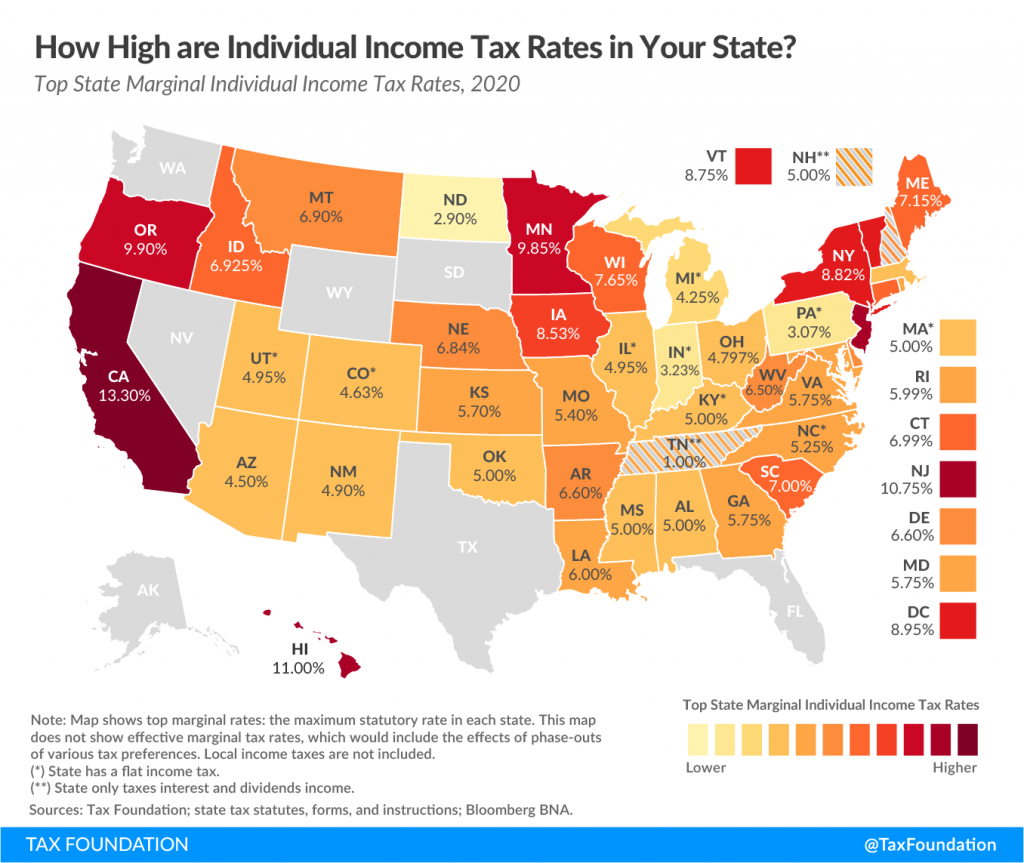

Whenever we mention to people that we moved from California to Reno, NV, they all say it makes sense because we get to avoid the high state income tax in California. I don’t blame them. California has a reputation for high taxes. When you Google state income taxes, you get a map like this:

California is shown in the darkest color. Its 13.3% top marginal tax rate is the highest in the country. Nevada has no state income tax. On the other hand, even when we worked full-time in California, we never paid 13.3%. The 13.3% rate is only for people making over $1 million. Our marginal state income tax rate was 9.3%, which was still high, but it was at least lower than the 9.9% rate in the neighboring state Oregon, or the 9.85% rate in Minnesota.

When you’re working, a 9.3% marginal state income tax rate isn’t ideal but you accept it for the job opportunities. When you’re no longer tied to a job, you think you finally get to escape it by moving to a place with no or low state taxes. That’s the motivation behind many searches for relocating to a retiree-friendly low-tax state. However, I like this tweet on this topic from Christine Benz, Director of Personal Finance at Morningstar:

Taxes were very low on our list of considerations as well when we decided to relocate. We moved primarily to be closer to the destinations for the activities we enjoy — hiking in the summer and skiing in the winter. Besides, the state income tax can be completely different when you no longer have a high income. Our California state income tax last year was under $1,000, whereas we paid five figures when we were working full-time. It isn’t productive to relocate out of a state only to escape a tax under $1,000.

