I came across the Fidelity retirement planning calculator six years ago when I met with a Fidelity employee at their branch office. Her title was Vice President, Financial Consultant. She explained to me that, at the VP level, she didn’t have a requirement to have clients use Fidelity’s paid wealth management services. A part of her role was to help clients with financial planning.

Retirement Planning Tool

Her primary tool was the retirement planning tool in Fidelity’s Planning and Guidance Center, which is available for free to all Fidelity customers. You can run the tool on your own without working with someone at a Fidelity branch office. Fidelity employees there help people run the tool and look for up-selling opportunities.

Fidelity’s Planning and Guidance Center also has tools for other goals, such as saving for college and buying a home. I only used the retirement planning tool. The basic idea is that you have some income, some investments, and some expenses, and the tool tells you how well your income and investments will cover your planned expenses.

I’ve used the retirement planning tool for three years, and here’s a walkthrough of how it works.

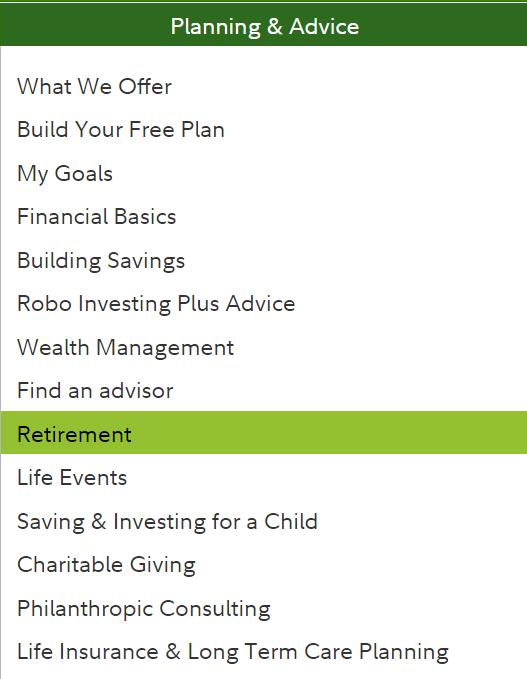

To get started, click on “Planning & Advice” at the top, and then “Retirement.”

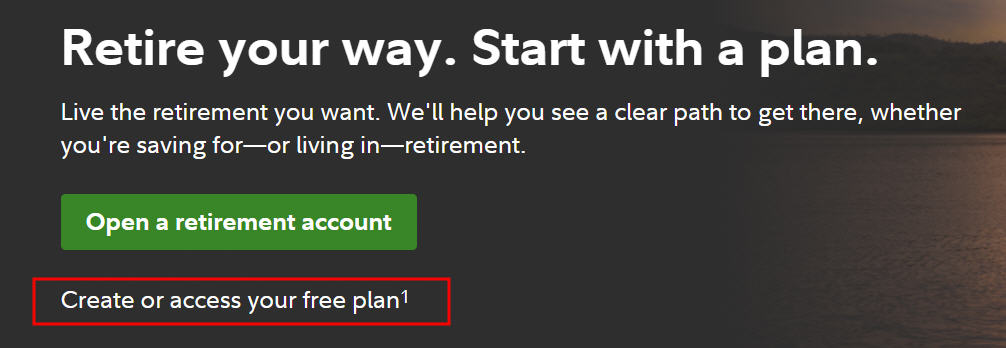

Click on the “Create or access your free plan” link in the header banner.

If it’s the first time you’re using the tool, it’ll ask you a series of questions: age, gender, when you plan to retire, life expectancy, income, expenses, etc. It jumps into your existing plan if you already have one.

