[Update on August 19, 2024: Fidelity officially removed the foreign transaction fee on its debit card. The foreign transaction fee was never charged on ATM withdrawals anyway. Now it won’t be charged on purchases either.]

You can request a debit card when you use Fidelity as a checking or savings account. Fidelity used to say this in their debit card FAQs:

For each foreign transaction, there is a foreign transaction fee (currently, 1% of the transaction for non-US dollar transactions), which may be included in the amount charged to your account. This charge may apply whether or not there is a currency conversion.

Fidelity customer service also had repeated this as an official response in this Reddit post. Because I don’t use a debit card for purchases whether in the U.S. or in foreign countries (no rewards), the only way this foreign transaction fee could be relevant to me is on ATM withdrawals when we travel internationally.

The FAQ used to say that a foreign transaction fee “may be included.” It implied that the fee wasn’t always included. When exactly was it included and not included?

A Real-World Test

I had a chance to see in real life whether a foreign transaction fee applied to an ATM withdrawal using the Fidelity debit card.

My wife took a trip to Canada last week. She withdrew $200 Canadian from an ATM at a gas station. Fidelity sent me this debit card activity alert in real-time:

A bank teller withdrawal on card ending in XXXX for $153.06 from CANCO #XXX XXXXXXXXX was posted to your account on 08/03.

$200 Canadian for $153.06 U.S. gave an exchange rate of 1 US dollar = 1.307 Canadian dollars. Google showed that the exchange rate on that day was 1 US dollar = 1.33 Canadian dollars. Using that exchange rate, we should be charged $200 Canadian / 1.33 = $150.38. Fidelity charged us $2.68 more than that. Did Fidelity include a foreign transaction fee in the amount charged to us?

Fidelity posted another entry to our account a day later:

ADJUST FEE CHARGED ATM FEE REBATE (Cash) +$2.26

Ah, the original $153.06 included an ATM fee charged by the machine. Fidelity reimbursed us that fee. The net charge after the ATM fee reimbursement was $153.06 – $2.26 = $150.80. This makes the exchange rate $200 Canadian / $150.80 U.S. = 1.326. That’s close to the 1.33 number from Google but it still doesn’t quite match it. Was the difference a foreign transaction fee that Fidelity included?

