Although every financial institution would like to have us use them for everything, most people have accounts at multiple places. It helps to consolidate, but no single institution excels in everything. Vanguard has some good funds not available elsewhere. Fidelity has good IT systems and great customer service. Bank of America has a good credit card rewards program; the best way to qualify for it is through a Merrill Edge account.

It’s helpful to have a holistic view of all your investments in different accounts at various places. Some brokers offer functionality to track investments held elsewhere. I use the Full View feature from Fidelity.

Many bloggers recommend Empower (formerly Personal Capital) because Empower pays bloggers for referrals. I’m not paid by Fidelity to write this. I’m only writing as a long-time Fidelity customer.

Powered by eMoney

Fidelity’s Full View feature is powered by eMoney behind the scenes. eMoney is a popular financial planning software used by financial advisors, with the highest market share according to one survey. Because financial advisors need to see the full picture of a client’s investments across multiple accounts before providing advice, eMoney has built features to pull in account and holdings information from a wide array of sources.

Fidelity bought eMoney some years ago. When you activate the Full View feature in your Fidelity online account, Fidelity uses the account aggregation functionality from eMoney to link your non-Fidelity accounts. Full View only displays and updates your holdings and account balances. The financial planning features of eMoney aren’t accessible in Full View unless you work with a Fidelity wealth advisor.

If you don’t have a Fidelity account, you can open a small account to use Full View.

Activate Full View

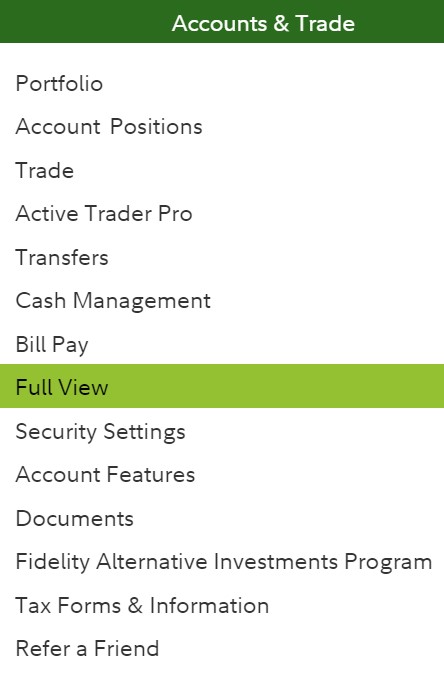

To activate or access Full View, click on Accounts & Trade in the top menu and then Full View.

Link Accounts

Fidelity accounts are automatically populated in Full View, including other people’s accounts that you’re authorized to access. If you’re married and you’d like to track accounts owned by both of you, it’s best to get authorization from your spouse first. See How to Manage a Family Member’s Fidelity Accounts.

You can link non-Fidelity accounts or add them manually. Linking accounts is the most convenient, but it depends on where you have your other accounts.

Some financial institutions treat eMoney as an approved application to pull information through a secure read-only interface. Because eMoney is widely used by financial advisors, these financial institutions have vetted eMoney’s security, and they’re comfortable providing special read-only access to eMoney.

You search for your financial institution and enter your username and password once in Full View. eMoney pulls data through a secure, special channel. Some financial institutions don’t require two-factor authentication (2FA) from eMoney because they treat eMoney as a trusted aggregation service.

When your non-Fidelity accounts are linked in Full View, any changes in the accounts are automatically reflected in Full View. Try linking your accounts first. eMoney has established connections to many financial institutions.

Add Account Manually

The link can be problematic when the financial institution requires a security code but doesn’t provide a special channel to eMoney. It works once, but it stops working the next time because eMoney can’t get your security code. You’ll have to add your account manually in that case.

You can also choose to add all non-Fidelity accounts manually if you aren’t comfortable entering the username and password in eMoney.

However, there isn’t a direct interface in New Full View to enter holdings details for a manually added account. You can only input a total balance. This requires manual updating, and the account can’t be examined in the asset allocation analysis.

