Update on July 3, 2020: New California state budget for 2021 preserved funding for the state premium assistance. The program design for 2021 carried over the same design from 2020.

Ever since the Affordable Care Act came out, some people who buy health insurance on the ACA exchange have to watch carefully for the premium subsidy cliff. The Premium Tax Credit is cut off at 400% Federal Poverty Level. If your income is $1 higher than the cutoff, you lose all the premium subsidy, which can be well over $10,000 depending on your age and your household size.

If you live in California, you may be able to breathe a sigh of relief in the next few years. California passed a law in 2019 that extends the premium subsidy to 600% Federal Poverty Level (FPL) for three years starting in 2020. California will pick up where the federal government leaves off. News media such as Los Angeles Times reported this in California Gov. Gavin Newsom has signed his first budget. Here’s where the $215 billion will go:

“Based on federal guidelines, subsidies will be available starting in January to individuals earning up to almost $75,000 a year and families of four earning as much as $154,500. The subsidies to purchase health insurance will be highest for those who earn the least, with the lowest earners eligible for enough financial assistance to pay their entire monthly premiums.”

However, in typical treatment by news media, they don’t tell you the details. Subsidies will be available. How much can people expect? If you want to know how the California state subsidies really work, you have to come to my blog. 🙂

Caveats

Before you get too excited, please note:

1) This only affects California. The additional subsidies come from the state budget.

2) The law only covers three years: 2020, 2021, and 2022. The law may or may not be extended for 2023 and beyond.

3) The specific program design depends on the state budget appropriations each year. The state board has published the program design for 2020 and 2021. The subsidies in 2022 may be substantially higher or substantially lower.

4) In the program design for 2020 and 2021, the state subsidy for incomes greater than 400% FPL drops off sharply. If your income is more toward the higher end of the range, you may not get much from the state after all. And if your income is above 600% FPL, you will get nothing.

California State Premium Assistance

The California law also offers small additional premium subsidies on top of the federal Premium Tax Credit for incomes between 200% FPL and 400% FPL. In this post I will first focus on the state subsidy for those who don’t qualify for the federal Premium Tax Credit today when their income is above 400% FPL. Please skip to the end for the additional state subsidy for incomes between 200% FPL and 400% FPL.

The California state subsidy is called the State Premium Assistance.

The State Premium Assistance follows the same structure as the federal Premium Tax Credit (see ACA Health Insurance Premium Tax Credit Percentages). The state says based on your income, you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. After you pay that amount, and after any federal Premium Tax Credit (none for those with income above 400% FPL), the state will pick up the rest. If you choose a more expensive policy or a less expensive policy than the second lowest-cost Silver plan in your area, you pay or save 100% of the price difference.

Also similar to the federal Premium Tax Credit, you first get an advance premium assistance in the form of a lowered premium based on your estimated income. Then you calculate your actual State Premium Assistance based on your actual income when you file your California state income tax return. You pay or get a refund of the difference between the advance premium assistance and the actual premium assistance.

Calculation

To calculate the California State Premium Assistance, first you find out where you stand relative to the Federal Poverty Level for your household size. For 2021 coverage, the Federal Poverty Levels are:

| Number of persons in household | FPL |

|---|---|

| 1 | $12,760 |

| 2 | $17,240 |

| 3 | $21,720 |

| 4 | $26,200 |

| more | add $4,480 each |

Then you find out the percentage of income you are expected to pay toward a second lowest-cost Silver plan in your area.

| Income | Expected Premium |

|---|---|

| 400% – 450% FPL | 9.68% – 14% of income |

| 450% – 500% FPL | 14% – 16% of income |

| 500% – 600% FPL | 16% – 18% of income |

Finally when you choose a less expensive plan, your net premium is:

Expected Premium – (2nd Lowest-Cost Silver Plan – Plan Chosen)

When you choose a more expensive plan, you net premium is:

Expected Premium + (Plan Chosen – 2nd Lowest-Cost Silver Plan)

Let’s see an example.