Expenses

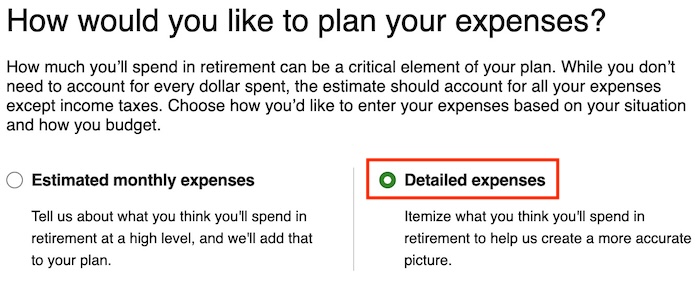

If you give just one number as your estimated expenses in retirement, the planning tool assumes it’ll be that number every year, adjusted for inflation. It’s adequate if you’re far away from retirement, but it’s probably too simplistic when you’re close to retirement or already retired.

Choosing “Detailed Expenses” opens up a worksheet.

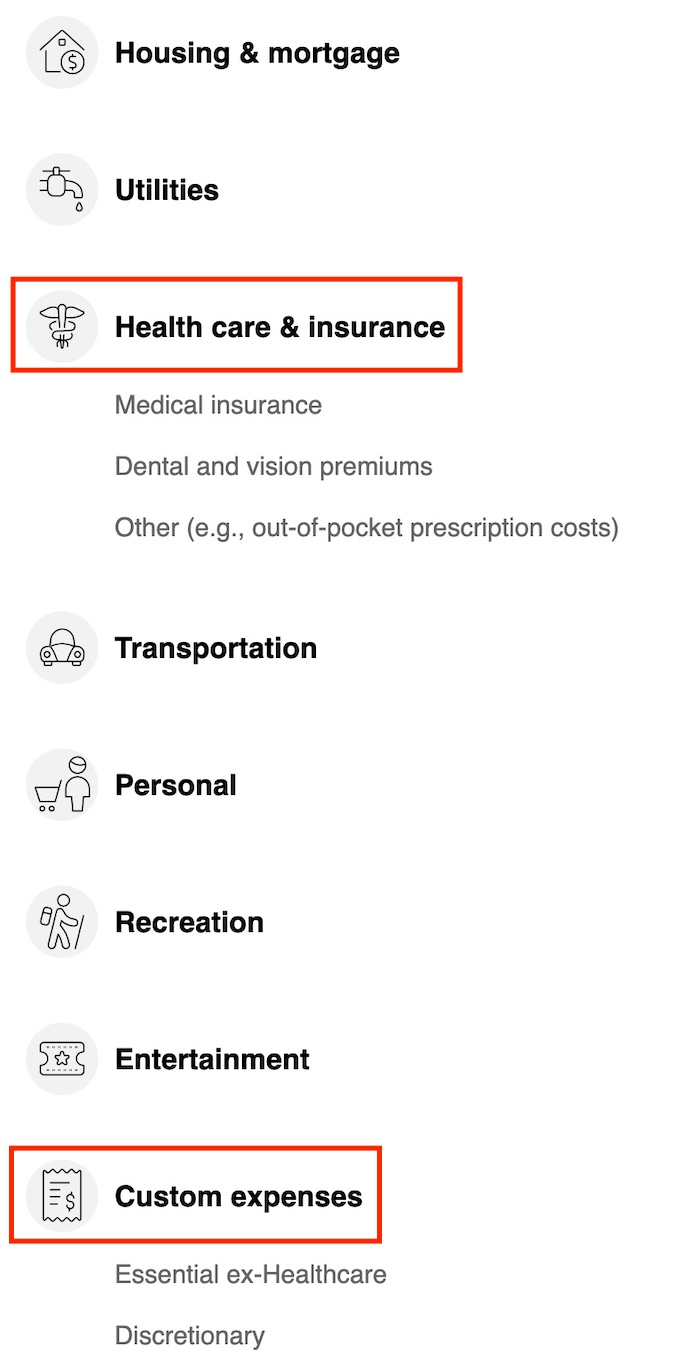

The detailed expense worksheet is broken into too many categories, in my opinion. You lose sight of the big picture when you’re bogged down by whether your utilities are really $300 a month or $350 a month. I suggest only using the healthcare portion and then going to “Custom Expenses.”

