I use the free Fidelity retirement planning tool to keep an eye on our current investments relative to our spending. Using that tool revealed two fundamental drivers of financial success in retirement.

| Good Returns | Bad Returns | |

|---|---|---|

| Low Spending | OK | OK |

| High Spending | OK | Not OK |

Although my wife said the two fundamental drivers were only too obvious, the planning tool gives us an idea of how low is low and how high is high.

Conventional Retirement Calculator

The Fidelity retirement planning tool uses a conventional approach. It gathers your investments and asks you how much you plan to spend. Then it simulates future returns to see how well your investments will cover your planned spending. It’s a success if your projected balance is above zero at the end of your planning horizon. Many retirement planning tools work like this. I just happen to use the one from Fidelity because it’s available and free.

It isn’t easy to use the tool to model big financial decisions such as staying in a high-cost-of-living area after retirement versus relocating as we did last time in Moving to Lower Cost of Living After You Retire. You can run the projections and save the report as a PDF, change the assumptions, run it again, save the new report as a PDF, and compare the two PDFs. If you’d like to go back to your original assumptions, you must remember where you made changes and back out all your changes.

When I compare the effects of different levels of spending, I use my login to run one level of spending and my wife uses her login to run a different level of spending. Then we compare the two PDFs. It works for a simple A-B comparison but it’s difficult to do more than that.

MaxiFi

Other financial planning applications are better equipped for tactical planning. MaxiFi is one of them.

MaxiFi is online financial planning software from a company led by Boston University economics professor Larry Kotlikoff. A one-year license costs $109 for the Standard version, or $149 for the Premium version, with a discount for renewals. I bought the Premium version last year to see how it worked.

I played with the software but I’m not a power user. Reader Dennis Hurley is more experienced with MaxiFi. He helped me get up to speed. I’m only describing how I used MaxiFi. It may not be the officially correct way as intended by the software maker. I’m not paid by MaxiFi or anyone else to write this review. I don’t benefit financially in any way if you buy MaxiFi or any other software.

MaxiFi takes an unconventional approach. It doesn’t link your accounts. It only asks for the total amount in your pre-tax, Roth, and taxable buckets. It doesn’t ask what investments you have in your accounts. You enter your expected safe return for each bucket in the settings. It doesn’t ask how much you plan to spend unless it’s one-time or episodic (“special expenses”). The software calculates your available discretionary spending based on the principle of consumption smoothing.

Discretionary spending in MaxiFi is in economic terms. It isn’t what we normally think of as discretionary in everyday life. MaxiFi treats housing, taxes, Medicare Part B premiums, life insurance, and special expenses as fixed spending. Everything else is discretionary spending. You would think food isn’t discretionary, but that’s just how MaxiFi categorizes things. If the term “discretionary” bothers you, you can call it “other spending.” Discretionary spending in MaxiFi represents a living standard.

Base Plan and Maximized Plan

MaxiFi starts by asking about your current financial situation and your assumptions for inflation, expected returns, your desired retirement age, when you’ll start withdrawing from your retirement accounts, and when you’ll claim Social Security. This generates a Base Plan.

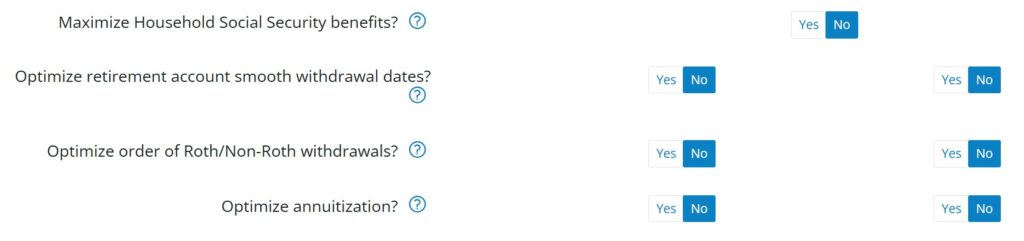

Then it offers to improve the Base Plan by automatically testing changes to when you’ll claim Social Security, when you’ll start smooth withdrawals from your retirement accounts, whether you’ll withdraw from pre-tax accounts first or Roth accounts first, and whether you’ll consider buying an annuity.

You can say yes or no to each item you want the software to change. MaxiFi will generate a Maximized Plan by testing different combinations of those items and picking a plan that has the highest lifetime discretionary spending. If you’re happy with the changes, you can apply them to the Base Plan in one click.