A workaround is to add the account manually in Old Full View while it’s still accessible.

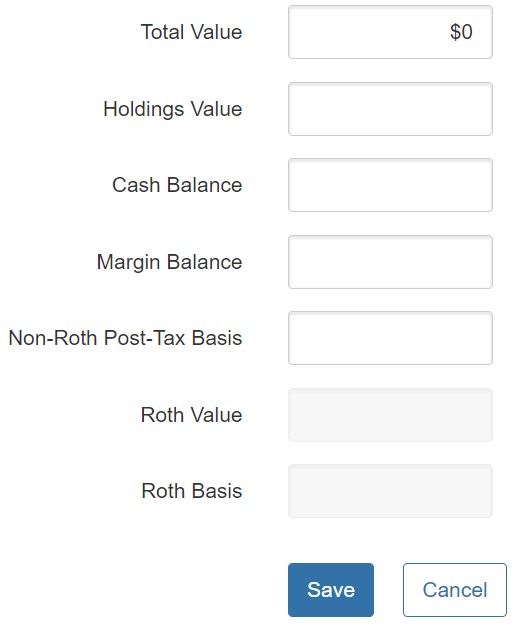

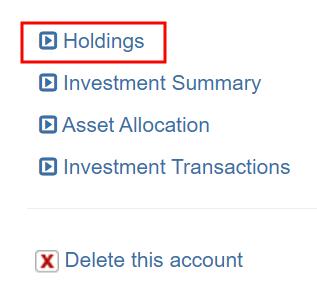

Enter $0 as the total value first in Old Full View. Then go back into the account and find the Holdings link.

Now you can enter ticker symbols and the number of shares.

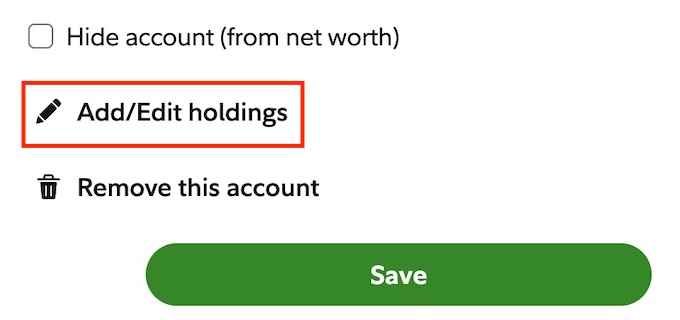

Accounts manually added in Old Full View display an “Add/Edit holdings” link in New Full View. It’s missing from accounts manually added directly in New Full View. This is an oversight. I hope Fidelity will add the “Add/Edit holdings” link to all manually added accounts.

With the holdings information, Full View will update account values using daily share prices, but if the holdings and the number of shares change, you’ll have to update them manually, whereas linked accounts are automatically updated.

Ignore the Spending Tab

Full View also supports linking bank accounts and credit cards to track budget and spending. You’re better off ignoring that part of Full View altogether.

eMoney was created for financial advisors, and not many people go to a financial advisor to track their budget and spending. It’s not a strong point for eMoney or Fidelity. Trying to make Full View work for budget and spending is like putting a square peg in a round hole.

If you want to track budgeting and spending, you should look for other software specifically made for that purpose.

Analysis

The purpose of Full View is to put all your accounts in one place. It creates the foundation for Fidelity’s portfolio analysis and retirement planning features.

Click on Accounts & Trade -> Portfolio to get back to your Fidelity online account.

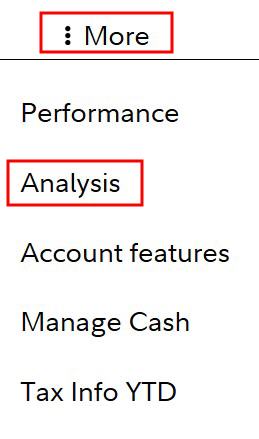

Click on the More tab to the right of Summary, Positions, … and then the Analysis menu option.

