Despite a long list of things that Fidelity’s retirement planning tool doesn’t do, I still use it as a high-level model. The planning exercise I did at the end of last year revealed two fundamental drivers of financial success in retirement.

Baseline Spending

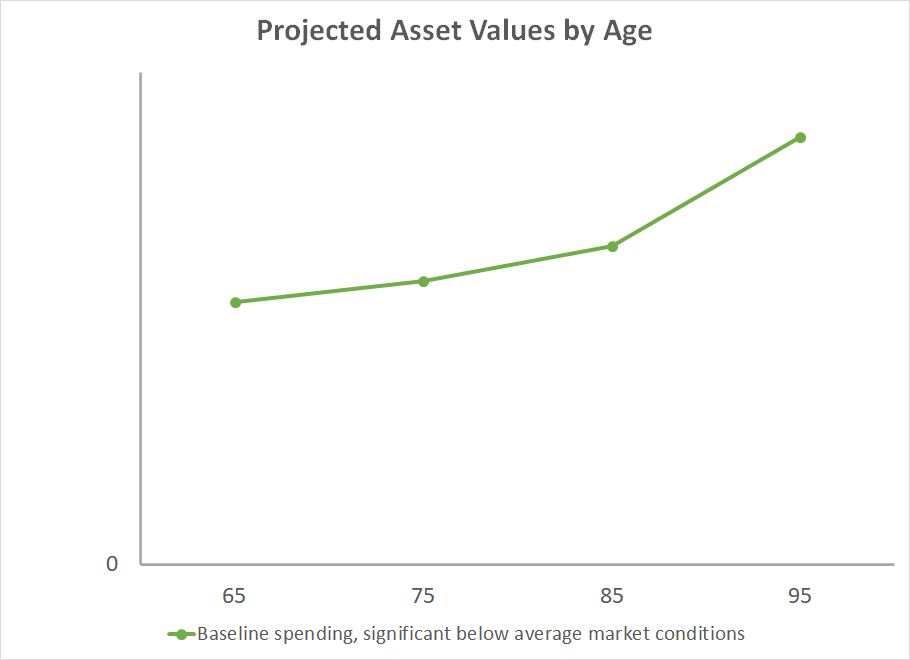

First, I created a baseline annual spending. The planning tool showed a table of the projected values of our investments at different ages when the investment returns are “significantly below average.” Significantly below average means “a scenario in which your outcome was successful 90% of the time” using historical data. I created this chart by sampling a few age milestones from the table:

All values are in today’s dollars. I’m not showing numbers on the vertical axis for obvious reasons.

Our investment portfolio is projected to increase while we take withdrawals to support the planned annual spending. That’s both good and bad. It’s good because it shows we have enough for our retirement. It’s bad because we don’t need or want 60% more money at age 95 than at age 65.

Higher Spending

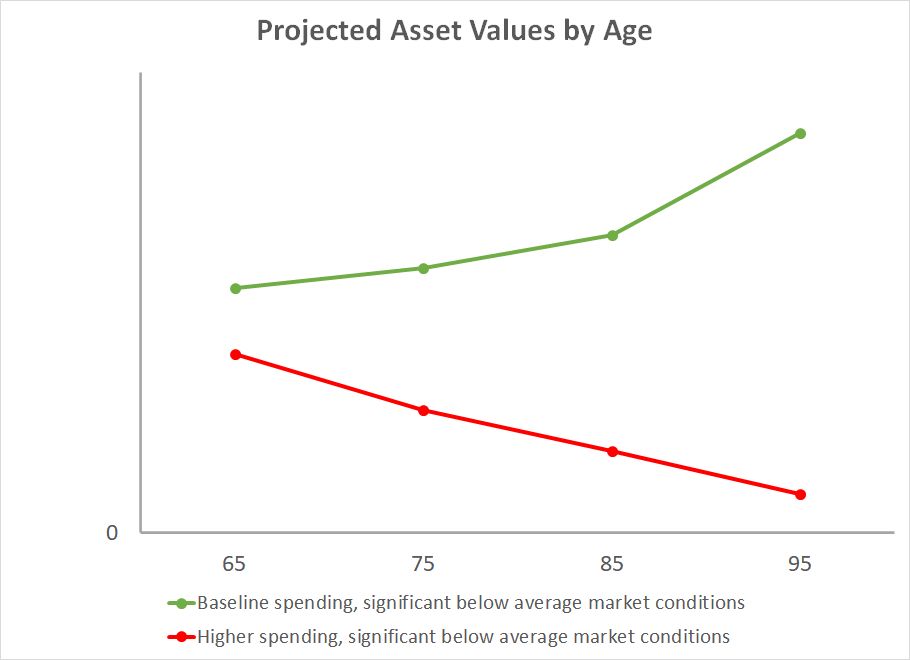

Next, I increased the annual spending by 20%. The planning tool showed a different set of projected values:

Now the projected values go down with age. It gets dangerously close to zero at age 95. This means that our sustainable spending is somewhere between these two levels. If the future market returns are below 90% of returns in the past, we can still spend a little more than the baseline plan but not 20% more.

