I wrote in a previous post Our Experience in Building a Home Over Buying an Existing Home that I built a new home. By coincidence, the final all-in cost of this new home came to about the same as the net proceeds from selling my previous home in California four years ago. That previous home is worth a lot more now. If I take an average of the estimated value from Zillow and Redfin, it’s worth 50% more than my new home.

As a house though, the previous home has nothing to compare to the new home. It was a tract house built in the 1960s with 1/3 of the living space of my new home. Successive owners updated it here and there over 60 years but the structure was still the original.

How come a 60-year-old home is worth 50% more than a brand-new home three times its size? The value is obviously in the land. The land under that previous home is worth at least five times the land under my new home although the two pieces of land are of similar size.

When people talk about low-cost-of-living (LCOL) areas, high-cost-of-living (HCOL) areas, and very-high-cost-of-living (VHCOL) areas, the difference in cost of living is mostly driven by the cost of housing. After all, prices are the same when you order stuff from Amazon. Groceries and gas may cost a little more in some places but they don’t make up a large part of spending. Why is housing so much more expensive in some places than others?

We get some clues by looking at where home prices are most expensive in the country.

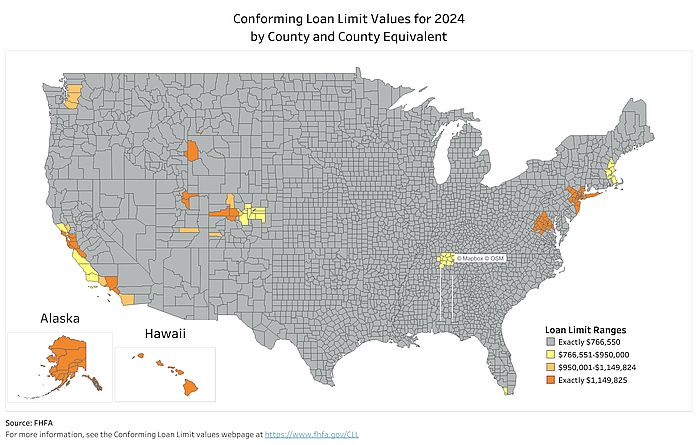

Conforming Loan Limit Map

The Federal Housing Finance Agency (FHFA) sets a dollar limit on “conforming loans.” Mortgages under the conforming loan limit can be sold to Fannie Mae and Freddie Mac. The loan limit is the same in most places across the country. It’s 50% higher in some pockets with high home prices. The conforming loan limit map shows where these high-cost areas are.

Source: Conforming Loan Limit Map, Federal Housing Finance Agency

This map goes by counties. The dark orange counties on the map have the highest conforming loan limit in the country, which is a sign of the highest home prices.

- Alaska

- Hawaii

- Northern California near San Francisco

- Southern California near Los Angeles

- Two counties in Wyoming and Idaho near Jackson, WY

- Two counties in Utah near Park City, UT

- Three counties in Colorado near Aspen, CO

- Washington D.C. and nearby areas in Maryland, Virginia, and West Virginia

- New York City and nearby areas in New York, New Jersey, and Pennsylvania

- Two counties in Massachusetts near Martha’s Vineyard

We see two themes from this list: major economic centers and vacation spots.

Homes are more expensive in major economic centers but so are incomes. I couldn’t have made it this far if I didn’t live in a VHCOL area with abundant good-paying jobs.

Homes are more expensive in vacation spots because people buy second homes there for their vacations and to rent to vacationers.

If you’re working, is it worth moving to a VHCOL area for a higher salary? If you’re retired, is it better to move away from a VHCOL area when jobs are no longer a factor?

Cost of Ownership

Although I said a buy-or-rent calculator should be the last step you take when you explore whether you should buy or rent, it’s a useful tool to compare the cost of owning a home in different places because the calculator converts the various costs of owning a home to a single rent-equivalent number. If owning a home in one place is equivalent to $4,000/month in rent and owning a home in a different place is equivalent to $3,000/month in rent, we know that housing in the first area costs $1,000/month more.