This sends you to a Guided Portfolio Summary, which examines all investment accounts you have in Full View. This makes it worthwhile to add your non-Fidelity accounts in Full View.

The analysis is only based on holdings. It doesn’t include transactions or investment performance.

Asset Allocation

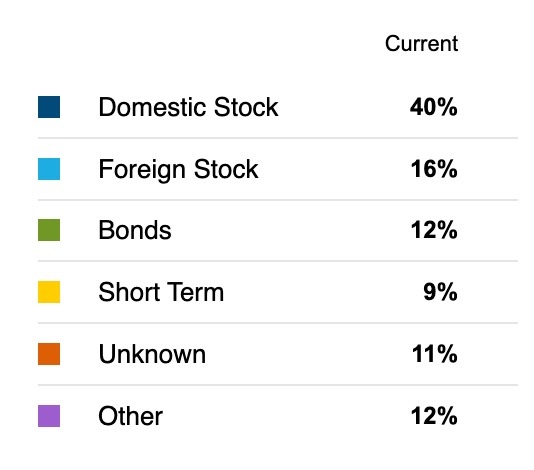

The Summary tab displays a pie chart and a table for your asset allocation. If a large percentage is categorized as “Unknown” or “Other,” click on the “Learn more” link below the pie chart. Look for an “Export Data” link in the table header to the right. It will download the data to a spreadsheet. Then you can move the Unknown and Other numbers to the appropriate columns and recalculate.

Stock Analysis

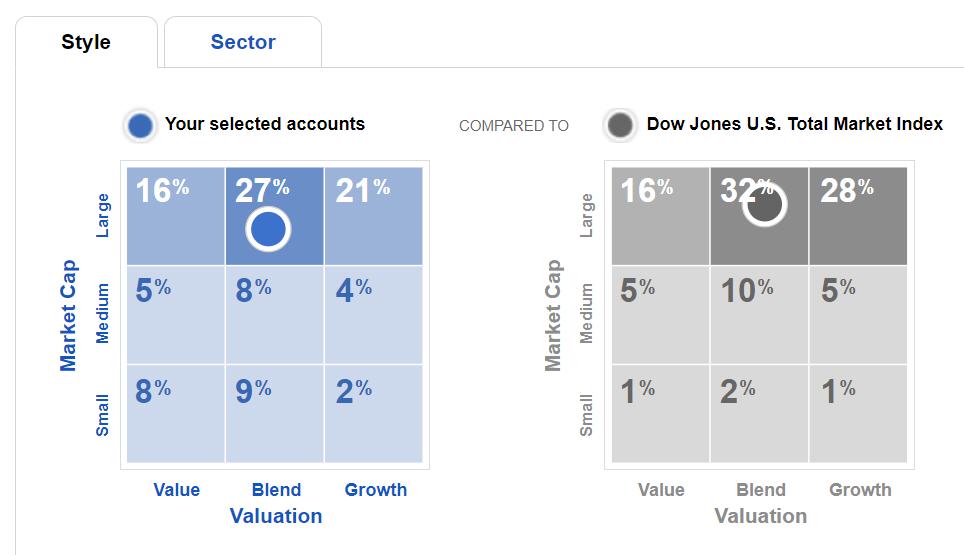

Stock Analysis displays a Morningstar-type style box breakdown compared to the total stock market.

Fixed Income Analysis

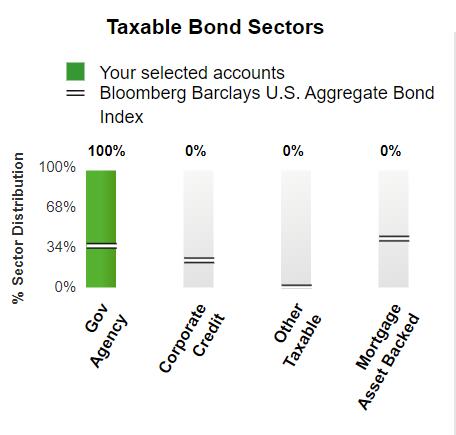

Fixed Income Analysis shows your bond holdings by sector.