Suppose a household size of two in California has $70,000 income in 2021. The full premium for the second lowest-cost Silver plan in their area is $16,000/year. The full premium for their chosen Bronze plan is $12,000/year. What will this household pay in 2021 after the California State Premium Assistance?

Their income as a percentage of FPL is:

$70,000 / $17,240 = 406%

Because this is above 400%, they don’t qualify for the federal Premium Tax Credit. Without the California State Premium Assistance, they will pay $12,000, the full premium for their Bronze plan.

With the California State Premium Assistance, when their income is between 400% and 450% FPL, their expected premium as a percentage of income is prorated between 9.68% and 14%:

9.68% + (406 – 400) / (450 – 400) * (14% – 9.68%) = 10.20%

Their net premium for their Bronze plan after the California State Premium Assistance is:

$70,000 * 10.20% – ($16,000 – $12,000) = $3,140

When their net premium is reduced from $12,000 to $3,140, that’s nearly $9,000 in subsidy from the state of California. For a married couple with $70,000 AGI, their California state income tax is about $1,400. The $9,000 health insurance subsidy from the state is over six times the California state income tax they pay!

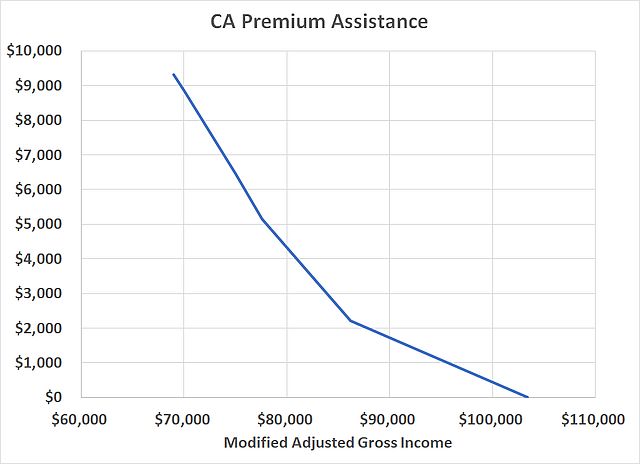

If we do the same calculation for different incomes, the results look like this for our two-person household:

Remember a Bronze plan has $6,000 deductible for single and $12,000 deductible for a family plan. It’s still expensive at higher income levels, but at least you won’t have to worry about the sudden jump when you fall off the cliff for the federal Premium Tax Credit.

Also note the California premium assistance decreases sharply in this chart. At the beginning of the range, the California premium assistance decreases by about $500 for each $1,000 in additional income. When you lose the state subsidy that fast, you have a big incentive to keep your income down.

Bottom line, the California State Premium Assistance for ACA health insurance is great news to California residents who don’t qualify for the federal Premium Tax Credit because their income is too high. If ACA health insurance is too expensive for you because you don’t qualify for the federal subsidy, go to California.

Additional Subsidy for 200% – 400% FPL

Now we look at the small additional premium subsidy from the state of California to those who already receive the federal premium tax credit. The additional subsidies from the state are calculated by lowering the applicable percentages of income you are expected to pay toward a second lowest-cost Silver plan.

| 2021 Income | Federal | California |

|---|---|---|

| 200% – 250% FPL | 6.52% – 8.33% | 6.24% – 7.80% |

| 250% – 300% FPL | 8.33% – 9.83% | 7.80% – 8.90% |

| 300% – 400% FPL | 9.83% | 8.90% – 9.68% |

Translating the savings to dollars, for a household size of two in 2021:

| 2021 Income | California Premium Subsidy |

|---|---|

| $34,480 | $8/month |

| $43,100 | $19/month |

| $51,720 | $40/month |

| $68,960 | $9/month |

For a household size of four in 2021:

| 2021 Income | California Premium Subsidy |

|---|---|

| $52,400 | $12/month |

| $65,500 | $29/month |

| $78,600 | $61/month |

| $104,800 | $13/month |

As you see from the tables, the additional subsidy from California first increases as your income goes from 200% FPL to 300% FPL. Then it drops down as your income goes from 300% FPL to 400% FPL. I guess the theory is that at the lower incomes your premium after the federal premium tax credit is already low enough. Therefore you don’t need much additional subsidy from the state. As your income goes past 300% FPL, you can afford more of the premium yourself. So again you don’t need as much additional subsidy from the state.

