We all should assume by now that our names, addresses, phone numbers, and Social Security Numbers are all out there in the open after all the hacks. We can only protect ourselves by adding two-factor authentication to all our accounts (ideally with security hardware or Google Voice numbers protected by security hardware).

ChexSystems Security Freeze

Freezing our credit helps prevent identity thieves from applying for credit in our names. Getting an IP PIN from the IRS helps prevent thieves from filing a fraudulent tax return using our information.

It’s less known that we should also place a security freeze with ChexSystems. ChexSystems is a credit reporting agency that provides information about the use of bank accounts. Banks and credit unions may report you to ChexSystems if you bounce checks or otherwise cause a negative balance in your bank account. When you open a new account at another bank or credit union, they may check your reputation with ChexSystems. According to Wikipedia, 80% of commercial banks and credit unions in the U.S. use ChexSystems to screen applications for checking and savings accounts.

If someone opens a bank account in your name and defrauds the bank, the bank will report the incident under your name and Social Security Number. It will make it more difficult when you want to open a new account. Placing a security freeze at ChexSystems helps prevent fraud by someone opening a bank account in your name.

Opening a fake account in your name is also often the first step in stealing money from your real accounts. Banks scrutinize transfer requests less when they see the money is going to another account in your name (but the receiving account is actually controlled by the thieves). You make your accounts safer by blocking that exit path when you prevent thieves from opening a fake account in your name.

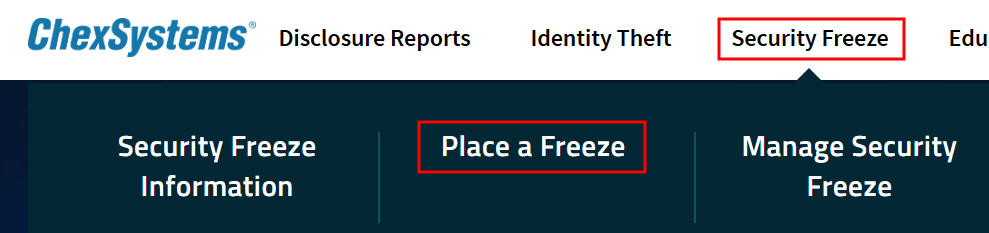

To place a security freeze with ChexSystems, go to chexsystems.com, click on “Security Freeze” at the top, and then click on “Place a Freeze.” You’ll be asked to register with ChexSystems. You’ll receive a 12-digit Security Freeze PIN after you place the freeze. This PIN is required to thaw the freeze before you open a new bank account.

Consumer ID from the Past

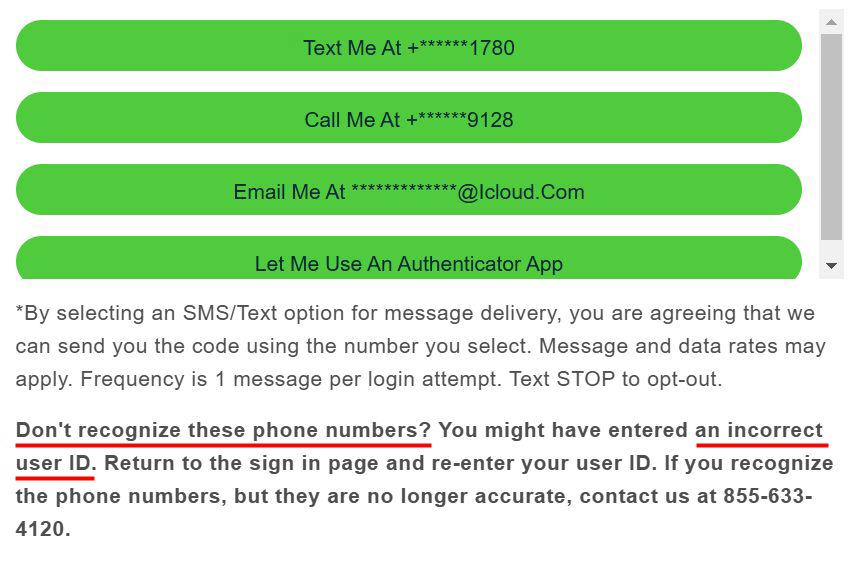

I placed a security freeze with ChexSystems several years ago. ChexSystems sent me an 8-digit Consumer ID and a 12-digit Security Freeze PIN by mail at that time. I saw something like this when I tried to use the 8-digit Consumer ID to log in at ChexSystems:

It threw me off for a minute because I didn’t recognize the displayed phone numbers or the email address. Then I read the footnote and realized it only meant that I couldn’t use the 8-digit Consumer ID to log in. ChexSystems changed its system. The new consumer portal requires a username and a password separate from the Consumer ID. It displays random phone numbers and email addresses when it doesn’t recognize the username.

I needed to re-register with the new consumer portal and create a username and a password when I only had an 8-digit Consumer ID from the past. The existing 12-digit Security Freeze PIN is still good.