Discretionary Spending as a Metric

MaxiFi sees a change as an improvement when it increases the calculated discretionary spending. I treat the annual discretionary spending from MaxiFi only as a metric. I see it as a living standard available to me, not as the software mandating that I must actually spend that amount every year. I only use the discretionary spending number to compare different situations. I know that a move is a good one if it increases my available discretionary spending.

Social Security Claiming Strategy

If you’re married and you set the maximum age to 98 or 100 for both of you, MaxiFi will most likely suggest that you both delay claiming Social Security to age 70. Don’t be surprised when you see it differs from the output of other tools such as Open Social Security.

Open Social Security uses mortality tables with weighted probabilities of living to different ages. MaxiFi uses fixed ages from your inputs. If you say both of you will live to 100 for sure, the best strategy naturally is to delay until age 70 for both. You’ll see different strategies when you create different profiles with both spouses living to 85, or one spouse living to 95 and the other living to 83, etc. I like Open Social Security’s approach better in this regard.

The maximum age inputs also affect annuity suggestions in the Maximized Plan. If you say both of you will live to 100 in the profile, buying an annuity will naturally be helpful if you turn on optimizing annuities. I set the annuity options to “no” when I run a Maximized Plan.

Assumptions, Assumptions, Assumptions

MaxiFi is a modeling tool. It can’t predict the future. No software can. All outputs are based on a specific set of assumptions. I automatically add “based on this set of assumptions” to every output I read from MaxiFi. This applies to all software. Every output is based on a specific set of assumptions.

The Maximized Plan is optimal only based on one set of assumptions. The optimal plan will be different under a different set of assumptions. I see the value of MaxiFi not as much in generating a withdrawal and spending plan based on a set of assumptions, but more in testing different assumptions.

Alternative Profiles

MaxiFi makes it easy to compare different scenarios. You duplicate the Base Profile into an Alternative Profile, make changes in the Alternative Profile, and compare it with the Base Profile. You can create up to 25 alternative profiles and compare outputs among those profiles. This helps answer all sorts of “Can I afford it?” and “Should I do A or B?” questions:

Can I retire now versus 5 years from now?

Can I afford to buy an expensive house or a second home?

Will helping my kids derail my retirement?

Should I sell investments and realize capital gains to pay cash for a home or get a loan?

Should I stay in my current home or downsize or relocate?

Should I sell my house or rent it out because my mortgage is below 3%?

These big financial decisions require more attention because they tend to be one-time, all-or-nothing, and costly to switch. See Which Financial Decisions Require Extra Attention and Which Don’t.

You’ll see the impact on your available discretionary spending when you compare outputs between alternative profiles. You know you’ll have more money to spend if you work another 5 years, but by how much? You create one profile with retiring now, duplicate it, change the retirement date, and compare. You know you’ll have less money for retirement if you help your kids or grandkids, but by how much? You duplicate your current profile into an alternative profile, add the extra expenses, and compare it with your current profile.

Example

A reader said he was interested in moving from a high-cost-of-living area, but selling his home would trigger taxes on a large capital gain well above the $500,000 tax exemption. The NYT buy-or-rent calculator I used in the previous post doesn’t take into account the built-in capital gain. MaxiFi does.

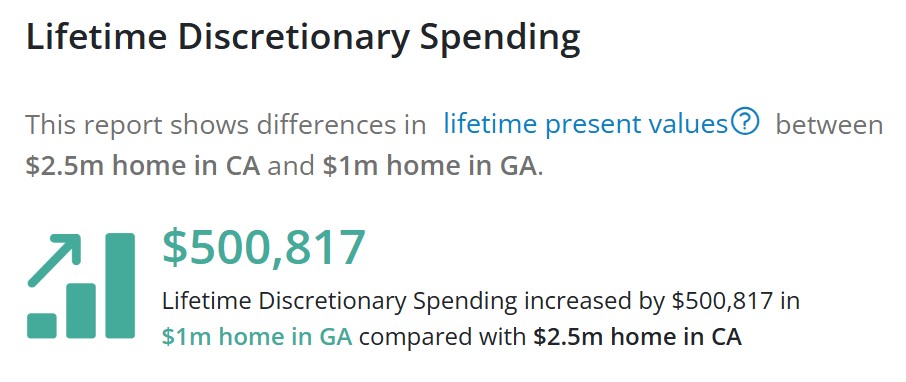

I created one hypothetical profile in MaxiFi with a home in California worth $2.5 million, with a cost basis of $500,000 ($2 million unrealized capital gain before the tax exemption). I duplicated it into another profile and made changes to sell the home in California, pay federal and state taxes on the capital gains, and buy a $1 million home in Georgia. MaxiFi shows this when I compared the two profiles:

It shows how much the lifetime discretionary spending would increase based on a set of assumptions by selling the California home and moving to Georgia, despite having to pay capital gains taxes on $2 million. I can create additional profiles and compare again, assuming the home value grows faster in California than in Georgia, or different inflation rates and investment returns.

MaxiFi can’t predict the future, but it can help you model different scenarios.

Roth Conversions

You can also use alternative profiles to model Roth conversions. The Standard version of MaxiFi doesn’t suggest how much you should convert, but you can test converting different amounts between age X and age Y in alternative profiles. Here’s a video from MaxiFi on how to model a Roth conversion in the Standard edition:

The Premium version includes a feature that automatically suggests how much you should convert. Here’s a video on the optimizer feature in the Premium edition:

Ignore the Precision

Any modeling software will calculate to the exact dollar, but I ignore the precision. Because projections are based on assumptions, it will be a miracle if a projection gets the first two digits correct in real life. It’s difficult to even get the first digit right.

In the previous example, if a retired couple sells a $2.5 million home in California and moves to Georgia, will they really increase their lifetime discretionary spending by $500,817? It could turn out to be $300k, $400k, $600k, or $700k. I don’t think you can have high confidence that it’ll be $500k in real life. All you can say is that it’s directionally beneficial if the assumptions aren’t too far off.

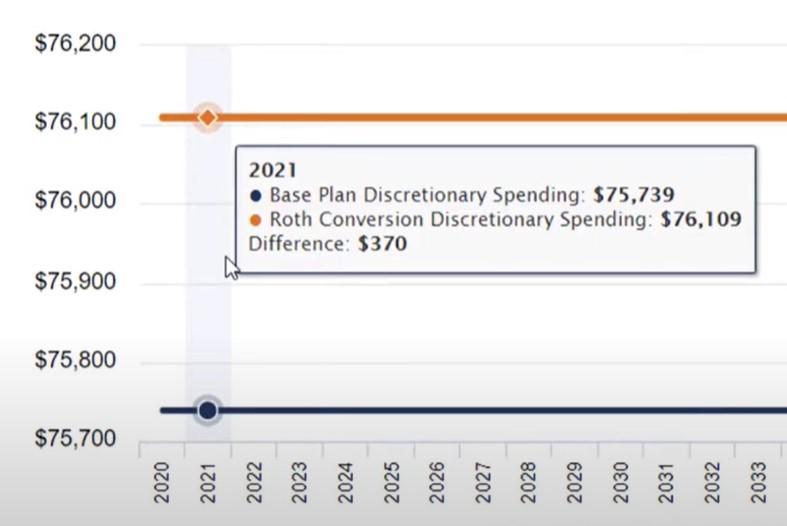

The first Roth conversion video from MaxiFi shows that the conversion amount being considered would raise the annual discretionary spending from $75,739 to $76,109 based on a set of assumptions. I would call this result a toss-up. The $370 difference is too small because it’s less than 0.5% of the annual discretionary spending. Converting that amount in real life could be better or it could be worse. I can’t even say it’s directionally beneficial. I would look for moves that make a bigger difference.

Monte Carlo

The Premium version of MaxiFi includes a Monte Carlo feature, which simulates how different investment strategies and spending behaviors impact your living standard. The $40 price difference between the Stand version and the Premium version in the first year isn’t much. You might as well get the Premium version to see if the Monte Carlo reports and the Roth conversion optimizer are helpful, but I find the standard reports more useful than the Monte Carlo reports.

A problem with Monte Carlo is that it always shows a wide range of outcomes. My available spending can be $50,000 a year if returns are poor, or it can be $200,000 a year if returns are good. So do I spend $50,000 or $200,000? If I spend $50,000 a year and returns aren’t that bad, I’ll have a ton of money left that I could’ve enjoyed. If I spend $200,000 a year and returns are poor, it won’t be sustainable. This isn’t unique to MaxiFi. That’s just the nature of the beast. No software can remove this uncertainty.