Reference:

- 2021 State Subsidy Program – Program Design Document, Covered California

- Resolution 2020-41 — State Subsidy Program Design for PY 2021, Covered California

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

always_gone says

Not being able to print money, how does California continue to pay for this, whilst in so much debt?

Harry Sit says

You can read all the details about the state’s budget this year in the report from the Legislative Analyst’s Office.

https://lao.ca.gov/Publications/Report/4083

Out of $148 billion of spending funded by $144 billion of tax revenue, the new State Premium Assistance only costs $0.4 billion. Taking the scale down to the household level, if I have an annual budget of $148k, I can easily find $400 for something I want by spending $400 less elsewhere.

upper48 says

The state is running a surplus today. It’ll pay for this as well as pay down the debt.

As an early retiree, it looks like I will get subsidized healthcare if I keep my income down (ie: minimize realizing capital gains). It is absurd that with my net worth, the state would subsidize this for me.

Gary Whiddon says

I have sold health insurance for 40 years and it is so sad that California is trying their best to provide free subsidy money for families within 600% of poverty level. It costs our state more money that we do not have to waste. Giving subsidies to families within 400% of poverty is more than reasonable, but California is trying to keep their Covered CA dream alive regardless of expense. Giving more subsidies is their last ditch effort at our expense.

If you look at small group rates, you can find Kaiser and Blue Shield bronze plans for significantly less, but there is no subsidy. Covered CA actually encourages older people to enroll with their subsities which means the Covered CA pool will have more older people. And with Obamacare restricting insurance companies to limit the rate spread between a 21 year old and a 64 year old to be no more than three times, it means they will not collect enough money to cover the risk of an older person. So this means a higher prices (paid by our state) as younger people leave the Covered CA pool. Government takeover of our healthcare system is not the answer to getting good care. They want to create a monopoly so they can restrict coverage and manage it like the post office. We the people will not have choice if that happens. Choice in a free market is important, I hope and pray California will elect people who will promote the free market system. Why don’t we pay for subsidies to illegals?

People who do not receive subsidies will go to the small group market and start a two person group so they can get cheaper health insurance. That is my prediction.

Ron says

Does CA use the same rules for MAGI that Fed uses, particularly with regard to HSA’s? CA does not recognize HSA’s but thinking they must be allowed for income calculation for insurance.

Harry Sit says

It does for the purpose of calculating the state premium assistance. From the Program Design document referenced at the end, bottom of page 3:

“(10) “Modified adjusted gross income” has the same meaning as the term is defined in subdivision (d)(2)(B) of Section 36B of the Internal Revenue Code and its implementing regulations in 26 C.F.R. Section 1.36B-1(e)(2).”

John Hamnn says

Thank you. Very informative article, but I plugged you numbers into the Covered California website and the subsidy was only about $180 per month. Here is where I did it: https://apply.coveredca.com/lw-shopandcompare/

Harry Sit says

Which numbers? What income, household size, ages, and zip code? For the same income and household size, younger people face lower premiums and will receive a lower subsidy than older people.

Brenda says

Hi, I was wondering if my husband can get the subsidy. I have insurance from my work, but we can’t afford 800.00 a month for his insurance. He is unemployed right now studying to be real-estate agent. I only make 24, 000.00 dollars a year. He is 58.