Card Network Exchange Rate

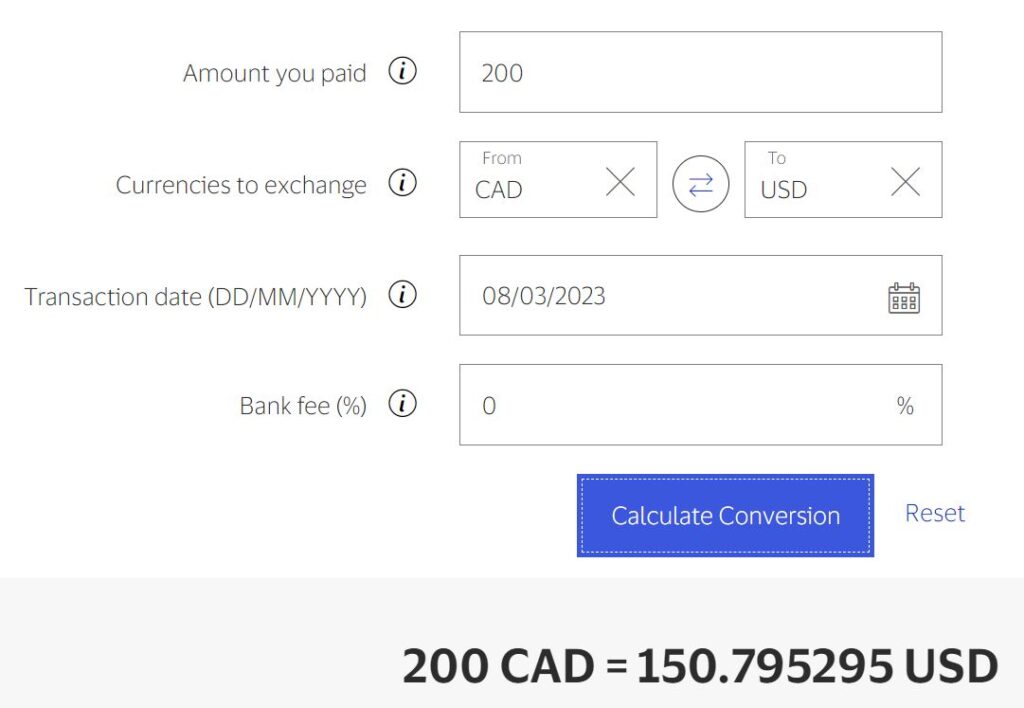

Fidelity’s debit card is a Visa debit card. Visa has an online Exchange Rate Calculator to show how the Visa network converts currencies each day. The calculator showed this when I put in the transaction date and a 0% bank fee:

$150.795295 USD rounds to $150.80. That’s exactly the net amount Fidelity charged us after the ATM fee reimbursement. There was NO foreign transaction fee from Fidelity on the ATM withdrawal.

Visa has a small markup in the exchange rate used on its network. Fidelity is only passing along the exchange rate from Visa. It’s the best exchange rate you can get as long you’re using a Visa card. A Schwab Visa debit card can’t do any better.

***

Some side notes on spending money in a foreign country:

Get Local Currency from ATM

The best way to get local currency is to use a local ATM machine. You pay no ATM fee and you get the best exchange rate when you have the right card. Don’t buy foreign currency in the U.S. before you leave. Don’t use the currency exchange booths at the airport. Just take your debit card and use an ATM when you’re there. You don’t need to bring US dollar bills to exchange them except as a backup in case you lose your debit card or you can’t find a working machine.

It doesn’t matter which ATM you use. An ATM at the airport works. One at a gas station also works, as you see in my wife’s ATM withdrawal. So does an ATM outside a bank branch.

If your bank charges an out-of-network ATM fee plus a foreign transaction fee and it doesn’t reimburse you the ATM fee charged by the machine, you’re with the wrong bank. Consider one of the 2 Ways to Use Fidelity as a Checking or Savings Account.

Use Contactless

Contactless payment terminals (“tap-and-pay”) are widespread in many countries. Many cards are already contactless-enabled (look for a sideways wifi symbol on the card). If yours still doesn’t have it, you can put it into Apple Pay or Google Pay and tap your phone to pay. You won’t have to take the card out of your wallet when you use Apple Pay or Google Pay. You won’t be asked to sign if you use contactless.

Act as a Local

Act as a local when you’re in a foreign country. If you see any mention of the U.S. dollar on any ATM machine or credit card terminal, back out and press a different button to transact in the local currency. They certainly don’t offer to charge locals in U.S. dollars and you shouldn’t pay any differently.

If you’d like to verify whether your bank included a foreign transaction fee on your international charges, use the Exchange Rate Calculator from Visa (or the Currency Converter Calculator from MasterCard if your card is a MasterCard). MasterCard may give better exchange rates on its network than Visa. If you do a lot of foreign transactions, get a MasterCard when all else is equal.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Samir says

Hi Harry,

I appreciate the recent focus on Fidelity since I use their Cash Management Account as my primary bank account. But that’s another matter.

The global ATM fee reimbursement is not unconditional. According to footnote 3 of https://www.fidelity.com/spend-save/fidelity-cash-management-account/overview, the ATM must display the Visa®, Plus®, or Star® logos.

Practically speaking, I have yet to run into a situation in which I was not reimbursed the fee – and I’ve not paid attention to which logos the ATM displays. That leaves me unsure of when I’d encounter an ATM that doesn’t display one of those logos, but the exception is worth noting.

Re the 1% fee for foreign transactions, I’ve made ATM withdrawals in a few different countries and I have never been charged the 1% fee. This is, of course, a Your Mileage May Vary situation, since it is applicable in some scenario that prompted mention of it in the terms.

Harry Sit says

Because Visa is the largest international card network, a machine that doesn’t join the Visa network won’t have much international business. If a machine doesn’t display one of the three logos because it’s only on a domestic network, the Fidelity debit card won’t work on that machine anyway.

The theory is that the 1% foreign transaction fee is only on purchases. I’ll ask my wife to do a test.