You still fill out the healthcare portion because the planning tool makes a higher inflation adjustment for healthcare expenses than for other expenses. I would enter only two custom expenses besides healthcare: Essentials ex-Healthcare and Discretionary Expenses. These are the base expenses that will last throughout retirement.

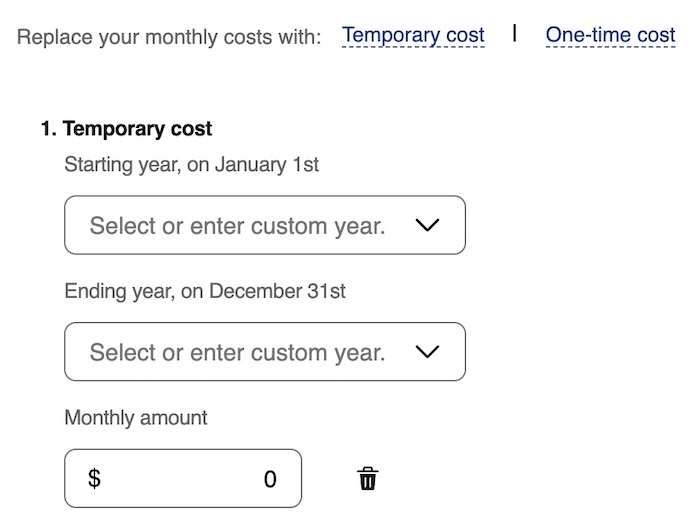

Then you can add your spike and one-time expenses, such as home improvement, college tuition, extra budget for travel in the initial years of retirement, helping children with a down payment, etc. These expenses have a start year and an end year.

Accounts

All the investment accounts you have in Fidelity’s Full View are automatically populated in the retirement planning tool. You should add your non-Fidelity accounts to Full View before you run the retirement planning tool. See the previous post Fidelity Full View + Analysis: Track Your Portfolio Across All Accounts, on how to use Full View. You can exclude some accounts by setting them to “unassigned” under “Goal Assignment” if they’re not intended for retirement.

These accounts should only be financial assets that can be liquidated partially. If you’re planning to sell a rental or a business to fund your retirement, enter the anticipated sale as a one-time income in the Income section below.

Retirement Income

If you’re still working, the employment income is assumed to continue until your planned retirement age. If you’re self-employed, reduce your income by 1/2 of the self-employment tax to account for the higher taxes.

If you aren’t receiving Social Security yet, you need to tell the calculator when you’ll claim Social Security and what your benefits will be in today’s dollars. See Retiring Early: Effect On Social Security Benefits for how to get your earnings data from Social Security and feed them into other tools to calculate your benefits.

You can also add one-time and episodic income sources, such as an inheritance, downsizing your home, part-time work, rentals, etc.

Taxes

This planning tool only uses an estimated tax rate based on the projected gross taxable income for a given year, your tax filing status, and your state of residence. It doesn’t perform detailed tax calculations. Nor does it perform Roth conversions to take advantage of low tax years.

There’s an input field for local taxes, which you can repurpose to model higher taxes.

Projections

After you enter all the information, the retirement planning tool runs 250 simulations based on historical returns. By default, it uses the current asset allocation in your accounts.

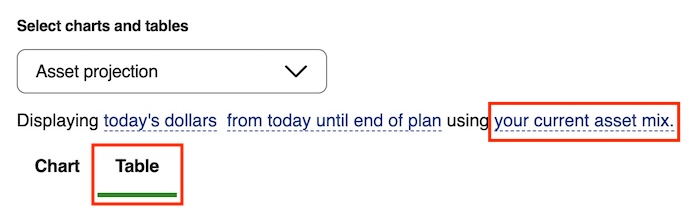

Switching to the Table view gives you more details than a chart. It displays three scenarios for market returns: Significantly Below Average Market, Below Average Market, and Average Market. Significantly Below Average says 90% of historical returns will end up above this number. Below Average is 75%, and Average is 50%.

The tool suggests that you look at the Significantly Below Average Market scenario for conservative planning. If your income and assets are sufficient to cover your planned expenses when the future returns are above the bottom 10% of historical returns, your income and investments have a good likelihood of covering your planned expenses.

