After Alabama made its state law conform to the federal law, California and New Jersey are the only two remaining states that don’t recognize Health Savings Accounts. After reading my updated Best HSA Provider for Investing HSA Money, a reader asked me about having an HSA as a California resident.

I’m familiar with it, because I also live in California. Someone in New Jersey please point out how New Jersey works differently than California. If you live in other states, you don’t have to be concerned with this unless you are curious for a family member or you think one day you will come to live in the great state of California or New Jersey.

Contributions Through Payroll

Because the state of California does not recognize HSAs, your HSA contributions are not tax deductible for California state income tax.

If you are contributing through your employer, a properly configured payroll system will handle this for you. Your HSA contribution will be deducted from your gross pay for calculating the federal tax withholdings. It will not reduce your California state income tax withholding. If your employer contributes to your HSA, you pay California state income tax on that money as well.

After the year-end, the total HSA contributions (your own and your employer’s) will be excluded from the number on your W-2 box 1 Wages, tips, other compensation. As a result you don’t pay federal income tax on the HSA contributions. However, the total will be included in the number on your W-2 box 16 State wages, tips, etc. It also shows up in Box 12 with a code W. The difference between the higher number in box 16 and the lower number in box 1 will go as an adjustment on the California state income tax return, on Schedule CA (540), line 7, column C Additions.

Tax software usually handles this automatically when it sees different numbers in those two boxes on your W-2.

After-Tax Contributions On Your Own

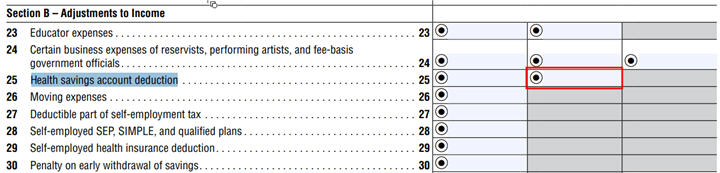

If you contribute to the HSA on your own with after-tax dollars, the HSA contributions you fill out on IRS Form 8889 becomes a negative adjustment to income on your Form 1040. On the new draft form, it’s on line 25 of Schedule 1. Your federal AGI is reduced. You pay less federal income tax.

However, on your California state income tax return, because your federal AGI is reduced, you have to back out that deduction. This is done on the Schedule CA (540), line 25, column B Subtractions.

Tax software also usually handles this automatically when you have an entry on line 25 of your federal Form 1040 Schedule 1.

Earnings Inside The HSA

Because the HSA earnings are tax-free at the federal level, the HSA provider won’t send any 1099 for the earnings. Those earnings are still taxable by California. You have to go into the HSA account statements and tally up all the earnings during the year. This includes all interest and dividends paid inside the HSA.

The HSA earnings again must be included on the Schedule CA (540), column C Additions. If you use tax software, you have to figure out how to make the software do it. If you use a tax preparer, make sure you give the HSA earnings to your tax preparer and make sure the earnings are included on Schedule CA (540), column C Additions.

Realized Capital Gains Inside The HSA

When the investments inside your HSA distribute capital gains, or when you sell investments inside your HSA for more than what you originally paid, the gains are not taxable at the federal level. The HSA provider won’t send any 1099 for the gains. In order to calculate the gain or loss on each sale correctly for California state income tax, you have to track very carefully every purchase and sale inside the HSA, including all the reinvested dividends and interest.

After you calculate the gain and loss on each sale during the year, you add them up. If the total is a gain, you include the gain as a positive adjustment on Schedule CA (540), column C Additions. If the total is a loss, you include the loss — up to a limit — as a negative adjustment on Schedule CA (540), column B Subtractions.

The limit of the negative adjustment is your federal capital gains plus $3,000.

- Suppose you had $1,000 in capital gains on your federal income tax return, you can take up to $4,000 in California capital loss as a negative adjustment to your California income. If you have a higher loss than that, you will have to carry the remainder to future years.

- Suppose you already took $3,000 in capital loss against your income on your federal tax return, you can’t take any additional California capital loss. All the California capital loss must be carried over to future years.

By the book you are supposed to file Schedule D (540) to reconcile the additional California capital gain or loss. However, because California does not tax capital gains any differently from ordinary income, whether it’s a long-term gain or a short-term gain, I take a shortcut. I just lump the capital gains together with the dividends and interest paid inside the HSA as Other Income for California in the tax software. I don’t think they will have a problem with me treating [positive] capital gains as ordinary income. If you are able to do it by the book, do it by the book.

If I have a loss instead of a gain, I can’t do this lumping because there are limits on how much loss I can take as a negative adjustment to income. Because of this complexity, I just don’t sell when I have a loss.

Only Treasury Bond Funds In HSA?

Due to the additional tax complexity when you have an HSA as a California resident, some people suggest investing the HSA money only in Treasury bonds or Treasury bond funds.

Interest paid by Treasury bonds are exempt from state income tax. Limiting yourself to only Treasury bonds or Treasury bond funds will spare you from worrying about paying California tax on the earnings inside the HSA. But, it won’t make it any easier for capital gains. Capital gains on Treasury bonds or Treasury bond funds are still taxable by California. You still have to track all your purchases and your sales. You will have more tracking when you reinvest interest.

Investing only in Treasury bonds or Treasury bond funds in the HSA helps a little bit on the distributed earnings, but it doesn’t relieve the bigger hassle of tracking purchases and sales. After all, adding up the total distributed earnings during the year isn’t that difficult. Many financial institutions report the total interest and dividends paid on the statements.