Harry Sit says

You have to compare the cost of insurance from your work for you alone with the household income for both of you. You qualify if that ratio exceeds a certain number.

https://www.healthcare.gov/glossary/affordable-coverage/

Chris says

What is going to happen if I estimate our income above the 400% FPL in Covered CA, but we end up below it? California will pay the subsidy based on the estimate. How does CA get that money back from the federal government when we file our taxes showing the <400% FPL MAGI?

Harry Sit says

Think of the money they pay to the insurance company as an interest-free loan to you. When you file your taxes, if you qualify for the federal premium tax credit, you will get it from the federal government, and if you don’t qualify for the California subsidy, you will have to pay back the loan from California.

Glenn says

It is an ill-conceived concept to maximize subsidies for 2 people to $101,460 and then completely eliminate those subsidies if this couple makes $102,000. The difference in premiums between those two cases is around $20,000 in my zip code for a bronze plan. That means an extra $500 in income results in this couple taking home $19,500 less in income. This is an egregious lack of foresight. The subsidies should be prorated in a gentle slope not a precarious cliff.

Harry Sit says

Which zip code is that and at what ages? Without the California subsidy the difference is only larger and it comes much sooner.

Steve says

If I go through 2020 estimating my family of 4 at 350% of FPL, but end up at 450% of FPL, how does it play out when I file my taxes? As the article notes “Also similar to the federal Premium Tax Credit, you first get an advance premium assistance in the form of a lowered premium based on your estimated income. Then you calculate your actual State Premium Assistance based on your actual income when you file your California state income tax return. You pay or get a refund of the difference between the advance premium assistance and the actual premium assistance.” So… when I file… I go over the ACA Subsidy Cliff… the IRS wants say $20,000 back… Does CA write me a check for $20,000 to cover that when I “get a refund of the difference between the advance premium assistance and the actual premium assistance”?

Harry Sit says

As the chart shows, the California premium assistance is less than the federal premium tax credit. If you must pay $20,000 back to the IRS, you get a portion of it as a refundable tax credit on your California state income tax return, not the full $20,000.

Steve says

If I could make a helpful contribution, you can also just look at the chart here https://www.coveredca.com/PDFs/FPL-chart.pdf Covered CA seems to put up new versions every year. Just be sure you’re looking at the right year.

Steve says

This is really kind of amazing. So for the next three years, California rounds off the cliff. I asked my tax accountant to run some simulations of different income levels. But I don’t think the data processing service they use to run their clients returns is ready to process this yet at the time of this writing. My family income is difficult to predict, and the old cliff could really play havoc with our taxes. But in our situation, early next year when their software is up to date, we can still stay clear of that roll off by using traditional IRA or SEP IRA to keep our MAGA down. Does “refundable tax credit” mean CA FTB actually gives me all that money back by direct deposit into my checking account or mailing me a check? The other amazing thing is you’re one of the few people discussing or quantifying the old sharp cliff or the new gentle cliff. For certain households this should be front page news.

Harry Sit says

A refundable tax credit means money from the state after you file the state income tax return. In the example in the post, if they didn’t get the premium assistance as an advance paid by the state directly to the insurance company during the year, they will get that $8,377 when they file their tax return. If they would owe the state $1,000 without this credit, they will get a $7,377 tax refund now. If they otherwise would get $1,000 tax refund from the state, they will get $9,377 now.

This made news when the law came out last year. Most people affected already saw a reduction in the premium quote during open enrollment for 2021. They are getting the state premium assistance as an advance. The tax return only reconciles the difference between the credit due based on the actual income versus their estimate at open enrollment. If their estimated and actual 2021 income will sit on different sides of the 400% FPL line, they will either pay back the IRS and get a portion back from the state or pay back the state and get more back from the IRS.

Having a catch net is great for Californians who fall off the federal ACA cliff.

John Dsouza says

Harry, is this calculation updated at coveredCA so I can price it directly on their website?

I want to do Roth conversions so need to get the amount more or less accurate for 2021.

