[Originally published in 2018. Updated on January 5, 2023.]

My wife and I have been 100% part-time self-employed since 2018. As things stand now, and for the foreseeable future, we don’t expect that our self-employment income will be sufficient to cover our expenses.

Spending more than we make is quite a change from living below our means. We know the open secret in early retirement is to maintain a positive cash flow outside the investment portfolio, but we don’t have that luxury. We’ll actually start withdrawing from our investments.

Many say managing portfolio withdrawals is much more difficult than saving for retirement. I disagree. It’s just different, something you’re not used to, which requires some planning, a different setup, and some finetuning as you go along. Saving for retirement was also confusing for us in the beginning until we figured it out after some stumbles. Now we already have a lot more knowledge and years of experience in managing our money. Not everything is new.

I came up with this plan in 2018. We’ve been using it since then. I’m sharing our setup here. It’s not going to be the best for everyone. Only we are going with it. As you’ll see, it’s not hard at all, and many parts are still familiar.

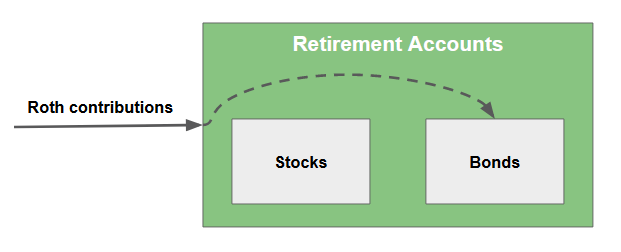

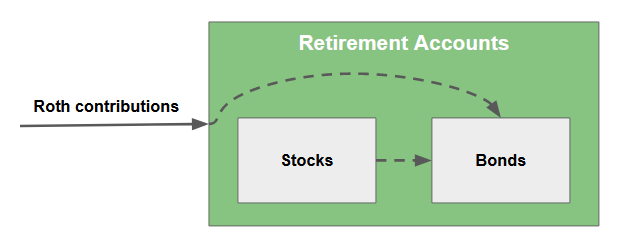

Self-Employment Income To Roth Accounts

We continue maxing out all eligible retirement account contributions from our self-employment income. Because we don’t make much from self-employment, nearly 100% of that income goes into our solo 401k and Roth IRAs. To the extent we can, we make Roth contributions because we’re in a lower tax bracket. These Roth contributions help fund our retirement in the future.

Because we have a choice between making traditional or Roth contributions, these contributions also become a lever we can use to make our AGI higher or lower. We’ll make Roth contributions if we want our AGI higher. If we want it lower, we’ll make some traditional contributions. For this reason, we delay making our IRA contributions to between January 1 and April 15 in the following year when we have a better picture of our income tax situation, whereas we used to make the IRA contributions early in the current year. It’s possible to go ahead with contributing to Roth IRAs early in the year and then recharacterize as needed, but it’s too much hassle for too little gain.

Retirement contributions will also possibly qualify us for the saver’s credit when our income is low enough to reach into its 10% tier (AGI $73,000 for married filing jointly in 2023).

We will invest 100% of the retirement account contributions in bonds, for reasons that I will explain later in this post.

Other than delaying the IRA contributions to the following year, this part isn’t much different than before. Maxing out all eligible retirement account contributions is still the modus operandi.

For those without employment income, this part can be replaced by Roth conversions to take advantage of lower tax brackets.

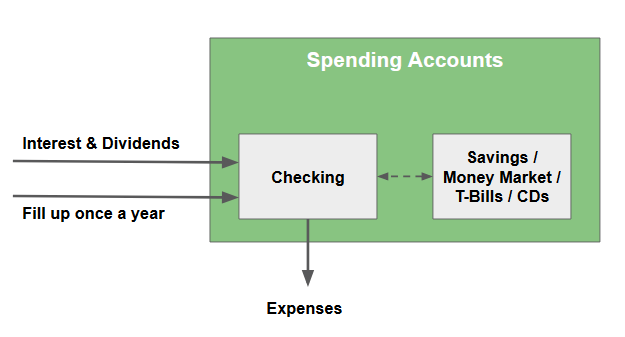

Spend From Cash Accounts

We have a conceptual spending account for paying bills. This can be a combination of a checking account plus a savings account or a checking account plus a money market fund. Before the year starts, we fill this up with the anticipated spending in the upcoming year. Money for spending later in the year will go to the savings account or the money market fund, or very short-term, 3-month or 6-month, Treasury bills (see How To Buy Treasury Bills & Notes Without Fee at Online Brokers).

Interest and dividends from our taxable investments also drop into the spending account. Any money left unspent at the end of the year rolls over to the following year. It reduces the required fill-up for next year.

Other than filling up once a year versus twice a month from paychecks, the spending part also isn’t that different than when we were working full-time. As an alternative, we can set up automatic withdrawals from our investments on a schedule once or twice a month to mimic the “paychecks” behavior. We choose not to do that because we think that’s too rigid for us. Filling up once a year works just fine.

Variable Percentage Withdrawal (VPW)

“How much can you safely spend?” is a question with no precise answer, because we don’t know how the future will play out. We follow the Variable Percentage Withdrawal (VPW) method collectively developed by a group of Bogleheads.

