By now it’s obvious I botched our relocation last year. The decision to relocate was correct but I executed it poorly due to my lack of experience. I also didn’t think through all the options when I only relied on some “rules” that were either outdated or didn’t apply to our situation. In the end, my poor execution cost us $300,000 $500,000 $700,000.

Many people may be considering relocation for remote work or retirement. I’m writing down the lessons I learned from my mistakes.

Rent First In a New City?

We thought we should rent because we heard the rule that you should rent first when you move to a new city.

The reason behind this rule is that if you jump directly into buying, you may buy in the wrong place when you’re not familiar with the new city. Renting gives you time to figure out where exactly you’d like to settle in.

That’s all good but it introduces two problems.

The first problem is availability. It may be easier if you’re willing to rent an apartment, but if you’d like to live in a single-family home as you’re used to, far fewer single-family homes are available for rent than for sale.

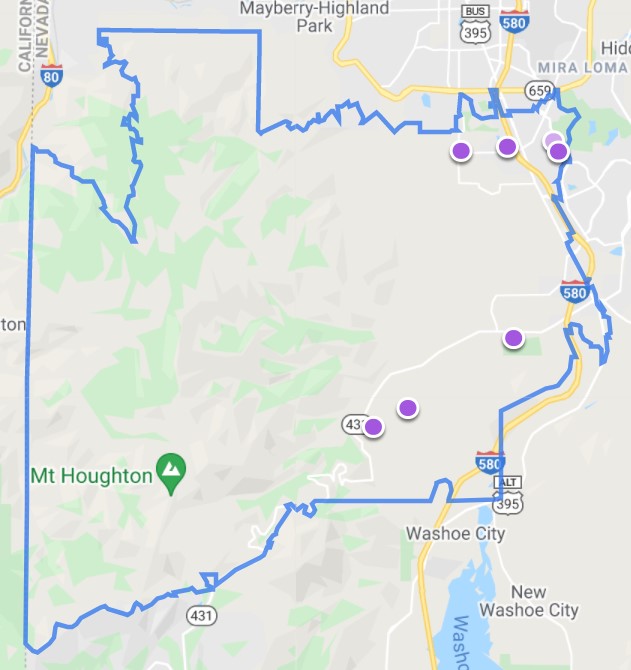

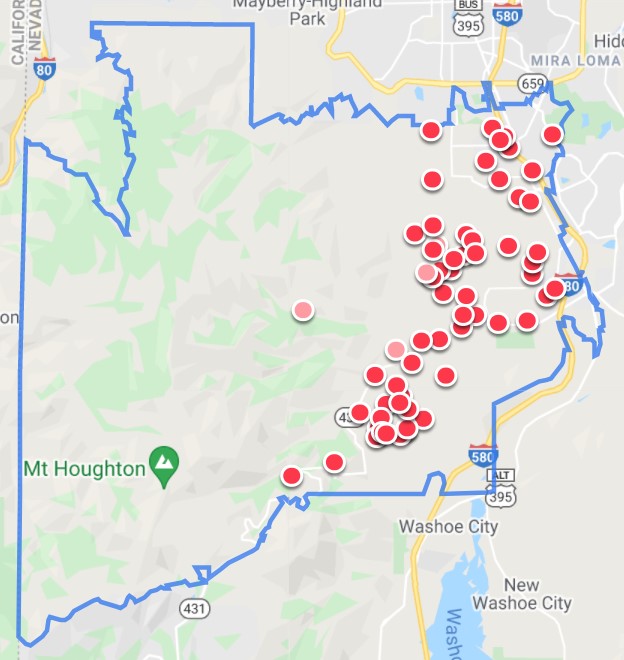

These two maps from Zillow show the single-family homes for rent and for sale in my zip code. You see a big difference in available choices.

This isn’t a new phenomenon due to the COVID pandemic. It was like this when we were looking for rentals in 2019.

The second problem of insisting on renting first is quality. The average quality of the homes for rent is a step lower than the average quality of the homes for sale. If you want to rent a single-family home you actually like, in terms of its location, cleanliness, ages of the appliances, etc., you have even fewer choices.

Because we only looked for rentals, it took us a full year to finally find one we liked. If we also considered buying, we could’ve moved and enjoyed our life in the new area much sooner. So:

Old Rule: Rent first when you move to a new city.

New Rule: Consider both buying and renting. Don’t be too picky if you rent.

