of ABC in your new account. You don’t sell your shares. The value of these shares will fluctuate but they’ll be the same whether they stayed in the original account or they’re held in a different account.

Individual stocks and ETFs are easier to transfer than mutual funds. Individual bonds and brokered CDs can be transferred as well. They go by their CUSIP numbers, which are equivalent to the ticker symbols of stocks and ETFs. Keep any cash in your existing account.

If you intend to trade some of the shares, leave those in the existing account. Rebalancing and withdrawing from the IRA usually involves only a small percentage of your holdings. For example, suppose you have 1,000 shares in a holding, 800 shares can be transferred to the new broker. You use the remaining 200 shares in your existing IRA to rebalance or take withdrawals.

The idea is that you’ll split your IRA into an “at-home” account and a “traveling” account. You still do everything you normally do in the “at-home” account that you’re already familiar with. The “traveling” account contains holdings you won’t touch. It travels from one place to another to earn bonuses. You won’t do any trading in the “traveling” account at the new broker besides turning on automatic dividend reinvestment. You don’t need to learn how the new account works. It only sits idle waiting for the bonus.

Open a New Account

After you identify which IRA and which shares you’ll transfer, you open an empty new account of the same type at the new broker. Be sure to read the promotion requirements. This part is critical to receive the bonus. If you need to enter a promo code when you open the account, include the promo code. If you must use a specific link, use the link. If you must visit a branch, visit a branch. If it’s a combo deal that requires you to open both a checking account and an investment account, make sure the two accounts are properly linked (this is the case in Wells Fargo’s promotion I used as an example).

Make sure to match the exact spelling of your name and your Social Security Number between your existing and new accounts. Set up your online login, password, and 2-factor authentication at the new broker. Designate beneficiaries for your new IRA.

Confirm with customer service that your account is coded for the bonus promotion. Save any promotion enrollment confirmation emails.

Submit Transfer Request

Inter-broker transfers go through a system called ACATS, which stands for Automated Customer Account Transfer Service. You always initiate it at the receiving broker. You give them your account number at the sending broker with a recent account statement. You request a partial account transfer with a list of the positions and the number of shares you identified. It takes a week or two to complete.

If the promotion requires you to complete the transfer by a certain date, be sure not to miss the deadline.

If the sending broker charges you a transfer fee, you can request a reimbursement from the receiving broker. If they don’t reimburse you, chalk it up as being covered by the transfer bonus you’ll receive.

Turn On Dividend Reinvestment

Turn on dividend reinvestment at the new broker after your transferred assets arrive. Now the new account will run on autopilot while it waits for the bonus.

Set Calendar Reminders

Set a calendar reminder for when you expect the bonus to show up based on the terms of the promotion plus 7-10 days. I received the promised bonus in all the promotions that I participated in before. Some of them might have been late by a few days but they always came.

Set another calendar reminder for when your assets are free to move again without losing the promotion bonus. Give a liberal buffer. If the promotion requires a 90-day holding period, hold your assets at the new broker for 120 days. Look for the next destination for your “traveling” account after you’ve fully satisfied the terms of the promotion. Your next transfer can be a full-account transfer of this “traveling” account to its next destination.

***

It takes some time to plan and execute for the first time but it isn’t too difficult. It gets easier the second time or the third time around. You decide whether it’s worth making $5,000 a year with this endeavor.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Keith says

I’m probably most aligned with the TFB’s recent post that chasing bonuses is not for me (smaller account and I just don’t want/need the complexity). I do have a related question, though. I recently initiated a transfer from an old workplace 403b to my Vanguard IRA. It has been 8 days since TIAA confirmed completion of the transaction and the funds still don’t show in the Vanguard account. Is this normal? Is this related to the transfer of a 403b? Would a taxable or IRA transfer be quicker? Is the potential loss of time out of the market a potential offset to any bonus gain one may accrue?

Harry Sit says

Transferring a taxable account or an IRA is faster because it goes electronically through ACATS. Transferring out of an employer plan almost always goes by a paper check unless it’s staying in house (TIAA 403b to TIAA IRA). Funds in the plan must be sold. A check has to be printed and mailed (rarely by overnight delivery unless you requested it and paid extra for it). Sometimes the check is mailed to you. Sometimes it’s mailed to the receiving institution. The receiving side has to pick up the mail, recognize what it is, and apply it to your account. You can wait a long time if anything goes wrong in this process.