We like the adaptable nature of this method. Every year you take a look at the total portfolio value and then you multiply it by a percentage you look up in a table based on your age and your asset allocation. That’s the amount you can spend this year. When your portfolio value is up, the amount you can spend goes up. When it’s down, the amount you can spend goes down. You don’t automatically ratchet up your spending by inflation every year.

For instance, a 40-year-old using an asset allocation of 70% stocks and 30% bonds can spend 4.4% of the portfolio value next year. A 50-year-old using an asset allocation of 60% stocks and 40% bonds can also spend 4.4% of the portfolio value next year. A 60-year-old using an asset allocation of 50% stocks and 50% bonds can spend 4.5% of the portfolio value next year.

The tradeoff of this method is that the amount you can spend will fluctuate with the portfolio value. It can go down in consecutive years. It can also stay down for many years when your portfolio value stays down. We’re OK with this fluctuation. It’s intuitive that when the portfolio performs poorly you should cut back. You just make your budget fit under the calculated amount. It’s just Living Below Your Means — the same way we always did.

Because we will spend the interest and dividends from our taxable investments, they count as part of the amount withdrawn.

Annual Fill-Up To Spending Account = Portfolio Value * VPW % – interest & dividends not reinvested – money left over from previous year

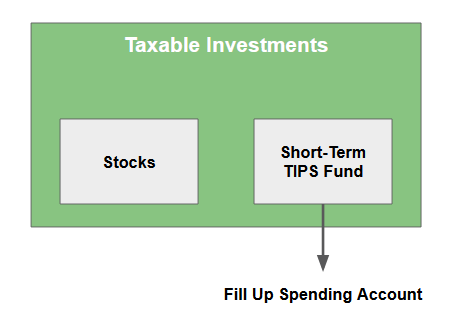

Withdraw From Bonds In Taxable Accounts

We’re not taking any money out of our retirement accounts. We won’t do any Roth conversion ladder (convert traditional to Roth, wait 5 years, withdraw from Roth) because we’d like to reserve the money in retirement accounts for years after we’re 59-1/2. In my opinion, if you have to touch the retirement accounts money before 59-1/2, you don’t have enough money saved.

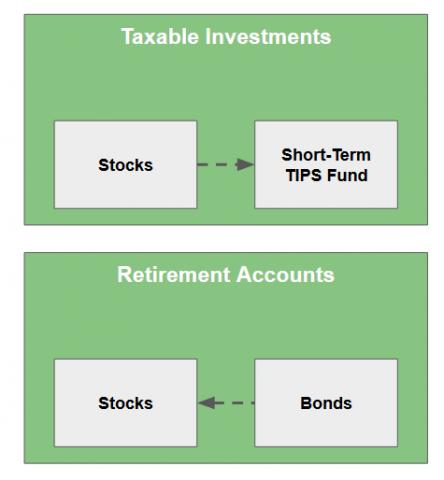

Our taxable investments are in stock funds and Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX, a short-term TIPS fund). The short-term TIPS fund is the source of the annual fill-up to the spending account.

We use a short-term TIPS fund because we want inflation protection and the lower risk of a short-term bond fund. A ladder of short-term TIPS can also be a good option. See Two Types of Bond Ladders: When to Replace a Bond Fund or ETF.

We chose a bond fund over a TIPS ladder because our spending can vary greatly from year to year based on the Variable Percentage Withdrawal method. A ladder would only deliver a fixed amount. Of course we can also use a ladder plus a bond fund — the ladder for basic needs and the bond fund for discretionary spending — but we choose the simplicity of just a bond fund. I don’t think this choice makes a big difference. If you are more comfortable with the predictability of a ladder over a fluctuating bond fund, go for it. If you prefer a different bond fund over a short-term TIPS fund, that works too.

The stock funds in our taxable accounts are for growth. Eventually, the short-term TIPS fund will be nearly exhausted after some years of draining. At that time we will sell shares from the stock funds to refill the short-term TIPS fund.

This setup can be described as a bucket strategy. Stock funds, a bond fund, and cash spending accounts form three buckets that cascade down. Although mathematically it can be shown that withdrawing only from bonds followed by rebalancing is equivalent to withdrawing proportionally from both stocks and bonds, withdrawing only from bonds in taxable accounts allows us to control the timing of realizing capital gains. If we withdraw proportionally from both stocks and bonds in the taxable accounts every year, we will have to realize capital gains every year.

Because we don’t have a series of guaranteed payments earmarked by a ladder of instruments such as TIPS, Treasuries, CDs, or annuities, our approach belongs to the probability-based school as opposed to the safety-first school. We chose the conventional probability-based approach because we’re comfortable with variance in the amount we can spend. We’re not too concerned about having a level of spending guaranteed to us.

Rebalance In Tax-Advantaged Accounts

Because we’re depleting bonds in our taxable accounts by the annual fill-ups to the spending account, we invest 100% of our new contributions to retirement accounts in bonds to partially counter-balance it.

Just doing that isn’t enough. Under normal market conditions, as bonds are drawn down more than the retirement accounts contributions, and as stocks grow, the percentage of stocks in our portfolio will go up. We will rebalance by selling stocks and buying bonds in the tax-advantaged accounts.

This rebalancing part also isn’t much different than when we were working full-time.