In New Jersey, capital gains from Treasury bond funds are also tax exempt. Therefore having the HSA money only in Treasury bonds or Treasury bond funds would help eliminate the need for tracking earnings and capital gains inside the HSA.

Make Your Life Easier

In theory, for state income tax purposes, having an HSA is just like having any other taxable account. Having to pay tax on earnings and capital gains isn’t a reason for not investing in the HSA. The meticulous investors would just use software or a spreadsheet to track all purchases and sales as they always do for their taxable accounts. In practice, for everyone else, not having 1099s from the HSA provider for the sales makes it difficult to calculate capital gains.

Now that we know tracking purchases and sales for calculating capital gains is the bigger issue, we can do these to make our lives easier:

0. In New Jersey, put everything into a Treasury bond fund. New Jersey does not tax capital gains from Treasuries.

1. Don’t automatically reinvest interest and dividends. Making frequent small purchases will increase your burden of tracking. Just keep the interest and dividends in cash and use them to reimburse some medical expenses. I reimburse the previous year’s medical expenses before I invest the rest of the HSA money. See previous post HSA Money: Cover Expenses Now or Let It Grow?

2. Buy just one fund. The fewer investments you have in the HSA, the easier it is to track. Even if you contribute through payroll and you invest new money throughout the year, when you have only one fund, you can treat all purchases as one, like this:

- Number of shares owned as of 12/31 prior year: 123.45

- Total basis as of 12/31 prior year: $2,000

- Number of shares owned as of 12/31 this year: 234.56

- New shares purchased this year: 234.56 – 123.45 = 111.11

- New money invested this year: $3,000

- Total basis as of 12/31 this year: $2,000 + $3,000 = $5,000

3. Don’t sell. If you don’t sell, you won’t have a capital gain or loss. No capital gain or loss, no extra reporting on the gain or loss. You still need to track purchases, because one day you may need to sell.

4. Don’t sell when you have a loss. Selling at a loss requires additional reporting and possibly carrying over the excess loss to future years. It just adds to the hassle. There is no deadline for reimbursing medical expenses. Wait until you have a gain.

5. If you must sell, sell all shares purchased in one specific year. To continue the previous example, if you must sell in the future, sell 111.11 shares purchased in a year as one unit. You know the basis associated with those 111.11 shares was $3,000. Doing so makes it easier to update your remaining basis.

- Number of shares owned as of 12/31 prior year: 234.56

- Total basis as of 12/31 prior year: $5,000

- Number of shares sold: 111.11

- Basis for the shares sold: $3,000

- Number of shares owned as of 12/31 this year: 198.76

- New shares purchased this year: 198.76 – (234.56 – 111.11) = 75.31

- New money invested this year: $2,000

- Total basis as of 12/31 this year: $5,000 – $3,000 + $2,000 = $4,000

It’s unfortunate that California doesn’t make it easy for us. Before the state changes the law, if you follow the practice above, you will have a much easier time in reporting California taxes for your HSA.

How Do They Know I Have an HSA?

After reading all this, some may be thinking “It’s so much hassle! How do they know I have an HSA?” As everything to do with taxes, we do it by what the law says, not by whether we think the law is justified or not, or by how likely the authorities will catch a violation. See previous post Paying Taxes: By The Book Or Catch Me.

Besides, it’s quite obvious to the state that you have an HSA. When you contribute to the HSA via payroll, the contributions are right there on your W-2, box 12, code W. When you contribute to the HSA on your own, you take the deduction on your federal tax return, Form 1040, line 25. You attach the federal tax return when you file your state tax return. The state sees your HSA deduction on your federal tax return. In the day and age of big data and artificial intelligence, it’s quite easy to figure out you have an HSA.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Trent McBride says

I was thinking #1 under “make your life easier” was going to be: “Move.”

How is this the first I’ve ever heard of this? I would have expected to seen people complaining about this on various groups and boards I frequent where people extol the virtues of HSAa, but no. Is it possible that people in these states don’t know?

Harry Sit says

I don’t know about New Jersey but California has been great for me. I couldn’t have made this far if I didn’t move to California.

Ann says

I don’t want to move from California any time soon, but would it make sense to hold onto HSA in an investment account and then sell it one day if I move? That way I only would report dividends and interest annually which is easier to keep track. It seems like a lot of work to keep track of every time i sell or buy something. I had enabled the HSA company to automatically invest money every time my cash balance is above $2000 so it’s probably going to be a nightmare to work backwards. I hopefully won’t need any of this money soon.

Harry Sit says

Ann – That would be part of #3 “Don’t sell” or “Don’t sell until the year you are no longer subject to California income tax.”

Hongyan says

I live in California and was thinking how to do HSA taxes. Your article is surely a big help. Thank you!

In the article, “The limit of the negative adjustment is your federal capital gains plus $3,000” is mentioned. Does it mean if I do not have any federal capital gains (I did not sell anything to incur it), I can at least claim up to $3000 loss? I have <$3000 realized loss in my HSA this year. Can I also take the "shortcut" as you did in tax software (lump the capital loss together with the dividends and interest paid inside the HSA as Other Income for California)?

Harry Sit says

That’s correct. If you don’t have any capital gains on the federal return, you can claim up to $3,000 loss against your income on the California return. However, I would feel more comfortable in listing the earnings and the loss separately.

msf says

With respect to people knowing about this, all I can say is that I did. I just checked my 2007 CA return where I declared my contribution on form CA540, line 25(B) as Harry described, and included the interest as part of the total interest adjustments on line 8(C).

