Interest rates have moved up sharply. You may still have Certificates of Deposit that pay a much lower rate. You’ll get a higher annual percentage yield (APY) if you break them to invest in new CDs but you’ll have to pay an early withdrawal penalty. Is the higher interest rate worth the drawback of paying the penalty?

DepositAccounts.com offers a When to Break a CD Calculator. However, it assumes the new CD has the same term as the remaining term on the existing CD. In other words, it compares keeping a CD with two more years until maturity with breaking the CD now and getting into a new 2-year CD.

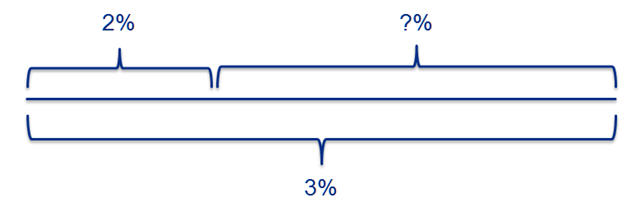

What if you’re considering CDs that have longer terms than the remaining term of your existing CD? Suppose you’re considering a new 5-year CD when your existing CD has two years left. Here are your choices:

1. Keep the existing CD for two years until its maturity date and buy a new 3-year CD at that time.

Or

2. Pay the early withdrawal penalty to break the CD and buy a 5-year CD now.

The missing piece of information is how much interest you can get when you buy a 3-year CD two years from now. Nobody knows but you can guess. If the annual interest rate two years from now is low, you are better off breaking the CD and getting into a higher rate now. If it is high, you may be better off just waiting until your current CD matures and getting into a higher rate at that time.

I didn’t find a calculator for this situation when I did a quick Google search. So I made one myself. Enter the numbers directly into the calculator below. The formula will do the math for you.

You enter the circumstances about your existing CD and the new CD you are considering:

- Each CD’s APY

- The remaining term on the existing CD

- The new CD term

- The early withdrawal penalty on each CD as in how many months of interest

You enter a guess of the interest rate when your existing CD matures. The calculator then tells you the additional amount of money you’ll get if you break the existing CD and buy a new longer-term CD now. If that earnings number is negative, it means you should keep the existing CD and just wait.

Because it automatically calculates, you can experiment with your guess of the rate in the future, from very low to very high. You will see how the comparison changes.

All else being equal, you’re better off paying the early withdrawal penalty to break the CD when:

- The early withdrawal penalty is low.

- The gap between the rate on your existing CD and the rate on a new CD is high.

- The remaining term on the existing CD is long.

- You think the rate will be low when your existing CD matures.

If the early withdrawal penalty is low and there’s a big gap between the rates on your existing CD and the new CD, the higher rate pays off quickly to cover the early withdrawal penalty.

If your existing CD only has a short term left anyway and you think the rate will stay high at the time of renewal, you’re better off waiting until it matures. If you think the rate on a new CD will be low when your existing CD matures, you are better off breaking the CD now because otherwise you just sit on a low rate for nothing. If the rate will be high when your existing CD matures, you also have the option to break the new CD again in order to get into a higher rate at that time. The calculator also takes that into account.

Next time you run into a situation like this, plug in your own numbers and see what the calculator says.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sam Seattle says

Wow. I like the calculator, Harry. So cool, Man.

jim says

This is a fantastic calculator in light of the Andrews 3% 7 year IRA and black Friday certificates of deposits. Thank you.

My concern now is IF the rates do rise what will Andrews do to not let us break the cd with the 6 month penalty. Maybe you or someone else can chime in.

Harry Sit says

Anything can happen. I’m not too concerned. I trust the laws and regulations in this country.

Rick Van Ness says

Wow. This is excellent. And I learned something that I did not know: that it is easy to embed an excel document in a web page. 🙂 Thanks!

Scott says

Hi Harry,

Thanks for building this tool!

Seeing your interest and ability for doing this type of analysis, would it be possible for you to modify this tool to determine when it is worthwhile to cash in an Series I Savings Bond to get a higher fixed rate?

Others could have a similar interest given that I Bonds are currently paying a 0% fixed rate so there is nowhere for rates to go, but up!!

The added complexity is to incorporate the impact of income taxes (assuming that the interest on the bond is growing tax-deferred). The variables are the number of years the bond has been held and the fact that the investor could be in a different tax bracket now versus the future, especially if the proceeds of the bond are used for educational purposes, which I am sure you realize allows the interest on the bond to be tax free.

However, I wonder how much rates would need to rise to make it worthwhile to cash the bond.

Thanks for your consideration!

Harry Sit says

When we see a higher fixed rate, sure. However, the annual purchase limit puts a cap on breaking old lower-rate I Bonds in order to buy new higher-rate I Bonds.

Zack says

I believe your calculator has a serious bug – it appears that the 60-month guessed rate is being used in both scenarios even though it applies only to the “Wait” scenario. I found that if I massively increased the guessed rate that I couldn’t make the Wait scenario outperform Break now.

Harry Sit says

It does not only apply to the “wait” scenario. It’s a feature explained in the article. “If the rate in 2 years is high, say 6%, you also have the option to break the 3% CD again in order to get into a 6% CD at that time.”

Zack says

Ack. I apologize for my gross negligence in reading.

Raymond says

what’s the GUESS portion mean in the calculator?

Harry Sit says

Your best guess of the rate of a new CD at the time when your existing CD matures. Because it’s in the future, you never know what it will be. You can only guess or try a few different guesses and see how the numbers change.

MaryBeth says

Nice tool!

Does this calculator still work if your new CD has a shorter term than your existing CD?

It seems to get confused?

atexit8 says

I would like to know the answer to MaryBeth’s question as well.

I am 1 year into a 3 year CD paying 1.95% APY.

A 12-month CD is paying 2.40% APY.

I have no intention of breaking the CD and getting a 2-year CD.

I am planning on getting a 12-month CD.

Should I break the 3-year CD?

Harry Sit says

Sorry this calculator isn’t made for buying a CD with a term less than the remaining term of the existing CD.

sam says

Could you please provide the calculations/ share the spreadsheet?

Thanks

Sam says

Thank you so much for the calculator. I do notice that sometimes it seems the template not loading correctly using a browser, even a different one. Would you please post a downloadable file/link to a file?

Thank you

Harry Sit says

Please use this direct link to the spreadsheet.

Sam says

Thank you for the link

Q Zhou says

Thanks Harry – exactly what I was looking for while evaluating whether to break the 2-3% CDs for the 4% CDs with the new CD terms open and the Deposit Accounts’ assumption not necessarily applies.

jk says

Hello, just a note that there seems to be a bug in the existing cd interest rate box. thanks!

Harry Sit says

Please elaborate with an example. Thanks!