Our California state income tax was low because the state’s income tax rates are progressive. In 2019, a married couple first got $9,074 as the standard deduction. Then it went by this tax schedule:

| Over – | But not over – | Tax |

|---|---|---|

| $0 | 17,618 | $0.00 + 1.00% of the amount over $0 |

| 17,618 | 41,766 | 176.18 + 2.00% of the amount over 17,618 |

| 41,766 | 65,920 | 659.14 + 4.00% of the amount over 41,766 |

| 65,920 | 91,506 | 1,625.30 + 6.00% of the amount over 65,920 |

| 91,506 | 115,648 | 3,160.46 + 8.00% of the amount over 91,506 |

| 115,648 | 590,746 | 5,091.82 + 9.30% of the amount over 115,648 |

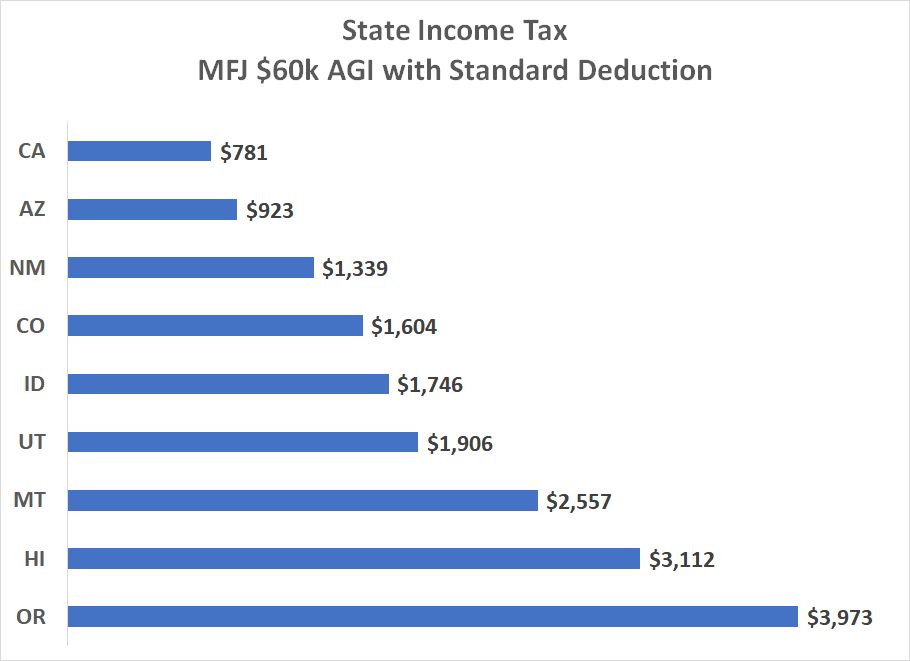

Finally, a married couple got an exemption credit of $244. When a couple had $60,000 in gross income in 2019, their California state income tax was:

$659 + ($60,000 – $9,074 – $41,766) * 4% – $244 = $781

When you don’t have a big income, most of the income is taxed at 0%, 1%, and 2%. It’s a lot different than paying 9.3% on the bulk of your income when you’re working.

Out of curiosity, I did a mock tax return for all the states west of Rocky Mountains for a married couple with $60,000 in gross income. Besides states with no income tax (Alaska, Washington, Nevada, and Wyoming), California has the lowest income tax. That was a big surprise to me.

Some states (such as Hawaii) give special treatment to certain sources of income. Here I only did normal income without distinguishing the income types. I also only took the standard deduction in each state.

Property Tax

What about property tax? California has the famous Prop 13. The property assessment increase is capped to 2% a year from the time of purchase. If you bought your home a long time ago, your property tax can be very low. Prop 60 and Prop 90 also allow someone 55 or older to sell their principal residence and transfer their low assessment to another property of equal or lesser value within the same county or in a welcoming county. Prop 19 passed in November 2020 expanded the transfer to the entire state, and it allowed transferring the low assessment three times as opposed to only once in a lifetime.