Better Market Conditions

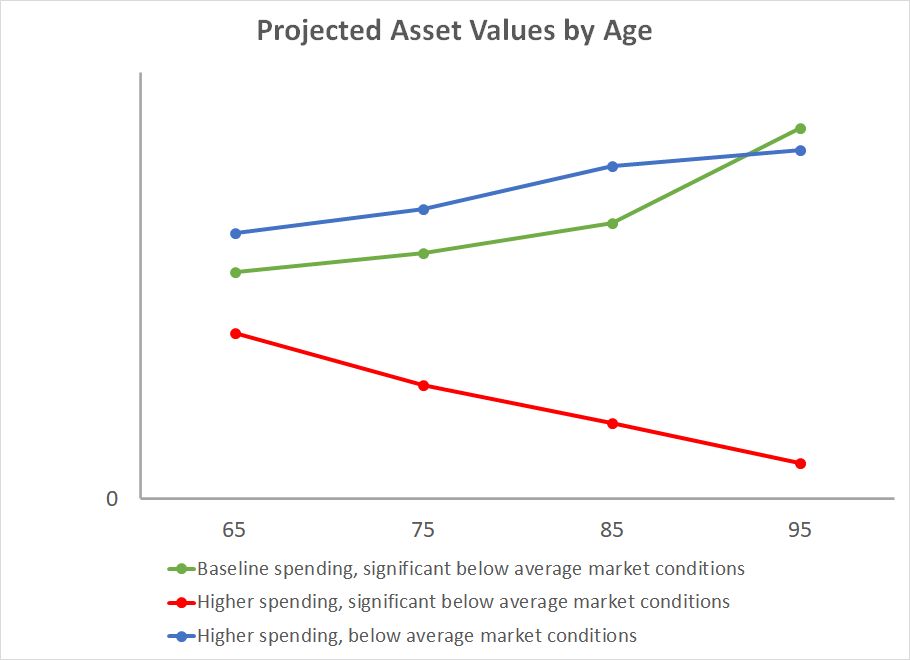

The planning tool also produced a table of projected values for returns merely below average but not significantly below average. Below average means “a scenario in which your outcome was successful 75% of the time” as opposed to 90%. The projected asset values under these better market conditions while supporting the higher spending looks like the blue line in this chart:

It shows that if the returns are only below average — not significantly below average — our assets would be higher than the baseline scenario through age 90 while supporting 20% higher spending every year.

Fundamental Drivers

When I presented these three scenarios to my wife, she pointed out that it was only too obvious.

“You didn’t have to run a fancy tool to tell me that higher spending will drain our investments faster and better returns will help.”

She told me the same thing when I said I discovered the secrets to a fat 401k 11 years ago.

It’s obvious because it’s true. Spending and investment returns are indeed the two fundamental drivers of financial success in retirement because they compound. We can handle low returns (the green line) or higher spending (the blue line) but not both year after year if we live long (the red line).

| Low Spending | High Spending | |

|---|---|---|

| Good Returns | OK | OK |

| Bad Returns | OK | Not OK |

When we think of the usual consternations in retirement planning — when to claim Social Security, which accounts to withdraw from first, when and how much to convert to Roth, buckets strategy or proportional withdrawals, buy an annuity or not, … — everything added together can’t alter our retirement trajectory as much as our annual spending and investment returns.

If we’re on the red line because our annual spending is too high relative to the investment returns, the most optimal tactics in Social Security claiming, Roth conversion, and withdrawal sequencing won’t yank us back to the green line. We’ll need to reduce spending. If we’re on the blue line because we aren’t so unlucky with investment returns, we’ll do just fine even if we aren’t so clever in retirement planning tactics.

You don’t have to use Fidelity’s retirement planning tool to see this effect. Any other tool will show the same two fundamental drivers.

Make It Robust

Retirement planning tactics are useful but we should make our plan NOT rely on them. If optimal executions of Social Security claiming, Roth conversion, and withdrawal sequencing make or break our retirement, it means our plan is too fragile. It isn’t robust enough when a slip in execution, a miscalculation, or a change of laws will knock us off track.