Alan says

I was in Japan recently and looked at my statements. There was no 1% foreign fee on ATM withdrawals. There was an ATM fee which Fidelity reimbursed me. I didn’t check the exchange rate on the days i did a withdraw, but i guess that is why i didn’t get the same exact U.S dollars for the Japanese Yen i withdrew.

Alan says

I want to clarify. I meant to say i withdrew the same amount of Japanese Yen on different days i was there and my statement shows a different amount in U.S dollars due to the exchange rate change each day. My statement shows all ATM machine fees reimbursed by Fidelity.

MM says

I believe this is true: The theory is that the 1% foreign transaction fee is only on purchases.

Once you price/disprove, it would be nice to update the article with that.

Also, for anyone taking USD as an alternative backup, as of my last 2 visits to Italy you could no longer exchange USD for Euros at a bank unless you are a bank customer. You had to do it at a post office.

MM says

*Prove/disprove

Alan says

Agree. I think 1% foreign transaction fee is only if you use the debit ATM card for buying things there, but not on ATM withdraws. The only fee i was assessed was from the ATM machine itself in Japan, but that fee was reimbursed by Fidelity.

MICHELLE says

I have used my Fidelity ATM card in at least 8 countries to get cash from various ATM machines and have always been reimbursed the fee. I have not always checked to be sure it was the “best” exchange rate but then, I rarely get all that much cash other than in Mexico.

Larry S says

Hi Harry,

I have used my Fidelity debt card consistently for getting cash in at ATMs in foreign countries for several years now. I usually get a good exchange rate and fee reimbursement but not always.

Last Fall I traveled to Greece and did three withdrawals and got hit with a 13% markup on the Euro rate on my first withdrawal. The rate was 1USD=0.84EU. The ATM was owned (I believe) by a smaller bank. Subsequent withdrawals I made during the trip (at larger banks) were in line with the going 1US=1.10EU rate at the time. The only reason I can think of for the large markup at the first ATM was that it was owned by a small bank, perhaps?

And then earlier this month I traveled to Ecuador, which is a country that uses the US dollar as its official currency, so there was no conversion necessary but there were ATM fees on the three transactions I made. On two of the transaction receipts, the ATM fee was separately marked as “Surcharge” or “Costo Transaction”, but on the third the fee was listed as “0.00” and a total amount withdrawn of $304.40. Looking at the receipt it appears that I withdrew $304.40 from my account and not the $300.00 I received. As a result, Fidelity’s system did not reimburse the fee to my account.

In hindsight I’m not sure how either of these could have been prevented but I am not going to complain about a few bucks lost just a couple of the many ATM transactions I have made with my Fidelity card. Overall, I am very pleased with their customer service. My wife and I have the majority of our investment accounts with them and have no intention of moving.

I also would like to say that I love your columns. You have provided a lot of great nuts & bolts info and instruction over the years. I read every one of your columns and books. Great stuff!

Harry Sit says

You got a bad exchange rate on that first withdrawal in Greece not because the ATM was owned by a smaller bank. It could’ve happened on a machine at a major bank too. It happened because the machine tricked you to press the wrong button. Suppose you were withdrawing 100 Euros, the machine said something like “This withdrawal will cost you 119.05 USD. [Continue] [Cancel]” By pressing Continue, you voluntarily agreed to the bad exchange rate at 1 USD = 0.84 EUR. You should’ve pressed Cancel. Then the 100 Euro withdrawal would be processed by Visa at the rate published by Visa. Your subsequent withdrawals either didn’t have that prompt to trick you or you unknowingly pressed the right button. Both a large bank and a small bank can present the trick prompt. You have to know to avoid pressing the wrong button. This is covered in the section “Act as a Local.” Be alert whenever you see any mention of US dollars. Locals in Greece don’t use US dollars. You shouldn’t either.

ATM transactions are supposed to break out the fee separately to Visa. That’s how Fidelity knows how much to reimburse. This one is impossible to prevent because you don’t know how the bank will send the transaction to Visa. You can complain to Visa that the bank didn’t comply to Visa’s rules but it’s not worth your time as you say.

Larry S says

Ah! Thanks for the clarification. I don’t recall what the screen prompts were when I made the withdrawals in Greece but what you say makes sense and most likely what happened. I will need to be more cautious next time when keying in my transaction.