Many California retirees’ property tax will increase if they move to another state.

ACA Tax Credit

In addition, if you’re retired and you need ACA health insurance before you’re eligible for Medicare but your income is over the cliff for the federal premium tax credit, California kicks in with its version of the premium tax credit. With the tax credit from the state, your effective California state income tax rate can be negative 10%!

***

My takeaway from this exercise: Don’t assume. Even if you consider state taxes as an important factor for relocating after retirement, high taxes when you’re working doesn’t mean high taxes when you stop. Contrary to the perception of many people, California may very well be a retiree-friendly low-tax state.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

TJ says

Where did you move to?

Harry Sit says

Nevada, a popular state for Californians who think they will avoid high state taxes after they retire. 🙂

TJ says

I’m confused. What activites are you close that you wouldn’t be close to in the Tahoe area of CA?

In the following post, they made the argument that the CA side of that border was much superior:

https://ournextlife.com/2017/11/01/why-california/

Harry Sit says

The western (California) side has more snow to shovel in winter. Reno is sheltered by the mountains. The Lake Tahoe towns in California are smaller and more rural, versus more city/suburban in Reno. Houses in those towns are also much older and more expensive (less expensive than in Incline Village, NV, yes, but about 50% more expensive than in Reno). On the other hand, Reno is close but not as close to the ski resorts as the Lake Tahoe towns (1 hour versus 10 minutes). Which is more superior is of course personal preference.

I don’t know whether it was the case when she wrote the post three years ago, but Nevada is a blue state. Democrats have a supermajority in both chambers of the state legislature, 3 out of 4 House Representatives, both Senators, and the governorship. It has the same commitment to healthcare she’s most concerned about.

erik says

Are you saying you regret leaving California?

Harry Sit says

We don’t regret leaving California. Our move wasn’t motivated by taxes. Whether California has high taxes or low taxes doesn’t make any difference. We’re closer now to destinations for the activities we enjoy. That hasn’t changed.

KD says

Excellent article! Love the specific analysis!

Outside of major cities, what kind of lifestyle does $60K buy in California? – these include smaller towns, or suburbs. I know it depends on individual tastes and as such, but can we put a generalized number dollar amount of mortgage, basic necessities food and transport etc? I need to look up BLS data and Fed Survey numbers. If you find the link, please do include it with your article. Thank you.

KD says

Average annual expenditures and characteristics, Consumer Expenditure Survey, 2018-2019

West: https://www.bls.gov/cex/2019/msas/west.pdf

South: https://www.bls.gov/cex/2019/msas/south.pdf

Northeast: https://www.bls.gov/cex/2019/msas/norteast.pdf

Midwest: https://www.bls.gov/cex/2019/msas/midwest.pdf

All tables are found here: https://www.bls.gov/cex/tables.htm

Harry Sit says

From the cash flow standpoint, without a mortgage, $60k a year provides a comfortable lifestyle even in major cities.

Lil says

Great topic! We just moved out of the Bay Area because of high taxes and cost of living in (especially in good school districts). I don’t regret it but I miss the weather already. When we retire, we might move back to a cheaper part of California.

Frugal Professor says

Fantastic article. I was patiently waiting the mention of property taxes, and you finally delivered at the end of the article with the appropriate reference to Prop 13.

I agree that a frugal retiree could retire well in CA due to the progressive tax rates and the ACA subsidy. GoCurryCracker has also spoken eloquently to this (https://www.gocurrycracker.com/going-back-to-cali/). However, for one to retire TO California seems to be a different story entirely due to the inability to exploit Prop 13 for perpetually low property taxes going forward (due to the sky-high property values now).

If I’m remembering correctly, you lived in Cupertino by De Anza and Bollinger. I grew up 2.5 miles from there. What a small world.

Can I ask where in NV you ended up? Carson City / Reno? Vegas? I’m seriously considering a move to NV in retirement.

Harry Sit says

We’re in Reno, which was a finalist when Karsten at Early Retirement Now considered for his move.

https://earlyretirementnow.com/2018/12/03/we-just-bought-a-house/

Harry Sit says

A reader reminded me of Prop 60/90. You’re not locked into the house you bought many years ago. After age 55, you can downsize and keep enjoying low property tax if you stay in the same county or move to a welcoming county.