The goal should be to make our retirement successful regardless. When we get our spending right for the market conditions, any optimization tactics will only be icing on the cake, and suboptimal executions won’t jeopardize our retirement. If we get our spending wrong for the market conditions, no amount of optimization will rescue our retirement.

***

We’ll be watching the trajectory of our investments. If we see we’re at risk of going on the red line when we have a combination of high spending and low returns, we’ll reduce spending and try to move toward the green line. If we see that the market returns aren’t too bad, we’ll know we have more leeway in our spending. That’s how we’ll keep our eyes on the two fundamental drivers of financial success in retirement.

I told my wife that’s all she needs to do if something happens to me. Everything else is optional. How does SECURE Act 2.0 alter the financial success of our retirement? It does not, because it doesn’t change the two fundamental drivers.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Rachelle says

Absolutely agree, many people get caught up in fine tuning. Retirement planning can be much simpler when you are willing to adjust spending. But that’s exactly the problem. People seem terrified of ever reducing spending, whether working or retired. Lately I’ve decided growing up poor has given me a super power. I’ve never had lofty lifestyle expectations. I will not be emotionally crushed by poor returns in the future. Extras are nice, but not necessary for me to be happy and content.

Thank you so much for your excellent insights over the years. Your book on TIPS was very helpful too!

Harry Sit says

Not being picky to appreciate the fine details of expensive stuff comes as a big advantage. You don’t feel deprived when you go without.

KD says

Great article, Harry! I understand that increase in expenses with time will happen due to inflation. Can you share insights on how spending has changed for you and your family with the investments returns in the past few years? Were there any unexpected life events that happened? Did you have to calibrate spending (either higher or lower) because of them? Using the understanding the drivers of retirement success and putting them into action if you will. My hunch from reading bogleheads forum is that folks that can calibrate it higher don’t do it, and those that have to calibrate it lower usually don’t sit around but try to supplement it with some income. I have found spending flexibility is rarely enacted in real life as financial planners and calculators envision it. What do you think?

Harry Sit says

We calculate a spending allowance based on the previous year’s ending balance. I wrote about this in Easy Early Retirement Portfolio Withdrawals. Returns were good in 2019, 2020, and 2021. Our allowance in each subsequent year grew rapidly. We didn’t hit our allowance in those years (nor did we try to). The allowance for 2023 is down from 2022 but I don’t think we’ll hit it either simply because it grew so much in previous years. Our inexperience in handling relocation and its unfortunate timing were the unexpected life events, which I mentioned in Relocating for Retirement: Buy or Rent. We had to calibrate to the higher cost of housing as a result.

We find that our enjoyment isn’t closely related to the cost. We visited Switzerland for a month last year. It cost over $10,000. We joined a cross-country skiing program at a nearby facility this past winter. It cost $1,000. I can’t say that we enjoyed visiting Switzerland for a month more than we enjoyed cross-country skiing all winter. The costs are vastly different but the level of enjoyment is about the same. A neighbor put out a bike by the curb with a sign that said “Free.” I picked it up and now I’m riding it around the neighborhood. If budget becomes an issue, we’ll do more cross-country skiing and bicycling and less world travel.

To the other direction, I don’t think we must spend only because we can afford it. When the free bike works fine for my purpose, I don’t feel compelled to buy a new fancier bike. I’ll buy one when my bike skills graduate to a level where a new bike makes a difference. I can understand why folks don’t calibrate up. It’s not because they’re afraid of running out. They’re simply happy with what they already have.

KD says

Thank you Harry for the detailed reply. I believe you hit upon the next stage of emotional development after FI or FIRE – lifestyle contentment that comes from being able to live the most aligned with one’s values and preferences. This is may result in not calibrating it up if returns are good because there is no need to do so or even inclination to do so. My FI journey has reached a fork in the road. It is not heading into RE part yet. I am emotionally stuck believing that if my portfolio is larger my lifestyle may be larger too in retirement – that I may be inclined to spend more with more time on my hands. The wisdom I am hearing from you is that it may not be so. I have fair enough idea of which areas may get inflated in spending and which may not. I hope to lean into that knowledge and the wisdom you shared to hopefully make choices that minimize my regrets and help me undertake actions on spending aligned with my values and preferences to make best use of the time I have left. Thank you again for this reply. It was very helpful.

Matt says

For those who haven’t retired yet, the other obvious driver is when you retire. Retire early and you need more money or you spend less. Retire later and you need less money or can spend more.

Harry Sit says

Some people denigrate this important driver as the One More Year Syndrome. Not everyone hates their job and wants to get out as soon as possible. Only FOMO promoters treat it as a race to see who retires at the youngest age. I wrote about this in Staying In Your Job After Financial Independence.