Report

There are many other metrics in Analysis. You can click on the different menu items for more analysis, or you can click on Reports on the right to generate a 30-page PDF report that includes all the analysis.

Review the report at your leisure and share it with your spouse.

***

It’s great to have a global view of all your accounts. If your accounts can be linked, having them automatically updated in Full View saves time. Analysis provides a more in-depth look at your entire portfolio, including both Fidelity accounts and non-Fidelity accounts you have in Full View.

Having all accounts in Full View also feeds into Fidelity’s retirement planning tool. Please read more details about this planning tool in Fidelity Retirement Planning Tool: High-Level Model, Not Tactical.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Frank Wang says

I have Full View for years and recently updated my portfolio. Notable issues are:

1. It does not link to CIGNA/HSA and Payflex HSA investment and cash accounts.

2. It does not link to Axos bank and investment accounts.

3. It does not link to Ally Invest accounts.

4. When you and spouse have multiple accounts at a financial institute (eg, CITI). It does not aggregate correctly or missing linking all accounts.

5. It does link to real estate investment account (eg. Fundrise).

Some of those issues maybe at the end of linked accounts. Please check out yours.

Here is an alternative financial aggregate site which is superior to Fidelity in my opinion.

Personal Capital – have everything what Fidelity offers and more

I suggest that you give it a try and it is free. [Referral link removed.]

Enjoy updating your portfolio.

Frank

MW says

Hi Frank,

Does Personal Capital able to capture the Treasury Notes or Bonds in the property asset categories? Or, does it allow manual override after the holdings are brought in thru the interface?

Fidelity Full View is putting them under ‘Unknown’. That really skewed the asset allocation.

Thank you in advance for your reply.

Charlie says

Harry, is it your overall opinion that the Fidelity product is superior to PC’s?

Thanks for the article, never knew Fido owned EMoney nor made this available this widely.

Harry Sit says

I don’t know whether it’s superior. I use it only because it works well enough for me. I don’t have accounts with smaller banks or brokers that eMoney doesn’t link to. I don’t use it to track spending.

Q Zhou says

Thanks Harry for the thorough guide! Would also like to add that with FULL VIEW set up, Fidelity’s Retirement Planning Tool is pretty useful as well. It’s like a spreadsheet that we all have for projection but somewhat on steroids. Its flexibility allows you to add events on the timeline. It factors in the inflation as well as the return based on your assets. Also it is real-time. Without any effort, you see where you are “at the end of the plan”, i.e. when you die (set by you) after a day of bloodbath in the market 🙂

A good sanity check for my manual spreadsheet.

It is under Planning & Advice – Retirement; In the meddle of the page under “A retirement plan that changes as you do” – click the Get Started green button. It has detailed description of the algorithm “under the hood” too.

Harry Sit says

That’s the topic of the post for next week. 🙂

Sam says

Harry

Are you concerned about security issues with entering the login ID and password?

I think your articles are spot on and consistently actionable.

Thanks for all you do.

Sam

Harry Sit says

I’m not concerned when the financial institution provides a special read-only channel to eMoney (Direct Web Service or Direct Web API). Typically the aggregation service doesn’t save your password in those situations. It only uses your login and password once to get a “token” from the financial institution. It will use the token to get your account information afterward. You can change your password with the financial institution and the aggregation service still works.

Kevin says

Harry, as usual, GREAT article! I am using Quicken to accomplish most of the same things, but have to enter all transactions manually. (Market value/current price updates automatically.) I will play around with Fidelity GPS and see how I like it. It may be more efficient for my purposes. Thanks, Harry!

Tom says

Hi Kevin, I use Quicken too, as it has more capabilities than either Fullview or personal Capital. But don’t have to enter anything manually, as I use Quicken update to add all transactions. Is there a specific reason you don’t?