The best way to roll over an employer plan is to roll it over to an in-house IRA and then transfer IRA-to-IRA to your preferred destination. See How to Roll Over a 401k without Going Out of the Market.

RH says

As I noted on the other recent article about brokerage bonuses, check Doctor of Credit before committing to an offer code as sometimes there is a better offer floating around on internet than is advertised in marketing materials and direct mailers. A brokerage might advertise $600 bonus on their homepage but you can actually get $750 bonus with a different code, for otherwise identical terms (same deposit amount, etc.)

The brokerage bonuses are great since you get the bonus on holding anything – stocks etfs etc., not the same as savings account bonuses where you have to suffer paltry interest rates for eventual bonus. The Wells Fargo one in particular is awesome if you have that much in assets ($250k+ to get the $2500), since you can get it for having assets just sitting there invested in the exact same stock/ETF you would otherwise be holding in a different account elsewhere.

One downside of the WF offer is have to do branch visit to sign up (not online), and also if account dips below the $250k during 90 days then lose bonus. But one bright side – can access to other firms’ money market funds that normally require higher minimums to buy elsewhere – e.g. can buy fidelity MM treasury funds that at Fidelity you would need $1M+ account to purchase, but via WellsTrade buy for any amount (and account size).

Keith says

Thank you Harry. My bad for not checking your articles before initiating the 403b transfer. I did consider transferring the 403b to my TIAA IRA before the Vanguard transfer because I had some vague idea that that may be advantageous – I just didn’t follow up. Note though: I completed TIAA transfer forms for both the 403b and a tIRA. Neither balance has shown at Vanguard yet. Live and learn. I’ve bookmarked your article for a possible future transfer of a Fidelity 403b to Vanguard.

Harry Sit says

The IRA transfer request should’ve been submitted through Vanguard (the receiving broker). Then it would’ve gone through ACATS. When you request the IRA transfer through TIAA (the sending side), TIAA can only liquidate and send a check.

A side benefit of chasing transfer bonuses is that you master how to transfer an IRA through repeated practice. 🙂

Keith says

Thanks! IRA transfer process duly noted. Yep – I could use the practice. 🙂

If/when I transfer my Fidelity 403b and IRA I will be better prepared.

Keith

Bob says

Great post! Would you please follow up with the formulas to calculate: (1) the implied interest rate of a bank/brokerage offer; and (2) the APY for a bank/brokerage offer?

Harry Sit says

I don’t think the interest rate or the APY is a good way to measure the attractiveness of an offer. Because it takes the same amount of effort to transfer $500,000 versus $50,000, I’d rather have a low APY on $500,000 but a higher bonus in dollars than a high APY on $50,000 but a lower dollar amount.

Bob says

Harry — I can readily calculate the total return on a bank/brokerage offer, but what I (and other I think other investors) need is an easy way to compare, on an apples to apples basis (that is, APY), a bank/brokerage offer to either (a) another bank/brokerage offer of a different term or (b) other investment opportunities (like a T-Bill of a different term to the term of the bank/brokerage offer). Can you help us with that math, please? Thanks, and keep up the great work!

Harry Sit says

Bob – This post is about brokerage transfers. Bank transfers are totally different. An APY calculation makes sense for bank transfers but not for brokerage transfers.

In a bank transfer, you transfer cash, and the cash earns the interest rate set by the new bank with a bonus added on top. You compare the rate at the new bank plus the bonus with the rate at your current bank or with T-Bills.

In a brokerage transfer, you transfer shares and your investments stay in the same shares. They’ll earn or lose the same whether you transfer or not. It doesn’t make sense to compare with T-Bills because if you want T-Bills you can invest in T-Bills in both your current account and the new account and the bonus will still be on top of the interest from T-Bills. A brokerage transfer bonus is a pure bonus. You don’t need to calculate the APY. Just look at the dollar amount you expect to earn in a year.