Research Remotely

What about the worry of buying in the wrong part of the town?

That old rule of renting first probably came out before the internet era. Now locals get their information online anyway. You can get the same information when you’re remote.

You see where stores and other facilities are on Google Maps. You have satellite view and street view of neighborhoods. You see real-time traffic from DOT cameras. You see voting results, school test scores, air quality indexes, and whatever aspects you care about. You can read the local newspaper and watch the local television stations online. You can join local Facebook groups and see what’s going on there. When you combine online research with a couple of field trips, you don’t really need to live there for a year.

We’ve been here for a year and a half. I didn’t learn anything that someone remote can’t find out.

Buy a Rental and Treat It as Renting to Yourself?

Another push toward renting is this other rule that says you should buy only if you’ll stay in the home for a long time. A long time is defined as five years, seven years, ten years, or longer.

Thinking you must stay in the home for a long time makes you picky. Even though there are more homes for sale than for rent, the abundance of choices quickly disappears when you add all your requirements for staying in the home long term. This home is a one-story and you want a two-story (or vice versa). This home is too old. That home isn’t in the most desirable neighborhood. This home is on a small lot. This other home requires too much work, etc., etc.

However, when you’re considering renting anyway, you may also consider buying a home of similar quality to a rental. Think of it as renting it to yourself until you find your ideal home. You don’t have to be too picky when it isn’t long-term.

You’re the best landlord in the world when you rent to yourself. You don’t have to worry about breaking a lease or large rent increases. You don’t have to worry about disputes over damages or the security deposit. You can stay however long or however short. When you finally buy your ideal home, you either sell your transition home or keep it as a rental, whichever makes more sense at that time.

Dropping the requirement to stay in the home for a long time opens up more choices. So:

Old Rule: Buy only if you’ll stay in the home for a long time.

New Rule: Consider buying a home of rental quality and have the option to keep it as a rental.

What to Do with the Money?

If you end up renting or buying a rental that’s much less expensive than the home you really want, what should you do with the money from the sale of your previous home?

Another rule says you should keep the money safe if you’re planning to use it in the near future, which is usually defined as five years or less.

If you sell a paid-off home, you may intend to buy your next home with all cash from your sale. You should keep the money safe if that’s your only source of funds to buy your next home. What if you can borrow?

You may intend to buy it with all cash, but you don’t have to. You only need the down payment when you can borrow. The rest of the money can be invested in your normal portfolio allocation. If the market is up when you buy your next home, you sell for a profit. Paying taxes on the gain still beats low interest in a savings account. If the market is down, you borrow. You pay off the loan when the market recovers.

It’s a myth that you can’t get a mortgage if you don’t have a paycheck. Social Security benefits and retirement plan withdrawals count as income for mortgage qualification. Fannie Mae and Freddie Mac also allow banks to qualify you for a mortgage with your assets, including retirement accounts. It’s called an Asset Depletion mortgage or Asset Dissipation Underwriting. You don’t have to actually sell your investments or withdraw from your IRA. The lender only uses the size of your accounts to calculate an equivalent income for the purpose of qualifying you for the mortgage.

We inquired with a lender earlier this year. They easily pre-approved us for a mortgage.

If you have a large taxable account, you can also get a loan using securities-based lending. You use your investments as opposed to the home as collateral for the loan. Because the interest rate is variable and investments are more liquid than a home, the interest rate can be as low as the federal funds rate plus 1%. See How To Use Securities-Based Lending to Manage Cash Flow.

Having options to borrow allows you to invest the money while you wait to buy your next home. I wish I explored these options after we sold our previous home.

Old Rule: Keep the money safe at low returns if you plan to use it in the near future.

New Rule: Set up borrowing options and keep the money invested.

A Better Way

If we relocate again, we will do it this way:

- If we see a home that we like for the long-term, buy it.

- Also consider buying a home of rental quality and treating it as renting it to ourselves. Keep it as a rental or sell it when we buy the ideal home.

- If a suitable home is available for rent, rent it. Set up contingent borrowing options and keep the money invested.

If we stop at (1) and housing prices go up, great. If housing prices go down, we’re in it for the long-term anyway.

If we stop at (2) and housing prices go up, the gains on the rental and the residual investments can keep up or at least offset some of the increase. If housing prices go down, great, buy at the lower price and keep the rental as a rental.