Harry Sit says

CoveredCA has 2020 prices right now. 2021 prices will be available when open enrollment starts in October. This state premium assistance is more for people who can’t make their income qualify for the federal premium tax credit. If you do Roth conversions, you don’t want to activate the state subsidy by taking your income above 400% FPL, because for each $100 over 400% FPL, you pay almost $50 more for health insurance. Although it’s a lot better than getting no subsidy at all, it’s still a very steep price to pay when you go over the 400% FPL cliff.

Eric says

Preliminary 2021 prices are available on this CoveredCA web page: https://hbex.coveredca.com/data-research/

Dave Jespers says

I experienced a “life event” (job loss) at the end of July. I called covered California and answered a number of questions, after which they determined my income level and a corresponding subsidy. Based on this I enrolled in a plan, but the agent requested that I submit an “income verification” affidavit after my final paycheck. I did so, and after it wasn’t processed for 3 weeks I called covered California back. They recalculated the subsidy and found that it dropped by approx. $300/mo.

Is subsidy calculation in this situation based on the entire year’s estimated income (including unemployment) or the estimated income from the time of the “life event” (including unemployment)?

Thanks!!

Harry Sit says

It’s based on the entire year’s income (including unemployment). If you find a job or receive more in unemployment, you may have to pay back some of the subsidy when you file your taxes.

Nusrat Asrar says

Hi,

I am in a bind here as a result of income more than reported to covered Ca difference of about 5k. I got FTC for the whole of 2020. Since my income exceeded the limit for FTC I have to pay back the whole amount listed in 1095-A.

Does anyone here know in this situation will Covered Ca send me a corrected 1095-A and 3895 ?

Since I did not take any state subsidy the 3895 form has all zeros in 3rd column. As a reason my state tax return has gone up a significant amount covering what I need to pay IRS.

If I file my taxes as it is. Will the State refund of this big of an amount be added to my income next year ?

Most of the state refund will be utilized to pay IRS tax due.

Thanks in advance

Harry Sit says

That’s exactly how it’s supposed to work. When your income is too high for the federal subsidy, California makes it up partially. You pay back the federal government and you get a refund from the state. When you take the standard deduction on your federal tax return, which ~90% of all taxpayers do, the state tax refund isn’t taxable.

Wazizi says

The ARP act forgives any penalties on the federal subsidies for 2020 only so you don’t have to pay back the fed at all and the CA refund still kicks in – seems like a windfall coming your way.

Nusrat Asrar says

Hello Harry,

Thanks for the prompt reply. It helps .

Leslie Cornofsky says

Hi Harry. At this point with new covid 19 bill. Capping ACA 8.5 % of income. Will covered cali. Be adjusting costs?

If retired I have been keeping income at 400% FLP.

Will I be able to adjust my draw. During the current year?

Many thanks

Les.

Harry Sit says

I don’t think California will pass a new law to give additional benefits. When the federal government gives a better benefit for 2021 and 2022, California won’t have to pitch in extra anymore.

Eric says

Hi Harry, Section 9663 of the recently passed American Rescue Plan states that for Premium Tax Credit purposes, for those who receive unemployment compensation in 2021, “there shall not be taken into account any household income of the taxpayer in excess of 133 percent of the poverty line for a family of the size involved”.

However, in California, 133% of FPL puts you into the Medi-Cal program. Does this mean that if you receive unemployment benefits in 2021, you are not eligible for the PTC?

Harry Sit says

The opposite. It means if you get one week of unemployment in 2021, even if you end up making $1 million during the year, you get PTC equal to the full cost of the second lowest cost Silver plan. It gives a strong incentive to apply for unemployment.