I ran the New York Times buy-or-rent calculator with these assumptions for three homes in different places costing $500k, $1 million, and $2 million:

- Plan to stay in home: 20 years

- Down payment: 100% (no mortgage)

- Home price growth rate: 3%

- Rent growth rate: 3%

- Investment return rate: 7%

- Inflation rate: 3%

- Property tax rate: 1% of home value

- Marginal tax rate: 25% (federal and state)

- Closing cost to buy: 0%

- Closing cost to sell: 6%

- Maintenance: $5,000 a year

- Homeowner’s insurance: $2,000 a year

- Utility covered by landlord if renting: $0

- Monthly common fees: $0

- Common fees deduction: 0%

- Security deposit if renting: 1 month

- Broker’s fee if renting: $0

- Renter’s insurance if renting: $150/year

I set the maintenance cost and homeowner’s insurance to a fixed amount because the difference in the home values in different places is primarily in the land. An expensive home in a VHCOL area doesn’t necessarily cost more to maintain or insure.

These are the rent-equivalent numbers for homes in three different places under my assumptions above. Please re-run the numbers if you prefer a different set of assumptions.

| $500k Home | $1 million Home | $2 million Home | |

|---|---|---|---|

| Cost of Ownership | $2,215/month | $3,939/month | $7,439/month |

The first thing that jumps out from this exercise is that the cost of owning a home free and clear isn’t only the property tax and maintenance. The largest cost of owning a home without a mortgage is the opportunity cost of the money tied down to the home. Owning a $2 million home in a VHCOL area costs several times more than owning a $500k home in a different area. See more about this in Paying Off Mortgage Did Not Lower My Housing Cost.

Under the assumptions above, a job seeker moving from an area where a home costs $500k to an area where a home costs $1 million will need to make $1,700/month or $20k per year more after taxes to cover the higher cost of housing. A retiree moving from where a home costs $2 million to where a home costs $1 million will save $3,500/month or $42k per year from the lower cost of housing.

The difference in housing costs is sensitive to the assumed home price growth rate. If home prices in a VHCOL area grow faster because the area is a major economic center or a popular vacation spot, it lowers the gap in costs of ownership. Here are the costs of ownership with different home price growth rates:

| $500k Home | $1 million Home | $2 million Home | |

|---|---|---|---|

| Home Price Growth | 3%/year | 4%/year | 4%/year |

| Cost of Ownership | $2,215/month | $3,476/month | $6,492/month |

If home prices in a VHCOL area grow only 1%/year faster, a $2 million home in the VHCOL area is still more expensive to own than a $500k home in the LCOL area, but it’s only 2.9 times as expensive, not 4 times. A 1% faster growth rate reduces the gap in costs of ownership between a $1 million home and a $2 million home from $42k a year to $31k a year. 1% faster growth lowers the gap between a $500k home and a $1 million home from $20k a year to $15k a year. A 2% faster growth will shrink the gap by yet more.

When you’re working, it’s worth moving to a VHCOL area when higher incomes and better career opportunities cover the higher cost of housing. That’s why housing costs more in those places.

For retirees, whether to move out of a VHCOL area is ultimately a lifestyle choice. Yes, it may cost $30k or $40k more per year but if you have family there and you can afford it, it may be worth it for you to stay put. Living in a place you want to live in is an important part of retirement. On the other hand, if you aren’t too attached to a VHCOL area and you were there only for jobs, moving to a different place may free up $30k or $40k per year on other things that are more important to you.

I still like this tweet on where to live in retirement from Christine Benz, Director of Personal Finance at Morningstar:

You hear a lot about the difference in state taxes but I think the tax aspect is way overblown. We saved less than $1,000/year in state income tax when we moved from high-tax California to no-tax Nevada. It’s not worth moving to save only $1,000 a year. The difference in the cost of housing is more substantial. Running the numbers helps you quantify it. You may choose to stay put or move to a place closer to family, friends, activities, or a place with the weather you prefer. Quantifying the difference in housing costs helps you make an informed decision.