If we stop at (3) and housing prices go up, the gains on the investments can keep up or at least offset some of the increase. If the investments have losses, borrow and wait for them to recover. If housing prices go down, great, buy at the lower price.

This setup is much more robust than the old rules of renting first and keeping the money in cash. The old rules work when:

- Desirable rentals are widely available.

- Home prices more or less track inflation.

- Returns on safe money keep up with inflation.

Under these assumptions, you can rent and take your sweet time to figure things out. If any one of the assumptions isn’t true, the old rules fail.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

indexfundfan says

Very interesting new “rule of thumb”.

I moved to Georgia four years ago. Never thought about renting at all, because I wanted to get into a permanent home with good schools for my kids. If I rent, I might be forced to move if the landlord decides to sell.

And yes, you can do a lot of research online before buying.

Hopper says

I wouldn’t say you made a mistake or that the rules changed. I think you just suffered from bad timing that no one could have anticipated.

I bought a house twice and the first time you could say I made a mistake because I waited too long. The second time, just a few months before COVID hit, I bought a new house in a different part of the country and sold my old house. Due to local pricing and availability quirks, my timing was very advantageous financially (bought low and sold high).

Both times, I lost and won purely because of luck (bad than good) and timing (bad then good), not really any skill or foresight on my part.

Harry Sit says

While everything has an element of luck (good or bad), some strategies are more robust than others. They work in more situations and they leave fewer things to chances. The old rules rely on assumptions that don’t necessarily hold true. It was a mistake not to consider all possibilities and mitigate the risks.

KD says

What wonderful article! It has such great wisdom. It is indeed hard learnings. I believe this – as and when you purchase in the future, you may gain from the rising value of the property, and all of this will be forgotten in the rear view mirror.

We did the opposite – purchased our new property, and then sold two old ones. It was more logistic consideration of being able to move stuff from the two homes into the new one and then getting old ones ready for the market. Yes, we bought new one cheaper and then sold the other two at much higher valuations.

For us the lesson learnt – rules of thumb are meant to de-risk major life decisions especially if you are cashflow constrained as nearly all buyers typically might be. If you are not cash flow constrained, then Harry’s wisdom applies.

We didn’t know this but our lender had simply used our assets for underwriting even though we had provided income proof.

Last few years have rewarded handsomely those that have taken even small amount of extra risk and endured volatility – be it real estate, crypto currency, leveraged ETFs, Tesla, meme stocks etc. I don’t know if it is a trend, a blip, or permanent shift. It has turned folks who had a million or two into folks with 8 to 10 millions. We did not take the risk. We did just the buy and hold, and invest in three fund portfolio. We did fine and feel grateful for it.

Eric B says

(Hopefully I didn’t just miss it, but…) No mention of transaction costs on buying and selling a house you might not end up actually liking? In my locality, you’re looking at ~8% in taxes and fees, which would be over $40,000 on the median home (pre-COVID).

Harry Sit says

When you have the option to keep the house you don’t like as a rental, you reduce the impact of transaction costs (postpone, spread over more years, pay with the rental profit).

Eric B says

True, but in many higher cost areas rents are low compared to purchase prices (meaning negative monthly cash flow), because apparently everyone is betting on appreciation (which apparently has been a good bet lately, even if it would make me nervous 🙂

Frugal Professor says

Thanks for the sincere post.

Aside from the unfortunate market timing / financial aspects, are you generally happy with your decision to relocate to Reno/Carson City? If so great. If not, what did you overlook previously?

I ask because I’d like to complete a similar move at some point in my life.

Harry Sit says

I don’t think we overlooked anything in terms of lifestyle. If you still want the convenience of a medium-sized city, Reno, Sparks, and Carson City are the only cities in this area with a Costco. Truckee and Tahoe towns are closer to skiing. Mammoth and Bishop are closer to the Sierra mountains. But they’re all smaller. No Costco or Home Depot there.

Barry Northrop says

Great distillation of lessons learned and new realities. Moves almost always shake out some ah-hahs. Thanks for bringing up investment-based loans…another tool for retirees to consider.

Sookie. Bush says

I do not agree that the internet provides you everything you need to make a decision on relocating. For example, we can get temperature and humidity information for FL on the internet, but until you live there for an entire summer, you will not know whether you can handle it. Whenever this topic comes up on an Internet forum, about half the responses will be you can escape it in the mall or ocean, the other half will be it’s so long and unbearable. You will need to experience it yourself before you can decide whether you can handle it.

always_gone says

I tend to agree. We moved to Memphis, TN two years ago. There are lots of nice areas and lots of sketchy areas. We are still renting. No way I’d buy a home without first living in the neighborhood/area first as there are just too many variables that the internet doesn’t take into account.