Disclosure and Score

Banks and credit unions only report negative feedback to ChexSystems. They don’t say how good you are. They only give you a black mark when they don’t like something. You should see nothing has been reported to ChexSystems.

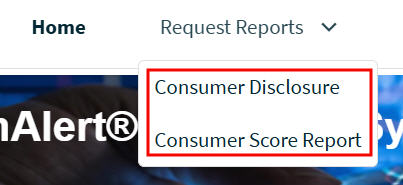

You can check your records after you place the security freeze. You see these two options on the top under “Request Reports”: Consumer Disclosure and Consumer Score Report.

If either the Consumer Disclosure or the Consumer Score Report doesn’t display instantly, ChexSystems will email you in a few days when it’s ready for you in the portal.

The Consumer Disclosure report lists any negative information ChexSystems received from banks and credit unions. A blank section is a good report. You should file a dispute if you see something inaccurate there. This disclosure report also shows who inquired about your reputation with ChexSystems in the last five years.

The Consumer Score Report shows a score similar to a credit score. The consumer scores range from 100 to 899. A higher score indicates a lower risk. My score was 648. It sounds low but it’s apparently a good enough score. I never had any problems with opening bank accounts. I found another blogger saying his ChexSystems score was 652 and he had never been declined for a bank account either. It sounds like I’m in good company.

Check your ChexSystems report and score if you’re curious but the most important part here is to place the security freeze.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jim says

Thank you for this reminder to get a new Chex report. I have a calendar reminder to get credit reports and NexisLexis reports annually, but I did not have Chex on my calendar.

It is possible to obtain a report and to place a freeze without creating an account. Scroll down until you see a “Submit Request by Other Methods” tab. I prefer not to create online accounts unless absolutely necessary.

Marc says

Thanks for this post, Harry. I was not aware of this system. I just created an account easily, and when I requested the Consumer Disclosure, I received it instantly.

scoothome says

Similar to Marc, I received the Consumer Disclosure instantly. The Consumer Score Report did not show up for me; I’m assuming that it will be available on the portal later.

Harry Sit says

I’m not sure why it gave me the score instantly and had me wait for the disclosure report but it did the opposite for you. I’ll edit that part.

Indra Patel says

Thank you Harry. I had no clue about Chex until now. Thanks to Jim’s comment about LexisNexis I will get that report too.

Jackie B says

Thank you, Harry. You are right, I had not heard of Chex before. I appreciate your good information presented in careful and concise style.

Roman says

I cannot register to chexsystems. I get error could not generate security quiz or something like that and that I should use different method what is using mail.

Ms Livvy says

Thanks for the info about Chex. Speaking of checking account fraud, I’ve often wondered why check fraud is not more common. If I write a check , the person now has my bank account info, name, address, and signature. Seems it would be easy to forge a check and do an electronic deposit, or initiate another type of fraudulent transaction. Do you have any thoughts about this?

Josh Rothman says

Hi Harry. In addition to ChexSystems, do you think it’s worth the effort to place a security freeze on any of the following, and if so, which ones? Perhaps you could create a new blog post listing all of the places you suggest your readers place a security freeze, including the relative importance of each one considering the hassle involved.

1. Innovis: Innovis is a lesser-known credit reporting agency that collects similar information as the big three.

2. National Consumer Telecom & Utilities Exchange (NCTUE): NCTUE maintains data on utility accounts (electric, gas, water, telecommunications, and pay TV).

3. LexisNexis: LexisNexis collects and maintains extensive data on individuals, including insurance claims, background checks, and public records.

4. SageStream: Another consumer reporting agency that some lenders use to assess creditworthiness.

5. Clarity Services: This bureau focuses on subprime lending data (payday loans or similar services).

6. CoreLogic: Handles data related to property records, tenant screening, and background checks.

7. Medical Information Bureau (MIB): The MIB maintains medical and insurance records.

8. Early Warning Systems: Used by banks and includes ChexSystems data plus additional banking information.

9. Advanced Resolution Services (ARS): Another specialty consumer reporting agency.

10. PRBC (Payment Reporting Builds Credit): A credit reporting agency that tracks non-traditional payment history.

Harry Sit says

I haven’t done any of those on your list. When I want to do more, I would start with LexisNexis and NCTUE. LexisNexis says freezing LexisNexis also freezes SageStream. Early Warning Systems doesn’t appear to allow a freeze. You can only request a report and dispute items in the report.

Sam Rayanna says

Hi Harry

How is the 12 digit PIN sent?

Via email or USPS?

Thanks

Harry Sit says

It came by USPS when I added the freeze back in 2017 because they didn’t have a portal at that time. I’m guessing you’ll get an email to retrieve it from the portal when it’s ready.

joey says

it allows you to choose portal or mail, if you chose portal it appears as a document.pdf format in documents

larrys says

My credit score is a wildly high 9999. Per the ChexSystems explanation it means that “is an indication that there is insufficient information in ChexSystems files to create a consumer score.”