Tom says

I use both Fidelity Fullview and Personal Capital for my retirement and investment planning. They both have strong points and it is great to have them as a reasonableness check against each other.

Gary says

I have been tempted, but am always uncomfortable with loading my entire financial snapshot anywhere: a) Security – every additional linkage increases the minuscule risk that my assets can be hacked and; b) Salesmen – when i worked, we always wanted to estimate the size of clients’ wallet. One of the first steps to making additional sales!

However, please know that I am also very risk adverse. So much so, that our risk management thinking has us using four brokers, so that all our eggs are not located in one basket. Was very handy in 2008, when anyone could go bankrupt.

Marty says

I have my securities split between in Fido & Schwab for the same reason. Despite the potential security issues, I am using account aggregators.

Marty says

Harry, I’ve been using Full View for many years. I feel it was a far better product when the “engine” was Yodlee. I’ve had trying Yodlee out directly on my to do list for a while. T Rowe Price used to have a great one that allowed you to change the type of a particular holding. For example, Full View includes my preferred stocks as equities whereas I classify them as long bonds. So that throws off all the allocation and future forecasts.

I also use Personal Capital but their reporting is not robust as I’d like. However, I find it simpler to use for basic balances and transaction tracking of accounts and credit cards which I double check every few days.

PS: I don’t receive notifications when there is a response to any of my posts. Is that something you can turn on?

Harry Sit says

Full View may not work that well for tracking spending accounts but I only use it to track investments. GPS has its own way to categorize investments. If Full View does it wrong, try GPS. I agree it would be better to allow the user to override the classification.

Receiving notifications is controlled by checking the box “Notify me of follow-up comments” when you enter your comments. I just noticed that box wasn’t displaying for some reason. I fixed it now.

Horton says

Harry, how do you classify I Bonds within Full View? I’ve categorized mine as a “cash balance” because I can’t think of a better way to do it. I suppose I could also use a ST bond or MMF ticker.

I was unaware of the GPS tool, so that’s somewhat helpful.

Currently, I use the “Holdings Detail” report within Full View to consolidate my holdings across all accounts at Fidelity and Vanguard into one place. I toggle “Show Account Name” to “No”. Then, I pull the summary into an Excel sheet for my own custom asset allocation review.

Frank Wang says

You can link your TreasuryDirect account to Full View. Personal Capital is working on the link, as I was told

Horton says

The problem is that Full View’s access to Treasury Direct is “Web Access”, similar to Merrill Edge shown above.

Harry Sit says

I treat TreasuyDirect as a delicate object and I do as little as possible with it. I don’t want my account locked and have to go through a painful process to unlock it. I put in a ticker of a money market fund and manually update the number of shares. Full View treats it as short-term holdings.

thefinancebuffReader says

Thanks!

I have been used Beiley’s Fund Manager, a Windows application. Fund Manager started sunsetting some of their features like price retrieval downloads unless you updated the application annually. The application also wasn’t able to download transactions from a niche broker that I use. End result, I have been spending far too much time manually updating Fund Manager data in order to get a high level view of my portfolio.

This will be very helpful.

joe says

I have emoney through planvision. I link my accounts through Emoney once a year (Jan 1) to update my portfolio. Then I break the links by changing my Password on each account for extra security. Furthermore, I don’t need daily or monthly updates to my portfolio.

A fellow says

Somewhat informative comment, but I second that full view went downhill when they took it in-house. Constant breakdown for credit card accounts. Problems with TSP. Lots of stuff that made it no longer of value to me.

Roland Torres says

Nice guide. As limited as it is, the GPS insights and interface are still better than what Vanguard did to the similar Portfolio Watch interface. Portfolio Watch is still powered by Yodlee though, so it may support more financial institution connections.

MW says

Unfortunately, Vanguard’s Portfolio Watch download feature broke. It would not download complete holdings for me. I download it into Excel to add additional information and analysis. I filed tickets months ago. Nothing is fixed to date.

anon says

Is there any tool which monitors and tracks performance of your entire portfolio over time?