Brian says

It’s important to be in the area through 4 seasons (allergies, agricultural / industrial smells, fire/smoke patterns, traffic, tourists, etc) before buying.

Rent in a nearby cheaper community (20-30 minutes from target area), get a feel for your target areas through 4 seasons, buy on crash (or at least dip). Right now the housing market is very overvalued.

Plus you have cash, so you can just wait for rates to increase and that will lock a segment of buyers out of the market and force owners on adjustable mortgages to sell…forcing prices down.

Patience is the key. No FOMO. Enjoy the cheap nearby rental and exploring the area. Research your targets and buy when the tide turns.

On the flip side: if you love the place you bought and it will be a great retirement home for you, then just enjoy retirement. You’ve got a great place. You lost some, but not as much as it seems, because you made out well on your SJ sale. Did you maximize all ends of the transaction, no. But you still did well.

Frank says

Another risk of renting first is getting priced out of the market.

I rather miss out on a downturn, than getting priced out.

If it is within your budget to buy, any paper losses will have little impact on your quality of life, but if a future price increase stretches your budget or prices you out completely, it will have an impact on your quality of life.

Buying and renting it to yourself at least locks you into the market, and transaction fees might be an acceptable insurance policy against getting priced out / not having to break a lease when a suitable property hits the market.

I’m curious if you thought your previous home was due for a correction when you sold it without buying a new one. I understand that you moved across states and the real estate market is often local, but it would have hedged against the overall trend.

Harry Sit says

I thought renting first was the standard procedure in a new city (the old rules). So we sold after we signed a lease. We weren’t trying to time the market and front-run any correction.

Laurel says

So rent an easier-to-find apartment instead of a single-family home for the first year. Trust me, it won’t kill your family to live in an apartment for a year. And you can use the time saved on home maintenance to house hunt.

I’m a fan of the old rules. I re-located almost three years ago to an area with a lot of retirees. Many who rushed to buy when they first arrived have since rushed to sell, even at a loss. They discovered they wanted to live in a different neighborhood, or a bigger house (because they get so many visitors), or a smaller house (don’t want the endless house guests!), or closer to the beach. Or farther, because everything oxidizes and molds at the beach.

I rented two very different houses in two neighborhoods my first year here. From what I learned, I bought my (hopefully) forever home in a neighborhood I wouldn’t have thought to consider. It’s also a smaller house, with much more outdoor living space than I’ve ever had, because I learned from my second rental that I spend almost all my time in the outdoor living/dining room.

Harry Sit says

Buying a rental mitigates these risks. You get your foot in the door. You don’t have the pressure to find the perfect house. You don’t have to rush to sell at a loss.

Frank says

Apartments tend to require annual leases and leaving early means you are still on the hook for the rest of the term unless you find someone to take over your lease. Some places offer 6 months leases or month to month, but that comes at a steep premium to the point where it isn’t economically unless you know for sure when you’ll find something.

That creates pressure to find something before the lease is up, or keep paying after you’ve already moved.

If you are selling at a loss, you are now also paying less for the replacement home. The real loss are transaction costs.

TJ says

When I moved back to California in the early spring, I thought about renting or buying..both were a possibility..four months later, I could not buy anywhere that I would want to live. Condos appreciated substantially, but my wages did not.

So I moved back to Arizona..and bought a place that has appreciated quite a bit since the first time I lived in AZ four years ago, but still super affordable on my wages.

Unfortunate timing. I hope my place doesn’t lose value, but I don’t plan on leaving, so it doesn’t really matter I suppose.

We’ll see what happens in the future.

Frank says

That really stings. To me, it’s like re-balancing a stock portfolio; you never want to be out of the market. Don’t sell your existing home until you closed on another one. If you don’t own a home, but can afford to buy one, lock into the market if you are planing on staying long term (unless owning isn’t your thing).

Friends of mine recently sold their home but weren’t sure what they wanted as a replacement (same general area). They had a 3 month rent back clause added to the sales contract, but by the time they made up their mind they kept getting outbid, and now can’t even afford their previous home.

NC says

Can you provide more info on security based lending? What if the value of the securities decreases substantially–is it like buying on margin in a brokerage account and experiencing a margin call?