In Calif. and NJ, one does not need to invest in Treasury bond funds to get taxable interest that is exempt from Calif. tax. One can invest in other federal government bonds or bond funds – the income may still be state tax-free. (Calif. taxes interest on bonds issued by FNMA, FHLMC, and GNMA, but not bonds issued by some (not all) other federal agencies like FHLB and FFCB.

See Calif. FTB Pub 1001 (2017) and Vanguard, U.S. government agency bonds.

On the flip side, unless 100% of the income comes from federal obligations, a small portion of the income is state taxable (in all states). See, e.g. JP Morgan’s Funds 2017 Distribution Notice; even its 100% U.S. Treasury Securities Money Market Fund distributed taxable income (2.72% of its income for 2017).

Finally, even for those Treasury funds, don’t forget to include reinvested dividends as part of your basis. So in example #2 above, the ending basis includes not just the original $2K plus the $3K invested this year, but the (tax free) dividends reinvested this year.

David D says

I live in NJ and didn’t realize this. It appears that I receive a tax form from the company that handles my HSA, so I don’t have to track anything myself. The tax software handles the rest. However, I’m disappointed to learn that NJ is taxing me more in another area of my life.

Harry Sit says

Please take a look at that tax form. Chances are it’s reporting your contribution into the HSA or your distribution out of the HSA, not your interest, dividend, or capital gains inside the HSA.

David D says

Well, you may be correct. I do not make enough interest in the HSA to claim anything (less than $4/year). But, I see nothing concerning the dividends being reinvested. I only have 2 index funds, so it should not be too hard to figure out. I have emailed the HSA service provider to get their take on this.

David D says

Just to follow up to my last comment. I contacted the HSA provider and they recommended I consult a tax consultant/advisor. So, they do not provide this information, nor will they help obtain it.

Bob says

How about holding Berskshire Hathaway BRK.B in the HSA since they never pay any dividends?

One problem might be the large share price ~$200. I checked at Schwab where I hold my HSA and the bid/ask spread for a small number of shares was pretty small, about a dollar IIRC.

Another is that Buffet and Munger are both in their 90’s. But they claim to have good succession plans and so far have managed the company superbly.

Thoughts?

tomh says

How do you have an HSA at Schwab? They don’t offer them AFAIK.

Joe K says

New Jersey does not tax capital gains of Treasury Funds, so it makes sense to go all Treasuries in an HSA in New Jersey. You will still need to report any ordinary interest on money in the HSA.

As for handling on your taxes, NJ does not start with Federal numbers and adjust. The return starts with the NJ wages. There is a medical deduction over 2% NJ AGI, so be sure to track your medical costs. You can claim expenses that were reimbursed from the HSA since the HSA is not recognized as a tax advantaged account and transfers between taxable accounts are not taxable events.

NJ also does not reduce income for Medical, Dental and Vision insurance premiums deducted by the employer, so be sure to include those premiums when calculating your total medical expenses for the NJ medical deduction.

Harry Sit says

Thank you for the information about New Jersey not taxing capital gains on Treasuries. I added it to the body of the post so more people will see it. California still does.

John says

Not all the income from a treasury fund is derived from treasuries.

https://personal.vanguard.com/pdf/USGO_022018.pdf

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/GSE-MF-letter_2017.pdf

That means in NJ, you have to pay taxes on the non-exempt portion.

John says

Also, from my reading NJ doesn’t tax cap gains on the sale of treasuries but not treasury funds. So you’re in the same boat as CA.

Craig says

Is there any evidence that New Jersey taxes interest, dividends, and capital gains inside an HSA? California is pretty clear about it: “Interest or other earnings earned from a Health Savings Account (HSA) are not treated as taxed deferred. Interest or earnings in a HSA are taxable in the year earned.” (https://www.ftb.ca.gov/forms/2018/18-540CA-instructions.shtml) But I see no similar language from New Jersey. Is it possible they treat them like non-deductible Traditional IRAs, where contributions are not deductible, but everything that happens inside is tax-advantaged?

Harry Sit says

NJ 1040 instructions, page 12 (page 14 of the PDF): “Any other interest not specifically exempt”

https://www.state.nj.us/treasury/taxation/pdf/current/1040i.pdf

You need to find where the state specifically exempts interest earned inside an HSA. HSA or Health Savings Account isn’t mentioned in the instructions. It’s not specifically exempt.

Anon says

I see what you (Craig) are saying about interest and earnings being taxable in CA. But I have never received a form from any of the HSA custodians listing the income nor has the tax software ever prompted to get this detail. And this also has all kinds of implications – for example, if you have invested in some mutual fund under some HSA custodian, when you transfer to another custodian, you are forced to sell the mutual fund. So now, you would generate capital gains.

Craig says

It may seem unfair but those are the rules. When they say “other earnings” from an HSA it’s pretty unambiguous. And there is no law saying your brokerage has to report the amounts to you, but it’s still your responsibility. I know for California, TurboTax has separate additions for HSA interest, dividends, and capital gains in forms mode. But they don’t seem to ask you about it during the walkthrough.

Anon says

When there is no process for people to realize that (1) they have income, (2) they need to pay taxes on it, effectively it works out that almost nobody is following the law. Doesn’t seem any different from “use” tax for internet purchases that exists on the book but nobody that I have talked to has ever paid it. I am curious if you pay the “use” tax on internet purchases – may be we get lucky and finally find one citizen who pays this tax.

Having not known about this law, even if I were to try and fix the situation, there is no way for me to fix it. Between multiple custodians, I have no idea of what is my cost basis in the HSA. In the absence of paperwork, there is no way for me to say what is my “income”.

And talking about law – just go drive on any road in CA – most people are not following the speed limits. So if there is no enforcement, that is exactly what happens.