FinancialDave says

Here is possibly a better link to use if your goal is comparing retirement taxes.

https://www.kiplinger.com/slideshow/retirement/t054-s001-taxes-in-retirement-how-all-50-states-tax-retirees/index.html

You have to be careful in using this list as it is alphabetical and you have to find the ranking in the text such as “least friendly” to “most tax-friendly” and a number of measurements in between.

CA is just “tax-friendly” which is surprisingly the same rating as WA, but better than Oregon which is rated “Not tax-friendly.”

Bill in NC says

Sure, there are plenty of high tax states…while working, especially if household income is over $100k, that are low-tax states once retired.

Hawaii is attractive because of its dirt-cheap property taxes & since it doesn’t tax certain types of pensions or SS retirement.

OTOH, my state charges a flat 5.25% on all income (previously 6%-7.75% brackets, though not very progressive) so I plan to move to another state (probably TN) for retirement.

Barry N. says

I retired from Colorado and relocated back to Hawaii because it was a better lifestyle fit. Before the move, we visited some income tax-free states and realized, as the article points out, that was low on our priority list. Our total tax picture (income, property, sales) is lower than it was in CO. My income has actually been higher; our house is newer, nicer, bigger; our expenditures are about the same. All factors must be taken into account.

indexfundfan says

I moved out from SF Bay Area 3 years ago. I agree that financially, state taxes did not have the largest impact. Rather, for me, it is the ability to free up my home equity that made the most difference financially.

Ocho Sin Coche says

We moved from WA to VA a few years ago, and going from 0% to 5.75% was not insignificant. However, it factored little into our equation of whether we should move or not. Thanks for the great perspective on CA’s tax rates.

Hao says

Thank you for this post. It is very helpful as we live in California. In retirement, we can move abroad or to different states. But we would most likely maintain our California residence for the low state income tax, long-acquainted healthcare providers, beautiful nature, countless hiking opportunities, ethnic food,… I have read this post twice and I often go back to your previous posts. You always share helpful information. Thank you.

Bruce Berris says

MN is absolutely the highest taxed place for people with average incomes.

While MN’s top rate is lower than CA’s, for people with average incomes the tax rate is much higher. CA has a marginal rate of 4 % at up to 65,000 and 1 and 2 % brackets below. MN starts at 5.35 and goes to 6.8 % at 39,000.

So I can move to CA and cut my taxes.

Beau W. says

Good for you for leaving that awful state. Nevada is much better for retirement. The tax is much better. California is in for a big surprise in the near future when it comes too thier budget deficit. Its going to keep climbing because everyone is leaving. I could go on and on.

Beau Bridges says

First, it’s “to”, not “too”. Learn to English Beau.

Second, that awful state has a large population due to the nice weather and attractions. The COL in LA is higher than Trailer Park, Nevada because they have actual houses in LA and things to do. Not inbred anti-vaxers like Trailer Park, NV.

Third, be all means, go on and on. I know you want to.

Fourth, say hi to your wife, er, I mean cousin.

Londa Jericho

Anita says

Great article, thanks!! You mention doing a “mock return”. What tool do you use for that. I used OLT this year for taxes, but not sure how I’d do a return for a fictitious situation without mucking up my original return? They don’t seem to let me continue with a faux ss. ???

Alex says

Hi Harry, if you don’t mind what do you think about wildfires in the last several years in Reno? Smoke from wildfires in Reno was for about a month in 2020 and 2021. It looks like with global warming Reno will get more and more smoke days in the future. Most wildfires are happening in CA and the wind in the US blows from the west to the east.

I really like Reno, the beautiful nature around it, low property taxes, and no income taxes, but wildfires are the only thing why I hesitate to move there.

Harry Sit says

Of course no one likes the wildfires. Wildfires in 2020 and 2021 were bad but somewhat “acceptable” with reduced activities during the pandemic. I’m hoping big fires such as those in 2020 and 2021 don’t become routine.