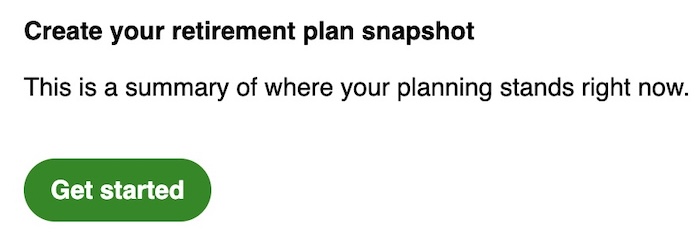

You should save a report now before you explore further. Scroll down to find the button to create a retirement plan snapshot. This serves as your baseline scenario.

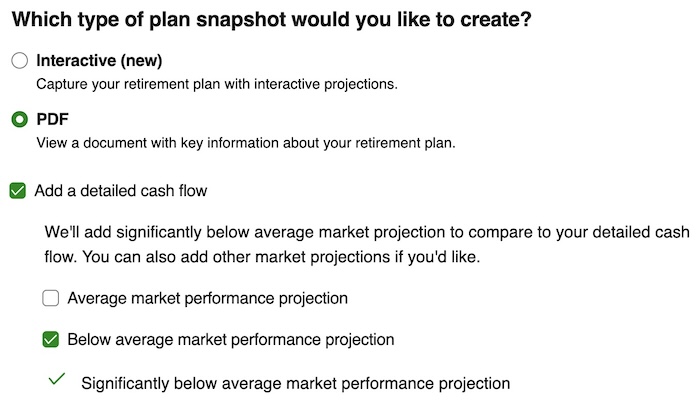

Choose the PDF format, and check the box to add a detailed cash flow. Significantly below average is automatically included. You can add “below average” and “average” for comparison.

Explore What-If’s

Whether your baseline says you’ll end up with $15 million when you die or you’ll have a shortfall, you should explore some alternative scenarios to see how different inputs affect your outcome.

What if you work longer or retire sooner?

What if your expenses are higher or lower?

What if the spike and one-time expenses are higher or lower?

What if you buy a second home? What if you sell that second home?

What if you claim Social Security earlier or later?

What if taxes are higher? Use the local tax field to dial up taxes.

The point of the exercise is to understand how much leeway you have in each input. If you see that you have a lot of leeway in one area, you can relax a bit and not worry too much about it. If you see that you have little leeway in another area, now you know where you must pay close attention.

You reach a happy medium by trial and error in altering your inputs. Your goal is to have sufficient money to cover your expenses when you live long. Using different inputs revealed to me Two Fundamental Drivers of Financial Success in Retirement.

I suggest using age 100 as the time horizon, but only looking at the asset value at a more reasonable old age, say 85 or 90. Investment returns compound exponentially over a long time horizon. The end asset value easily grows to a huge number at age 100. The value at age 85 or 90 is more realistic.

You save another PDF report when you find your happy medium. That’s your improved plan over your initial baseline.