I find more value in the reports in the Standard version of MaxiFi because I only use the annual spending from the software as a metric to compare different scenarios. I don’t go by the spending output from the software for my actual spending. If you want to save a little money, maybe start with the Standard version and upgrade to Premium when you decide to use MaxiFi long-term.

Support

MaxiFi has a user’s manual on its support website and how-to videos and webinars on YouTube. The company also offers online office hours twice a month to answer questions. If you can’t figure out how to model something, you can send an email to MaxiFi customer service, and they’ll tell you. If you want a MaxiFi expert to review your plan and help you interpret the results, you can pay $250 for a one-hour video session. I get the sense that they really want to help you make good financial decisions with the software.

Other Software

I’m satisfied with MaxiFi overall. It’s inexpensive and useful to model big financial decisions. No software can predict the future or remove uncertainty, but you don’t have to throw up your hands and leave big financial decisions to gut feelings.

It’s unrealistic to expect any software to give you a withdrawal plan that won’t lead to having a big pile of money at the end when returns are good or having to adjust the spending down when returns are poor. That’s not how I use MaxiFi.

Set a wide range of assumptions and evaluate the wide range of outcomes. You still won’t know how exactly a big financial decision will turn out in real life, but you’ll have some idea of a range and understand what will influence the outcomes. It’s a steal to pay only $109 or $149 for a tool to help you make big financial decisions that are one-time, all-or-nothing, and costly to switch.

MaxiFi isn’t the only financial planning software. I can’t say it’s the best because I haven’t used many other software programs to compare. I only know it’s more powerful than the free Fidelity retirement calculator. Boldin, Pralana, and ProjectionLab are also in the same $100 – $150 price range. If you have big financial decisions coming up and you’re not sure which software to use, try them all and pick your favorite. I bought Pralana to try it after my MaxiFi license expired.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Bryan says

I have not used MaxiFi, but have tried a few different planners and have stuck with NewRetirement. I find that UI is fairly easy to use, allows quick comparison between scenarios (to better help make decisions), has numerous ways to look at different aspects of our financial situation, and has nice graphs and reports that are useful when showing my wife what’s going on.

With regards to the scenarios, can quickly toggle between them to see the impact to lifetime taxes and End-of-Plan savings along with detailed graphs on expenses, income, taxes, depending on where we a user is within the planner. A user can also compare in one page details of 3 different scenarios; can have up to 10 different scenarios in the premium version.

The Roth conversion and Social Security explorer tools are nice as well to help model around these areas.

I also like the educational portion of the planner and company. They have an extensive database of topics and articles, regular monthly meetings (different zoom calls targeted for new users, power users and financial topics), paid 1-1 coaching (if needed) and the ability to quickly send a message within the planner for specific questions or issues.

It is easy to give NRP a try since they have a free version along with a 14 day trial on their premium version.

No planner is perfect, but it is nice to have options to help us make better intentional decisions.

John Gallatin says

Is this post sponsered by MaxiFi in some way?

Harry Sit says

No one paid me anything to write this. I paid $149 to use the software for one year when I faced big financial decisions in how much house I can afford and if I should pay cash or get a loan.

John Gallatin says

I now see in red letters that it isn’t :

“I’m not paid by MaxiFi or anyone else to write this review.”

thanks

KD says

My general impression was that your spending was well below 4% of your portfolio, that you were purchasing a home for much less than what you sold for in the Bay area few years ago. Given this, why would the optimal choice be important here? You say, “It isn’t easy to use the [Fidelity] tool to model big financial decisions” but the article doesn’t compare the outcomes from Fidelity tool and MaxiFi for your case. We’re the answers different? by how much? Did it affect your decision making? If granularity can give a sense of false precision, then why not go with something like Fidelity that guides you to the upper and lower bounds? I understand MaxiFi was used as an assurance tool for one time irreversible decision. But beyond the intention, what was it’s perceived value?

Harry Sit says

The final cost of the new home wasn’t much less than what our previous home sold for. It was about the same but we couldn’t know the final cost when construction started. The cost-plus contract meant that we had to pay whatever it took to build it. Cost overruns are common in new construction. We were fortunate we didn’t have a massive cost overrun.