Craig says

I agree, it’s a crazy system where most people are not even aware they are breaking the law, and those that do would struggle to follow the rules anyway. I take no issue with those that decide not to report HSA earnings. The only sane way to run a state income tax system is to follow the federal rules. Adjust rates if you need more revenue, but don’t add special rules that will only punish people who are aware of them.

Anon says

Craig – fully agree with your comment about state(s) follow the federal rule!

Sergio says

Hi, Do you know if has changed the California rule to include HSA contributions (W-2 box 12 with code W) in the box 1 schedule CA (540) ?

I ask because I read this file from California FTB https://www.ftb.ca.gov/law/legis/17-18bills/ab1140-010318.pdf

(not very familiar with the interpretation of this type of document).

Craig says

The HSA deduction is included in Line 1 of Schedule CA (540), but there’s a separate adjustment to eliminate it. Check out Line 25. https://www.ftb.ca.gov/forms/2018/18_540ca.pdf

Harry Sit says

The rules didn’t change. That bill didn’t even make it out of the committee. The last page of the PDF shows who opposed the bill.

Sergio says

Hi, thanks for your support and prompt answer; this clarify the results of the software I’m using for Tax.

Anon says

You have to be careful that HSA contribution does not get taxed twice in CA. From what I am seeing, the HSA contribution is included in the state income on W2. However, the software is not recognizing that this difference is due to HSA. So then it takes the HSA amount and adds it as an “addition” to state income. So now the taxable state income has the HSA amount added twice.

[I am using HR block Deluxe crap edition].

Harry Sit says

The state income on W2 is listed on the CA 540 form but it’s not used in the calculation. The calculation starts with the federal AGI. And then you add or subtract the items on Schedule CA.

Anon says

Harry Sir – I checked and you are correct! It completely threw me off because of that state income computed based on W2.

ey says

Great article. i have fidelity tips fund only for my hsa but did not sweep dividends/interest to the core account until i read your article. How do I handle all the small reinvestments up until now? Is there some other way to handle the tax basis if I haven’t kept records of all these? thanks

Harry Sit says

If you have the fund at Fidelity, you can see the records of all the purchases. Click on the fund in the Positions tab, and then “Purchase History / Lots.” You will see the date, quantity purchased, and the cost basis. You can copy those out just to have another set of records of your own.

Tim says

I moved to California from Minnesota during the middle of 2018 and switched employers during this move. My employer while I was a Minnesota resident made HSA contributions. This HSA contribution is being considered as taxable income on my California state tax return. As this was income generated while I was a Minnesota resident, should this be taxed on my California state tax return?

Craig says

You should be able to take the HSA deduction on your Minnesota taxes. California would only be able to tax earnings (interest, dividends, and capital gains) in your HSA while you were a California resident.

Harry Sit says

State income tax for a part-year resident is usually pro-rated. You first calculate your California state income tax with income from both MN and CA, including the HSA contributions because California sees it as part of your total income. Then you multiply it by the percentage of your California income over your total income. Now because the HSA contributions are earned outside of California, you are not really taxed on them. For example, suppose you earned $50k in California, $47k plus $3k HSA contributions in Minnesota, and the California income tax for a full-year resident with $100k income is $X. You would then pay 50% of X. The $3k is part of your income in calculating X but it’s not in the numerator in calculating the percentage.

TH says

For California folks, for example, would investing 100% of your HSA funds into a CA muni fund simplify this a bit?

Assumption: this aligns to your overall allocation strategy

Harry Sit says

Investing in a CA muni fund has the same issue as investing in a Treasury fund. Income is not taxable but selling can generate a gain or loss, which requires tracking your purchases in order to calculate the gain or loss. So you might as well invest in a Treasury fund, which typically earns more interest than a muni fund of similar terms.

Anon says

I don’t know why anybody would invest in CA muni fund or treasury fund just for the tax reason. I have taken the long term view and invested in S&P 500 and it has done really well. And even after paying taxes on it, I would be way-way ahead of CA muni fund and/or treasury fund.

Leon says

Great website Harry! Although Alabama now conforms to the federal law for deducting HSAs (H.B 109 (Act #2016-345)), it doesn’t appear to have changed the state’s taxation of activity within an HSA account. Is this how you interpret the law change?

Even before 2018, an HSA contribution was state tax free but only if it was part of a Cafe-125 plan. This was unfair to folks who contributed to HSAs outside of Cafe-125.

Thanks – Leon

Harry Sit says

I’m not a lawyer. The act itself didn’t say (or change) anything about the earnings inside the HSA. I don’t know whether the earnings were already exempt before this act.

Leon says

Harry – Thanks for your reply. The HSA in Alabama has always been treated as if it were a taxable account and it looks like that won’t change (yet). This is still a nice step in the right direction.

Your blog has always been a favorite of mine… cheers!

FM says

The 2018 California FTB Pub 1001 discusses the addition of HSA contributions, interest, and dividend earnings (the “other earnings”) on Schedule CA (540), but there is no mention of capital gains in a HSA. Prior year publications were more ambiguous regarding taxing capital gains, but now that the 2018 edition specifically discusses interest and dividends and makes no mention of capital gains, I think the FTB has given up on cap gains for the complications listed in this post and comments. However, because the fair market value of the HSA is listed on Form 5498-SA, California will know that you have to have earned interest and/or dividends on that money, which is why they probably revised the language in Pub 1001. So definitely gray area with regards to HSAs in California and capital gains.