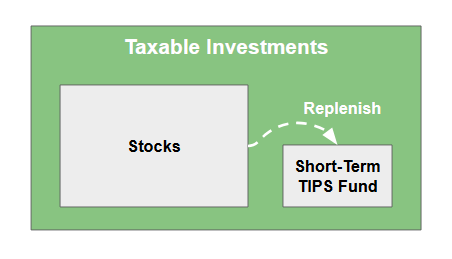

When Stocks Crash

Stocks don’t always go up. Sometime they crash, as they did in 2022. When that happens, we sell stocks in taxable accounts to buy bonds. Yes, you read that right. Sell stocks when stocks are down.

Selling stocks when they’re down makes the realized capital gains lower. We do the opposite in our retirement accounts: sell bonds to buy stocks. That maintains our exposure to stocks.

This is just rebalancing. Other than the accelerated replenishment of the short-term TIPS fund, it’s also not that different than when we were working full-time.

***

Many parts of our portfolio withdrawals setup are familiar. There are a few new wrinkles here and there, but they are really not too complicated. A summary can easily fit on an index card:

- Continue maxing out all eligible retirement account contributions. Favor Roth over traditional. Fine-tune after the end of the year.

- Spend from cash. Fill up once a year by the Variable Percentage Withdrawal method. Count interest and dividends not reinvested as part of the withdrawal.

- Don’t touch retirement accounts before we’re 59-1/2. Withdraw from bonds in taxable accounts. Replenish when low or when stocks crash.

- Rebalance in retirement accounts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve says

Hi TFB,

Thank you for this article and all your great posts.

I observed you wrote “…It’s possible to go ahead with contributing to Roth IRAs early in the year and then recharacterize as needed,…”. Didn’t the option to re-characterize recently get taken away? My impression is it is gone, so you want to be sure about a Roth contribution when you make it. Here’s a link to an article with further info, and if you google you’ll find more: https://www.investors.com/etfs-and-funds/retirement/tax-reform-killed-a-key-roth-ira-legal-loophole-heres-what-to-do/

Thanks and best wishes,

Steve

Harry Sit says

Recharacterizibg a conversion is no longer allowed but recharacterizing a straight contribution is still allowed.

FinancialDave says

Steve,

I think Harry said he wasn’t going to do it anyway

What I ususally do is when the new tax software comes out in December, I total things up and make my last minute decisions by about the 26th of December.

Great article.

Hongyan says

Hi Harry,

Thank you for sharing your thoughts. You mentioned when stocks go down, you will sell stocks to buy bonds in taxable accounts and do the opposite in retirement account. But what if after you do all that, in a few years stocks go down again? We won’t be able to use the same method again, will we?

Harry Sit says

Sell stocks doesn’t mean sell all of them. If they go down again we will sell again.

always_gone says

I too, like the VPW method as it seems much less rigid and follows common sense. So many of us in the “financial hobby” lean on our spreadsheets to come up with a rigid number, when in fact, life is much different. Thanks for the great article and wisdom on withdrawals.

I want to research more about probability vs safety, but I think I’ll agree with you there, too.

Serbeer says

Sounds like a pretty solid plan to me if you can withstand the potentially large fluctuations of VPW method in downmarkets. A few questions:

1) RE: “For this reason we will delay making our IRA contributions to between January 1 and April 15 in the following year when we will have a better picture of our income tax situation, whereas we used to make the IRA contributions early in the current year.”

You will not be able to do so with Solo 401K, will you? I think perhaps profit sharing portion of it can be done after Jan 1st of next year (though I have mine at Fidelity and their contribution form does not have designation year on it, assuming current year always), but not employee contribution portion for sure. So what do you plan to do about it?

2) Also, what are yours/spouse ages, think you posted before but cannot recall? VPW method calls for using younger spouse age for withdrawals. Do you agree with it — or planning to average up ages instead? Can matter if gap is larger and I like VPW but wonder about this part of it.

Harry Sit says

The $12,000 IRA contributions should be enough of a buffer for us. If we need more, we can use FinancialDave’s December 26 method and change our contribution elections at that time. The profit sharing part can be declared after the year ends. We are in our late 40’s. We happen to be of the same age. So we don’t have to wonder whether we should go with the younger age or the average age. I haven’t looked into that part closely. Of course going with the younger age is more conservative.

Mike says

60 years old and just retired.

Do you agree with my VPW approach that accounts for social security (SS)?

I plan on taking SS at age 70. I determine what it would cost to buy an annuity (if I was 70) (www.immediateannuities.com) that would produce the same monthly payout as my monthly SS payment. I add that annuity purchase cost to my nest egg. Should I feel OK about withdrawing a minimum of 4.5% of this total until I begin drawing SS? Then, when I start receiving SS my benefit, I will withdraw a minimum of 4.5% of my nest egg

Harry Sit says

The VPW authors have a “VPW Advanced” model that incorporates Social Security as a COLA’d pension. I didn’t look into it because Social Security is quite far ahead for us.

Arun says

Hi Harry,

Thank you for a nice blog! I am unclear how it will help to sell stocks when socks go down, and not just because it sounds counter-intuitive. Your goal would be to get a certain amount of cash out, while leaving the remaining amount of stocks intact. If you sell while stocks are still up, the tax bill may be (slightly) higher, but in the long run, will you not get higher returns from the higher remaining amount of stocks?

Now, your approach might work favorably when the stocks go down by just a few percent and you sell to generate cash to keep a low tax impact. However, when the stocks go down a lot, by greater than a certain threshold percentage loss (10% 20% more?) and you sell to generate cash, you might lose too much of future growth.