Harry Sit says

Maybe Personal Capital or Quicken reports the performance of the entire portfolio but I don’t know for sure because I don’t use them.

MW says

Hi Harry,

Thank you for all of your knowledge sharing. Can you please clarify for me what your reply on 12/28/22 is below? Do you mean ‘Direct Web Service’ as in Vanguard that uses tokens or ‘Direct Web Access’ as in Merrill Lynch?

————————————————————————————————————-

Harry Sit says:

DECEMBER 28, 2022 AT 3:08 PM

I’m not concerned when the financial institution provides a special read-only channel to eMoney (Direct Web Access or Direct Web API).

Harry Sit says

I meant Direct Web Service as in Vanguard.

MW says

Hi Harry,

Thank you for the article.

Just want to provide an update and see if anyone else experienced the same issue.

I added Vanguard and changed the password after the connection was established. When I refreshed the connection in Full View, it says “The institution rejected your credentials.”

It seems changing the password is causing an issue.

MW says

I forgot to mention that it’s for Vanguard.

MW says

Hi Harry,

I connected my various accounts using Full View. Here are some issues that I am seeing and wondering if you have any suggestions to work around the issues besides manually entering them which defeats the purpose of automatic updates.

1. The accounts linked via Web Access cannot be properly categorized in the correct asset allocations, stocks v. bonds. They all came through as ‘Unknown’ even though, they are Fideility’s mutual funds.

2. Treasury Bills, Notes, and Bonds are all classified as ‘Unknown’ by Full View held in Vanguard using Web Service.

These issues seem to make Full View not useful when it comes to asset allocation and even the projection for the retirement goal.

Thank you in advance for your reply.

Harry Sit says

1. I guess it depends on whether Full View is able to get the ticker symbols from your linked accounts. Pull up that account and see if it shows ticker symbols. You may have to update the holdings manually if you don’t see ticker symbols. If you see ticker symbols but Full View doesn’t categorize them, try the asset allocation in GPS.

2. Full View doesn’t categorize Treasury Bills, Notes, and Bonds based on CUSIPs but GPS does. Try viewing your asset allocation in GPS.

Gill says

Hello Harry,

Thanks for this and other insightful posts. FYI, it appears full view manual entry has changed. Fullview does not appear to allows adding holding to manual entries. It appears the connectors is likely the only option to get holding information into Fullview. I personally don’t feel comfortable with the connectors after reading the TOS.

Harry Sit says

I just tried it. The “Add Account Manually” section still works. You add a new account, save it with 0 total value. Then you go back to the newly added account and click on Holdings to add holdings.

ikomrad says

Full view is still trash for my purposes.

1. I cannot access old Full View

2. I cannot create custom categories.

3. I cannot create rules to automatically categorize transactions.

4. I cannot split transactions

…

I could go on but I’m tired of typing.

Harry Sit says

Full View isn’t meant for spending and budget tracking. Don’t be distracted by those inadequate features. Its role is to pull in investments from external accounts to feed portfolio analysis and the retirement calculator.

ikomrad says

Ok, the Full View spending and budget tabs led me to believe those were FV features. Silly me.

Joseph King says

The Full View GPS report would be much more useful if all the individual holdings were listed in some type of sequence at the beginning of the report and in the holdings section at the bottom of the report. They are in random order making it difficult to aggregate my portfolio by financial institution.

Harry Sit says

You can use the export data feature to rearrange the order in a spreadsheet.

Joseph King says

Thanks for your reply. I have been using the export feature and copying and pasting to an Excel spreadsheet for many years.

Unfortunately, there is no way for users to edit/organize the GPS report before it is produced in the PDF file. Listing my individual holdings in some unknown random sequence makes the report virtually useless. Individual accounts with the same financial institution are scattered all over the GPS list of non-Fidelity accounts lists at the top and bottom of the GPS report.