This post gave the best explanation on the subject (thank you). I spent several hours researching, calling my old and new HSA custodians, calling TD Ameritrade, and talking a couple tax preparers. Every year a bill is presented to align California with federal treatment of HSAs, and every year it fails because the state would lose $100 million in tax revenue. The simplest thing would be to treat the HSA like a Roth IRA: tax contributions, but don’t tax any earnings or qualified distributions. Make our lives easier.

Harry Sit says

Ending Balance = Starting Balance + Contributions – Distributions + Earnings – Account Fees

We can back into the earnings:

Earnings = Ending Balance – Starting Balance – Contributions + Distributions + Account Fees

After subtracting interest and dividends you get the capital gain or loss. Starting and ending balances are on the year-end statements (and 5498-SA forms). Contributions and distributions are on your Form 8889.

msf says

That computes total cap gains, both realized and unrealized.

For example, suppose you start with $1000 already invested in a non-div-paying stock, no contributions, distributions, or fees. Let’s say it goes up up to $1100. If you just let it sit there, you’ll have $100 in unrealized cap gains. If you sell it and buy a different stock (within the HSA) you’ll have $100 in realized cap gains.

The formula correctly computes the $100 gain. What it doesn’t do is identify how much of the gain is realized. That’s the tricky part. (No one taxes unrealized gains based on mark-to-market.)

Harry Sit says

You are absolutely right. You can have unrealized gains for several years and then realize them all in one year. We can’t avoid tracking then.

CV says

I was wondering if you could shed some light on the HSA contribution Shareholder S-corp more than 2% . Is it subject to UI and Sdi in CA or only included in PIT wages.

Harry Sit says

California doesn’t recognize the HSA as anything special. It’s subject to everything. See document from EDD: https://www.edd.ca.gov/pdf_pub_ctr/de231eb.pdf

aahana says

I moved to CA recently. My company did not provide HSA, so I enrolled in FSA. So when I needed a major medical expense, I used my current FSA and money left in the HSA with my previous company. I used turbotax and it didn’t correctly guide me even though I stated CA as my state of residence. After assessment by IRS I was asked pay a tax on the balance that was in my HSA account when I moved to CA and also an early withdrawal tax on amount used for a qualified medical expense. Essentially I was taxed twice and I did not get any benefit towards medical expense by saving is HSA.

In other states where HSA is exempt from state taxes, at the end of the year, we receive two forms – one for the amount contributed and one for qualified medical expense and I did not have to do anything extra to prove that it is a medical expense.

In CA, does HSA really help with medical expense? How do we prove that the amount withdrawn was for a qualified medical expense and NOT an early withdrawal?

Craig says

Why would the IRS (1) charge you a tax on the balance in your HSA and (2) charge you an early withdrawal tax on HSA money used for a qualified medical expense? At the federal level HSAs are obviously valid, so the IRS should have no issue. In CA, HSAs are just like a taxable brokerage account, so there should be no tax on withdrawals for any reason. Interest, dividends, and capital gains inside your HSA would be taxed by CA though.

Harry Sit says

I’m also not clear on why you paid those taxes. Did someone say your HSA money shouldn’t be there because you weren’t eligible to contribute to begin with? If you did your taxes wrong, and if it’s recent enough, you can amend your return to make it right and get the money back. California does two things differently than other states with regard to the HSA:

(1) California doesn’t allow a deduction at the state level for contributing to an HSA, but you didn’t contribute to an HSA while in California, and you weren’t talking about state income taxes.

(2) California taxes the earnings made by the HSA money, but you were talking about the HSA money itself, not its earnings.

Other than these two points, having an HSA when you are in California works exactly the same as having an HSA elsewhere. If you take money out of the HSA, you would still receive the 1099-SA form from the HSA custodian. If you have receipts to document the qualified medical expenses, you still fill out that Form 8889 to show that your distributions were for qualified medical expenses.

Anon says

Agree with craig – #1 makes no sense – i.e. charging tax on the balance in the HSA.

With regards to #2 – qualified medical expense – you must have some receipts or something? Use that for establishing qualified medical.

I live in CA – had a problem only once. The problem is that you may be dealing with some idiot low level agent who doesn’t understand how HSA’s work. That is what happened in my case and I just had to ask them back – if I can’t use it for medical expense without taxation, what is the purpose of having an HSA. Then it got fixed.

James says

What if my HSA changes its fund offerings and switches funds, selling what I owned in the current fund, and buying the exact same amount of the new fund? In CA, can this kind of transaction be treated like a stock swap M&A, that is with no tax consequences? I didn’t sell anything for gain/loss. The HSA administrator just ‘swapped’ one fund for another.

TJ says

https://www.ftb.ca.gov/tax-pros/law/legislation/2019-2020/AB2384-021820.pdf

I suppose this bill will die like all of the others.

Harry Sit says

It already died. August 31 was the deadline to pass bills.

Marc says

I’m so frustrated with California. Why can’t states just follow federal tax laws. This is why all the big companies are leaving Cali (I.e. Tesla moving to Texas).

I already bought a bunch of high dividend ETFs and REIT ETFs in my HSA account through TDAmeritrade before knowing this CA-hates-HSA law and reading this very informative post. I’m basically screwed. I’m just going to stop funding my HSA and focus on maxing out my Roth 401k and Roth IRA every year. Or sell all my positions in my HSA and invest in Treasury funds instead. Any good recommendations?

Marc says

Can investing in one fund that has high growth like the $VOO ETF in a HSA account beat the returns of a Treasury bond fund in a HSA account, even with all the state tax burden of the $VOO HSA account?