Asset Allocation

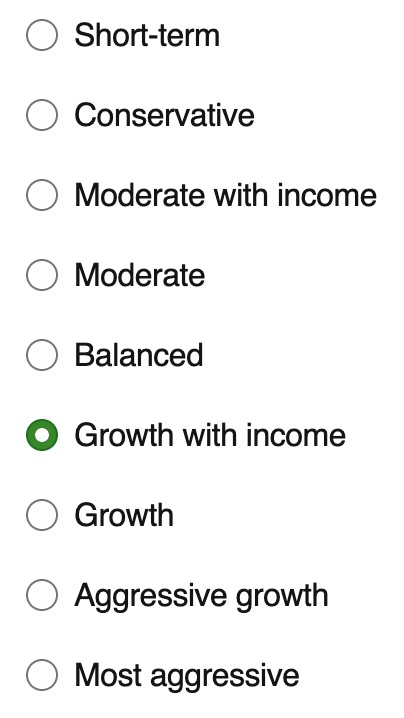

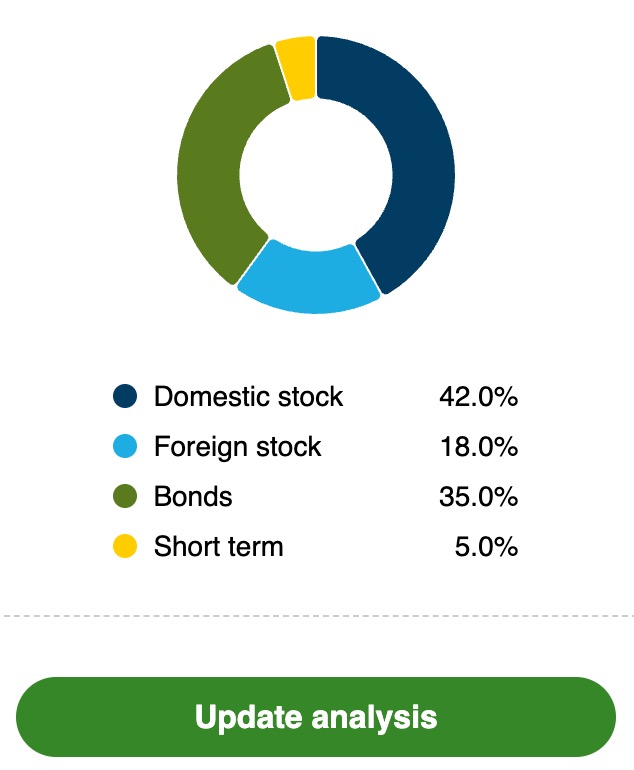

By default, the planning tool uses your actual asset allocation from the holdings in your accounts. You can also switch to one of nine model portfolio allocations, ranging from 100% short-term investments to 100% stocks.

Click on “your current asset mix” above the asset projection chart or table.

You’ll see one suggested target asset mix to consider. You can switch to a different suggestion by clicking on the three dots to the right.

After selecting a target mix, click on “Update Analysis” to see how it affects your projections.

This becomes another what-if variable. You observe how investing differently affects your retirement. If it doesn’t make that much difference whether you invest 50% in stocks versus 60%, maybe you won’t need to obsess about your exact asset allocation.

Soft Sell on Annuity

The last section of the retirement planning tool suggests using a portion of your portfolio to buy an income annuity.

The theory is that when more of the planned expenses are covered by guaranteed income streams, a portfolio can handle more withdrawals when returns are low. The theory isn’t necessarily wrong, but an automated recommendation based on only rough estimates looks like a soft sell to me.

I would ignore the Explore Income Strategies section at the end.

What It Doesn’t Do

I would call this a retirement modeling tool. It’s useful to model different inputs, but don’t treat the output as a tactical action plan that guides your retirement year by year.

It doesn’t tell you when you can retire if you’re still working. You can’t say “I’d like to cover 120% of my planned expenses (giving some margin for error), tell me when I can stop working.” You’d have to do trial-and-error to derive it.

It doesn’t tell you how much you can spend. If your planned expenses are low, the tool will show that you’ll have a lot of money left at the end. You’d have to dial your expenses up and down by trial and error and see how much you can spend without leaving too much money behind or running out of money.

It doesn’t suggest an asset allocation. You can change the target asset allocation and see what difference it makes, but the tool won’t tell you that given your income and assets, this asset allocation will cover the highest expenses when future returns are significantly below average.

It doesn’t change the asset allocation over time. This planning tool assumes that the asset allocation will stay the same for all years. It doesn’t apply a glide path to reduce your risk as you move along.

It doesn’t model inflation. The planning tool assumes 2.5% annual inflation for all expenses except healthcare. You can’t change that assumption.

It doesn’t model dynamic spending. The planning tool will use the given expenses adjusted for inflation, regardless of market conditions. It won’t reduce your withdrawals when the market is down.