What would that threshold % be? I don’t know off-hand, but there might be a way to calculate that based on some assumptions about the portfolio size and cash to be drawn.

Harry Sit says

Because we will buy stock funds in the retirement accounts at the same time as we sell (different funds to avoid wash sale if we are selling below our cost basis) we won’t lose future growth. The future growth is just transferred to the retirement accounts. If we sell as soon as the price reaches our cost basis, that would still be enough to get us to 59-1/2.

Arun says

A-ha! I see – That is a smart way!

Vince Gruenwald says

Hi Harry,

Great post. We are nearing retirement so this is top of mind.

Regarding this calculation:

Annual Fill Up To Spending Account = Portfolio Value * VPW % – interest & dividends not reinvested – money left over from previous year

Are the interest & dividends the anticipated dividends for the coming year? Or are they the actuals for the current year that you’ve kept track of?

Thanks..Vince

Harry Sit says

The anticipated dividends and interest in the coming year. It can be estimated by the fund balance multiplied by a distribution yield. The actual dividends and interest received in the current year can also serve as a guide. Some brokerage accounts report these totals on the statements.

Joe Bleaux says

Hi Harry,

Thanks for sharing this. I’m wondering about why you wouldn’t do Roth conversions, particularly if your income remains in a low bracket. If your traditional retirement account balances are high, you’ll likely pay tax in a higher bracket when RMDs kick in at age 70-1/2. Just because you convert Traditional to Roth doesn’t mean you have to withdraw it after five years.

Harry Sit says

Because Roth conversions may push us over the cliff for the ACA premium tax credit. Even if we are able to stay off the cliff, the marginal tax rate for Roth conversion isn’t necessarily that low. See this example for a married couple with $45k AGI paying 24.5% marginal tax rate if they convert $10k to Roth:

https://thefinancebuff.com/tax-calculator-aca-obamacare-subsidy.html

We can take another look in December 2019.

Joe Bleaux says

Makes sense, thank you for the clarification. In short, you have to compare the 24.5% resulting tax rate against whatever bracket you’ll fall in when you make RMDs.

FinancialDave says

Joe

“In short, you have to compare the 24.5% resulting tax rate against whatever bracket you’ll fall in when you make RMDs.”

That’s not exactly the correct way to look at it.

A more exacting way to look at it is if you spend 24.5% on taxes for the conversion, in order to make that action at least a “wash” in retirement you need to spend that Roth money in at least the 24.5% tax bracket or higher. If you don’t need to or can’t spend the Roth money in a bracket higher than 24%, then you are wasting money doing the conversion.

Of course we never know what bracket we are going to be in with “all” our retirement money, but I am just trying to put it in perspective.

In many cases, especially if you retire early before SS, then you could be spending money out of your Traditional account in tax brackets all the way from zero to your upper marginal rate of your expense needs. Just think of all the tax money wasted if you converted too much of your money to a Roth and you can’t fill those lower tax brackets!

Joe Bleaux says

Financial Dave,

That’s not exactly the correct way to look at it.

Maybe the case you describe might be valid, if you retire after age 59-1/2 (minimum age to access TIRA / T401(k) without tax penalty):

1) Without a pension

2) Without any interest or dividends

3) In short, without any income at all.

In the case of someone with a pension and other income, whether earned or unearned, the lower brackets are already getting filled up, and a bigger problem looms in the way of RMDs. Just think of all the tax money you wasted when you withdraw RMDs because you didn’t use your lower bracket space to convert your TIRAs and T401(k)s to Roths!

FinancialDave says

Joe,

There are of course many variables, but in almost all cases, (notice the “almost”) during retirement your tax rates will be lower than when you were working if you are retiring now for two important reasons:

1. Tax rates on income have been going down over the last 25-30 years at least.

2. Tax rates in retirement are lower (for the same “budget” or spending level) because you are not putting money away for saving and you aren’t paying SS & Medicare taxes.

Obviously, if a pension and dividends covers all your spending needs, maybe the problem is you haven’t put the right assets in your taxable account to “allow” you to spend down your IRA account, or you haven’t put the correct assets in your IRA account, such as your bond allocation to allow it to grow slower.

It is not necessary to put a lot of dividend paying assets in a taxable account if your real problem is too large of a Traditional IRA.

Also, if you are single, I agree RMD’s are going to hit you a little harder, but still if you were always single for most of your life then your tax rate will still be lower in retirement.

East Coast says

Hi. I guess I’m not understanding the exchange between FinancialDave and Joe. An advisor ran my #s and recommended I max out the 12% bracket with Roth conversions up until age 70, to reduce the projected tax (due to RMDs) on my social security (when I take it at age 70). I may be retiring soon at age 63 1/2. If i follow this recommendation I’ll be incurring higher up front tax bills for 7 years in order to pay less in tax over all, assuming i live to a ripe old age (I don’t know what age is the break even point). Is FinancialDave arguing against this strategy? Thanks.

FinancialDave says

East Coast,

In Joe’s case the conversation was about a tax rate of 24.5%, so your case at what you say is 12% may be different. Certainly I don’t know everything about your situation like your FA should know, so I am not saying what you are doing is wrong. Let’s just look at some things to consider:

1. Are you paying state tax on your income? In which case your tax rate probably won’t be 12%.

2. The other very large factor is the SIZE of your IRA funds. If you have a multi-milion dollar IRA at this point in your career, then I would certainly lean towards doing Roth conversions if you can keep your tax rate in the 12% bracket.