Craig says

If you bought those ETFs recently you can sell them and the capital gains should be minimal, or even slight losses. The CA handling of HSAs is annoying, but don’t let it make you lose sight of the federal benefits, which are substantial. A tax-efficient stock fund like VOO could certainly make sense. But you’ll have to report the dividends as taxable income, which is a nuisance (especially since you won’t get a 1099 with that information). Hence the recommendation to hold Treasuries. I think the assumption is you’re probably holding some bonds anyway, so might as well put them in your HSA to simplify your CA taxes.

JR says

When moving to California from another state, how do you calculate cost basis for the positions currently in your HSA account at the time you move to California? Does California consider the cost basis to be zero? The value at closing on the day you moved to California? Actual purchase price (and the whole nightmare of tracking that down)?

Craig says

It’s like any other capital gain in a taxable account, where it’s your actual cost basis, even if it was acquired in a different state. So if you’re moving from a state that honors HSAs, consider selling and re-buying appreciated assets to reset your basis immediately before moving to California!

Shawn says

I just changed to a insurance that has an HSA with my company. My first paycheck of 2021 was $200 less than usual. I noticed my CA State withholding almost doubled. I asked our company’s payroll dept. and they said I get taxed on the HSA for CA the 1st paycheck of the year. They said my next paychecks should be back to normal.

Is this correct

Harry Sit says

That’s correct. When you receive a lump-sum employer contribution to your HSA in the first paycheck, you pay the CA tax.

BP says

HSA is taxed in CA – so it is appropriate for the employer to withhold CA taxes on it. But it is not as if you are paying additional tax – you pay it either as tax withholding or when you file the taxes.

One thing you didn’t say was whether it was a lumpsum or not. If a lumpsum, only that that paycheck gets affected. But if your HSA contribution is distributed over the year, I don’t believe that your next paycheck will be back to normal – so be ready for it.

If you did a lumpsum – all in the 1st paycheck, you may not be maxing out your HSA. A lot of people try to set their HSA withholding to match the max deductible on their health plan. I always try to max it – since it is pre-tax contribution, grows tax free and withdrawals are tax free when used for medical expenses. With the extra money invested in some growth etf’s I am accumulating a nice bundle for the increased medical expenses in my golden years but in the absolute worst case, can withdraw like IRA post-age 65 without penalty.

TomH says

Yes. HSA is just a taxable income & investment vehicle for CA purposes. Contributions are not tax deductible for CA franchise tax purposes.

And, you can have taxable gains and losses for CA purposes on any capital transactions within your HSA account. That means you need to track your basis for any investments you make just like you would a brokerage account for CA franchise tax. (I didn’t do this with mine and had a lot of forensic work to do after I retired.) What a PIA!

However, it was well worth it. My employer contributed to my HSA. Federal income tax free for me and on top of my salary. But still subject to CA income tax.

And, I didn’t spend any of it while still working. Instead, I invested it in a balanced growth fund and grew it did.

I retired with a more than $40,000 HSA account to draw on. And, I only contributed a couple of thousand dollars myself to the HSA over the six or seven years I was working and eligible for the HSA. My measly contributions were deductible for Fed purposes but not for CA purposes.

An HSA can be even better than an IRA for several reasons. Although I would recommend that everyone have BOTH. Google it to see a nice list of reasons why.

I did SAVE every deductible medical receipt for those years where I paid for them from my taxable earnings. There is no requirement for HSA distributions to occur in the same year as the expenditure. I will be reimbursing myself from the HSA in one, tax free lump sum in the next year or two.

And, after I turn 65, I will draw upon the HSA balance each year to reimburse myself for the Medicare Advantage premiums for myself and my wife.

And, should I need more cash after age 65, I can withdraw from the HSA for non-medical purposes too an only pay income tax on that withdrawal amount. That’s a nice emergency fund to have.

If I drop dead before age 65, my wife can keep the HSA as her own and treat it just like I would have.

BP says

> That means you need to track your basis for any investments you make just like you would a brokerage account for CA franchise tax. (I didn’t do this with mine and had a lot of forensic work to do after I retired.) What a PIA!

Can you elaborate on the above – did you do this on your own to comply with the law or you were forced to go figure this out due to some tax form/FTB notice or something.

TomH says

No. I did this on my own to comply.

I had always reported the income that the HSA investments generated each year for CA purposes. I figured I was good with nothing to worry about.

But, in that year, I had also sold some of my holdings and reinvested them in a different fund. So, I needed to report the capital gains on the sale. And, I needed to track the basis is my holdings back to the original investments. Only for CA purposes though.

So, I went through my annual reports from the various custodians and worked my way up to what the basis was in my holdings that year and what my gains had been on the sale that year. I did this all in a spreadsheet which I maintain every year as I prepare my income taxes. It’s basically a P&L and BS for my HSA account for CA purposes.

That was also one of my incentives for working up to a lump sum payout of the entire HSA for accumulated medical expenses and Medicare Advantage premiums. I wouldn’t have to track my HSA activity any longer and there would be even less items to audit should I ever be subjected to a CA FTB audit. And it would simplify my annual income tax returns even more, which is something I have wanted to do in retirement.

Some of this is a bias I developed handling the finances and taxes and estates of elder relatives before I retired. Some of them were a mess because they hadn’t thought about keeping decent records and there were holes and discrepancies I had to “fill in” for them. Add to that, they were elderly and had poor memories now. They had assumed their tax preparer or banker or broker or financial planner had taken care of any record keeping. Which had not been done. So, it was a lot of work for me. And I don’t want my spouse or heirs to have to go through all of that work if I can avoid it.

Hope this helps.