It doesn’t manage withdrawals for taxes. The tool follows a preset order of withdrawals from different account types (taxable first, then pre-tax, and finally Roth). It doesn’t manage the withdrawals to smooth out taxes.

It doesn’t model Roth conversions. You can’t tell the tool to add an amount for Roth conversions between age X and age Y.

To the extent that you can withdraw less when the market is down or manage your taxes better through withdrawal sequencing or Roth conversions, your results will be better than the tool shows.

Conclusion

This free retirement modeling tool from Fidelity can be useful in showing you how much leeway you have and what moves the needle and what doesn’t. Integration with Full View saves you time in updating your asset values.

Through some rounds of trial and error, you can make it show you when you can retire for a given expense budget or how much expense your assets can cover for a chosen retirement date under various market conditions. You can also see the effect of portfolio asset allocation by picking different target allocations. It’s useful to establish some high-level boundaries.

It isn’t designed to give you year-by-year tactical guidance on structuring your retirement withdrawals or Roth conversions. You compare what-if scenarios by saving outputs to a PDF report, changing some inputs, saving outputs to a PDF again, and comparing the PDF reports. This isn’t as easy to use as some other tools designed to compare different scenarios, for example, MaxiFi (see Model Big Financial Decisions with MaxiFi Software).

I still use this retirement planning tool from Fidelity every year because I like its simplicity. It tells me one thing I’m most interested in: whether I’m on track. I don’t need to maximize withdrawals because a rich life isn’t about spending more money.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

John Paveza says

Check out Optimal Retirement Planner (ORP). ORP is an online retirement calculator that uses Linear Programming to compute maximum annual disposable income over retirement by balancing the minimizing of taxes against maximizing of returns on savings. ORP is available on the Internet to the public at no charge and with no registration at http://www.i-orp.com.

Financial Freedom Countdown says

Harry, did you go for the 25X or a more conservative 33x number for your FI?

I played with the Fidelity tool but found it adequate for a free software. I have seen a few paid retirement software used by financial planners which are quite sophisticated.

Harry Sit says

You bring up another big flaw of this calculator, especially for early retirement. The desired expenses in the next 40-50 years really can’t be predicted with any good confidence. Our value and preferences will change way more than we perceive today. Psychologist Dan Gilbert calls this the end-of-history illusion.

The budget we enter into the calculator may turn out to be way too high because we think we will need something but we will only know in the future that we actually don’t. Or it may be way too low because we think we don’t want something but we will actually want or need it in the future. Going by 25x, 33x, or any multiple of the currently expected expenses pretends the desired expenses will stay more or less the same, and only adjust by inflation. It also suffers from the end-of-history illusion. That’s why I don’t use that type of metric or pretend that I have locked in a certain lifestyle for the next 50 years.

Fred Eng says

Thanks Harry for the timely article. I found out about the tool when I was transferring a 401K to an established IRA via the 800 number. The representative informed me that free help was available. For accounts $250,000 or less, they would do that over the phone. There seem to be a couple of dollar slices but for my particular asset amount, I was offered an in person meeting at a local Fidelity office. As Harry described, the advisor, who was a CFP, input the numbers for me – I was made aware ahead of time to bring in expenses, Social Security statements, and non-Fidelity accounts. Since this was new to me, I was unsure what the report did not cover – thus the timeliness of Harry’s article. I also came across an article in Financial Advisor Magazine, September 2019 entitled “Easing Efficient Retirement Withdrawals”. Since this is a trade magazine, it lists software available to run more detailed withdrawal management strategies. I don’t know if any of the listed companies are available for the general public, even for a fee. I did run across a web site, NewRetirement.com which has some tools for something like $100 a year which is obviously inexpensive but again, I don’t know how cost effective it is following the old adage “You get what you pay for”.

Aaron says

The Retire Early Scenario Tool (REST) handles those issues (www.RetireEarlyScenarioTool.com). It’s only free the first day during the trial period, but it’s been worth it to me.

Gabe says

I’m unable to download the REST application. Is it no longer available?