Laura says

Hello, July 2020 I reached 62 and started drawing my Social Security of $1270 per month. I immediately notified Covered CA of my earnings increase. The outcome of that made my premium go down by over $100 per month! Still don’t understand why if making more money I pay less premium? Prior to March Relief Plan changes I try to enroll in Covered CA but the rates for me were all over $800 per month and subsidy only under $20 per month. Turns out I exceeded the 400% of poverty level for 2021 so I didn’t enroll. Now since the Relief plan changes I can get an affordable rate for a Bronze Plan, so I enrolled again effective 5/1. OK here’s my problem, I have read that for 2020-2022 California will give subsidies to people who earn up to 600% of the FPL but California is making me pay back every bit of the $2600 of subsidy they chipped in for me for. This I don’t understand. Thank God for the American Rescue Plan forgiveness from the IRS or I would be paying them back over $4000 as well! Does this seem right that I would have to pay everything back to CA FTB? Is it possible that they messed up my 1095 & 3895 forms? Is it worthwhile to try to call them to make sure they are correct?

Thank you for your help, I do my taxes online so I don’t really have anyone to consult.

Harry Sit says

California’s subsidy for income up to 600% of FPL was based on the assumption that you didn’t qualify for a subsidy from the federal government. After you do your taxes, if it turns out you’re getting a federal subsidy after all, California wants its money back. You’re using the money from the IRS to pay California. You’re still better off because the federal subsidy is higher than the California subsidy.

Chris says

Hi Harry, back on 12/31/2019, I asked:

“What is going to happen if I estimate our income above the 400% FPL in Covered CA, but we end up below it? California will pay the subsidy based on the estimate. How does CA get that money back from the federal government when we file our taxes showing the <400% FPL MAGI?"

You answered:

"Think of the money they pay to the insurance company as an interest-free loan to you. When you file your taxes, if you qualify for the federal premium tax credit, you will get it from the federal government, and if you don’t qualify for the California subsidy, you will have to pay back the loan from California."

This indeed happened, and now I am doing my taxes. Sure enough, the Federal form 8962 is showing that I am owed about $17k. Now I am filling out the CA form 3849. The "excess advanced payment of PAS" is about $14k (line 27). BUT line 28 is a "repayment limitation", which is only $1550. It appears that I could legally PROFIT by about $12.5k (at CA's expense). That clearly isn't right. However, if I do have to pay the full $14k back to CA, it means I have to pay that on May 17th, but I won't have the federal refund until sometime later. Fortunately, that wouldn't be a problem for me, but it could be for some people. I'm really not sure what to do now.

Chris says

Replying to myself. Found this: https://www.caltax.com/forums/topic/form-8962-3849-premium-tax-credit

It’s pretty clear that the “Repayment cap may not apply” box SHOULD have been checked on my form 3895, so I will assume that. It still means I’ll have a very large CA tax bill that I have to pony up before I have the federal refund in hand. It’s too bad that the money cannot be transferred directly from the IRS to the FTB.

Patrick says

For 2020, I estimated that I would earn less than 400% of FPL, but I actually earned a bit more than that (but less than 600%). As a result, I had to re-pay my Federal subsidy as part of my Federal taxes, but received a portion of it back, included in my California state tax refund, as a California insurance subsidy. So, looking to my 2021 taxes, I know state tax refunds are normally taxable for Federal tax. But, is the portion of my California refund that was a 2020 insurance subsidy also taxable?

Harry Sit says

The American Rescue Plan waived the repayment of the federal advance premium tax credit for 2020. If you already repaid the federal subsidy, you will automatically get it back from the IRS (many people already did, with interest). Because you received the federal subsidy, you’re not eligible for the California subsidy. You should amend your California return and send the California subsidy back to the state.

Kristen says

How do you avoid the gap in coverage between when you lose Medi-cal and start Covered California?

Harry Sit says

Apply for Covered CA as soon as you get the inkling you’re about to lose Medi-Cal.

Kristen says

Covered CA refers you back to Medi-Cal if you’re still eligible and doesn’t allow you to apply until you’re ineligible for Medi-Cal. And Medi-Cal doesn’t give you much notice–I think 10 days? So this almost guarantees there’ll be a break in coverage. Why doesn’t Medi-Cal cover until the end of the month so there isn’t a gap?