Amanda says

How about CA non-residents? I am a full year resident of NY but I was sent to CA by my NY employer. My W2 shows about $1,000 in CA income. Do I also have to include my HSA contributions to my CA income? that does not make sense. Anybody can help?

Craig says

Yes, you’d need to add your HSA contributions to your CA income, even as a non-resident. But with only $1,000 in CA income your CA tax is likely to be minimal anyway. It won’t be like you get taxed by CA on $1,000 + all HSA contributions as a result, unless you somehow allocate the entire year’s HSA contributions to your time in CA.

Kevin says

I have an HSA in New Jersey invested in a NJ “QIF” treasury fund. I had a short-term loss of $2,000 this year. Can I take the loss on my New Jersey tax return?

Harry Sit says

When gains from Treasuries aren’t taxed in NJ, you can’t deduct losses either.

“Gains or losses realized from the sale or exchange of exempt obligations such as United States Treasury bonds are not taxable, nor are capital gains distributions from a qualified investment fund attributable to exempt obligations.”

https://www.state.nj.us/treasury/taxation/njit9.shtml

Chris C. says

Thanks so much for this explanation. This is the only place on the internet with clear guidance on this issue and it’s very frustrating to see the “Invest in HSAs!” mantra repeated online without noting these exceptions.

Quick question: I took your advice and didn’t re-invest the dividends and interest in my HSA this year. Is that amount (it’s not much, like $50) what I’ll be taxed on this year and should report as income from the HSA to California? And once I do that, can I then re-invest that amount in stocks (I didn’t have any qualified medical expenses) or does that make things too complicated because I’d then have to calculate how much that new investment grew? (I think it’s the latter, but I just wanted to check).

Thanks again for the post.

Harry Sit says

The dividends and interest are taxable income for CA whether you reinvest or not. The idea is to reduce the number of transactions and have fewer items to track. If you’re adding more money to the HSA this year, you can invest the $50 together with the new money. Otherwise it’s probably not worth the required tracking to invest only $50.

Lisa says

Hi Harry,

Even though I did not sell anything, my year end statement shows the amount of net investment gain. I forgot from where I saw that this amount should be taxed for CA. But from what you wrote, it should not until you really sell it and get a capital gain, right?

Thanks so mcuh.

Lisa

Harry Sit says

HSA is treated by California as any other regular investment account. Unrealized gains are not taxed. Realized gains and received dividends and interest are taxed.

Kevin says

Thanks Harry. Figured it out myself in the meantime but appreciate the confirmation and link.

Kevin

Jeff says

Thanks for all of the commentary on this. My employer’s custodian provides an HSA summary listing DIVIDEND RECEIVED, INTEREST RECEIVED, INVESTMENT WITHDRAWL and “CAPITAL GAINS DISTRIBUTION”. Is the “CAPITAL GAINS DISTRIBUTION” different than your realized gain? The total of my “CAPITAL GAINS DISTRIBUTIONS” is just over $100 for the year but my unrealized gain is I know in the thousands for the year. And I also did a couple of “INVESTMENT WITHDRAWLS” for the same year that will probably result in a realized gain. The problem is that I had funds for about 6-7 years and my custodian only goes back about 4 years and I didn’t know about keeping records until about a week ago. Sorry about some of the caps, that’s the way my statement prints it.

Harry Sit says

Capital gains distributions come from the funds you invest in. They are treated the same as realized capital gains. Add them up as your capital gains.

Jeff says

Also, it appears Turbo Tax has just boxes for HSA interest, dividends, and capital gains. Do I add the capital gains reported and the realized gain and put it in the capital gains box? Thank you!

Jeff says

Thanks Harry! So I add the capital gains from the funds PLUS the unrealized gain when I sell = total capital gains to put on my return?

Harry Sit says

The capital gains distributions plus your realized capital gains during the year are your total capital gains for the tax return. Your unrealized gains aren’t taxed until you realize gains in the future.

bob says

I can’t find any guidance on HSA transfers from one custodian to another for CA state tax.

1). Is the transfer a taxable event for CA?

2). I have investments I must liquidate in order to transfer – is this a taxable event for CA?

Harry Sit says

Think of transferring a regular taxable account in California. It’s a taxable event if investments are sold. It’s not a taxable event if investments transfer in-kind or if you only transfer cash.

Lorraine says

CA resident, say you are interested in treasury bills. Would purchasing a 1 yr treasury bill every year be easy to track since you know exactly what it cost and the gain when it matures and you just start again with your next 1 yr purchase or am I misunderstanding things?

Harry Sit says

Interest from Treasury Bills isn’t taxed by California. No tracking is necessary if you hold the Treasury Bill to maturity.

Lorraine says

Okay I’ve never purchased t-bills directly so wasn’t sure. Sounds like I can do shorter terms while the rates are pretty good without worrying about tracking. Thank you for your articles.

Aimers says

This article is extremely helpful. Thank you!

Does CA care what year the contribution is for? My employer made a $300 contribution in 2022 and noted it was for 2021. The amount is included on my 2022 W2 which shows $3,700. Do I need to amend my 2021 tax return for CA or can I put it on my 2022 return to match my W2? Not sure if CA cares but I am also concerned the IRS and CA will think I went over the $3650 limit for 2022. My 5498-SA does say it was for 2021 however.

Harry Sit says

CA doesn’t care what year the contribution is for. To the state of California, the HSA account is just a regular taxable account. There’s no contribution limit. Therefore “what year it’s for” is irrelevant.

Aimers says

That makes sense. Thank you for replying to my question and the others above. It has given me a better understanding of how the HSA works in CA and what to do with mine now and in the future.