The $149 cost of the software is peanuts relative to the house. It’s worth having a better tool. The Fidelity calculator has only one profile. Any new input overwrites the previous input. It’s difficult to compare different scenarios. I had to use two logins and manually sync all inputs between the two logins to compare two profiles. The point isn’t to get just one answer. It’s to get a range of answers with different inputs.

Even if the software turns out to be completely redundant or unhelpful for my personal planning, it’s worth testing it as a public service to readers of this blog.

RH says

Thanks for the review. Might also consider exploring Projection Lab (https://projectionlab.com/). I am currently looking at these types of software to do some planning (job change, moving to HCOL renting vs owning home today, etc) and keep seeing it recommended on Bogleheads for its simplicity and ease of use. I think the gist is that it is more customizable and transparent as to what is going on under the hood than NewRetirement (& maybe MaxiFi too?) but can still flexibly scenario plan and model life events etc. Also offers a free version, and a free trial for the paid product, which MaxiFi does not. And it is similar to MaxiFi in what it doesn’t link your accounts (I think you can through a YNAB plugin if you want live updates, but normally it just asks for account type and you plug the dollar values in yourself)

good Projection Lab overview video here by the developer: https://www.youtube.com/watch?v=R5qOiUe_8no

there also have videos specifically around Tax Analytics and Roth IRA conversions.

I will probably try both NewRetirement and Projection Lab over the same 2 weeks and stick with whichever I like better.

Would be interesting if you have the time to play around with the other software (on trials) to know how they the same input data for you, compared with what MaxiFi recommended, and how the user experience was to arrive at those recommendations. They seem to be all at roughly the same price point.

Lastly: Pralana is launching a new web hosted version, separate from their existing spreadsheet offering, this June 2024 supposedly (it’s been delayed)

Harry Sit says

Thank you for the suggestion. I’ll check out Projection Lab when I have time. I should buy the spreadsheet version of Pralana while it’s still available. The spreadsheet doesn’t require a subscription. I don’t mind not having the latest tax brackets because I ignore the precision anyway.

RobI says

I just gave Parlana Bronze a try. Its easy to use, esp if you like using Excel models and see tables vs only charts. Bronze by design is limited such as only a few assumptions and uses manually estimated marginal tax rate and return assumptions. Still its useful for first approximation planning and simple what ifs. I’m not yet sure if its any better than Fidelity or the planner in Quicken Deluxe which I’ve relied on for years.

May pony up for the Gold paid version as it seem to model all the complexities such as tax calcs over time – IRMAA, NIIT and changes when one partner becomes widowed later in life. I downloaded the Gold manual to understand what it can do.

CA Academic says

I bought ESPlannerPLUS, the Windows-based stand-alone program which preceded MaxiFi, several years ago. I’m glad I was able to buy ESPlannerPlus outright rather than pay a subscription. I was also glad I didn’t have to enter sensitive financial information into an online portal. At the time I set up a profile and ran various scenarios and found them helpful, mostly as an assurance check. Then I got away from it because I was sticking with my savings plan and not much had changed for us, scneario-wise. I did revisit it again when projecting whether a Roth conversion would be beneficial, costly, or (mostly) a wash and at the time it looked to be mostly a wash. I’ll likely revisit it again next year when I become eligible to do Roth conversions. If the financial side still looks to be mostly a wash, I’ll base my decision on other factors (e.g., the potential likelihood of the ability to do conversions being taken away by Congress). I recognize my version of ESPlanner is out of date on the finer details, but, like Harry, I’m not focusing on the minute details and precision. Instead, I’m trying my best to adopt his “build a bigger bowl” philosophy so the smaller things don’t matter and I can satisfice more than optimize. That said, I join others who have posted thanking Harry for this thoughtful review and welcome reviews of Pralana Gold and other programs, especially ones that can be bought outright and run locally (as opposed to subscription-based programs run on websites). Thank you, Harry, for all you do, especially in helping us to separate out the things that make a big difference from the things that don’t in the world of finance and investing.

Harry Sit says

It’s handy to have software for off-line use at any time but paying $109 for one year isn’t too bad. MaxiFi sends renewal reminders but they don’t automatically bill renewals. The license expires by default unless you actively renew. Big decisions don’t come up every year. You just let it lapse when you’re done and pay again when you have another big decision in the future. The cost of the software is negligible relative to the big decision.

Like a blind squirrel, I find some nuts once in a while. The bigger bowl theory is one of them. Safety in the mainstream is another.