3. There are also many other things that all come into play, such as the size of a taxable account, which for someone in the 12% bracket in retirement has properties very much like a Roth account. Also the size of your expenses in retirement.

3. Let’s look at a more likely scenerio for most, which is a IRA of $1 million or less.

4. If you are in retirement at 63 and your expense needs are such that you are in the middle to lower end of the 12% bracket (allowing you some margin for conversions) then it is quite likely that when you reach age 70 you will still be firmly in that 12% bracket. Let’s just say that is true then the math suggests that there is absolutely no difference between spending money from your IRA @ 12% or spending tax-free money from your Roth which you have paid tax @ 12% already. So if this is the case your FA is wrong in saying you will have more money in retirement. There still may be some reasons to do some conversions but it will not “necessarily” give you more spendable income in retirement.

What I am trying to get at is to make sure you understand it is NOT about how much tax you pay or when you pay it. It is about whether you have more spendable income in retirement. The math is such that if tax rates are the same for the money converted on the front end as they are when you spend the money in retirement, the total spendable income will be exactly the same no matter how much the money grows over 20 or 30 years in the IRA OR Roth.

If you need a workout of the math you can find it here:

https://seekingalpha.com/instablog/3752451-financialdave/4845086-roth-vs-non-roth-401k-403b-457-etc-and-time-value-money

Dave

TJ says

Harry, you might consider Ally’s current promotion to park $$$ for a few months. I haven’t seen something easy like this since BBVA Compass and Santander.

https://www.allypaybacktime.com/

Harry Sit says

Thank you TJ. I signed up for the no-penalty CD. $1,000 free is too good to pass up.

Avi says

“In my opinion if you have to touch the retirement accounts money before 59-1/2, you don’t have enough money saved.”

I’m not sure I understand this opinion as a blanket statement as anything more than mental accounting. Whether you have enough saved isn’t a function of what an account is called by the IRS it is a function of the amount saved – for example, I have over six-figures in retirement account space every year so save very little in taxable savings (particularly when you throw in the other tax-advantaged saving for kids tuition, healthcare etc.) but it would be silly for me to not take advantage of the tax-management opportunity to avoid ‘touching’ retirement accounts in my early retirement years or pretending that a mid-seven figure portfolio isn’t enough saved because the IRS considers it a ‘retirement account’.

YDG says

“Selling stocks when they are down makes the realized capital gains lower. We will do the opposite in the retirement accounts: sell bonds to buy stocks. That will maintain our exposure to stocks.”

Isn’t it just a way to effectively shift gains from taxable to retirement accounts over several market cycles? And (assuming the retirement accounts are traditional as opposed to Roth) wouldn’t it result in more ordinary income (and, eventually, more RMD) and less capital gains? How is this a better tax strategy?

Of course, if retirement accounts in question are predominantly Roth, then it is a better strategy. I just happen to suspect that more people have lager traditional accounts and a comparatively smaller Roth space.

Always great food for thought!

Harry Sit says

What makes sense for us isn’t going to be the best for everyone. If we are not contributing our self-employment income to Roth accounts, we will use it for spending. We will need less from our portfolio and trigger less in capital gains. With more money being added to Roth accounts, we are able to buy stocks there when we sell stocks from taxable accounts. It’s like shifting future capital gains to the Roth accounts.

Jay Jay says

“If we need more, we can use FinancialDave’s December 26 method and change our contribution elections at that time. ”

Can someone point me to a discussion of this method?

Thanks!

Harry Sit says

See reply to comment #1 from FinancialDave. On December 26 (or another day close enough to the end of year), I will have a very close estimate of our income. I can project our taxes with tax software or spreadsheet. If it’s too high even when we make our IRA contributions 100% traditional, I can increase the amount that I elect to contribute to the solo 401k as pre-tax, and decrease the amount as Roth. This will lower our income. The actual contribution will happen in the following year after I close the books but I need to elect the pre-tax/Roth mix before the end of the year, on a form I give to myself as the solo 401k sponsor/employer.

Jay Jay says

OK, I understand now. Thank you for the quick follow up!

Tweedle says

Perhaps you were intentionally silent on this but I’ll ask anyway.

Since you expect to have variable expenses, how are you sizing your near term buckets. That is, how much money are you putting into TIPs, especially since you aren’t sure what you are going to spend over the next few years.

I’m not asking for your exact budget, of course, but if you did have predictable expenses, you might expect X% from self employment, Y% from investment income, and then have K years of (100-(X+Y)) per year in TIPs. I’m curious what K is.

I’m also curious why you prefer VPW over something like a CAPE ratio based WR. Even the VPW guys seem to imply that it i only really useful for discretionary funds after your have accounted for your required expenses in some other fashion.

Harry Sit says

I didn’t say much about the amount to be put in the TIPS fund because the amount is just a coincidence, not something deliberately planned. It’s basically everything except money already tied down — in stock funds with large unrealized gains, high fixed rate I Bonds not available any more if sold, etc. We happen to have some CDs maturing. When we bought the CDs five years ago we didn’t know we would need that money for withdrawals now. If we didn’t buy those CDs back then we would sell from whatever else we have. We are not targeting any specific amount in TIPS.