Barbara says

This is not related to the foreign transaction fee, but it does concern Fidelity. We recently moved our retirement and savings accounts to Fidelity and have learned so much from you about the ins and outs of the website. We are earning more interest/dividends than we did at our previous bank and are happy with Fidelity. My question is about the shareholders’ meeting/proxy vote info we just received. This is our first time encountering such a thing, so I went to the website to access the paperwork and it’s almost 200 pgs of legal mumbo-jumbo (or at least that’s what I saw after scanning a few pgs). Can you break this down into layman’s terms for those of us who are at a loss? Maybe a subject for a blog post?

Harry Sit says

The proxy is only asking us to vote for the new board of directors of Fidelity mutual funds. The current board recommends voting yes. I don’t have any problems with either the current board or the proposed candidates for the new board. I’ll vote yes.

Jonas says

Quick question tho. I have a fidelity Brokerage account and their debit card. It’s not a CMA. Does it work the same way?

Harry Sit says

I haven’t traveled internationally after I switched from the CMA debit card to the brokerage debit card but I don’t expect that it makes any difference in terms of foreign transaction fees.

Harry Sit says

Confirmed now. The brokerage account debit card works the same way as the CMA debit card in terms of foreign transaction fee on ATM withdrawals. The exchange rate matched the rate from the Visa network with 0% bank fee.

jason says

I’m not so sure. I noticed on several different days, i got more taken out of my bank account than expected even with the different exchange rate on each day i withdrew. The ATM fees were reimbursed, but i question the exchange rate i got was close enough to the real exchange rate.

Harry Sit says

Use the currency converter from Visa linked in this post. Enter the transaction date (not the posted date) and 0% bank fee. It should match exactly the amount taken out from your account.

JP Jordan says

6/24/2024

Just took this off Fidelity’s CMA agreement…(note that the waiver of the 1% fee is no longer in the subjunctive)

Fidelity® Debit Card (Debit/ATM)

Fidelity currently covers the annual fee for the Fidelity® Debit Card.

This card is issued by PNC Bank, N.A., and administered by BNY

Mellon Investment Servicing Trust Company, neither of which is

affiliated with Fidelity Investments. The Fidelity Debit Card

Agreement and Disclosure Statement will accompany your debit

card. With this debit card, you can make withdrawals from any

ATM machine displaying the Visa®, Plus®, or Star® logos or make

purchases wherever Visa is accepted. All Fidelity ATM withdrawal fees

will be waived. In addition, your Fidelity Cash Management Account

will be reimbursed for ATM fees charged by other institutions

wherever your card is accepted. Reimbursement will be credited the

same day the ATM fee is debited from your account. Use of the card

and right to reimbursements are subject to Fidelity’s policy on abusive

and excessive use of features, explained in this Agreement. Please

note that there is a foreign transaction fee of 1% that is not waived,

which will be included in the amount charged to your account.

Please see the Fidelity Debit Card Agreement and Disclosure

Statement for additional information on the use of the card. The

third-party trademarks appearing herein are the property of their

respective owners.

Harry Sit says

It still doesn’t say whether the 1% is on purchases or ATM withdrawals or both. If actual withdrawals continue to show that the amount taken out of the account matches the number from Visa’s currency converter at 0% bank fee, that’s what matters in the end.

icemule1 says

I always thought Fidelity charged a 1% fee on international debit purchases, so I’ve been using my Schwab debit card instead for the past several months. But today I did a test – I bought the same item twice – once with my Fidelity debit card, and once with my Schwab card. I was charged the exact same amount for the Fidelity purchase as I was charged for the Schwab purchase.

Did Fidelity remove the 1% international debit purchase fee?

Harry Sit says

Wait until the charges settle and see if they stay that way. Use the Visa currency converter to confirm that the converted amount had 0% fee from the bank.

icemule1 says

Harry,

It looks like your theory about being charged 1% on POS purchases was correct. Initially the pending charge amount didn’t include the FTF, but after the charge settled, it increased exactly 1% so the fee was definitely charged.

Harry Sit says

Thank you for testing it and reporting the results!

Harry Sit says

Fidelity officially removed the debit card foreign transaction fee effective on 8/19/22024. The foreign transaction fee was never charged on ATM withdrawals anyway. Now it won’t be charged on purchases either.