Lorraine says

I just want to make sure I understand this… With money market accounts having 7 day yields >4% lately, even parking your money in the core account still incurs interest that you have to track, correct? or is it like a low interest savings/checking where you don’t need to bother of earned interest is less than $10? I have my HSA with Fidelity.

Pan Fan says

Lorraine:

You can invest in a Federal money market fund

J says

Be sure to check the Federal money market fund details–Treasury obligations are exempt from state tax but repurchase agreements are not. For example: For 2022, Vanguard Federal Money Market Fund VMFXX had only 37.79% of ordinary dividends from US Govt obligations but the Treasury Money Market Fund VUSXX had 100% and met the CA, CT, NY, NJ requirements for qualifying funds.

R says

I live in NYC but I was sent to California for a week in the year 2023 by my employer, so I have to file a non-resident CA state return. Do I have to include the earnings inside my HSA as an addition to my CA income? If so, do I just tally up the amounts based on the time frame I was in CA for business or for the total year? Thanks!

Harry Sit says

California taxes the income you received from California sources while a nonresident. HSA earnings aren’t from California sources.

Craig says

It would still count toward total income “as if you were a CA resident” which would impact CA tax owed though.

G says

So I’m still a bit confused. I just finished my filing and apparently owe the state of CA $1300 due to the contributions made to the HSA, mind you these were uninvested in the year 2023 (was figuring things out). Is it normal to owe so much on just the contributions? If I’d known I likely wouldn’t have set up the HSA to begin with.

Is this because my employer failed to properly withhold the appropriate about of state taxes to account for HSA contributions during the year hence the necessity now of the out-of-pocket expense due?

Harry Sit says

Owing the state of CA $1,300 is unrelated to the contributions made to the HSA. California doesn’t see any difference between contributing to an HSA and putting money in a bank account. You would still owe the state $1,300 if you didn’t contribute to the HSA. You owe now because you didn’t withhold enough. So just increase your withholding.

G says

Just wanted to say thank you for clarifying this. Working with my jobs payroll to address the issue. Took too long for it to click about what you were getting at here about witholding but now I get it.

Gah tax season, if only there was a good remediation on understanding those damn boxes haha

Nathan says

Thank you for this information.

But my question is,

I dont have W2, but I do have 1099 from my works.

And, I do contribute by myself to HSA. (I just started)

This contribution can be deductible from my gross income in CA?

thank you

Harry Sit says

It’s deductible for federal income tax but not for California state income tax. It doesn’t matter whether you have W-2 or 1099.

Tom says

I have had an HSA since 2007, and have been a NJ resident that entire time. Until 2016, all the funds were in an interest bearing account. In late 2016, I invested the majority of the balance in mutual funds within the HSA and have maintained that allocation. I have not withdrawn funds from the HSA and it now holds more than $100,000.

Until recently, I was unaware of the NJ tax liability for interest received and my (as yet unrealized) capital gains. Now I am ready to start realizing gains and draw down my balance.

My problem is that the various custodians (I’ve had several, as I’ve transferred the account each time I’ve changed employers) haven’t provided 1099 forms (as they were not required to), and I am missing most of the statements I was provided.

How should I address this with the State of NJ? I would like to pay the taxes I’m liable for, but don’t know how I can document interest recieved or the cost basis of my investments. I’ve tried contacting the various custodians, but they’ve told me they don’t retain statements for closed accounts.

Thank you for any advice you can provide.

Harry Sit says

You can only do the best you can with the statements you have. Your HSA contributions through the employers were on the W-2 forms, Box 12 code W. If you always contributed the maximum, you can also go by the maximum for each year. Using the sum of those contributions as your cost basis gets you close to the true basis.

Joe M says

Thanks for all the great info on your site! My spouse and I are in NJ and we file jointly. I work in NJ, and my spouse works in NY and is a high earner (and earns more than me). My spouse files NY taxes, and then we get a credit on our joint NJ return. What is the best way to allocate HSA contributions between the two of us (say out of $8000 total for our HSA family limit)?

If I contribute more, then we could reduce my FICA taxes. My spouse as a high earner may not get a FICA benefit after passing the max income limit used for FICA anyway.

However, NY would recognize the HSA deduction, so we could save on the NY tax portion by allocating more of the HSA to my spouse. Then when we file the NJ joint resident tax, we would add the “NY” HSA contribution to our NJ income, but at least the amount of NY tax paid was lower. The credit from NY tax paid tends to be more than what NJ would tax, so in a way we already max out this out-of-state credit anyway.

Maybe I am overthinking it. Do you have any thoughts on what might be the ideal HSA allocation to minimize our overall taxes? Thanks so much!

Harry Sit says

Just do it on paper both ways and see which way comes out ahead.

You contribute $8,000. You save FICA tax (7.65% of $8,000).

Your spouse contributes $8,000. Save only the Medicare portion (1.45% of $8,000). Reduce NY tax by $____. Reduce NJ credit for NY tax (increase NJ tax) by $___ (possibly zero).

Dan says

Seems like there are three options depending on what you value:

1. If the goal is to reduce the management complexity as much as possible just but a treasury money market fund. There are no capital gains to worry about because the NAV is always $1. Of course the drawback is that growth will be limited.

2. If you’re looking for more growth with a medium level of complexity you could purchase something that doesn’t pay dividends such as Berkshire Hathoway. But you’ll need to deal with capital gains when you eventually sell shares.

3. If you want maximum growth potential (and diversification) then purchase an S&P 500 or Total Market Index. This will be the most work due to yearly dividends that are taxable and you’ll need to pay capital gains on sold shares as well.