Harry Sit says

It is. So don’t borrow close to the limit and don’t use highly volatile securities.

Credence says

This is great advise being me and my husband are considering relocating. He and I thought about purchasing land and building our house but he said it may cost more than just purchasing a resale in the area we decide to live. My thoughts were we may have to do upgrades to an existing home any way so it maybe better to build. what do you think?

Harry Sit says

Sorry, I don’t know much about building versus renovating.

Steve says

One reason for the rule to only buy if you will live there for a while is the transaction costs of buying and selling a house. The minute you sign on a house, you are down 6-10% (the smallish transaction costs of buying and the larger commission and other costs of selling) if you tried to get your money back out.

There’s also more work that has to go into a six (or seven) figure transaction. You’ll want to do some due diligence to make sure you’re not way overpaying, buying a lemon, etc. And then to sell it, painting, landscaping, staging, finding a trustworthy seller’s agent, ad infinitum.

Neither of these aspects go away just because you mentally pretend you are a renter, or hand-wave it away saying you’ll just rent it out to someone else until the enough time passes to justify the sunk costs. Surprise surprise, “enough time” will probably end up being about 5-7 years. The exception is times of excessive appreciation like we’ve had recently.

Harry Sit says

What if you’re prepared to keep it as a rental for 5-7 years or longer?

Steve says

“keep it as a rental” i.e. take on a part-time job. Or you can hire out the management – at a price. Either way and depending on the market, you may end up with negative cash flow, paying money every month to prop up the rental until you can “afford” to sell (either literally, or because of mental accounting where you don’t want to sell it for less than you paid).

MaryF says

I am a new subscriber to your blog, and am finding great value in your articles.

We are retired, with substantial assets in our IRA’s. We have considered relocating and downsizing (we are on the outskirts of the SF Bay Area) but have been unable to find a lender who could pre-qualify us for a mortgage without our having to begin withdrawals from these accounts. We have talked with three brokers and all have given the same advice, although we have excellent credit scores and our current home is in a desirable area.

Would a bank be a better place to pursue an asset depletion loan? Any tips about how to find one and qualify so that we can search for a home in earnest?

Harry Sit says

If you intend to sell your current home after you relocate, you may be able to get a Home Equity Line of Credit (HELOC) more easily. You draw from your HELOC to buy your next home. You pay off the HELOC when you sell your current home. Also try First Republic Bank in the Bay Area or the “private bank” department of mega banks such as Bank of America or Chase. They serve more affluent clients and they may be more flexible than other banks that sell their loans to Fannie Mae and Freddie Mac.

Gary says

Hello Harry, I always enjoy your news letter. I wanted to say thanks for this post. Separate from the comments above debating old rules, news rules and luck, I appreciate your ongoing willingness to share the results of a decision that did not turn out in your favor. My experience is I have learned more in my life from my failures than my mistakes. Yet they can be hard to share. I have made numerous financial decisions that were not wise— sitting on cash rather than believing in a sound diversified portfolio comes to mind. And, I have also come to see that I also could have made even worse decisions with that money! Thanks again.

Gina says

Great article. I tend to view my decisions with a 10 year timeframe. Currently, there is a housing shortage. Building permits demonstrate within 10 years the situation might reverse. Also there is general population decline. For those reasons I am hesitant to purchase. Appreciation might very well stall or decline. What are your thoughts?

Sabrina says

Hey Harry,

You’ve got a couple of typos (qualify –> quality). Thanks for the newsletters!

“The second problem of insisting on renting first is quality. The average qualify of the homes for rent is a step lower than the average qualify of the homes for sale. If you want to rent a single-family home you actually like, in terms of its location, cleanliness, ages of the appliances, etc., you have even fewer choices.”

Harry Sit says

Thank you! I fixed those typos.

Holi says

Thank you, I always learn from your clear, expert writing. Different reasons, but I am still renting too. Since 2020 the housing market changed so dramatically and so quickly. There is very little inventory, bidding wars, no inspections, etc. There is a housing shortage along with many other issues contributing to this situation. I am looking and patient. I look forward to more inventory. For me, it is better to rent than buy a mistake. I hope to hear more about your experience with this, as I go through it myself.

Harry Sit says

My experience so far is that it’s more difficult to rent good quality housing than to buy good quality housing. I just renewed the lease at a 23% increase after one year. It was going to be a 25% increase but the landlord threw me a bone after my begging.