In our case, we didn’t save much money by moving but we improved our lifestyle. We could’ve chosen a different place with a lower cost of living but we like it here. That makes it worth it. Lifestyle comes first when you can afford it.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dunmovin says

Very nice! Couple of thoughts…

When one is close to a decision point factor in whether or not the (soon to be new) state is a non-recourse state (anti-deficiency loan state…around 13 as last I recall) and consider at least an initial home loan on the property if one of those states…meaning if one fails to make payments there may be no personal liability. Where this could come up is something big shows up unexpectedly with the new home with that purchase loan on it. Or, think earthquake or landslide, etc. One can walk away with no personal liability. Started in the Depression to help people not suffer more through/after foreclosure…the lender is looking to the value of the property and thus not the personal liability of buyer/occupier…talk to an attorney.

The other aspect is how to avoid capital gain taxes after living in a high cost area for years and the federal $500K exemption is nothing for them!

Harry, any thoughts? Glad you like your financially viable new home!

Dan says

Might want to check the math on this…

7% opportunity cost alone is 500k * 7% = $35,000 per year or $2,916 per month.

Harry Sit says

The extra $500k in the home also grows with home prices. The investment return is taxable. Home price growth is tax-exempt up to a cap.

Dunmovin says

Thanks but how does a fixed $500k exemption grow…it seems to me its value decreases over time. Please expand

Other than converting the current home to an investment and doing later a 1031 exchange which merely defers or delays the “pain,” how about an installment sale or?

Harry Sit says

Dan asked why the difference in costs of ownership between a $500k home and a $1 million home wasn’t at least $35k a year when the extra $500k could be invested at 7%. I was explaining that the extra $500k tied up in the $1 million home also grows with home prices. The NY Times calculator assumes that you’re buying the home fresh, with the full $500k exemption available. You need a different calculator if you already owned the home for many years and the $500k exemption is already spoken for by the existing gains.

I just paid the capital gains tax when I moved. It’s fair to pay taxes when I made money.

Mandy Doda says

We moved to Florence, Italy after FIRE. Best thing ever! There are loads of American expats here but many Italians speak English so I have a rocking social life! Its a small walking city so you don’t really need a car. Not too difficult to get an Elective Residence Visa from your nearest Italian Consulate but best to visit Italy for a couple of months first and then decide where you want to live. Lots to see and do. Easy and cheap to travel around Europe. Food quality is good. Weather is good for the most part. Larger cities have better medical also English is widely spoken in larger cities. Cost of living is low. Smaller towns are way cheaper but you will need to be fluent in Italian.

Cons: You will be fending of lots of visitors from back home!

Harry Sit says

Florence as in the home of Michelangelo’s David and the Uffizi Gallery? I want to visit you too!

Tim says

Any insights for leaving Reno?

In your linked post you mentioned Nevada for similar health care initiatives as California. How does UT factor into that?

Harry Sit says

Reno was good. Utah is better (for us). The blog post linked in the previous comments was by another blogger Tanja. It was written when Congress tried to repeal the Affordable Care Act, which was saved by one vote from Senator John McCain. Tanja chose to stay in CA because CA was more likely to set up something similar to the ACA at the state level if the repeal was successful. I thought NV would do the same. UT is a conservative state. I don’t know what it would do in that scenario. It’s less of a concern now after the effort to repeal the ACA died down.

Don G says

I recall my first trip on Southwest Airlines. Unlike assigned seating I stood in line by boarding group. I had my pass in my hand which said 38. The guy behind me saw my pass and said I am 37 so I want to be in front of you which I said please do. It was a 150 seat aircraft.

This analogy is relevant in this space as you have citizens speaking about how well they have done and criticisms of various strategies abound.

I would say there is a very high probability that they pass a homeless person on a street corner everyday while they debate whether a capital outlay is more efficient than renting. So very funny! The interest people possess in outdoing each other is amazing!