I chose VPW because it’s directly connected to the portfolio value as a result of investment performance, whereas a CAPE ratio only indirectly links to performance. It’s possible to have a high CAPE ratio and good performance or a low CAPE ratio and poor performance. VPW can give a withdrawal number below the required expenses. That’s why they want you to account for required expenses in other ways. I don’t see any expenses as required. Whatever the VPW number is, we will fit our budget within it by whatever means necessary.

Kile says

Thanks for the article. One of my hobbies (which will hopefully pay off soon) is to study the various methods for determining the amount to withdraw each year in retirement. Like you, we are targeting an early retirement so stretching the funds over a longer time horizon is key. VPW is a great method for doing that plus the fact that it reflects annual portfolio performance. I’m also intrigued by the CAPE method where an individual can adjust the a & b parameters accordingly. However, pure CAPE does not account for bond performance unless another factor is added. Another easy method that I’ve been looking at is the RMD method. The IRS provides a table for annual RMD’s starting at age 70. I plotted these values into Excel and matched a trendline to get the overall equation. With the equation, I can now extrapolate to ages before 70 and come up with an annual withdrawal rate to our current age. As it worked out, at age 52 this withdrawal rate is 2.06% and goes up every year by ~3% due to shorter life expectancy. This w/r % is then multiplied by the portfolio value to give you the allowed spending amount for that year (just like VPW).

Fritz at Retirement Manifesto wrote a good article on this RMD method.

https://www.theretirementmanifesto.com/how-much-can-you-safely-spend-in-retirement/

I need to spend more time on Excel and compare RMD vs. VPW. Fantastic stuff!

YDG says

@Kile, IRS publishes tables and methods for calculating RMDs for ages before 70 as well (for inherited IRAs). So no need to extrapolate. Most of it is in https://www.irs.gov/publications/p590b if you’d like it straight from the horse’s mouth (and with all the gory details), but I am sure there are tables and calculators all over the web. (VPW is, essentially, one of them — just for a fixed life expectancy that you get to pick.)

You can still use CAPE(-like) method for a portfolio with bonds and other asset classes. It’s probably overkill, but I use separate CAPE figures for my US equity, developed international and emerging markets respectively. I use current SEC yields for bond funds. I adjust yields for expected inflation. I do NOT adjust CAPE/CAPY figures for inflation. (Any critique on this approach, anyone?)

Phil says

Do bonds ever tank like stocks sometimes do?

Say one is nearing retirement, say 2-3 years hence, and you know the s:b ratio you want in retirement, say 50s:50b , and you have been on a glide path to get there adding more bonds each year.

“…We will have a conceptual spending account for paying bills. This can be a combination of a checking account plus a savings account or a checking account plus a money market fund. Before the year starts, we will fill this up with the anticipated spending in the upcoming year.

and

” …Our taxable investments will be in stock funds and Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX, a short-term TIPS fund)…. The short-term TIPS fund will be the source of the annual fill-up to the spending account.

Say you like having 3 years worth of expenses in cash, or instead of cash you like the VTAPX.

At what point, how many months or years away from retirement, does one get his “3 years worth of expenses in VTAPX”? Or can you really just do that about one month prior to retirement because with a portfolio at or very close to 50s:50b you simply sell bonds in that amount and buy VTAPX? Are there ever periods when bonds tank & you don’t want to sell bonds? I know stocks can tank & you’d hate to sell stocks at depressed prices in a bear market to buy VTAPX. Is this a possibility with bonds? If so, then one wants to get his “3 years worth of expenses in VTAPX” about how many months or years prior to retirement so he is sure he isn’t selling in a bear market 1 month prior to retiring? Thanks

Harry Sit says

Some lower quality bond funds can “tank” but a good quality bond fund doesn’t. Portfolio Visualizer shows that since 1987 the worst calendar year performance of Vanguard Total Bond Market Fund was -2.7%. The worst drawdown (from top to bottom) was -5.9%.

Whenever you move from asset A to asset B, you run the risk of asset A not doing so well at that time. If you say you don’t want to do it right before you retire but you would do it 3 years before, then it’s possible asset A isn’t doing well at that point. If you say you can wait a year, there is no law that says asset A must recover in a year. It can get worse. So I don’t think you can always avoid this problem. What happens after the 3-year cash runs out? You will be selling again. You just hope over time it balances out.

Phil says

From the section called Withdraw From Bonds In Taxable Accounts

“… Our taxable investments will be in stock funds and Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX, a short-term TIPS fund). … The stock funds in our taxable accounts are for growth. Eventually the short-term TIPS fund will be nearly exhausted after some years of draining. At that time we will sell shares from the stock funds to refill the short-term TIPS fund.

How conservative is this taxable account for you Harry?

Say you are comfortable with an overall portfolio of ALL accounts of say 60s:40b; is this particular taxable account more conservative such as 30s:70b and others accounts hold a larger portion of stocks to achieve your OVERALL 60s:40b? Or, you really just go by the dollar amount for the # of years you want of bonds, say you your estimated expenses are $40K/year & you want 3 years or 5 years of VTAPX so that would be 40×3 or 40×5 in VTAPX & all the rest of the money in this taxable account is in your stock funds?

Also how many years of VTAPX do you like, 3 years, 5 years, 10 years?