Brian says

I’m a Fidelity customer via my employer’s retirement savings program and set up scenarios in the Fidelity calculator with the help of our employer’s local fidelity representative. I agree with the evaluation stated here that it’s okay as a free sanity check type of tool. I wound up doing research online and eventually purchasing a license for a program called ESPlanner (www.esplanner.com). It uses an approach called economics-based planning to help you figure out how much you can spend each year. I like the detail it gives on Roth conversions and it also gets the taxes right more so than some of the other simpler tools. ESPlanner, which is a Windows application, is being phased out in favor of a web-based newer platform called MaxiFi. MaxiFi is over $100/year to use, though, and I don’t need its precision until I’m closer to retirement; at that point, I’ll check back and see how MaxiFi is doing and what other tools might be available then. One thing to look out for with retirement planning software programs is that less you have to enter into them, the less accurate they tend to be, so while it’s a pain to input a lot of data into the programs that want more inputs, you may be helping your projections by doing so.

Dennis Hurley says

Brian and Harry: I can shed some more light on MaxiFi Planner (from http://www.esplanner.com or directly in maxifiplanner.com ).

1. I find MaxiFi excellent and have been using it for about 5 yrs. for myself, my family, and a few friends.

2. It covers all the 8 items that Harry Sit mentions are lacking in Fidelity product and does more.

3. Well known Economics Prof. Larry Kotlikoff from Boston University started developing it in 1993 on a mainframe computer and it has evolved since then now running on the Web (at AWS) in any browser so huge computing power to do calculations and simulations without installing any program on your computer. Prof. Kotlikoff continues to lead the company and the planning tool is getting continued updates to improve and as federal and state tax laws change.

4. Particularly useful is an unlimited # of alternate scenarios that you can propose and track without printing anything out. (Thorough reports are available in PDF and in Excel formats useful in my experience to save once you get to a “final” plan.) And if you find a better strategy, you can in one click define it as a base strategy to continue improving from there. So easy what if planning.

5. Easy to use (similar to a TurboTax interface) so you can immediately get improvements in your plan (including retirement, college expenses, bequeathing, moving between states, Social Security claim dates, purchasing life insurance, etc.)

6. But powerful enough to use periodically to further improve as you get to decision points in your life and have become more sophisticated in your understanding of personal finance. There is a lot of free learning together with the program (contextual help, videos, case studies, and Prof. Kotlikoff regularly authors articles using the software, and books (latest in 2022: Money Magic, a great read.) As Harry Sit recommends you can use the MaxiFi program to get “Good enough” plan and then “Set and forget” for several years.

7. Cost is very reasonable: $149 for 1st yr., and $109 for subsequent years, for the MaxiFi Premium version that includes Living Standard Monte Carlo and Contingency Planning (if one of a couple passes away before the other).

8. Excellent free support with use of product or any technical issue. And expert review is also available at reasonable prices if you need more help.

9. If you want to get a useful and inexpensive taste of what the product can do, I suggest trying out Prof. Kotlikoff’s other product Maximize My Social Security (maximizemysocialsecurity.com), that just covers Social Security (all 13 programs that SS Administration has). It maximizes SS claiming dates for max income.) the cost is only $40 per year and gives a good sense of what the full product MaxiFi is like to use. It is a $40 well spent.

Thanks, Harry, for covering such timely topics so well. I am excited to be able to read your articles every time you produce another one. (Amen to your most recent book My Financial Toolbox.)

KD says

Thank you for bringing up the end of history illusion. It is a consideration that it missed in how much is enough to retire or give up gainful employment for other lesser cash flow streams kind of discussion. I would like to hear more from you on how to navigate that aspect in planning and in execution stage.

Harry Sit says

I don’t have a good answer except to prepare mentally for changes. Just looking back four years since I ended full-time employment, I couldn’t have imagined back then this would be the journey and I would be here now. I can’t say I see how the next four years will play out, let alone the next 20, 30, or 40 years. You’re never “all set.” You’re always taking a chance.

Lori says

Thanks for the update. Another way I’ve used the tool is to check how the numbers change if one or the other spouse dies early. It can show you if you have a gap in your income planning for either surviving spouse.

Retire2023 says

Lump sum vs pension is what this tool helped me understand as to retirement plan implications. I too ‘found’ the Fidelity tool by chance via my wife’s work 401K account. Fidelity owns e-Money the SW company that most financial advisor use. What is on the Fidelity site is about 85% of e-Money functionally I am guessing. If you want more features / reports you have to call someone at Fidelity to run them (an oppty to sell or get you on a AUM arrangement-I met with the local VP and they ran me some reports that only they can assess – all without any sales pitch – easy, free, and nice visit). I really liked the ‘what-if’ reports I could build on my own- and to compare them against other tools (I use NewRetirement the paid subscription as I am one year from retirement). I liked playing with the Fidelity tool as when to take SS, and looking how Guaranteed Income (annuity or in my case pension) impacts plan. It really changed my views on how having a guaranteed income for me positivly impacts to my plan (for me significantly improving my annual spending power -with little impact to ‘ending’ value – I was a big NO to a monthly pension before this). So after diligently playing with the Fidelity tool I am now convinced for my plan, and now I will take a Monthly Pension over a Lump Sum (forgoing annuity purchases) for my monthly pension. Using this tool really help me see the value that long term Guaranteed income has for my plan. And I was really surprised how it impacted overall plan (it was not a Lump Sum vs Monthly analysis – I used the earlier Blog that Harry wrote to help with that analysis). If you have not used the Fidelity tool – for free, it is a very nice free “second opinion” resource, worth the time to play ‘what-if’ scenarios on Investing, SS, and fooling with the Guarantee income impacts (changed my views).

PS – Thanks Harry for your site and writings – I also bought your e-book on Amazon as a “thank you” 🙂 for your good work and knowledge sharing.

Frank Wang says

If you are a customer of TD Ameritrade, you can set up a goal planning meeting with them. They use a site called moneyguidepro for financial planning. The system allows modeling with different scenarios as others. It has a unique feature called “Bad Timing” – you hypothesize that you retire right before or during the bear markets and your portfolio value is down 20% (typical bear market return), what would be the impact to your withdrawal rate and spending plan?

Horton says

Harry,

What other tool(s) do you use regularly for the things that Fidelity’s tool doesn’t do – e.g., how much to spend, asset allocation, Roth conversions, etc.?

Harry Sit says

How much to spend – The VPW table based on the portfolio balance and our ages, mentioned in Easy Early Retirement Portfolio Withdrawals.

Asset allocation – 60/40 based on our ages and risk tolerance/gut feeling.

Roth conversion – Case Study Spreadsheet mentioned in Roth Conversion and Capital Gains On ACA Health Insurance.

Frank Wang says

Harry,

I just read your 2018 post “Easy Early Retirement Portfolio Withdrawals” with interests. Given both stocks and bonds are down, what is your new rebalancing strategy for the taxable and retirement accounts?

Harry Sit says

I’m still using the same strategy. Both stocks and intermediate bonds went down in 2022 but stocks had a bigger loss. So I sold stocks to buy bonds in taxable and sold bonds to buy stocks in retirement accounts.

anon says

won’t actually allow me to create an account, in various browsers, says “can’t verify your data” ; which sounds like it wants you to have a fidelity account already , shrug , what a pain

Steve Chappell says

Thanks for the excellent article and insightful comments. I am new to this site.

Steve says

Harry,

I have used the Fidelity retirement planning tool for my own retirement planning.

Is there a way I can run it separately to do retirement planning for a friend who is also in retirement?

From what I can tell the only way to do that would be to completely replace the info I have already entered for myself with the friend’s profile, goals, funds, etc.

My friend has his own Fidelity account but is not into using the tool.

Harry Sit says

No, you can’t run two plans in one account. You can control your friend’s screen over Zoom and let him watch how you do it, or he can come to your house with his laptop. He can also make an appointment with an advisor at a Fidelity branch. They can do it either in person or via Zoom.