Thanks

Harry Sit says

I’m not targeting a specific amount in bonds, either driven by a set allocation for only the taxable account or a set number of years of spending. As I explained in the reply to comment 15, the current number is more of an accident. Selling stock funds to achieve a specif amount at this point will generate too much in capital gains for me. If I don’t have this constraint, or if I was planning several years out before I quit, I would target maybe 6 years of spending. Christine Benz at Morningstar suggested 8 years (years 3 – 10).

https://www.morningstar.com/articles/839520/the-bucket-investors-guide-to-setting-asset-alloca.html

Spending under VPW shrinks when the market goes down. So I think I can get away with 6 years.

Phil says

Can you explain a bit more about when you stated “Because we will buy stock funds in the retirement accounts at the same time as we sell (different funds to avoid wash sale if we are selling below our cost basis) we won’t lose future growth.”, the part about the wash sale

from https://www.investopedia.com/terms/w/washsalerule.asp

sells or trades a security at a loss and, within 30 days before or after this sale, buys a “substantially identical” stock or security,

Do I need to worry about “substantially identical”? We are talking index funds for the most part, and some of us have only 2-4 kinds (VTI, maybe a small cap value, 1 international, etc). You would have to buy a whole new asset class say an emerging market fund after you sold your S&P500 fund? Or a non issue because they are different accounts? They/IRS goes by account or individual? If by individual then a good case for having 2 separate taxable accounts individually in the 2 spouses names & 2 ROTHs for the 2 spouses? On the other hand hate to have a taxable accounts not held jointly for liability reasons?

If anyone has any comments on my other 2 posts above, awesome.

Thank you

Harry Sit says

You worry about wash sale and substantially identical only when you are selling at a loss. If you are married wash sale applies to both spouses. You can’t avoid wash sale by buying it in a different account or have your spouse buy it. The IRS never defined what makes two funds substantially identical. I treat as not substantially identical when two index funds follow different indexes. Both of them can be U.S. large cap funds but if one follows S&P 500 and the other one follows the CRSP large cap index, I say they are not substantially identical.

Phil says

“When stocks crash”.

What are your guidelines/ definition of a crash? I remember an article you wrote to the effect of a 10% drop sell x% and the next 10 or 15% drop sell y,% etc down to when it drops maybe 50%? Can you please provide the link to that article or explain what a market crash means to you now in retirement & how you might behave in sequences such as 10 % drop to 20 % drop etc > Thanks & if anyone has any comments on my other 3 posts above – also much appreciated

Harry Sit says

That previous post was Embrace the Bear Market with Overbalancing. That was 10 years ago when the size of my portfolio was smaller and I still had income from my job. Would I follow the same schedule now? Probably not. The stock market dropped 20% through Christmas Eve last year. I didn’t increase my stock allocation. What if it dropped 30%? Maybe.

Phil says

Harry wrote: “Every year you take a look at the total portfolio value and then you multiply it by a percentage you look up in a table based on the age of the youngest spouse and your asset allocation. That’s the amount you can spend this year.”

I assume that ” total portfolio value” does not include the equity in your primary residence? It only includes the value of investment accounts (taxable, retirement, spending/checking account, cash under the mattress), and equity in rental property or other non-primary-residence-properties?

I do see in the wiki article in the section called “How to use variable-percentage withdrawals during retirement” that it states “…Missing payments, between retirement and the start of Social Security pension, can be provided by using a simple CD ladder or short-term bond fund. For the purposes of VPW calculations, the money set aside in this CD ladder or short-term bond fund should not be considered as part of the portfolio.” I’m unsure what they mean by ” Missing payments”? If it means ” between retirement and the start of Social Security pension” then isn’t that, let’s say typically, your Taxable Investments? If yes, then aren’t Taxable Investments part of your total portfolio ? So I’m confused.

Harry, what do you define as total portfolio value when using the VPW?

Thanks

Harry Sit says

I don’t include the value of my primarily residence (I have no mortgage). If I sell my home (downsize, relocate, etc.) I will then have more available for withdrawal.

Phil says

Harry, do you have an opinion about the types of bonds one can hold in their taxable account. I like VTIPS and hold those in my tax-deferred accounts. I see you like VTIPs as well and hold them in your taxable account. Reason I ask is I just recently opened my first taxable account and before doing so did some studying and thought the prudent thing to do was to hold intermediate AMT tax-exempt Muni bonds in a taxable account (example: ITM, or a short-term like SHM). You did not choose tax-exempt Muni bonds in your taxable account but instead chose TIPS because the inflation hedge is more important to you than the tax savings?

I’m trying to decide what the best bond position is for my taxable account. No doubt it depends on many things such as age, when you plan to tap the taxable account, how much of your total portfolio that your taxable account comprises. For me, I am about 3 years away from retiring, and my taxable account is only about 20% of my total portfolio, and that taxable account will likely be the first account tapped and will probably be spent down to zero after about 5 years, so all of those circumstances may be quite different from yours.

Thank you

Harry Sit says

At the current low yields, for money that will be spent down to zero in five years, I don’t think the choice really matters that much. Let’s do some back of the envelope calculation. Replace the numbers with your specific numbers. Suppose the initial balance is $500k. When you spend it down to zero in 5 years, the average balance during those 5 years is $250k. The 30-day SEC yield of the short-term TIPS fund VTAPX is 0.5% plus inflation. The expected inflation in the next 5 years is about 1.3%. So $250k will generate 250,000 * 1.8% = $4,500 in taxable income. Suppose your federal income tax bracket in retirement is 24% because you have a $170k/year pension. After paying $4,500 * 24% = $1,080 in taxes, you have $3,420 left in your pocket. Now if you put the money in the AMT-free intermediate-term muni ETF ITM, with its 30-day SEC yield at 1.48%, you will have $250,000 * 1.48% = $3,700 tax free. Yes, $3,700 is greater than $3,420, but by how much? The difference is $280/year for someone drawing down $100k/year for five years on top of receiving a pension of $170k/year. If you are not drawing down $100k/year or if you are not getting a $170k/year pension, the difference will be even smaller.

FinancialDave says

Phil,

Harry may have a different opinion but personally, if your goal is to spend down the taxable account you need to be careful about filling too much of it up with stocks and bonds. Granted you don’t have to spend it down, but generally, at retirement, you want between 3 – 5 years of cash to get you through any large down years, especially if you are planning on pushing SS out beyond those 5 years.

Right now interest rates are such that I own very few bonds at all in my accounts. A Money Market account at Vanguard or Fidelity is still paying about 1.8% and a 5-year treasury bond is paying 1.36%. IMHO just put your bond allocation into a MM fund if you have an account that is paying a decent rate.

As for the stock allocation, if there is one, it’s ok for now, but once you get within about 3 years of wanting to spend it down, that would be a good time to think about liquidating it when the market is up (if it still is.)

The important point is to fit the usage of the money to your own personal situation. If your taxable account is going to be spent down in 5 years then your retirement bond allocation should be in either your IRA or your Roth account. Which one is really a function of your retirement tax rates and the size of your pre-tax savings (IRA) vs the size of your Roth and how much of these funds are going to need to be spent in retirement. Most people just think they should save the Roth funds until later, but really they are most useful at any time to avoid going into a higher tax bracket. IRA funds should be spent in the lower 10% and 12% tax brackets.

I know I went way beyond what you were asking, but only because I probably wouldn’t put bonds in my taxable account at all. In fact, if you aren’t spending the income in the taxable account (pre-retirement) I don’t really like anything that generates income unless the income doesn’t generate extra taxes ( such as qualified income if it is not taxed because your total income is low enough.)

Phil says

Thank you FinancialDave, very helpful because both things are new to me ( having a taxable account, and retiring in maybe 3 years ) so I’m not used to thinking of the things you mentioned . Yes I too want 3-5 years in cash and so the taxable account is the best place to keep that cash and then anything BEYOND 3-5 years in cash could be in stocks & bonds.

Stubby says

Harry:

Just came across this post and I really appreciate your detailed explanation and 2021 updates. I retired last year and my withdrawal strategy looks strikingly similar to yours. Been a long time reader and always enjoy your posts. Please keep doing what you’re doing!

Phil says

I put aside $8.9K into my Reserve Fund each year (roof, repairs, etc). Say my VPW table says I can spend $40K for the year, do I take 8.9K from that $40K so I’m left with 31.1K to spend, or, do I withdrawal from investments 40K+8.9K?

Thank you

Harry Sit says

You still withdraw $40k. If you don’t put the money into the reserve fund, you will have to finance the large spending, and the monthly payments have to be deducted from your budget anyway.

Holi says

Thank you, Harry. I appreciate your clear, concise communication style and the great information you share.

Casey says

Hi Harry, I have read this article at least 3 times over the past few years and keep coming back to it as I plan for retirement in about 4 years. One question: why not spend your earned income instead of investing it in Roth IRAs? If you used it as spending money, it would decrease the overall amount of withdrawals you’d be making from your investments. I’m sure you’ve done the math and I trust your methods, but I just can’t figure it out. When I put myself in your shoes, I’d envision myself treating earned income the same way as I’d treat dividends and interest, i.e., money to be spent in order to decrease my portfolio withdrawals. Thanks so much for your insight.

Harry Sit says

Sending the earned income to Roth accounts and selling investments for living expenses has the same effect as spending the income and moving some investments to Roth accounts. When investments are outside Roth accounts, the dividends are taxed and the capital gains will be taxed in the future. Those taxes stop When the investments are moved into Roth accounts.

If I only have dividends and interest, no earned income (and therefore can’t contribute to Roth accounts directly), I would convert some pre-tax money in Traditional IRAs to Roth and sell some taxable investments to cover the taxes.

joe says

so did you say about how many years of spending do you keep in the

short-term TIPS fund.?

I think I read it somewhere else, but don’t see it here, thanks

Harry Sit says

I answered it in the replies to comments 15 and 18. I still don’t have a set target. It’s driven by the size of capital gains I’m willing to realize.

TJ says

At what point did you determine that easy deposit cash bonuses – such as the following just aren’t worth the bother for you anymore ? – https://us.cibc.com/en/agility/agility-savings.html ?

Was it hitting a certain dollar amount in your portfolio or choosing to not spend your time tracking such opportunities?

I recall your double the bond yield series from a decade ago and how retail investors had much better opportunities for fixed income than institutional investors, but it sounds like you’ve deviated from that pursuit in your own portfolio within the past few years.

I see your reply to comment 11 5 years ago that it was still worth the hassle at that point in time. 🙂

Harry Sit says

I’ll write a new post about it.